내가 좋아할 만한 콘텐츠

EA agreed to a record $55B buyout, the largest ever. Gaming remains a pillar of digital culture and global capital is betting big on its future. linkedin.com/posts/thomasja…

Consumers stepped up spending in August even as inflation held steady. Core PCE stayed at 2.9% YoY, but the saving rate fell to its lowest this year. Growth looks strong now, yet sustainability depends on whether households can keep spending at this pace. linkedin.com/posts/thomasja…

US GDP grew at a 3.8% pace in Q2, the fastest in nearly two years. Consumer spending was strong, durable goods orders rebounded, and jobless claims hit the lowest since July. Growth, investment, and jobs are all moving higher. linkedin.com/posts/thomasja…

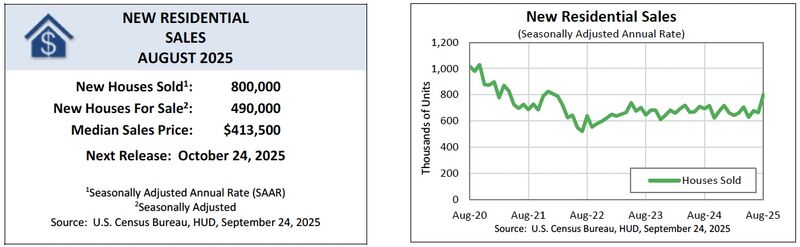

US new home sales surged 20% in August to an annualized 800,000 units, the strongest pace since early 2022. Builder discounts and incentives helped unlock demand and signaled that housing momentum is returning. linkedin.com/posts/thomasja…

PMI data shows U.S. growth cooling. Manufacturing fell to 52.0, Services to 53.9, Composite at 53.6. Still expanding, but momentum is fading as demand softens and inventories rise. linkedin.com/posts/thomasja…

Fed officials split today: Gov. Miran says rates are 2 pts too tight, while Pres. Hammack warns inflation is still too high. The dot plot shows each policymaker sees the same data differently. linkedin.com/posts/thomasja…

National jobs data looks steady but state reports tell another story. South Dakota 1.9 percent, California 5.5 percent, DC 6.0 percent. National is not local and that gap shapes how businesses and consumers experience the economy. linkedin.com/posts/thomasja…

Jobless claims fell to 231K, down from last week’s 264K, while continuing claims also slipped. A sign of resilience just as the Fed shifts focus to jobs. The challenge now is turning stability into the virtuous cycle of jobs, income, confidence, and spending.…

US housing starts fell to their lowest since May, down 8.5% in August. Builders are pulling back as inventories rise, even with mortgage rates easing. With the Fed set to cut rates, housing remains a headwind for growth. linkedin.com/posts/thomasja…

U.S. retail sales jumped 0.6% in August, beating forecasts. Core sales up 0.7% and July revised higher. Consumers say they’re cautious, but the receipts show wallets still open. With a Fed cut likely tomorrow, momentum into fall looks strong. linkedin.com/posts/thomasja…

Alphabet just joined the $3T club with Apple, Microsoft and Nvidia. Markets are betting on AI growth and strong results even as consumer sentiment slips. linkedin.com/posts/thomasja…

US consumer sentiment fell more than expected in September, dropping to 55.4 vs 58.2 forecast. Expectations plunged to 51.8, down 30% from last year. Inflation expectations steady at 4.8% (1yr) but rose to 3.9% (5yr). linkedin.com/posts/thomasja…

Gold just broke its inflation-adjusted record, hitting $3,674 an ounce. A weaker dollar, deficit fears, and central bank buying are fueling the rally. Gold proves markets move on numbers but endure on belief. linkedin.com/posts/thomasja…

US producer prices fell 0.1% in August, the first drop since April. Year-over-year wholesale inflation is 2.6%. Signals easing supply chain pressures, giving the Fed more room to consider cuts. CPI tomorrow will show if relief is reaching households. linkedin.com/posts/thomasja…

BLS just cut 911,000 jobs from the record. One of the largest benchmark revisions ever, showing the labor market was weaker all along. Fed now under even more pressure to cut rates next week. linkedin.com/posts/thomasja…

US consumer borrowing rose by $16 billion in July - largest increase in three months. The surge was driven by a $10.5 billion jump in credit card balances. Total consumer credit now stands at a record $5.06 trillion, with credit card debt above $1.31 trillion.…

Jobs report falls far short of expectations. Payrolls rose just 22K in August vs 75K forecast. Unemployment up to 4.3%, wages slowing, participation stuck. Weakness adds pressure on the Fed to cut rates this month. linkedin.com/posts/thomasja…

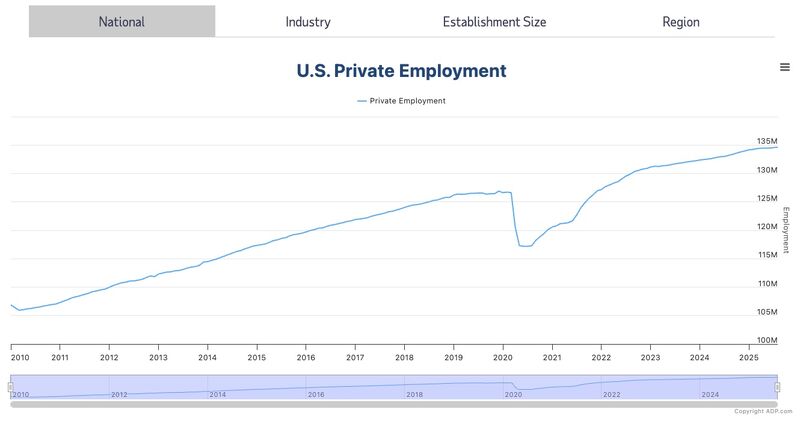

ADP shows private employers added just 54K jobs in August vs 73K forecast. Momentum is fading fast after July’s 106K. Wages steady at 4.4% for job stayers, 7.1% for job changers. linkedin.com/posts/thomasja…

US job openings fell to ~7.2M in July, the lowest in 10 months. Employers are posting fewer jobs but holding onto workers (a no hire no fire economy). Low layoffs keep spending resilient while easing wage pressure shapes Fed policy. linkedin.com/posts/thomasja…

US factory data sent mixed signals in August. The ISM Manufacturing PMI registered 48.7, marking a sixth straight month of contraction, while the S&P Global PMI jumped to 53.0, its strongest reading in more than three years. linkedin.com/posts/thomasja…

United States 트렌드

- 1. Jets 92.8K posts

- 2. Jets 92.8K posts

- 3. Justin Fields 14.6K posts

- 4. Aaron Glenn 6,218 posts

- 5. Sean Payton 3,027 posts

- 6. London 209K posts

- 7. Garrett Wilson 4,010 posts

- 8. Bo Nix 4,066 posts

- 9. #HardRockBet 3,486 posts

- 10. Tyrod 2,175 posts

- 11. #DENvsNYJ 2,450 posts

- 12. HAPPY BIRTHDAY JIMIN 169K posts

- 13. #JetUp 2,358 posts

- 14. #OurMuseJimin 214K posts

- 15. Breece Hall 2,199 posts

- 16. #30YearsofLove 186K posts

- 17. Bam Knight N/A

- 18. Peart 1,986 posts

- 19. Kurt Warner N/A

- 20. Sutton 2,974 posts

Something went wrong.

Something went wrong.