Term Labs

@term_labs

Pioneering fixed rate auctions onchain. http://app.term.finance

You might like

📣 Staking and governance are live on Term! $TERM holders don't just earn rewards—they safeguard the protocol itself. Here's how it works ⤵️ Term Finance was built for fixed-rate lending with transparency and decentralization at its core. To make that vision real, protocol…

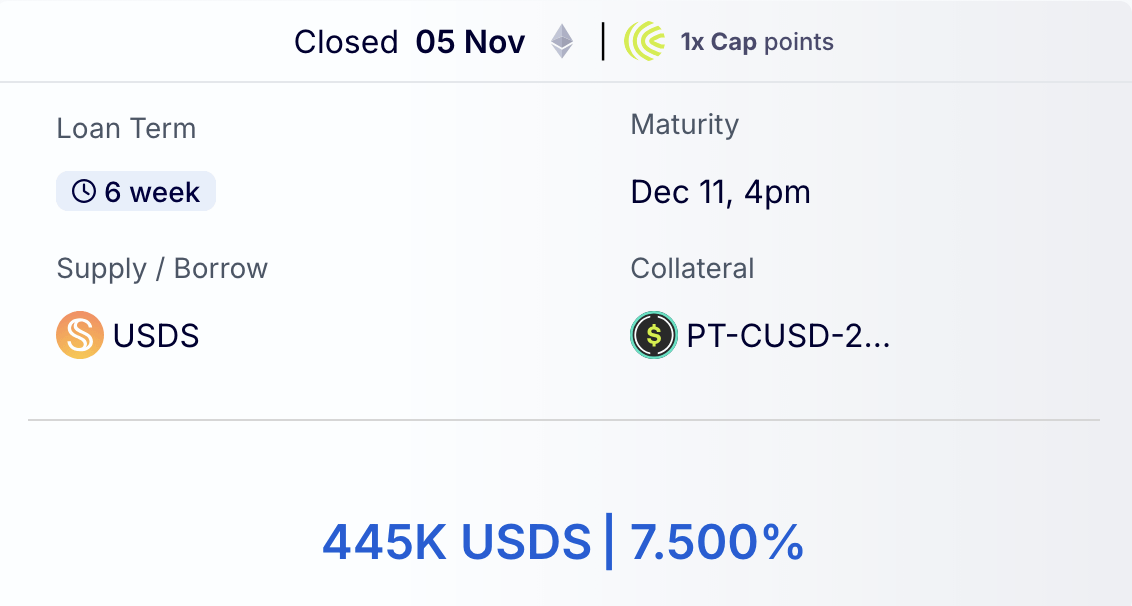

Flow of funds on this is quite an example of Yearn V3 Initial funds are from yvDAI-2 (a Yearn V3 vault) Deposits into a Yearn curated @term_labs USDS vault (also a Yearn V3 vault) Lending against a @capmoney_ PT, whose underlying USDC yield is generated using... a Yearn V3…

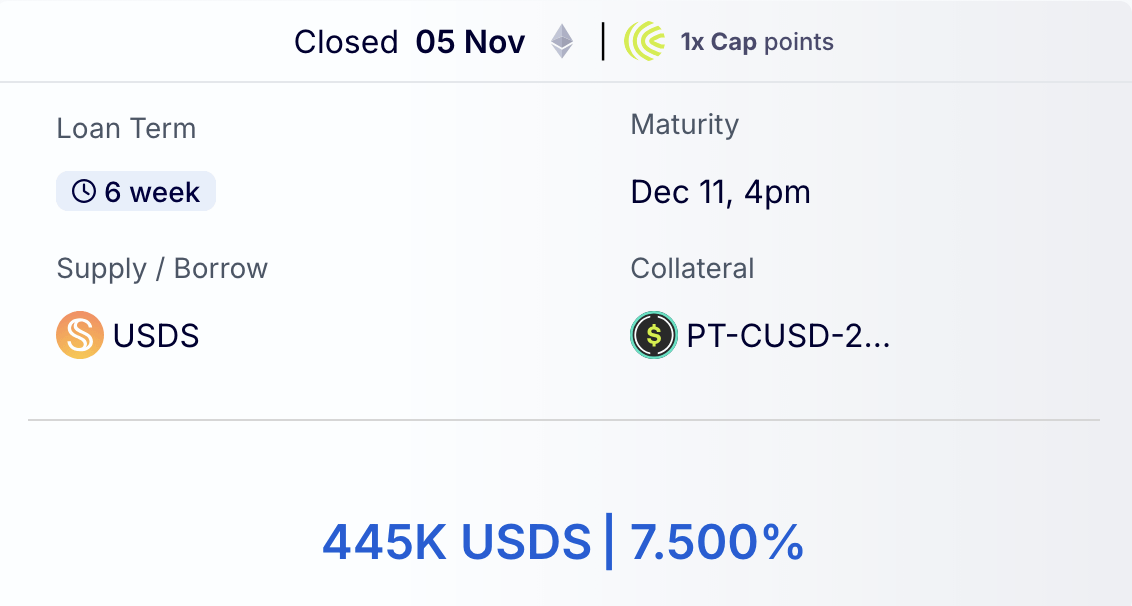

The new, Yearn-curated @term_labs USDS vault is ramping up! The vault now earns a fixed 7.5% APY on ~69% of USDS deposits and ~4.8% APY on the remaining deposits through Yearn USDS Vault. It's also earning @capmoney_ points. Let's walk through how the depositors are earning…

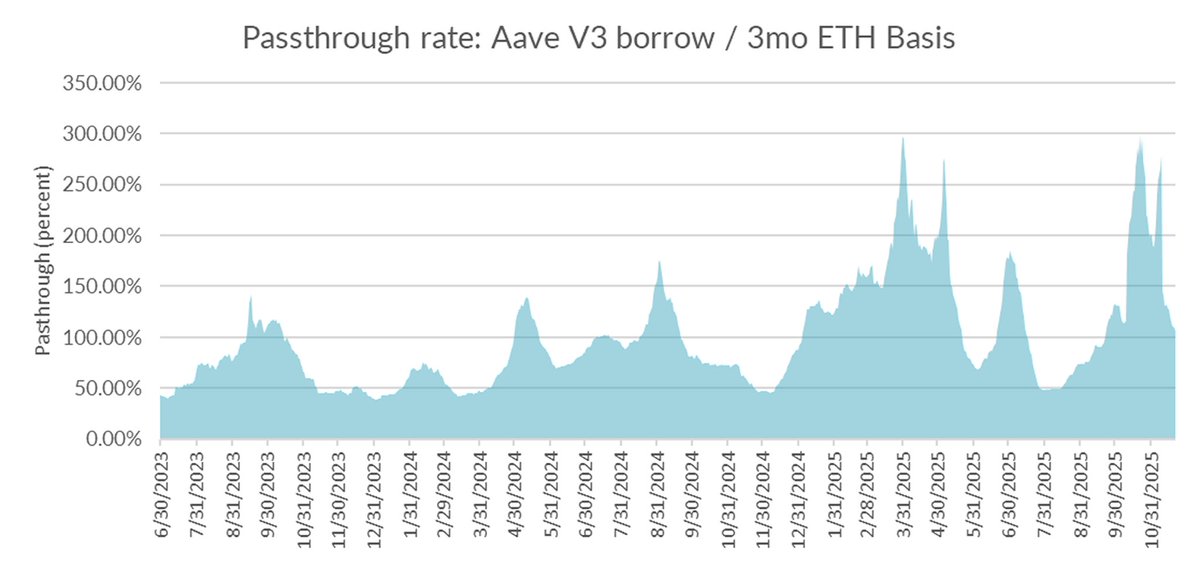

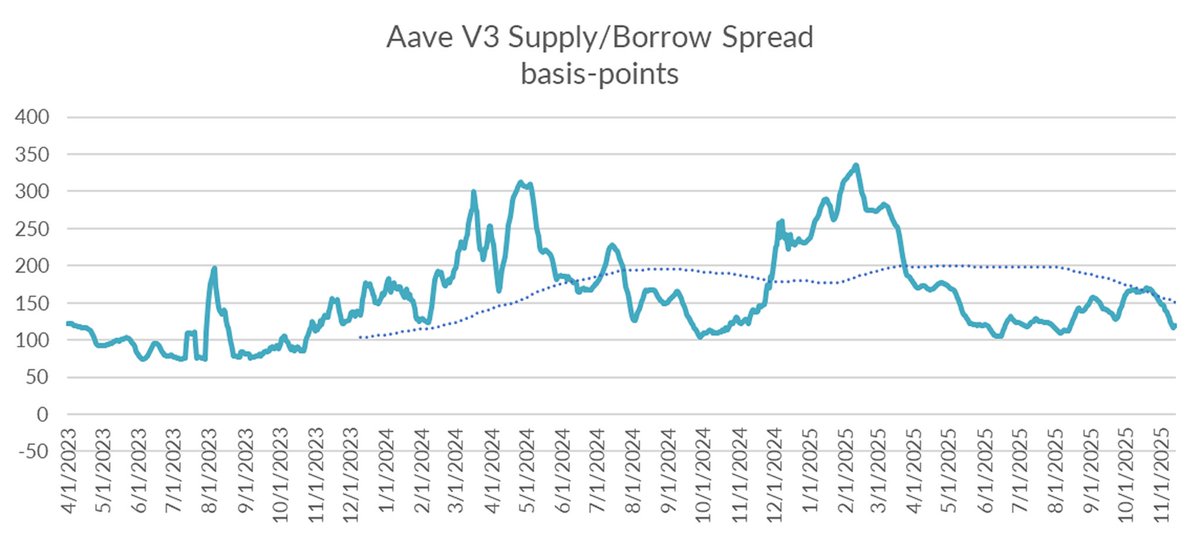

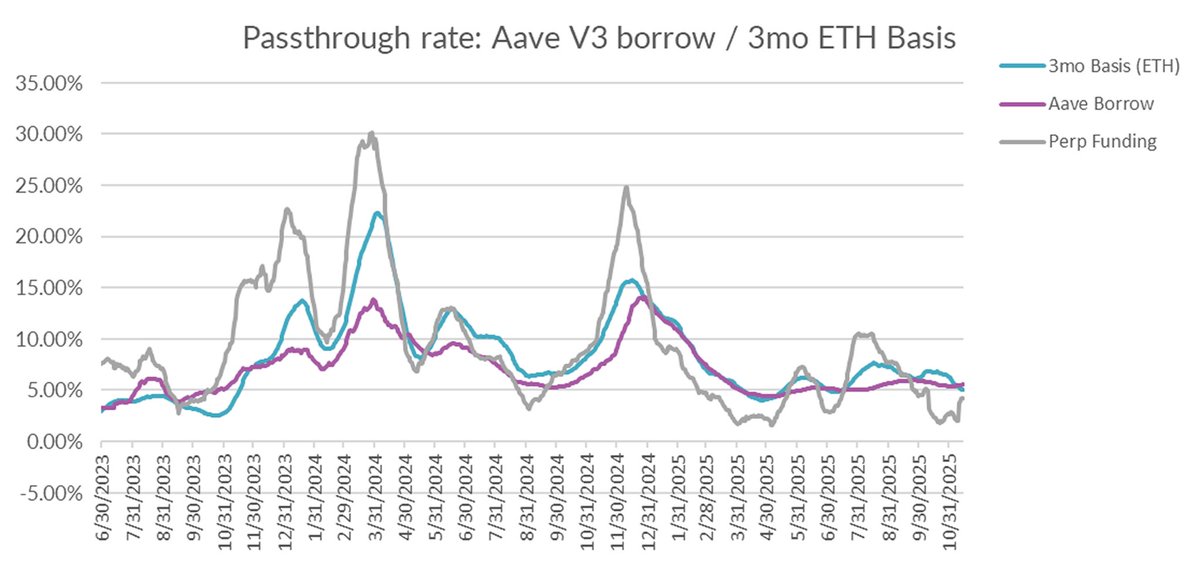

This reversal in perp funding rates continues to normalize the spread between DeFi and CeFi rates back toward historical averages

The new, Yearn-curated @term_labs USDS vault is ramping up! The vault now earns a fixed 7.5% APY on ~69% of USDS deposits and ~4.8% APY on the remaining deposits through Yearn USDS Vault. It's also earning @capmoney_ points. Let's walk through how the depositors are earning…

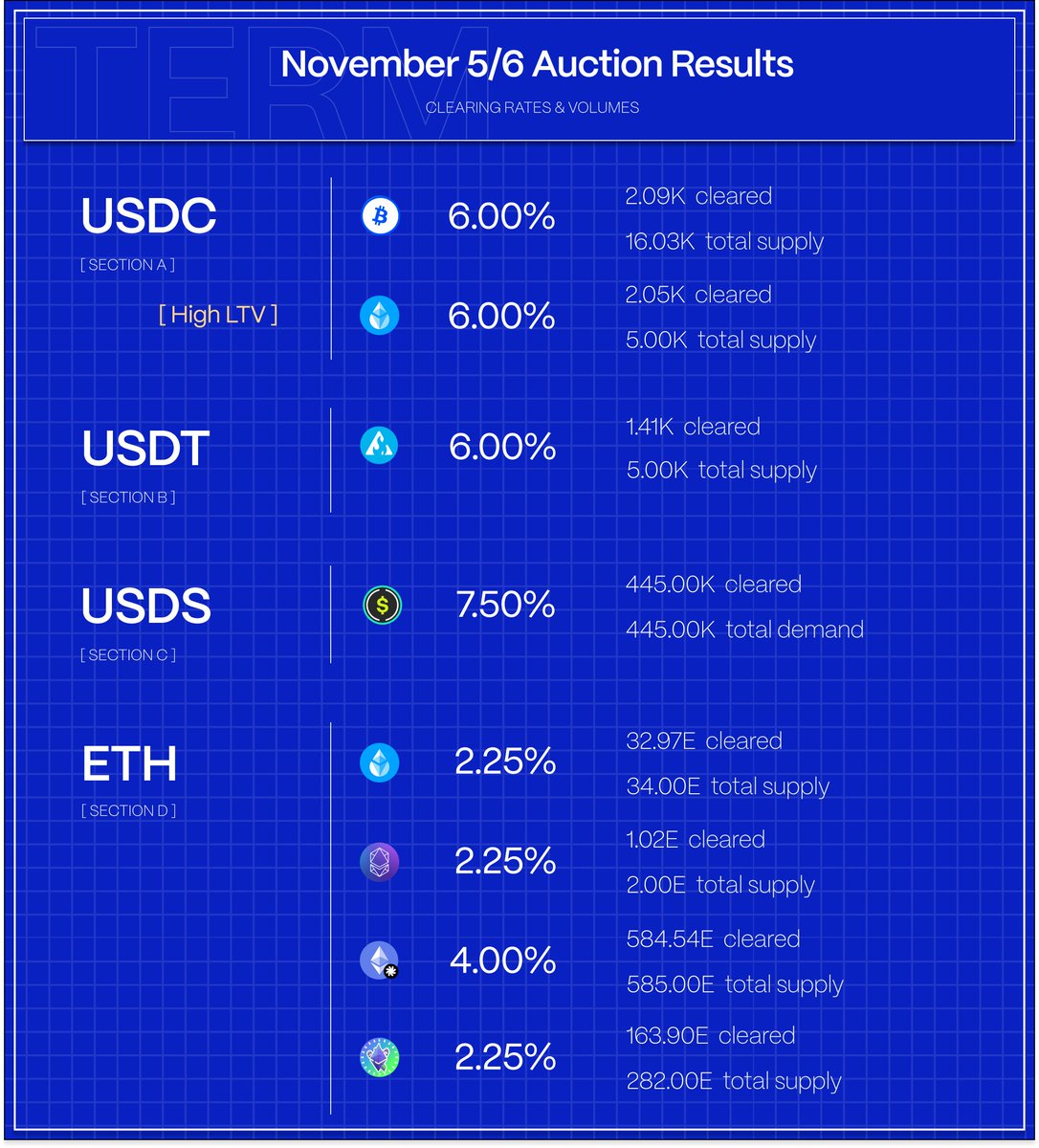

We’re beginning to see reverse inquiries to borrow against USD-denominated exotics, but the market still refuses to reprice risk. As a result, no stablecoin loans cleared except those backed by liquid collateral

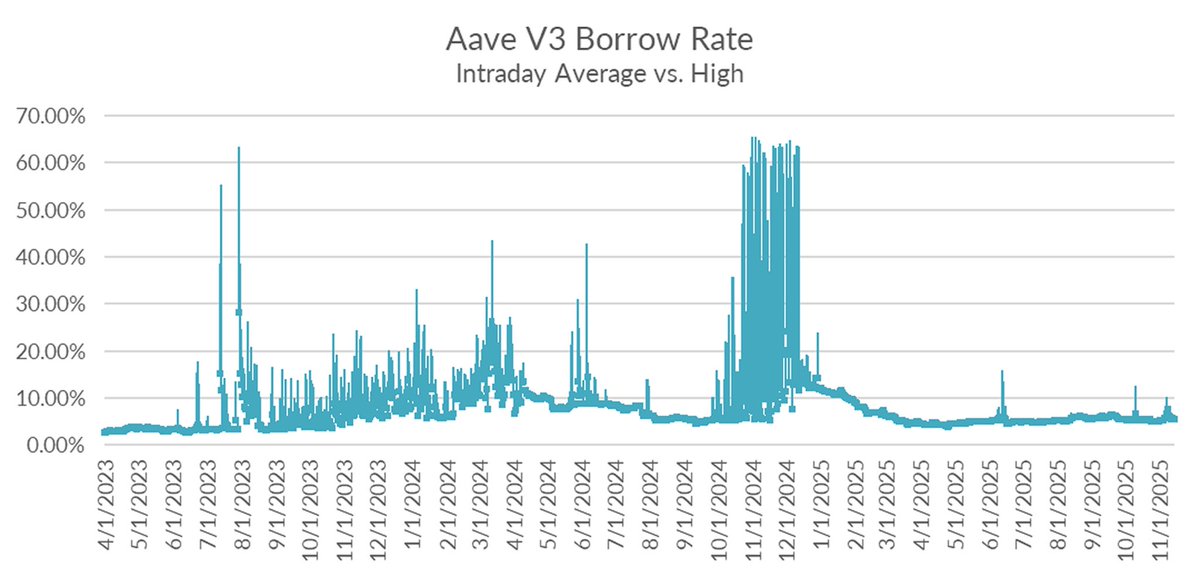

in the near term, the path for rates is highly uncertain. Falling asset prices are likely to trigger deleveraging, whether through forced liquidations or voluntary risk reduction. While lender skittishness continues to pull in the opposite direction. In the short run, rate…

In derivatives markets, funding rates were mixed, with 3-month basis falling another -50bps to 5.01% and perpetual funding rates rising by +200bps to 4.19% on a 30-day trailing basis

may i collateralize you

📔 Last week in DeFi Lending ▫️ Perp rates bounce on short covering ▫️ Aave supply recovers ▫️ Term sees deleveraging Full report: bit.ly/4oOdnCL Subscribe: bit.ly/3KgJTxR

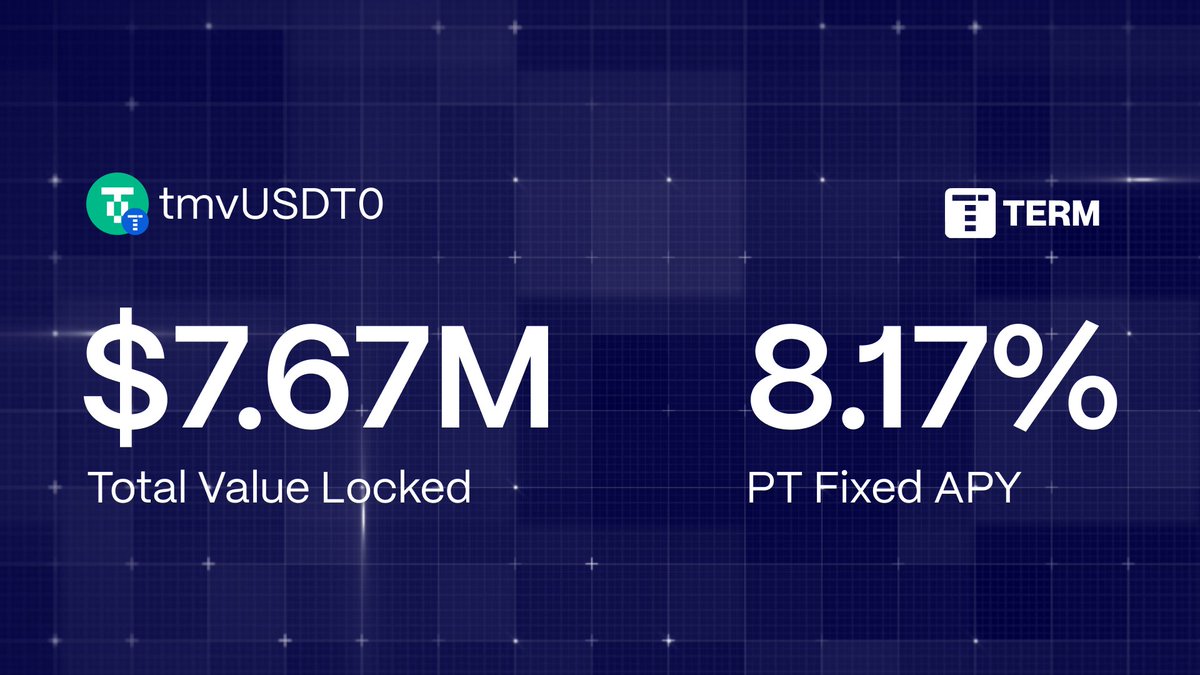

Term USDT0 Meta Vault PTs on @pendle_fi are one of the highest yielding USDT0 opportunities in the market. Lock in above market fixed yields now. Link below...

📘 back in business with friday blue sheets 👀 lenders earn @capmoney_ Cap points when lending against PT-CUSD ⚡ earn 5.25% USDC lending against BTC-backed collateral

.@term_labs is bringing institutional-grade protection to fixed-rate DeFi lending with Hypernative 🤝 The auction-based protocol that matches borrowers and lenders at transparent, fixed rates is deploying Hypernative's Pool Toxicity monitoring: 💧 Quantify the cleanliness of…

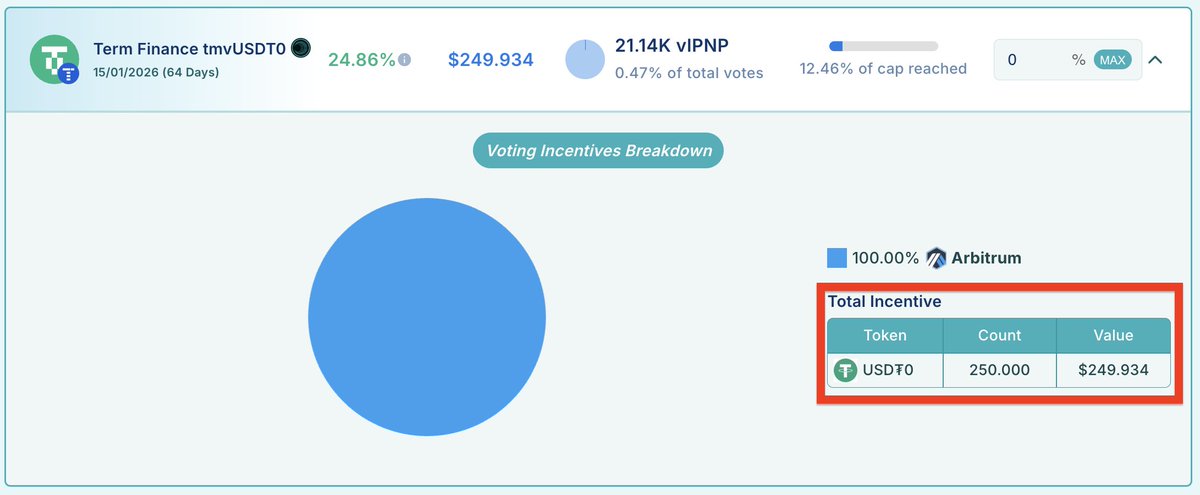

Grow $USDT rewards on the @Penpiexyz_io Voting Market!🌿 @term_labs has planted $250 in $USDT incentives, offering #vlPNP voters a steady +24% APR for supporting the tmvUSDT0 pool this epoch.🌱 Cast your vote and watch your rewards bloom!🗳️

📔 Last week in DeFi Lending ▫️Perp rates continue to slide ▫️Aave spikes on liquidity crunch ▫️Fixed-rates on Term stable Full report: bit.ly/4nLr7fW Subscribe: bit.ly/4hVoXt2

United States Trends

- 1. Eagles 119K posts

- 2. Eagles 119K posts

- 3. Jalen 26K posts

- 4. Ben Johnson 12K posts

- 5. Caleb 46.3K posts

- 6. AJ Brown 5,074 posts

- 7. Philly 24.4K posts

- 8. #BearDown 2,154 posts

- 9. Patullo 11.3K posts

- 10. Sirianni 6,607 posts

- 11. Black Friday 515K posts

- 12. Lane 53.9K posts

- 13. Swift 57.5K posts

- 14. Swift 57.5K posts

- 15. #CHIvsPHI 2,419 posts

- 16. Saquon 7,636 posts

- 17. NFC East 1,641 posts

- 18. Gunner 5,246 posts

- 19. Nebraska 14.4K posts

- 20. Georgia Tech 4,172 posts

You might like

-

XSTAR (mainnet arc)

XSTAR (mainnet arc)

@xstar_id -

Hyperbolic Protocol

Hyperbolic Protocol

@HyperbolicETH -

HAVAH

HAVAH

@HAVAHofficial -

Bitget Wallet 🩵

Bitget Wallet 🩵

@BitgetWallet -

Base

Base

@base -

Fuel

Fuel

@fuel_network -

Guild

Guild

@guildxyz -

Symbiosis

Symbiosis

@symbiosis_fi -

Slingshot

Slingshot

@SlingshotCrypto -

Secured Finance

Secured Finance

@Secured_Fi -

Jumper

Jumper

@JumperExchange -

Myria | The web3 gaming platform

Myria | The web3 gaming platform

@Myria -

DMAIL.AI

DMAIL.AI

@Dmailofficial -

Nar.bet ♓ (mainnet arc)

Nar.bet ♓ (mainnet arc)

@nardotbet -

WIFI

WIFI

@wifimoneykila

Something went wrong.

Something went wrong.