You might like

I would like to remind the public that @FuzzyPandaShort said he would maintain his short on $NUAI. He probably shorted around $4.5, meaning he is down about $3+ per share at this point. Fuzzy Panda is objectively smart. He graduated from Harvard. He knows how to manage risk,…

Retail investors can't say🐼didn't warn you. Tons of $NUAI shares are set-up to be dumped

$NUAI: Research Threads BTM Natural Gas History: x.com/jiahanjimliu/s… Business Model: x.com/ConvexityStock… Differentiator/Moat: x.com/litigious_dulc… The Derisk: x.com/Agrippa_Inv/st… PDI (Primary Digital Infrastructure): x.com/litigious_dulc… Whale Watching:…

A firm such as PDI does not engage with an emerging platform like $NUAI unless the risk-adjusted return profile is compelling on its own merits. In infrastructure and hyperscale data-center development, counterparties underwrite assets, not company size. When land, power,…

As I said if $IREN bulls see potential in $NUAI then you really have to take a look

Why I initiated a position in $NUAI $NUAI is a stock that has been on my radar since late November. Up until late last week, I had completely written it off. I saw it as an extremely speculative “story stock” and wanted nothing to do with it. However, my stance has changed over…

I just left the PTC conference, and from talking to many developers, companies, etc., I have learned how incredibly difficult evaluating and procuring land is. Yes, behind the meter sites are more common than front of the meter ones, but they are much more harder to do DD on due…

All the $IREN bulls are piling into $NUAI Don't miss out

Just bought some $NUAI The new position now represents a little over 10% of my portfolio. I'll make another post in a couple of hours explaining the rationale behind the purchase.

$MOLY Today we announced the signing of an agreement for molybdenum supply with one of the largest and most sustainable steel companies in Germany. Our current success with offtakers will also positively impact #Greenland. According to our NI 43-101 Feasibility study, our…

After a fairly long hiatus, I am now posting a bunch (when basically no one is paying attention lol). But my reasoning is simple. I doubt that retail fully appreciates the importance of the partnership between $NUAI and Primary Digital Infrastructure. Retail needs to understand…

Value creation requires catalysts $NUAI Catalyst #1: lock down prized gigawatt-scale campus for first project = TCDC. Check! Catalyst #2: Establish strategic relationship with a leader in datacenter development = PDI. Check! Catalyst #3: Now comes the hyperscaler… Final…

Most people misread why institutions aren’t piling into $NUAI at ~$250M market cap. It’s not lack of conviction. It’s mandates + liquidity math + compliance friction + career risk. A stock can be “obvious” and still be structurally hard to buy for the AUM that actually moves…

A firm such as PDI does not engage with an emerging platform like $NUAI unless the risk-adjusted return profile is compelling on its own merits. In infrastructure and hyperscale data-center development, counterparties underwrite assets, not company size. When land, power,…

People like to imagine themselves to be great stock pickers or deep value investors, but really they just chase price. The most asymmetric risk reward is when no one appreciates the thesis, and I firmly believe that’s the case with $NUAI. I was right about $PLTR, $HOOD, and…

Peter Thiel’s “last mover” idea isn’t about being late. It’s about entering after the market’s failure modes are visible, then winning by building the machine that scales when the bottleneck shifts from “idea” → “execution.” AI data centers are in that exact phase shift. Demand…

Drop the tenant and it's game over for shorts $30 stock this year. Long term $100+ $NUAI

🚨 Big move from $NUAI We’re co-developing a 1+ GW hyperscale data center campus in Texas with @PrimaryDigitalX. 📍 Ector County ⚡ Grid + behind-the-meter power 🧠 Built for the AI era 🎯 Anchor tenant on track Read the release: businesswire.com/news/home/2026…

$NUAI announced it has partnered with Primary Digital Infrastructure (PDI), an independent data center investment platform, to co-develop Texas Critical Data Centers (“TCDC”). See businesswire.com/news/home/2026…. The parties will co-sponsor the project and jointly bring deep…

As per RESourceEU announcement, ec.europa.eu/commission/pre…, we are working with the European Commission on our equity financing requirements... linkedin.com/posts/jozef-s%…

X, my substack is apparently #4 on the new bestsellers list. If I've made you money over the past year(s), you know what to do 😉🍻 $APM.TO $ANPMF $VLE.TO $VLERF $CVE.TO $DNN $DML $U.UN $URC.TO $CCJ $OKLO $TAL.TO $MAI.V $MAIFF $BIG.V $BADEF $AFM.V $AFM $MOLY.TO $ENB $EU.V $MOLY

$NUAI Valuation Report Recommendation: Strong Buy Price Target: $23.01 Full Report: open.substack.com/pub/seqhcapita…

The recent announcement that $NUAI will acquire full control of its TCDC data center project is a definitive statement of intent and an impressive exercise in shareholder-focused financial engineering. First, this move is an unmistakable declaration of confidence from…

📢 $NUAI just signed to acquire full ownership of its flagship #AI datacenter project in West Texas, buying out Sharon AI’s 50% stake in TCDC for $70M. A major step forward in the Permian Basin. Read the release: loom.ly/9zTpvGk

BTC $315,000 ETH $20,000 CIFR $60 CLSK $50 STZ $225 DEO $135 MSTR $1000 ASST $25

Very excited to host Will, Chairman and CEO of $NUAI and his colleague Charlie Nelson, Executive Director, next week! Mark your calendars, set your reminders!

$MOLY positive step, we will commence trading on the Toronto Stock Exchange (TSX) as of the opening of trading on December 5, 2025, under the same symbol "MOLY". We thank BMO for acting as our sponsor in connection with the TSX listing! more to come..😎 businesswire.com/news/home/2025…

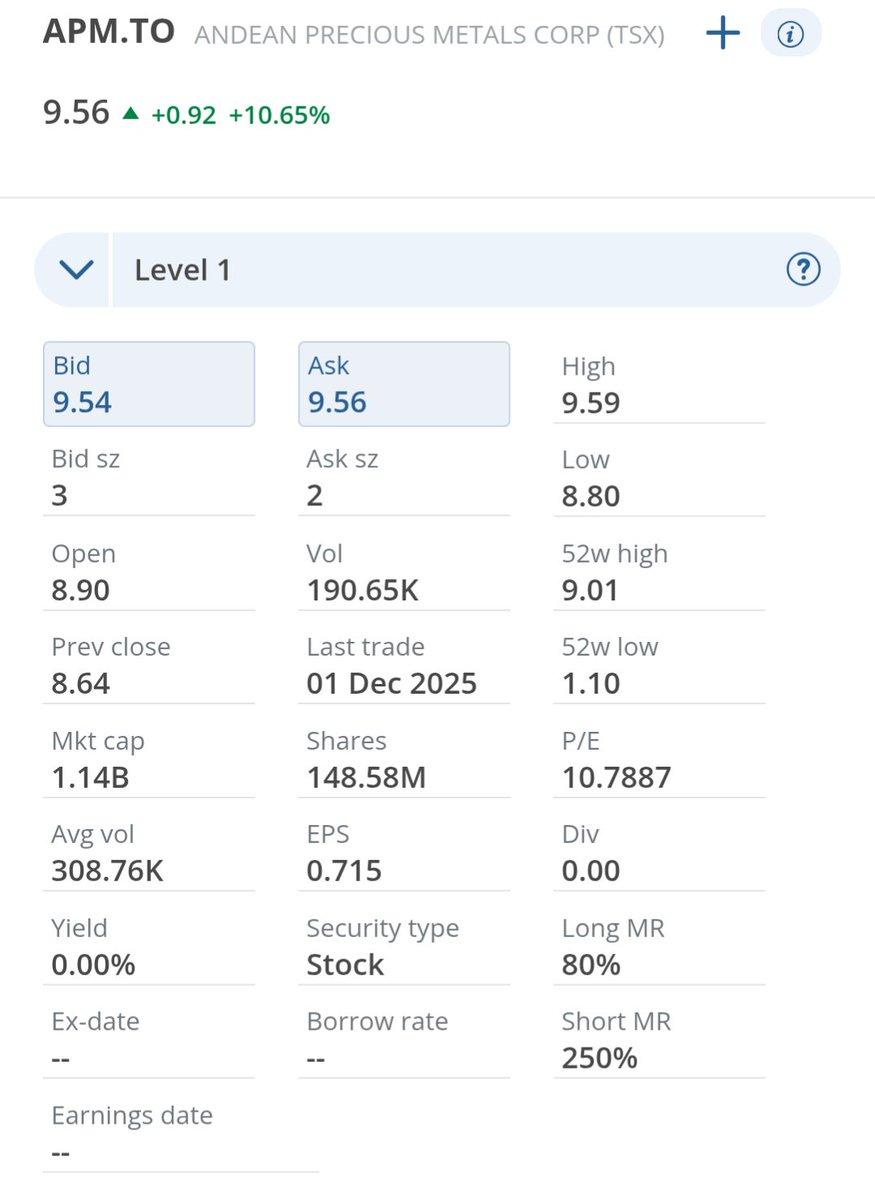

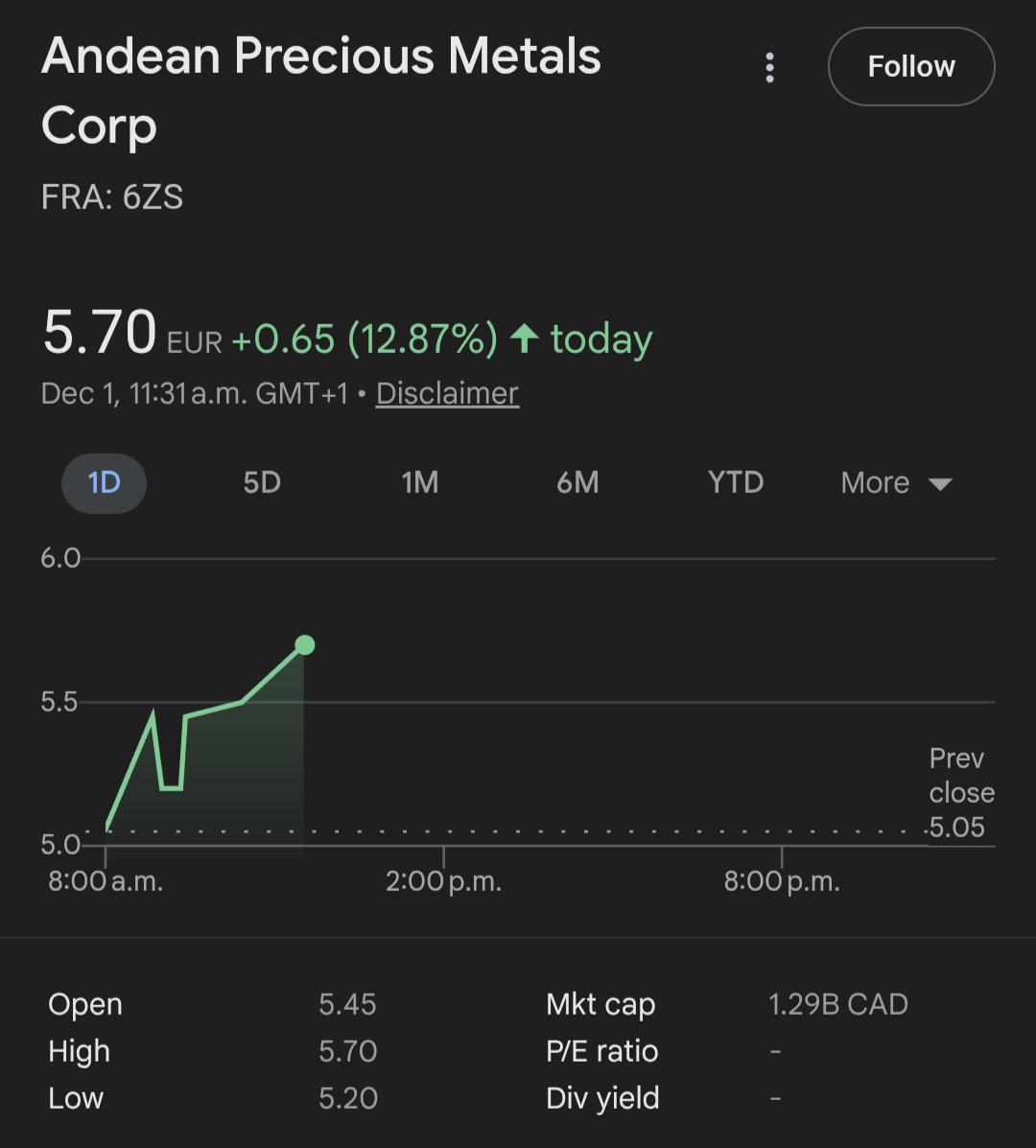

Oh no! Up 10.65% on 190k shares of volume. If all of that is shorts covering, which it's not, they only got 10mil shares more to go. $APM.TO $ANPMF heading passed Pluto.

New ATH of 9.27/share, previous was 9.01. 40 days to cover. EVERY single short position is at a significant loss. They'll call $APM.TO $ANPMF the $GME of 2025 if this b*tch has fuel poured into the momentum engine before year end!

United States Trends

- 1. 1.3 SOL N/A

- 2. Good Friday N/A

- 3. #FanCashDropPromotion N/A

- 4. #สนามอ่านเล่น2026xJimmySea N/A

- 5. JS AVOCEAN FAM SIGN N/A

- 6. #ราคีTHESTAIN N/A

- 7. #FridayVibes N/A

- 8. Happy Friyay N/A

- 9. #KawasakiHeavenlyWord N/A

- 10. RED Friday N/A

- 11. Christ Jesus N/A

- 12. Hire Americans N/A

- 13. Autopilot N/A

- 14. TACC N/A

- 15. Ari Lennox N/A

- 16. Cudi N/A

- 17. Luka N/A

- 18. Jim Jones N/A

- 19. Uncle Ted N/A

- 20. Massie N/A

You might like

-

Mr. #Uranium

Mr. #Uranium

@ABongo888 -

Chriso

Chriso

@Chriso26619000 -

Big Mike

Big Mike

@Big_U_Dawg -

uBeliever

uBeliever

@peterzhou15 -

DimasUranium

@DimasUranium -

Sightlineu3o8

Sightlineu3o8

@sightlineu3o8 -

UraniumDK

UraniumDK

@UraniumDk -

UrBull

UrBull

@bull_ur -

Wildstylez NL

Wildstylez NL

@Wildstylez_ned -

Lukester588

Lukester588

@lukester588 -

Jim

Jim

@uraniumNI -

uraniumfilledbatteries

uraniumfilledbatteries

@uraniumfilledb1 -

Griup

Griup

@jgrimold -

Andy

Andy

@AndyShazam -

Dre

Dre

@DreUranium

Something went wrong.

Something went wrong.