Alchemize PF || Seeking Alpha in Indian markets

@thinkreturns

Journal of my stock market journey. Tweets for Education purposes only. Not a buy/sell recommendation. Not SEBI registered. Do your own diligence.

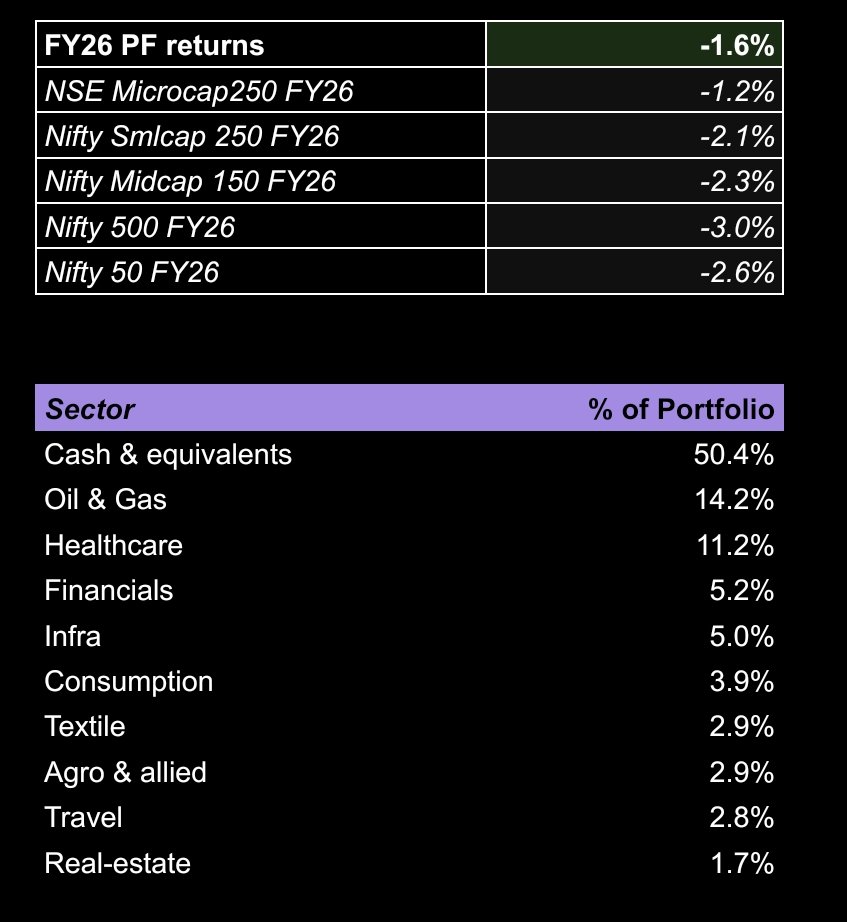

Holding high cash paid off. #TrumpTariffs tantrums hit bad last week & I expect this week too. Deployed some in #financials etf/index. Shrimp took a huge beating & loads of profits evaporated. Might cut that, o&g exposure. Cautious, but deploying. #Nifty D: not a recommendation

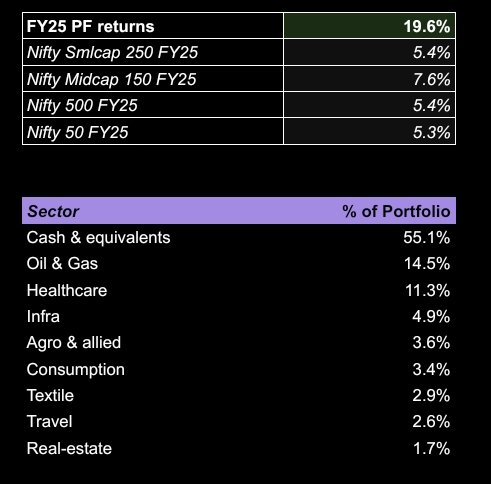

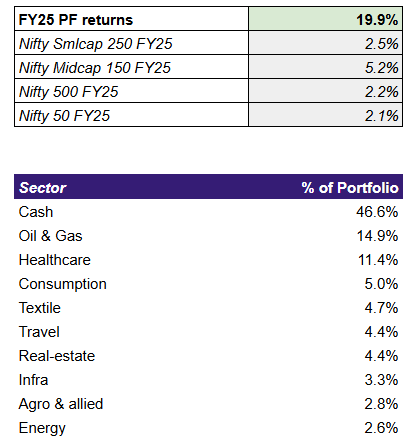

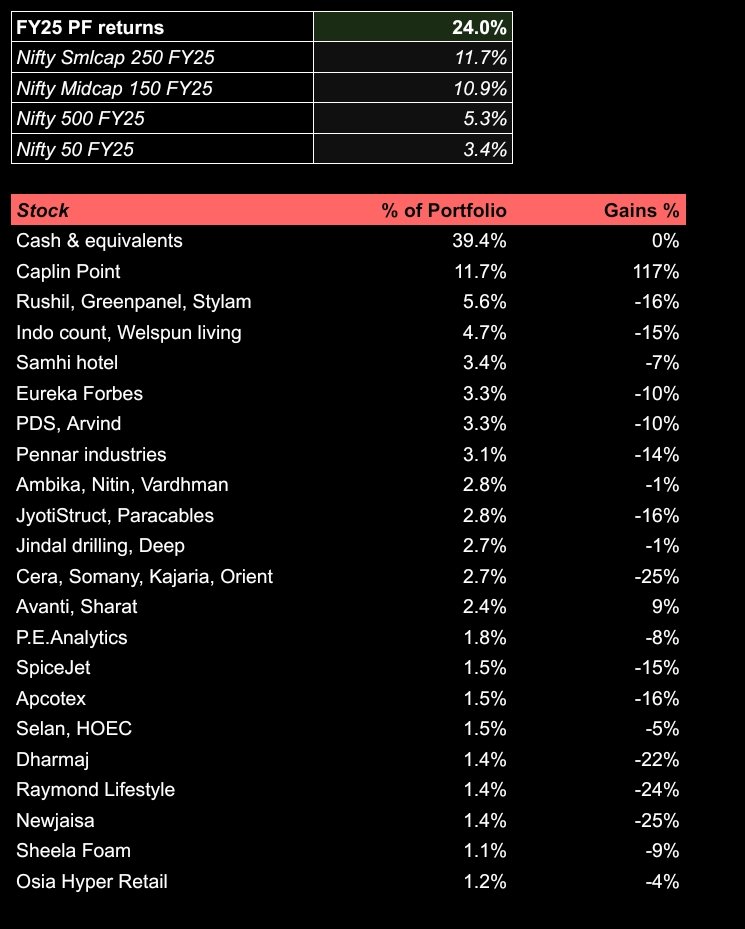

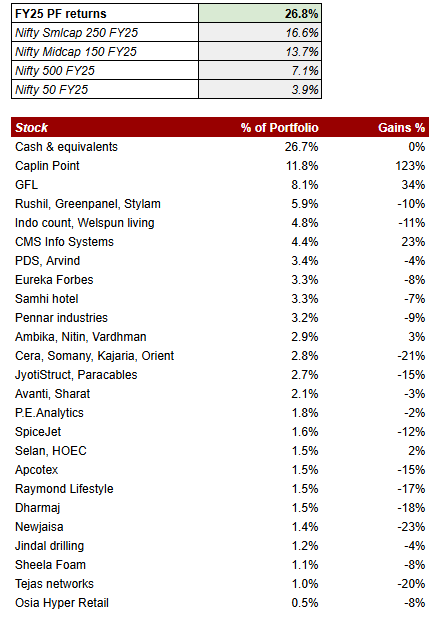

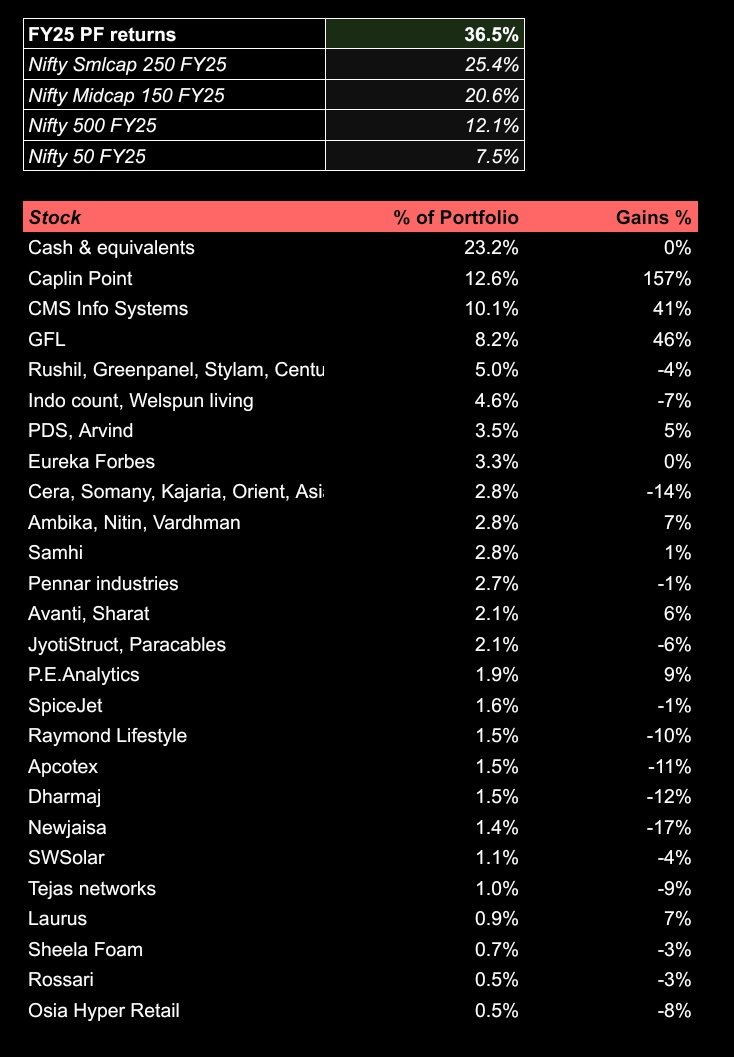

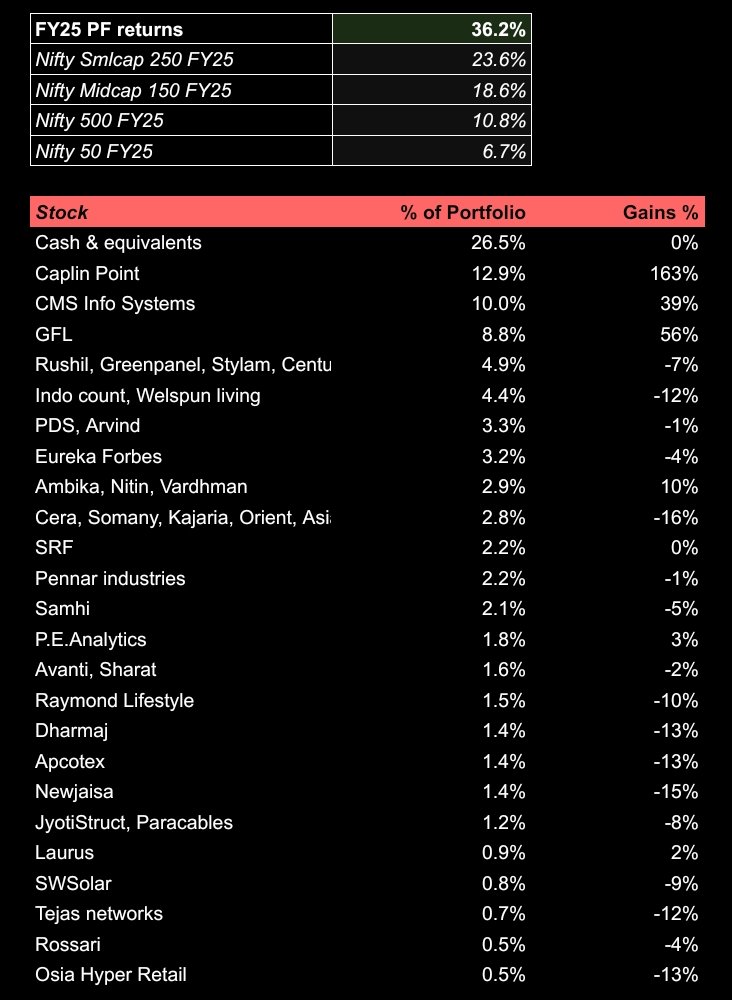

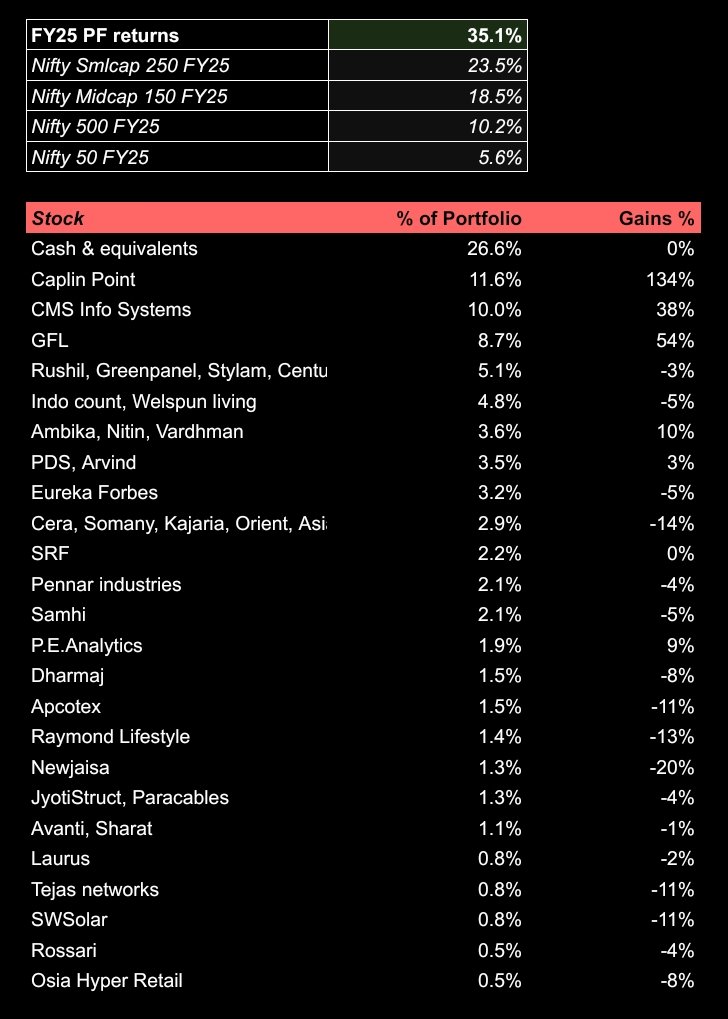

Ending fy25 with ~20% return despite massive correction in last 6 months & numerous blunders, unforced errors made by me personally. Lots of learnings. Determined to do much better in future. Couldn't devote much time last 3 months. Will double down on research now D: not a reco

Another down leg. Don't think lot more downside will happen. Time correction likely now. Unless trump Apr tariff announcements trip us all majorly. Did some tax loss harvesting, but yet to buy back. Might be a mistake, but waiting for March end/apr start D: not a reco

bounce at index level as expected this week. some PF stocks have bounced. need to keep an eye on others if they are eggs/tennis balls. took small trades in relief rally & sold by end of week. mkt remains a. to keep buying slowly. D: not a reco #stockmarketcrash #Nifty

We ignored promoter selling, preference shares, QIPs, relentless IPOs at crazy prices, slowdown in economy, low government spending, bad results, RBI tightening and restrictions, etc. We were blinded by GREED. Currently we are ignoring promoter buying, pickup in govt spending…

Previously, we were ignoring bad news. Now, we are ignoring good news. The pendulum always swings away from center, in either directions.

At the peak there were lot of #viviana #oriana #e2e networks fans giving gyan that 1-3 stocks make a portfolio & they are making multi bagger returns due to skill. Now all are silent. Markets are humbling. Keep learning & don't let luck, hubris get to one's head D: not a reco

another bloody week. tax loss harvested some stocks. Expect March to be bad as well, with more folks doing tax-loss harvesting. Watchlist getting very attractive in many names. Will continue to keep slowly deploying. #stockmarketsindia #LTCG #SIP D: not buy/sell reco

Trimmed few laggards & reallocated. Deployed some cash. Surprised by today's fall in #JINDALDRILLING - hoping its just routine selling & nothing wrong with company. If not for this, week would have been much better. #stockmarketcrash #stockmarketsindia #Nifty50 D: not a reco

absolute carnage. but very high probability we are at bottom/very close to it. need to start deploying more. strong feeling market will turn strongly in coming months after Q1fy26 results #stockmarketcrash #stockmarketsindia #stockmarketscrash d: not buy sell recommendation

Flat week. Had to exit bunch of stocks in Textiles, Woodpanel after bad numbers. Healthcare might be seeing next leaders - great results all across. Cash remains quite high (more than my liking) - want to deploy! Studying! #stockmarketcrash #Nifty D: not buy/sell recommendation

Investing in Microcaps #Microcaps #Smallcaps #HiddenGems #Equities

and somehow today all the stock market gurus in X will be 100% invested, and yesterday they were in 80%+ cash 🤣 If you know, you know 😅 #stockmarketcrash #SmallCaps #niftycrash #StockMarketIndia #Nifty50 #itchotels

Absolute wealth destruction. Money getting vaporized 🤣 Now is when we see if people will remember theory or panic. Looking at the trend of general market, seems latter is more likely. Stay strong and patient folks. This too will pass #stockmarketcrash D: not a recommendation

Beaten black and blue. Got kicked from #gfl and #CMS to stoploss. continuing to buy good companies I see potential in & not sitting on sidelines fully. The down slide has to stop at some point. Holding on. #stockmarketcrash #stockmarketsindia #SmallCaps

#StockMarketIndia is humbling. reflecting i think many buys in bull-market are regrets now. what a cliche. very humbling. sticking to process is key. will be much more disciplined. Had to sell #swsolar as results not in line. Enough time given. #stockmarketcrash D: not a reco

Sold #SRF few days back to make money for ideas which I thought will move faster, and now it's up 10% 🤣 Entire fluorine pack up in fact. Lucky #gfl is still in PF. Trying to time markets is a dangerous game. Investing is a game of never ending regrets. D: not a recommendation

Overdone #stockmarketcrash. expect #Q3results will be slightly muted, but don’t expect med term prospects will be as bad as fear going around. Focusing on companies bottom up & not drawing phantom co-relations, phantom chart lines, predict. Back to studying! d: not a reco

Slowly buying into intresting opportunities, selling laggards. Q3 results & market reaction is a big milestone upcoming. Ensuring cash remains ~20% in hand when we enter Q3 results season - can go both ways D: not buy sell recommendation #stockmarketsindia #smallcap #Nifty500

#CAPLIPOINT carrying the entire #pf tbh for now. Sowing seeds for the next gen. Hoping some of them sprout & pull their weight once #StockMarketIndia recovers. Loving the time market is giving to research. Also reading book on TA/trading - plan to apply learnings. D: not a reco

Tough week. #nifty #stockmarketcrash continues. But have started shopping since last 2 weeks. Coincidentally some recent additions featured also by #IAS2020 speakers - #samhi and #paracables Staying cautious & slowly deploying D: not a buy/sell recommendation

United States Trends

- 1. Thanksgiving 402K posts

- 2. Golesh 2,686 posts

- 3. Camp Haven 7,468 posts

- 4. Fani Willis 17.8K posts

- 5. #WipersDayGiveaway N/A

- 6. Trumplican 3,464 posts

- 7. Khabib 7,324 posts

- 8. Hong Kong 88.2K posts

- 9. NextNRG Inc 1,222 posts

- 10. Denzel 3,537 posts

- 11. Tom Hardy 1,837 posts

- 12. Wine 40.1K posts

- 13. Mendy 5,234 posts

- 14. Stranger Things 169K posts

- 15. Africans 27.5K posts

- 16. Riker N/A

- 17. Idris 7,979 posts

- 18. Breyers 2,636 posts

- 19. Bayern 141K posts

- 20. #PuebloEnBatallaYVictoria 4,892 posts

Something went wrong.

Something went wrong.