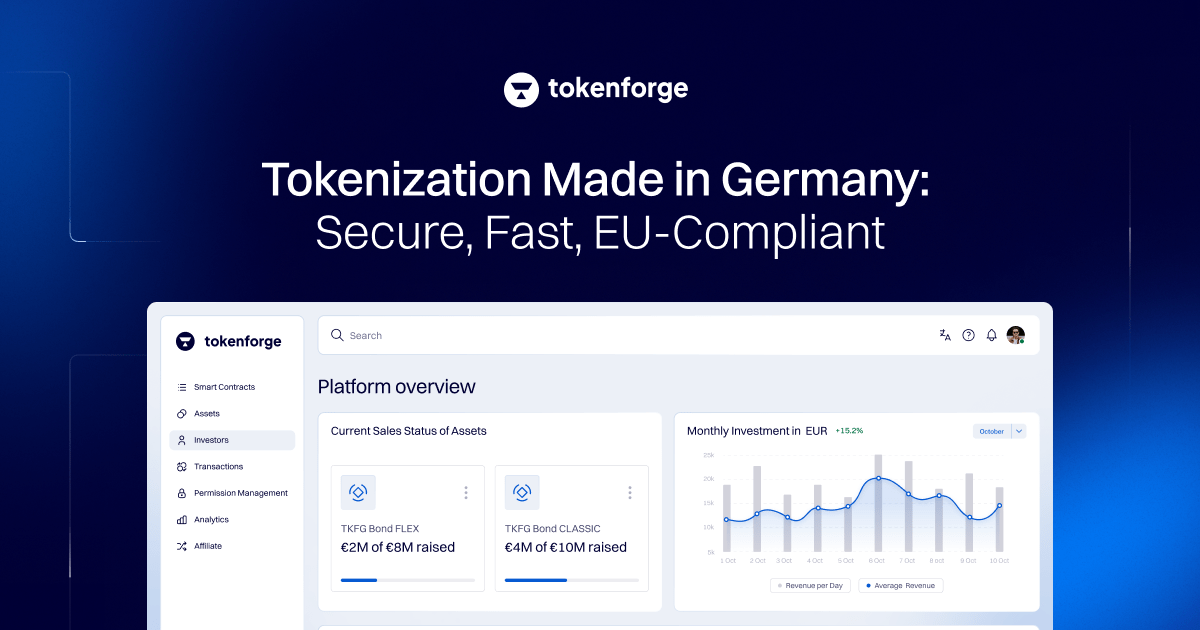

tokenforge

@tokenforge

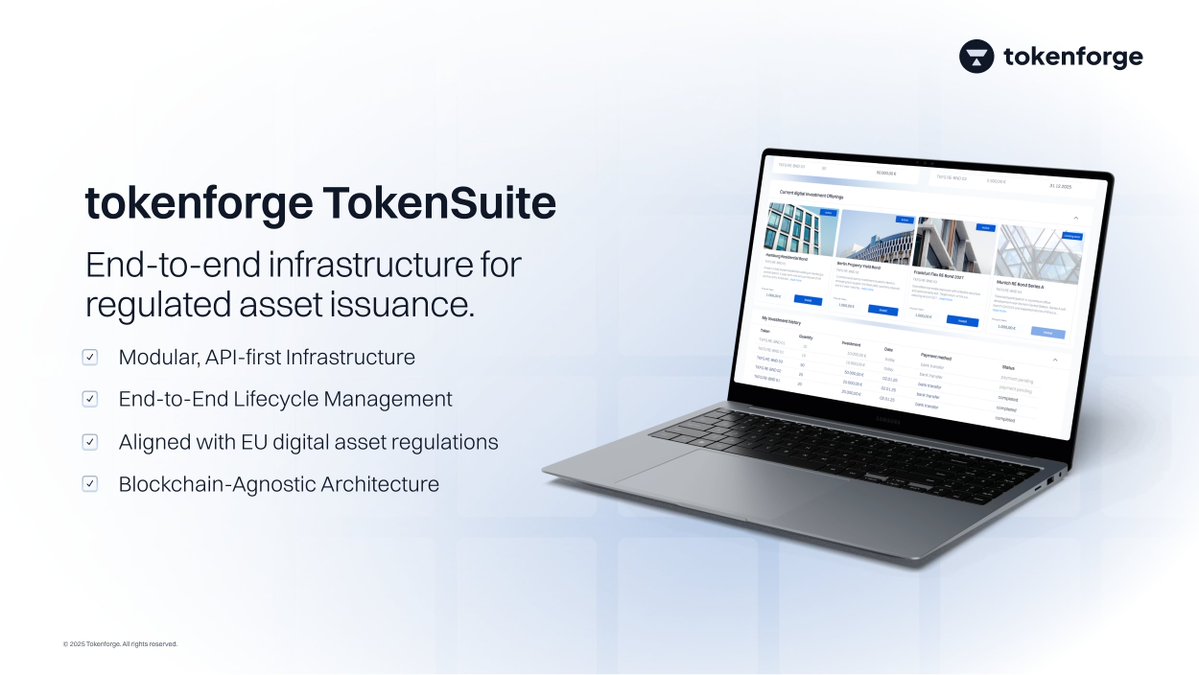

Compliant infrastructure for real-world asset tokenization in Europe, covering the full asset and investor lifecycle and aligned with EU regulations.

You might like

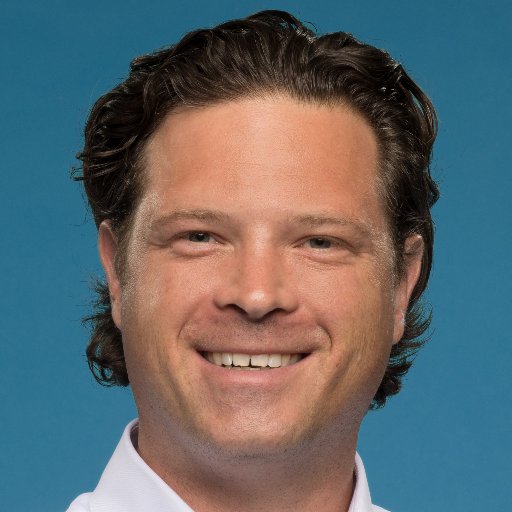

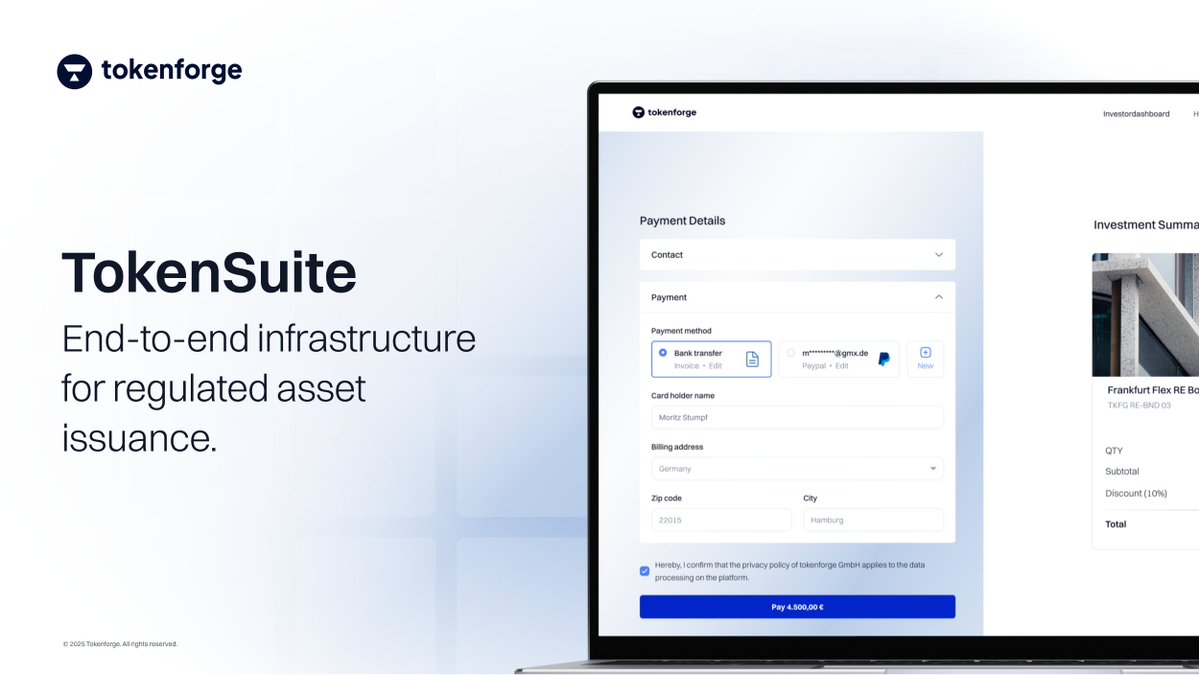

TokenSuite: Operational Infrastructure for Regulated Digital Assets TokenSuite provides a unified operating layer for compliant digital asset lifecycle management, including issuance, KYC/AML onboarding, investor operations, payout automation, permission controls, reporting and…

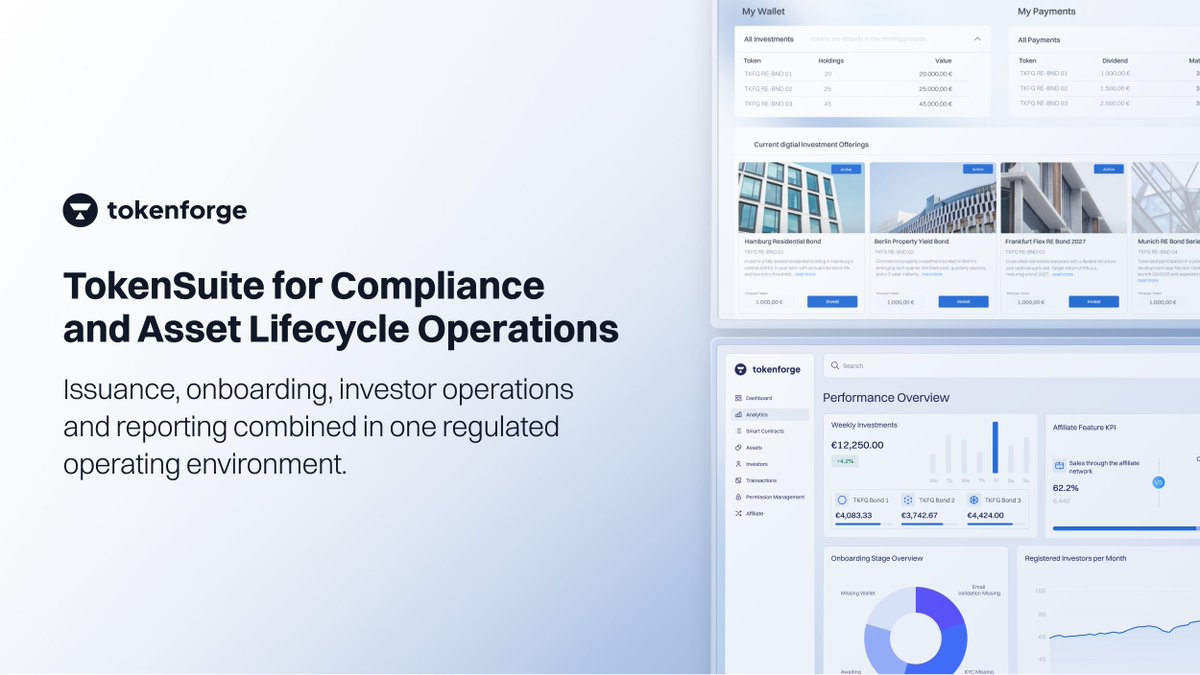

Tokenized bond issuance continues to expand across regulated markets. More than 13 billion USD has been issued globally, with Germany representing almost 60 percent of the total volume. Germany’s clear regulatory framework under the eWpG has been a key driver, establishing…

What we are seeing is more than a trend. It is a structural shift in how financial instruments are issued, managed and settled. A transition from siloed systems to programmable and standardized market infrastructure. Institutions are no longer in an exploratory phase. They are…

TKFG RWA Digest (Week 47, Nov 17 – Nov 23, 2025) Tokenization is accelerating across global finance. BlackRock’s BUIDL fund enters institutional trading, Societe Generale issues regulated onchain bonds, and Robinhood moves toward permissionless 24/7 equities. Saudi Arabia…

Before Europe moved toward harmonized regulation, Germany set the benchmark with KWG amendments and the eWpG creating a regulatory framework for digital securities that mirrors the rigor of traditional capital markets. TokenSuite was designed natively within this environment,…

Partnership Announcement We are pleased to announce our partnership with @edeldotfinance. Edel is a decentralized, non custodial protocol that turns tokenized equities into income generating assets. Instead of brokers capturing the majority of securities lending revenue, Edel…

"Clients want to move money around the world instantaneously, 24/7, 365 days a year, safely and without friction or complexity. That’s what tokenization does. Tokenization digitizes entire markets." — Jane Fraser, CEO @Citi Global financial institutions are redesigning their…

Tokenization is not the creation of a token. It is the digitalization of the entire financial process and its recurring operations.

We are proud to be pitching at the #OVHcloudPartnerNetworkSummit25. We will present our asset-lifecycle solution for fully compliant issuance across the EU at the grand finale of the OVHcloud Blockchain & Web3 Accelerator, pitching in front of industry experts and leading…

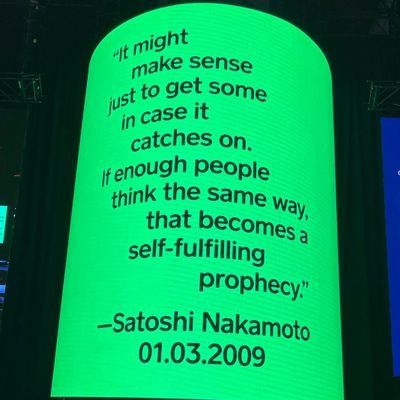

“Tokenization is an unstoppable freight train and it can't be stopped.” - Vlad Tenev, CEO Robinhood The capital markets of tomorrow are on-chain. Not because assets become tokens, but because identity, settlement, registry, and governance consolidate into a unified market…

Market growth follows regulation. Despite volatility in the broader crypto markets, the value of tokenized real-world assets continues to increase. Institutions are entering at scale, issuing regulated products onchain and building new payment and settlement rails that operate…

RWA Digest Week 46 This Week in RWA & Regulated Digital Finance, the key developments you shouldn’t miss: 1. Alibaba adopts JPMorgan’s tokenized deposit rails for USD/EUR payments Cross-border B2B payments will now route through JPMorgan’s blockchain-based deposit tokens…

tokenforge participated in Medellín this week, engaging with industry leaders and market operators at Blockchain Summit Latam. Our CPO Markus Kluge joined representatives of the stock exchange associations of Chile, Colombia and Peru to discuss how regulated tokenization…

The real challenge in tokenization isn’t technology or regulation - it’s connecting every layer of the financial stack. tokenforge enables issuers to manage compliance, custody, settlement, and reporting within one integrated, production-ready system, covering the full Asset…

Our Head of Marketing & Brand, Nils Lucas, will be at @MVenturesLabs in Cologne this Friday, joining the panel talk “RWA Revolution: How Tokenized Assets Are Changing Traditional Finance.” We’re looking forward to great conversations and insights, if you’ll be there too, feel…

Tokenization isn’t about hype, it’s about infrastructure. The shift has already started across asset classes, and the next phase of market efficiency will be built on-chain. As Robinhood CEO Vlad Tenev said, “This will become bigger and bigger in the coming years.”…

United States Trends

- 1. #StrangerThings5 226K posts

- 2. Thanksgiving 659K posts

- 3. robin 85.9K posts

- 4. BYERS 50K posts

- 5. Reed Sheppard 5,396 posts

- 6. Afghan 276K posts

- 7. Podz 4,155 posts

- 8. holly 61K posts

- 9. Dustin 87.5K posts

- 10. National Guard 651K posts

- 11. Vecna 54.4K posts

- 12. Gonzaga 8,363 posts

- 13. hopper 15.1K posts

- 14. Jonathan 72.4K posts

- 15. Erica 16.2K posts

- 16. noah schnapp 8,575 posts

- 17. Lucas 81K posts

- 18. Tini 9,020 posts

- 19. Amen Thompson 1,694 posts

- 20. Joyce 30K posts

Something went wrong.

Something went wrong.