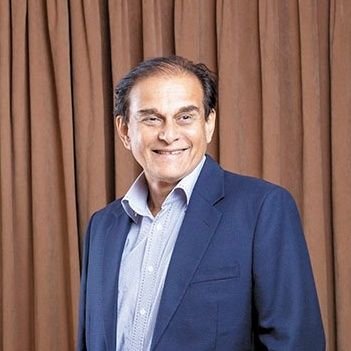

Uday Kotak

@udaykotak

Founder & Director, Kotak Mahindra Bank

你可能會喜歡

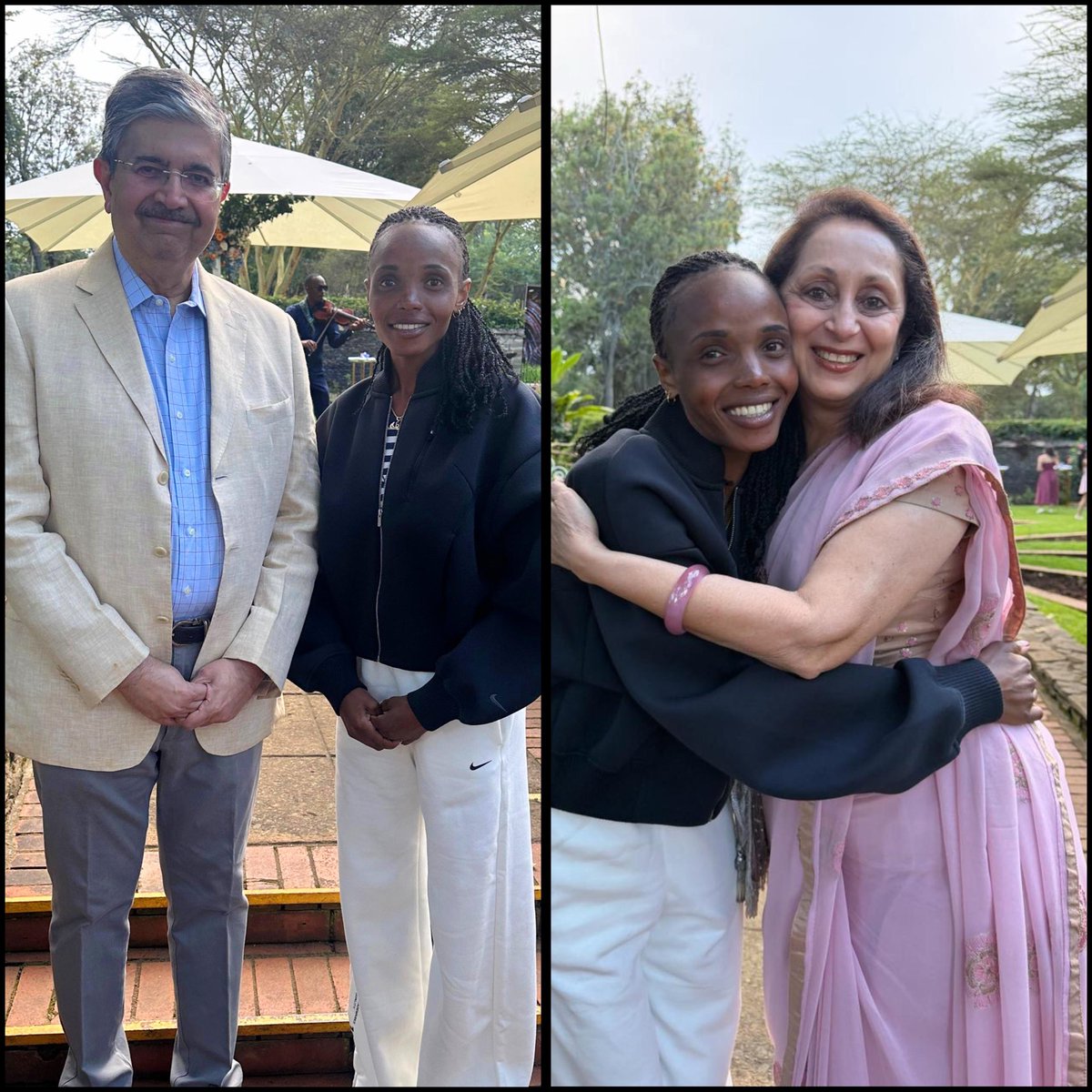

Met Beatrice Chebet in Kenya. She is the Paris 2024 Olympics champion in 5,000 and 10,000 metres. She said “when I am on the track, I think of nothing else but the track.” Reminds me of my cricket coach from childhood, Ramakant Achrekar who used to say: “treat each ball on its…

40 years ago today, I started a company with ₹30 lakh capital, in a 300 sq ft office in Fort, Mumbai. Today that company, which I ran for 38 years, is Kotak Mahindra Bank. As this Indian institution navigates changing times, may it prosper. Happy Birthday…tum jiyo hazaaro saal.

Sad that Piyush Pandey leaves us. He launched Kotak Mahindra Bank with a campaign in 2003, describing banking as “common sense”. Amazing out of the box thinker and a humble person. He weaved creativity with an Indian context. Will miss him.

I welcome opening up of the banking sector to global financial institutions for majority stake. This, along with ensuring guardrails to manage conflict of interest, and providing a level playing field to players,will unleash capacity to serve India’s aspirations. Exciting times.

#MYMODISTORY Every interaction with Prime Minister Narendra Modi has been an experience filled with learning and inspiration. What strikes me most is the way he blends vision with execution, curiosity with humility. Over the years, I have had several opportunities to engage with…

As geo politics interferes with economics, India quickens domestic reform. Reduction in GST rates, and now capital market changes. Time to transform, for every Indian to get out of comfort zone, to embrace atma nirbhar and create negotiating leverage. Only the paranoid survive.

Japanese bullet train Shinkansen was delayed by 35 seconds! The conductor apologised to all passengers and refunded their tickets! Japan is truly an amazing nation of discipline and commitment for all of us to learn from.

Kotak is the first financier for Tesla in India! Reminds me of 1989, the year I was born, when Kotak was amongst the first to offer car finance to Indians - later partnering with Ford. History may not repeat but it rhymes! autocarpro.in/news/kotak-mah…

India’s share in number of contracts in index and stock options is a staggering 80% of the world!

Recent stock market actions signify 3 aspects: money power, low liquidity in single stocks vs.index derivatives, exchange, broker business models linked to volume, less to fundamentals. Primary role of market is to promote capital formation, fair price discovery.

India’s saver turns investor. Post Covid, mutual fund AUM share, mainly equity,has doubled to 31% of bank deposits. Reflects structural change in financial intermediation. It grows domestic risk capital and creates an equity culture. But let’s be alert about excessive exuberance.

Monetary policy: bold and strategic. 50 bps rate cut, 100 bps CRR cut, move from accommodative stance to neutral. Nuanced combination of policy measures.

India 10 year bond yield at 6.20% pa. US 4.60%. Gap of 1.60% is probably lowest I recollect. Will we 1 day see Indian yields lower than the US? Depends mainly on relative inflation, risk premium, trust, and liquidity, for global and domestic investors in these 2 countries!

The performance of gold over time highlights that the Indian housewife is the smartest fund manager in the world. Governments, central banks, economists, who support pump priming, high deficit funding, may need to take a leaf from India, a net importer of store of value forever!

Trump tariffs. World in a tizzy. Famous Lenin quote: there are decades when nothing happens, and weeks when decades happen. In 1973, OPEC cartel changed rules on energy prices. Despite chaos then, 50 years later, the Middle East gained, many others lost. Where will this end?

There is a video circulating on social media where I am apparently seen promoting an investment scheme and guaranteed returns. This is FAKE. Please do not be entrapped by it.

Leading banks are taking 1 year wholesale deposits at ~8%. Translates to loaded marginal deposit cost of 9%+ after CRR (0 interest), SLR, deposit insurance, priority sector. Excluding opex. Low cost Retail Deposits (CASA non wholesale) show muted growth across the system. Yet,…

Trump, tariffs, turbulence. US imposes fresh import duties on Canada, Mexico and China. It will have a major impact on global supply chains and markets. Time for emerging markets including India, to prepare for and be resilient to, outflow shocks from global investors.

A budget for steady fiscal consolidation. A tax sweetener for the middle class should help consumption.Welcome steps to improve ease of doing business.

China intensifies the global tech race with DeepSeek to challenge US supremacy in the AI world. It has topped Apple App Store rankings. As the race to the top progresses, it is time other aspiring countries step up the game.

United States 趨勢

- 1. Thanksgiving 425K posts

- 2. National Guard 66.1K posts

- 3. #InfoSecVPN N/A

- 4. Bayern 161K posts

- 5. Mbappe 83.8K posts

- 6. Frank Ragnow 1,824 posts

- 7. Arsenal 294K posts

- 8. D.C. 218K posts

- 9. Kimmich 4,923 posts

- 10. Lennart Karl 4,647 posts

- 11. Denzel 4,175 posts

- 12. Patrick Morrisey N/A

- 13. Olympiacos 18.9K posts

- 14. Golesh 3,112 posts

- 15. Camp Haven 7,652 posts

- 16. Wine 41K posts

- 17. #ARSBAY 3,896 posts

- 18. Anthony Rendon N/A

- 19. Pizza 49.2K posts

- 20. Fani Willis 22.6K posts

你可能會喜歡

-

anand mahindra

anand mahindra

@anandmahindra -

Nikhil Kamath

Nikhil Kamath

@nikhilkamathcio -

Raamdeo Agrawal

Raamdeo Agrawal

@Raamdeo -

Deepinder Goyal

Deepinder Goyal

@deepigoyal -

Anil Agarwal

Anil Agarwal

@AnilAgarwal_Ved -

Gautam Adani

Gautam Adani

@gautam_adani -

Bhavish Aggarwal

Bhavish Aggarwal

@bhash -

Sanjiv Bajaj

Sanjiv Bajaj

@sanjivrbajaj -

Nandan Nilekani

Nandan Nilekani

@NandanNilekani -

Nithin Kamath

Nithin Kamath

@Nithin0dha -

Jay Kotak

Jay Kotak

@jay_kotakone -

Vijay Kedia

Vijay Kedia

@VijayKedia1 -

Anuj Singhal अनुज सिंघल

Anuj Singhal अनुज सिंघल

@_anujsinghal -

Basant Maheshwari

Basant Maheshwari

@BMTheEquityDesk -

Nikunj Dalmia

Nikunj Dalmia

@nikunjdalmia

Something went wrong.

Something went wrong.