Union Finance

@unionprotocol

Give people, programs, and robots credit onchain. ~ ~ ~ get started at http://app.union.finance

You might like

Sometimes you need more than you have in the moment. To realize a dream. To cover an emergency. This is why credit exists. But why let banks and credit agencies have a monopoly on such a vital resource? Enter Union, permissionless credit, now supporting USDC on @base.

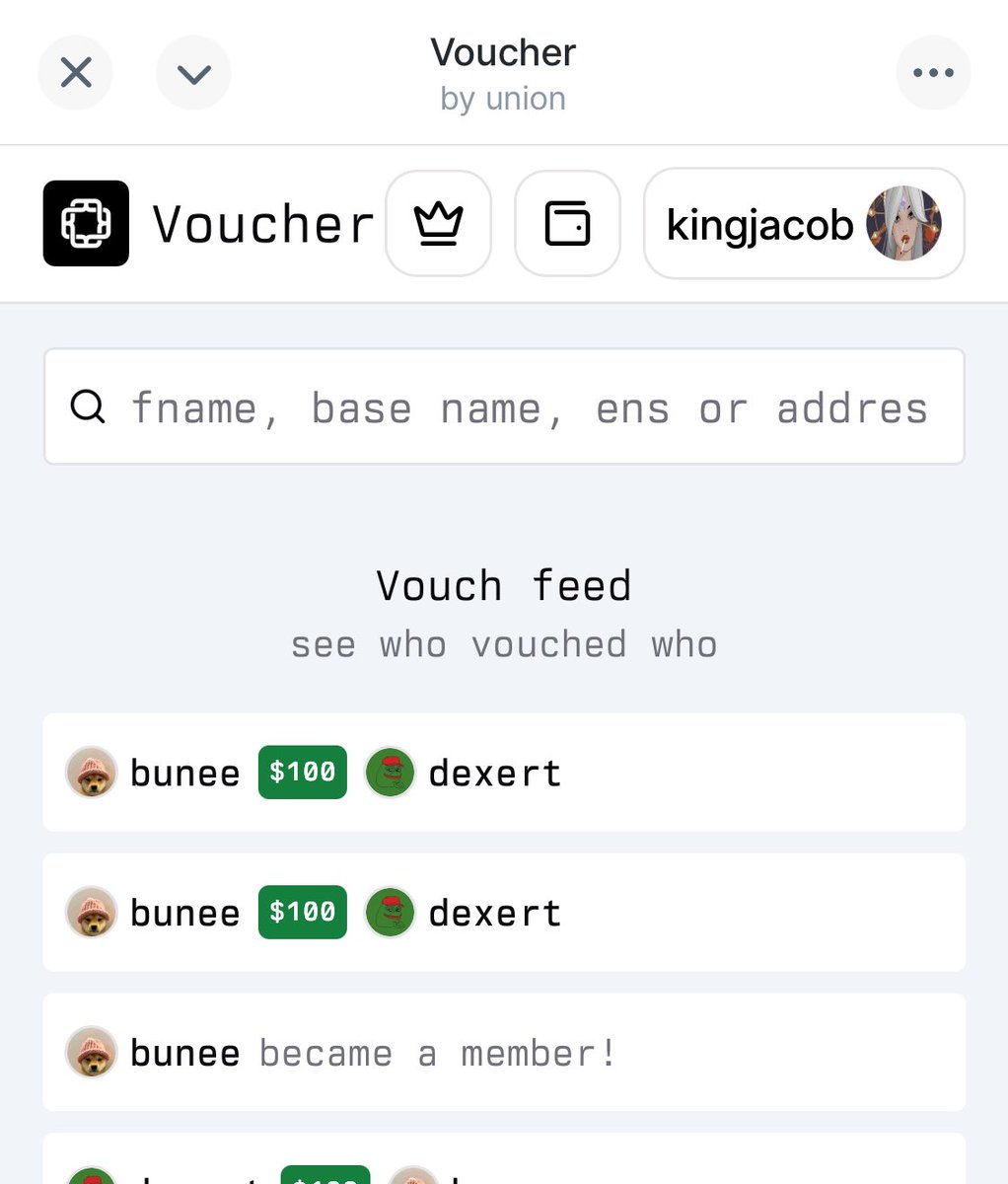

One of the biggest missing pieces for onchain p2p credit has been access to a social graph.

Union x @farcaster_xyz = Decentralized Social Credit If you’re on farcaster, you can now more easily vouch for your social graph using the voucher miniapp.

help us test CreditClub ~ a defi protocol for deploying tokenized credit pools (uncollateralized). the first credit club is Builders Credit ($BUILDERS) supporting top onchain builders on base! ◸ ◹ ◺ 🦫 ◿ ▹ the top 1000 addresses with a @TalentProtocol score & isHuman…

UIp18 has been passed and successfully executed. Stake and debt limits have all been raised.

Our token distribution strategy is simple: Use the onchain credit protocol, Earn the onchain credit protocol token.

Union Token(UNION) is now streaming successfully from Union dao treasury to the comptroller on Base. If you are staked, you can now withdraw rewards and use UNION on L2. If you haven’t staked yet, Union rewards are ongoing and live through at least 2025. Note : the base CA…

Im gonna start putting my money where my mouth is. Moving $10k of my traditional savings to @unionprotocol on @base and underwriting friends and founders i trust (with $1k+ each). Starting with those who have supported me, in big and small ways. Building through multiple bears…

How many of your friends would you lend money to if they asked? How many of those same friends are borrowing money from banks… …at APRs higher than your bank pays you for your savings?😓🤦♀️ peer-to-peer credit = more interest for lenders & lower rates for borrowers. 💳🤝💵

How many of your friends would you lend money to if they asked? How many of those same friends are borrowing money from banks… …at rates higher than the banks paying for your savings deposit? Multiply that by every trusted friend. That’s the value of a p2p credit network.

Sometimes you need more than you have in the moment. To realize a dream. To cover an emergency. This is why credit exists. But why let banks and credit agencies have a monopoly on such a vital resource? Enter Union, permissionless credit, now supporting USDC on @base.

Crazy idea…it’s good actually to invest in your friends.

❄️Say hello to Santa’s littlest helper, there are many miles to go for a creature soo small, help this penguin find its way through the sleet and the snow, to those who supported you this year. On 12.25 whoever holds this token will receive a bit of the credit they deserve. 🐧🎁

United States Trends

- 1. Araujo 189K posts

- 2. Chelsea 659K posts

- 3. Barca 264K posts

- 4. Wizards 6,592 posts

- 5. Hazel 9,673 posts

- 6. Seton Hall 2,165 posts

- 7. Estevao 273K posts

- 8. Godzilla 26.9K posts

- 9. Barcelona 470K posts

- 10. Bishop Boswell N/A

- 11. Yamal 207K posts

- 12. Eric Morris 3,446 posts

- 13. Ferran 79.4K posts

- 14. Oklahoma State 5,074 posts

- 15. Leftover 6,811 posts

- 16. Witkoff 68K posts

- 17. Skippy 5,583 posts

- 18. Raising Arizona 2,016 posts

- 19. National Treasure 8,173 posts

- 20. Jalen Johnson 2,023 posts

You might like

-

Paradigm

Paradigm

@paradigm -

Cozy 🦥

Cozy 🦥

@cozyfinance -

1kx

1kx

@1kxnetwork -

Pareto

Pareto

@paretocredit -

Variant

Variant

@variantfund -

Index Coop 🎟️

Index Coop 🎟️

@indexcoop -

Charlie

Charlie

@_charlienoyes -

Gauntlet

Gauntlet

@gauntlet_xyz -

Maple

Maple

@maplefinance -

Fernando | Balancer 🦇🔊

Fernando | Balancer 🦇🔊

@fcmartinelli -

Aevo (fka Ribbon Finance)

Aevo (fka Ribbon Finance)

@ribbonfinance -

Nascent

Nascent

@nascent -

Reflexer

Reflexer

@reflexerfinance -

Syndicate

Syndicate

@syndicateio -

Dan Elitzer

Dan Elitzer

@delitzer

Something went wrong.

Something went wrong.