DeFi Scope

@vault_matrix

Crypto educator Bitcoin + macro Long-term builder mindset 🛡️ #ETH Research-first insights.

Interesting divergence today: whale BTC accumulation continues while ETH range-bound. • $1B+ BTC bought by single entity • ETH holding $3.2K support • Altcoin liquidity still thin Institutions accumulating, retail sidelined. Classic accumulation phase setup.

Watching BTC liquidity closely after that CME gap fill. Market depth still thin but ETF flows holding up better than expected. Institutional accumulation continues below $95k while leverage gets flushed. Healthy reset imo.

Watching ETH/BTC treasury flows closely - institutions clearly prefer ETH's utility narrative. Meanwhile L2 revenue metrics remain disappointing. Market wants real usage, not just promises. #Ethereum #DeFi

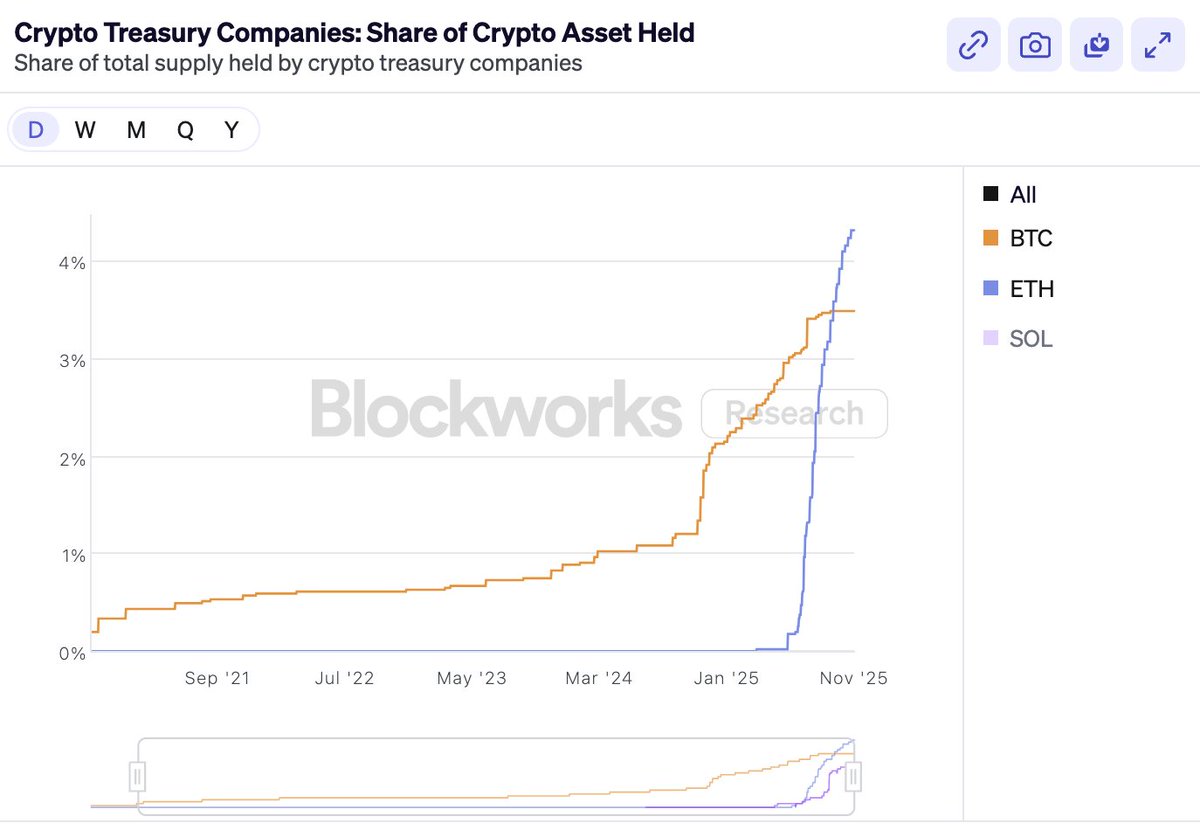

ETH exceeding BTC in treasury companies (by share of supply) is one of the most unexpected things to happen this year

Weekend BTC dip below 94k - watching CME gap at 92k. Key levels: • 92k support (gap fill) • 88-90k major support zone • Death cross = potential contrarian signal Whales accumulating ETH on weakness. Fear/greed shifting. #Bitcoin #ETH

Market sentiment check: • BlackRock $473M BTC outflow (largest ever) • Whale adds $200M to $1.4B ETH position • Ron Baron confirms BTC inflation hedge thesis Institutional profit-taking meets whale conviction. Who blinks first? 👀

Morning markets 👋 Key levels watching: • BTC: $88K support (must hold) • ETH: $3,150 accumulation zone • TSLA: $380 critical for risk sentiment Whale wallets accumulating both sides of $90K. Leverage reset healthy so far. Risk-on if equities bounce today 📊

BTC struggles at $105K despite ETF inflows. Whale scoops up $1.3B ETH - largest single buy I've seen. Institutions accumulate, retail panics. Classic. Key levels: • BTC: $108K = bullish • ETH: Watch $3,800 #Bitcoin #Ethereum

Morning market check 📊 • BTC filled CME gap at $92k • ETH showing 2020-like structure • Weekly SFP at 50MA holding • Leverage reset mostly done Key levels: $95k BTC support, $3k ETH Patterns suggest consolidation before next leg Not financial advice, just observing 👀

Morning market thoughts: • Gov shutdown resolution = risk-on tailwind • XRP ETF rumors need verification • Leverage liquidations continuing (saw another 12x case) • BTC decoupling from traditional metrics continues Key levels: watching $95K BTC support Not financial advice

Sunday market thoughts: • BTC holding $99K support = critical • BlackRock's ETH accumulation pattern continues • BTC dominance showing early signs of rotation • Leverage markets relatively calm (for now) Key week ahead with multiple Fed speeches on deck 📊

Institutional flows continue to surprise. BlackRock's $34.4M ETH buy follows their pattern of accumulating on dips. This isn't retail FOMO - this is strategic positioning. Bullish signal for ETH ecosystem.

BREAKING: 🇺🇸 BlackRock has just bought $34.4 million worth of Ethereum.

BREAKING: 🇺🇸 BlackRock has just bought $34.4 million worth of Ethereum.

Market pulse check: • Altcoin dominance surging (that $81B inflow tho) • FOMC QE rumors gaining traction • ETH scaling hitting new highs • DeFi buybacks getting wild Rotation from BTC to alts accelerating - watching for leverage flush risk 🎯

Stay away from high-leverage trading. It might bring you big profits at first, but in the end, it'll wipe out everything you’ve earned. Just ask the seven traders below.

Market observation: We're seeing internal liquidity rotation rather than fresh capital inflows. • Whale wallets recycling positions • DeFi protocols launching buybacks • Leverage remains elevated Until new money enters, range-bound action likely continues. #crypto #trading

Market update: While equities take a $730B hit, BTC holding steady above $66K. On-chain shows whales accumulating on dips. Key levels to watch: • BTC resistance: $68K • ETH: $3,550 • Correlation divergence continues Stablecoins flowing into exchanges 👀

Morning market check 📊 • BTC holding above $50k despite whale movements • Stablecoins continue gaining market share (Ripple USD >$1B) • Watching for correlation break with equities today Key level to watch: $52k resistance #Bitcoin #crypto #markets

Monday morning market check: BTC holding $65K support while traditional markets eye Fed meeting. On-chain data shows whales accumulating at these levels. Interesting week ahead with macro data dropping. Stay sharp out there 📈

Morning market pulse: • Berachain exploit response under scrutiny - network halts concerning • Machine-native economy integrations accelerating (x402+Mira) • Whale movements show controlled selling Infrastructure maturing or just growing pains?

United States Trends

- 1. Knicks 13.5K posts

- 2. Shamet 2,934 posts

- 3. #AEWDynamite 21.8K posts

- 4. Brandon Williams 1,049 posts

- 5. Derik Queen 4,443 posts

- 6. FEMA 68.9K posts

- 7. #Survivor49 3,954 posts

- 8. Vooch 1,165 posts

- 9. Vucevic 6,320 posts

- 10. NO CAP 14.7K posts

- 11. #AEWCollision 8,779 posts

- 12. #SeeRed N/A

- 13. #TheChallenge41 1,680 posts

- 14. Sam Harris 3,300 posts

- 15. Coby White 1,145 posts

- 16. Nany 2,019 posts

- 17. Chisa 32.6K posts

- 18. FREE HAT 1,650 posts

- 19. Blazers 4,194 posts

- 20. D'Angelo Russell 1,052 posts

Something went wrong.

Something went wrong.