You might like

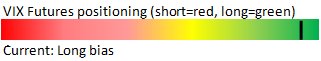

Haven't seen SP500 9-day IV at 9 since May-24 And no, most Santa rallies don't see that level of complacency $VIX $VIX9D (9.17 12/24/2025)

One little sell off yesterday w/o news and everyone points finger at 0 DTE. We’ve had that possibility every 3rd Friday for the last 40 years #SPX

Many are expecting an '08-like September crash. Well..it won't be from housing fred.stlouisfed.org/graph/fredgrap…

Not typically looking for single stock ideas How about a less correlated growth insurance play? $HGTY stocktwits.com/symbol/HGTY

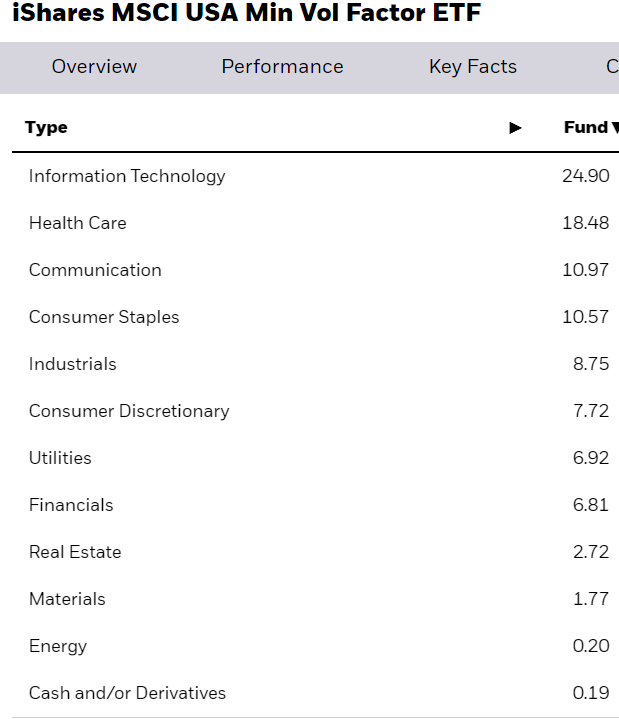

How times have changed! Low vol fund (USMV) now has 25% exposure to Tech

Theory of relativity.. S&P daily chg -0.2% (after 7 straight record daily highs) Russell 2000 -1.4%

Contrarian signal? "TD Ameritrade clients increased equity exposure during the June IMX period. The IMX increased to 9.08, up 9.13%, reaching the highest point on record."

$VIX closed below 20, first time in about a year $VIX9M closed at 15, first time in about a year $VVIX remains elevated

I don't see much "different" with this $BTC rally to ATH vs. 2017. 1) Broad speculation. Of top 10 mcap coins, #bitcoin ranks 9th for 7-day performance. 2) Bitcoin first-mover? Really late-mover vs. USD. Too volatile for legit exchg of goods if end of day folks want USD value

If you were waiting for Goldman's March $SPX PT 2000 level to buy you're kicking yourself. If currently long and strong, do you want to wait for 4,300 before you sell? cnbc.com/2020/11/11/gol…

cnbc.com

Goldman sees the S&P 500 rallying to 4,300 by end of 2021 on vaccine, divided government

"A vaccine is a more important development for the economy and markets than the prospective policies of a Biden presidency," a Goldman strategist said.

How does $SPX run like this when the Divvy futures are basically calling the index a bond ? A 2030 div yield of 2% on 59.20 div implies 2030 price target of 2,960 🤔 cmegroup.com/trading/equity…

Fed Chair Powell sees rates "just below" neutral. Is this $SPY bullish? $VIX not declining much. Comments probably only flatten the yield curve further as Fed now firmly in the slower growth camp

Should CFE/@CBOE lower VIX Futures min tick from .05 to .01? Seems would attract more trading! Comparing popular US fut spread trade cost (min tick/5D avg true range): VX 6.6% ZN 3.0% ES 1.1% RTY 0.5% NQ 0.3% YM 0.004% @dynamicvol @6_Figure_Invest @VixCentral @RussellRhoads

Flat VXJ8 (April) @ 20.25 +$950/contract VXK8 (May) @ 19.05 +$550/contract $VX $VIX

Flat VXJ8 (April) @ 19.90 +$950/contract VXK8 (May) @ 18.80 +$550/contract $VX $VIX

United States Trends

- 1. Giannis N/A

- 2. Gigi N/A

- 3. LINGORM HK ONLY YOU MEET N/A

- 4. #LingOrmHongKongFMD1 N/A

- 5. Sinner N/A

- 6. #PersonaLive N/A

- 7. Adam 22 N/A

- 8. WILLIAMEST ECHO IN SG N/A

- 9. #WilliamEst1stFMinSingapore N/A

- 10. Trans N/A

- 11. #SmackDown N/A

- 12. #DragRace N/A

- 13. Jason Luv N/A

- 14. Bucks N/A

- 15. Jim Jones N/A

- 16. Djokovic N/A

- 17. Wawrinka N/A

- 18. Fritz N/A

- 19. Antarctica N/A

- 20. Attitude Era N/A

Something went wrong.

Something went wrong.