你可能會喜歡

Google: "I am the death [to the AI capex market], the destroyer of worlds"

How is AI actually changing the way engineers work? Andrew Wang (@wangandrewd) from Valon explains: Engineers used to think while coding. Now with LLMs writing the code, most of the thinking has to happen upfront in the planning phase. That's no small shift. It changes work…

If we sacrifice boomer wealth to build the ai infra needed for the future, we can effectuate one of the greatest wealth transfers to future generations

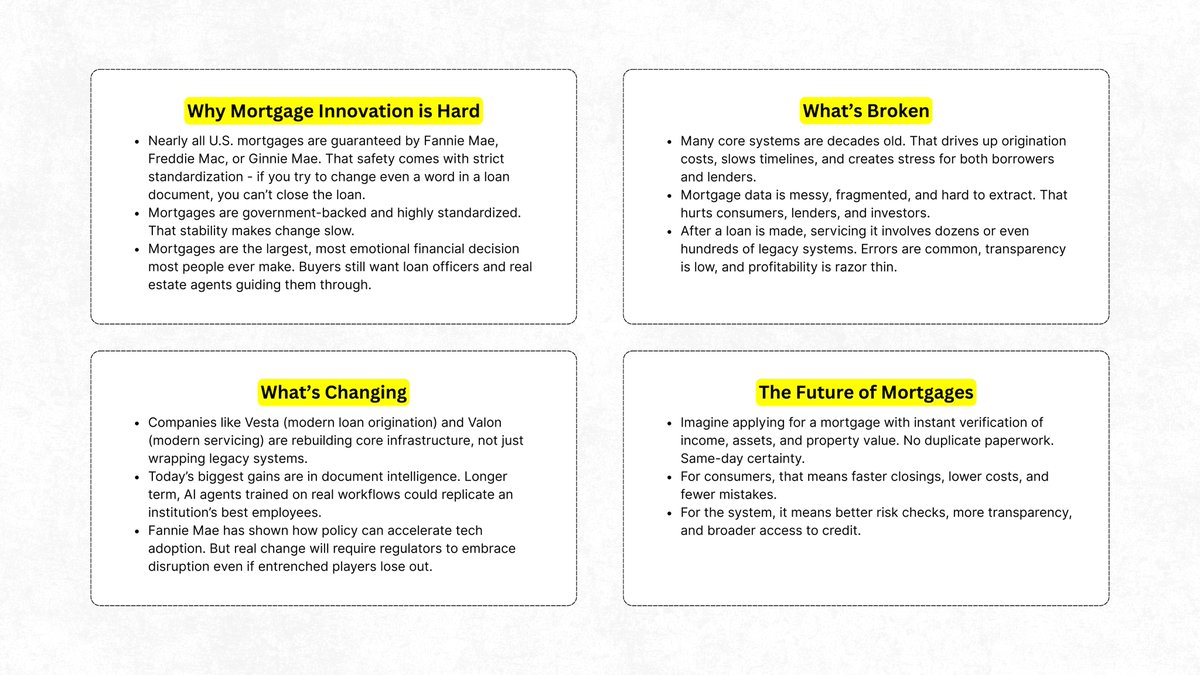

Buying a home is the biggest financial decision most people ever make, but the mortgage process sucks. I spoke with Tim Mayopoulos (Former CEO of Fannie Mae), @michael_yu (CEO @usevesta ), and @wangandrewd (CEO Valon) on the a16z podcast about how to fix this $13T industry…

we're going to have a whole new definition for startup winter when cash burn catches up to valuations

GPT 5 year 1 economics will be interesting. If growth in usage scaled with model improvements, it’s going to be no bueno very quickly Which got me thinking, if performance plateaus… Nvidia hit first, then race to cheap inference? Google / whoever has custom chips wins?

Venture investors probably need to start taking life insurance policies on AI researchers the same way sports teams buy specialized disability policies

One thing that I think folks are miscalibrated on in the AI SaaS fervor is the relationship between growth in ARR and moat. Before adoption meant you had signal that you built something durable and compoundable. Today, it’s probable that today and tomorrow the growth is just llms

It turns out humans hallucinate can hallucinate just as badly as llms

This is just an absolutely bonkers reaction shot youtube.com/clip/UgkxZl8Fy… via @YouTube

youtube.com

YouTube

✂️ reflex shot

There’s a group of Centerview analysts that have been carrying the team on their back for the last 72 hours. Just straight pain and the American dream in their hearts working this Bank deal. They’re my North Star.

I’m just laughing at the hypothetical new world where every company asks it’s bank for financial DD packages on a quarterly basis

1) Anyone confidently saying there is zero risk of contagion from SVB should read the “Panic of 1907.” Especially with Treasury saying they are carefully monitoring “several other banks.” Contagion is a real risk.

United States 趨勢

- 1. Broncos 40.8K posts

- 2. Mariota 11.9K posts

- 3. Bo Nix 9,057 posts

- 4. Treylon Burks 11.3K posts

- 5. Commanders 30.9K posts

- 6. #RaiseHail 5,490 posts

- 7. Ertz 2,995 posts

- 8. #BaddiesUSA 20.9K posts

- 9. Bobby Wagner 1,012 posts

- 10. Washington 121K posts

- 11. Riley Moss 2,204 posts

- 12. #RHOP 10.8K posts

- 13. #ITWelcomeToDerry 16.1K posts

- 14. Jake Moody N/A

- 15. Sean Payton 1,466 posts

- 16. #DENvsWAS 3,094 posts

- 17. Collinsworth 2,722 posts

- 18. Chicharito 27.3K posts

- 19. Deebo 2,952 posts

- 20. RJ Harvey 2,469 posts

你可能會喜歡

-

Jackie Vergne,PhD

Jackie Vergne,PhD

@vergnj11 -

Alex Immerman

Alex Immerman

@aleximm -

Kristin Elise McDonald

Kristin Elise McDonald

@Kristine1ise -

Seema Amble

Seema Amble

@seema_amble -

Brian O'Malley

Brian O'Malley

@omal -

Santiago Regan

Santiago Regan

@SGRegan_ -

Ari Rubin

Ari Rubin

@ariexchange -

Miguel Armaza 🎙🎧

Miguel Armaza 🎙🎧

@MiguelArmaza -

Matt Lanter

Matt Lanter

@melanter -

Ryan Falvey

Ryan Falvey

@Ryan_Falvey -

Jason Henrichs

Jason Henrichs

@jasonhenrichs -

Jacqueline Wibowo

Jacqueline Wibowo

@jayquelynnnn -

mbernardy.eth

mbernardy.eth

@BernardyMax -

Ted Kucklick

Ted Kucklick

@TKucklick -

Ryan Orley

Ryan Orley

@ryanorley

Something went wrong.

Something went wrong.