你可能會喜歡

If you like my views I post, don't hesitate to like and retweet. If you don't like my views I post, don't hesitate to unfollow me. ✌️✌️

Pasupati acrylon Shared earlier also many times and recently near 46 Disclaimer - personally holding for 3 digit

Manba Finance*l CMP 141 Good Support near 120-125 Disclaimer - personally holding and low volume stock.

#gmbrew More than 30% Returns in 3 days 🐎 🐎 Disclaimer - Chart for study purpose. @what_chart_says

📊 GM Breweries Ltd (GMBREW) CMP: ₹894 Q2 FY26 ✅ Revenue: ₹718 Cr vs ₹596 Cr YoY | QoQ: ₹638 Cr ✅ EBITDA: ↑ 64% YoY ✅ PBT: ₹46.6 Cr vs ₹29 Cr (YoY) | ₹34.5 Cr ✅ PAT: ₹35 Cr vs ₹22 Cr YoY | ₹26 Cr QoQ Disclaimer - Chart for study purpose. @what_chart_says

📊 GM Breweries Ltd (GMBREW) CMP: ₹894 Q2 FY26 ✅ Revenue: ₹718 Cr vs ₹596 Cr YoY | QoQ: ₹638 Cr ✅ EBITDA: ↑ 64% YoY ✅ PBT: ₹46.6 Cr vs ₹29 Cr (YoY) | ₹34.5 Cr ✅ PAT: ₹35 Cr vs ₹22 Cr YoY | ₹26 Cr QoQ Disclaimer - Chart for study purpose. @what_chart_says

youtube.com/shorts/vCK8Dd-… #Electrocast Shared near 124 and made high till 135 Subscribe to YouTube if you don't want to miss

youtube.com

YouTube

#electcast #what_chart_says #stockstowatch #stockstobuy #ytshorts...

youtube.com/shorts/xTpUooN… #dhani Do subscribe our YouTube channel

youtube.com

YouTube

#dhani #stockstowatch #stockstobuy #what_chart_says #ytshorts...

youtube.com/shorts/k2a5X6Y… #winsome Shared near 92 and hit high 97+ Subscribe to YouTube channel so that you don't miss the videos

youtube.com

YouTube

#winsome #stockstowatch #stockstobuy #what_chart_says #ytshorts #viral

youtube.com/shorts/XhxQxSm… #uniteddrilling Please subscribe to channel

youtube.com

YouTube

#uniteddrilling #what_chart_says #stockstowatch #stockstobuy #ytshorts

#aurum Shared at 225 in telegram and today made high 255 t.me/Smart_Charts/1… Disclaimer - personally invested

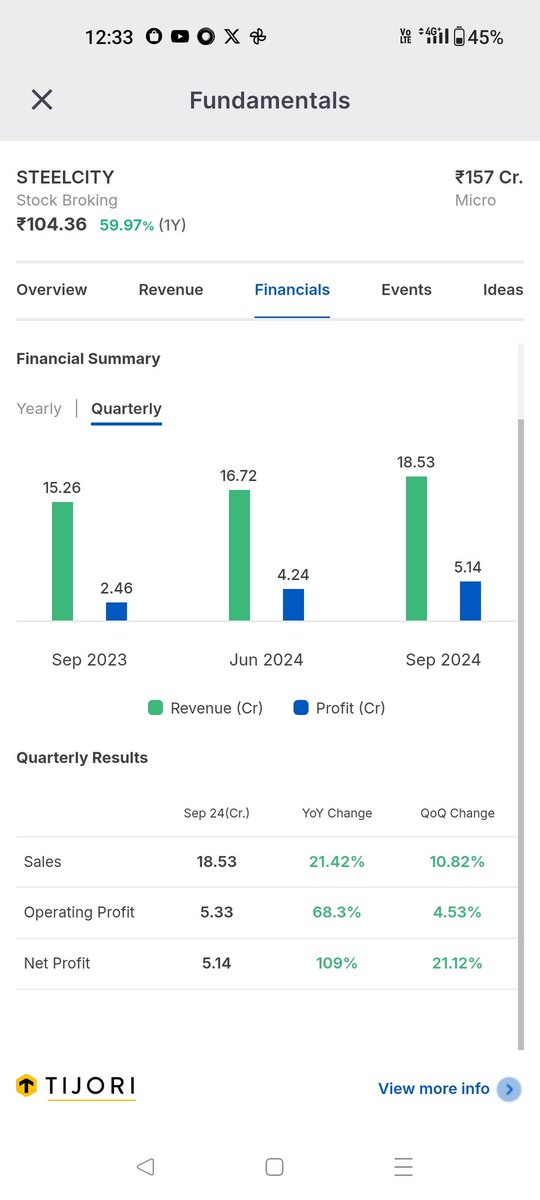

#steelcity #analysis My little analysis on steel city securities Please like, share and retweet if you liked it.

#silinvestment Last week hit 743 Gave near 300-340 range with constant target updates on telegram 800/900/1000 soon Long term 1500+ 🇹- t.me/Smart_Charts 𝕏 - @what_chart_says

United States 趨勢

- 1. #SpotifyWrapped 202K posts

- 2. Chris Paul 26K posts

- 3. Hartline 8,231 posts

- 4. Clippers 37.6K posts

- 5. #HappyBirthdayJin 90.9K posts

- 6. Henry Cuellar 2,889 posts

- 7. GreetEat Corp N/A

- 8. David Corenswet 4,732 posts

- 9. Jonathan Bailey 5,967 posts

- 10. ethan hawke 3,119 posts

- 11. South Florida 5,585 posts

- 12. $MSFT 14K posts

- 13. #NSD26 22.3K posts

- 14. Chris Henry Jr 1,032 posts

- 15. #WorldwideHandsomeJin 71.6K posts

- 16. #JINDAY 72.8K posts

- 17. Collin Klein 1,664 posts

- 18. Chris Klieman 1,776 posts

- 19. Apple Music 258K posts

- 20. Penn State 23.9K posts

你可能會喜歡

-

Eagle Eyes Multibagger Investment

Eagle Eyes Multibagger Investment

@EagleEyesTrades -

EQUITY JUNCTION

EQUITY JUNCTION

@EquityJunction -

Trading Adda

Trading Adda

@Tradinggadda -

NAYAN PATEL

NAYAN PATEL

@nayanrp -

@KM.BHAI

@KM.BHAI

@kapoorsmede1 -

Mohan Chand

Mohan Chand

@Mohantiwari1984 -

Arjun

Arjun

@puneetjoshi7687 -

Kaal Rider

Kaal Rider

@Trndline_Trader -

Amit Gautam

Amit Gautam

@Amitgautam3001 -

Akshit shah

Akshit shah

@equistake_in -

Gaurav 🇮🇳

Gaurav 🇮🇳

@LoveforEquity -

Arrush narang

Arrush narang

@arush_narang -

Samarjit Talukdar

Samarjit Talukdar

@SAMARJITTALUKD4 -

Manoj Kumar Garg

Manoj Kumar Garg

@ManojKu86922375 -

Sagar Paryani

Sagar Paryani

@sagarforparyani

Something went wrong.

Something went wrong.