Alpha Covered Calls

@writingcalls

Selling covered calls for income | Covered calls can improve the yield of almost any portfolio without sacrificing long-term returns

You might like

Covered calls is the best way to be financially independent. Here's why it's 4x better than dividend growth investing: alphacoveredcalls.substack.com/p/covered-call…

If you hold $TSLA, you can yield 2 or 3% PER WEEK selling OTM calls on your position right now

New applications for federal tax ID numbers were 4.54 million from January through October this year, up 56% from the same period of 2019. Entrepreneurship is hitting new all-time highs

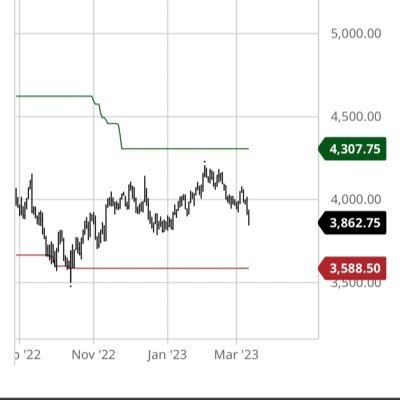

Your dividend portfolio might yield 3% or so That same portfolio could yield 5 to 6% selling out-of-the-money covered calls

If you are holding a stock, sell OTM calls on a green day, then buy those calls back cheaper when IV goes back down Easy way to increase yield

Thinking of documenting an actual covered call portfolio in my newsletter. What amount would you prefer the portfolio starts with?

My ultimate investing goal is having a growing long-term portfolio and selling covered calls when IV is high to generate extra yield

Every week, I write a newsletter about covered calls and how they can enhance your portfolio yield without sacrificing upside Check it out here: alphacoveredcalls.substack.com

Buying OTM calls is gambling Selling calls is income

United States Trends

- 1. #SmackDown 35.7K posts

- 2. Caleb Wilson 4,344 posts

- 3. Giulia 11.9K posts

- 4. #BostonBlue 2,780 posts

- 5. Rockets 19.2K posts

- 6. #OPLive 1,360 posts

- 7. #TheLastDriveIn 1,948 posts

- 8. Lash Legend 4,529 posts

- 9. Supreme Court 167K posts

- 10. Reed 24.6K posts

- 11. Chelsea Green 5,126 posts

- 12. #Dateline N/A

- 13. Sengun 3,880 posts

- 14. Harrison Barnes N/A

- 15. Darryn Peterson 2,145 posts

- 16. Kansas 23.4K posts

- 17. Northwestern 4,177 posts

- 18. NBA Cup 8,272 posts

- 19. End of 3rd 1,432 posts

- 20. Tulane 2,588 posts

Something went wrong.

Something went wrong.