#behaviorgap search results

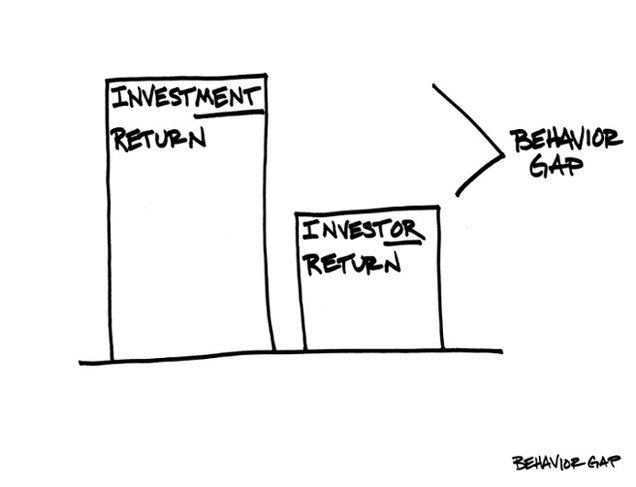

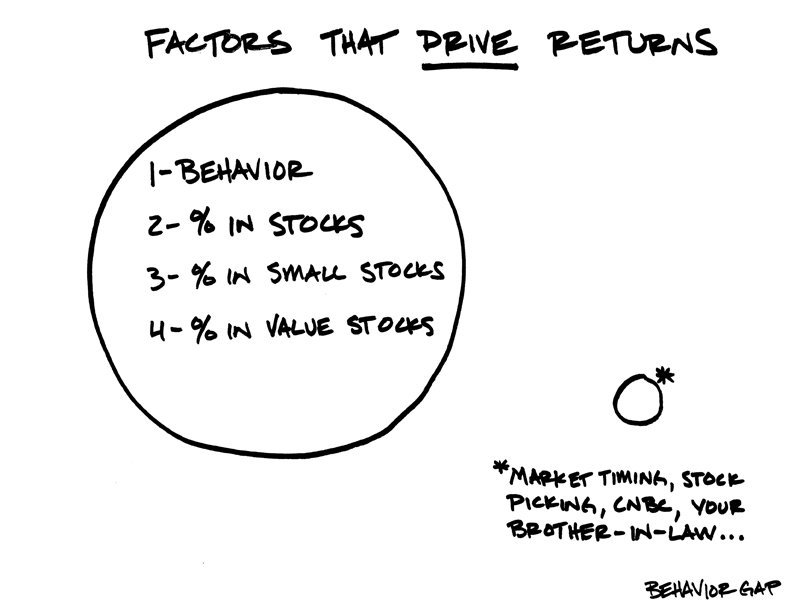

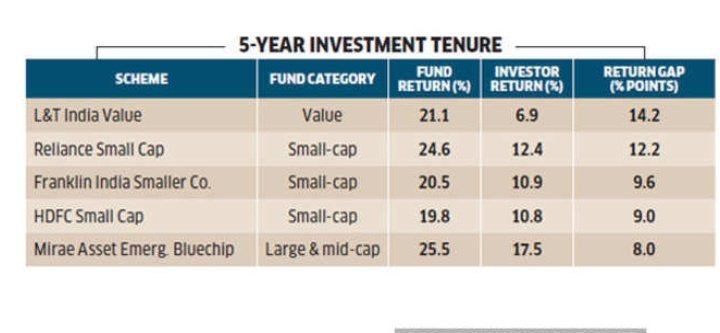

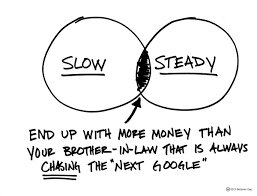

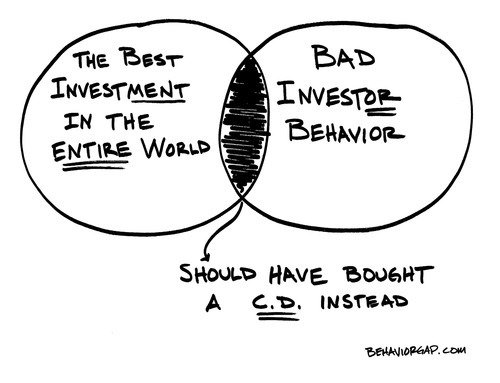

Investing in equities is simple but not easy. Buy an index fund, factor fund, regular mutual fund. After that the not easy part starts. Sticking with it. Then one wonders why did portfolio or fund under perform. But did you analyze your own role in that? #behaviorgap

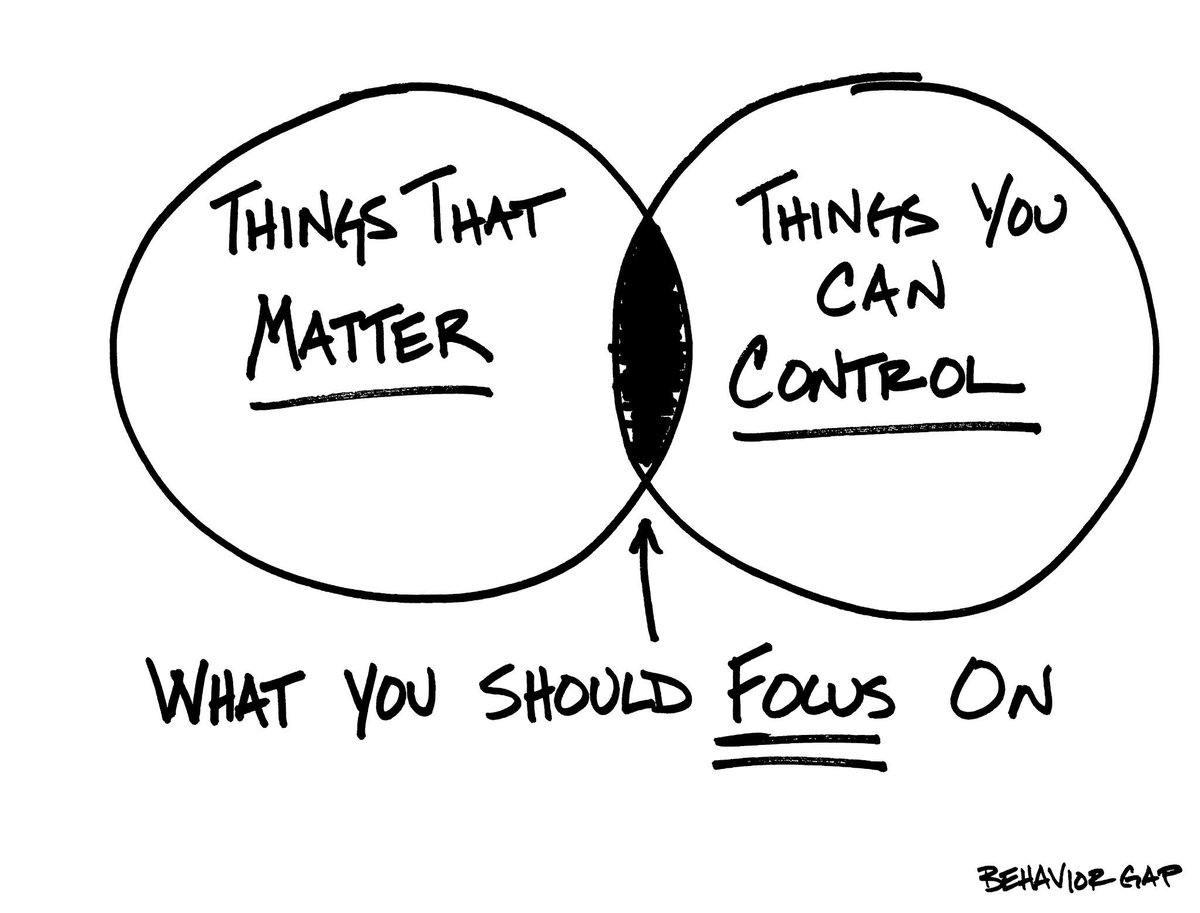

Wall helps to: Abstract the complex world See goals not markets Ignore Noises Ward off Fin Craziness #BehaviorGap

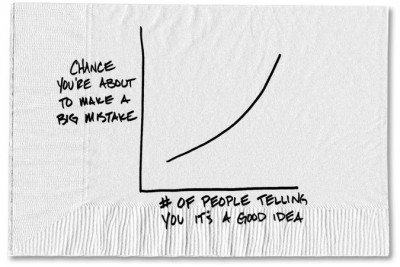

a simple reminder for this that have hit the jackpot with near bankrupt companies (or anything that ends in “coin”) over the past couple of weeks. 🚀📈 💰😳#BehaviorGap

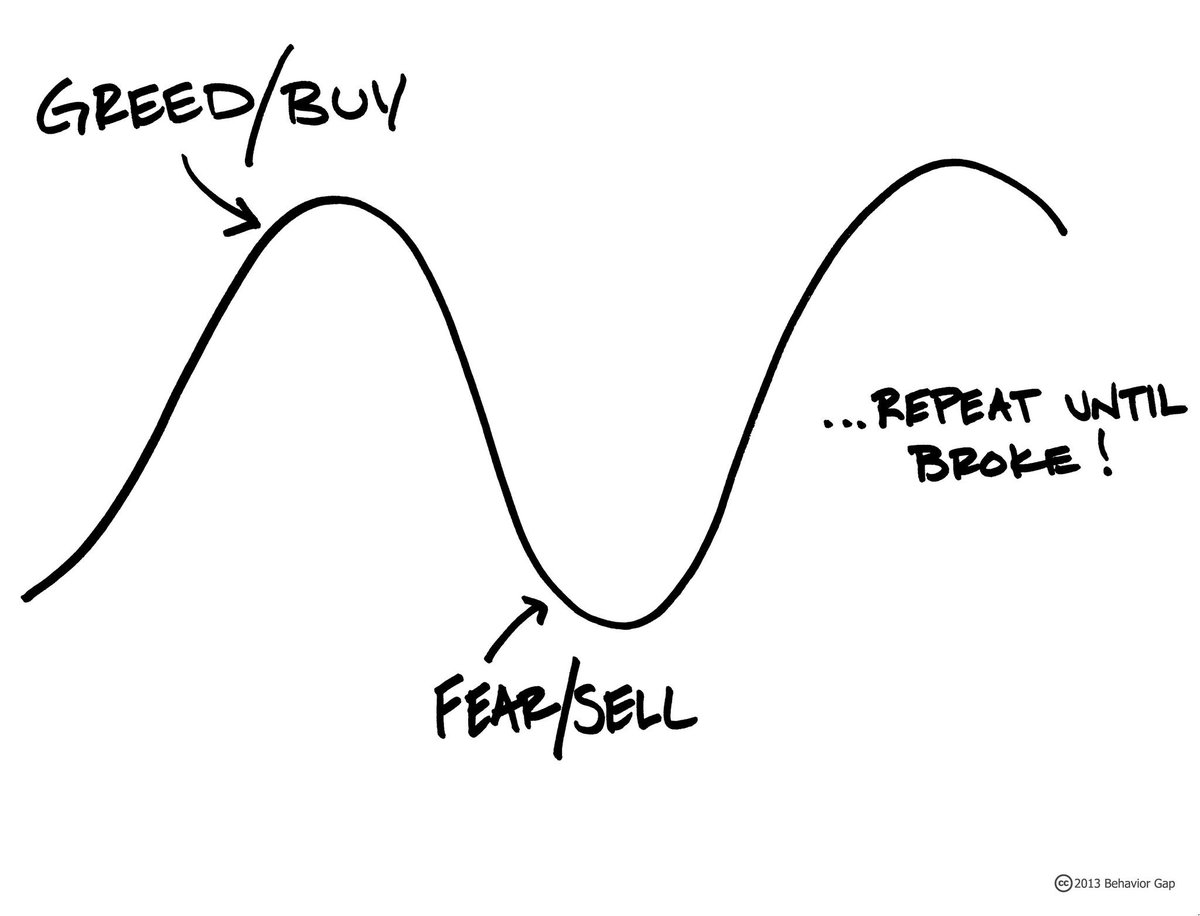

Ultra-slim definition of 'Markets' from #BehaviorGap Your money boat needs to sail in 'Feelings' to create wealth.

And time to break out the #BehaviorGap charts as we had a bad week as fears of the #Coronavirus spreading beyond China took down the markets. S&P gave up 11.5% for its worst week since 2008. 📉😱 @Nasdaq Comp -10.5% YTD S&P 500 -11.5% YTD Dow -12.4% YTD Russell 2000 -12.7% YTD

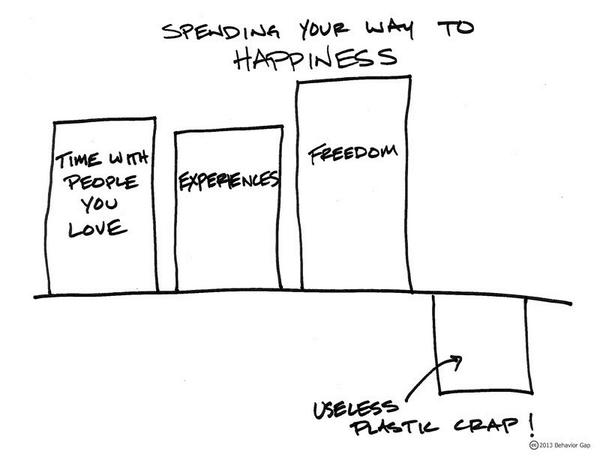

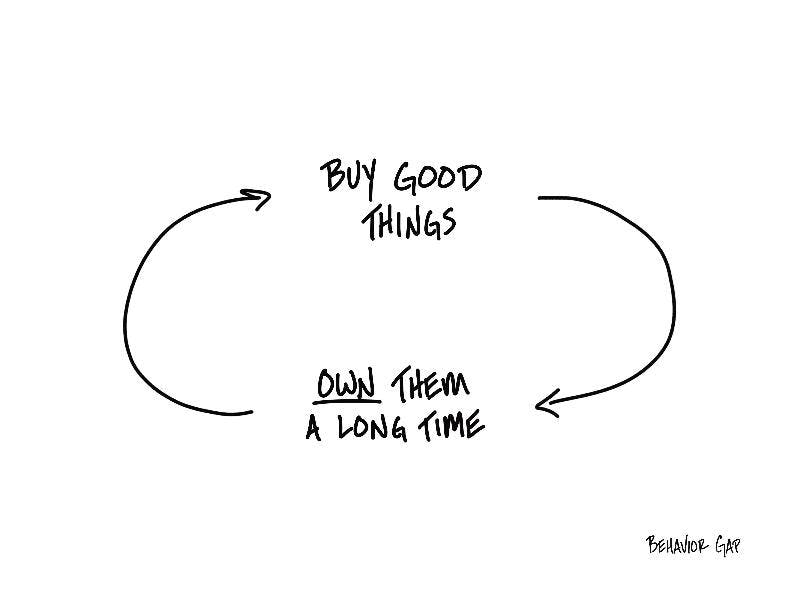

Save up until you can buy the nice thing, once. It hurts at first, but in the long run, it’s worth the value. After all, it's better than buying the cheap thing because you're going to have to buy it 20 times! #BehaviorGap

Investing in equities is simple but not easy. Buy an index fund, factor fund, regular mutual fund. After that the not easy part starts. Sticking with it. Then one wonders why did portfolio or fund under perform. But did you analyze your own role in that? #behaviorgap

📊 The average U.S. Savings Rate = ~3% ⚠️ The Elements target = 15%+ If you’re not tracking it, you’re probably not hitting it. Check your Savings Rate before the month gets away from you. #BehaviorGap #SavingsRate #ElementsApp

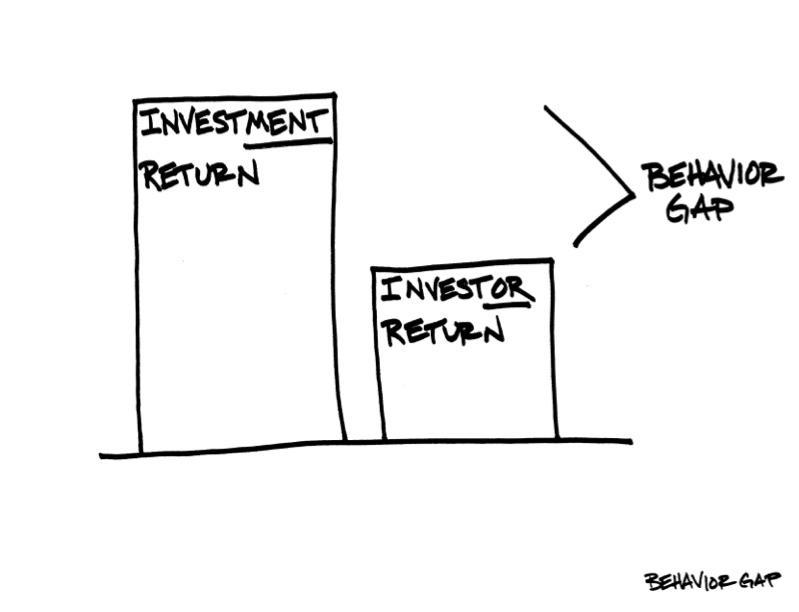

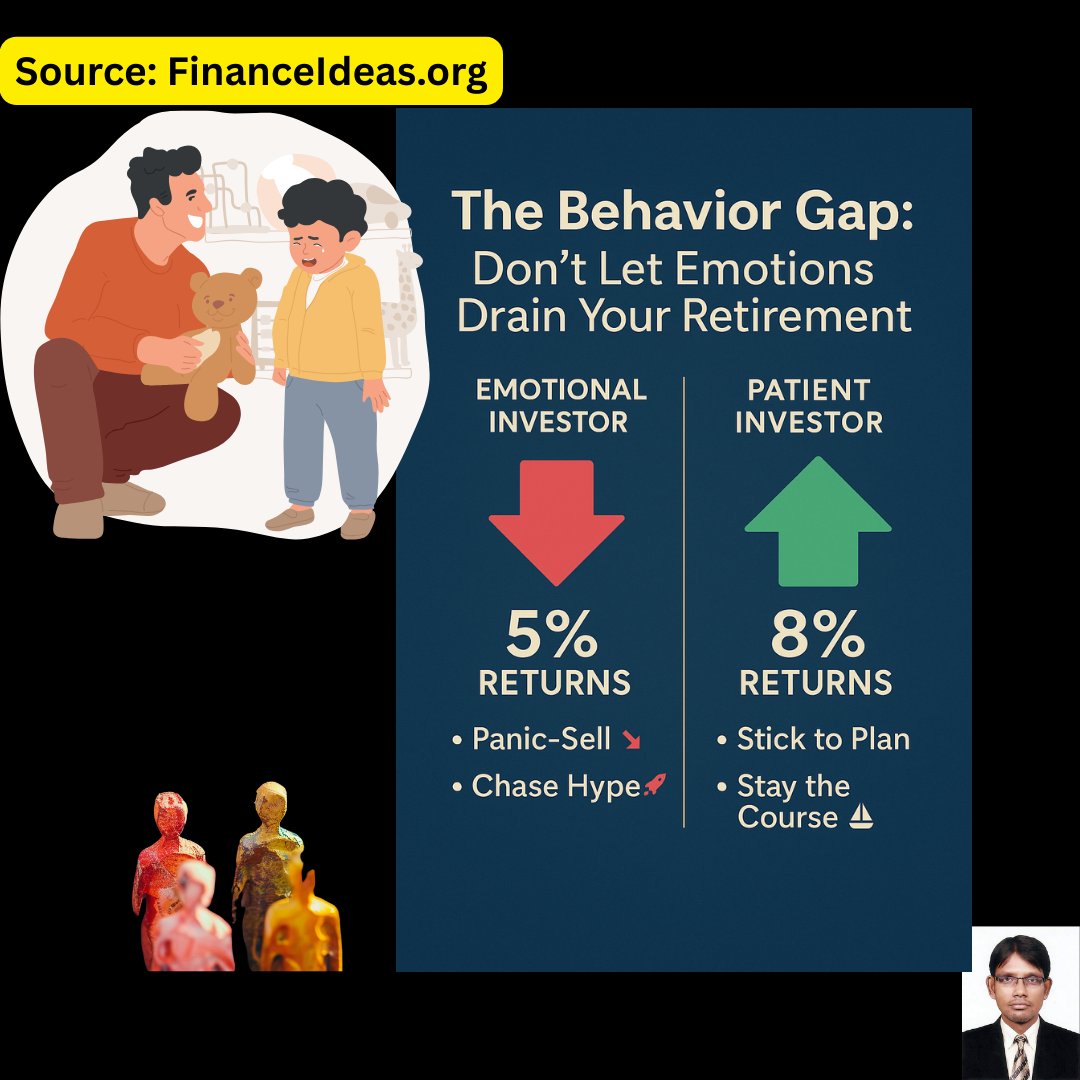

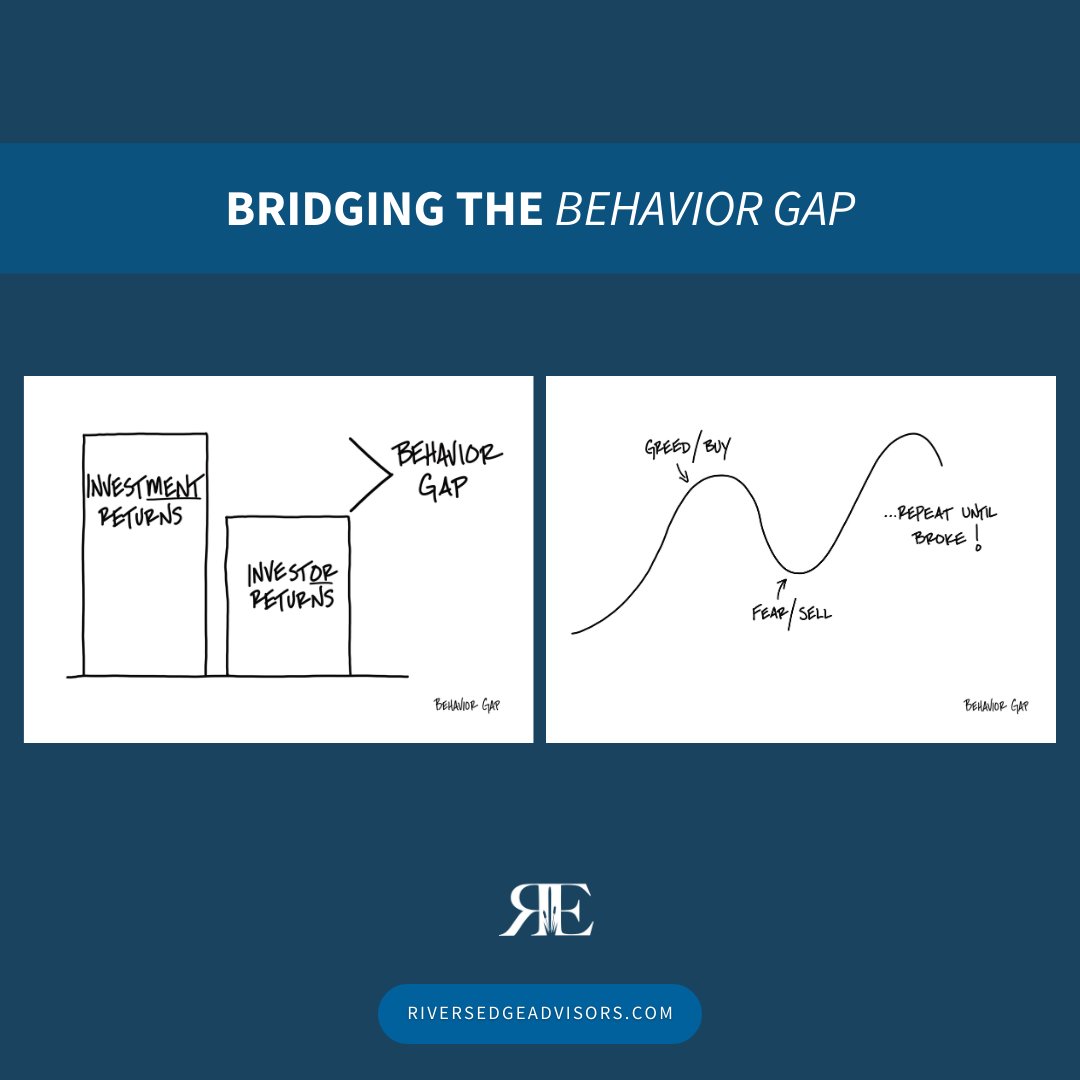

📊 The average U.S. investor underperforms the S&P 500 by 3–5% per year, due to poor timing and emotional trading Discipline = alpha Follow us here → @StockEducations #BehaviorGap #InvestorReturns #StayInvested #SmartMoneyMoves #FinanceResearch

Most investors underperform the market by 3–4% per year. Why? They sell too early and buy too late. Follow us here → @StockEducations #BehaviorGap #InvestorMistakes #StayInvested #FinanceTruth #SmartStrategy

Most people underperform not because of bad research But because they sell good stocks too early Follow us here → @StockEducations #InvestorDiscipline #BehaviorGap #SmartStrategy #LongTermThinking #StockReturn

Markets don’t drain retirements—emotions do. The “Behavior Gap” = selling in fear or chasing hype, costing investors 2–3% yearly. Solution: stick to your plan, automate, build a safety net. 👉 Have you sold too soon & regretted it? #RetirementPlanning #BehaviorGap

📊 The average investor earns ~4% per year, vs. ~10% from the S&P 500. The gap? Emotion. Follow us here → @StockEducations #BehaviorGap #InvestorPsychology #FinanceReality #StayInvested #SmartStrategy

The behavior gap was bigger than we thought. 🚨🔥 #BehaviorGap #HardTruth #MindsetMatters"

📊 S&P 500 average annual return since 1928: ~10.1% Average investor return: ~4.3% The gap is emotional Follow us here → @StockEducations #BehaviorGap #InvestorDiscipline #SmartReturns #FinanceStats #StayInvested

📉 The average investor sells after a 20% loss The best investors buy Follow us here → @StockEducations #CrashOpportunity #BehaviorGap #SmartTiming #MarketCycles #InvestorMindset

📉 Most investors underperform because they sell what’s working And hold what’s not Fix that Follow us here → @StockEducations #BehaviorGap #InvestorDiscipline #PortfolioMistakes #SmartStrategy #FinanceWisdom

📉 The average investor earns ~4%/year The S&P 500 earns ~10% The difference is emotional Follow us here → @StockEducations #BehaviorGap #InvestorReturns #MarketDiscipline #FinanceTruth #SmartStrategy

📊 Most retail investors underperform the market by 3–4% per year The reason? Behavior Follow us here → @StockEducations #BehaviorGap #InvestorMistakes #MarketDiscipline #FinancePsychology #SmartHabits

🔁 The average investor underperforms the S&P 500 by 3–5% annually. Why? They trade feelings, not fundamentals. Follow us here → @StockEducations #BehaviorGap #InvestorMistakes #MarketDiscipline #SmartInvesting #FinanceFacts

"Money is like soap, the more you play with it the less you have."- Justin Pugh And he's totally right. Sometimes less is more when you built a strong foundation. #investing #risk #behaviorgap

Don’t fall victim to the behavior gap! #BehaviorGap #behavioralfinance #TaxAware #QFS QFS is a registered investment adviser. This platform is solely for informational purposes and is not offering advisory services or sales of securities.

It’s not what the markets do in the long term that hurts investors but how investors react to the markets in the short term #behaviorgap

Historically, markets trend up despite fluctuations. The Behavior Gap, however, can derail investors. Remember, maintaining your course through market dips is key to long-term financial health. #InvestmentReturns #BehaviorGap

Wall helps to: Abstract the complex world See goals not markets Ignore Noises Ward off Fin Craziness #BehaviorGap

Ultra-slim definition of 'Markets' from #BehaviorGap Your money boat needs to sail in 'Feelings' to create wealth.

Something went wrong.

Something went wrong.

United States Trends

- 1. Sonny Gray 6,756 posts

- 2. Dick Fitts N/A

- 3. Red Sox 6,815 posts

- 4. Godzilla 19.8K posts

- 5. #yummymeets N/A

- 6. National Treasure 5,069 posts

- 7. Clarke 6,287 posts

- 8. Rush Hour 4 5,393 posts

- 9. Raising Arizona N/A

- 10. Gone in 60 1,811 posts

- 11. Happy Thanksgiving 20.9K posts

- 12. Giolito N/A

- 13. #GMMTV2026 4.2M posts

- 14. NextNRG Inc N/A

- 15. Lord of War 1,299 posts

- 16. Thankful 50.8K posts

- 17. Academic All-District N/A

- 18. Chuck and Nancy 5,006 posts

- 19. 50 Cent 3,345 posts

- 20. Ghost Rider 2,185 posts