#chartgym wyniki wyszukiwania

Week 5 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each…

#CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each point. The goal…

This is how I would have traded #EVERREADY #CHARTGYM by @iManasArora Sharing Entries, Exits & much more !! Late but Strong !! 1/n #Stock Selection

Week 3 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each point.…

#CHARTGYM @iManasArora FIRST I NEED BYING FORCE IN THE STOCK SO THAT THE STOCK WILL APPEAR IN MY WATCHLIST SO 61% OF BUYING FORCE IS THERE NOW AFTER THAT SHAKOUT IS THERE FOLLOWED BY NEXT DAY STRONG START SO THAT WOULD BE MY FIRST ENTRY IN THE STOCK

Looks Hindsight Easy.. Real Time Would take so much patience and self control.. Great Exercise... #CHARTGYM

#CHARTGYM ~ Weekly Practice by @iManasArora This is how I would have traded #hindcopper ~ June'20 to April'21 1/n #Stock Selection Keeping an eye after adding it to watchlist as it below trending MA 50 Will wait for the Crossover of 20*50 MA

Week 6 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each…

Starting CHART GYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each point. The…

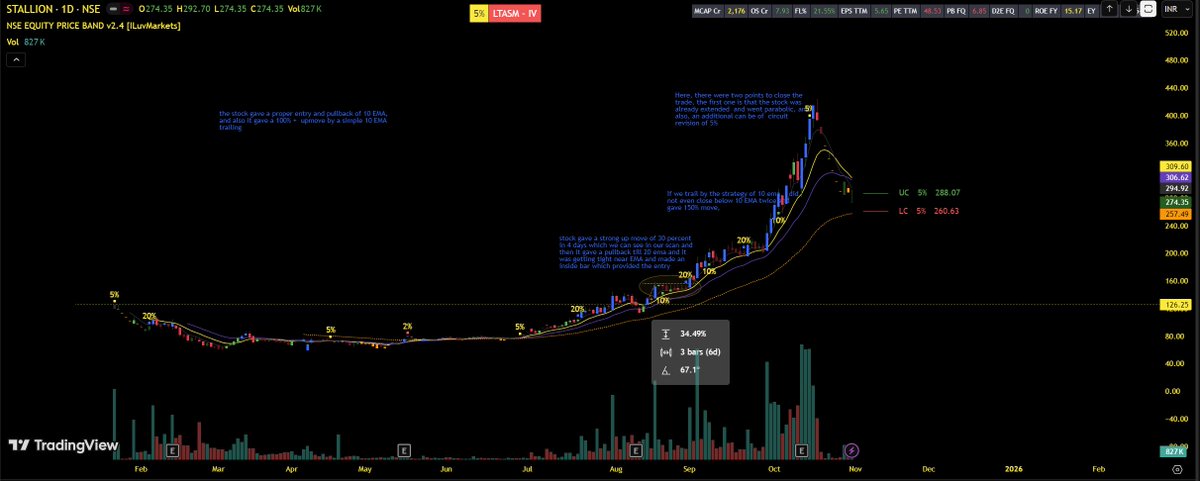

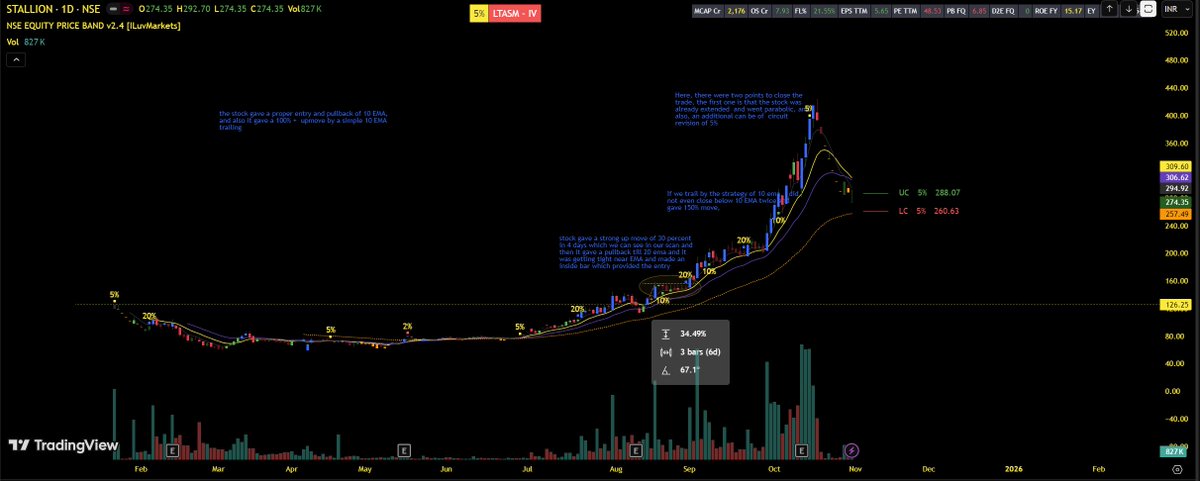

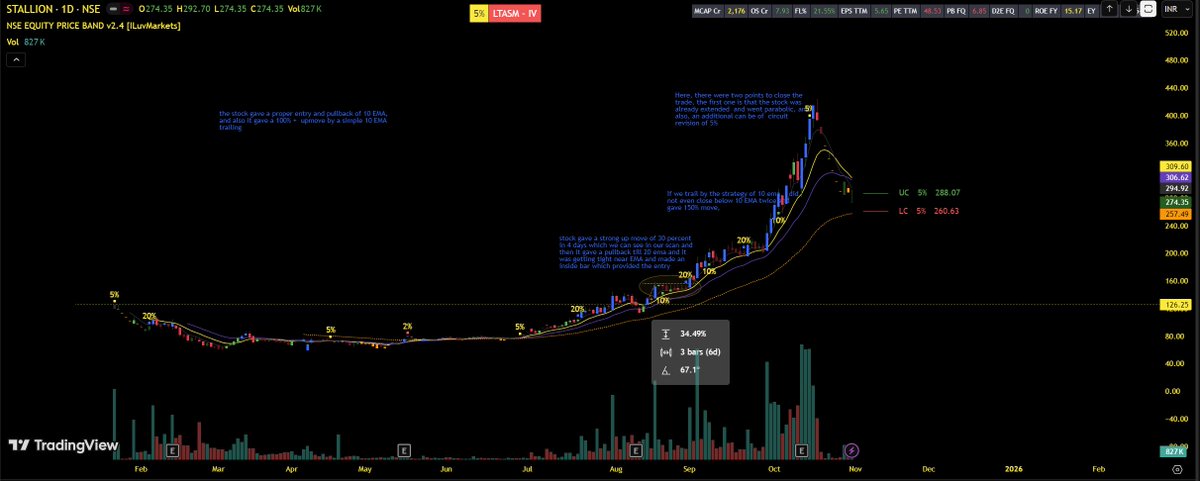

reviewed one of the top gainers, which gave a large 140% + gains in recent quarters #stallionfluoro , made a note of how it will come under scanner and how I will trade and exit and annotated on the chart weekly #CHARTGYM by @iManasArora

Institutional buying strategy #CHARTGYM #netweb +04 aug 2025 volume rise and made heightest volume year +Price consolidated near 10Ema and 20 Ema +04 sep 2025 stock give breakout o4 aug candle +Return 65%

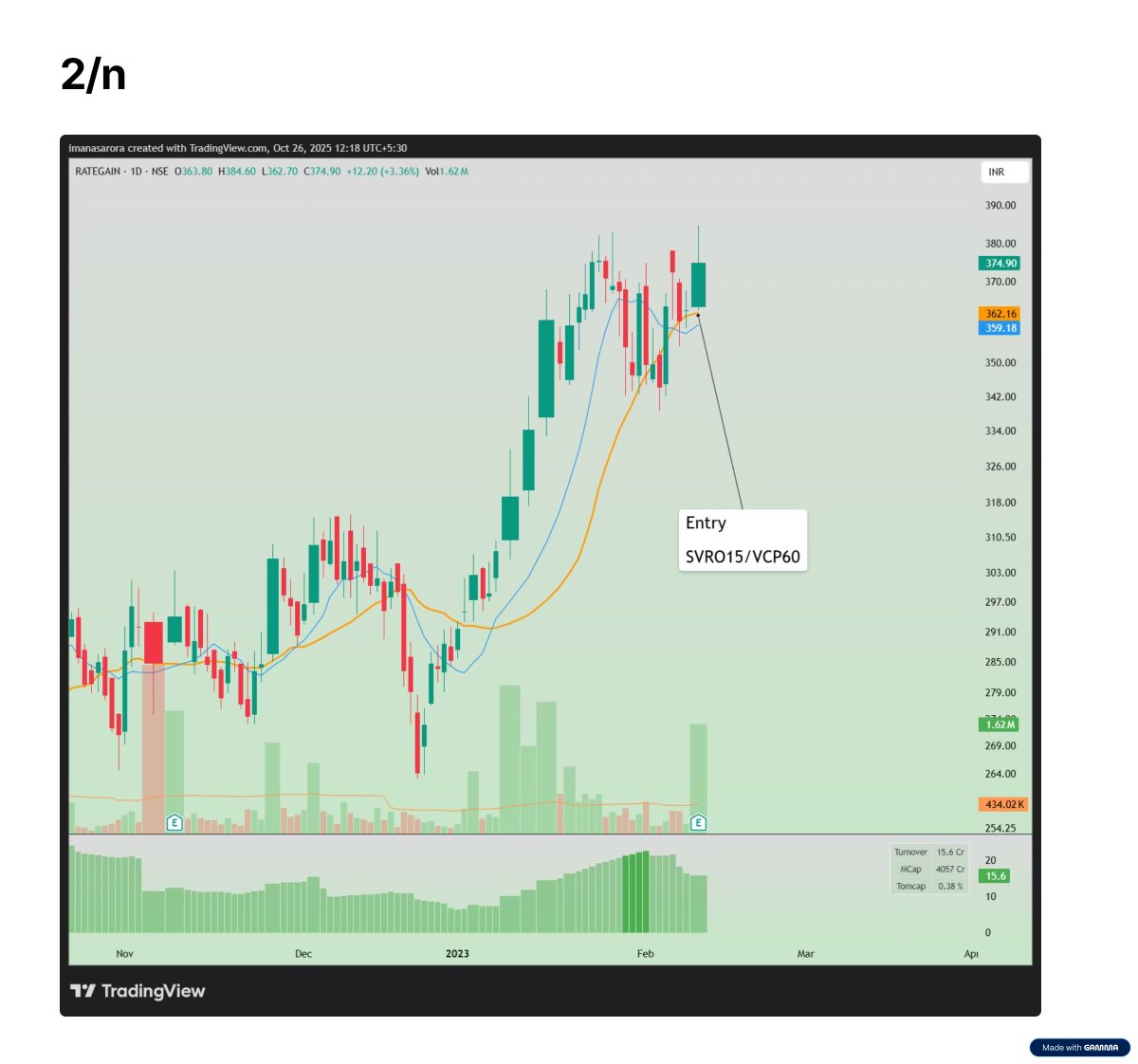

#CHARTGYM By @iManasArora 🫂 This is how I would have traded #RATEGAIN #TradeNote Simulation 📜👇 Capital : ₹3,00,000 Max. Position Size : 25% ~ ₹75,000 SL : 3% of Size PF Risk : 0.75% TG : SWL cut or ES #SwingTrading

Institutional buying strategy #CHARTGYM #MTARTECH + 12 SEP volume made HVY + Stock was consolidated 5 day near the price 1738 to 1800 + 23 SEP stock gave break -out near 1815 + After that price narrow near 10 ema & 20 ema + Again stockgave break out near2000& made 14 oct…

Week 7 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each…

Week 8 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at…

Institutional buying strategy #CHARTGYM #MTARTECH + 12 SEP volume made HVY + Stock was consolidated 5 day near the price 1738 to 1800 + 23 SEP stock gave break -out near 1815 + After that price narrow near 10 ema & 20 ema + Again stockgave break out near2000& made 14 oct…

Do check this out👇 Full trades of #CHARTGYM x.com/KartikMishra_M…

Week 8 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at…

#CHARTGYM By @iManasArora 🫂 This is how I would have traded #RATEGAIN #TradeNote Simulation 📜👇 Capital : ₹3,00,000 Max. Position Size : 25% ~ ₹75,000 SL : 3% of Size PF Risk : 0.75% TG : SWL cut or ES #SwingTrading

VCP60 - VCP on 60mins time frame SVRO15 - SVRO on 15mins time frame SVRO3 - SVRO on 3mins time frame BE - Breakeven More such trade breakdowns in the club manasarora.com #ChartGym

Week 7 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each

Week 8 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at…

Just read Manas Sir’s #CHARTGYM tweet and understand the mindset of a trader when he is in trade.

Week 7 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each…

Week 7 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each

This is how I would trade #VASCONEQ #ChartGym by @iManasArora 44 Sec Video showing Entry, Riding, Exit I have pdf of the full trade📜 Dm to Get!! 23 RR Trade ✅ 3% STOP ❌ 71% Profit 💰 Entry 1⤵️ #SwingTrading

Week 7 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each…

Week 7 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each…

Institutional buying strategy #CHARTGYM #netweb +04 aug 2025 volume rise and made heightest volume year +Price consolidated near 10Ema and 20 Ema +04 sep 2025 stock give breakout o4 aug candle +Return 65%

Week 7 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each…

This is how I would have traded #EVERREADY #CHARTGYM by @iManasArora Sharing Entries, Exits & much more !! Late but Strong !! 1/n #Stock Selection

Week 3 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each point.…

This is how I would have traded #hindcopper #ChartGym More such trade breakdowns in my club

#CHARTGYM ~ Weekly Practice by @iManasArora This is how I would have traded #hindcopper ~ June'20 to April'21 1/n #Stock Selection Keeping an eye after adding it to watchlist as it below trending MA 50 Will wait for the Crossover of 20*50 MA

Week 6 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each…

reviewed one of the top gainers, which gave a large 140% + gains in recent quarters #stallionfluoro , made a note of how it will come under scanner and how I will trade and exit and annotated on the chart weekly #CHARTGYM by @iManasArora

Looks Hindsight Easy.. Real Time Would take so much patience and self control.. Great Exercise... #CHARTGYM

reviewed one of the top gainers, which gave a large 140% + gains in recent quarters #stallionfluoro , made a note of how it will come under scanner and how I will trade and exit and annotated on the chart weekly #CHARTGYM by @iManasArora

This is how I would have traded #EVERREADY #CHARTGYM by @iManasArora Sharing Entries, Exits & much more !! Late but Strong !! 1/n #Stock Selection

Week 3 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each point.…

#CHARTGYM @iManasArora FIRST I NEED BYING FORCE IN THE STOCK SO THAT THE STOCK WILL APPEAR IN MY WATCHLIST SO 61% OF BUYING FORCE IS THERE NOW AFTER THAT SHAKOUT IS THERE FOLLOWED BY NEXT DAY STRONG START SO THAT WOULD BE MY FIRST ENTRY IN THE STOCK

#CHARTGYM ~ Weekly Practice by @iManasArora This is how I would have traded #hindcopper ~ June'20 to April'21 1/n #Stock Selection Keeping an eye after adding it to watchlist as it below trending MA 50 Will wait for the Crossover of 20*50 MA

Week 6 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each…

Institutional buying strategy #CHARTGYM #netweb +04 aug 2025 volume rise and made heightest volume year +Price consolidated near 10Ema and 20 Ema +04 sep 2025 stock give breakout o4 aug candle +Return 65%

#APOLLO - BO of the cup around 63 was the key entry to catch the move for me...Let's see how master execute the trade? #CHARTGYM Thanks!

#CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each point. The goal…

Week 5 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each…

Week 7 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each…

Week 7 of #CHARTGYM - weekly workout for your trading brain Every weekend you’ll get a past stock chart. Your job is to annotate it as if you were there. Mark where you’d enter, where you’d exit, where you’d put your stop, and even note what you’d be thinking at each

#CHARTGYM By @iManasArora 🫂 This is how I would have traded #RATEGAIN #TradeNote Simulation 📜👇 Capital : ₹3,00,000 Max. Position Size : 25% ~ ₹75,000 SL : 3% of Size PF Risk : 0.75% TG : SWL cut or ES #SwingTrading

Something went wrong.

Something went wrong.

United States Trends

- 1. Clay Higgins 24.9K posts

- 2. Scotland 80.6K posts

- 3. Grisham 4,233 posts

- 4. Peggy 7,319 posts

- 5. Cashman 1,228 posts

- 6. Saudi 260K posts

- 7. Dominguez 3,280 posts

- 8. Bellinger 2,622 posts

- 9. Nicki 129K posts

- 10. Mary Bruce 6,309 posts

- 11. Switch 2 26K posts

- 12. #UNBarbie 16.8K posts

- 13. Gemini 3 52.5K posts

- 14. Khashoggi 57.1K posts

- 15. Tierney 13.1K posts

- 16. Dearborn 55.3K posts

- 17. Shota 10K posts

- 18. The House 563K posts

- 19. Gleyber Torres 1,561 posts

- 20. Sedition 6,754 posts