#commservices search results

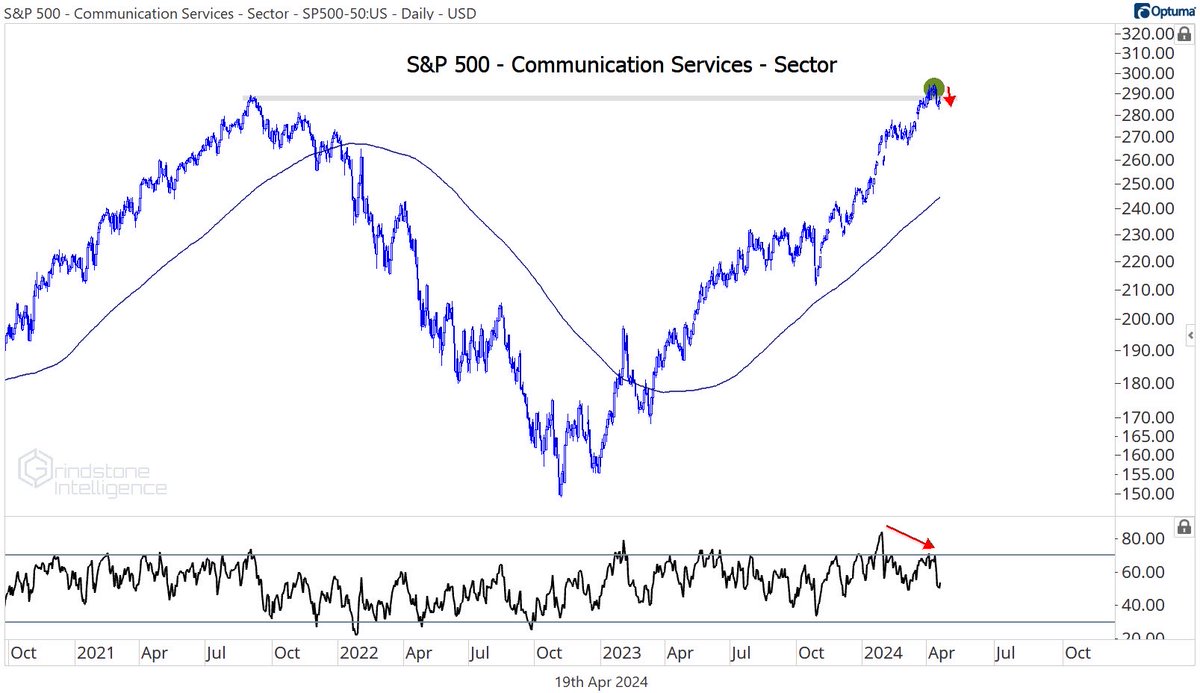

🇺🇸 The S&P 500 dropped -1.37% this week ⚖️ The average stock returned -0.99% 💪🏼 274 stocks outperformed the index 📈 Best sector: #CommServices +1.5% 📉 Worst sector: #Technology -3.3% 📈 Best stock: $PAYC +28.0% 📉 Worst stock: $SMCI -44.9%

🚨 Communications Services Scoop: Sector up 0.6% last week amid AI buzz & Alphabet’s bond play! 📈 Mixed earnings but $7.7T cap signals strength. My #1 Buy: GOOGL – AI giant set to surge! 💥🔥 Your pick? Like ❤️ & Follow for daily stock news, insights & tips! #CommServices…

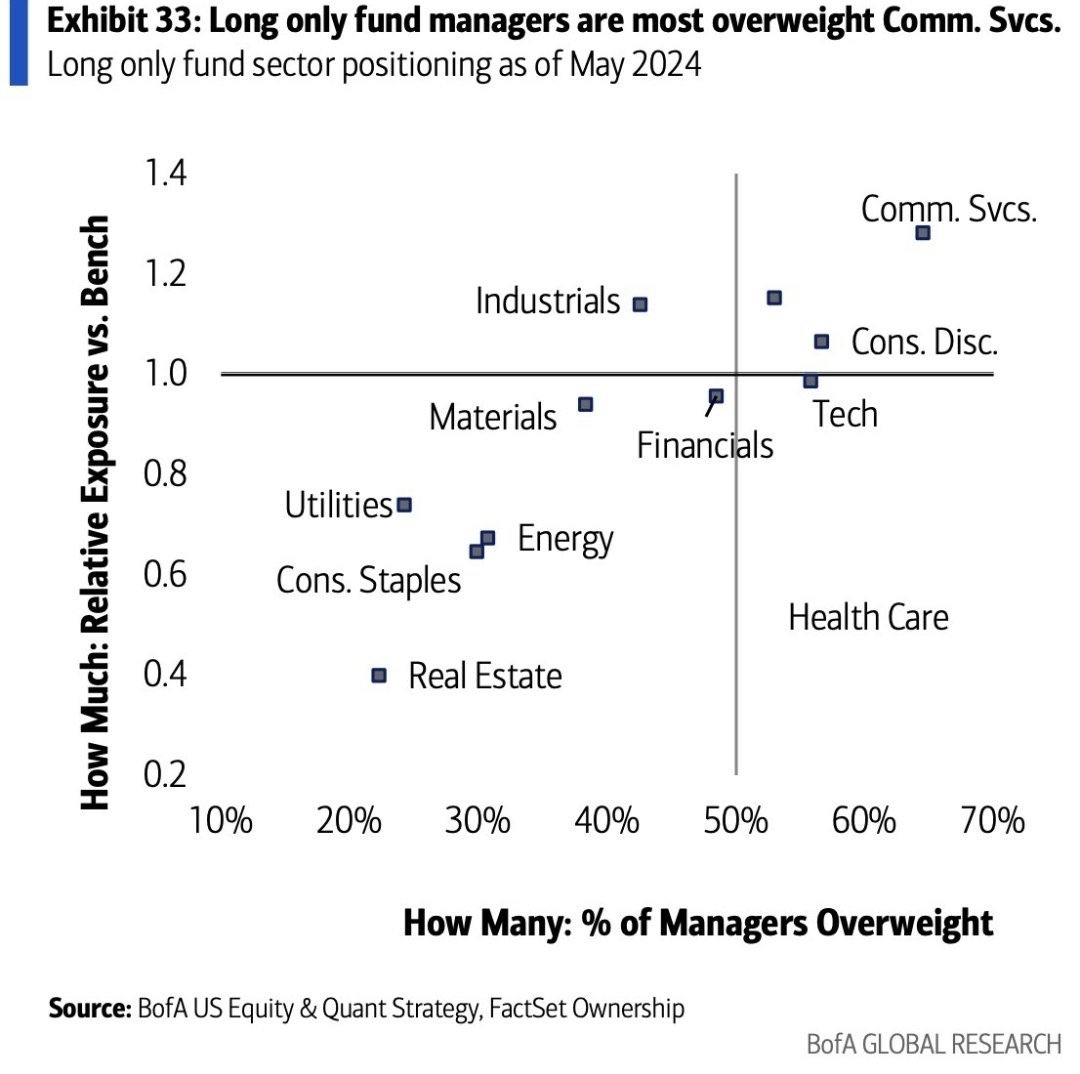

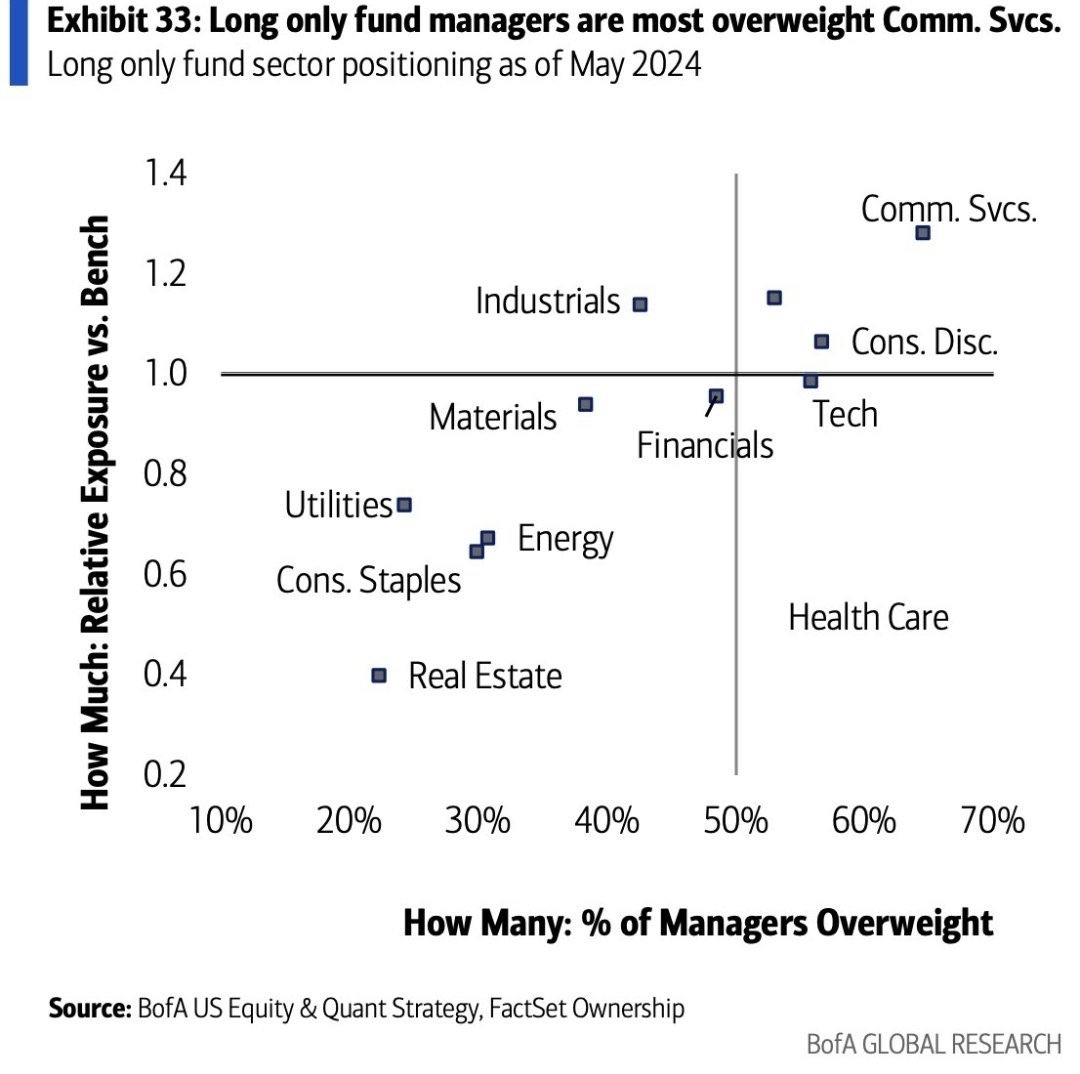

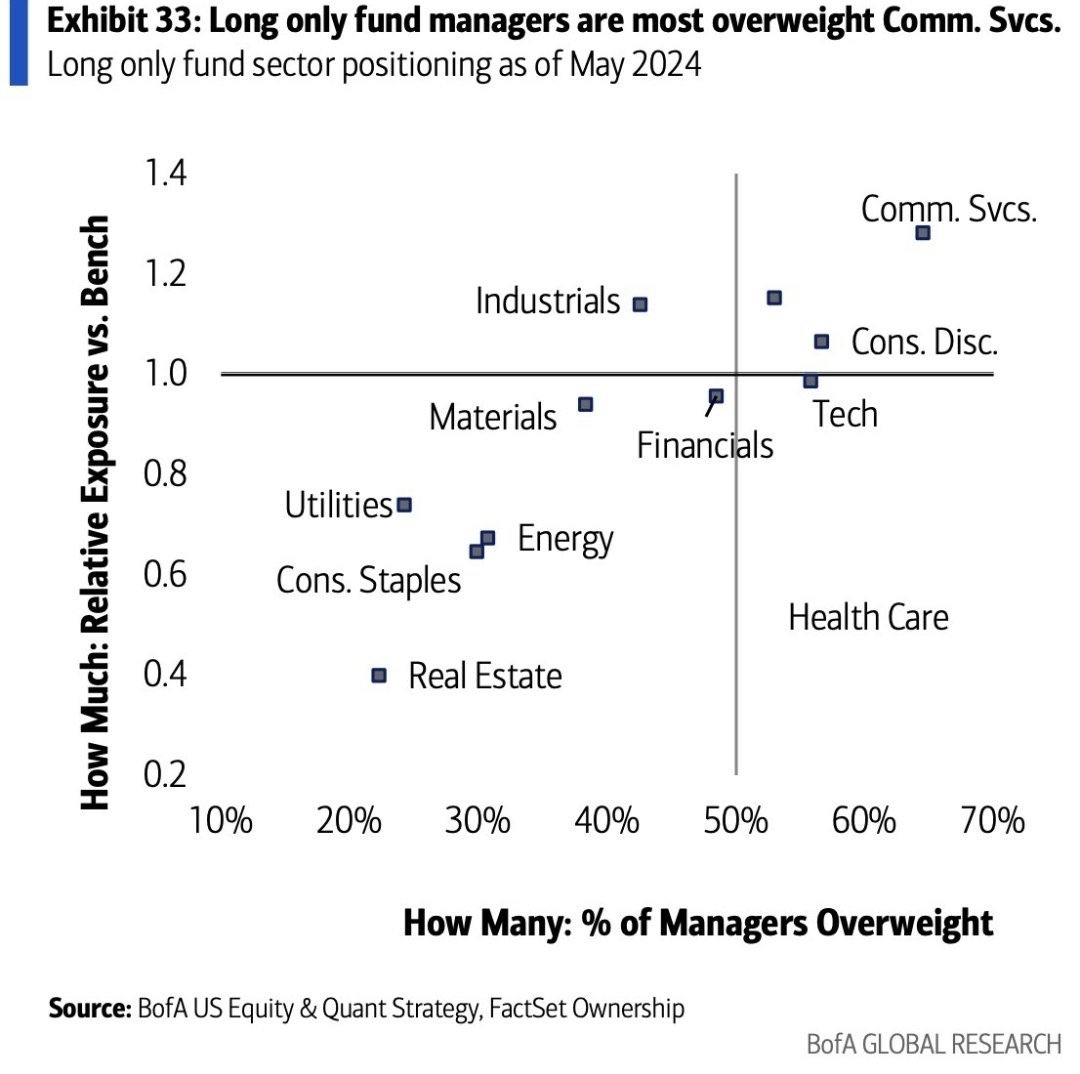

📈 Long only fund managers are placing their bets on Communication Services, making it their most overweight sector! 💬📡 #investment #strategy #commservices #stockmarket #financenews #investmentstrategy #trading #finance #economy #market #investing

Found this interesting 👇 - per @GoldmanSachs hedge funds shorted the rally yesterday - look at the surge in shorts in #technology and #commservices If #inflation is broken, yields will fall, tech to surge $QQQ $META $AMZN $GOOGL

5 Classic, Off-the-Shelf #CommServices to Start Using Today hubs.ly/H09TZs60 #UCaaS #CPaaS #SMS #Fax

> Sectorally, #Energy, #Financials, & #CommServices all have significantly beak expectations relative to #Staples, #HealthCare & #Industrials so far.

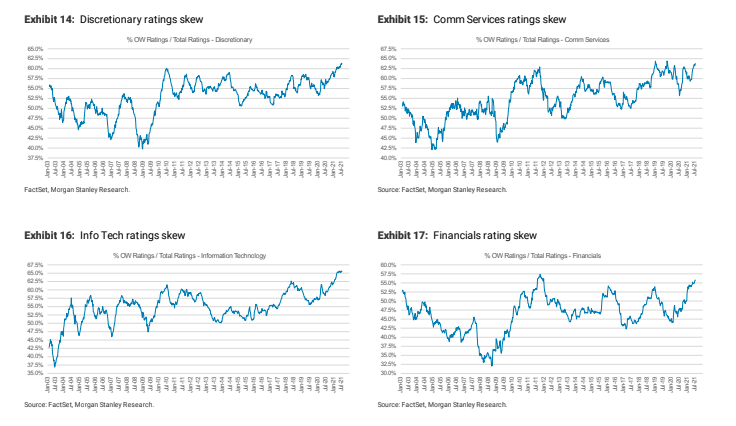

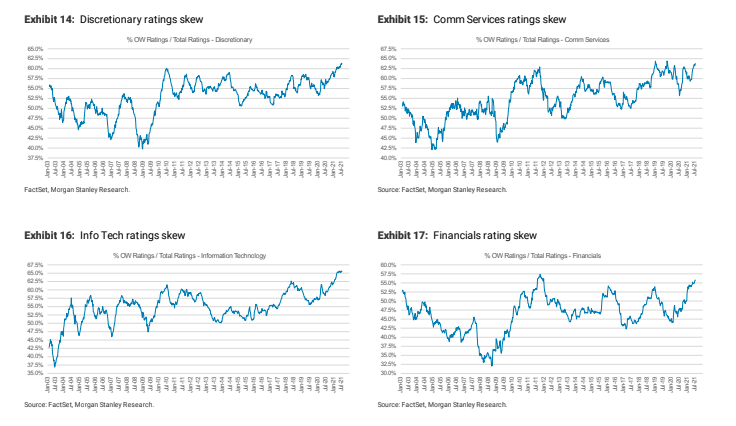

> Across sectors, the positive ratings #skews are fairly pervasive as the current %'s of OW's vs total ratings shows that #Discretionary, #CommServices, #Tech are all in the 99.5%+ percentile during this time period.

> Institutional clients sold for the second straight week and posted the largest outflow in the last 5 months - while retail clients were selling again for the last 3 weeks. > 8 of 11 sectors saw single stock inflows lead by #Financials, #CommServices, #Tech and #Healthcare

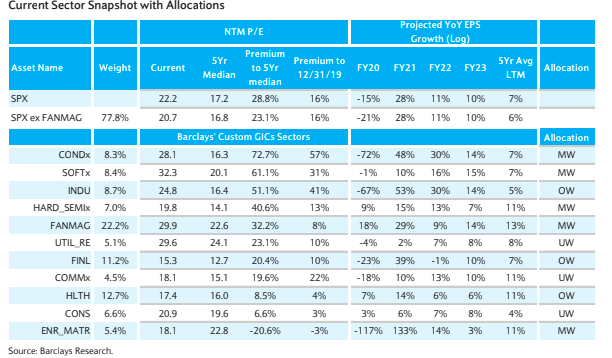

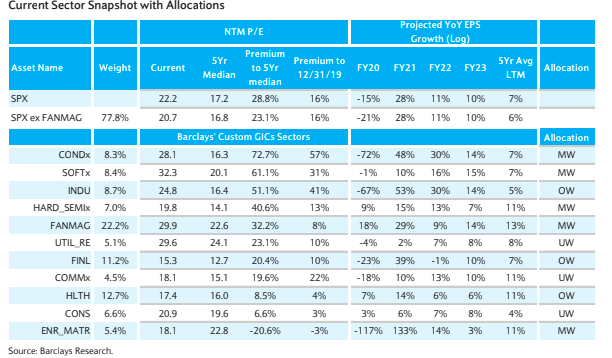

@BarclaysIB | Equity📈 Compass 🧭 > Current Sector Allocations shows that among the defensive sectors - the NTM P/E ratios for #Utilities & #RealEstate & #CommServices ex. #FANMAG are trading at a decent premium to their 5y median and Dec. 2019 levels

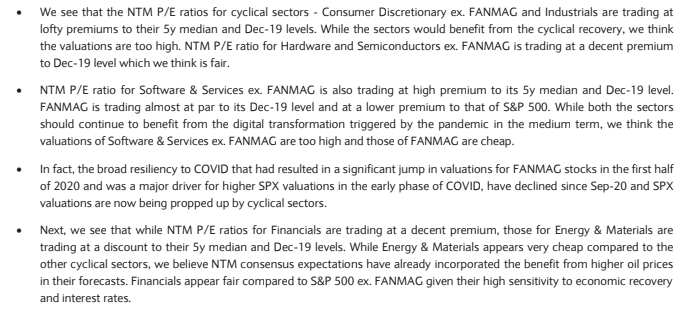

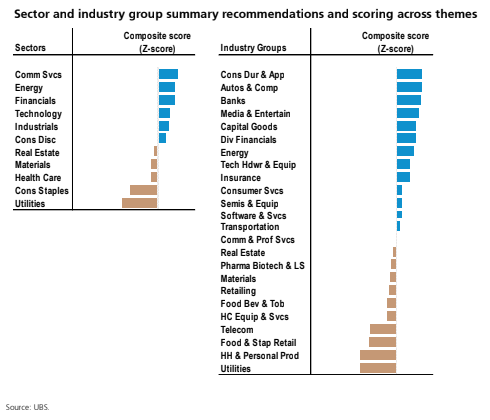

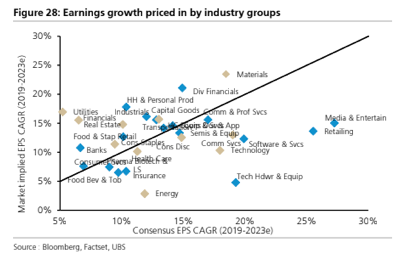

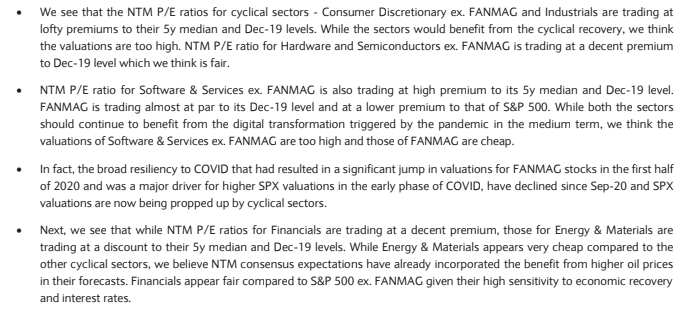

@UBSschweiz | $SPX $ES Earnings Growth > #CommServices, #Energy, #TechHardware, #Discretionary appear attractive with the market pricing less #ERP growth than consensus expectations through 2023. >#Materials, #HH products, #DivFinancials & #RealEstate show higher implied EPS

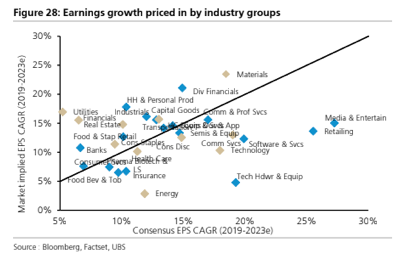

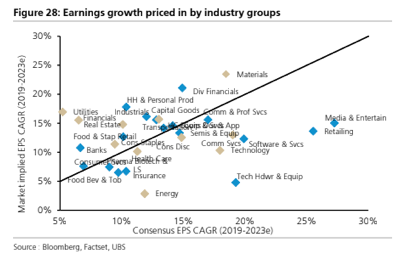

@UBSschweiz | $SPX $ES 2022 Themes > Going forward into 2022 - #CommServices is an obvious #Overweight along with #Technology which are expecting to show plenty of #momentum and solid #growth relative to historical averages.

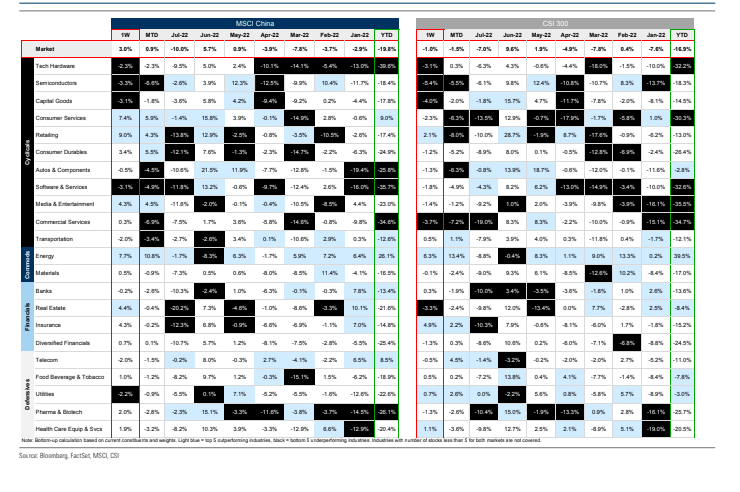

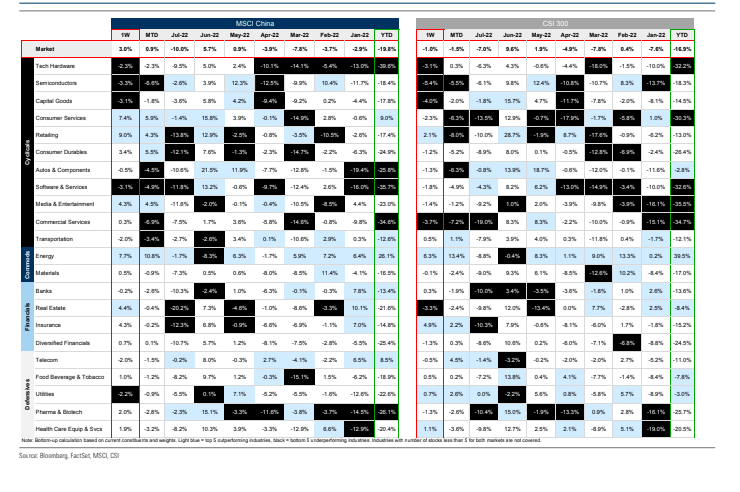

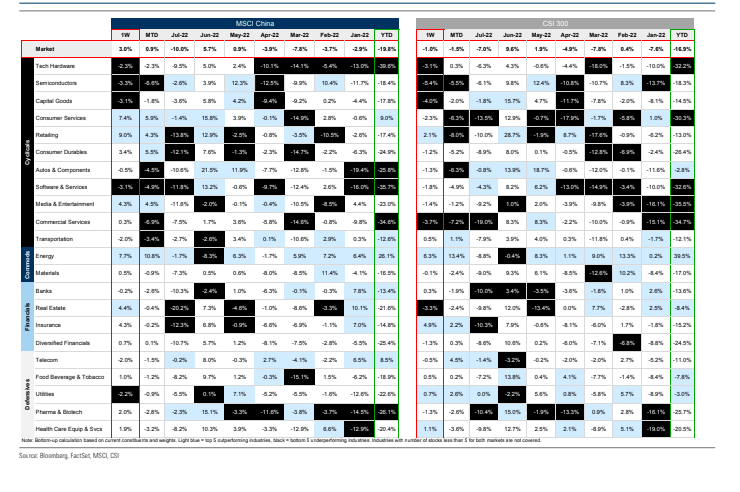

GS | @MSCI_Inc China 🇨🇳 Sector Performances > Performance matrix shows #YTD performance is still lagging w/ #TechHardware comprising the worst performing sector alongside #CommServices & #Software.

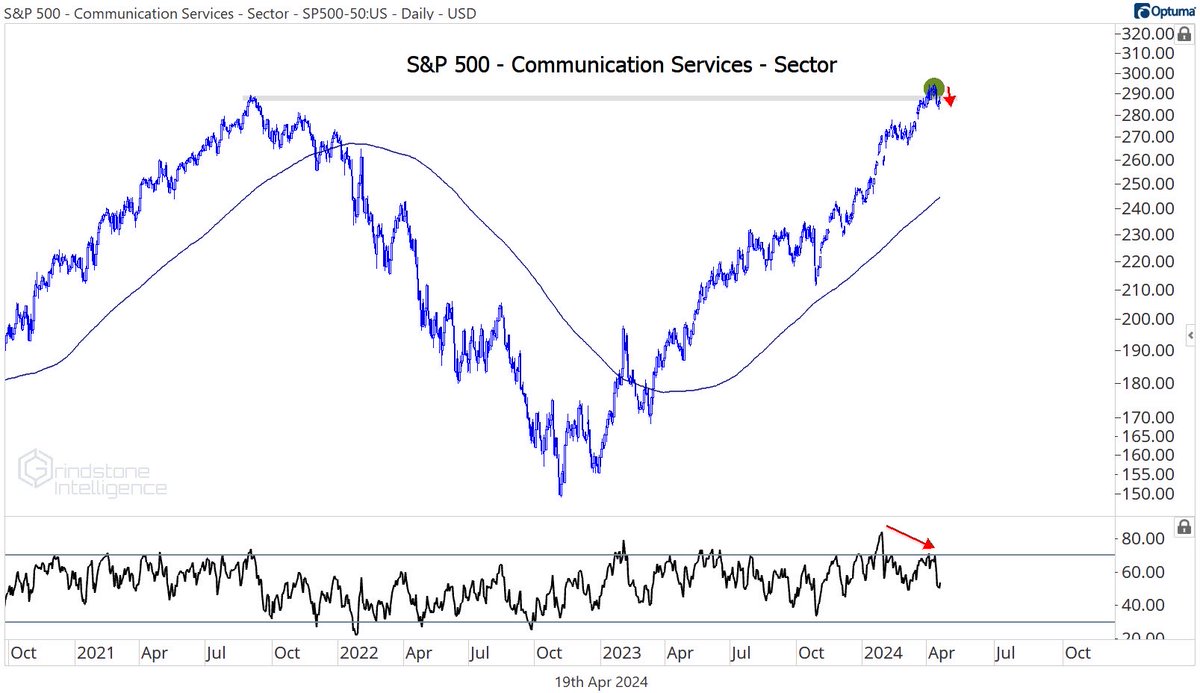

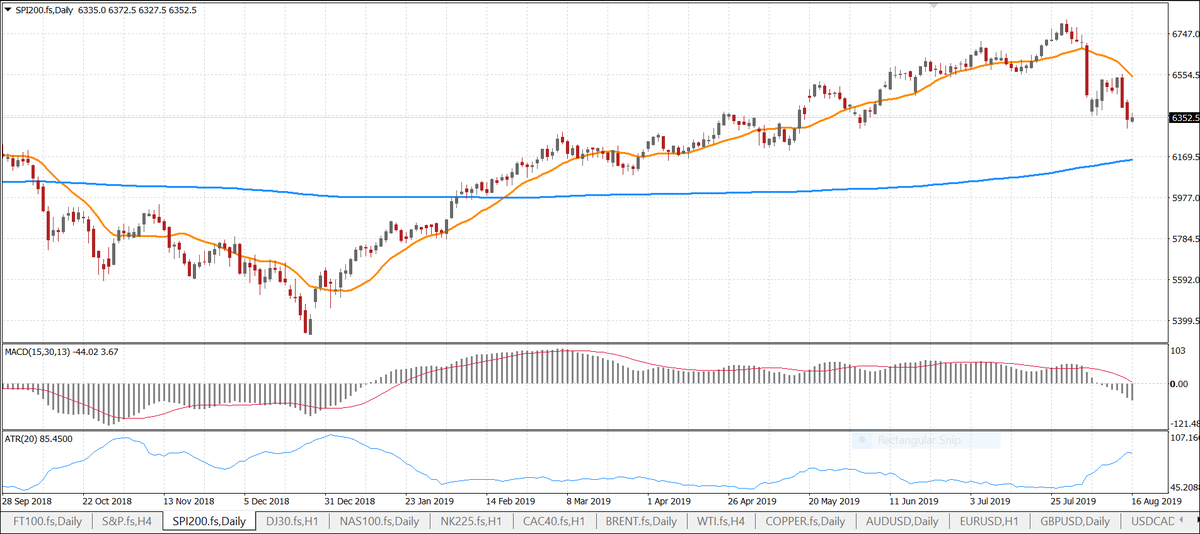

ASX 200 Communication Services is stabilising above EMAs with RSI > 57 📶. Watch for 1,700 resistance—breakout could trigger bullish follow-through. 👉 Free 7-day insights: kapitales.com.au/our-products/k… #ASX200 #TechnicalAnalysis #CommServices #Kapitales

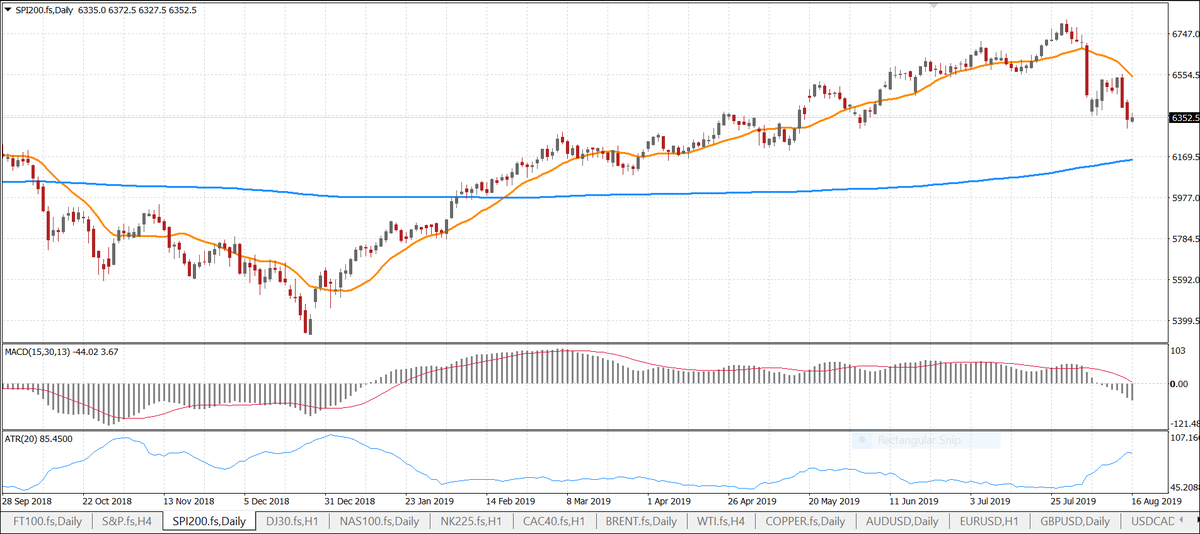

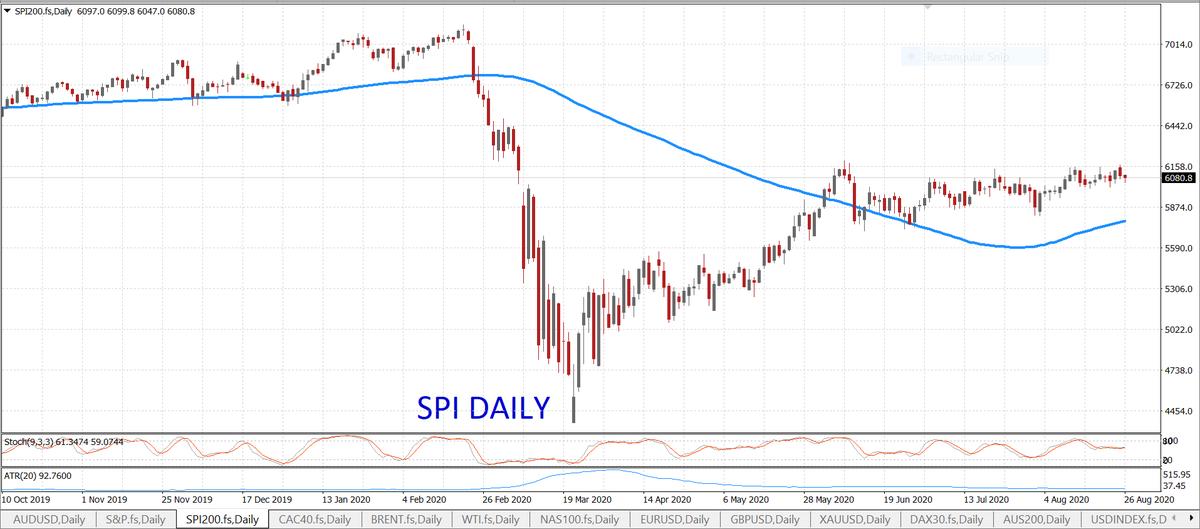

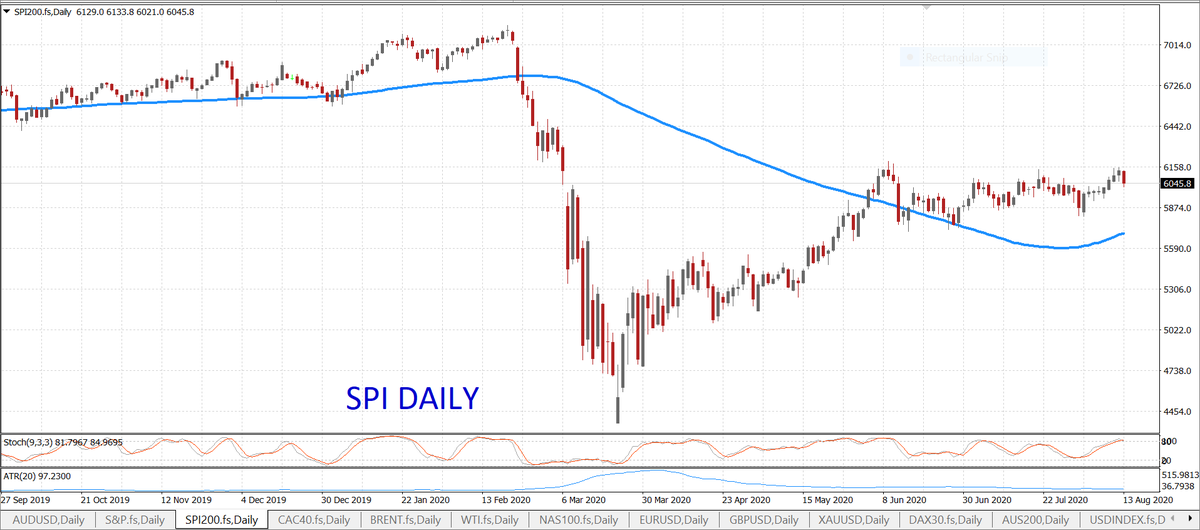

Another choppy day, but the $SPI edged higher and held on to a 21-pt gain to close the week. #REITs led the gainers, up 2.44%. #CommServices also up 1%. #Markets will focus on #JacksonHole conference & #JPowell speech. $XJO #ASX200 #ausbiz #trading Losses may exceed deposits

Local stocks failed to hang on to their early gains and closed just a tad above 6400 level. The $SPI lost 2.6 pts as #CommServices sector, down 2.78% proved to the heaviest weight on the index today. #Energy is down .89%. $XJO #ASX200 #ausbiz #trading Losses may exceed deposits

After a strong start to test the top range of the 6860 level, local #stocks drifted sideways for most of the day. The $SPI closed up 0.2% as #CommServices led the winners with a 2.80% gain. #Healthcare also rose by 0.77%. #Trading #Indices $ASX200 Losses may exceed deposits

With 10 out of the 12 industry sectors in the red, local #stocks failed to recover from early falls. The $SPI gave up -0.73% to trade at 6116.4 level. #CommServices sector, down -2.02% was the biggest loser. $AUD sits above 0.7190. #Trading #Forex #XJO Losses may exceed deposits

They rose. They fell. They didn't recover. The local #stock market eased -0.67% as the reporting season continues. The $SPI held above the 6000 level, closing at 6091 as the #CommServices sector took the biggest hit, down -4.95%. #Trading #FOREX #XJO Losses may exceed deposits

🚨 Communications Services Scoop: Sector up 0.6% last week amid AI buzz & Alphabet’s bond play! 📈 Mixed earnings but $7.7T cap signals strength. My #1 Buy: GOOGL – AI giant set to surge! 💥🔥 Your pick? Like ❤️ & Follow for daily stock news, insights & tips! #CommServices…

From memes to megabits, this sector owns your screen time. Want in before the next viral surge? 🚀 #CommServices #META #GOOGL #5G

ASX 200 Communication Services is stabilising above EMAs with RSI > 57 📶. Watch for 1,700 resistance—breakout could trigger bullish follow-through. 👉 Free 7-day insights: kapitales.com.au/our-products/k… #ASX200 #TechnicalAnalysis #CommServices #Kapitales

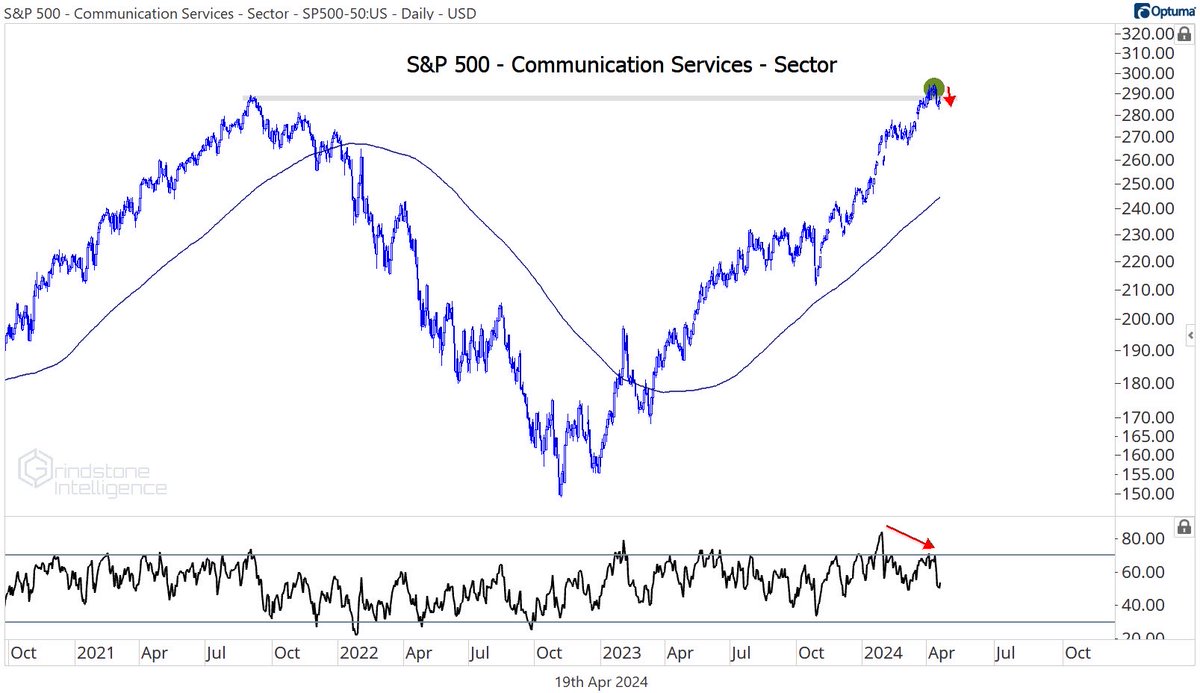

As we enter the month named after the Roman god of war, #GrowthSectors like the #SP500GrowthIndex, #CommServices, #ConsumerDiscretionary, & #Industrials are struggling, trading below their 10- & 40-week moving avgs. In contrast, #DefensiveSectors are outperforming MTD & YTD.

The Q4 2024 earnings season is about to begin, with #SP500 #EPS estimated to⬆️8.7% YoY, driven by strong double-digit gains in 7 sectors like #CommServices & #InformationTech. #GrowthStocks are projected to outpace #ValueStocks, with EPS gains of 17.4% vs a 3.1% ⬇️ respectively.

🇺🇸 The S&P 500 dropped -1.37% this week ⚖️ The average stock returned -0.99% 💪🏼 274 stocks outperformed the index 📈 Best sector: #CommServices +1.5% 📉 Worst sector: #Technology -3.3% 📈 Best stock: $PAYC +28.0% 📉 Worst stock: $SMCI -44.9%

📈 Long only fund managers are placing their bets on Communication Services, making it their most overweight sector! 💬📡 #investment #strategy #commservices #stockmarket #financenews #investmentstrategy #trading #finance #economy #market #investing

Have you added the new CHC quals to your scope? With 6 months remaining of the transition period, now is the time to get the ball rolling. For more info on our resources lnkd.in/gY5H8Cks Request a sample [email protected] #AspireLR #CHC #CommServices #Disability

👨💻Discover the power of Integrating Commio SMS Service with VitalPBX! 🤝Unlock limitless potential for your business and stay connected. 🙌Experience the possibilities first-hand today. #Commservices #SMSservice Begin today. Click here. vitalpbx.com/blog/commio-sm…

Found this interesting 👇 - per @GoldmanSachs hedge funds shorted the rally yesterday - look at the surge in shorts in #technology and #commservices If #inflation is broken, yields will fall, tech to surge $QQQ $META $AMZN $GOOGL

GS | @MSCI_Inc China 🇨🇳 Sector Performances > Performance matrix shows #YTD performance is still lagging w/ #TechHardware comprising the worst performing sector alongside #CommServices & #Software.

> Sectorally, #Energy, #Financials, & #CommServices all have significantly beak expectations relative to #Staples, #HealthCare & #Industrials so far.

@UBSschweiz | $SPX $ES 2022 Themes > Going forward into 2022 - #CommServices is an obvious #Overweight along with #Technology which are expecting to show plenty of #momentum and solid #growth relative to historical averages.

@UBSschweiz | $SPX $ES Earnings Growth > #CommServices, #Energy, #TechHardware, #Discretionary appear attractive with the market pricing less #ERP growth than consensus expectations through 2023. >#Materials, #HH products, #DivFinancials & #RealEstate show higher implied EPS

> Institutional clients sold for the second straight week and posted the largest outflow in the last 5 months - while retail clients were selling again for the last 3 weeks. > 8 of 11 sectors saw single stock inflows lead by #Financials, #CommServices, #Tech and #Healthcare

🇺🇸 The S&P 500 dropped -1.37% this week ⚖️ The average stock returned -0.99% 💪🏼 274 stocks outperformed the index 📈 Best sector: #CommServices +1.5% 📉 Worst sector: #Technology -3.3% 📈 Best stock: $PAYC +28.0% 📉 Worst stock: $SMCI -44.9%

🚨 Communications Services Scoop: Sector up 0.6% last week amid AI buzz & Alphabet’s bond play! 📈 Mixed earnings but $7.7T cap signals strength. My #1 Buy: GOOGL – AI giant set to surge! 💥🔥 Your pick? Like ❤️ & Follow for daily stock news, insights & tips! #CommServices…

📈 Long only fund managers are placing their bets on Communication Services, making it their most overweight sector! 💬📡 #investment #strategy #commservices #stockmarket #financenews #investmentstrategy #trading #finance #economy #market #investing

5 Classic, Off-the-Shelf #CommServices to Start Using Today hubs.ly/H09TZs60 #UCaaS #CPaaS #SMS #Fax

Found this interesting 👇 - per @GoldmanSachs hedge funds shorted the rally yesterday - look at the surge in shorts in #technology and #commservices If #inflation is broken, yields will fall, tech to surge $QQQ $META $AMZN $GOOGL

ASX 200 Communication Services is stabilising above EMAs with RSI > 57 📶. Watch for 1,700 resistance—breakout could trigger bullish follow-through. 👉 Free 7-day insights: kapitales.com.au/our-products/k… #ASX200 #TechnicalAnalysis #CommServices #Kapitales

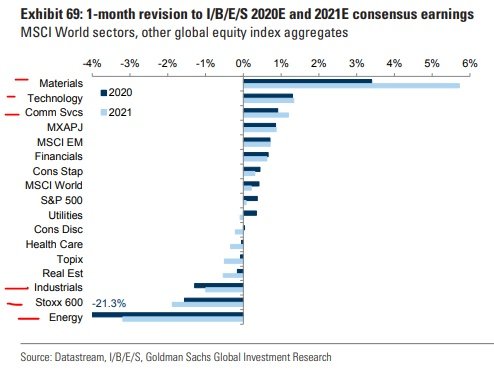

@GoldmanSachs chart in the 1-month revisions to I/B/E/S 2020E and 2021E consensus earnings shows #materials, #technology, and #CommServices are leading relative to #industrials, #STOXX600, and #Energy

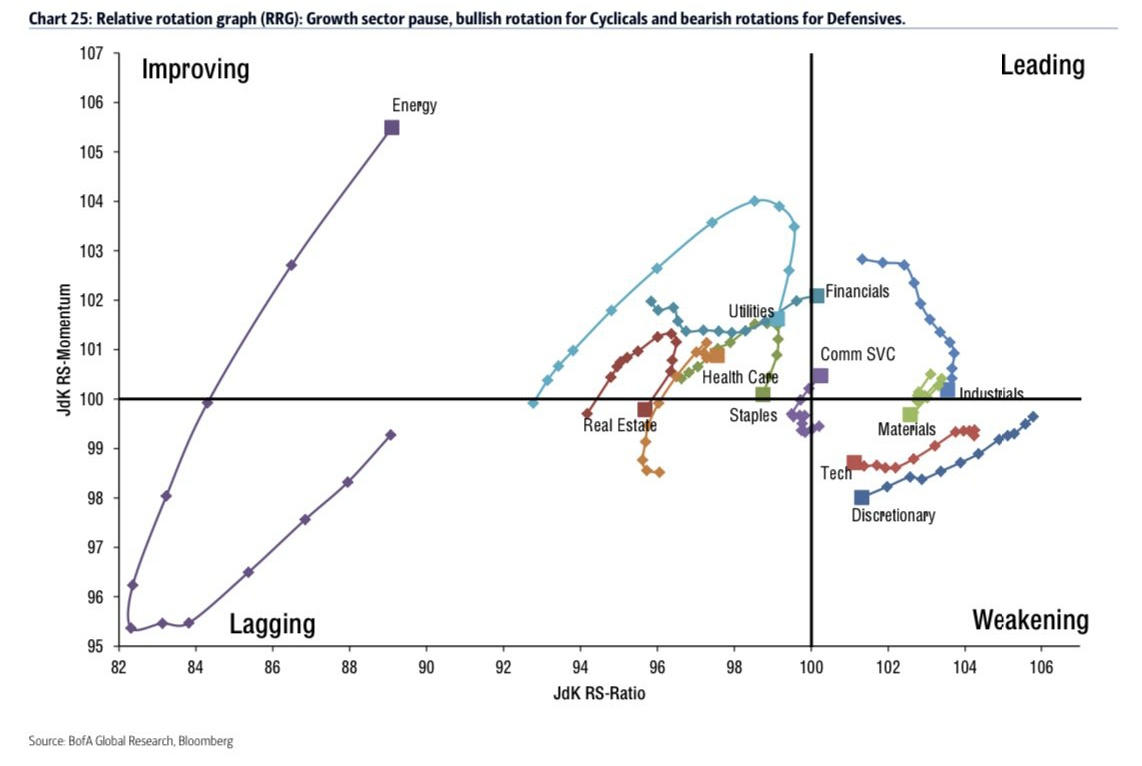

@BofAML | Relative Rotation Graph •》 6 sectors with #bullish 🐂 relative ratios: #Financials, #CommServices, #Industrials, #Materials, #Technology, #Discretionary •》 5 sectors with #bearish 🧸relative ratios: #Energy, #Utilities, #HealthCare,#Staples, and #RealEstate

> Sectorally, #Energy, #Financials, & #CommServices all have significantly beak expectations relative to #Staples, #HealthCare & #Industrials so far.

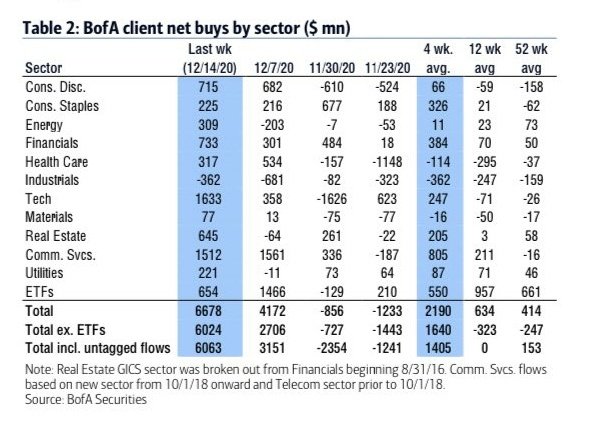

@BofAML | Client Net Buys •》 Last week, #Tech saw inflows of $1.6B, with #CommServices a close second at $1.5B. #Industrials came in last with outflows totaling -$362M •》 Total net buys came in at $66.78B; Total ex ETFs at $60.24B and Total including 'untagged' at $60.63B

Have you added the new CHC quals to your scope? With 6 months remaining of the transition period, now is the time to get the ball rolling. For more info on our resources lnkd.in/gY5H8Cks Request a sample [email protected] #AspireLR #CHC #CommServices #Disability

@BarclaysIB | Equity📈 Compass 🧭 > Current Sector Allocations shows that among the defensive sectors - the NTM P/E ratios for #Utilities & #RealEstate & #CommServices ex. #FANMAG are trading at a decent premium to their 5y median and Dec. 2019 levels

@UBSschweiz | $SPX $ES Earnings Growth > #CommServices, #Energy, #TechHardware, #Discretionary appear attractive with the market pricing less #ERP growth than consensus expectations through 2023. >#Materials, #HH products, #DivFinancials & #RealEstate show higher implied EPS

@UBSschweiz | $SPX $ES 2022 Themes > Going forward into 2022 - #CommServices is an obvious #Overweight along with #Technology which are expecting to show plenty of #momentum and solid #growth relative to historical averages.

> Across sectors, the positive ratings #skews are fairly pervasive as the current %'s of OW's vs total ratings shows that #Discretionary, #CommServices, #Tech are all in the 99.5%+ percentile during this time period.

> Institutional clients sold for the second straight week and posted the largest outflow in the last 5 months - while retail clients were selling again for the last 3 weeks. > 8 of 11 sectors saw single stock inflows lead by #Financials, #CommServices, #Tech and #Healthcare

GS | @MSCI_Inc China 🇨🇳 Sector Performances > Performance matrix shows #YTD performance is still lagging w/ #TechHardware comprising the worst performing sector alongside #CommServices & #Software.

Another choppy day, but the $SPI edged higher and held on to a 21-pt gain to close the week. #REITs led the gainers, up 2.44%. #CommServices also up 1%. #Markets will focus on #JacksonHole conference & #JPowell speech. $XJO #ASX200 #ausbiz #trading Losses may exceed deposits

Local stocks failed to hang on to their early gains and closed just a tad above 6400 level. The $SPI lost 2.6 pts as #CommServices sector, down 2.78% proved to the heaviest weight on the index today. #Energy is down .89%. $XJO #ASX200 #ausbiz #trading Losses may exceed deposits

Something went wrong.

Something went wrong.

United States Trends

- 1. Cheney 69.2K posts

- 2. Sedition 130K posts

- 3. Treason 78K posts

- 4. First Take 44.2K posts

- 5. Mark Walter 1,007 posts

- 6. Cam Newton 3,607 posts

- 7. Jeanie 1,258 posts

- 8. Buss 8,307 posts

- 9. #WeekndTourLeaks 1,440 posts

- 10. Trump and Vance 34.2K posts

- 11. Seditious 67.1K posts

- 12. Constitution 97.1K posts

- 13. Coast Guard 15.6K posts

- 14. Shayy 10.8K posts

- 15. #ExpediaChat 1,171 posts

- 16. Commander in Chief 42.6K posts

- 17. Nano Banana Pro 20.7K posts

- 18. #Geeksgiving25 N/A

- 19. Dameon Pierce N/A

- 20. Stephen A 40.5K posts