#europefintech search results

Tickets paid in seconds. CTS Eventim goes Wero—skip Visa/Mastercard, go instant A2A. 45M users already and climbing. ncblibrary.com/posts/137249?s… #A2Apayments #InstantPayments #EuropeFintech #NCBLibrary 👇Start Your 14-Day Free Trial ncblibrary.com/posts/137249?s…

May European #FinTech Deal Activity: $615 million in Financing Volume and $903 million in M&A Volume – For professional / institutional investors only, see all of the details in FT Partners' infographic finte.ch/EUMonthlyFinTe… #EuropeFinTech

FT Partners is looking forward to attending @money2020 Europe in Amsterdam next month! If you’ll be there and want to meet up with our team, please reach out here: [email protected] #FinTech #EUFinTech #EuropeFinTech

Sal e on, check #noq #norque #EuropeFintech #DigitalFinance @Bitpanda @WazirXIndia @binance @BinanceUS @Bitpanda_global

Binance France's President, David Prinçay, highlighted the platform's Q1 success, regulatory adaptation, and expansion strategy in the EU. #EuropeFintech #DigitalFinance @Bitpanda @WazirXIndia @binance @BinanceUS @Bitpanda_global @NorqueNoq #noq #norque #lab #sekk

More than 80% of European #FinTech capital raises in February were early-stage (up to Series A), compared to 66% in January, leading to a lower total dollar volume but a high deal count – see more details in FT Partners' infographic finte.ch/EUMonthlyFinTe… #EuropeFinTech

European #FinTech financing activity continued at a steady pace in November, with both volume and deal count increasing more than 20% year-over-year – see more details in FT Partners' infographic finte.ch/EUMonthlyFinTe… #EuropeFinTech

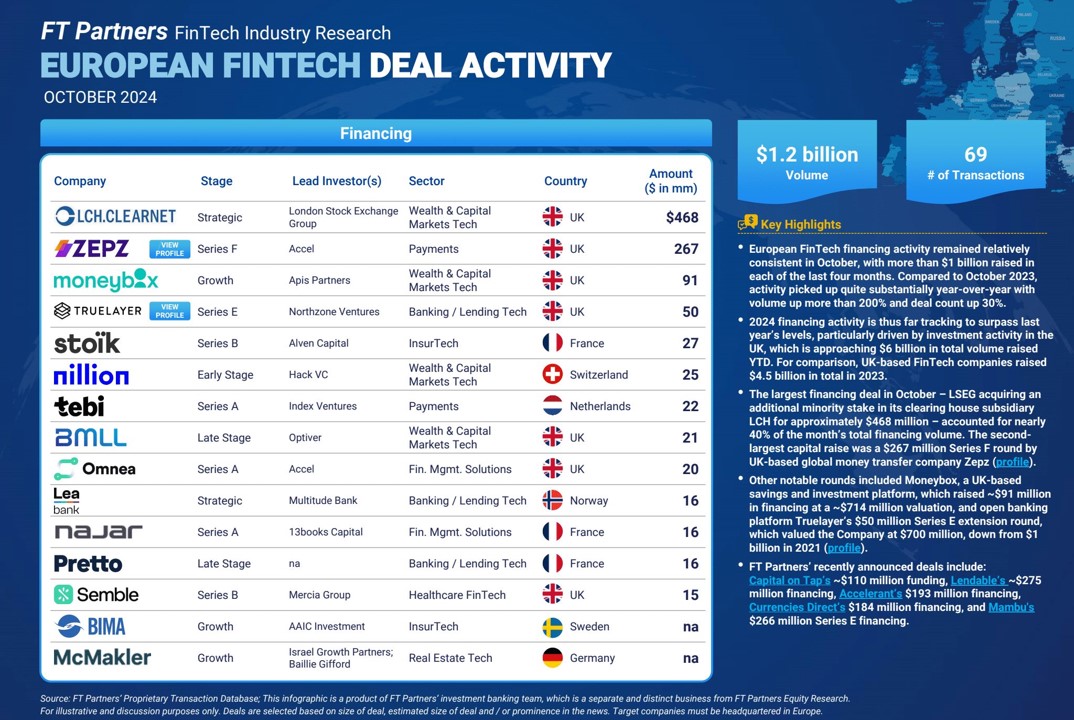

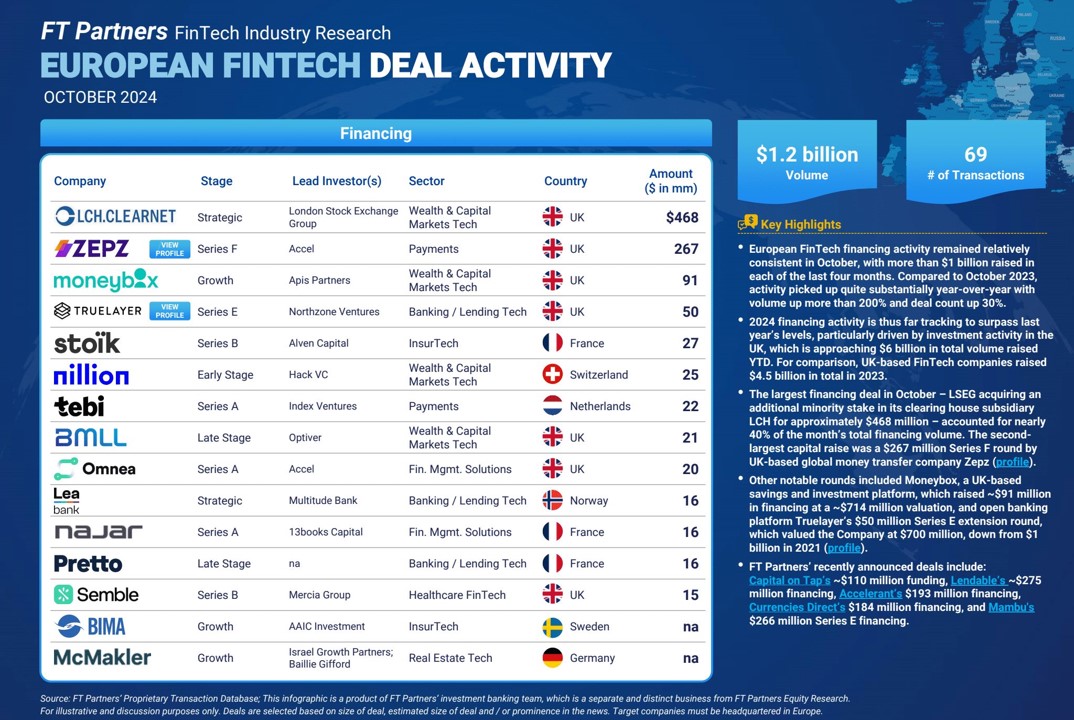

With more than $1 billion raised in each of the last four months, European #FinTech financing activity is tracking to surpass 2023 levels, particularly driven by investment activity in the UK – see more details in FT Partners' infographic finte.ch/EUMonthlyFinTe… #EuropeFinTech

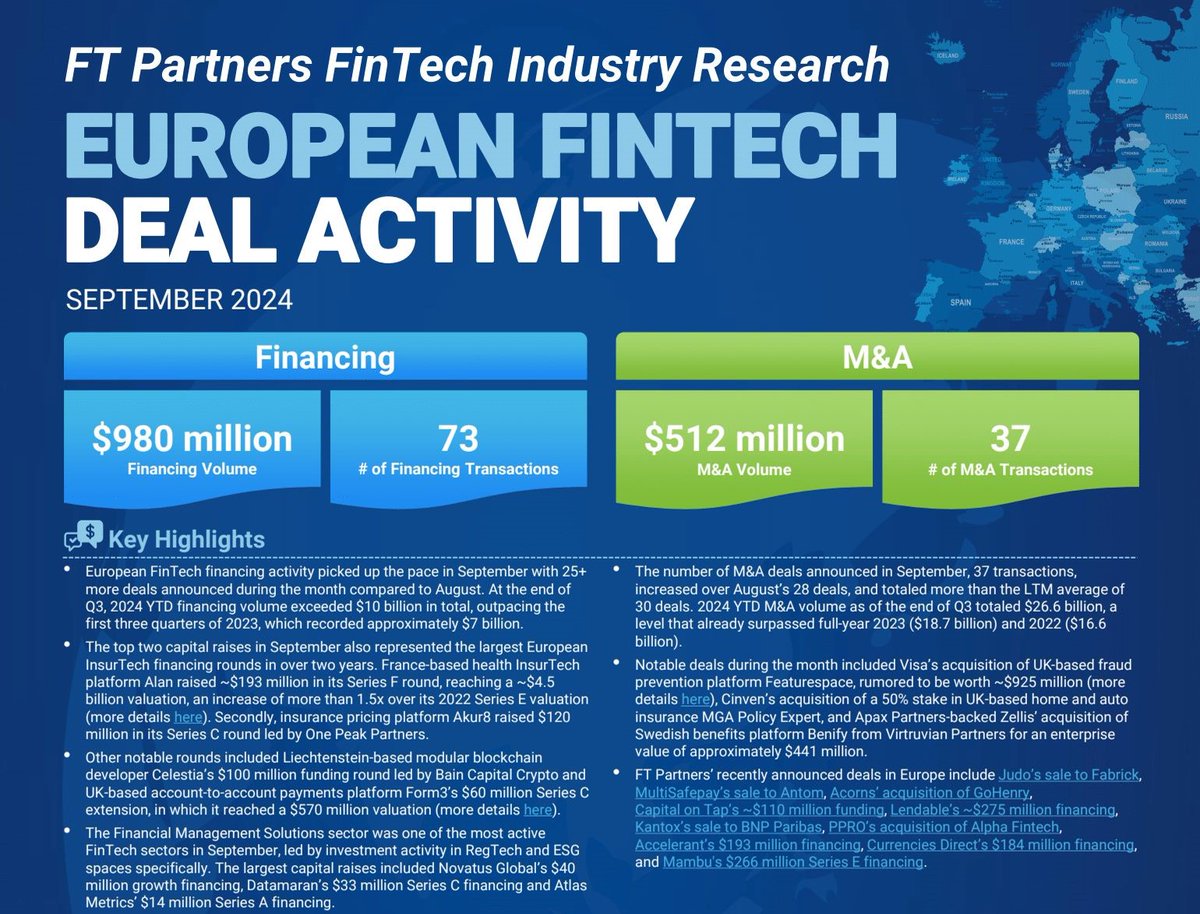

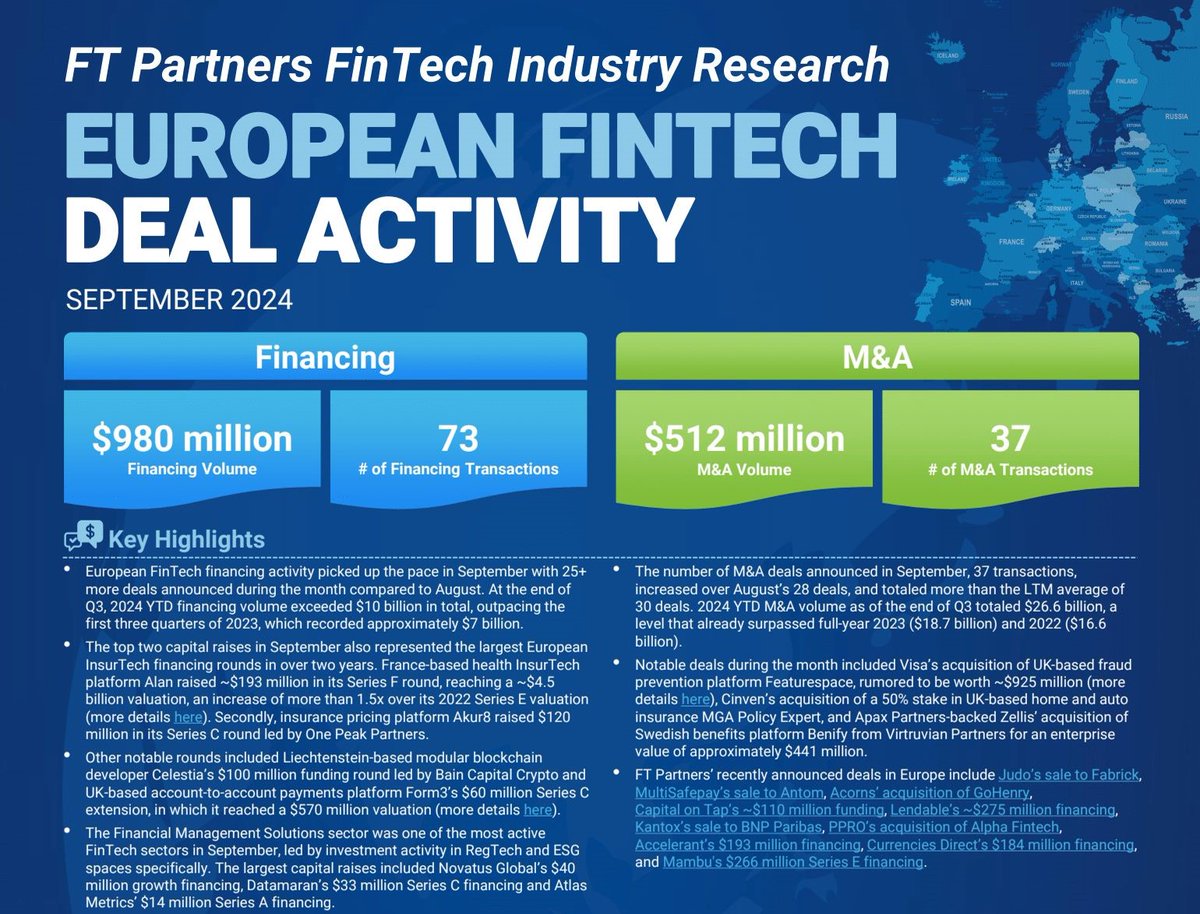

European #FinTech financing activity picked up the pace in September with 25+ more deals announced during the month compared to August – see more details in FT Partners' infographic finte.ch/EUMonthlyFinTe… #EuropeFinTech

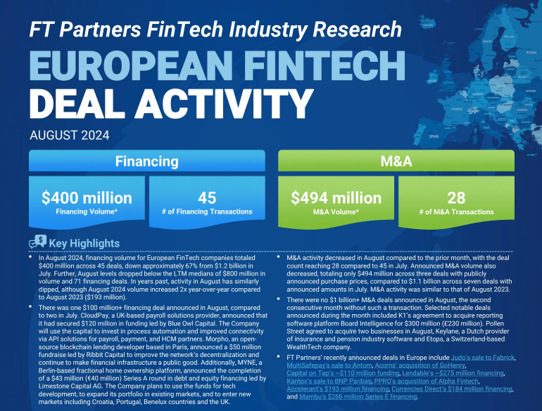

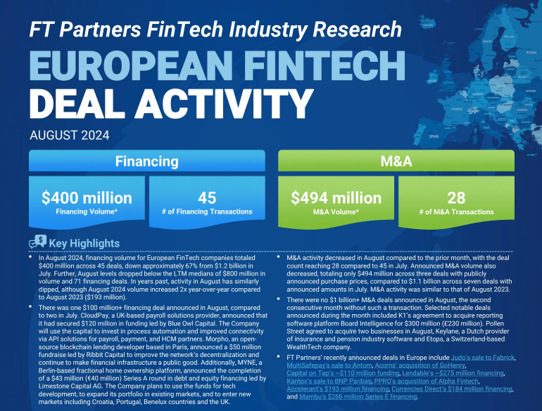

European #FinTech financing volume totaled $400 million across 45 deals in August, representing a drop in activity from July, but a 2x increase in volume compared to August 2023 - see more in FT Partners' infographic finte.ch/EUMonthlyFinTe… #EuropeFinTech

European #FinTech M&A volume reached $1.4 billion in February 2024, driven by Thomson Reuters’ acquisition of Sweden-based e-invoicing platform Pagero – see more in FT Partners' infographic finte.ch/EUMonthlyFinTe… #EUFinTech #EuropeFinTech

The Most Influential People in European #FinTech via @wesleyyuhn1 sco.lt/9ElBpZ#SaaS #europefintech #martech

A great #europefintech report by @CBinsights googleshortener.com/m9Bk #sthlmtech #fintech #fintechtrends

Global rise of #fintech VC: $13.8b deployed across 653 deals #asiafintech #europefintech dealstreetasia.com/stories/2015-t…

European #FinTech deal activity showed modest signs of recovery in Q1 2023, with March ending at $920 million in financing volume across more than 80 deals – see all the details in FT Partners’ infographic: finte.ch/EUMonthlyFinTe… #EUFinTech #EuropeFinTech

European #FinTech financing activity levels in April 2023 were lower than the LTM averages, while the number of M&A deals has slightly picked up in 2023 YTD compared to 2022 – see all the details in FT Partners’ infographic: finte.ch/EUMonthlyFinTe… #EUFinTech #EuropeFinTech

European #FinTech deal activity picked up in February, with financing volume nearly doubling over January – see all the details in FT Partners’ infographic: finte.ch/EUMonthlyFinTe… #EUFinTech #EuropeFinTech

European #FinTech financing volume in June reached $1.1 billion closing out H1 2023 at just under $6 billion, compared with more than $17 billion raised in H1 2022 – see all the details in FT Partners’ infographic: finte.ch/EUMonthlyFinTe… #EUFinTech #EuropeFinTech

European #FinTech M&A volume got a boost in July, reaching $2.1 billion as three of the top five largest European FinTech deals so far in 2023 were announced during the month – see all the details in FT Partners’ infographic: finte.ch/EUMonthlyFinTe… #EUFinTech #EuropeFinTech

European #FinTech financing activity continued at a steady pace in November, with both volume and deal count increasing more than 20% year-over-year – see more details in FT Partners' infographic finte.ch/EUMonthlyFinTe… #EuropeFinTech

With more than $1 billion raised in each of the last four months, European #FinTech financing activity is tracking to surpass 2023 levels, particularly driven by investment activity in the UK – see more details in FT Partners' infographic finte.ch/EUMonthlyFinTe… #EuropeFinTech

European #FinTech financing activity picked up the pace in September with 25+ more deals announced during the month compared to August – see more details in FT Partners' infographic finte.ch/EUMonthlyFinTe… #EuropeFinTech

European #FinTech financing volume totaled $400 million across 45 deals in August, representing a drop in activity from July, but a 2x increase in volume compared to August 2023 - see more in FT Partners' infographic finte.ch/EUMonthlyFinTe… #EuropeFinTech

More than 80% of European #FinTech capital raises in February were early-stage (up to Series A), compared to 66% in January, leading to a lower total dollar volume but a high deal count – see more details in FT Partners' infographic finte.ch/EUMonthlyFinTe… #EuropeFinTech

European #FinTech financing activity reached $5 billion in December, with 2023 finishing at $13 billion in announced volume, representing a 45% decline from 2022 totals - see more in FT Partners' infographic: finte.ch/EUMonthlyFinTe… #EUFinTech #EuropeFinTech

European #FinTech M&A volume reached $1.4 billion in February 2024, driven by Thomson Reuters’ acquisition of Sweden-based e-invoicing platform Pagero – see more in FT Partners' infographic finte.ch/EUMonthlyFinTe… #EUFinTech #EuropeFinTech

Driven by two large deals, European #FinTech financing and M&A volumes in May both exceeded $1 billion representing the largest monthly volumes so far in 2023 – see all the details in FT Partners’ infographic: finte.ch/EUMonthlyFinTe… #EUFinTech #EuropeFinTech

European #FinTech financing volume reached $692 million in January 2024 driven by three $50mm+ rounds, up more than 60% YoY - see more in FT Partners' infographic: finte.ch/EUMonthlyFinTe… #EUFinTech #EuropeFinTech

Europe’s FinTech Firms Raised $3.13 Billion In the First 5 Months of 2018; UK Firms Scored 50% of the Funds bit.ly/2MrZb0k #FinTech #EuropeFinTech #UK #venturecapital #VC

May European #FinTech Deal Activity: $615 million in Financing Volume and $903 million in M&A Volume – For professional / institutional investors only, see all of the details in FT Partners' infographic finte.ch/EUMonthlyFinTe… #EuropeFinTech

The Fintech opportunity for Europe, their ability to set up in the first place, the ease with which they can access capital, and how well they can grow and thrive. Find out more... ow.ly/JfVF50LxjM0 #Fintech #EuropeFintech #FinancialServices

Something went wrong.

Something went wrong.

United States Trends

- 1. Thanksgiving 328K posts

- 2. Trumplican N/A

- 3. Good Wednesday 30.6K posts

- 4. #wednesdaymotivation 4,982 posts

- 5. #PuebloEnBatallaYVictoria 2,410 posts

- 6. #Wednesdayvibe 2,537 posts

- 7. Colorado State 3,466 posts

- 8. Hong Kong 11.2K posts

- 9. Stranger Things Day 3,594 posts

- 10. #BurnoutSyndromeSeriesEP1 196K posts

- 11. Nuns 8,223 posts

- 12. Mora 21.6K posts

- 13. Karoline Leavitt 26.3K posts

- 14. Hump Day 12.7K posts

- 15. Gretzky N/A

- 16. Ribs 11K posts

- 17. Elton 9,291 posts

- 18. Trump Republican 24.6K posts

- 19. Happy Hump 8,575 posts

- 20. 28 Years Later 1,839 posts