#expectationsindex search results

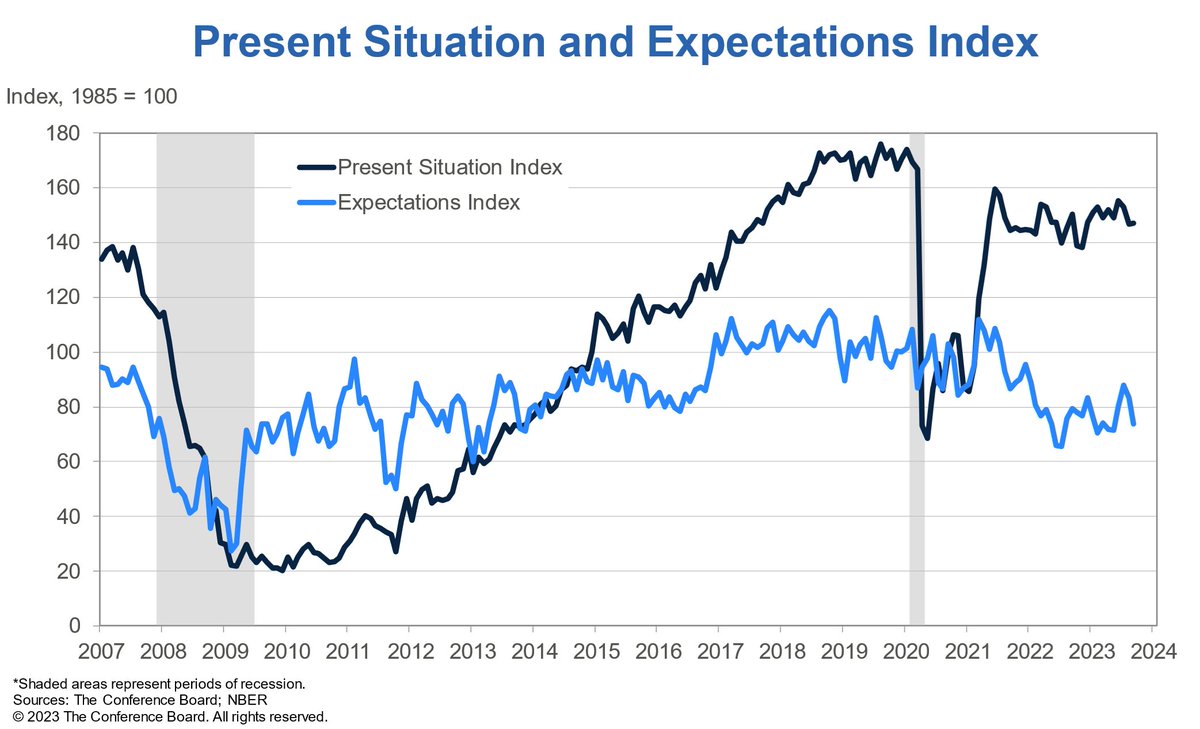

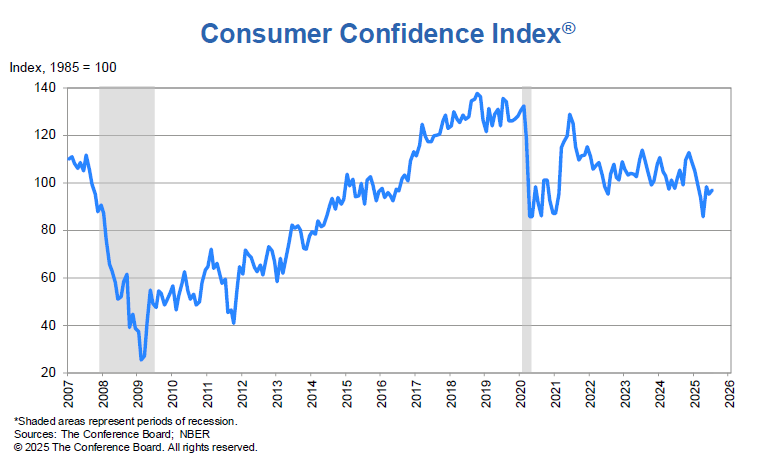

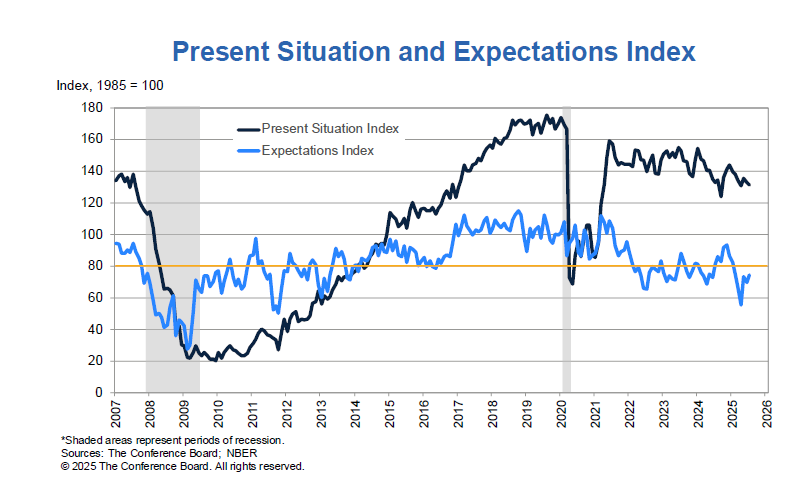

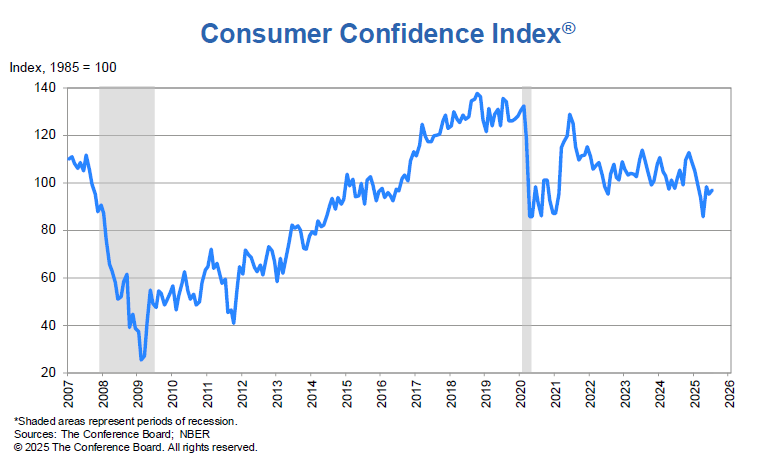

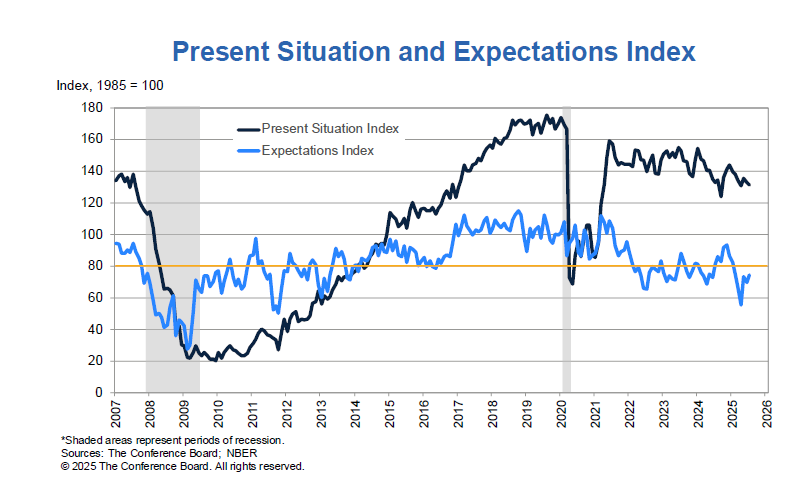

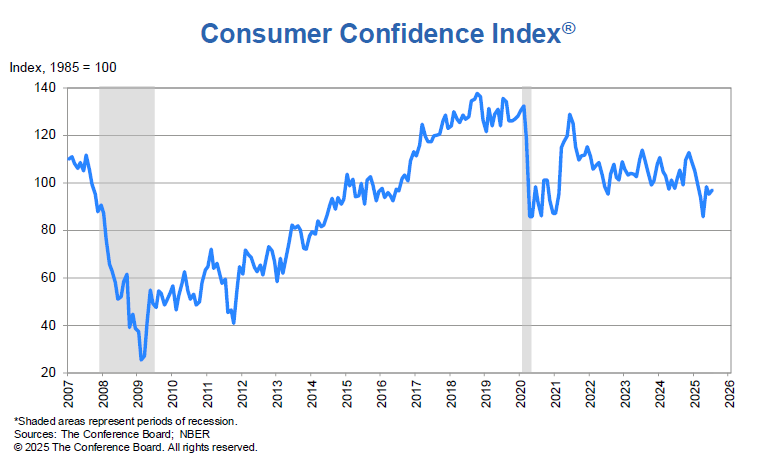

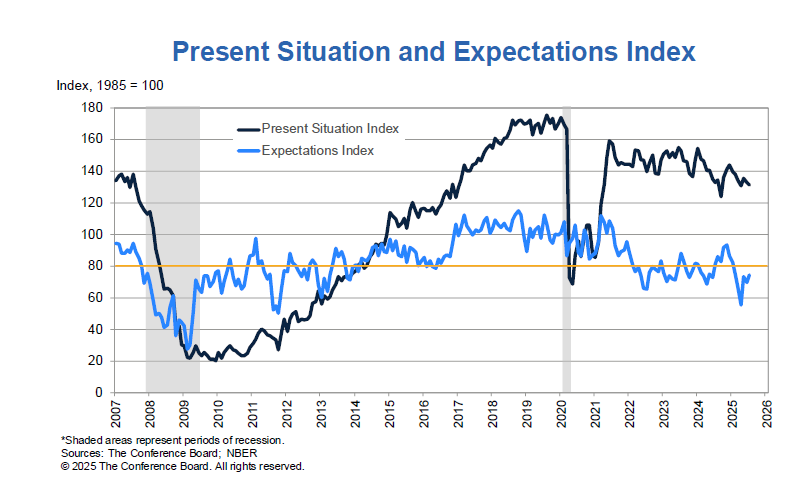

The #ExpectationsIndex plunged 12.5 pts to 54.4, the lowest level since October 2011 and well below the threshold of 80 that usually signals #recession ahead. All expectation components fell sharply, reflecting pervasive pessimism about the future.

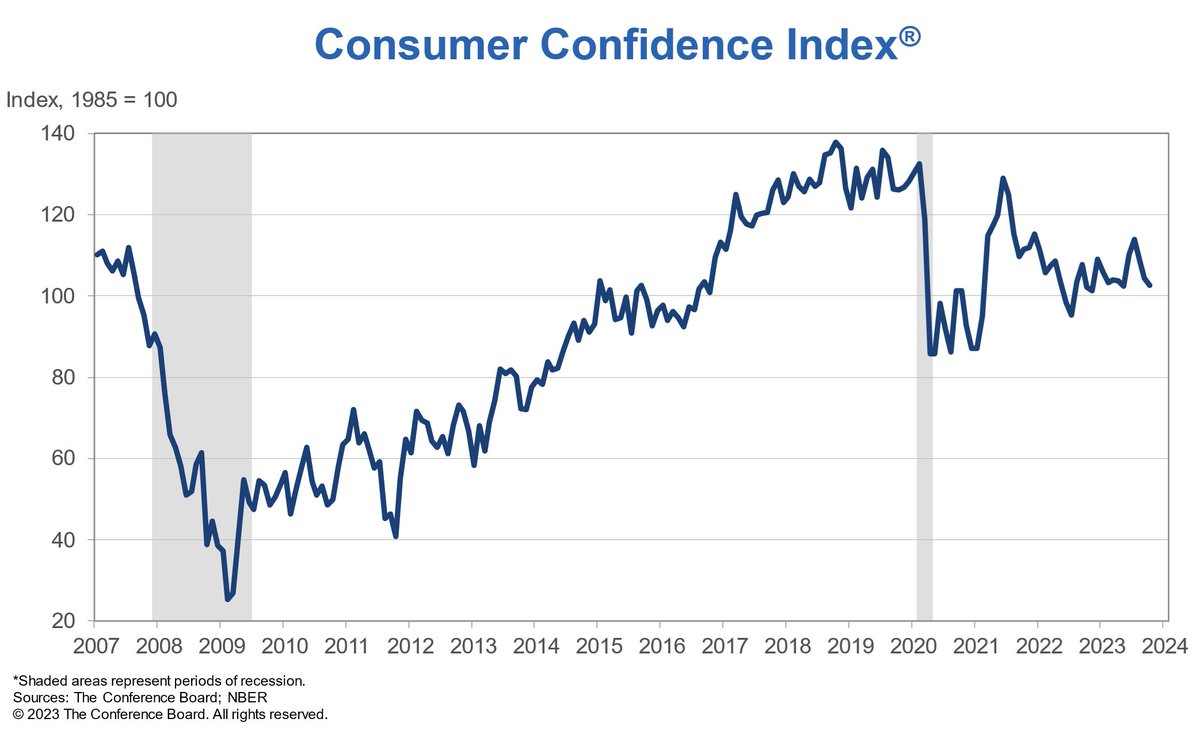

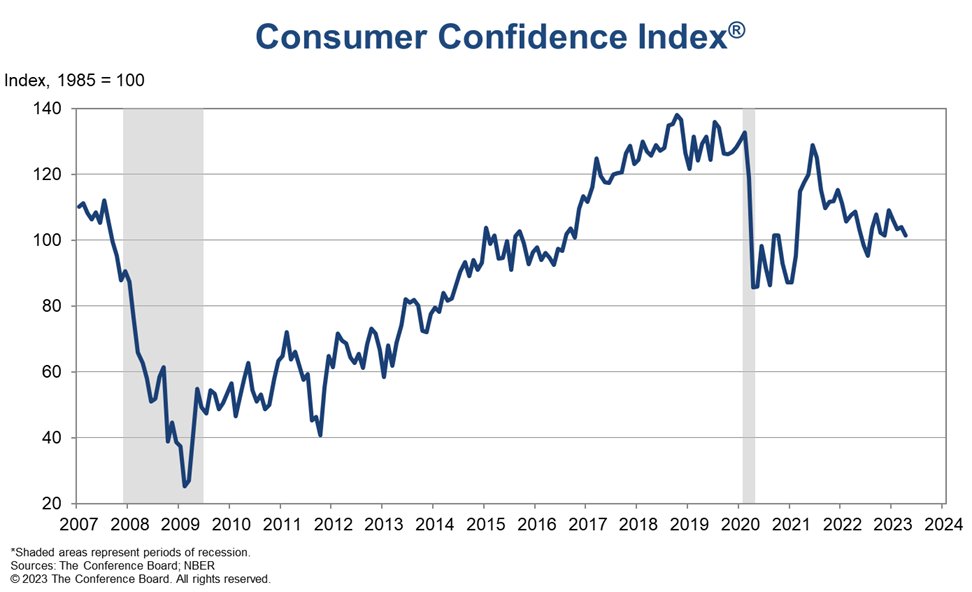

The Conference Board #ConsumerConfidence Index increased in October to 108.7 (1985=100), up from 99.2 in September. The #PresentSituation Index rose 14.2 points to 138.0. The #ExpectationsIndex rose 6.3 points to 89.1, well above the recession threshold of 80.

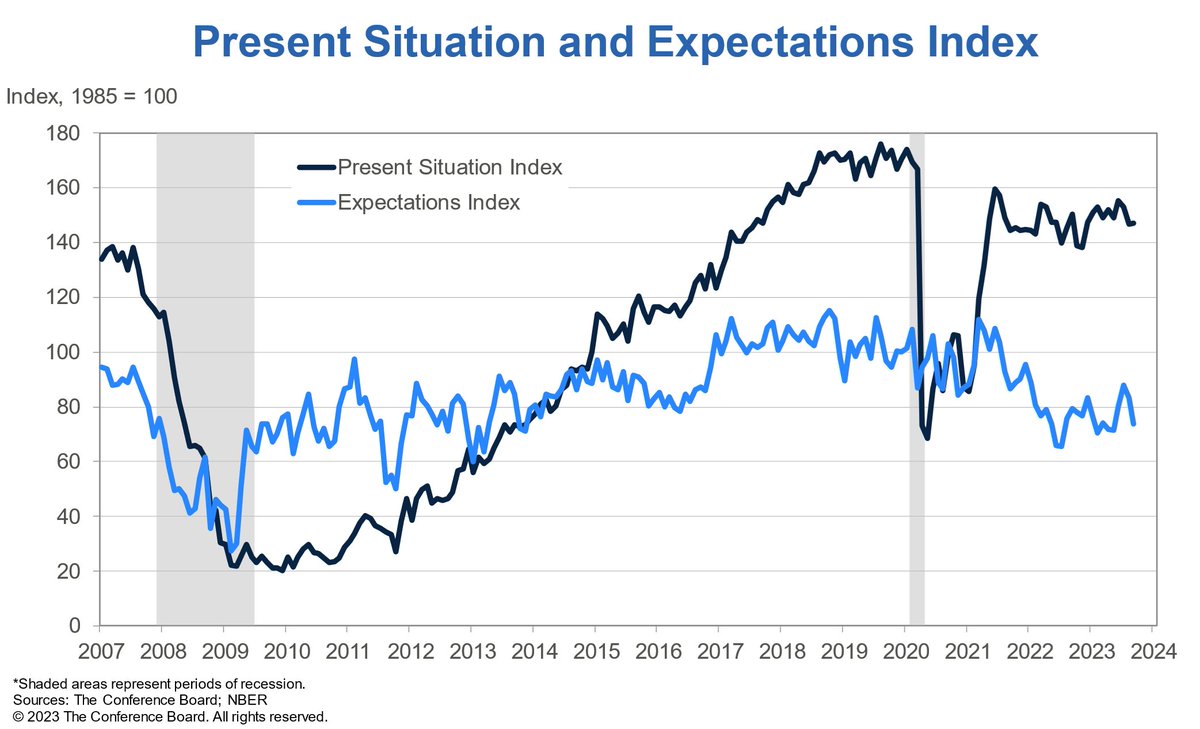

The #PresentSituation Index rose 4.8 pts to 140.9. The #ExpectationsIndex ticked up 0.4 pts to 92.3, well above the threshold of 80 that usually signals a recession ahead.

The #PresentSituation Index—based on consumers’ assessment of current business and labor market conditions—ticked down 0.4 pts to 138.2, from 138.6. The #ExpectationsIndex—based on short-term outlook for income, business, and labor market conditions—rose 5.1 pts to 77.8.

🌡️ The #PresentSituation Index rose to 151.0 in March from 147.6 last month. 🔮The #ExpectationsIndex fell to 73.8 from 76.3, as six-month expectations for #business, #labormarket, and #income conditions all deteriorated. Expectations below 80 often signals #recession ahead.

The #ExpectationsIndex — based on consumers’ short-term outlook for income, business, and labor market conditions — fell 9.6 pts to 65.2. That's well below the threshold of 80 that usually signals a #recession ahead, and #expectations for the future now stand at a 12-year low.

Consumer Confidence Index weakened slightly in June to 100.4 (1985=100), down from 101.3 in May. The #PresentSitutation Index rose 0.7 pts to 141.5. The #ExpectationsIndex fell 1.9 pts to 73.0—its fifth straight month below 80, the threshold which often signals #recession…

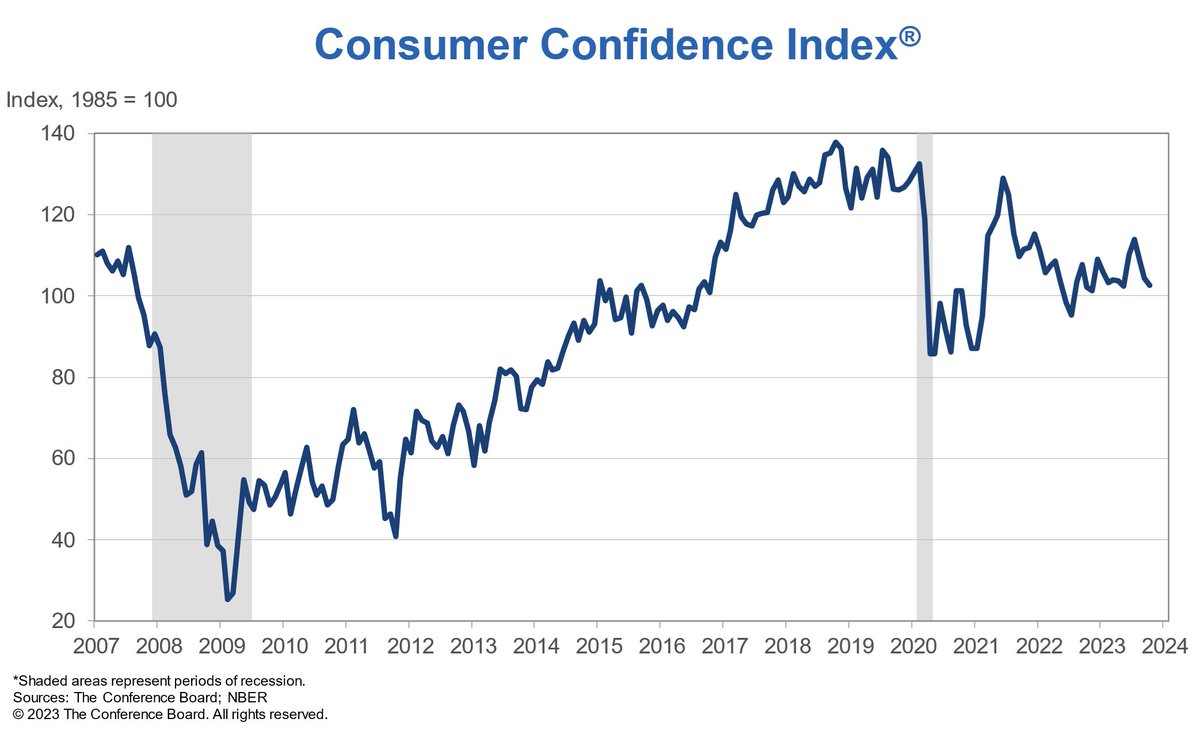

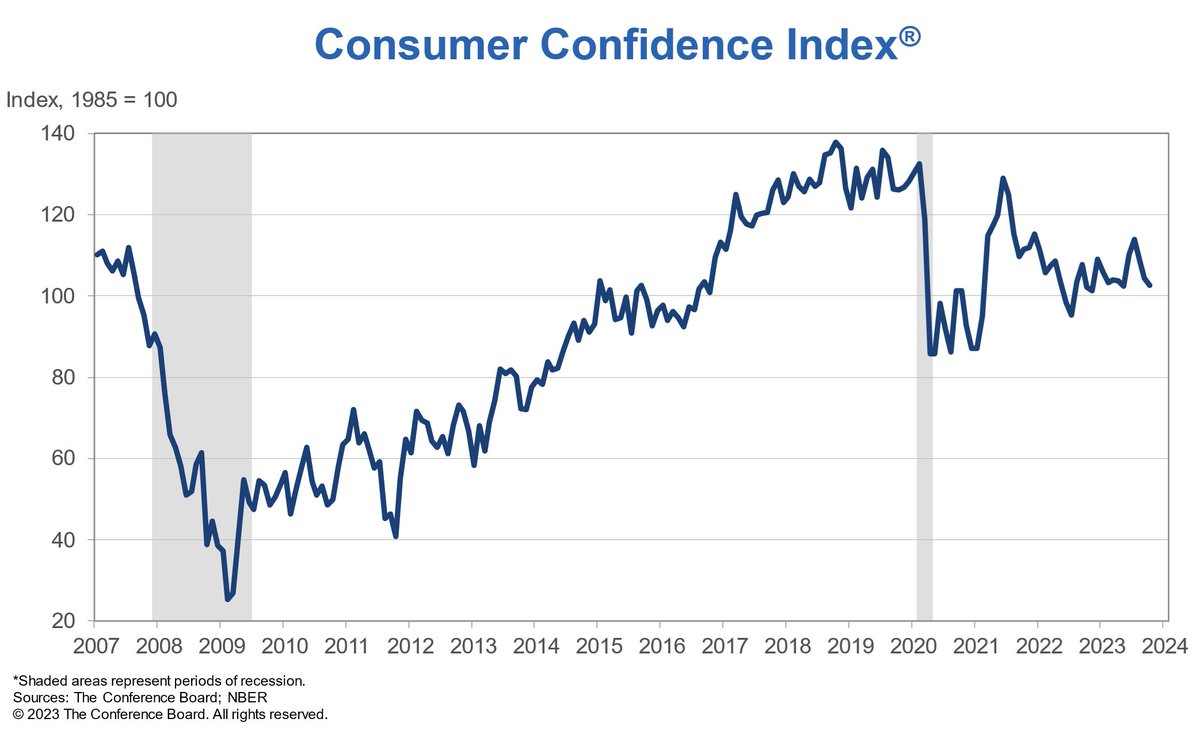

US #ConsumerConfidence fell to 103.0 (1985=100) in September, down from 108.7 (upwardly revised) in August. The #ExpectationsIndex declined for the second straight month, sinking back below the #recession threshold of 80 after gains earlier in 2023. ow.ly/aB0250PPI4N

#ConsumerConfidence weakened slightly in June to 100.4 (1985=100), down from 101.3 in May. The #PresentSitutation Index rose 0.7 pts to 141.5. The #ExpectationsIndex fell 1.9 pts to 73.0—its fifth straight month below 80, the threshold which often signals #recession ahead.

While the #PresentSituation Index ticked down 3.9 points to a still strong 142.9 in April, the Expectations Index fell to 66.4 (1985=100) from 74.0 last month. An #ExpectationsIndex reading below 80 can often signal a forthcoming #recession.

The #PresentSituation Index ticked up 2.5 pts in May to 143.1, while the #ExpectationsIndex rose 5.8 pts to 74.6. Despite this improvement, for the fourth consecutive month, expectations fell below 80—the threshold which often signals #recession ahead.

The Conference Board #ConsumerConfidence Index® inched up by 2.0 points in July to 97.2 (1985=100), from 95.2 in June. The #PresentSituation Index fell 1.5 points to 131.5, while the #ExpectationsIndex rose 4.5 points to 74.4. Read the full report: hubs.li/Q03zhP_p0

#ConsumerConfidence declined again in October, falling 1.7 pts to 102.6 (1985 = 100). The #ExpectationsIndex ticked down further into #recession territory, as US #consumers remain pessimistic—even as they continue to spend big. 🔗 ow.ly/wbxW50Q2C50

The #ExpectationsIndex — based on consumers’ six-month outlook for income, business, and labor market conditions—fell by 1.3 points to 73.4. Expectations have been below the threshold of 80 that typically signals a #recession ahead since February 2025.

🌡️ The #PresentSituation Index fell by 10.3 points in September to 124.3. 🗓️The #ExpectationsIndex declined by 4.6 points to 81.7, but remained above 80. (A reading below the threshold of 80 usually signals a #recession ahead.) Read the full report: conference-board.org/topics/consume…

#ConsumerConfidence fell by 8.1 points in December to 104.7 (1985=100). 🌡️The #PresentSituation Index fell 1.2 pts to 140.2. 🔮The #ExpectationsIndex tumbled 12.6 points to 81.1, just above the threshold of 80 that often signals a #recession ahead. conference-board.org/topics/consume…

The #PresentSituationIndex decreased from 135.3 to 133.6, while the #ExpectationsIndex improved from 72.8 to 78.2. Numbers below the 80 level usually signal a recession ahead.

According to new data released Tuesday morning, The Conference Board's #ConsumerConfidence Index for March came in at a reading of 104.7, little changed from a revised 104.8 in February. However, the "#ExpectationsIndex ,” which tracks consumers' short-term outlook for income,…

The #PresentSituation Index fell back to 147.2 from 154.9 in January. The #ExpectationsIndex slipped to 79.8 from a revised 81.5. A reading below 80 often signals #recession ahead. February's declines were broad-based, impacting most income groups and all ages besides 35-54yo.

The #ExpectationsIndex — based on consumers’ six-month outlook for income, business, and labor market conditions—fell by 1.3 points to 73.4. Expectations have been below the threshold of 80 that typically signals a #recession ahead since February 2025.

The Conference Board #ConsumerConfidence Index® inched up by 2.0 points in July to 97.2 (1985=100), from 95.2 in June. The #PresentSituation Index fell 1.5 points to 131.5, while the #ExpectationsIndex rose 4.5 points to 74.4. Read the full report: hubs.li/Q03zhP_p0

The #ExpectationsIndex plunged 12.5 pts to 54.4, the lowest level since October 2011 and well below the threshold of 80 that usually signals #recession ahead. All expectation components fell sharply, reflecting pervasive pessimism about the future.

The #ExpectationsIndex — based on consumers’ short-term outlook for income, business, and labor market conditions — fell 9.6 pts to 65.2. That's well below the threshold of 80 that usually signals a #recession ahead, and #expectations for the future now stand at a 12-year low.

The #ExpectationsIndex—based on consumers’ short-term outlook for income, business, and labor market conditions—fell 2.6 points to 83.9, but remained above the threshold of 80 that usually signals a #recession ahead. Read the full report: conference-board.org/topics/consume…

#ConsumerConfidence fell by 8.1 points in December to 104.7 (1985=100). 🌡️The #PresentSituation Index fell 1.2 pts to 140.2. 🔮The #ExpectationsIndex tumbled 12.6 points to 81.1, just above the threshold of 80 that often signals a #recession ahead. conference-board.org/topics/consume…

The #PresentSituation Index rose 4.8 pts to 140.9. The #ExpectationsIndex ticked up 0.4 pts to 92.3, well above the threshold of 80 that usually signals a recession ahead.

The Conference Board #ConsumerConfidence Index increased in October to 108.7 (1985=100), up from 99.2 in September. The #PresentSituation Index rose 14.2 points to 138.0. The #ExpectationsIndex rose 6.3 points to 89.1, well above the recession threshold of 80.

🌡️ The #PresentSituation Index fell by 10.3 points in September to 124.3. 🗓️The #ExpectationsIndex declined by 4.6 points to 81.7, but remained above 80. (A reading below the threshold of 80 usually signals a #recession ahead.) Read the full report: conference-board.org/topics/consume…

The #ExpectationsIndex—based on consumers’ short-term outlook for income, business, and labor market conditions—also improved in August, rising 1.4 points to 82.5. That's the second straight month above the threshold of 80. (A reading below 80 often signals recession ahead.)

The #PresentSituationIndex decreased from 135.3 to 133.6, while the #ExpectationsIndex improved from 72.8 to 78.2. Numbers below the 80 level usually signal a recession ahead.

Consumer Confidence Index weakened slightly in June to 100.4 (1985=100), down from 101.3 in May. The #PresentSitutation Index rose 0.7 pts to 141.5. The #ExpectationsIndex fell 1.9 pts to 73.0—its fifth straight month below 80, the threshold which often signals #recession…

#ConsumerConfidence weakened slightly in June to 100.4 (1985=100), down from 101.3 in May. The #PresentSitutation Index rose 0.7 pts to 141.5. The #ExpectationsIndex fell 1.9 pts to 73.0—its fifth straight month below 80, the threshold which often signals #recession ahead.

The #PresentSituation Index ticked up 2.5 pts in May to 143.1, while the #ExpectationsIndex rose 5.8 pts to 74.6. Despite this improvement, for the fourth consecutive month, expectations fell below 80—the threshold which often signals #recession ahead.

While the #PresentSituation Index ticked down 3.9 points to a still strong 142.9 in April, the Expectations Index fell to 66.4 (1985=100) from 74.0 last month. An #ExpectationsIndex reading below 80 can often signal a forthcoming #recession.

According to new data released Tuesday morning, The Conference Board's #ConsumerConfidence Index for March came in at a reading of 104.7, little changed from a revised 104.8 in February. However, the "#ExpectationsIndex ,” which tracks consumers' short-term outlook for income,…

🌡️ The #PresentSituation Index rose to 151.0 in March from 147.6 last month. 🔮The #ExpectationsIndex fell to 73.8 from 76.3, as six-month expectations for #business, #labormarket, and #income conditions all deteriorated. Expectations below 80 often signals #recession ahead.

The #PresentSituation Index fell back to 147.2 from 154.9 in January. The #ExpectationsIndex slipped to 79.8 from a revised 81.5. A reading below 80 often signals #recession ahead. February's declines were broad-based, impacting most income groups and all ages besides 35-54yo.

The #PresentSituation Index—based on consumers’ assessment of current business and labor market conditions—ticked down 0.4 pts to 138.2, from 138.6. The #ExpectationsIndex—based on short-term outlook for income, business, and labor market conditions—rose 5.1 pts to 77.8.

#ConsumerConfidence declined again in October, falling 1.7 pts to 102.6 (1985 = 100). The #ExpectationsIndex ticked down further into #recession territory, as US #consumers remain pessimistic—even as they continue to spend big. 🔗 ow.ly/wbxW50Q2C50

The #PresentSituation Index—based on consumers’ assessment of current business and labor market conditions—ticked down 0.4 pts to 138.2, from 138.6. The #ExpectationsIndex—based on short-term outlook for income, business, and labor market conditions—rose 5.1 pts to 77.8.

The #PresentSituation Index rose 4.8 pts to 140.9. The #ExpectationsIndex ticked up 0.4 pts to 92.3, well above the threshold of 80 that usually signals a recession ahead.

🌡️ The #PresentSituation Index rose to 151.0 in March from 147.6 last month. 🔮The #ExpectationsIndex fell to 73.8 from 76.3, as six-month expectations for #business, #labormarket, and #income conditions all deteriorated. Expectations below 80 often signals #recession ahead.

While the #PresentSituation Index ticked down 3.9 points to a still strong 142.9 in April, the Expectations Index fell to 66.4 (1985=100) from 74.0 last month. An #ExpectationsIndex reading below 80 can often signal a forthcoming #recession.

The #ExpectationsIndex plunged 12.5 pts to 54.4, the lowest level since October 2011 and well below the threshold of 80 that usually signals #recession ahead. All expectation components fell sharply, reflecting pervasive pessimism about the future.

🌡️ The #PresentSituation Index fell by 10.3 points in September to 124.3. 🗓️The #ExpectationsIndex declined by 4.6 points to 81.7, but remained above 80. (A reading below the threshold of 80 usually signals a #recession ahead.) Read the full report: conference-board.org/topics/consume…

#ConsumerConfidence slipped in May to 102.3 (1985=100), down from 103.7 in April. 🌡️ #PresentSituation Index fell 3.2 pts to 148.6. 📉#ExpectationsIndex fell 0.2 pts to 71.5—and has now been below 80 every month except one since Feb 2022. Full Report: ow.ly/jOGV50OzzuU

The #PresentSituation Index ticked up 2.5 pts in May to 143.1, while the #ExpectationsIndex rose 5.8 pts to 74.6. Despite this improvement, for the fourth consecutive month, expectations fell below 80—the threshold which often signals #recession ahead.

#ConsumerConfidence fell 2.7pts in April to 101.3 (1985=100). The short-term #ExpectationsIndex fell 5.9pts to 74.0 and has now remained below 80—the level associated with a #recession within the next year—every month since February 2022 besides December. ow.ly/N75q50NRrO5

The #ExpectationsIndex — based on consumers’ short-term outlook for income, business, and labor market conditions — fell 9.6 pts to 65.2. That's well below the threshold of 80 that usually signals a #recession ahead, and #expectations for the future now stand at a 12-year low.

Consumer Confidence Index weakened slightly in June to 100.4 (1985=100), down from 101.3 in May. The #PresentSitutation Index rose 0.7 pts to 141.5. The #ExpectationsIndex fell 1.9 pts to 73.0—its fifth straight month below 80, the threshold which often signals #recession…

US #ConsumerConfidence fell to 103.0 (1985=100) in September, down from 108.7 (upwardly revised) in August. The #ExpectationsIndex declined for the second straight month, sinking back below the #recession threshold of 80 after gains earlier in 2023. ow.ly/aB0250PPI4N

#ConsumerConfidence weakened slightly in June to 100.4 (1985=100), down from 101.3 in May. The #PresentSitutation Index rose 0.7 pts to 141.5. The #ExpectationsIndex fell 1.9 pts to 73.0—its fifth straight month below 80, the threshold which often signals #recession ahead.

#ConsumerConfidence declined again in October, falling 1.7 pts to 102.6 (1985 = 100). The #ExpectationsIndex ticked down further into #recession territory, as US #consumers remain pessimistic—even as they continue to spend big. 🔗 ow.ly/wbxW50Q2C50

#ConsumerConfidence fell by 8.1 points in December to 104.7 (1985=100). 🌡️The #PresentSituation Index fell 1.2 pts to 140.2. 🔮The #ExpectationsIndex tumbled 12.6 points to 81.1, just above the threshold of 80 that often signals a #recession ahead. conference-board.org/topics/consume…

The Conference Board #ConsumerConfidence Index increased in October to 108.7 (1985=100), up from 99.2 in September. The #PresentSituation Index rose 14.2 points to 138.0. The #ExpectationsIndex rose 6.3 points to 89.1, well above the recession threshold of 80.

The Conference Board #ConsumerConfidence Index® inched up by 2.0 points in July to 97.2 (1985=100), from 95.2 in June. The #PresentSituation Index fell 1.5 points to 131.5, while the #ExpectationsIndex rose 4.5 points to 74.4. Read the full report: hubs.li/Q03zhP_p0

Something went wrong.

Something went wrong.

United States Trends

- 1. #WWERaw 72.6K posts

- 2. Moe Odum N/A

- 3. Brock 39.3K posts

- 4. Bryce 20.8K posts

- 5. Panthers 37.4K posts

- 6. Finch 14.2K posts

- 7. Timberwolves 3,697 posts

- 8. 49ers 41.2K posts

- 9. Gonzaga 3,949 posts

- 10. Canales 13.3K posts

- 11. Keegan Murray 1,365 posts

- 12. Penta 10.5K posts

- 13. Niners 5,807 posts

- 14. #FTTB 5,785 posts

- 15. Amen Thompson 2,129 posts

- 16. Malik Monk N/A

- 17. Mac Jones 4,931 posts

- 18. Jauan Jennings 2,798 posts

- 19. Gunther 15.2K posts

- 20. Zags N/A