#feddata search results

The Federal Reserve has revised its indexes of industrial production, capacity, and utilization using benchmark data. Manufacturing production, capacity growth, and utilization are revised down over the past five years. federalreserve.gov/releases/g17/R… #FedData (1/3)

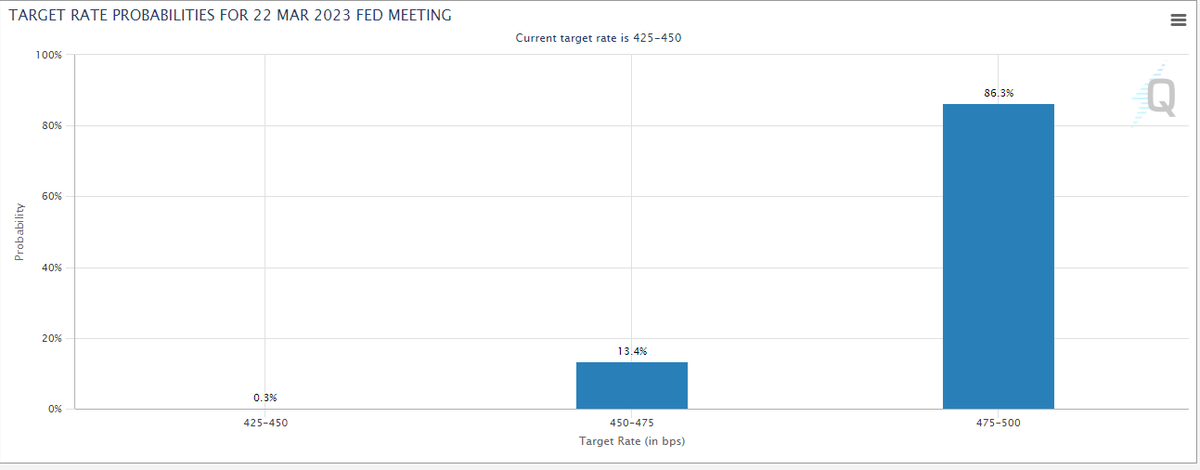

Wednesday’s JOLTs came out slightly above estimates. Powell will be looking closely at today’s payroll data and #unemployment numbers. If payrolls come out above estimates /unemployment flat or down…faster hikes will be confirmed! Very bearish 🐻⚠️ #FedData #markets #econ

In 1993 everyone I knew was excited for #Nirvana’s new album. In 2023 everyone I know is excited about #CPIdata. We should all be ashamed of how lame we have become. #FedData #stockmarkets

Manufacturing output now declines more than 1-1/2%, on net, from Feb 2020 through Aug 2025, whereas output was previously estimated to have risen over that period. The largest revision to output growth is in 2022. federalreserve.gov/releases/g17/R… #FedData (2/3)

U.S. CPI: +3% YEAR-OVER-YEAR (EST. +3.1%) U.S. CORE CPI: +3.3% YEAR-OVER-YEAR (EST. +3.4%)

I’ve been calling this out since last year. When these diamond hands are at zero, they’ll come back to work. This is why we had an unexpected surge in hires on the last report. This is quite sad. wsj.com/articles/once-… #FedData #inflation #fiag

Bugün saat 15:30’da ABD tarım dışı istihdam verisi açıklanacak. Mart ayı(gerçekleşen); 228K Nisan ayı(beklenen): 124K Veri Fed’in faiz politikaları açısından belirleyici olacaktır. #bist100 #FedData #ABD

📊 Watch Now: Andrew Housser, Achieve's Co-CEO and Co-Founder, breaks down the latest Fed data with Erica Bigley, Achieve’s VP of Communications. #welcometoachieve #feddata #financenews

NIFTY 20% DROP COMING? The last Nifty Bear Rally Started just around FED 2024 Rate Cut in Sept. The next FED Rate cut is being anticipated in Sept 2025. Is it a coincidence that we have formed Inverted Hammer on Weekly? Experts can comment. #nifty #niftycrash #FedData

According to evolving economic #FedData, we can expect further hikes in #InterestRates. Explore the benefits of a diversified cash management strategy in our latest report: ms.spr.ly/6017gq5B1

Global markets remain uncertain as investors weigh US jobs data. With 142k jobs added in Aug, the Fed is on track for a rate cut this month. #FedData. trendsmena.com/uncategorized/…

Consumer demand for auto loans is growing amid eased credit standards. #FedData #autofinance hubs.ly/Q03Bs5PD0

Chair Powell said, "the time has come for policy to adjust." How will this impact your bond portfolio? Listen to @PIMCO’s Jerome Schneider and me during this important webinar. Free registration. 1 CE credit: bit.ly/4dLKS2u #FedData #FederalReserve #TheFed #BondMarket

🇺🇸 Fed Jerome Powell says the Fed will never launch a digital currency CBDC. Banks win, Bitcoin pumps, and traders gear up for big market moves! #trading #FedData #StockMarketNews #India #Nifty

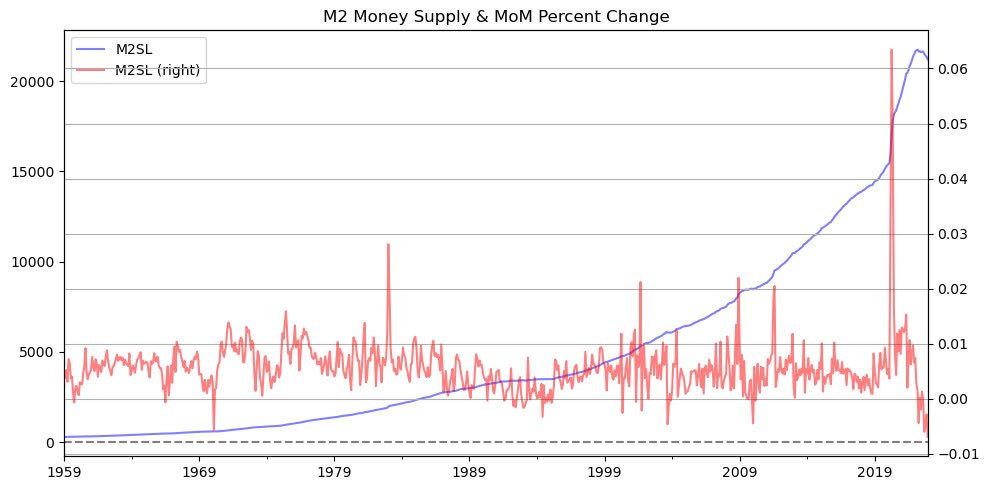

Fed data shows net interest payments absolutely exploding. That's a lot of new money flowing into the system. #FedData #Macro #Crypto

Manufacturing output now declines more than 1-1/2%, on net, from Feb 2020 through Aug 2025, whereas output was previously estimated to have risen over that period. The largest revision to output growth is in 2022. federalreserve.gov/releases/g17/R… #FedData (2/3)

The Federal Reserve has revised its indexes of industrial production, capacity, and utilization using benchmark data. Manufacturing production, capacity growth, and utilization are revised down over the past five years. federalreserve.gov/releases/g17/R… #FedData (1/3)

Now available: Weekly data on the H.8 release, Assets and Liabilities of Commercial Banks in the United States #FedData federalreserve.gov/releases/h8/cu…

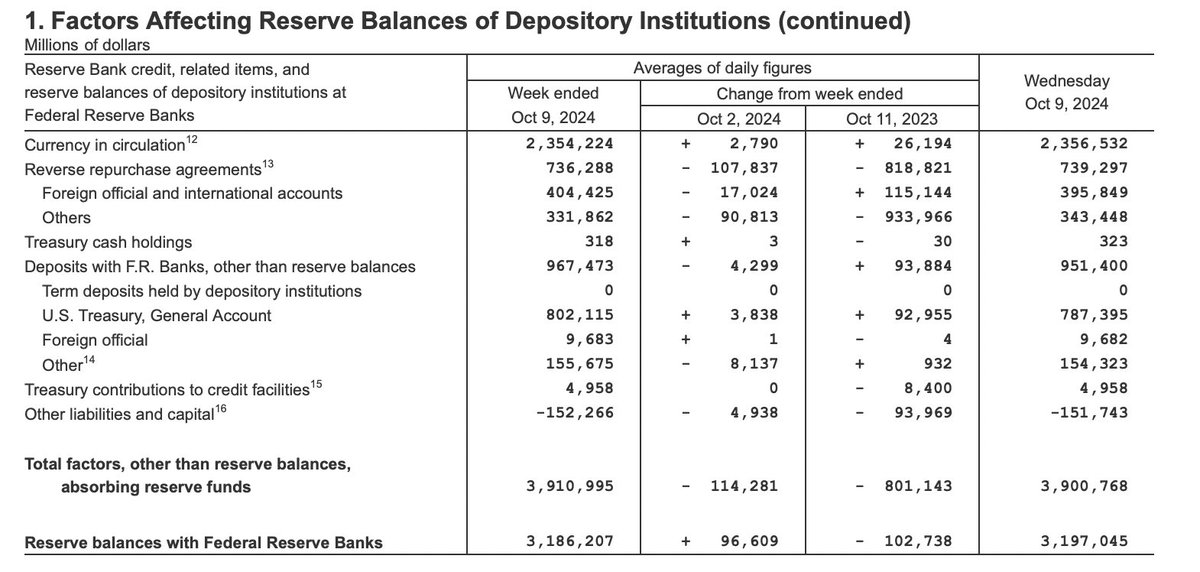

Interactive guide to our weekly #BalanceSheet report: federalreserve.gov/monetarypolicy… #FedData

Our weekly #BalanceSheet update: federalreserve.gov/releases/h41/c… #FedData

Now available: Weekly data on the H.8 release, Assets and Liabilities of Commercial Banks in the United States #FedData federalreserve.gov/releases/h8/cu…

Interactive guide to our weekly #BalanceSheet report: federalreserve.gov/monetarypolicy… #FedData

Our weekly #BalanceSheet update: federalreserve.gov/releases/h41/c… #FedData

Fed balance sheet insights: Peak $9T in 2020 → $6.6T now QT ends Dec 1, 2025 Repo market stress prompts reserve monitoring Asset purchases to maintain liquidity imminent Possible shorter debt duration strategy #FedData

Now available: Weekly data on the H.8 release, Assets and Liabilities of Commercial Banks in the United States #FedData federalreserve.gov/releases/h8/cu…

Interactive guide to our weekly #BalanceSheet report: federalreserve.gov/monetarypolicy… #FedData

Our weekly #BalanceSheet update: federalreserve.gov/releases/h41/c… #FedData

Now available: Weekly data on the H.8 release, Assets and Liabilities of Commercial Banks in the United States #FedData federalreserve.gov/releases/h8/cu…

Interactive guide to our weekly #BalanceSheet report: federalreserve.gov/monetarypolicy… #FedData

Our weekly #BalanceSheet update: federalreserve.gov/releases/h41/c… #FedData

Likidite dalgaları piyasada değil, bilançolarda başlar. Her döngünün başlangıç noktası H.8’dir. 🌊 #RBMasterClass #RBMacroView #FedData

Now available: Weekly data on the H.8 release, Assets and Liabilities of Commercial Banks in the United States #FedData federalreserve.gov/releases/h8/cu…

Interactive guide to our weekly #BalanceSheet report: federalreserve.gov/monetarypolicy… #FedData

Our weekly #BalanceSheet update: federalreserve.gov/releases/h41/c… #FedData

Wednesday’s JOLTs came out slightly above estimates. Powell will be looking closely at today’s payroll data and #unemployment numbers. If payrolls come out above estimates /unemployment flat or down…faster hikes will be confirmed! Very bearish 🐻⚠️ #FedData #markets #econ

📊U.S. DECEMBER CORE CPI INFLATION RISES 5.7% Y/Y; EST. 5.7%; PREV. 6.0% #FedData #CPI #inflation #USDT

The Fed's next moves are uncertain, keeping the USD sensitive to inflation data, employment reports, and broader risk sentiment. Happy New month🥰💯📊📈 traders #FedData #trading #Crypto #exness

Markets to Crash during rate cuts ? What does history tell us? Interesting take by Alok Jain of @WeekendInvestng #ratecut #InterestRates #FedData #rbipolicy

In 1993 everyone I knew was excited for #Nirvana’s new album. In 2023 everyone I know is excited about #CPIdata. We should all be ashamed of how lame we have become. #FedData #stockmarkets

Data is Mixed nanbas...Payroll : 223k vs Forecasted of 200k and unemployment rate : 3.5% vs Forecasted of 3.7% #US #FedData #Fed #unemployment #Bitcoin #Crypto #CryptoNews #BTC

NIFTY 20% DROP COMING? The last Nifty Bear Rally Started just around FED 2024 Rate Cut in Sept. The next FED Rate cut is being anticipated in Sept 2025. Is it a coincidence that we have formed Inverted Hammer on Weekly? Experts can comment. #nifty #niftycrash #FedData

Quiet day today - Jobless claims tomorrow Next Week is CPI data as well as Monthly Options expirations. #marketcalendar $SPY #FedData

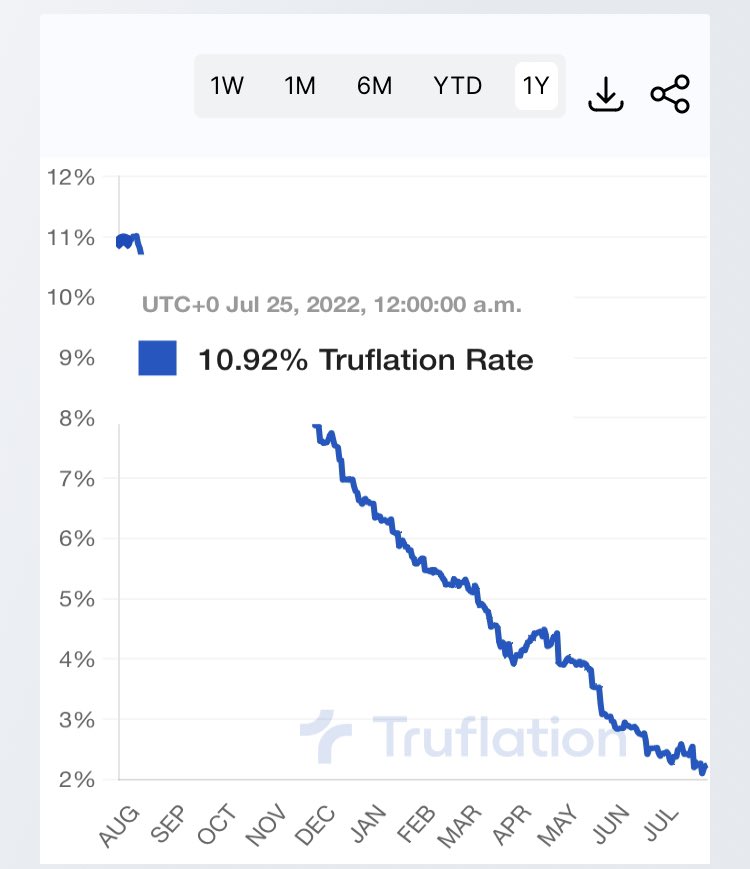

From July last year inflation is coming down fast perhaps too fast, with another rate hike looming are we entering a deflationary period? #Macro #FED #FedData #market #inflation #deflationary #BTC #Crypto #economy

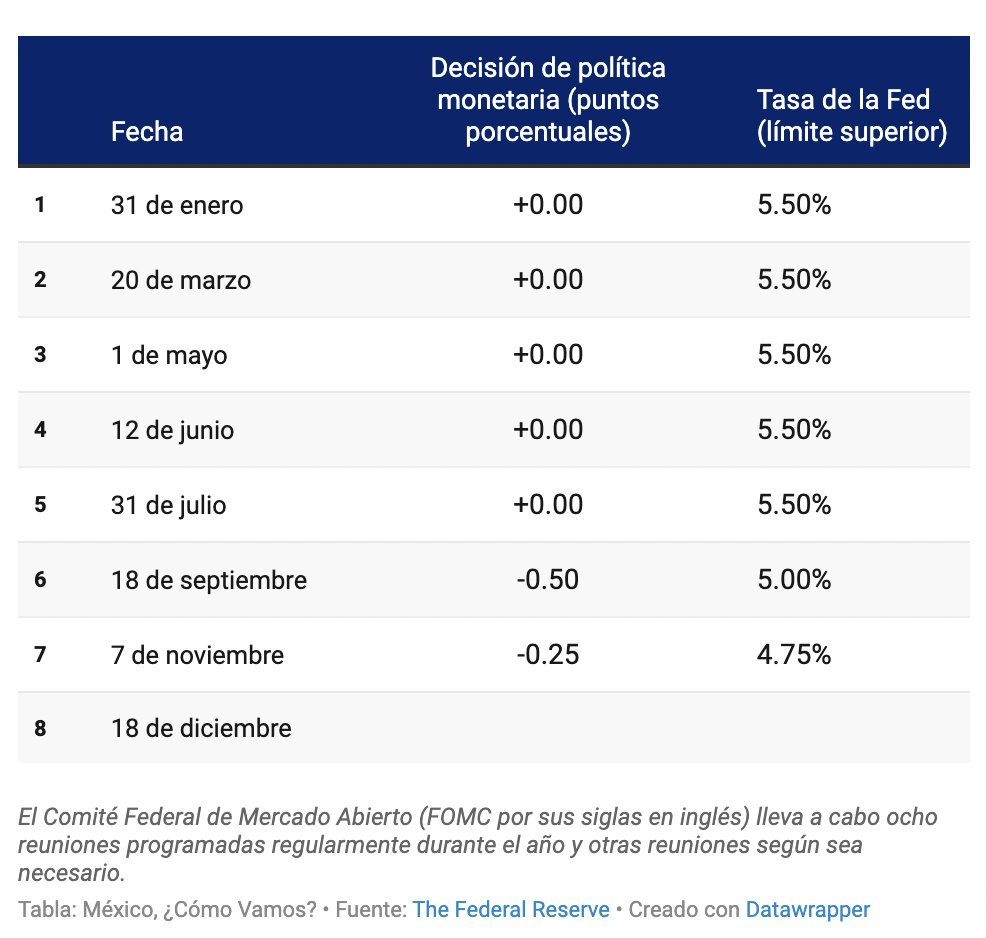

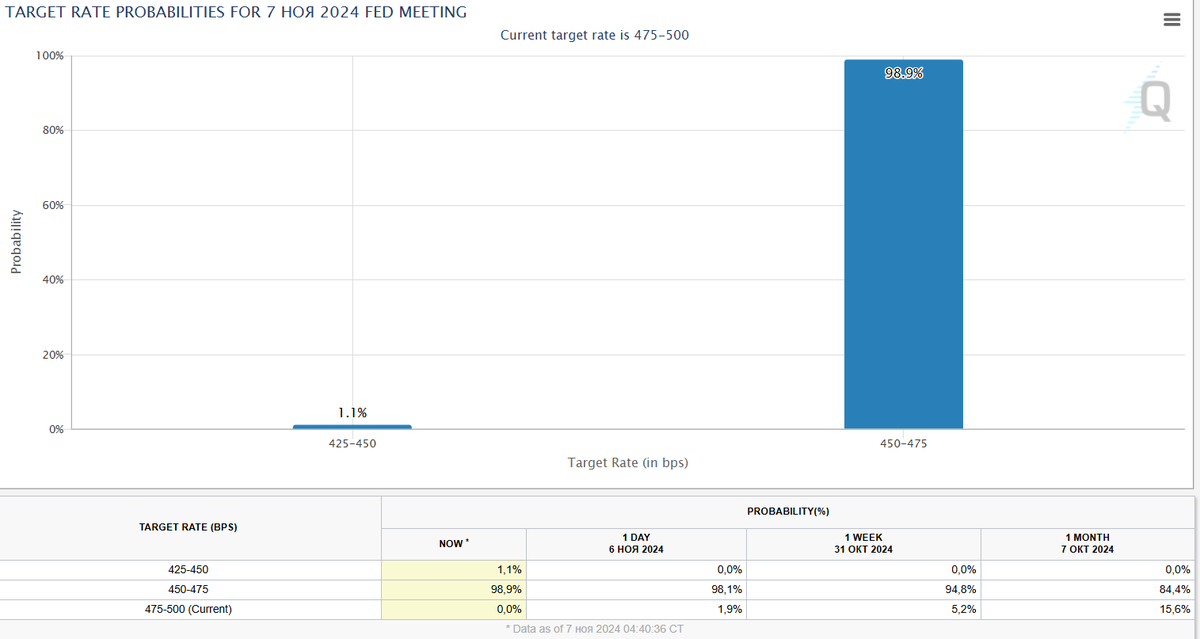

#FedData #FelizMiercoles 🏦🇺🇸Como era ampliamente esperado, la Fed redujo el rango objetivo de la tasa de los fondos federales en 25 pb, a un rango de 4.50% - 4.75%, luego del recorte de 50 pb en septiembre, en línea con las expectativas.

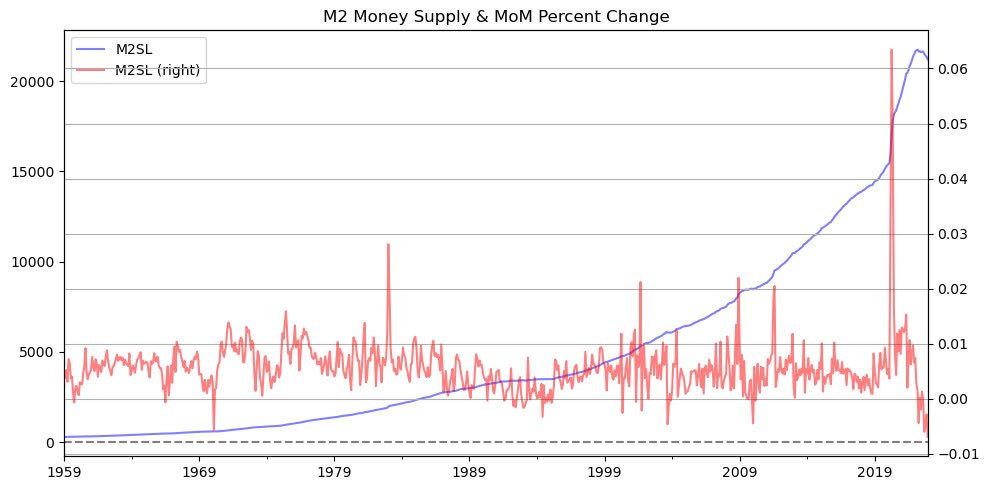

M2 Savings Rate,Total Credit Card Debt and Effective Federal Funds Rate Earliest Date 2019-06-28 Newest Date 2024-05-31 #FED #federalreserve #feddata #M2 #InterestRates #Debt

Investors are in “wait-and-watch mode” before Powell’s speech, while currencies and oil are moving slightly on global economic signals. #FedData #USEconomicData #ratecut #CurrencyRevaluation #USA #powell #LCDLFMX3 #StrayKids #LaCasaDeLosFamososMx #AHOF #paofc #Finance

There is a 98.9% probability that the Fed Funds rate will be cut by 25 bps today. The Fed may reconsider its monetary policy at its December meeting (will not cut the rate) when the chairmen fully understand Donald Trump's economic plans #FedData #trading #investing

Does anyone think the large drop in the weekly RRPs for the Fed have anything to do with the aberration of the high SOFR on 1st and 2nd Oct, that was attributed to balance sheet issues of primary dealers. #FedData #Banks

Something went wrong.

Something went wrong.

United States Trends

- 1. Araujo 186K posts

- 2. Chelsea 648K posts

- 3. Barca 259K posts

- 4. Estevao 267K posts

- 5. Barcelona 463K posts

- 6. Yamal 202K posts

- 7. Ferran 78.6K posts

- 8. Oklahoma State 4,865 posts

- 9. Eric Morris 3,307 posts

- 10. Hazel 9,376 posts

- 11. Godzilla 25.9K posts

- 12. Skippy 5,164 posts

- 13. Cucurella 104K posts

- 14. Witkoff 62.6K posts

- 15. Leftover 6,287 posts

- 16. Raising Arizona 1,884 posts

- 17. Rashford 24.4K posts

- 18. Flick 50.5K posts

- 19. Cooks 12.3K posts

- 20. Kounde 50.7K posts