#filenow search results

Don’t Wait to File — Even Without Full Medical Records Listen to the full episode in the bio link. bio.link/ericpines #FileNow #DisabilityFiling #SSDIAdvice #StartTheProcess #DontWait

2025 TAX SEASON ALERT! AVOID PENALTIES. FILE NOW & GET REFUND FAST! #filenow #ITR2025 #viralvideo #DiscoverAustralia #viralseason #ForYouPage (#FYP) #WorkFromHome

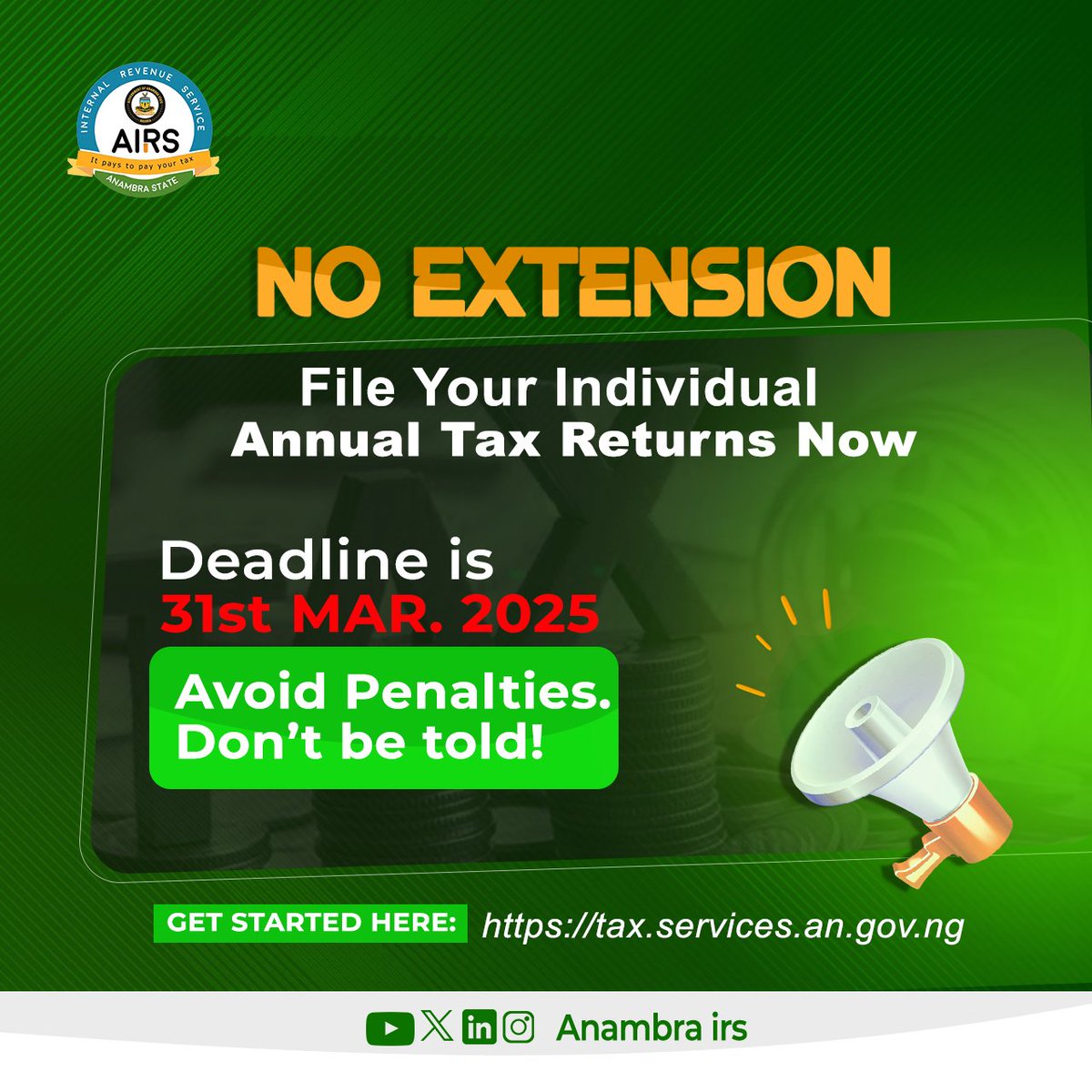

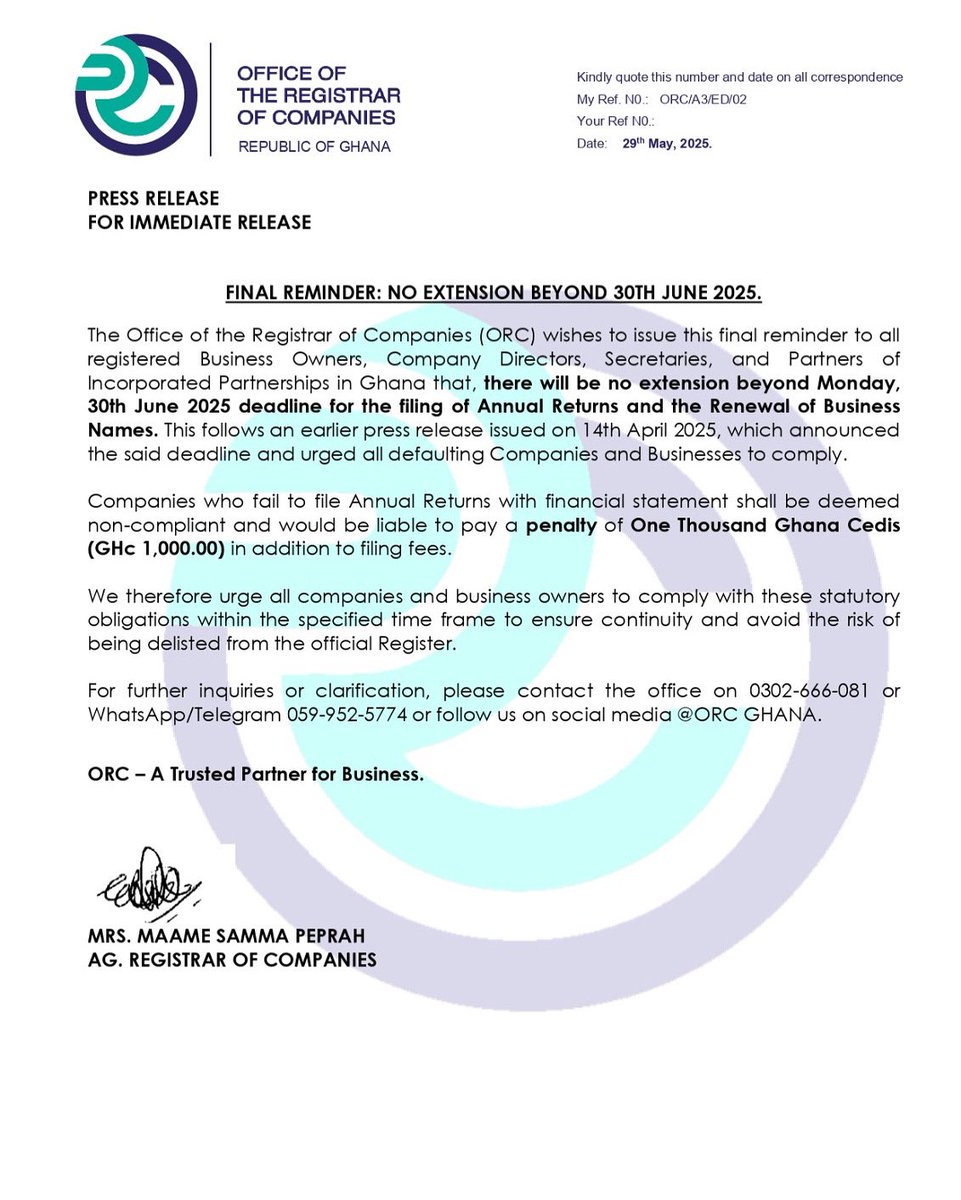

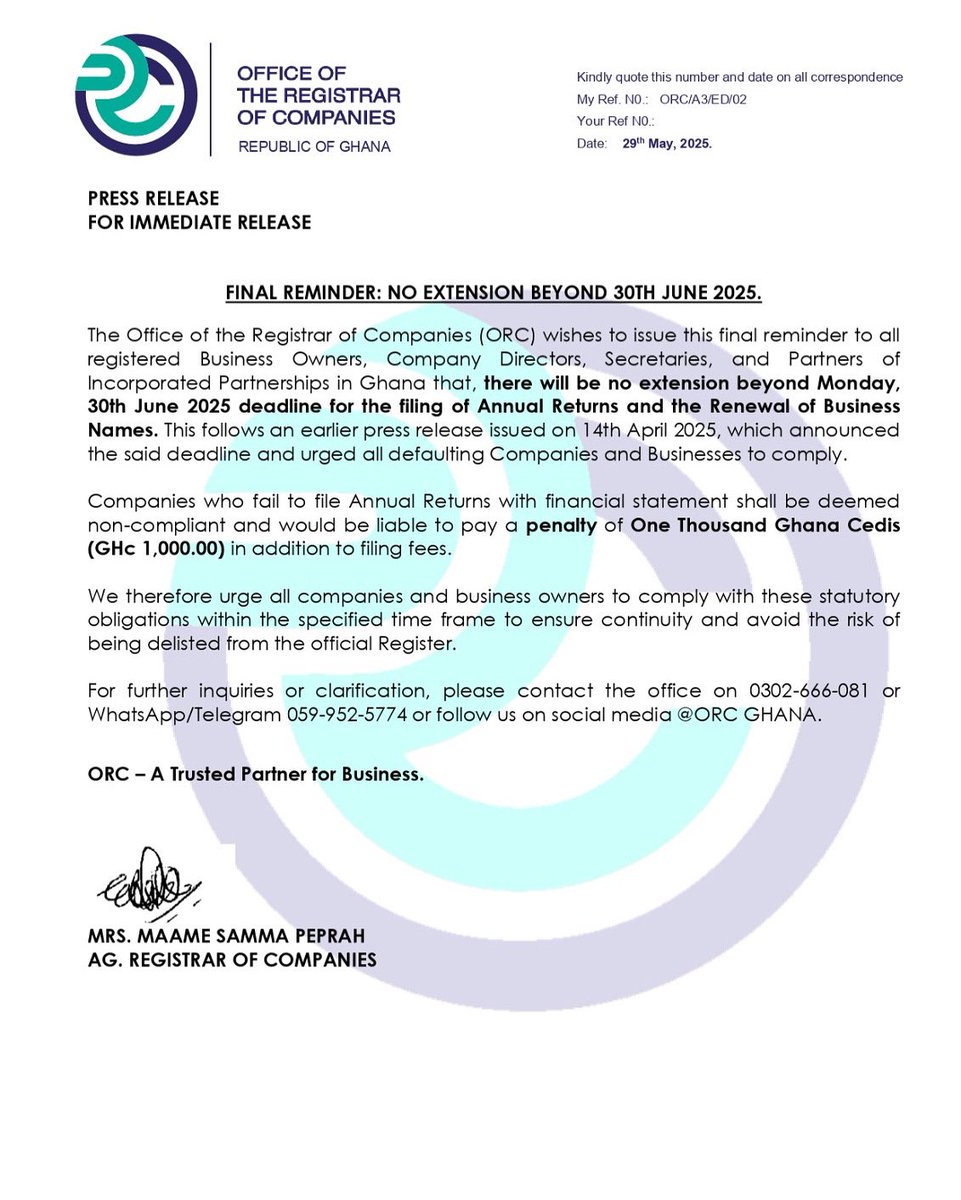

🚨 FINAL REMINDER 🚨 NO EXTENSION BEYOND 30TH JUNE, 2025. #ORCGhana #BusinessCompliance #FileNow #GhanaBusiness #AnnualReturns #BusinessRenewal #DeadlineAlert #NoExtension #ComplianceMatters

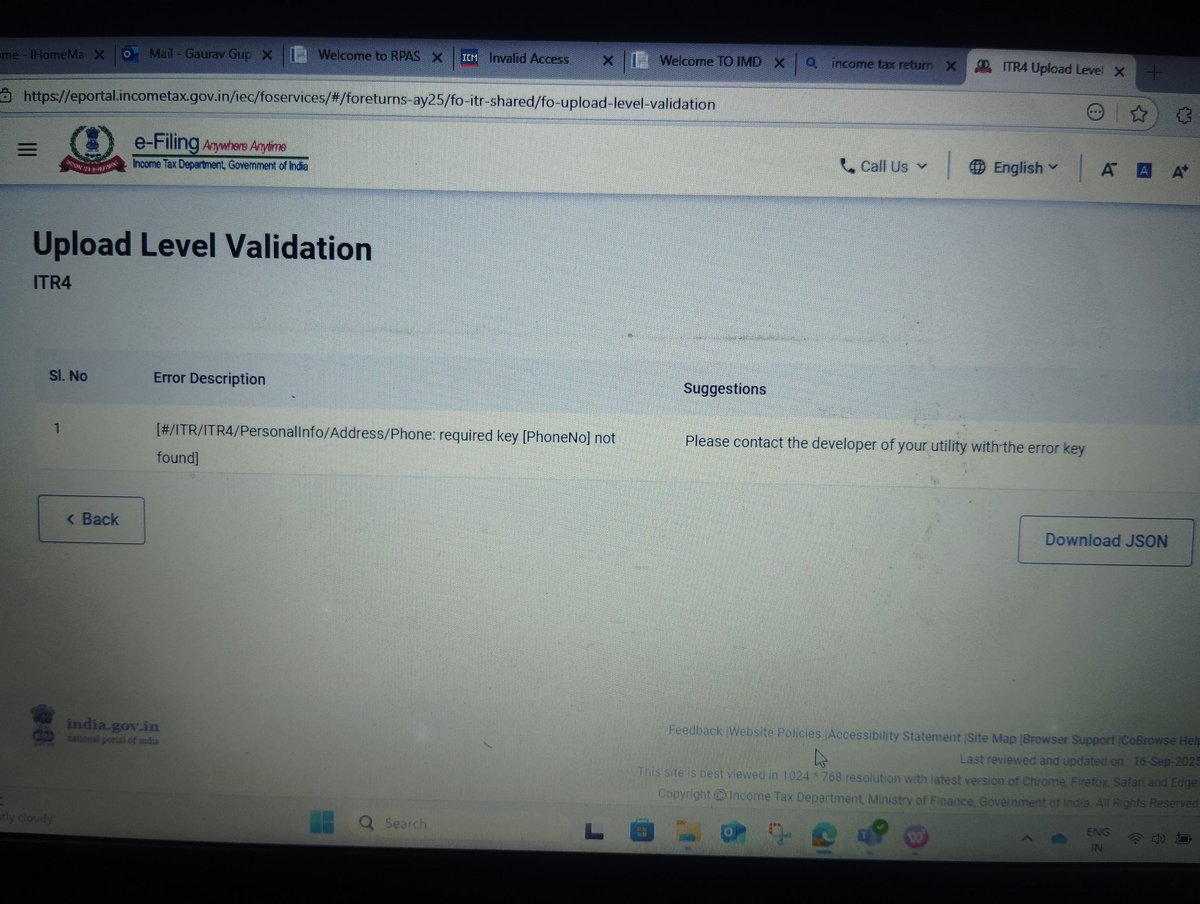

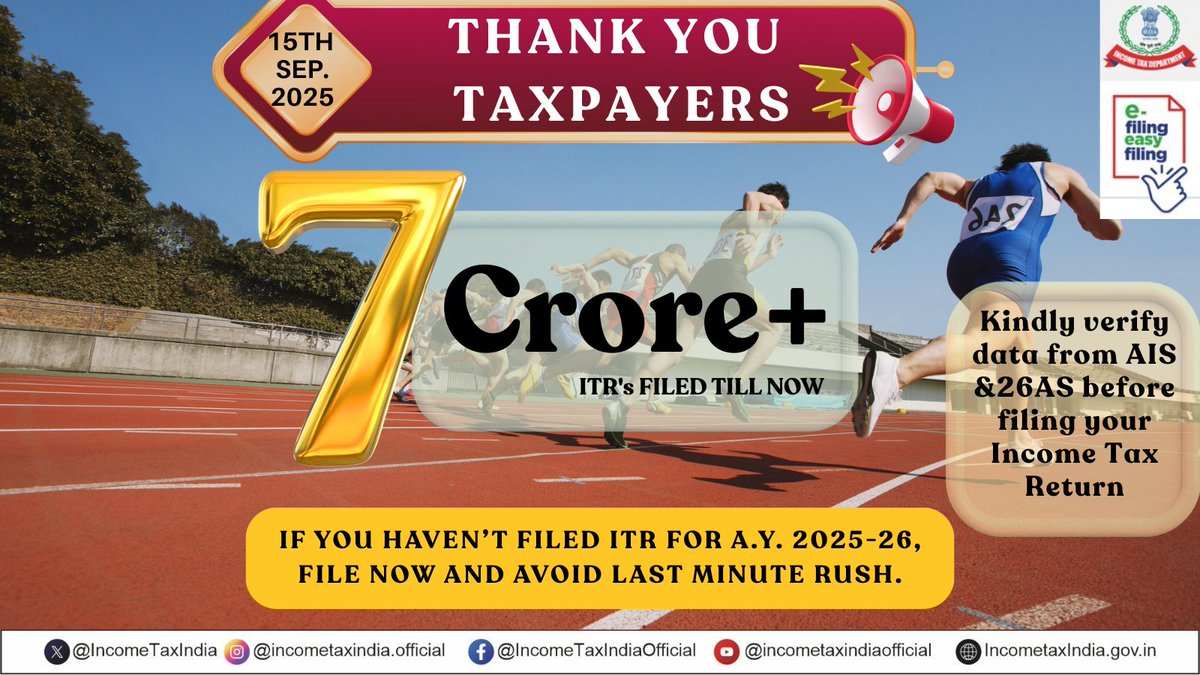

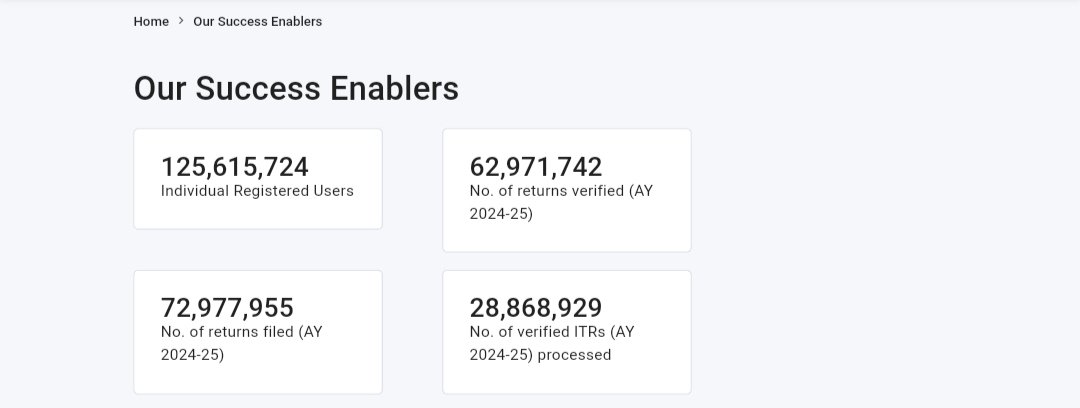

More than 7 crore ITRs have been filed so far (31st July), out of which over 50 lakh ITRs have been filed today till 7 pm! #FileNow

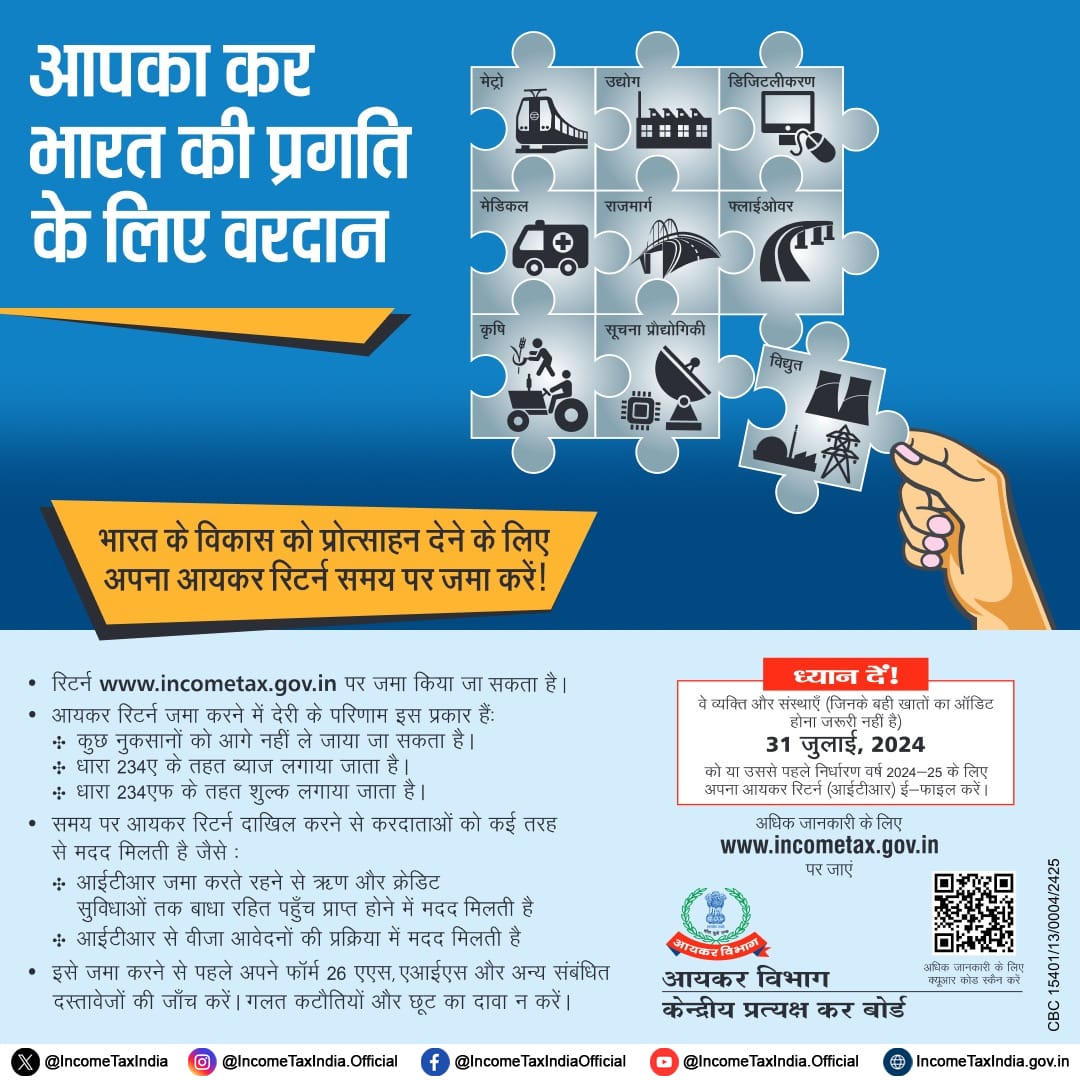

Kind Attention Taxpayers! Do remember to file your ITR if you haven't filed yet. The due date to file ITR for AY 2024-25 is 31st July, 2024. #FileNow

Today’s the last day to file your taxes! ⏳ Don’t let the deadline sneak past you. buff.ly/2iCPXTD #TaxDay #FileNow

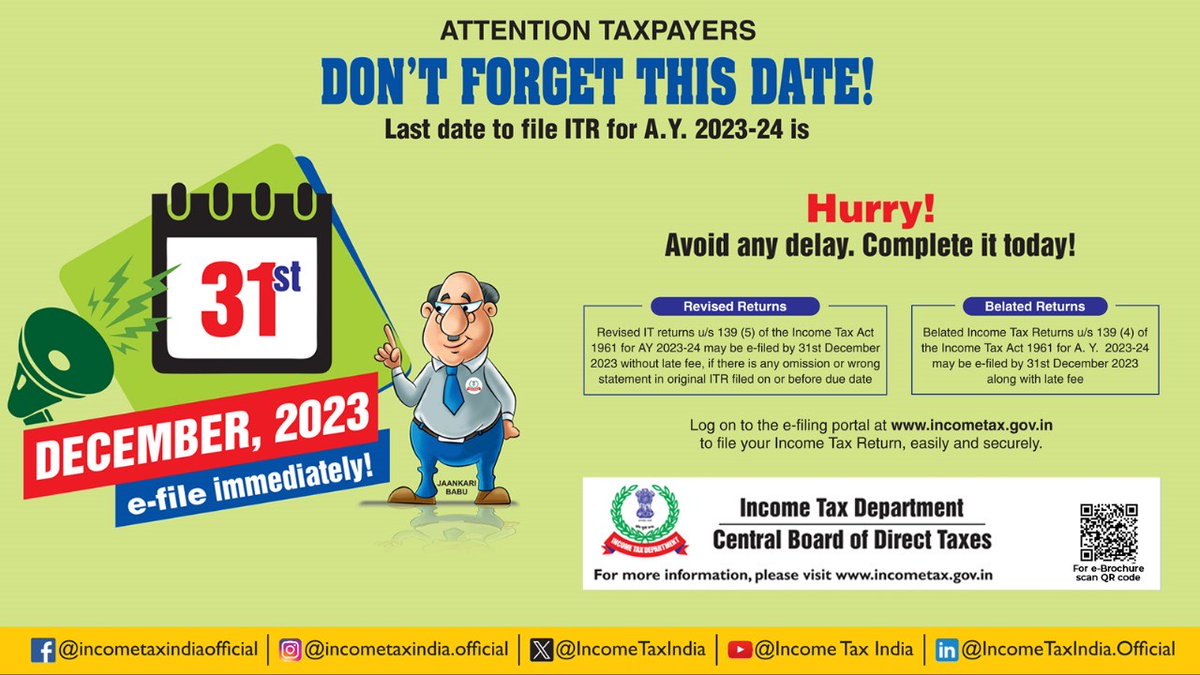

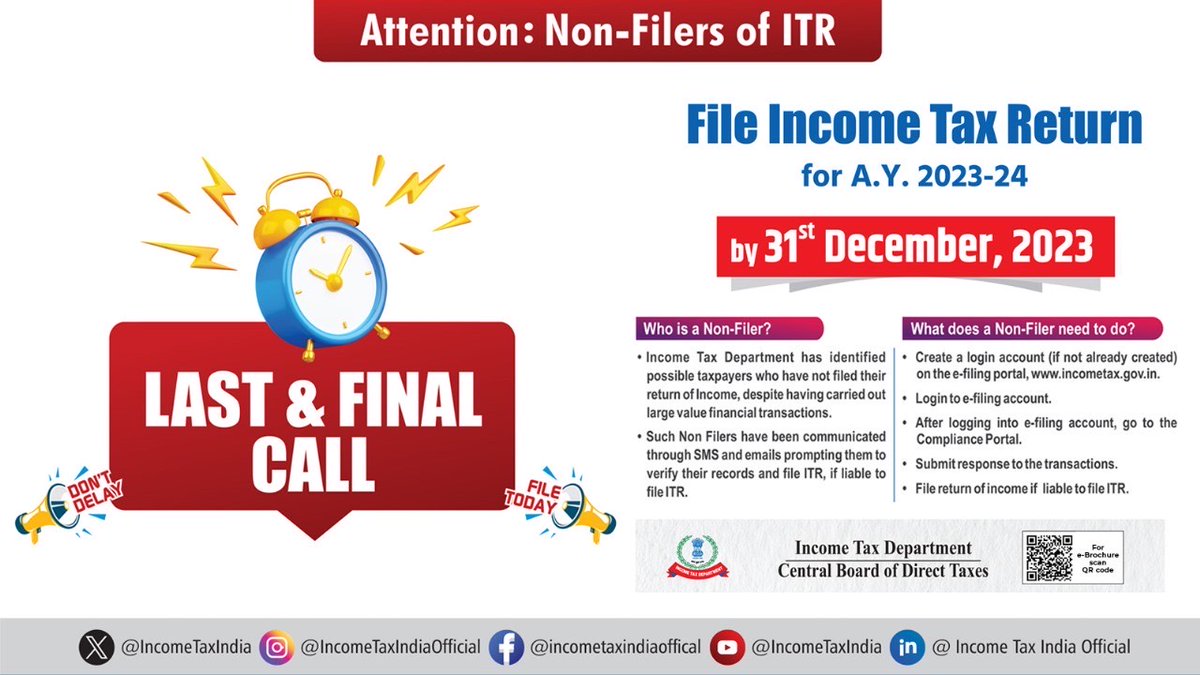

Kind Attention Taxpayers! Here's your last and final call to file your ITR for A.Y. 2023-24 by 31st December, 2023. Hurry! #FileNow. For more information, please visit incometax.gov.in/iec/foportal/

Kind Attention Taxpayers, 31st December, 2023 is your last chance to file a belated/revised ITR for AY 2023-2024. Hurry! File your ITR before the due date. Pl visit incometax.gov.in/iec/foportal/ #FileNow

करदाता कृपया ध्यान दें! यदि आपने अभी तक अपना आईटीआर दाखिल नहीं किया है तो दाखिल करना ना भूलें। निर्धारण वर्ष 2024-25 के लिए आईटीआर दाखिल करने की नियत तारीख 31 जुलाई, 2024 है। #FileNow

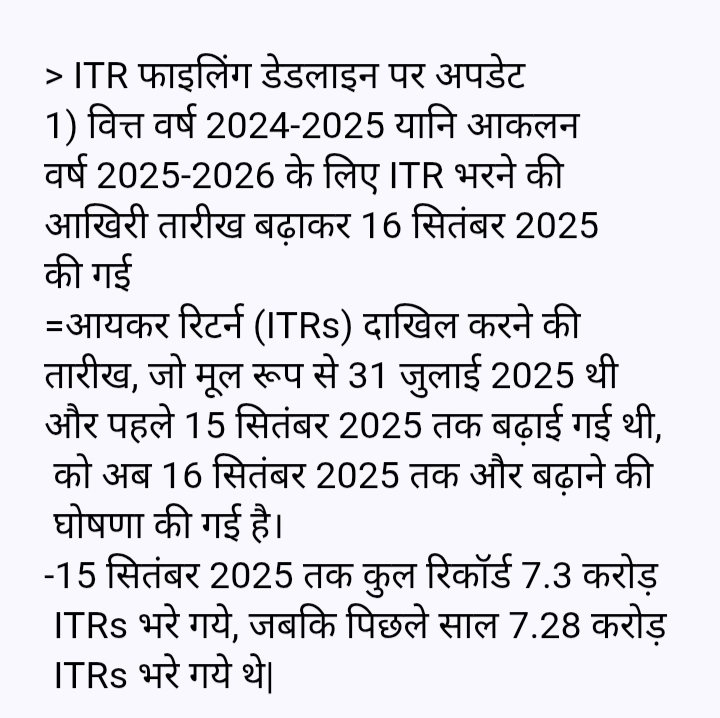

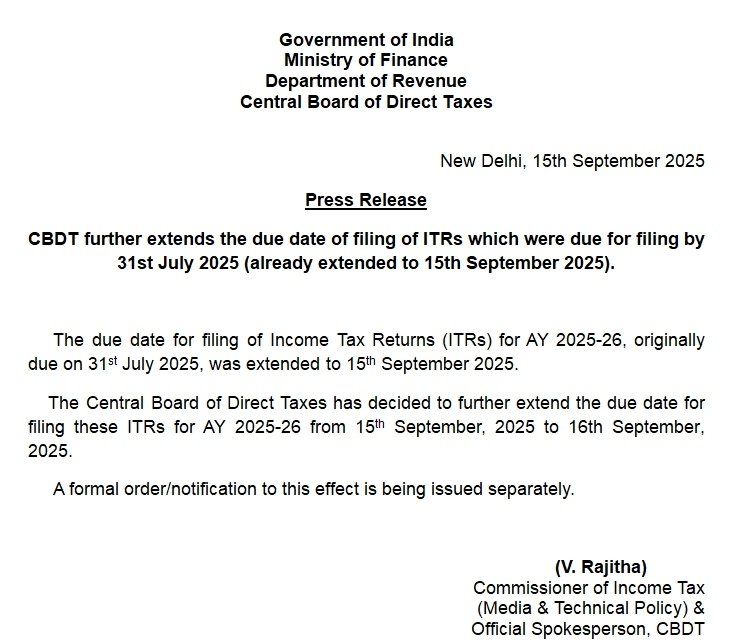

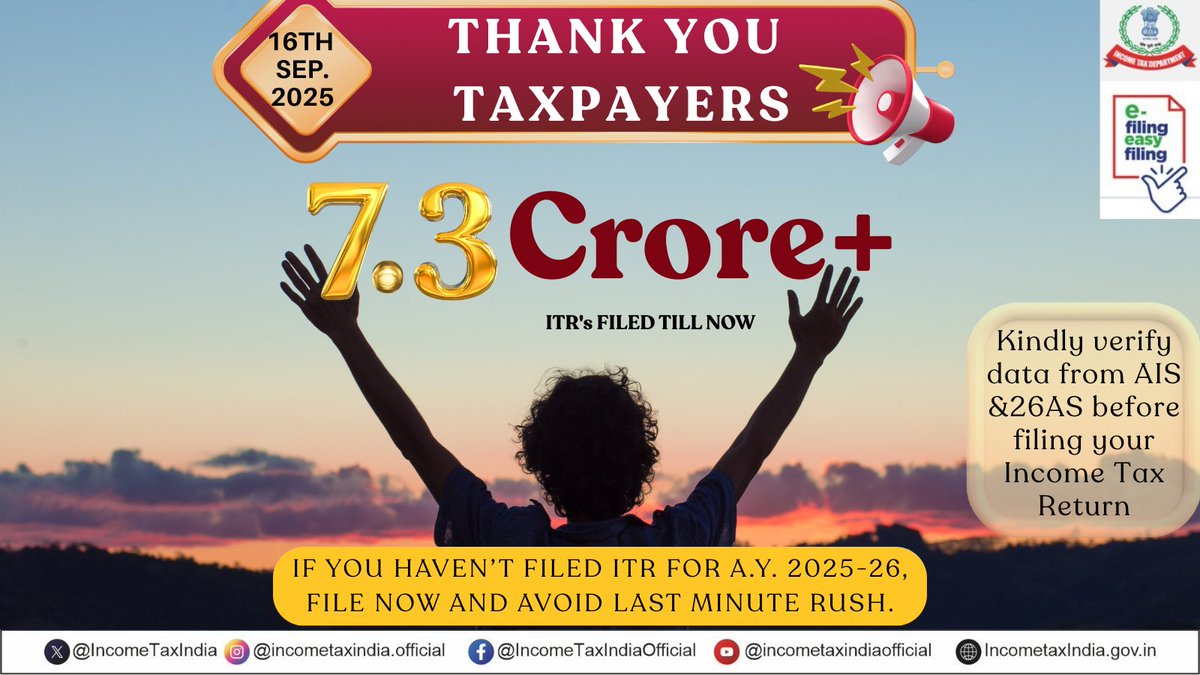

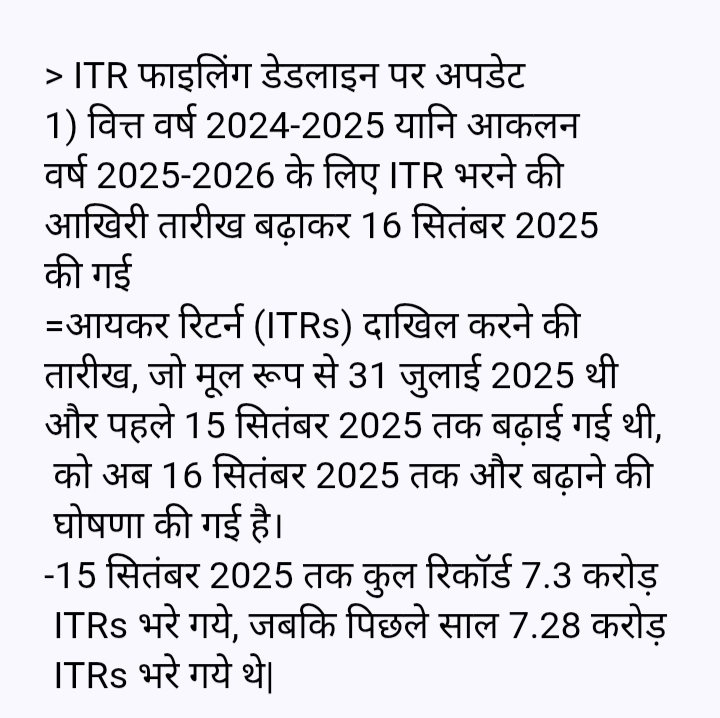

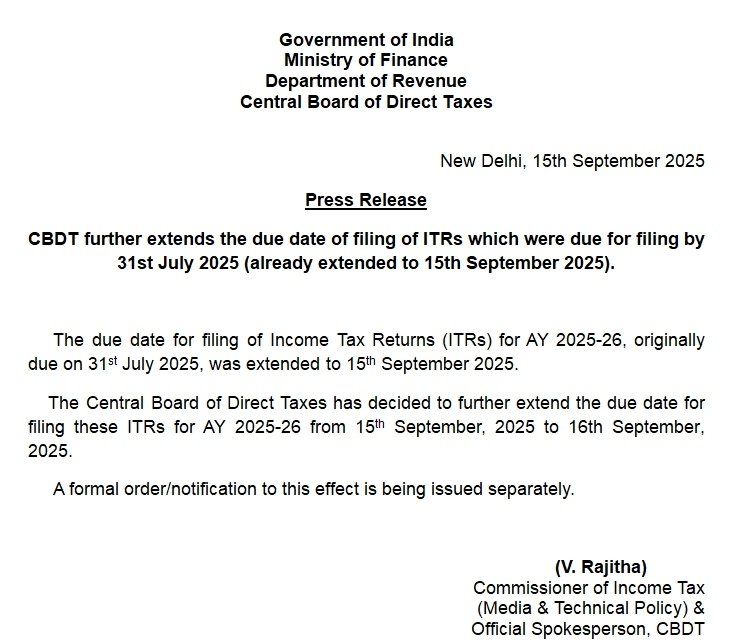

ITR फाइलिंग डेडलाइन पर अपडेट 1) वित्त वर्ष 2024-2025 यानि आकलन वर्ष 2025-2026 के लिए ITR भरने की आखिरी तारीख बढ़ाकर 16 सितंबर 2025 की गई #FileNow #ITR @IncomeTaxIndia

Kind Attention Taxpayers! Here's your last and final call to file your ITR for A.Y. 2023-24 by 31st December, 2023. Hurry! #FileNow. For more information, please visit incometax.gov.in/iec/foportal/

करदाता कृपया ध्यान दें! निर्धारण वर्ष 2023-24 के लिए आयकर विवरणी दाखिल करने का आपके पास यह अंतिम अवसर है । जल्दी करें! आज ही दाखिल करें । अधिक जानकारी के लिए कृपया incometax.gov.in/iec/foportal/ पर जाएँ। #FileNow

करदाता कृप्या ध्यान दें, 31 दिसम्बर, 2023 आपका आखिरी मौका है विलंबित या संशोधित आयकर रिटर्न जमा करने का, निर्धारण वर्ष 2023-2024 के लिए। जल्दी करें! निर्धारित तारीख से पहले अपना आयकर रिटर्न जमा करें। अधिक जानकारी के लिए incometax.gov.in/iec/foportal/ पर जाएं । #FileNow

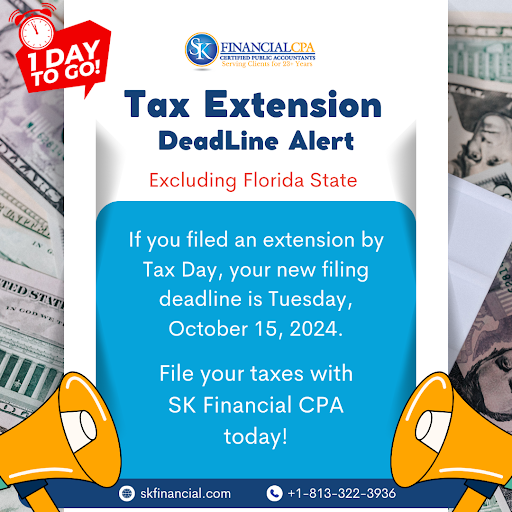

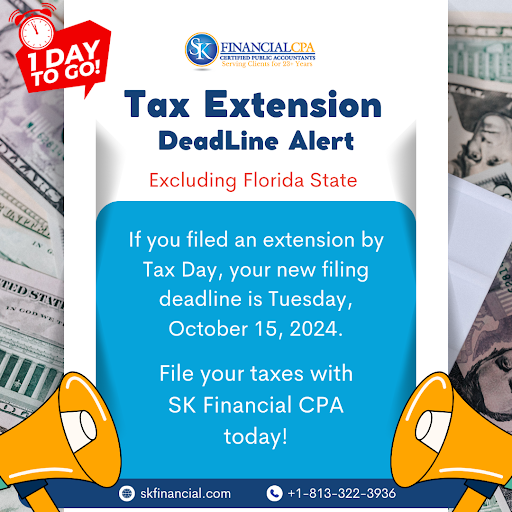

The October 15, 2024 deadline is almost here! If you filed for an extension, now’s the time to wrap it up. Let SK Financial CPA handle the rest! 📞 +1-813-322-3936 🌐 skfinancial.com #TaxDeadline #FileNow #TaxHelp #SKFinancialCPA #CPAServices #TaxTime

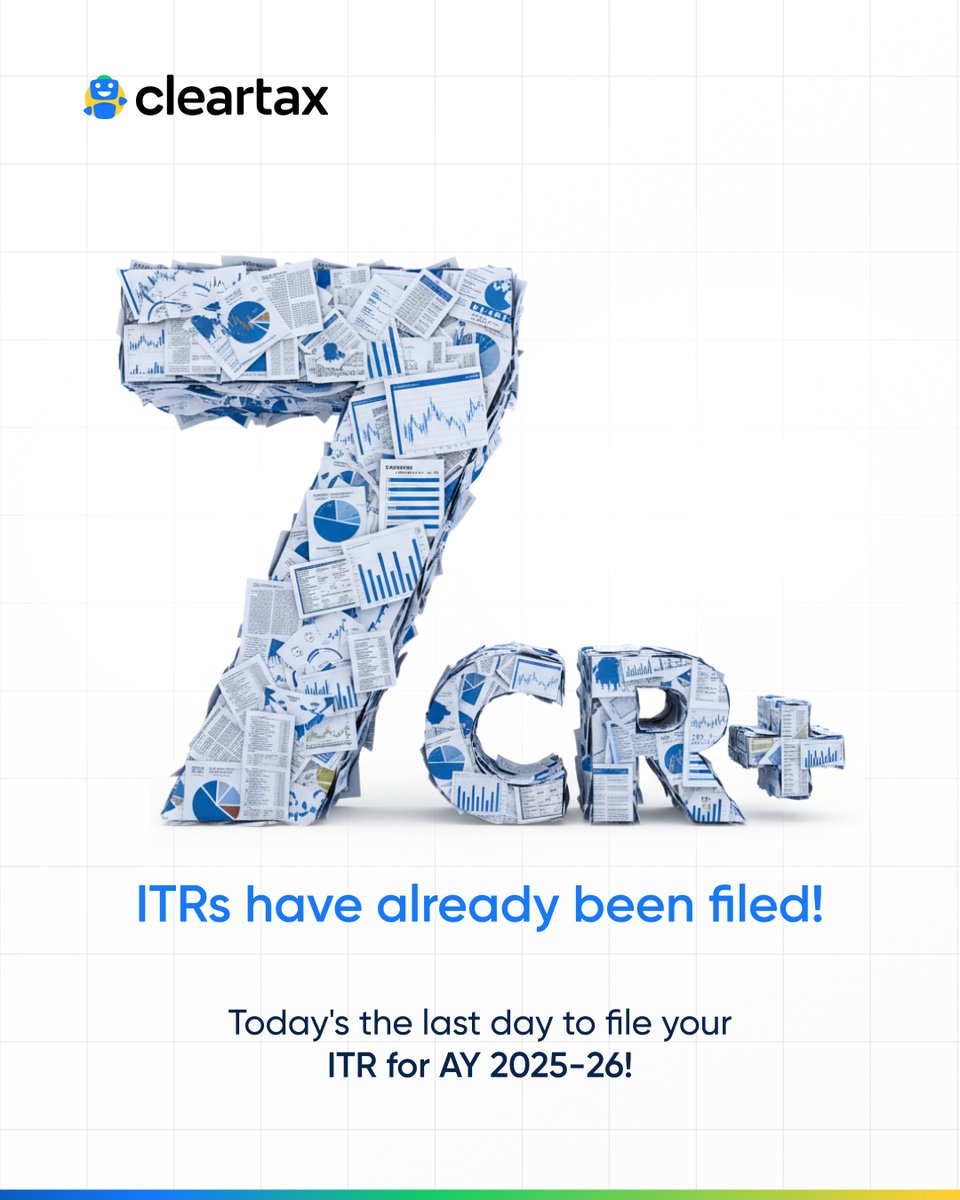

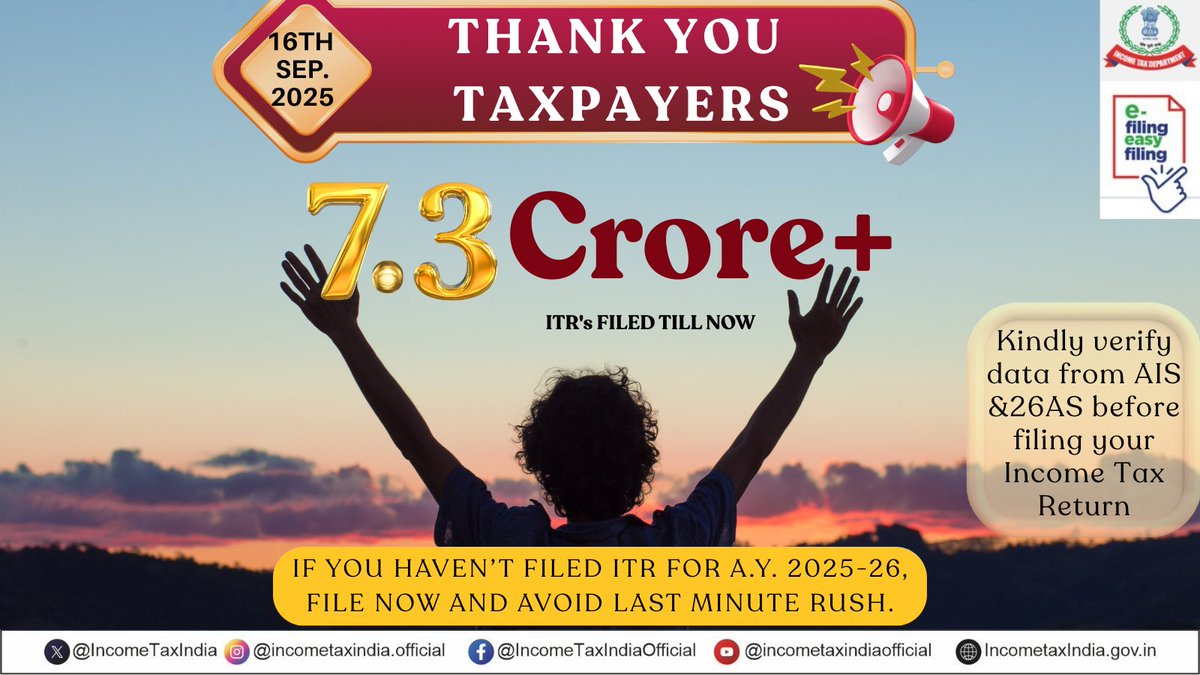

Over 7 crore ITRs have been filed! This is your last chance to file your ITR for AY 2025-26 without any penalty. File your ITR in just a few minutes: clr.tax/mjTBkRew #FileNow #ITR #Deadline #ClearTax #INCOMETAXPORTAL #IncomeTax #incometaxreturn

Just FYI: U.S. taxpayers living and working abroad have until June 17, 2024 to file their 2023 income tax returns. The clock is ticking! #TimeIsAlmostUp #FileNow #SnellCPA

Unfiled returns? We’ll help you catch up—without fear or judgment. #BackTaxes #FileNow bit.ly/3Ug275g

Stop IRS Collections and file your IRS tax notices with confidence. Get nationwide tax relief today. Call 833-836-6398 or visit tennextaxrelief.com #TaxRelief #IRSHelp #FileNow

Filing Your Income Tax Return Is Now Simple & Quick! Watch This Step-By-Step Guide And File Easily Through The FBR Portal. Don’t Wait! File your Income Tax Return Today! #FBR #TaxReturn #FileNow #EasyTaxFiling #RTOSahiwal

2025 TAX SEASON ALERT! AVOID PENALTIES. FILE NOW & GET REFUND FAST! #filenow #ITR2025 #viralvideo #DiscoverAustralia #viralseason #ForYouPage (#FYP) #WorkFromHome

Don’t Wait to File — Even Without Full Medical Records Listen to the full episode in the bio link. bio.link/ericpines #FileNow #DisabilityFiling #SSDIAdvice #StartTheProcess #DontWait

ITR फाइलिंग डेडलाइन पर अपडेट 1) वित्त वर्ष 2024-2025 यानि आकलन वर्ष 2025-2026 के लिए ITR भरने की आखिरी तारीख बढ़ाकर 16 सितंबर 2025 की गई #FileNow #ITR @IncomeTaxIndia

7+ crore ITRs already filed 📈 Looks like filing taxes is the new trending habit 😎 Kudos to all taxpayers & pros 🙌 #FileNow

Over 7 crore ITRs filed already! 💪 Hats off to all taxpayers & professionals making it smooth. If you haven’t filed yet, don’t wait! #FileNow #IncomeTax #DigitalIndia #TaxSeason

Over 7 crore ITRs have been filed! This is your last chance to file your ITR for AY 2025-26 without any penalty. File your ITR in just a few minutes: clr.tax/mjTBkRew #FileNow #ITR #Deadline #ClearTax #INCOMETAXPORTAL #IncomeTax #incometaxreturn

2025 TAX SEASON ALERT! AVOID PENALTIES. FILE NOW & GET REFUND FAST! #filenow #ITR2025 #viralvideo #DiscoverAustralia #viralseason #ForYouPage (#FYP) #WorkFromHome

We extend our gratitude to taxpayers and tax professionals for helping us reach this milestone, and urge all those who haven't filed ITR for AY 2025-26, to file their ITR. #filenow

🚨 FINAL REMINDER 🚨 NO EXTENSION BEYOND 30TH JUNE, 2025. #ORCGhana #BusinessCompliance #FileNow #GhanaBusiness #AnnualReturns #BusinessRenewal #DeadlineAlert #NoExtension #ComplianceMatters

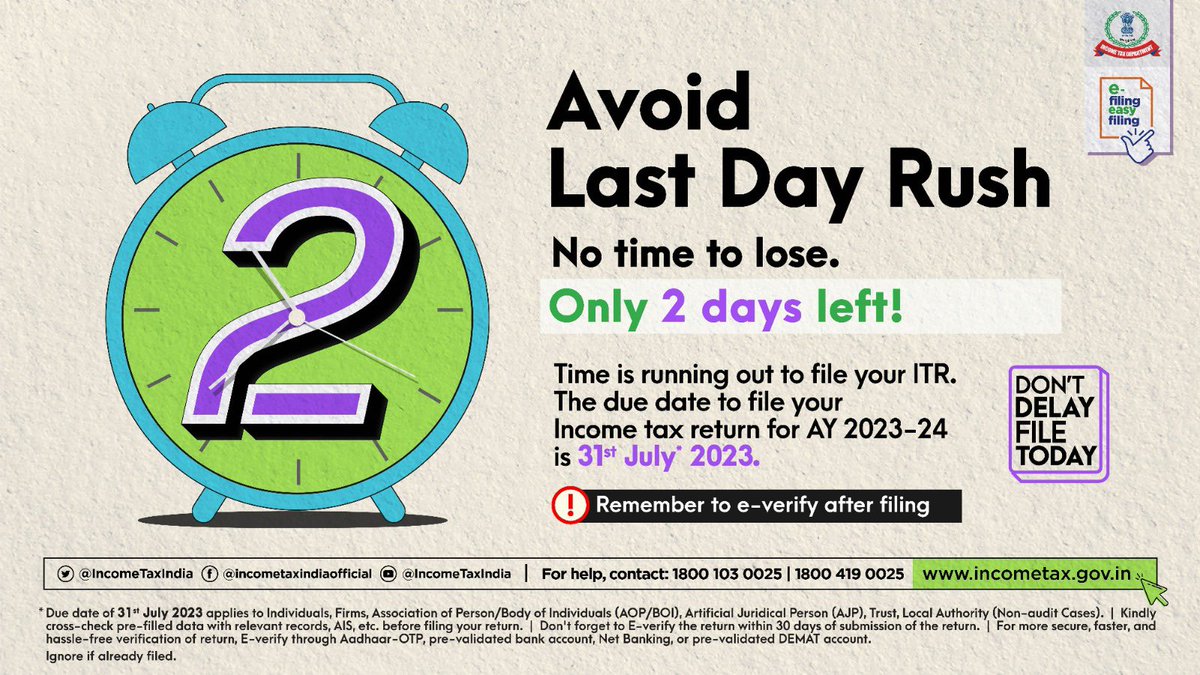

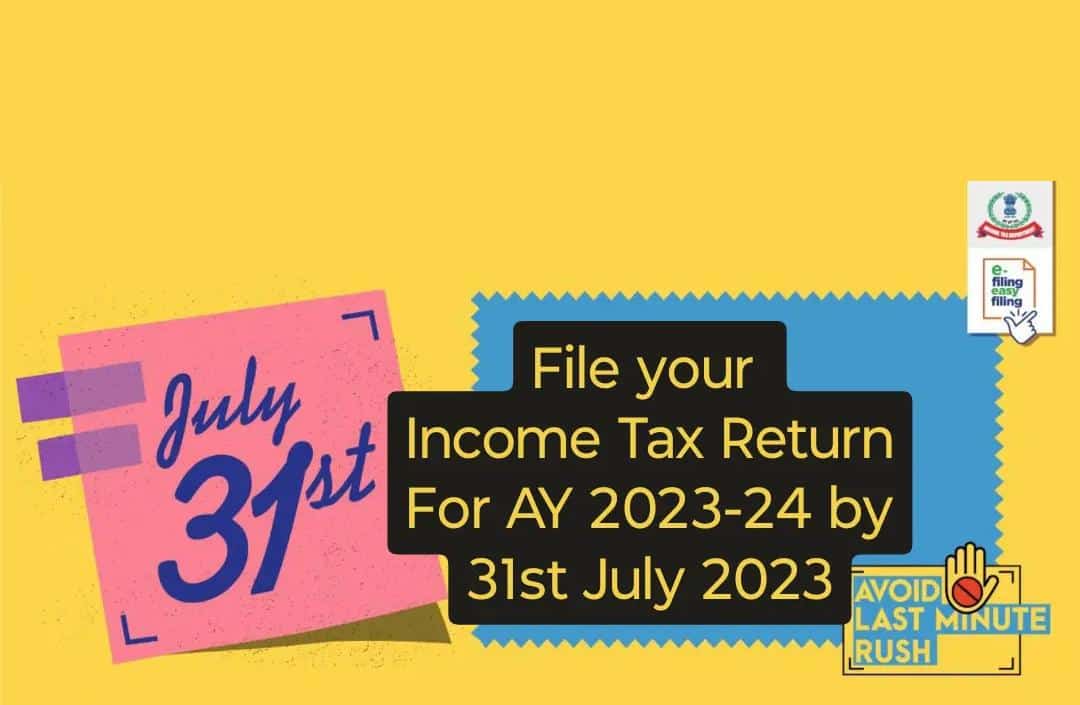

Time is running out. Only 2 days left to file your #ITR #FileNow if you haven't filed your return for AY 2023-24 yet. Due date to file your ITR is 31st July, 2023. Pl visit incometax.gov.in #ITD

Just FYI: U.S. taxpayers living and working abroad have until June 17, 2024 to file their 2023 income tax returns. The clock is ticking! #TimeIsAlmostUp #FileNow #SnellCPA

Today’s the last day to file your taxes! ⏳ Don’t let the deadline sneak past you. buff.ly/2iCPXTD #TaxDay #FileNow

Do you have unfiled tax returns? We can help! The deadline to file a 2019 tax return is July 17, 2023. Missing documents? Don't worry! We can obtain an IRS wage and income transcript. #unfiledtaxes #filenow #snellcpa

The due date to file ITR for AY 2023-24 is 31st July, 2023. File today and avoid the last minute rush! #ITR #FileNow #IncomeTaxReturn

If you haven't filed your #ITR for AY 2023-24 yet, we urge you to #FileNow to avoid last-day rush. Due date to file your ITR is 31st July, 2023.

More than 7 crore ITRs have been filed so far (31st July), out of which over 50 lakh ITRs have been filed today till 7 pm! #FileNow

7,29,77,955 ITRs have been filed till date #FileNow #ITRDueDate #ITR #incometaxwebsite #IncomeTaxReturns #incometaxfiling #IncomeTaxSiteIssues #Incometax_site_not_working #incometaxindia

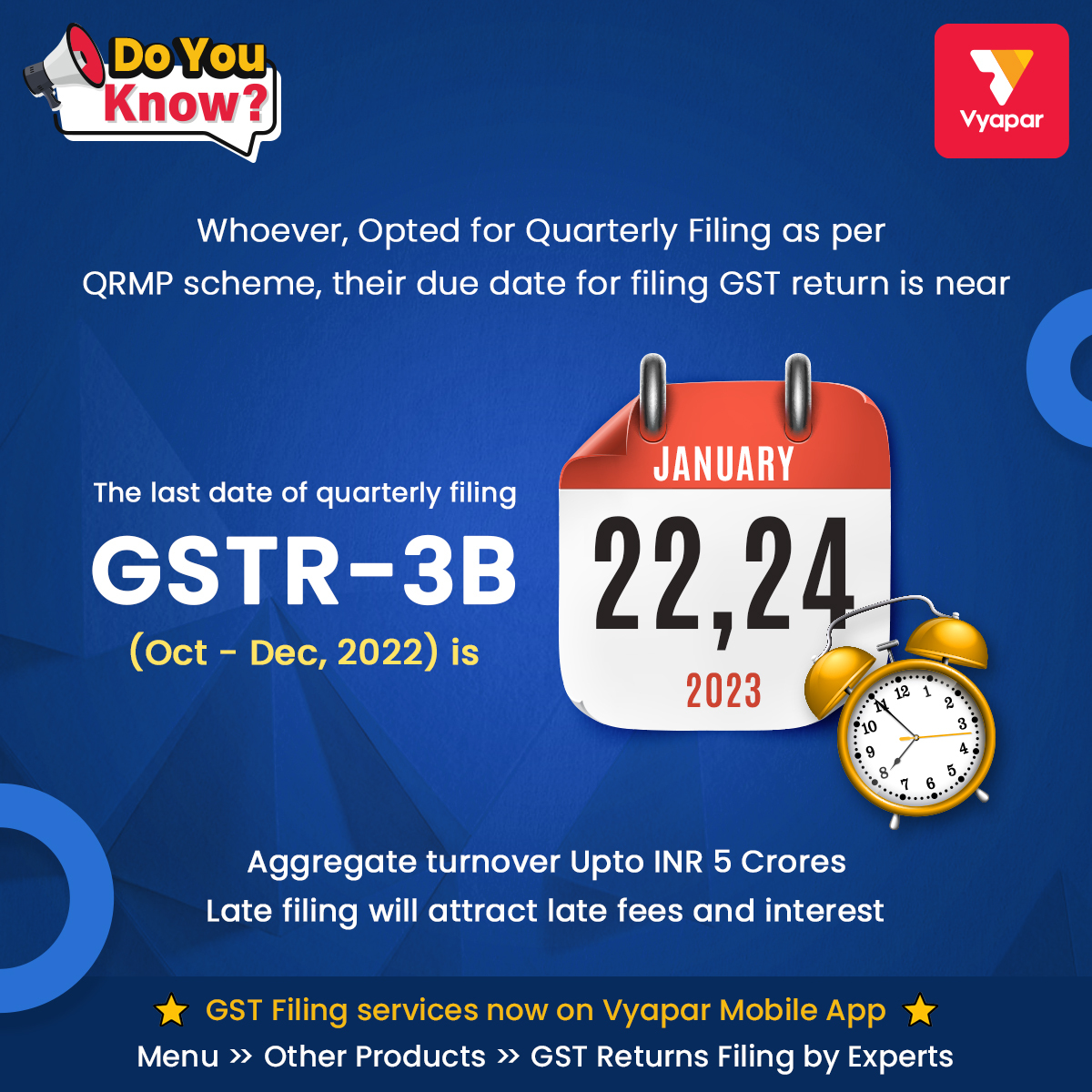

Tik-Tok-Tik-Tok⏰ Are you ready to file your GSTR-3B?? Only 6 days left!! #gstr-3b #filenow #tuesdaymotivation #gstalert #gstfiling #awarness #gstupdate #share #like #subscribe #trendingnow #viral #governmentalert #gstnews #Budget2023 #Budget #StartupIndia #Growth

Attention all taxpayers! Today is Tax Day! You have until midnight to file and pay your 2023 taxes or request an extension. Don't wait until the last minute - take action now! #TaxDay #DeadlineDay #FileNow #ICGnext

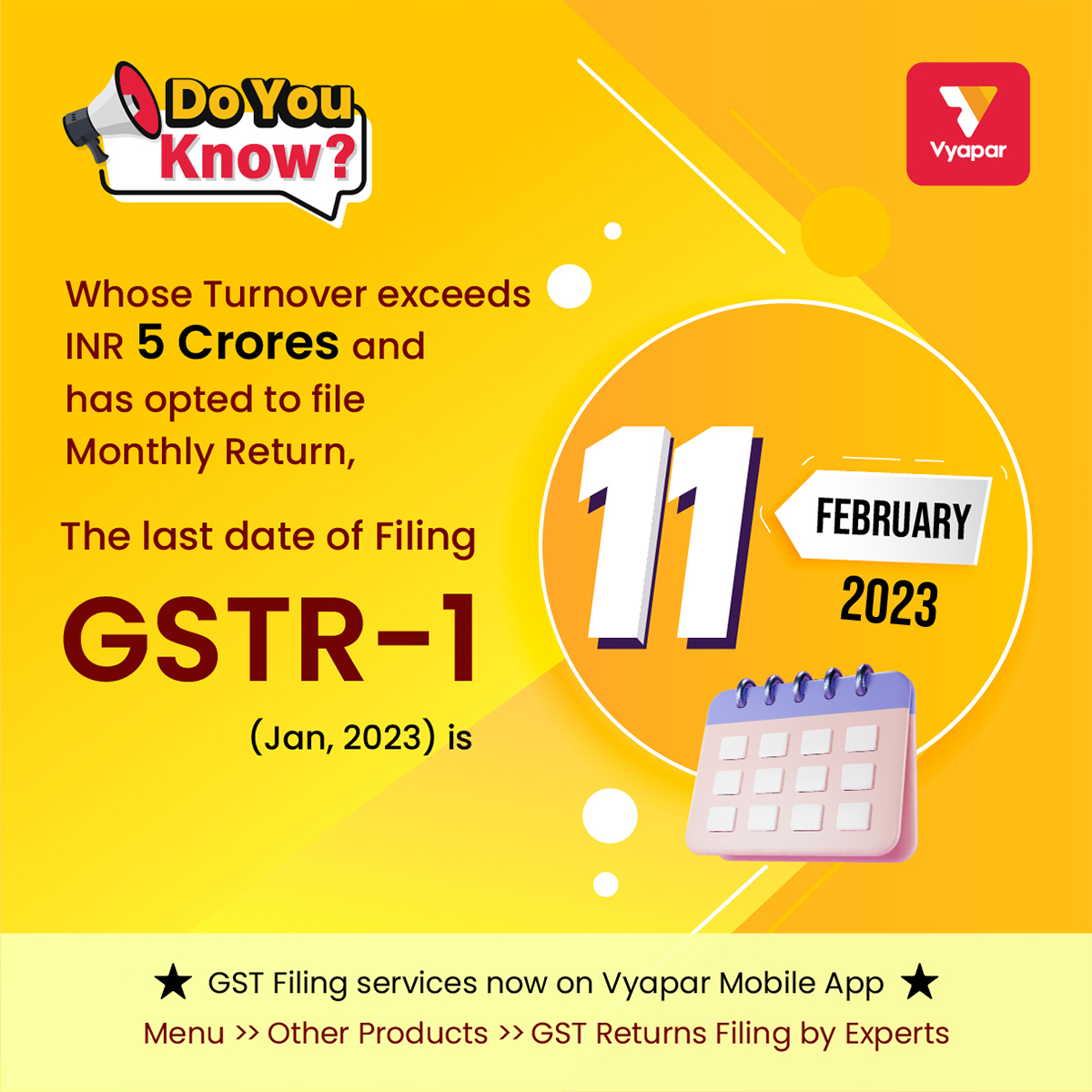

🚨Alert🚨 🔊 Only 3⏰Days Left To File Your GST Return!!⏳ Hurry-Up⏳ File On Time⏱️ And Avoid Your Penalty.🤝 #gstr-1 #filenow #MotivationalQuotes #gstalert #gstfiling #awarness #gstupdate #share #like #trendingnow #viral #governmentalert #gstnews #Budget2023 #BudgetSession

Kind Attention Taxpayers! Do remember to file your ITR if you haven't filed yet. The due date to file ITR for AY 2024-25 is 31st July, 2024. #FileNow

The October 15, 2024 deadline is almost here! If you filed for an extension, now’s the time to wrap it up. Let SK Financial CPA handle the rest! 📞 +1-813-322-3936 🌐 skfinancial.com #TaxDeadline #FileNow #TaxHelp #SKFinancialCPA #CPAServices #TaxTime

Something went wrong.

Something went wrong.

United States Trends

- 1. Mason 33.8K posts

- 2. Syracuse 7,600 posts

- 3. #RiyadhSeason 4,150 posts

- 4. Arch Manning 2,380 posts

- 5. Oregon 25.9K posts

- 6. Stoops 1,509 posts

- 7. Lincoln Riley 1,133 posts

- 8. Jeremiyah Love 3,269 posts

- 9. Harden 29.9K posts

- 10. #TheRingIV 2,672 posts

- 11. Fran Brown N/A

- 12. Joe Jackson N/A

- 13. Sadiq 7,901 posts

- 14. Arkansas 9,123 posts

- 15. Dante Moore N/A

- 16. Diego Pavia 1,377 posts

- 17. Kansas State 2,756 posts

- 18. #AEWFullGear 5,801 posts

- 19. #GoIrish 4,921 posts

- 20. Maiava 1,104 posts