#formgstr1 search results

Another Great move by Govt. that file #NIL #FORMGSTR1 through SMS, Come into force from the first week of july. @FinMinIndia @nsitharamanoffc #GSTRETURNS

Government to roll out facility to file Nil Form GSTR-1 through SMS from the first week of July. @nsitharaman @FinMinIndia @ianuragthakur

The amount of #Latefee shall stand #waived for the Reg. persons who fail to furnish the details of outward supplies for the months/quarter mentioned in #FORMGSTR1 by the due date, but furnishes the said details on or before the dates mentioned in "NN-53/2020-CT" #Latefee #GSTR1

4/4 Revised Requirement of declaring #HSN/#SAC in invoices and in #FORMGSTR1 w.e.f. 01.04.2021 as: a.HSN/SAC at 6 digits for agg. Annual T/O above Rs.5 crores, b. HSN/SAC at 4 digits for agg. Annual T/O upto Rs.5 crores c. HSN/SAC at 8 digits on notified class of supplies.

Late fees for delayed GSTR-1 filing to be auto-populated in GSTR-3B : 45th GST Council Meeting dlvr.it/S7pmw5 #GST #45THGSTCOUNCILMEETING #FORMGSTR1 Twitter @castudycafe

GSTN enables the facility to check if the tax has been paid by the seller or not for claiming ITC dlvr.it/SJKlNC #GST #FORMGSTR1 #GSTN #GSTNNewFunctionality Twitter @castudycafe

AAR ruled, #ITC is not allowed on invoices for the period of January-March 2020, even though the supplier has furnished #FORMGSTR1 & #FORMGSTR3B. #latestgstnews #GST #GSTindia

Non-Filers of GSTR-3B not allowed to file GSTR-1: Rule-59(6) implemented on GST Portal dlvr.it/SGRPXL #GST #formgstr3b #FORMGSTR1 #GSTNews Twitter @castudycafe

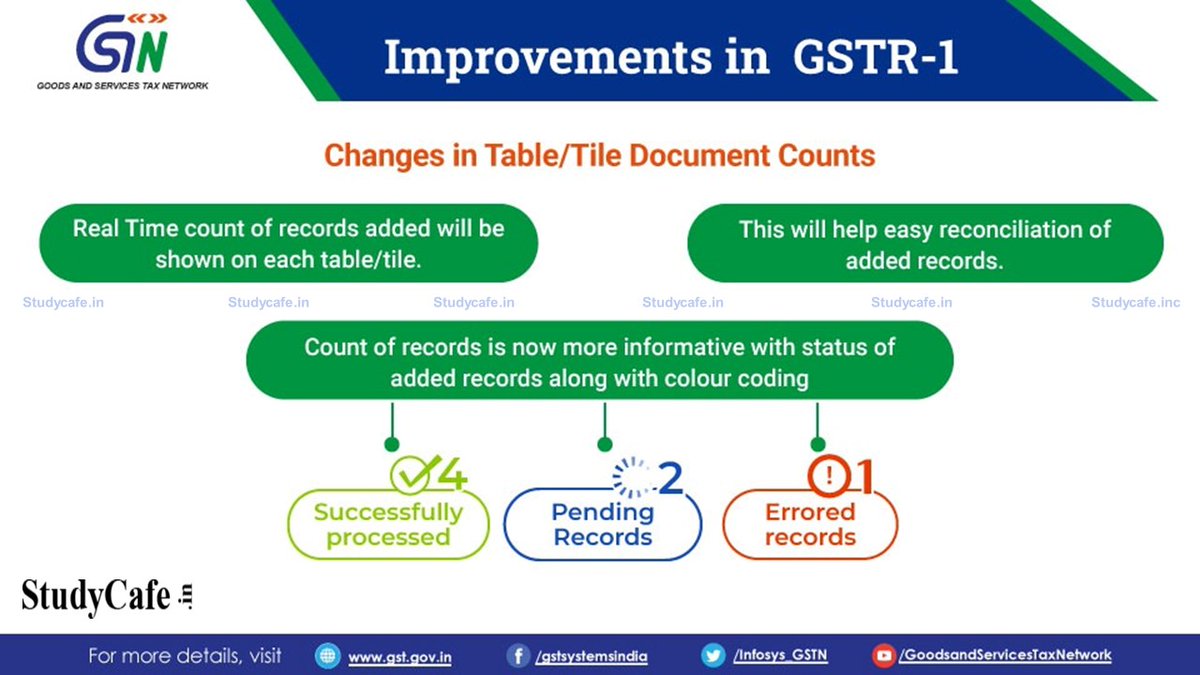

GSTR-1 Return’s Biggest Change at GST Portal dlvr.it/SPKlF4 #GST #FORMGSTR1 #GSTPORTAL #GSTN Twitter @castudycafe

Revamped & enhanced version of GSTR-1/IFF Facility dlvr.it/SDDGwV #GST #FORMGSTR1 #GSTPORTAL #GSTUpdate Twitter @castudycafe

Latest enhancements & improvements in GSTR-1 dlvr.it/SPQXVz #GST #FORMGSTR1 #GSTPORTAL #GSTR1 Twitter @castudycafe

GSTN added New Tax Rate of 6% in GSTR-1 on GST Portal dlvr.it/SRTYk9 #GST #FORMGSTR1 #gsttaxrate #GSTN Twitter @castudycafe

GSTN Introduces Single Click Nil Filing of GSTR-1 dlvr.it/SVwS9p #GST #FORMGSTR1 #GSTN #GSTR1 Twitter @castudycafe

GSTN Updates: Upcoming GSTR-1 enhancements & improvements dlvr.it/SKTlY3 #GST #FORMGSTR1 #GSTPORTAL #GSTUpdate Twitter @castudycafe

Beware GST Taxpayers! Today is the Last Date File Your GSTR-1 dlvr.it/SQ93Jv #GST #FORMGSTR1 #GSTTaxpayer #GSTR Twitter @castudycafe

GSTN Implements Mandatory Mentioning of HSN codes in GSTR-1 dlvr.it/SbgdQf #GST #FORMGSTR1 #GSTN #GSTNAdvisory Twitter @castudycafe

GSTR-1 dashboard has been updated to make it more user-friendly dlvr.it/SD9NTb #GST #FORMGSTR1 #GSTT1 #HowtoFileGSTR1 Twitter @castudycafe

Know all the GSTR-1/IFF enhancements deployed today on GST Portal dlvr.it/SPM8FV #GST #FORMGSTR1 #GSTPORTAL #GSTN Twitter @castudycafe

GSTN Enabled New Option to File NIL GSTR-1 by Selecting the Check Box dlvr.it/SVv4tL #GST #FORMGSTR1 #GSTR1 #News Twitter @castudycafe

GSTN issues new advisory on Auto-population of e-invoice details into GSTR-1 dlvr.it/SL0ld5 #GST #Einvoice #FORMGSTR1 #GSTNews Twitter @castudycafe

Key Action points to be considered before filing GSTR-1 & GSTR-3B of September 2021 dlvr.it/S874mf #GST #CGSTACT #FORMGSTR1 #GSTIN Twitter @castudycafe

GSTR-1 Return’s Biggest Change at GST Portal dlvr.it/SPKlF4 #GST #FORMGSTR1 #GSTPORTAL #GSTN Twitter @castudycafe

Latest enhancements & improvements in GSTR-1 dlvr.it/SPQXVz #GST #FORMGSTR1 #GSTPORTAL #GSTR1 Twitter @castudycafe

GSTN added New Tax Rate of 6% in GSTR-1 on GST Portal dlvr.it/SRTYk9 #GST #FORMGSTR1 #gsttaxrate #GSTN Twitter @castudycafe

Revamped & enhanced version of GSTR-1/IFF Facility dlvr.it/SDDGwV #GST #FORMGSTR1 #GSTPORTAL #GSTUpdate Twitter @castudycafe

GSTN Introduces Single Click Nil Filing of GSTR-1 dlvr.it/SVwS9p #GST #FORMGSTR1 #GSTN #GSTR1 Twitter @castudycafe

GSTN Updates: Upcoming GSTR-1 enhancements & improvements dlvr.it/SKTlY3 #GST #FORMGSTR1 #GSTPORTAL #GSTUpdate Twitter @castudycafe

Late fees for delayed GSTR-1 filing to be auto-populated in GSTR-3B : 45th GST Council Meeting dlvr.it/S7pmw5 #GST #45THGSTCOUNCILMEETING #FORMGSTR1 Twitter @castudycafe

Beware GST Taxpayers! Today is the Last Date File Your GSTR-1 dlvr.it/SQ93Jv #GST #FORMGSTR1 #GSTTaxpayer #GSTR Twitter @castudycafe

GSTN Implements Mandatory Mentioning of HSN codes in GSTR-1 dlvr.it/SbgdQf #GST #FORMGSTR1 #GSTN #GSTNAdvisory Twitter @castudycafe

GSTN enables the facility to check if the tax has been paid by the seller or not for claiming ITC dlvr.it/SJKlNC #GST #FORMGSTR1 #GSTN #GSTNNewFunctionality Twitter @castudycafe

Non-Filers of GSTR-3B not allowed to file GSTR-1: Rule-59(6) implemented on GST Portal dlvr.it/SGRPXL #GST #formgstr3b #FORMGSTR1 #GSTNews Twitter @castudycafe

GSTR-1 dashboard has been updated to make it more user-friendly dlvr.it/SD9NTb #GST #FORMGSTR1 #GSTT1 #HowtoFileGSTR1 Twitter @castudycafe

Know all the GSTR-1/IFF enhancements deployed today on GST Portal dlvr.it/SPM8FV #GST #FORMGSTR1 #GSTPORTAL #GSTN Twitter @castudycafe

GSTN Enabled New Option to File NIL GSTR-1 by Selecting the Check Box dlvr.it/SVv4tL #GST #FORMGSTR1 #GSTR1 #News Twitter @castudycafe

GSTN issues new advisory on Auto-population of e-invoice details into GSTR-1 dlvr.it/SL0ld5 #GST #Einvoice #FORMGSTR1 #GSTNews Twitter @castudycafe

CBIC Mandates Furnishing of Correct Information and ITC Reversal in GSTR-3B and GSTR-1 dlvr.it/STWVKJ #GST #CBIC #FORMGSTR1 #GSTCircular Twitter @castudycafe

Form GSTR2A is only a facilitator for taking an informed decision while filing GSTR-3B: SC dlvr.it/SBTDk9 #GST #FORMGSTR1 #GSTR2A #GSTR3B Twitter @castudycafe

Key Action points to be considered before filing GSTR-1 & GSTR-3B of September 2021 dlvr.it/S874mf #GST #CGSTACT #FORMGSTR1 #GSTIN Twitter @castudycafe

Something went wrong.

Something went wrong.

United States Trends

- 1. Araujo 46.7K posts

- 2. Ferran 32.5K posts

- 3. Chelsea 363K posts

- 4. Barca 137K posts

- 5. Sonny Gray 8,148 posts

- 6. Barcelona 273K posts

- 7. Godzilla 22.2K posts

- 8. Rush Hour 4 13.7K posts

- 9. Cucurella 23.9K posts

- 10. Happy Thanksgiving 22.9K posts

- 11. Kounde 13.7K posts

- 12. Enzo 39K posts

- 13. Raising Arizona 1,177 posts

- 14. Chalobah 5,844 posts

- 15. National Treasure 6,157 posts

- 16. 50 Cent 5,762 posts

- 17. Red Sox 7,769 posts

- 18. Rashford 16.7K posts

- 19. #CHEBAR 6,193 posts

- 20. #AskTems 1,834 posts