#gstcircular نتائج البحث

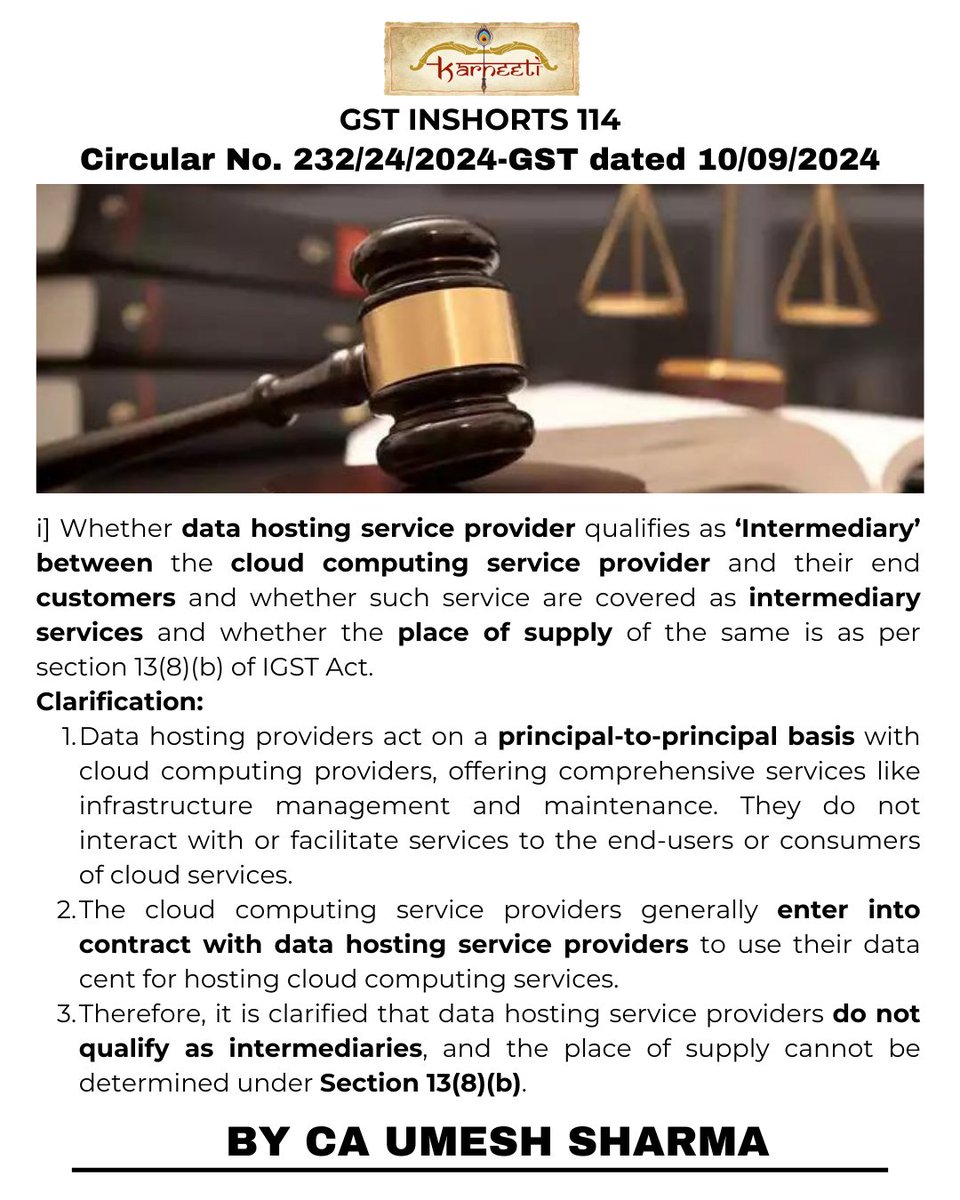

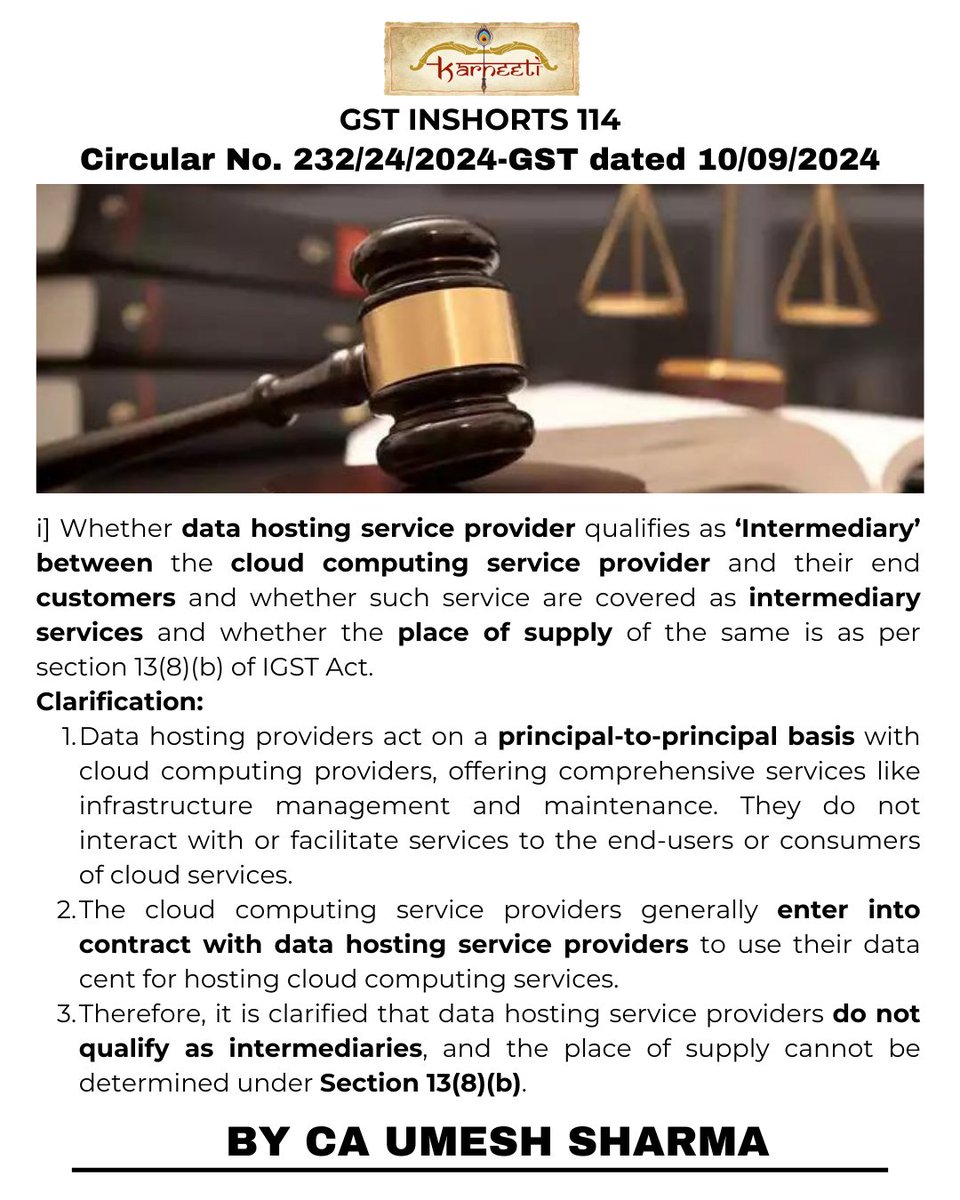

GST Inshort 114 #GSTUpdate #DataHostingServices #GSTCircular #TaxClarification #CloudComputing #IntermediaryServices #GSTInshorts #IGSTAct #PlaceOfSupply #Karneeti

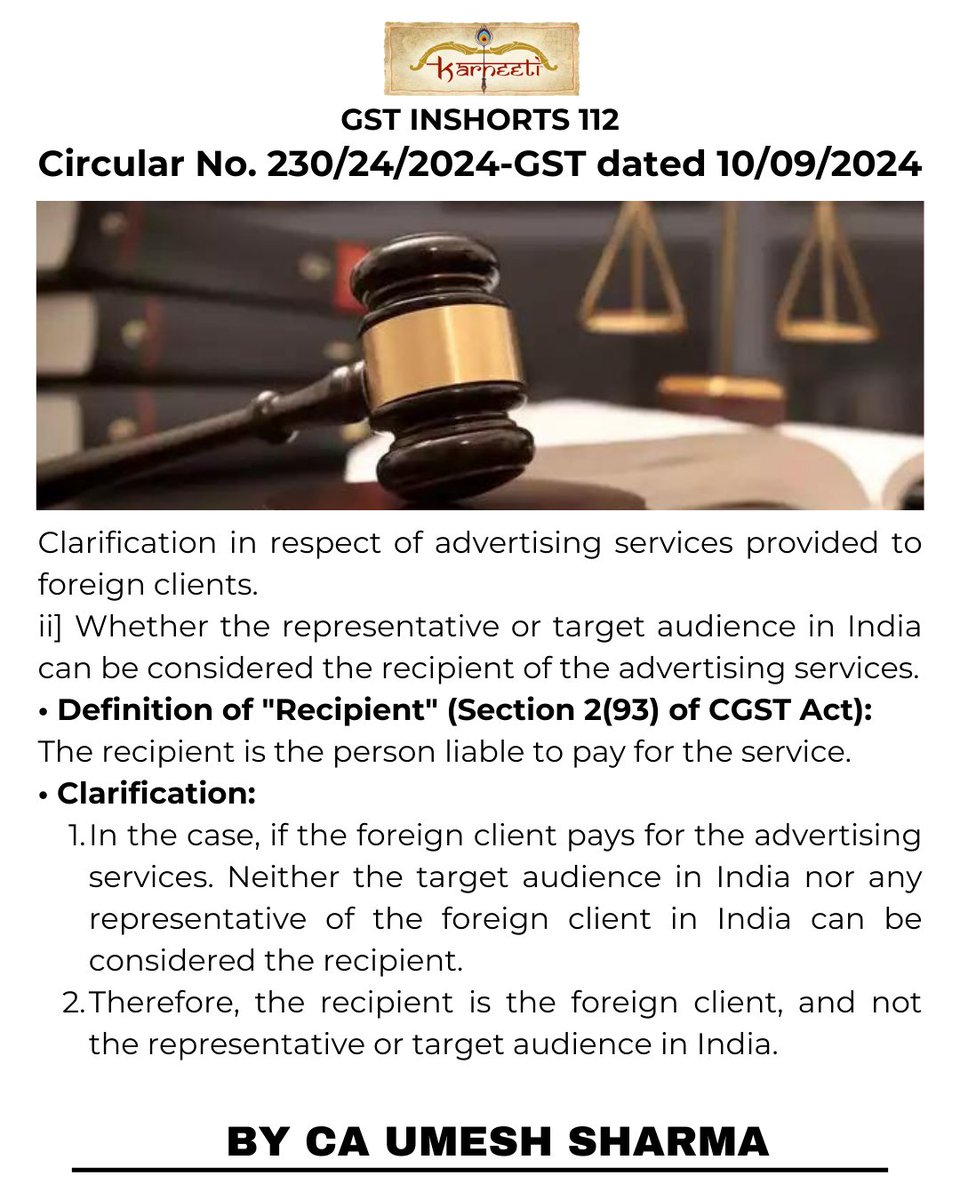

GST Inshort 112 #GSTUpdates #AdvertisingServices #GSTCircular #TaxClarifications #CGSTAct #ForeignClients #IndirectTax #GSTInshorts #IndiaTaxation #Karneeti

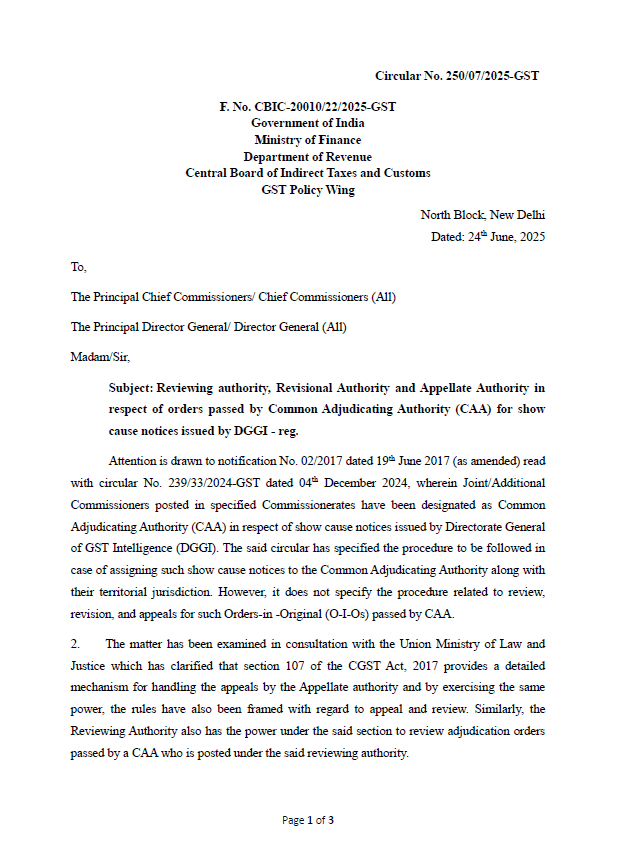

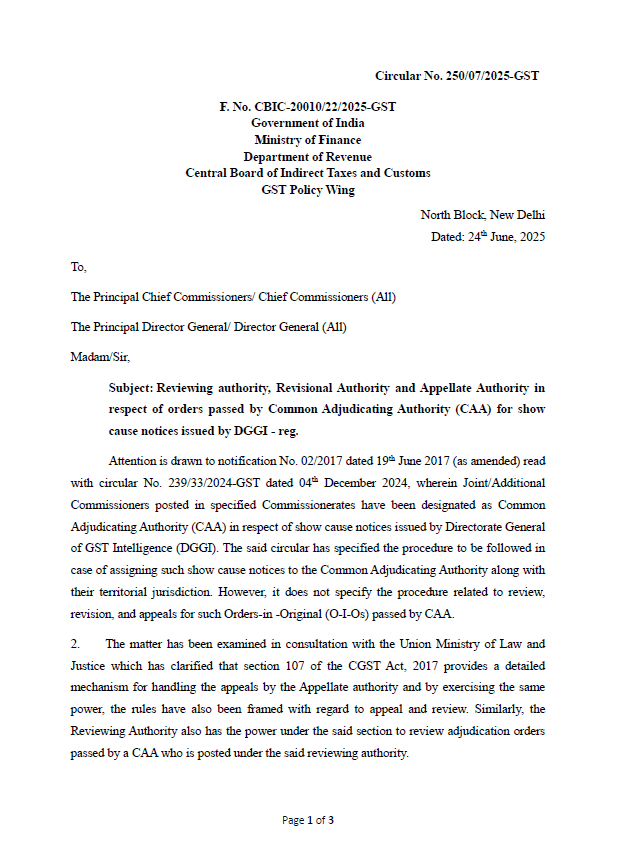

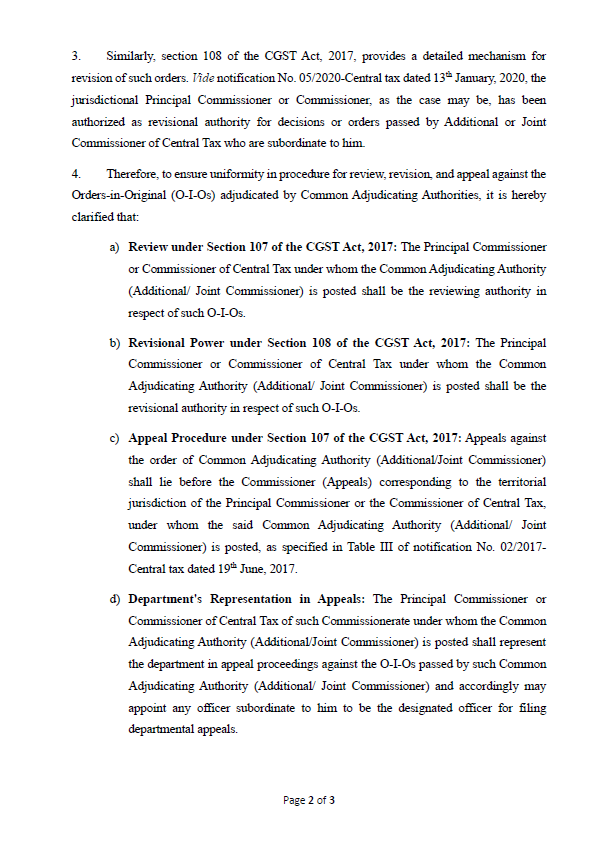

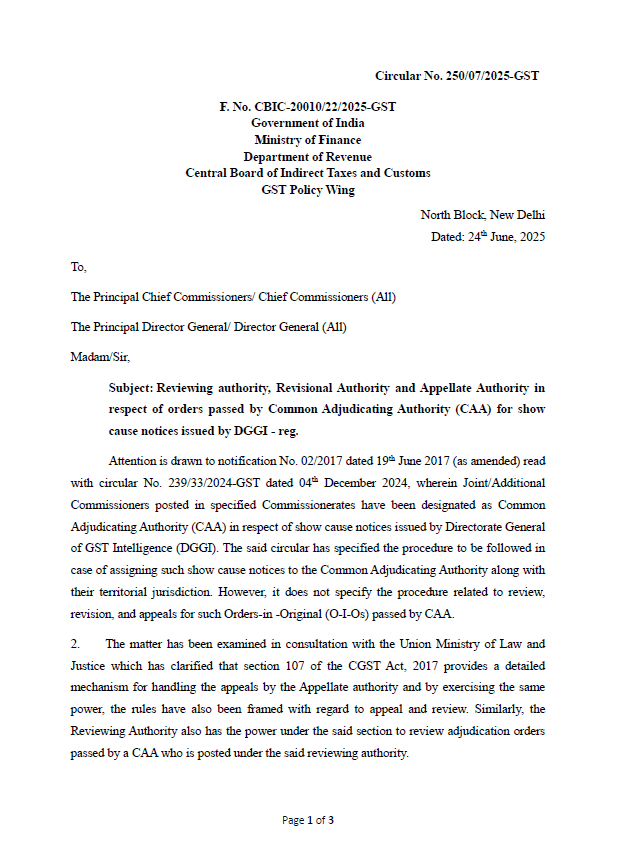

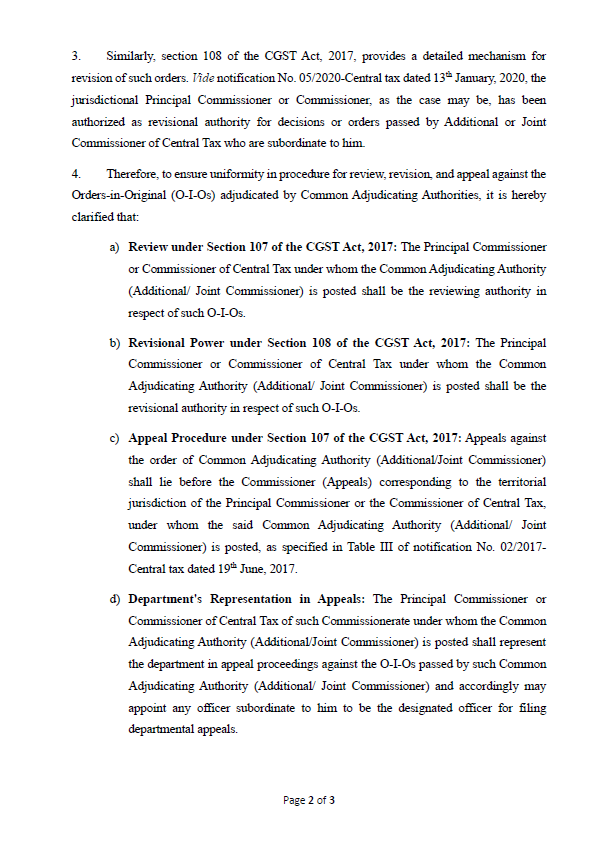

#CBIC clarifies Review, Revision & Appeal procedure for CAA orders on DGGI SCNs ✅ Review/Revision: Jurisdictional Commissioner ✅ Appeals: Concerned Commissioner (Appeals) ✅ Dept Representation: Jurisdictional Commissioner ✅ DGGI comments may be sought #GSTCircular 250/07/2025

📢 New GST Circular Alert! CBIC issues Circular No. 254/11/2025-GST (27 Oct 2025) defining Proper Officers under Sections 74A, 75(2), & 122 with new monetary limits. 📘 Clear guidelines for adjudication & penalties — explained here 👇 🔗 youtu.be/ztHv7HDlHvM?si… #GSTCircular…

youtube.com

YouTube

Circular No. 254/11/2025-GST, Proper Officer for Sections 74A, 75(2),...

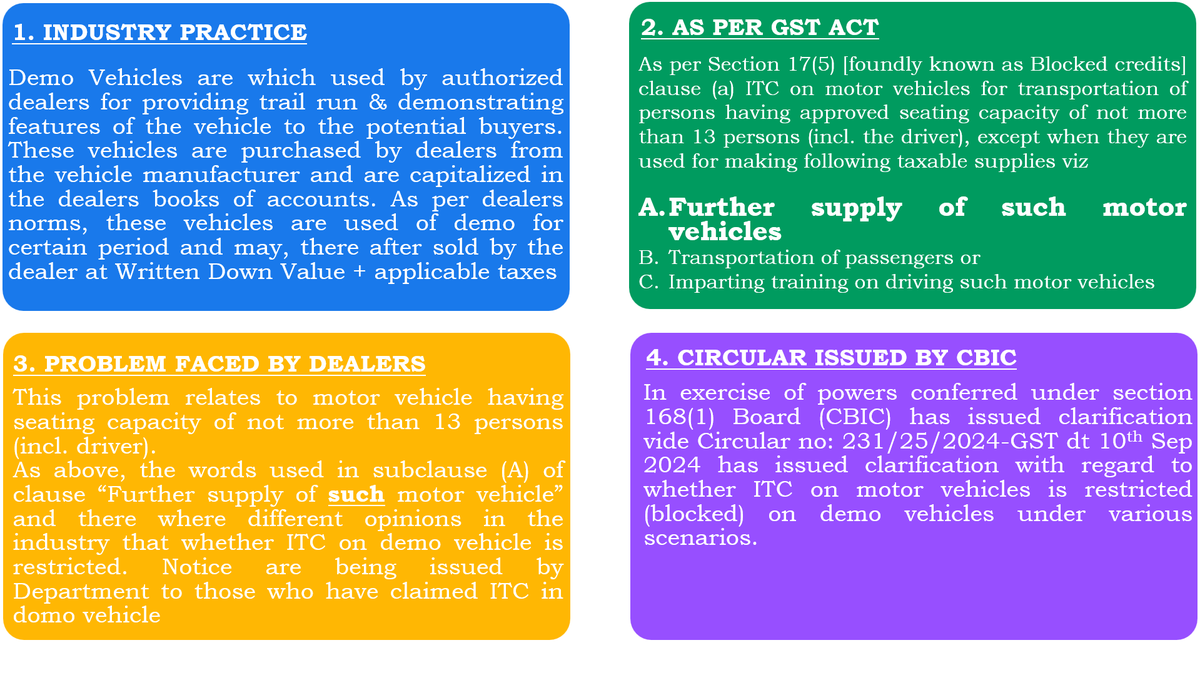

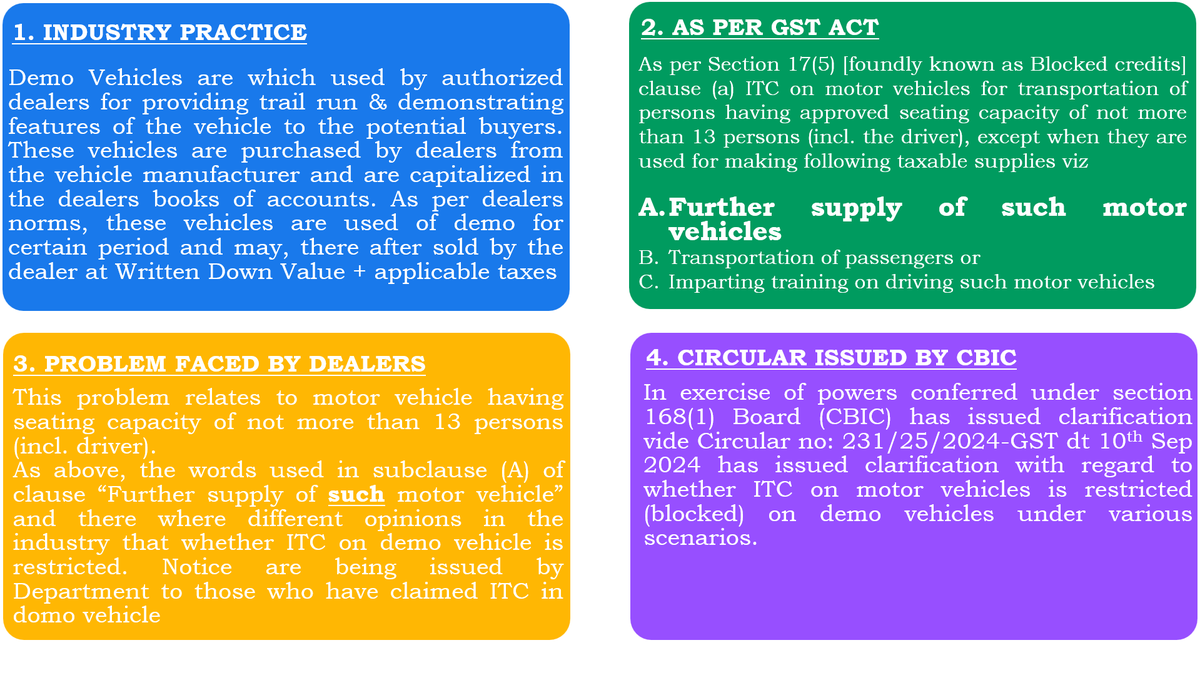

🏆CBIC on 10th Sep 2024 issued a circular no: 231/25/2024-GST on the subject clarification on availability of Input Tax Credit in respect of demo vehicles. This circular brings greater relief to the taxpayer, especially the vehicle dealers #GST #GSTCircular #DemoVehicle #ITC

#CBIC issued Clarification of various doubts related to Section 128A of the CGST Act, 2017- Amnesty Scheme. taxonation.com/show-detail-ne… #GST #GSTCIRCULAR #AMNESTYSCHEME #SECTION128A #GSTNOTIFICATION #GSTELIBRAY #ITC

Circular No.-221/15/2024-GST-Clarification on time of supply in respect of supply of services of construction of road and maintenance. taxonation.com/show-detail-ar… #gst #gstcircular #circulars #gstupdate #gstnotification #notification #councilmeeitng

Accutech Digi Accounto Private Limited #gstcircular #gstreturn #gstportal #gstdrive #gstverification #gst 16.05.2023 से येDOCUMENTS रखे तैयार | GST OFFICERS TO VISIT THE SHOPS FOR VERIFICATION | Whether GST officer will visit my shop also? GST Officer Visit Your Shop Soon | GST…

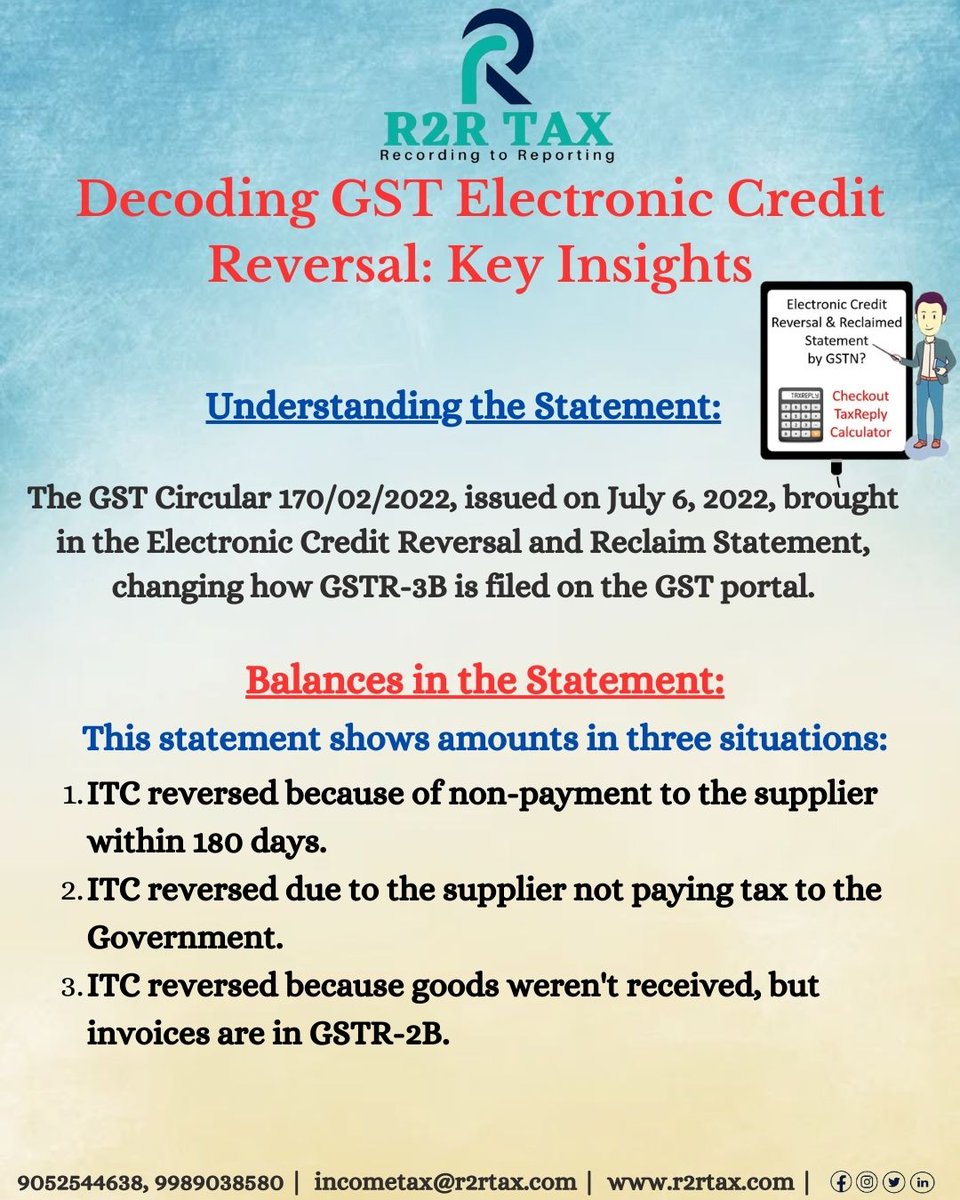

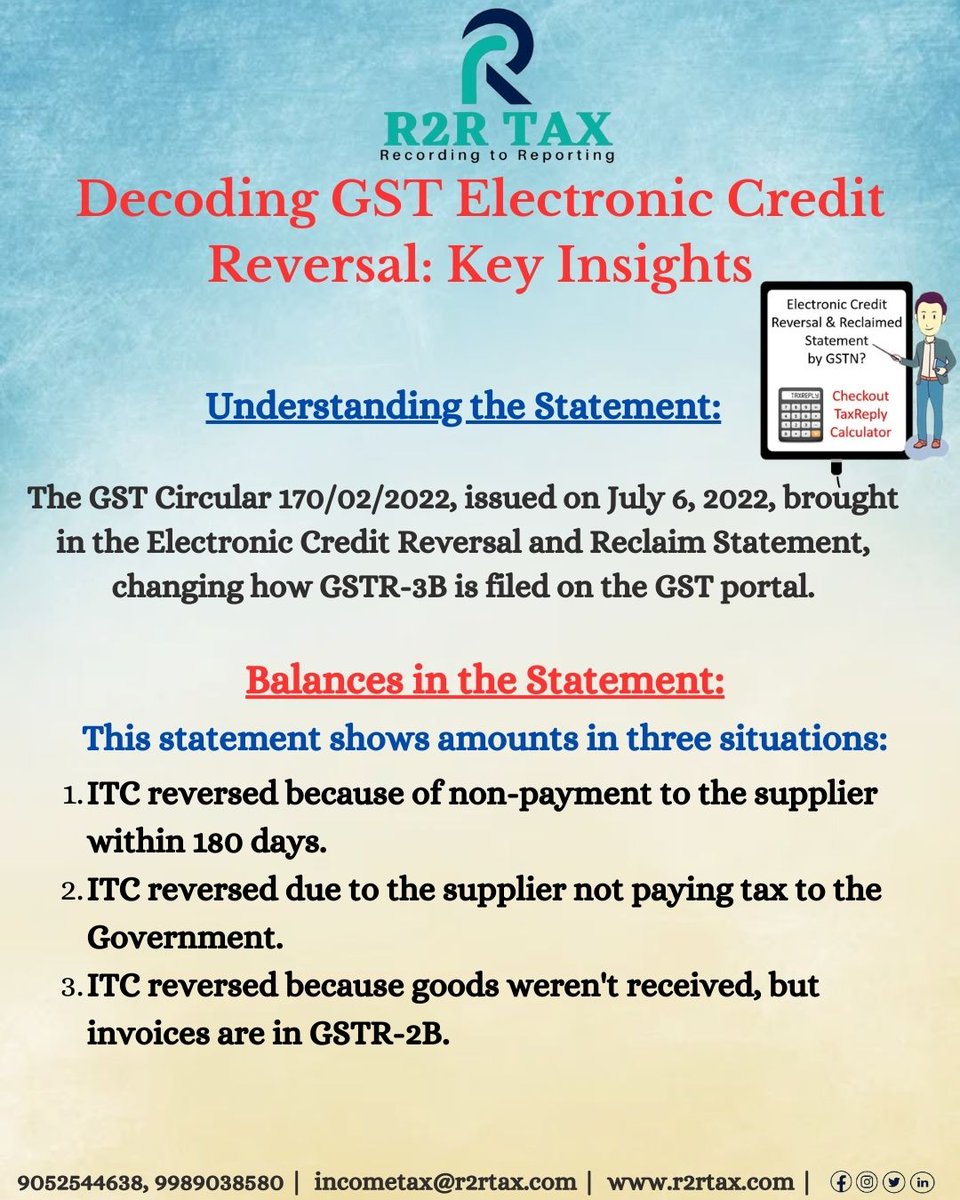

Decoding GST Electronic Credit Reversal: Key Insights. Follow @r2rtax for more updates and be a part of @r2rtax #GSTCircular #ElectronicCreditReversal #GSTR3B #TaxationUpdate #ComplianceChanges #GSTPortal #instagram #facebook #linkedin #twitter #r2rtaxlife #kadapasmartcity

Kerala GST Dept. Mandates Common Adjudicating Authority for Multiple SCNs to Ensure Uniformity Read more: aaermlawassociates.com/kerala-gst-dep… KeralaGST #SCNAdjudication #TaxCompliance #GSTCircular #StateGST #TaxpayerServices #SGST

aaermlawassociates.com

Kerala GST Dept. Mandates Common Adjudicating Authority for Multiple SCNs to Ensure Uniformity -...

The Kerala GST Department issued Circular No. 12/2024-Kerala SGST on

𝗨𝗻𝗱𝗲𝗿𝘀𝘁𝗮𝗻𝗱𝗶𝗻𝗴 𝗚𝗦𝗧 𝗖𝗹𝗮𝗿𝗶𝗳𝗶𝗰𝗮𝘁𝗶𝗼𝗻𝘀: 𝗧𝗶𝗺𝗲 𝗟𝗶𝗺𝗶𝘁𝘀 𝗳𝗼𝗿 𝗜𝗧𝗖 𝗼𝗻 𝗥𝗖𝗠 𝗦𝘂𝗽𝗽𝗹𝗶𝗲𝘀 𝗳𝗿𝗼𝗺 𝗨𝗻𝗿𝗲𝗴𝗶𝘀𝘁𝗲𝗿𝗲𝗱 𝗣𝗲𝗿𝘀𝗼𝗻𝘀 #GSTUpdate #ITC #GSTCircular #TaxCompliance #BusinessNews #VJMGlobal link.vjmglobal.com/NkLD

link.vjmglobal.com

Clarification On Time Limit To Claim ITC In Respect Of RCM Supplies Received From Unregistered...

CBIC has clarified that in case of supplies from unregistered person to registered person, where GST is to be paid under RCM, relevant financial year for availment of ITC u/s 16(4) shall be the year...

🔍 CBIC Clarifies GSTR-9C in Annual Return! Through Circular 246/03/2025, CBIC confirms that the annual return includes GSTR-9C, if applicable #GSTArticle #GSTCircular #GSTN #GSTCouncil #GSTNews #TaxUpdates #GSTR9 #GSTR9C #IndiaTaxNews #GSTUpdates #GSTInfo

Circular No. 227/21/2024 Processing of #refund applications filed by Canteen Stores Department (CSD) #gst #gstcircular #circular #guidelines #refund #litigation #gstcaselaw #taxonation

⚠️ Late Fee Alert! Under Section 47(2) of the CGST Act, any delay in furnishing the annual return (including GSTR-9C, if applicable) attracts a late fee! 💰 #GSTArticle #GSTCircular #GSTN #GSTCouncil #GSTNews #TaxUpdates #GSTR9 #GSTR9C #IndiaTaxNews #GSTUpdates #GSTInfo

Scenarios of Late Fee Calculation (Continues) ✔️If GSTR-9C is filed after GSTR-9, the late fee applies until the date of furnishing GSTR-9C. 🗨️ Dear #GSTExperts share your thoughts #GSTArticle #GSTCircular #GSTN #GSTCouncil #GSTNews #TaxUpdates #GSTR9 #GSTR9C #IndiaTaxNews

CBIC has vide circular no. 186/18/2022 Dt. 27.12.2022 made few clarifications under GST law as under: Representations have been received from the field formations seeking clarification on certain issues with respect to – i. #CBICcircular #GSTcircular taxontips.com/clarification-…

📢 New GST Circular Alert! CBIC issues Circular No. 254/11/2025-GST (27 Oct 2025) defining Proper Officers under Sections 74A, 75(2), & 122 with new monetary limits. 📘 Clear guidelines for adjudication & penalties — explained here 👇 🔗 youtu.be/ztHv7HDlHvM?si… #GSTCircular…

youtube.com

YouTube

Circular No. 254/11/2025-GST, Proper Officer for Sections 74A, 75(2),...

#CBIC clarifies Review, Revision & Appeal procedure for CAA orders on DGGI SCNs ✅ Review/Revision: Jurisdictional Commissioner ✅ Appeals: Concerned Commissioner (Appeals) ✅ Dept Representation: Jurisdictional Commissioner ✅ DGGI comments may be sought #GSTCircular 250/07/2025

The #Kerala #TaxDepartment has released #GSTCircular No. 12/2025, which amends Circular No. 5/2023 to streamline the waiver of interest or penalty under Section 73 for the fiscal years 2017-18, 2018-19, and 2019-20. blog.saginfotech.com/gst-circular-1…

blog.saginfotech.com

GST Circular No. 12/2025: Kerala Govt Amends Circular 5/2023 on Function Assignment

The Kerala Tax Department has released GST Circular No. 12/2025, which amends Circular No. 5/2023 to streamline the waiver of interest or penalty under Section 73 for the fiscal years 2017-18,...

Legality of the Restriction Posed by Circular No. 181/13/2022-GST Dated 10-11-2022: Adding to the Woes of the Edible Oil and Coal Industry by Ravi Raghavan, Meghna Lal and Vani Dwevedi [@LKSattorneys] #GSTCircular #GSTlegalchallenge #CBICCircular #scconline #SCC #scctimes

Scenarios of Late Fee Calculation (Continues) ✔️If GSTR-9C is filed after GSTR-9, the late fee applies until the date of furnishing GSTR-9C. 🗨️ Dear #GSTExperts share your thoughts #GSTArticle #GSTCircular #GSTN #GSTCouncil #GSTNews #TaxUpdates #GSTR9 #GSTR9C #IndiaTaxNews

⚠️ Late Fee Alert! Under Section 47(2) of the CGST Act, any delay in furnishing the annual return (including GSTR-9C, if applicable) attracts a late fee! 💰 #GSTArticle #GSTCircular #GSTN #GSTCouncil #GSTNews #TaxUpdates #GSTR9 #GSTR9C #IndiaTaxNews #GSTUpdates #GSTInfo

📜 What does Section 44(1) say? "Every registered person… shall furnish an annual return which may include a self-certified reconciliation statement..." 🔹 This means GSTR-9 may include GSTR-9C where required. #GSTArticle #GSTCircular #GSTN #GSTCouncil #GSTNews #TaxUpdates

🔍 CBIC Clarifies GSTR-9C in Annual Return! Through Circular 246/03/2025, CBIC confirms that the annual return includes GSTR-9C, if applicable #GSTArticle #GSTCircular #GSTN #GSTCouncil #GSTNews #TaxUpdates #GSTR9 #GSTR9C #IndiaTaxNews #GSTUpdates #GSTInfo

Article on Understanding the Late Fee Applicability for FORM GSTR-9C: Insights from Circular No. 246/03/2025-GST jayaramassociates.com/blogContent/8 #GSTArticle #GSTCircular #GSTN #GSTCouncil #GSTNews #TaxUpdates #GSTR9 #GSTR9C #IndiaTaxNews #GSTUpdates #GSTInfo

The #Kerala #government has issued #GSTCircular No. 3/2025, dated 20th January 2025, providing clarifications and instructions on issuing separate notices under Sections 73 and 74 of the Kerala #SGST Act, 2017. blog.saginfotech.com/kerala-gst-dep…

GST Inshort 114 #GSTUpdate #DataHostingServices #GSTCircular #TaxClarification #CloudComputing #IntermediaryServices #GSTInshorts #IGSTAct #PlaceOfSupply #Karneeti

GST Inshort 112 #GSTUpdates #AdvertisingServices #GSTCircular #TaxClarifications #CGSTAct #ForeignClients #IndirectTax #GSTInshorts #IndiaTaxation #Karneeti

#CBIC issued Clarification of various doubts related to Section 128A of the CGST Act, 2017- Amnesty Scheme. taxonation.com/show-detail-ne… #GST #GSTCIRCULAR #AMNESTYSCHEME #SECTION128A #GSTNOTIFICATION #GSTELIBRAY #ITC

#CBIC clarifies Review, Revision & Appeal procedure for CAA orders on DGGI SCNs ✅ Review/Revision: Jurisdictional Commissioner ✅ Appeals: Concerned Commissioner (Appeals) ✅ Dept Representation: Jurisdictional Commissioner ✅ DGGI comments may be sought #GSTCircular 250/07/2025

Circular No.-221/15/2024-GST-Clarification on time of supply in respect of supply of services of construction of road and maintenance. taxonation.com/show-detail-ar… #gst #gstcircular #circulars #gstupdate #gstnotification #notification #councilmeeitng

🏆CBIC on 10th Sep 2024 issued a circular no: 231/25/2024-GST on the subject clarification on availability of Input Tax Credit in respect of demo vehicles. This circular brings greater relief to the taxpayer, especially the vehicle dealers #GST #GSTCircular #DemoVehicle #ITC

Decoding GST Electronic Credit Reversal: Key Insights. Follow @r2rtax for more updates and be a part of @r2rtax #GSTCircular #ElectronicCreditReversal #GSTR3B #TaxationUpdate #ComplianceChanges #GSTPortal #instagram #facebook #linkedin #twitter #r2rtaxlife #kadapasmartcity

The #GSTCircular 183/2022 outlines several steps that must be taken by assesses or their representatives to ensure that their claims are based on accurate information. Read more here bit.ly/3WnuBb3 #GST #GSTIndia #GSTData #GSTSolutions

CBIC has vide circular no. 186/18/2022 Dt. 27.12.2022 made few clarifications under GST law as under: Representations have been received from the field formations seeking clarification on certain issues with respect to – i. #CBICcircular #GSTcircular taxontips.com/clarification-…

Something went wrong.

Something went wrong.

United States Trends

- 1. National Guard 167K posts

- 2. Thanksgiving 445K posts

- 3. Liverpool 119K posts

- 4. Arsenal 378K posts

- 5. Bayern 201K posts

- 6. Slot 104K posts

- 7. Neuer 20.2K posts

- 8. Frank Ragnow 6,898 posts

- 9. #InfoSecVPN N/A

- 10. Martinelli 22.9K posts

- 11. Konate 14.9K posts

- 12. Anfield 20.3K posts

- 13. Declan Rice 11.4K posts

- 14. Mbappe 107K posts

- 15. #ARSBAY 8,029 posts

- 16. Blood 155K posts

- 17. Arteta 25.8K posts

- 18. Olympiacos 26.7K posts

- 19. #COYG 5,958 posts

- 20. Patrick Morrisey 3,721 posts