#gstlitigation search results

✅ Delhi HC sets aside OIOs due to duplication & clerical errors in tax demand. ⚖️ Accuracy in adjudication is not optional, it’s mandatory. #GSTLitigation #DelhiHighCourt #TaxJustice #CAPS #GSTMitra #CAPraveenSharma

🧾 Delhi HC directs year-wise DRC-07 issuance; appeal under Sec 107 permitted! #GSTLitigation #NaturalJustice #DRC07 #CAPS59 #GSTMitra #CAPraveenSharma

📢 Delhi HC allows single appeal for SCN covering multiple years despite DRC-07 showing only FY 2017–18! #GSTLitigation #DelhiHighCourt #DRC07 #GSTAppeal #CAPS #CAPraveenSharma

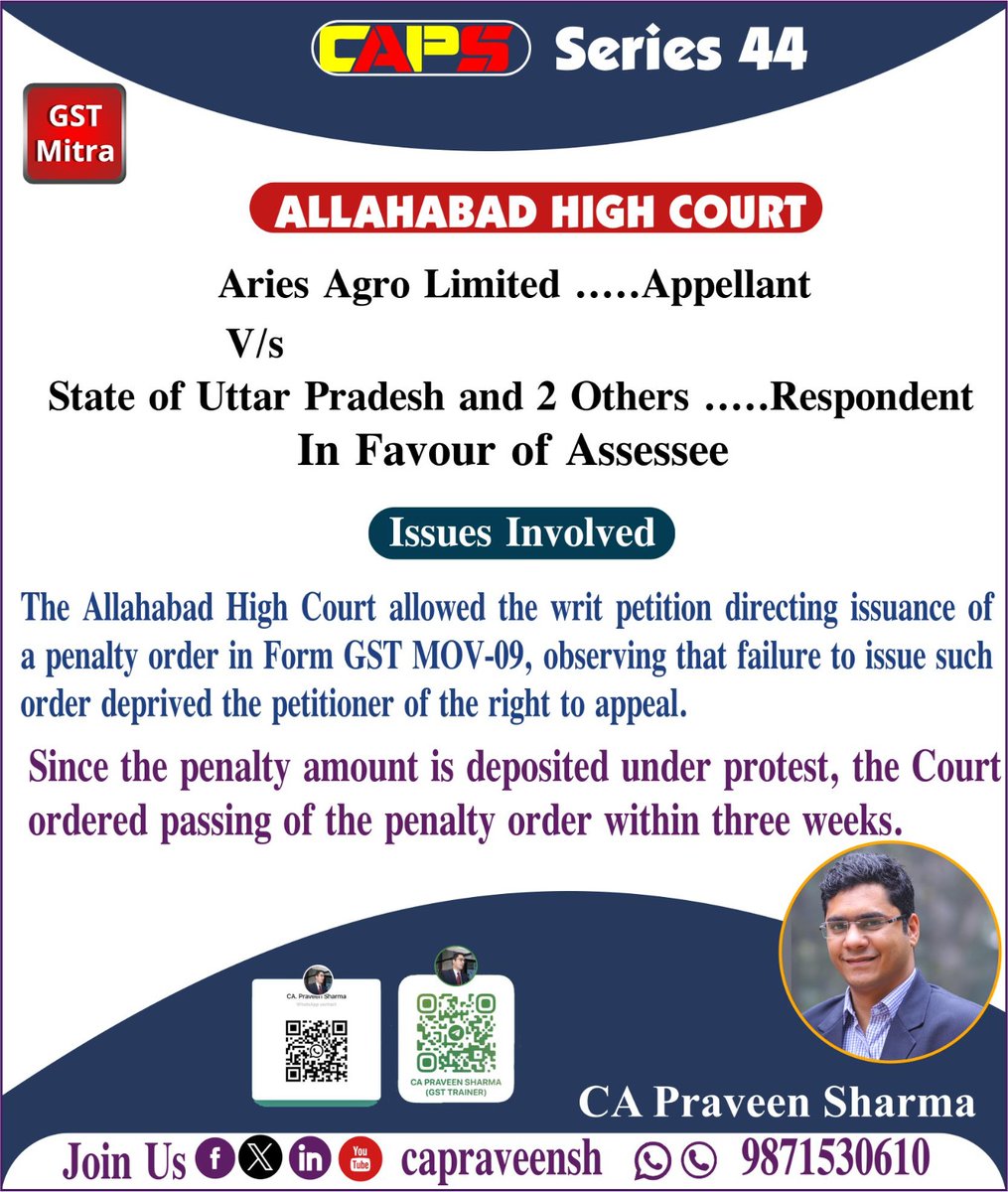

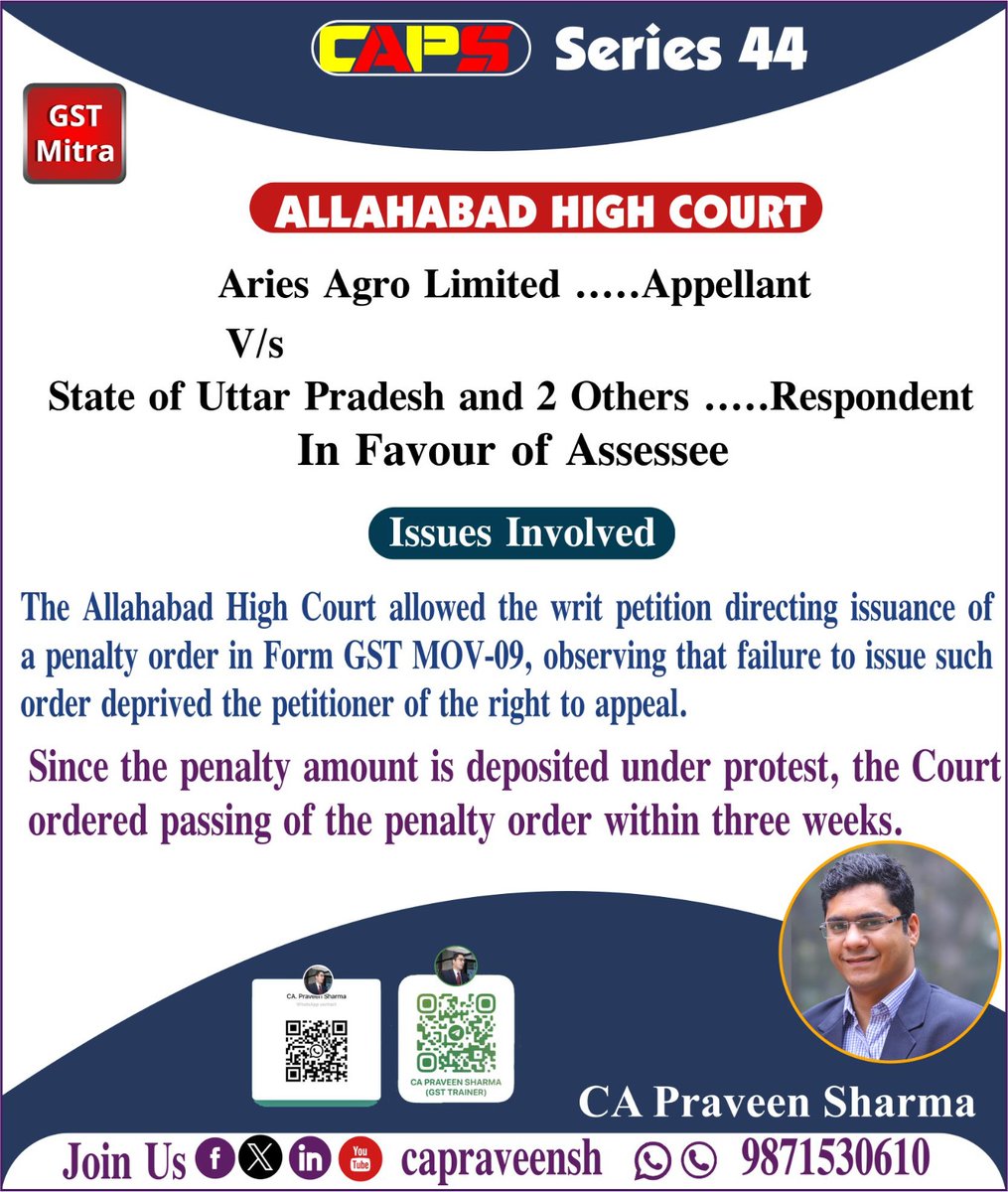

📢 Allahabad HC directs issuance of GST MOV-09 penalty order, upholding taxpayer’s right to appeal after payment under protest. #GSTLitigation #MOV09 #HighCourtRuling #TaxpayerRights #CAPS #CAPraveenSharma4o

📢 Allahabad HC rules: Mere non-filling of Part-B of e-way bill without tax evasion intent can't attract penalty under Section 129! #GSTLitigation #EWayBill #Section129 #CAPS #CAPraveenSharma #GSTUpdates

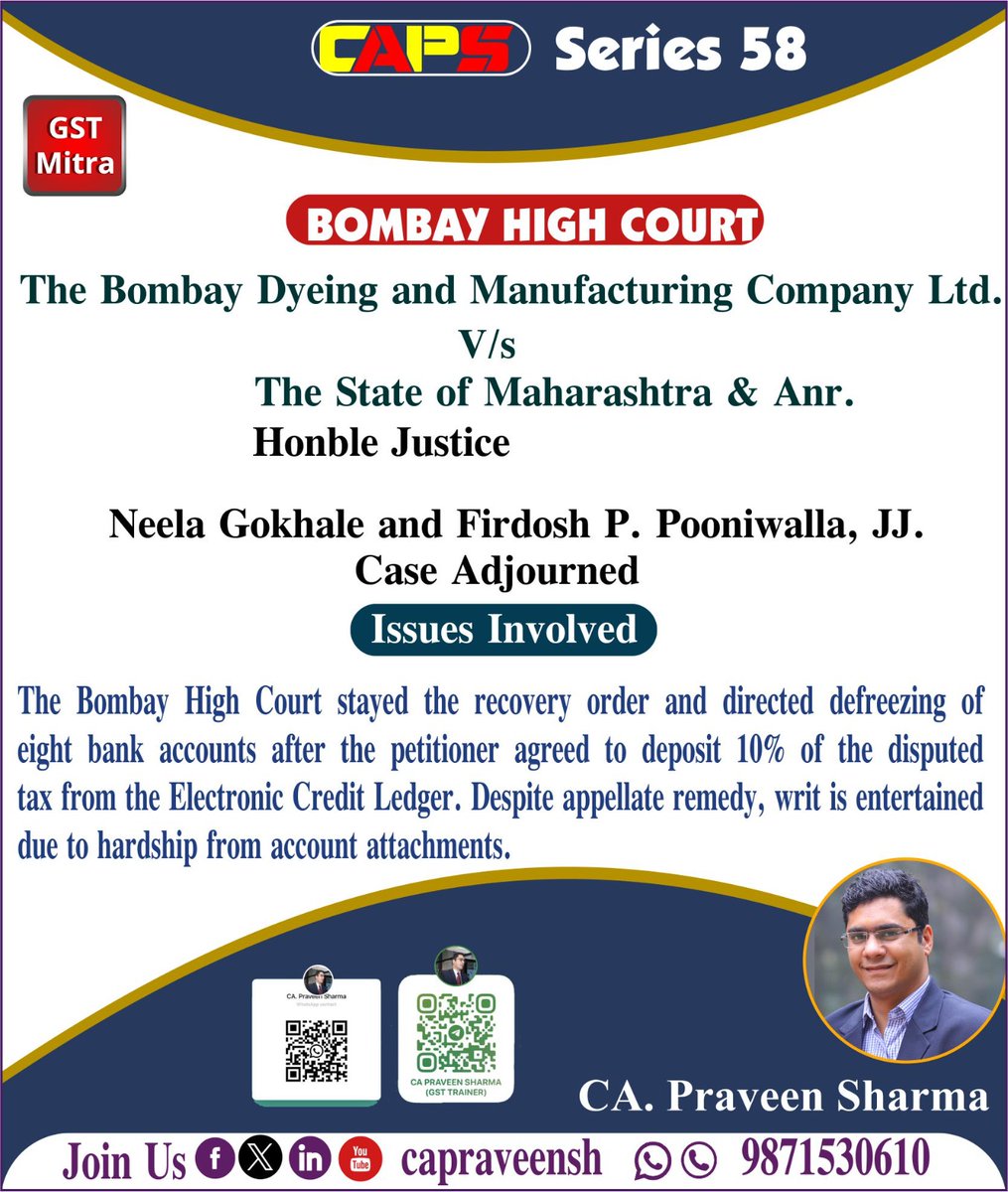

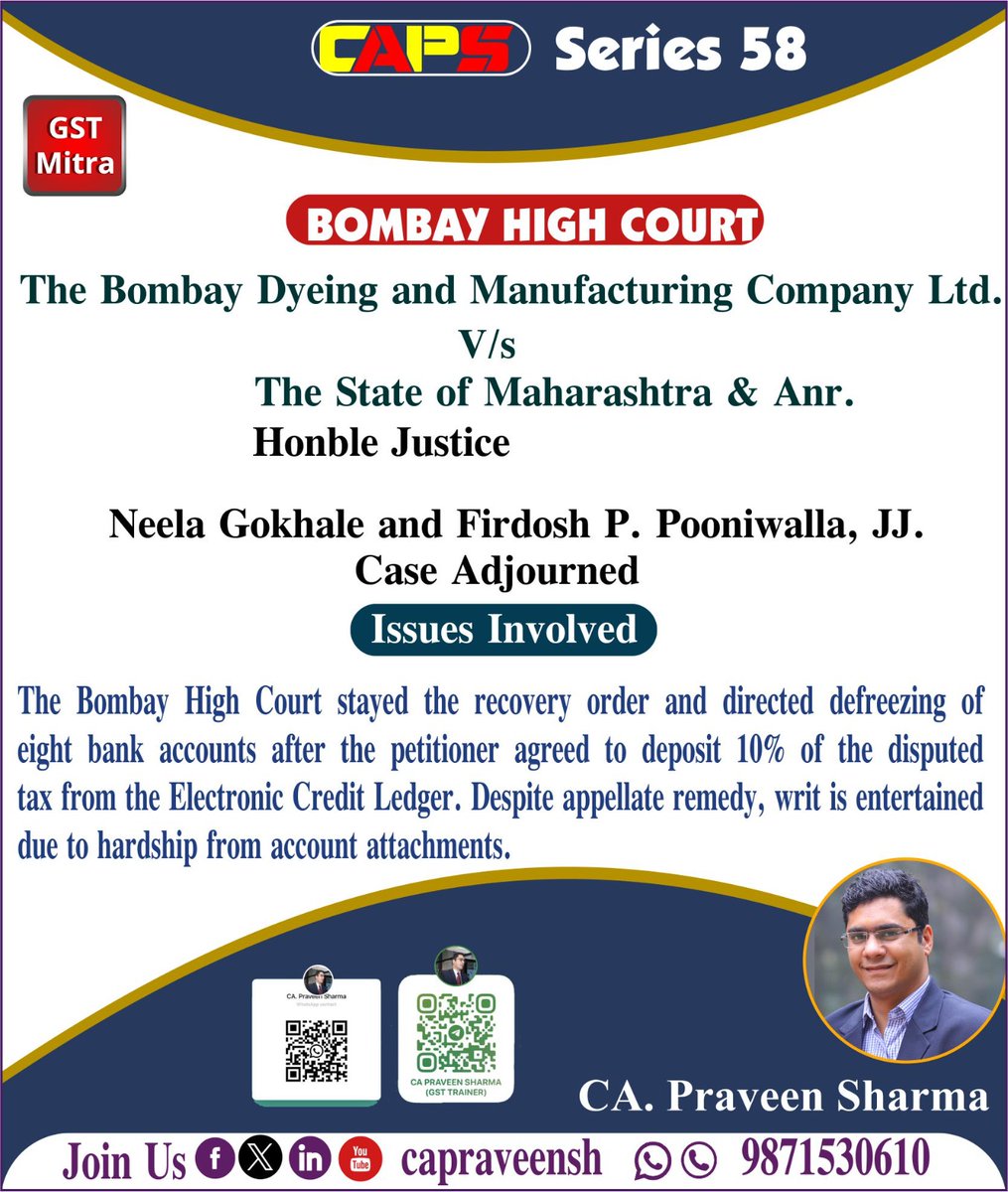

🚨 Bombay HC stays recovery & unfreezes 8 bank a/cs of Bombay Dyeing on 10% tax deposit from credit ledger due to hardship! #GSTLitigation #WritRelief #BombayHighCourt #CAPS58 #GSTMitra

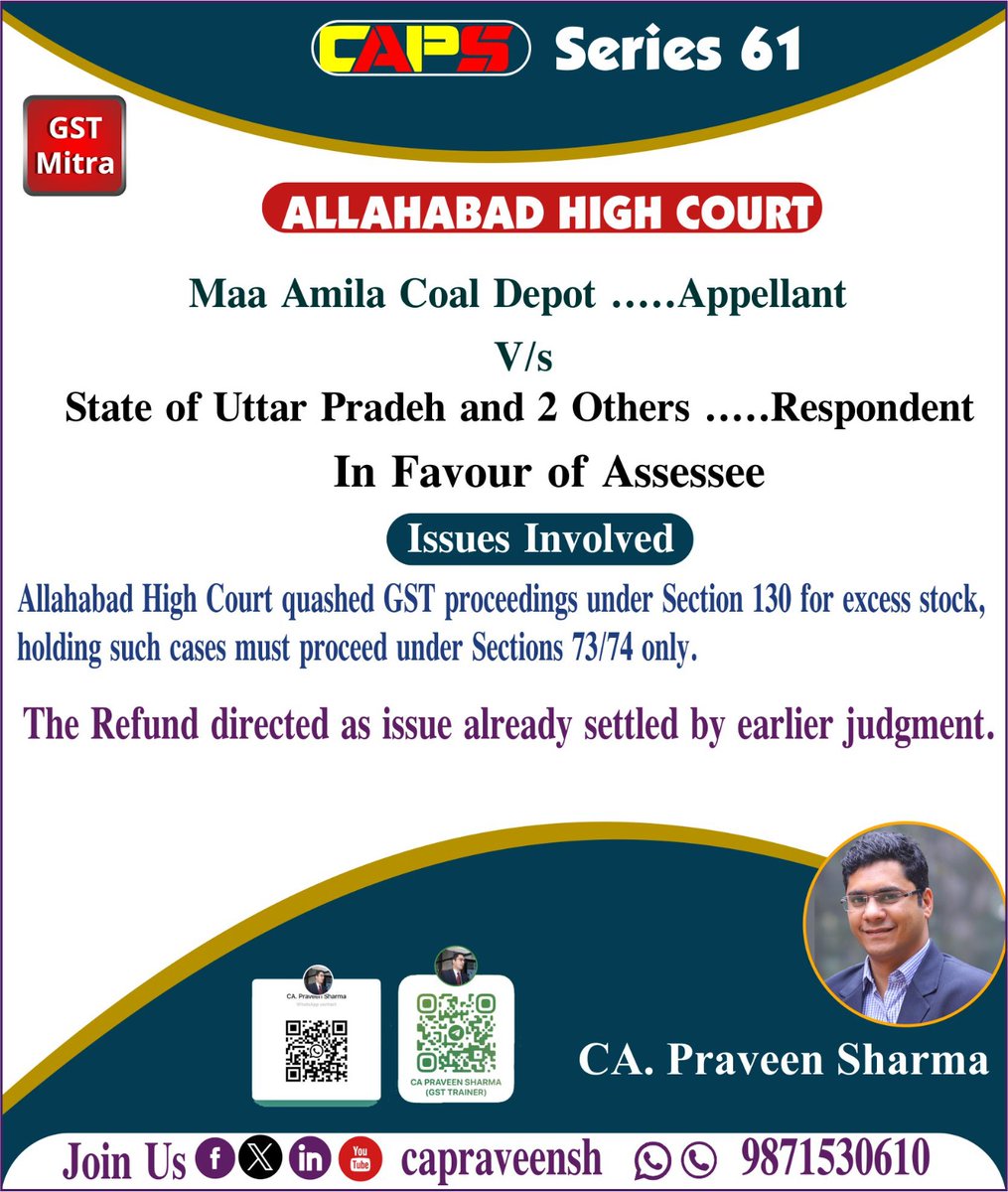

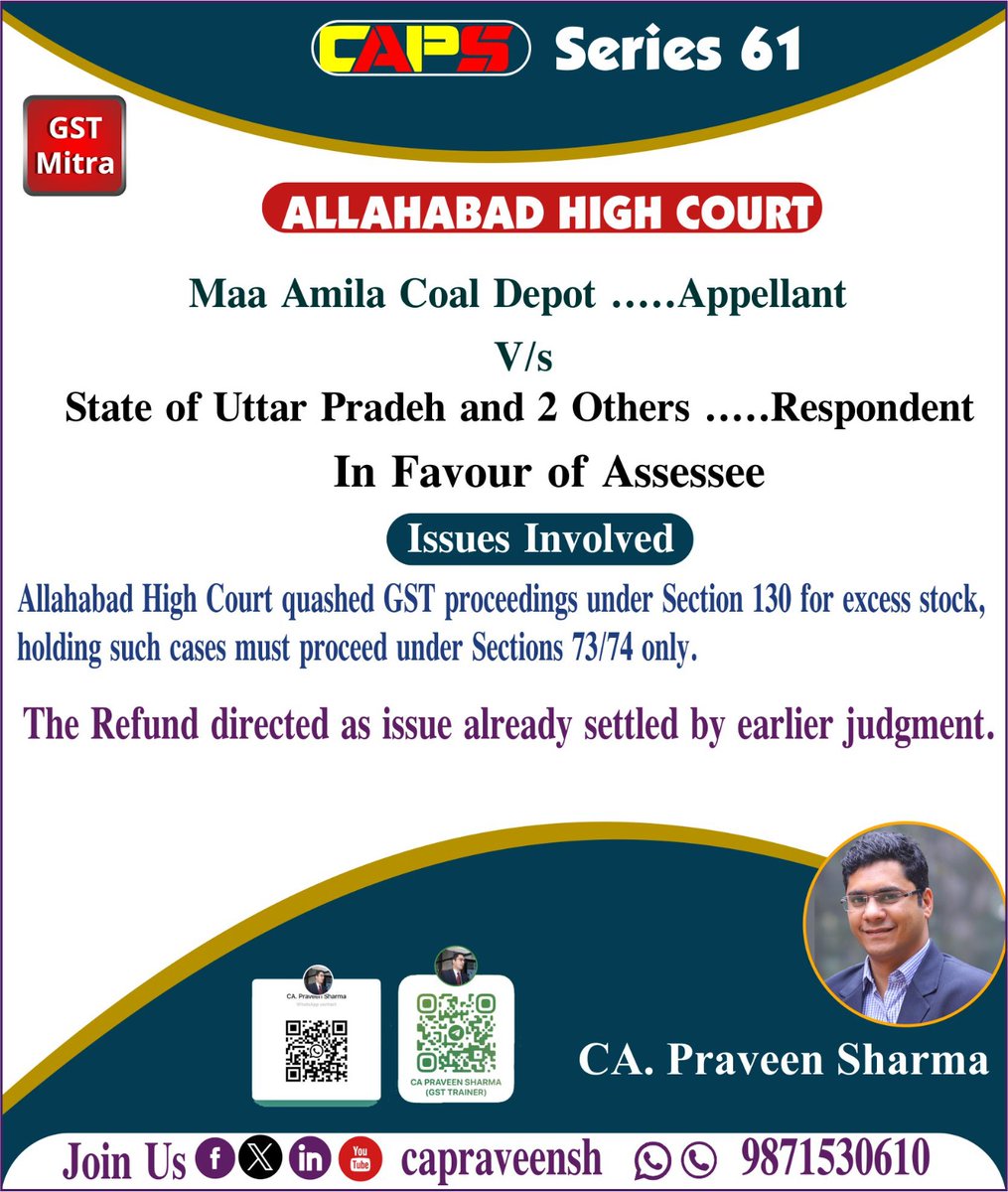

🔴 Allahabad HC: GST proceedings for excess stock cannot be initiated under Section 130—must follow Section 73/74. Refund allowed. #GSTJudgment #Section130Quashed #GSTLitigation #CAPraveenSharma

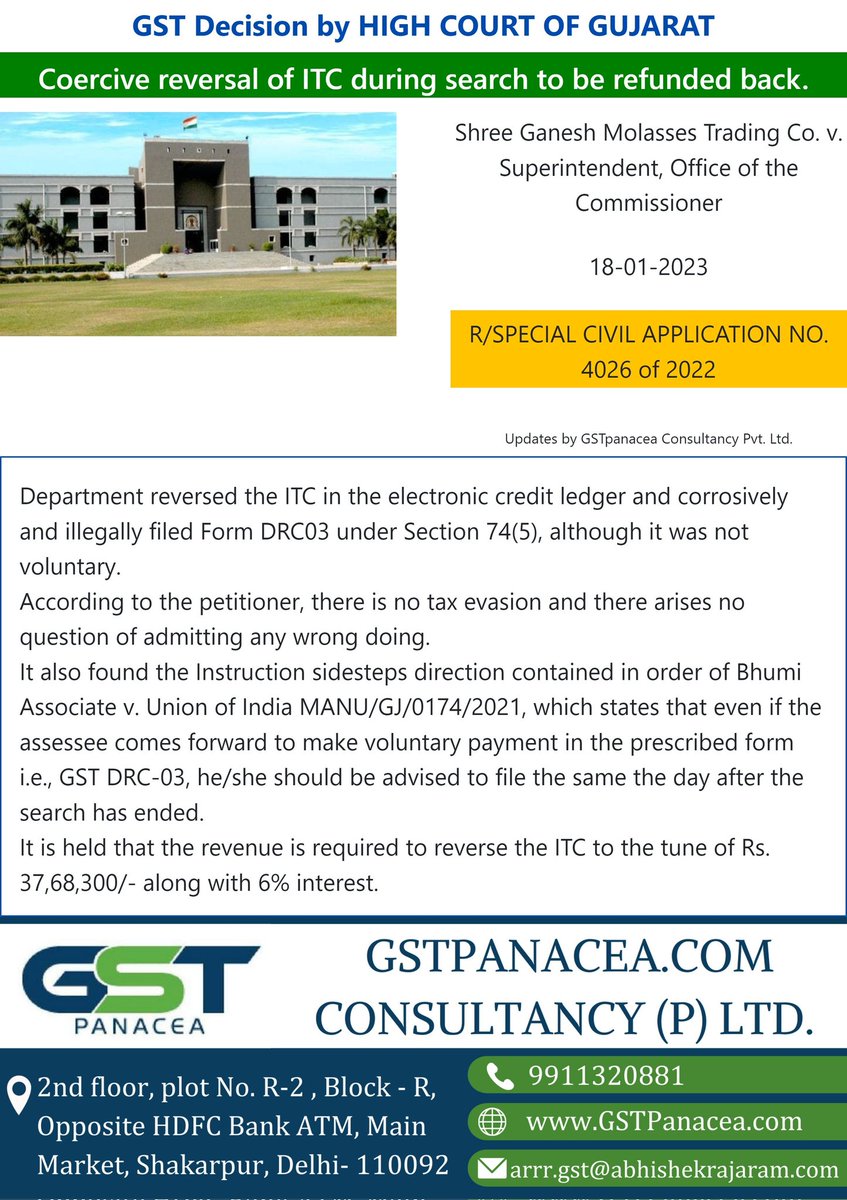

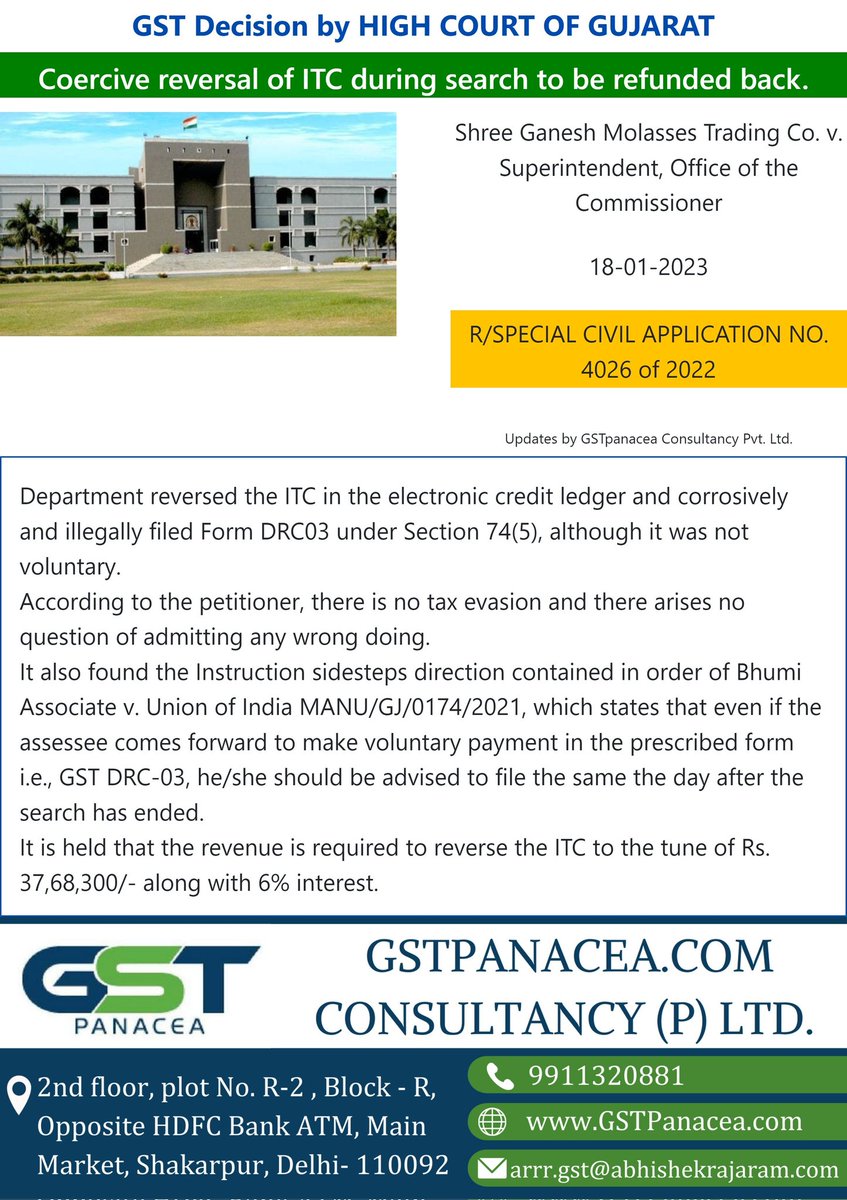

Coercive reversal of ITC during search to be refunded back. Title: Shree Ganesh Molasses Trading Co. vs Superintendent, Office of the Commissioner Court: Gujarat High Court Dated: 18-01-23 #gstlitigation

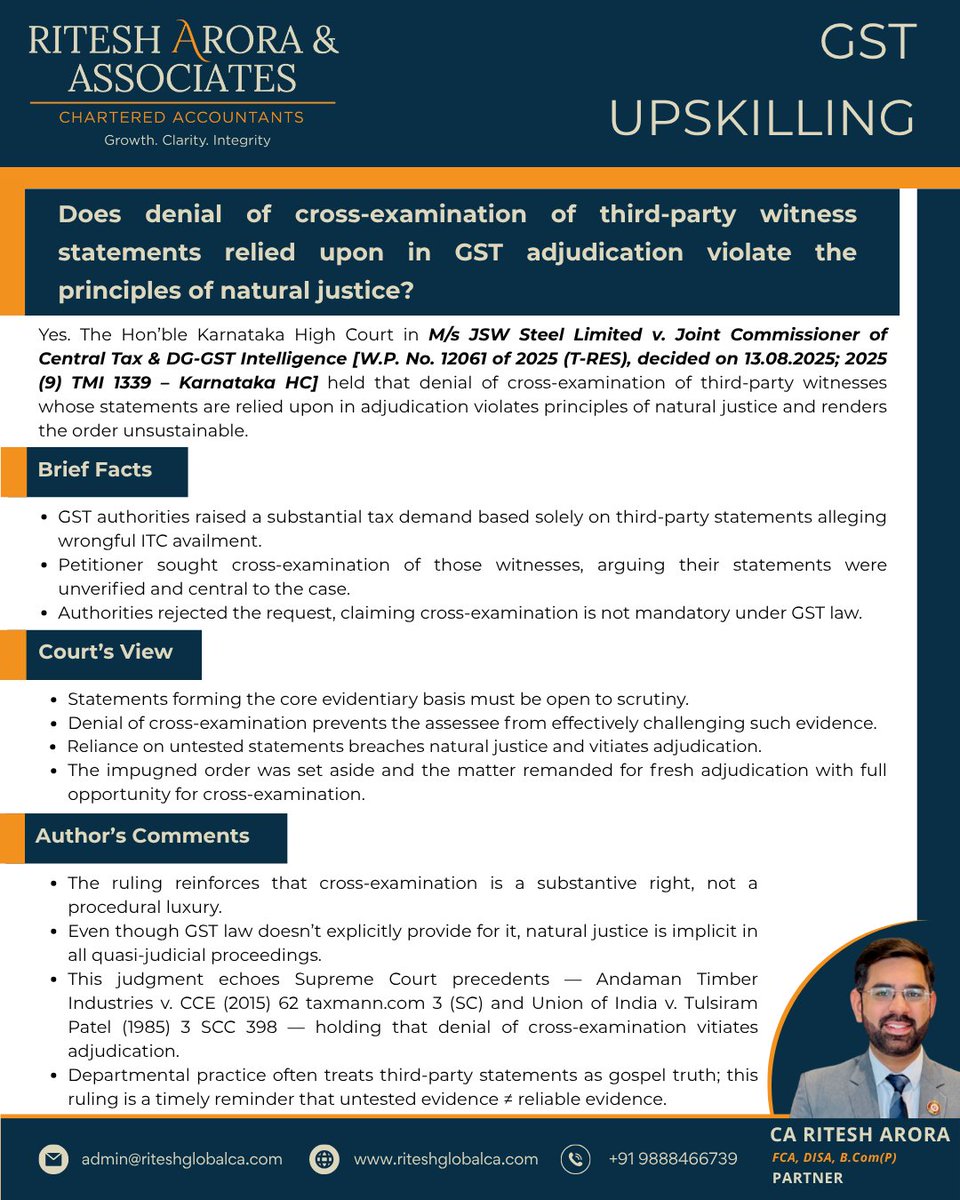

Can a GST adjudication order stand if cross-examination of key third-party witnesses is denied? The Karnataka HC says NO ➡️ Cross-examination is mandatory when 3rd-party #GSTLitigation #CrossExamination #NaturalJustice #GSTLaw #IndirectTax #TaxDisputes #LegalUpdate #Karnataka

💬 Have YOU faced GST portal issues? This judgement gives you legal backing! 🔄 RETWEET to spread awareness ❤️ LIKE if this was helpful 💭 COMMENT your portal horror stories Let's build a community that KNOWS their rights! #KnowYourRights #IndirectTax #GSTLitigation

Can Sec 61 scrutiny question valuation? The Jharkhand HC has made it clear —No. ASMT-10 notices based on “market price difference” are beyond the scope of scrutiny. Watch: youtube.com/shorts/UdiZohB… #gstlitigation #section61 #valuationdispute #gstlaw #cgstact #asmt10 #gstindia

When is a GST #SCN under Section 74 defective? Invoking fraud, wilful misstatement & suppression of facts together shows non-application of mind — making the SCN invalid in law. Watch: youtube.com/shorts/RVdAabl… #gstlitigation #section74 #defectivescn #gstlaw #cgstact #gstindia

GSTAT and the Future of GST Litigation: Will It Reduce Judicial Backlog? #gstat #gstlitigation #judicialbacklog #taxscan #taxnews taxscan.in/top-stories/gs…

taxscan.in

GSTAT and the Future of GST Litigation: Will It Reduce Judicial Backlog?

The journey to GST and GSTAT

We are proud to showcase our professional certifications that reflect our trust, credibility, and expertise #AarifAndAssociates #CertifiedAuditor #GSTLitigation #TaxConsultant #ZohoPartner #CostAccountant #TrichyAuditor #BusinessAdvisor

📢 Delhi HC allows single appeal for SCN covering multiple years despite DRC-07 showing only FY 2017–18! #GSTLitigation #DelhiHighCourt #DRC07 #GSTAppeal #CAPS #CAPraveenSharma

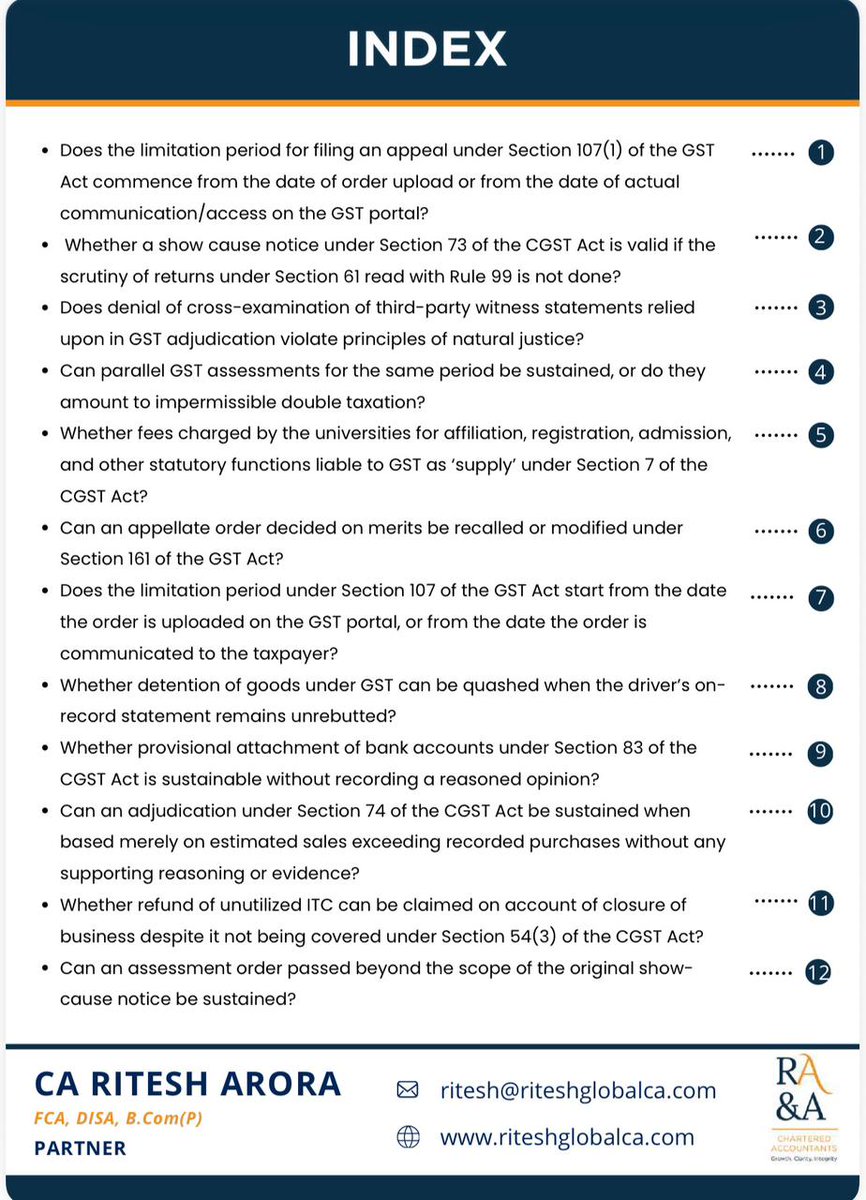

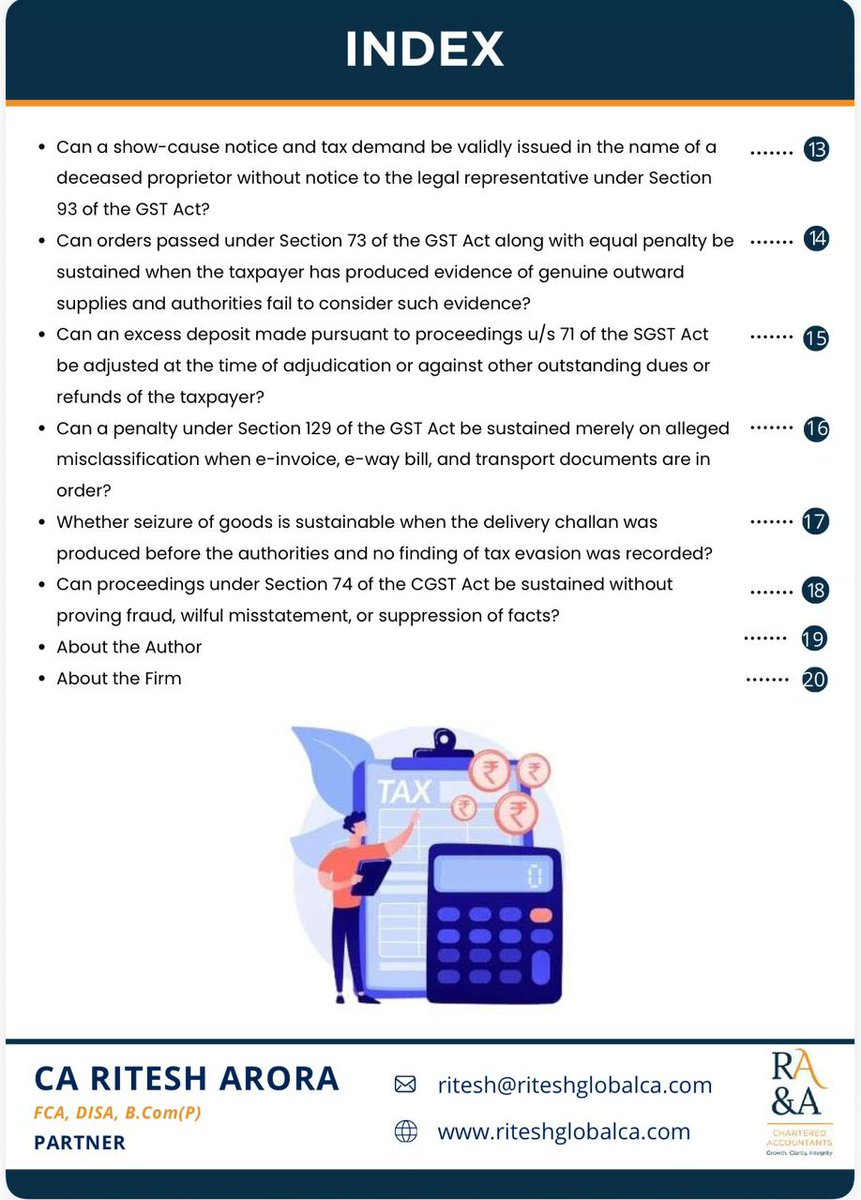

GST Case Law Compendium – October 2025 Edition Authored by @ritesharora1628 Read full Compendium → drive.google.com/file/d/18obUEU… #gst #gstlitigation #taxlaw #section73 #section107 #cgstact #indirecttax #legalupdates #ritesharoraassociates #gstcompendium #charteredaccountants

Coercive reversal of ITC during search to be refunded back. Title: Shree Ganesh Molasses Trading Co. vs Superintendent, Office of the Commissioner Court: Gujarat High Court Dated: 18-01-23 #gstlitigation

🧾 Delhi HC directs year-wise DRC-07 issuance; appeal under Sec 107 permitted! #GSTLitigation #NaturalJustice #DRC07 #CAPS59 #GSTMitra #CAPraveenSharma

✅ Delhi HC sets aside OIOs due to duplication & clerical errors in tax demand. ⚖️ Accuracy in adjudication is not optional, it’s mandatory. #GSTLitigation #DelhiHighCourt #TaxJustice #CAPS #GSTMitra #CAPraveenSharma

📢 Allahabad HC directs issuance of GST MOV-09 penalty order, upholding taxpayer’s right to appeal after payment under protest. #GSTLitigation #MOV09 #HighCourtRuling #TaxpayerRights #CAPS #CAPraveenSharma4o

📢 Allahabad HC rules: Mere non-filling of Part-B of e-way bill without tax evasion intent can't attract penalty under Section 129! #GSTLitigation #EWayBill #Section129 #CAPS #CAPraveenSharma #GSTUpdates

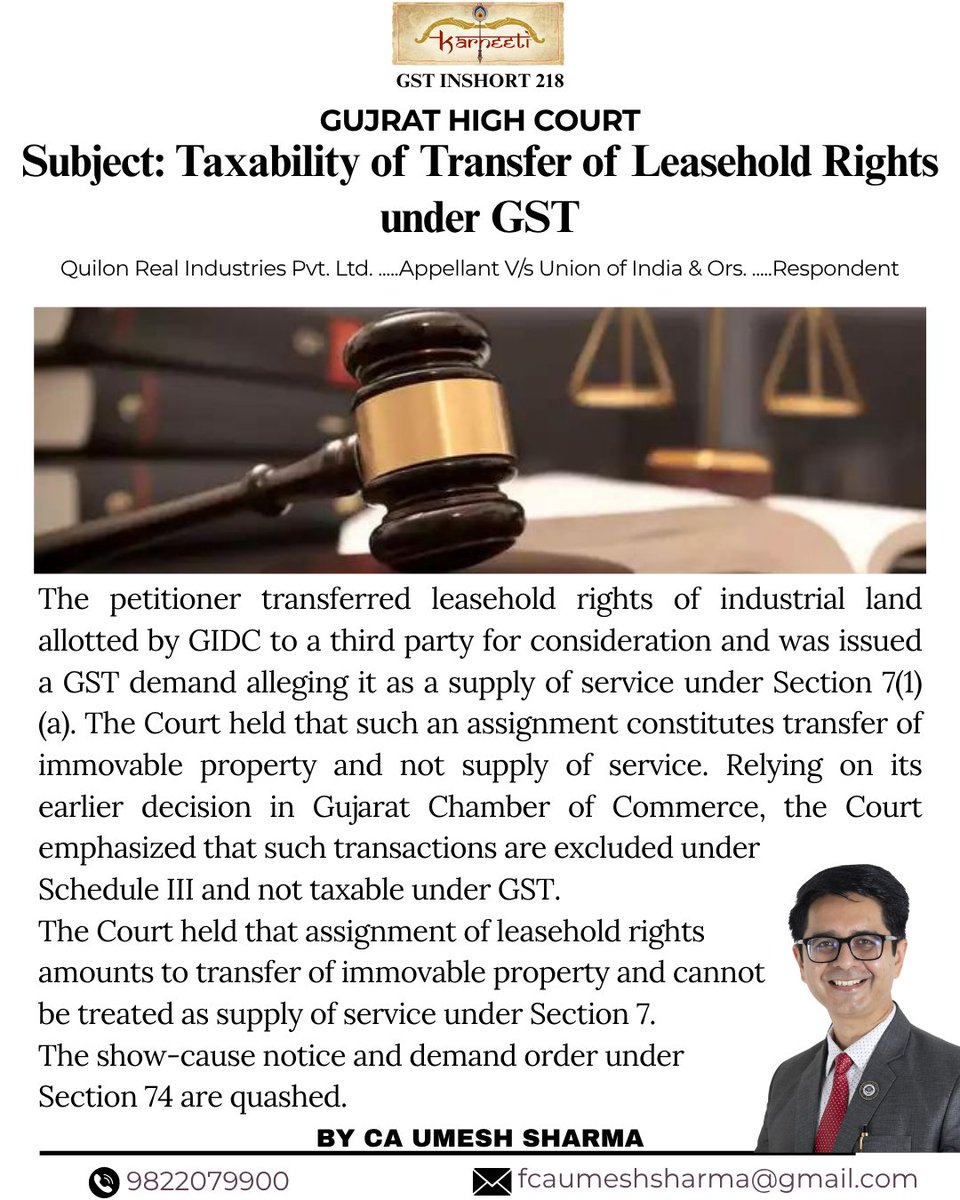

GST Inshort 218 Gujrat High Court Subject : Taxability of Transfer of Leasehold Rights under GST #GSTUpdate #GSTLitigation #TaxUpdate #IndirectTax #LeaseholdRights #ImmovableProperty #SupplyUnderGST #GSTJudgement #CharteredAccountant #TaxConsultant #GujaratHighCourt #LegalUpdate

🚨 Bombay HC stays recovery & unfreezes 8 bank a/cs of Bombay Dyeing on 10% tax deposit from credit ledger due to hardship! #GSTLitigation #WritRelief #BombayHighCourt #CAPS58 #GSTMitra

🔴 Allahabad HC: GST proceedings for excess stock cannot be initiated under Section 130—must follow Section 73/74. Refund allowed. #GSTJudgment #Section130Quashed #GSTLitigation #CAPraveenSharma

Something went wrong.

Something went wrong.

United States Trends

- 1. James Comey 19.9K posts

- 2. Thanksgiving 152K posts

- 3. Comey and James 12.8K posts

- 4. Jimmy Cliff 27.6K posts

- 5. #IDontWantToOverreactBUT 1,424 posts

- 6. #WooSoxWishList 4,566 posts

- 7. #NutramentHolidayPromotion N/A

- 8. Pentagon 9,879 posts

- 9. #MondayMotivation 14.2K posts

- 10. The Department of War 10.7K posts

- 11. DISMISSED 22.2K posts

- 12. DOGE 239K posts

- 13. #GEAT_NEWS 1,460 posts

- 14. Sen. Mark Kelly 15.7K posts

- 15. Monad 179K posts

- 16. TOP CALL 5,112 posts

- 17. Victory Monday 5,073 posts

- 18. Feast Week 2,335 posts

- 19. Hal Steinbrenner N/A

- 20. Zach Bryan N/A