#gstpam 검색 결과

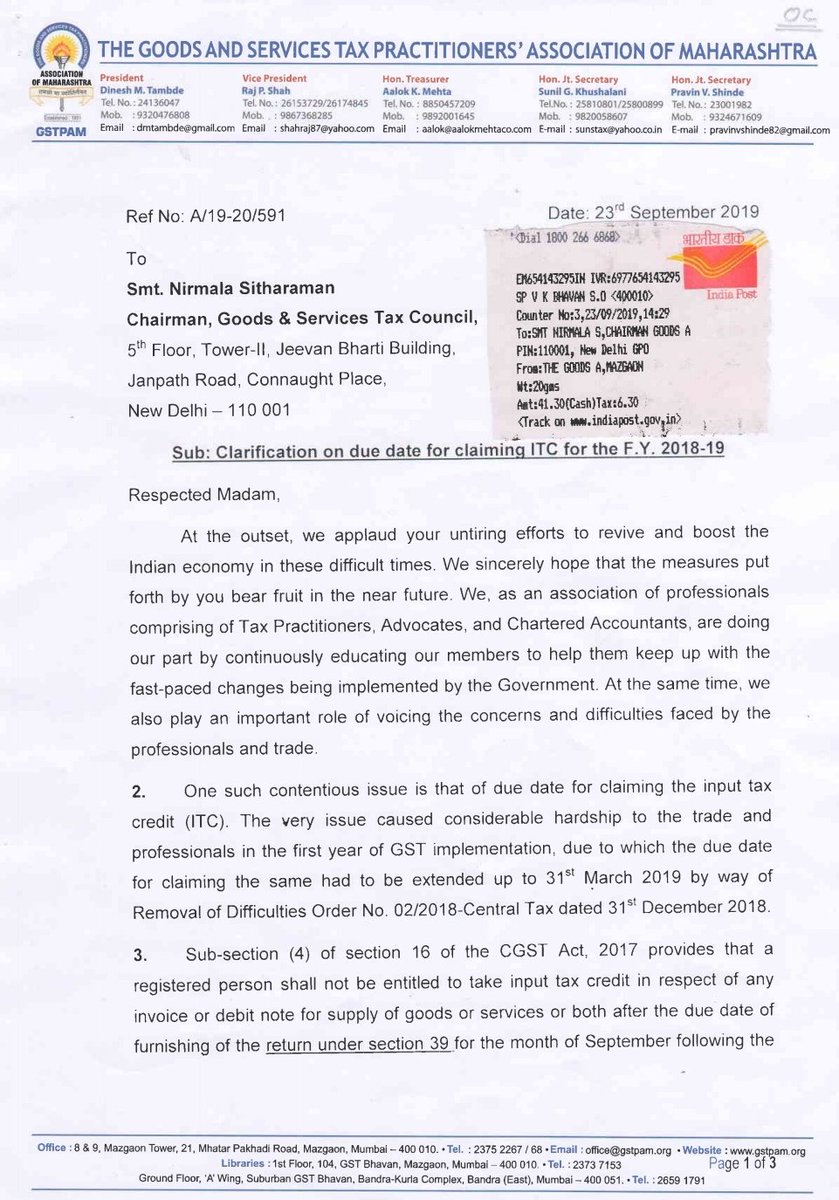

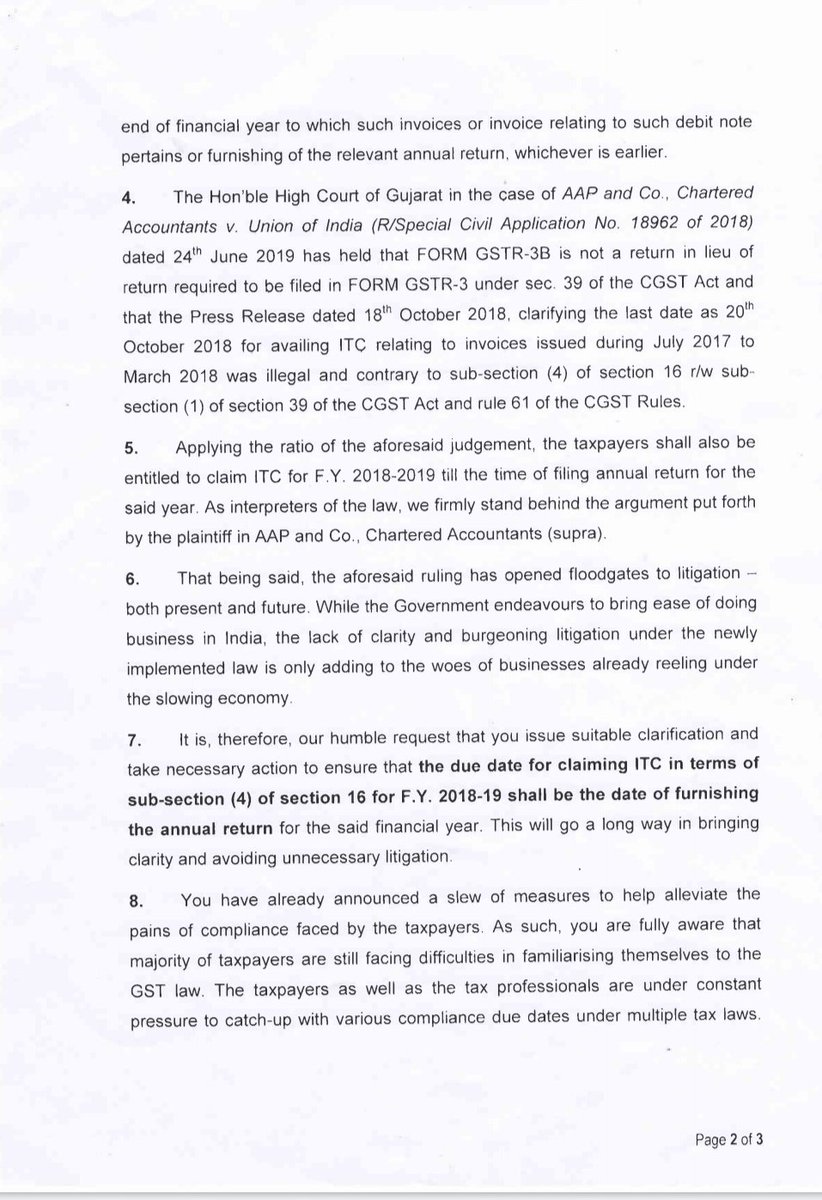

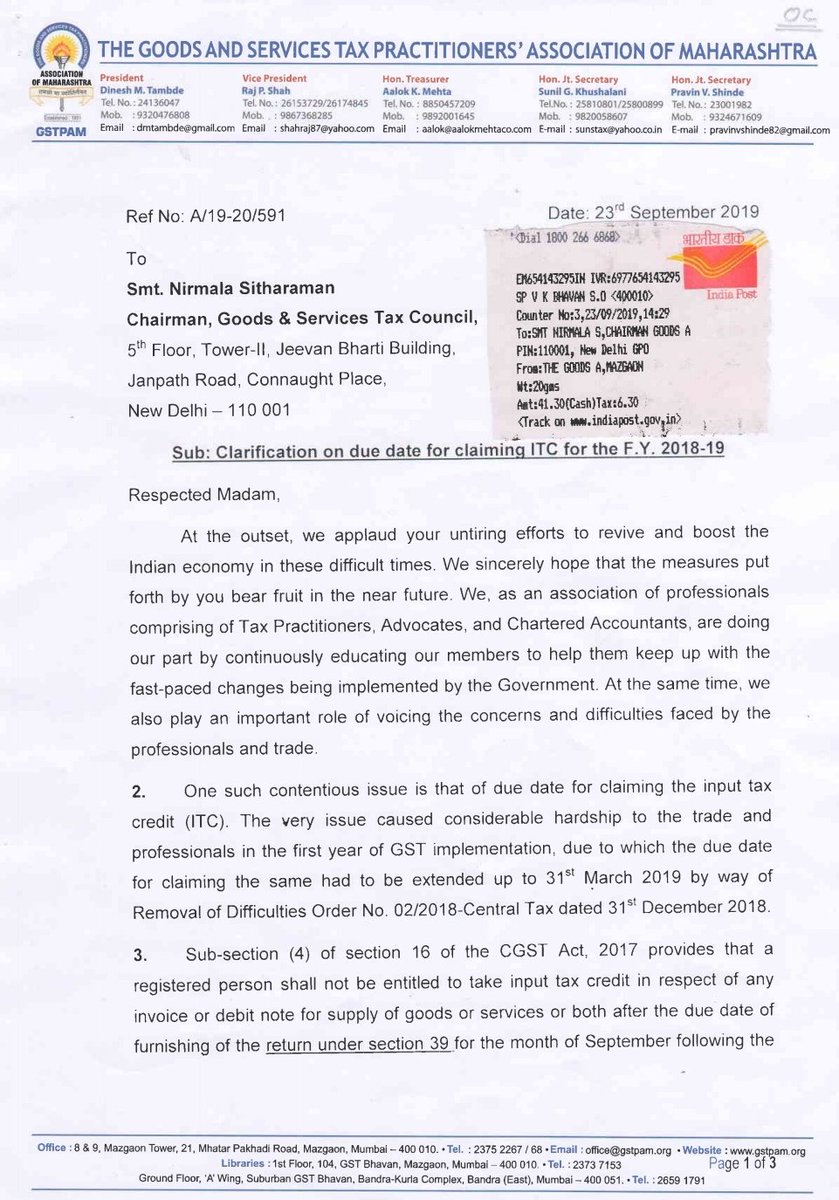

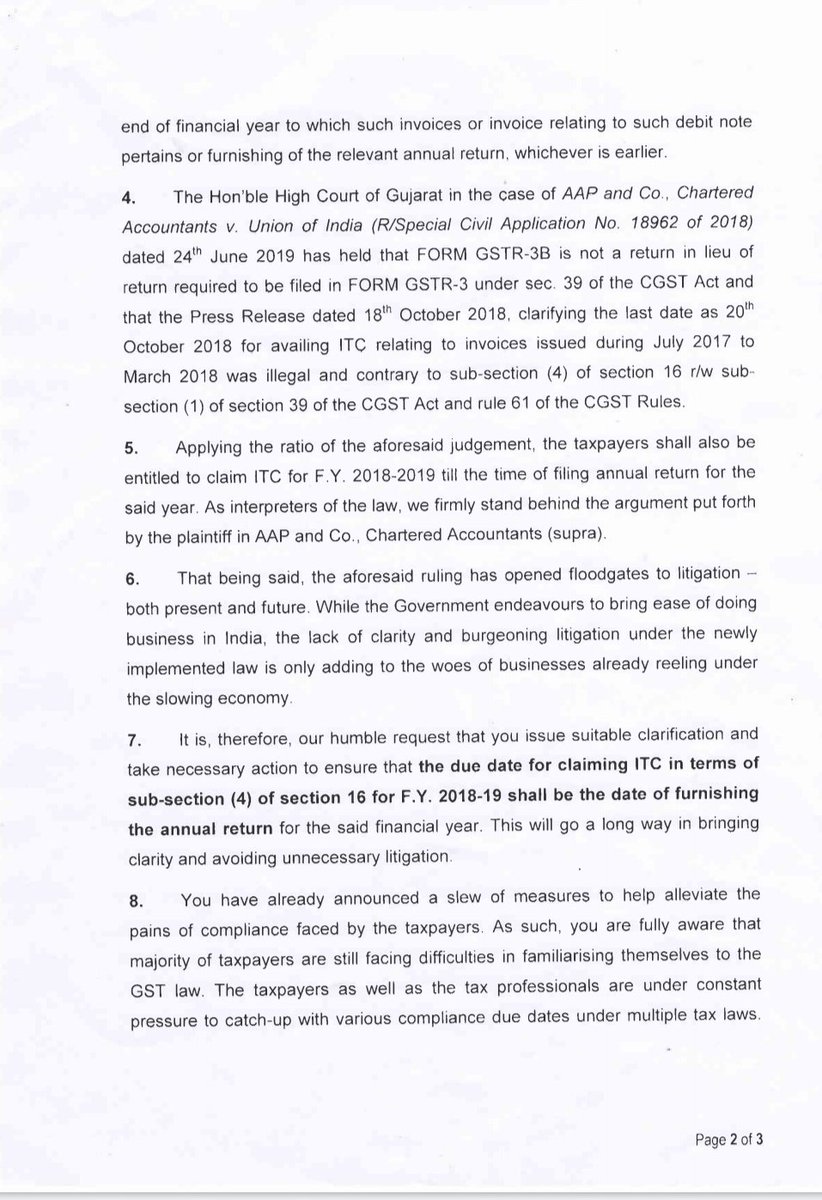

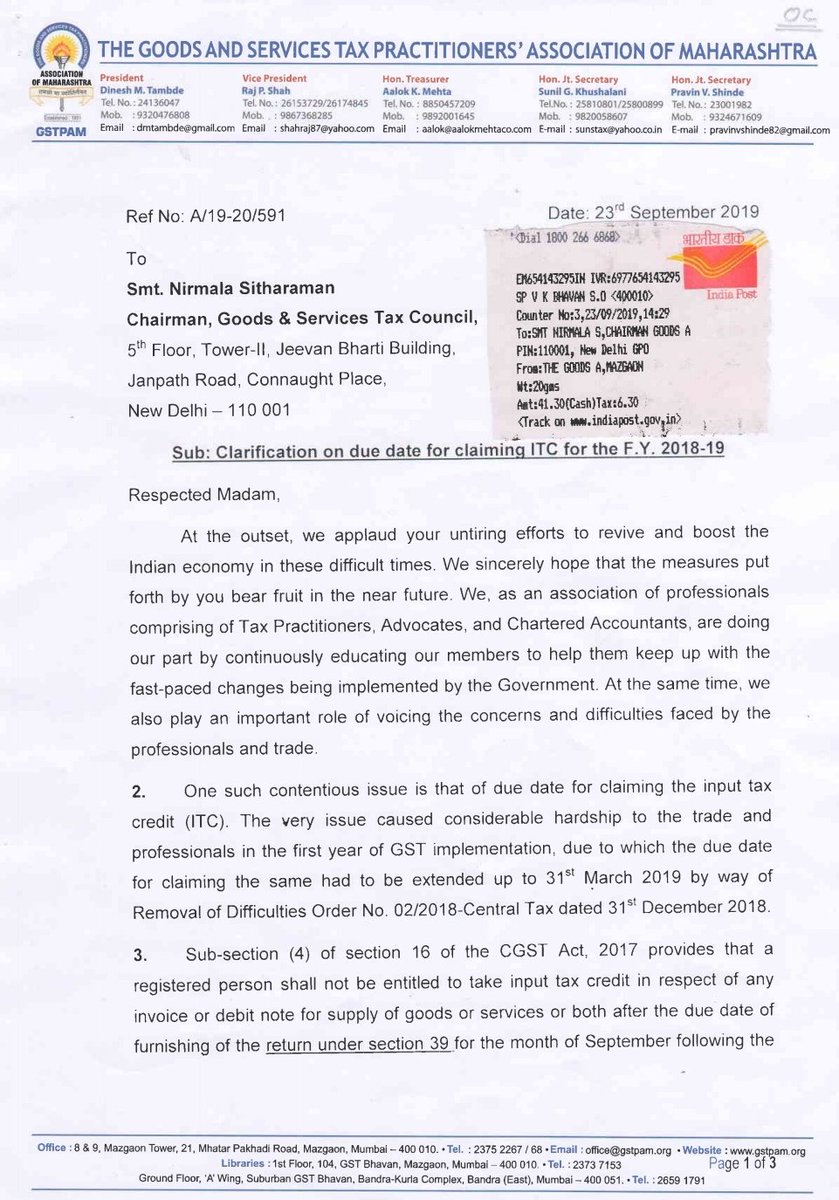

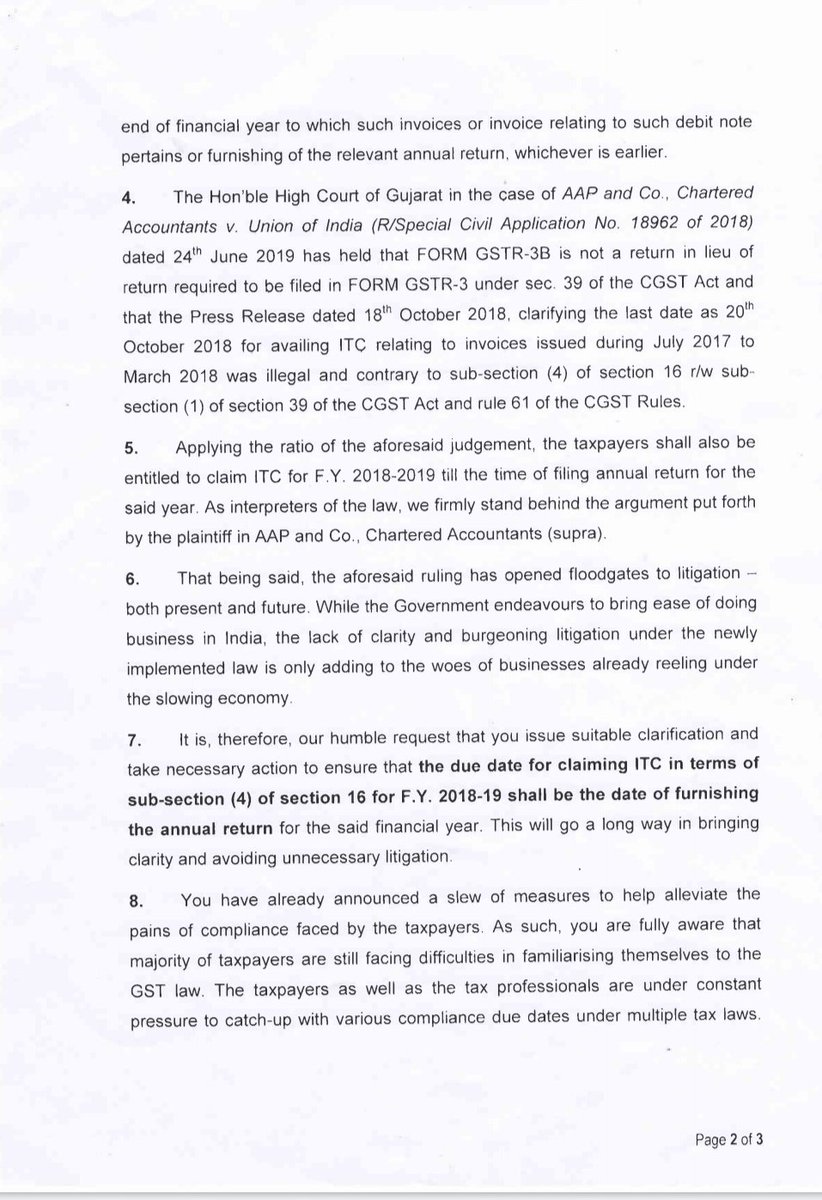

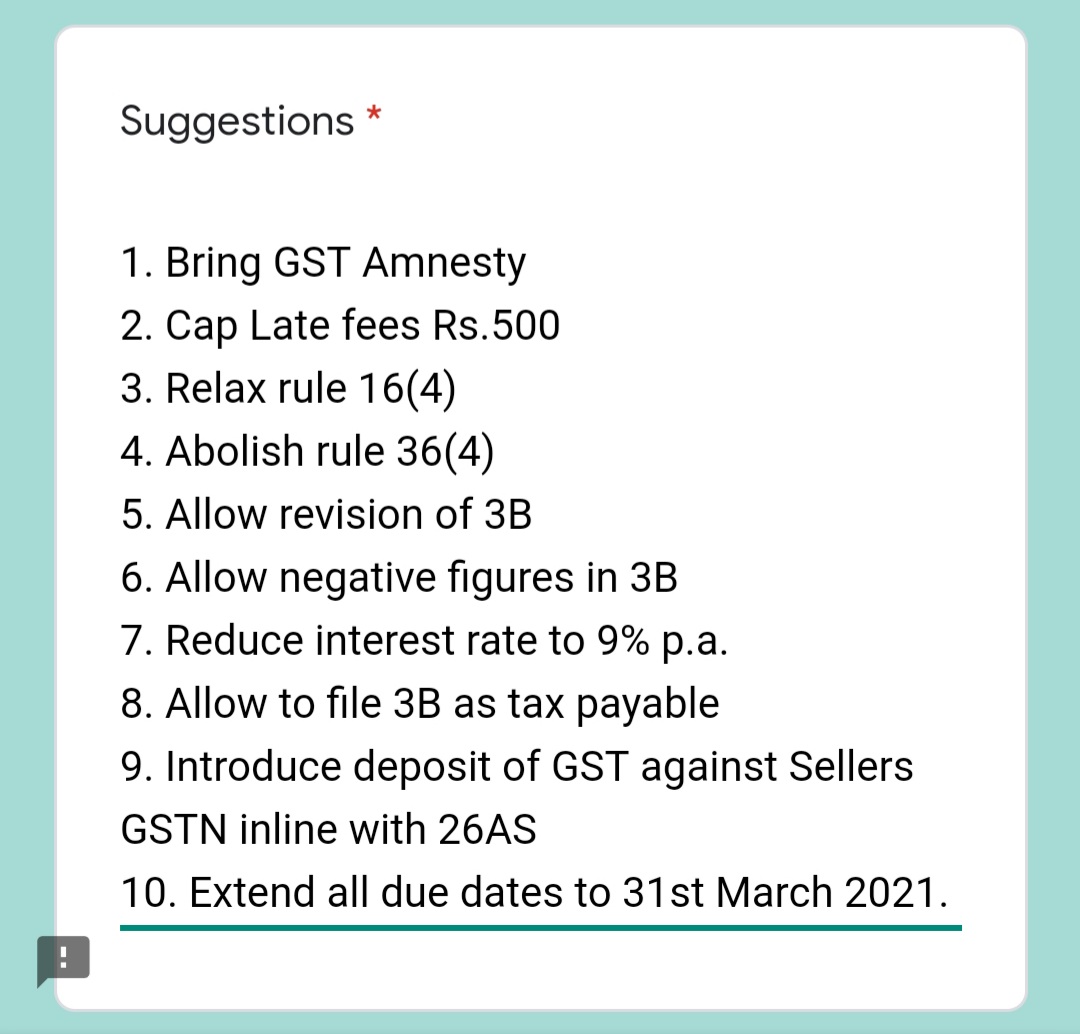

Representation made by #GSTPAM to the Union FM @nsitharaman and @GST_Council for clarification on the contentious issue of due date of claiming ITC for F.Y. 2018-19 and extension of the same in view of recent litigation. #GST

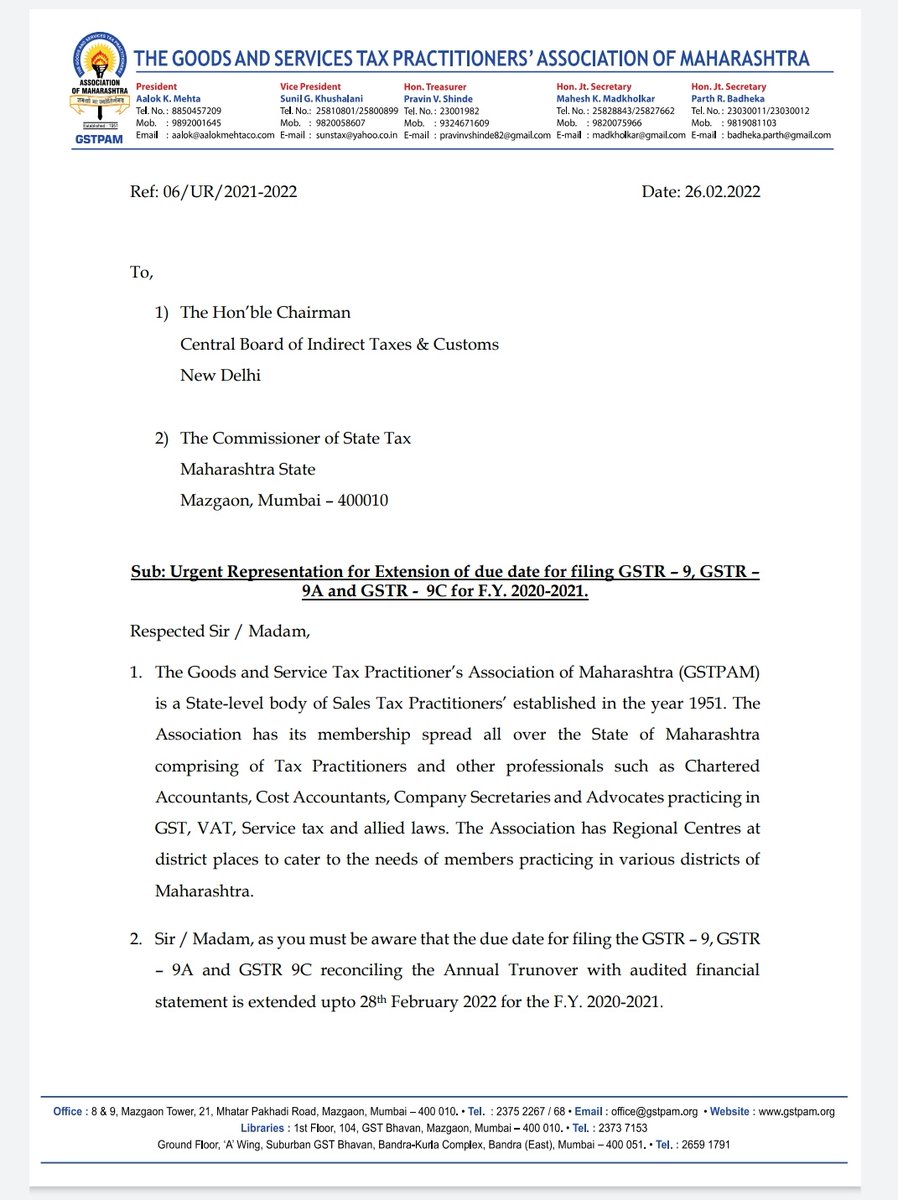

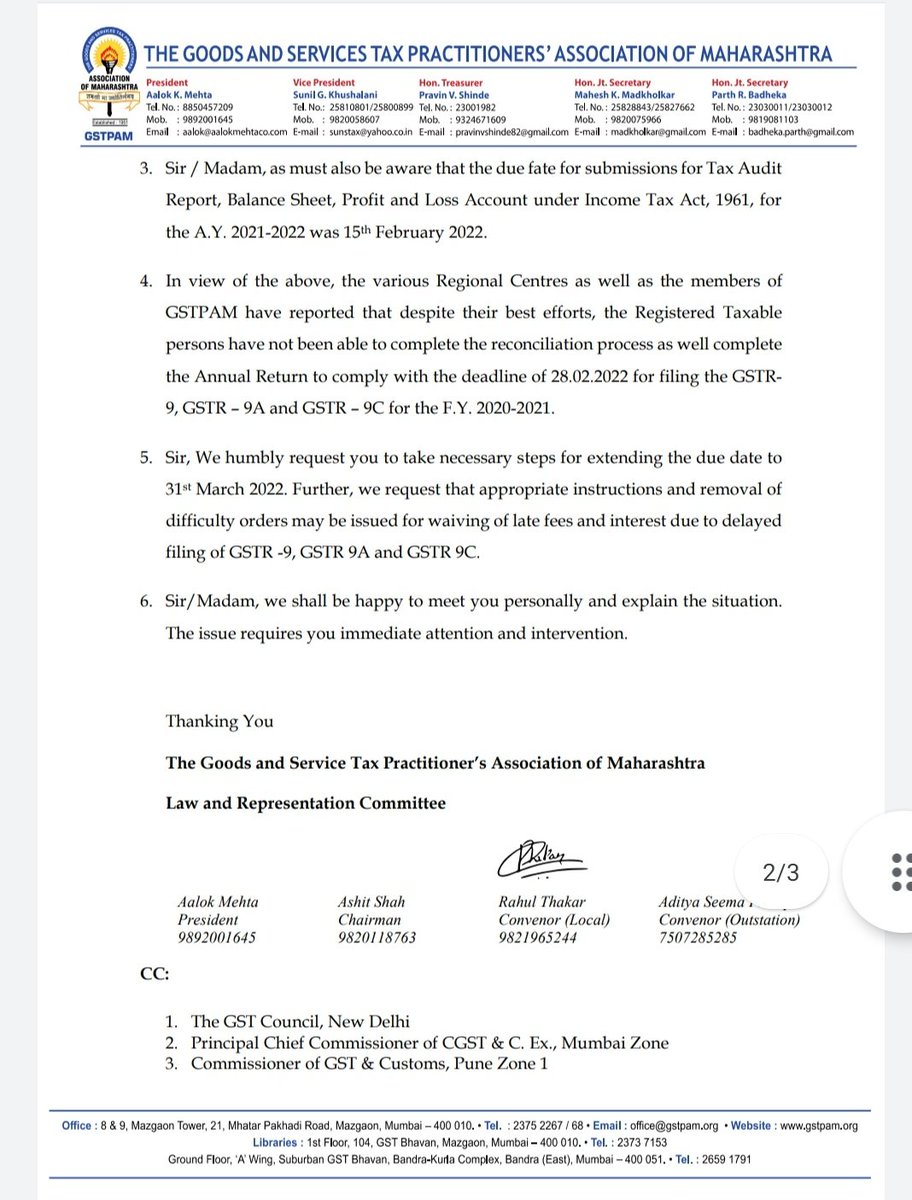

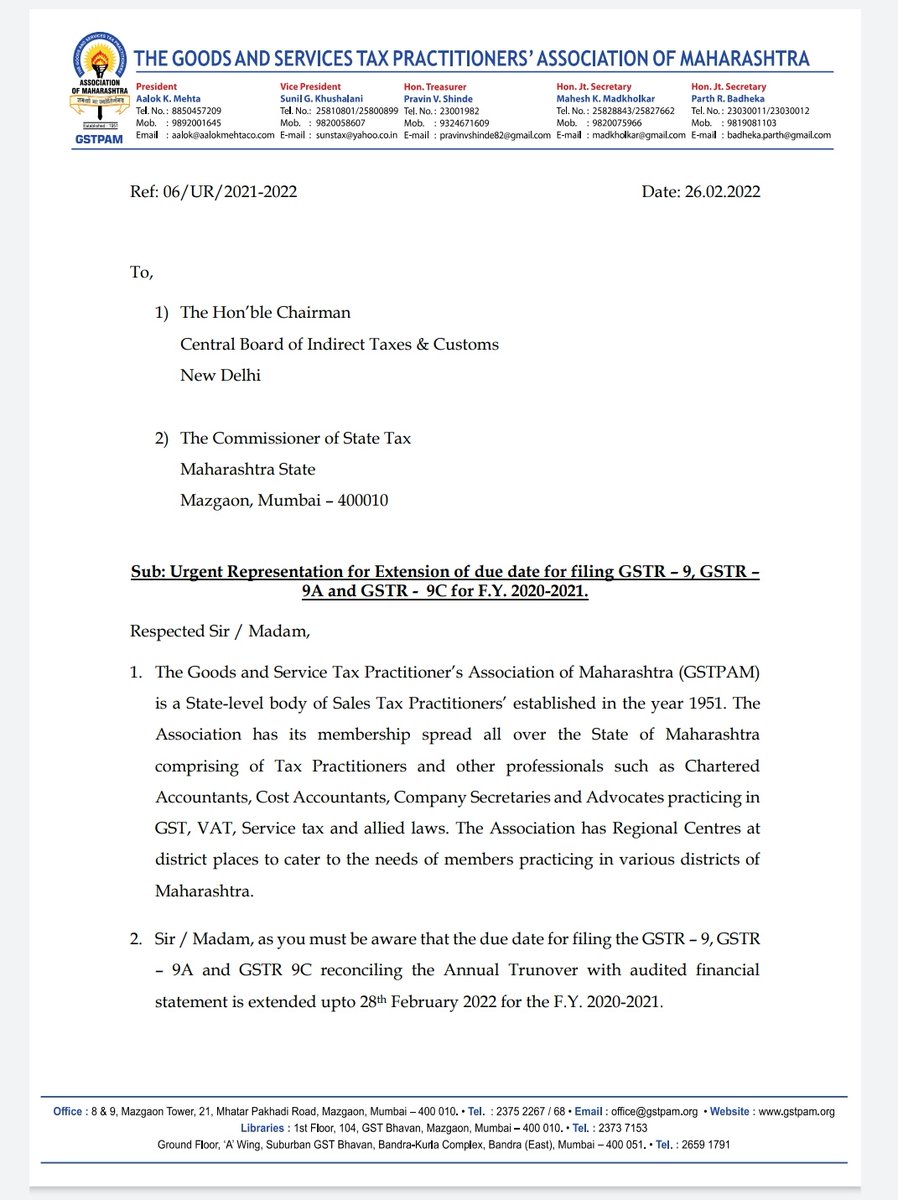

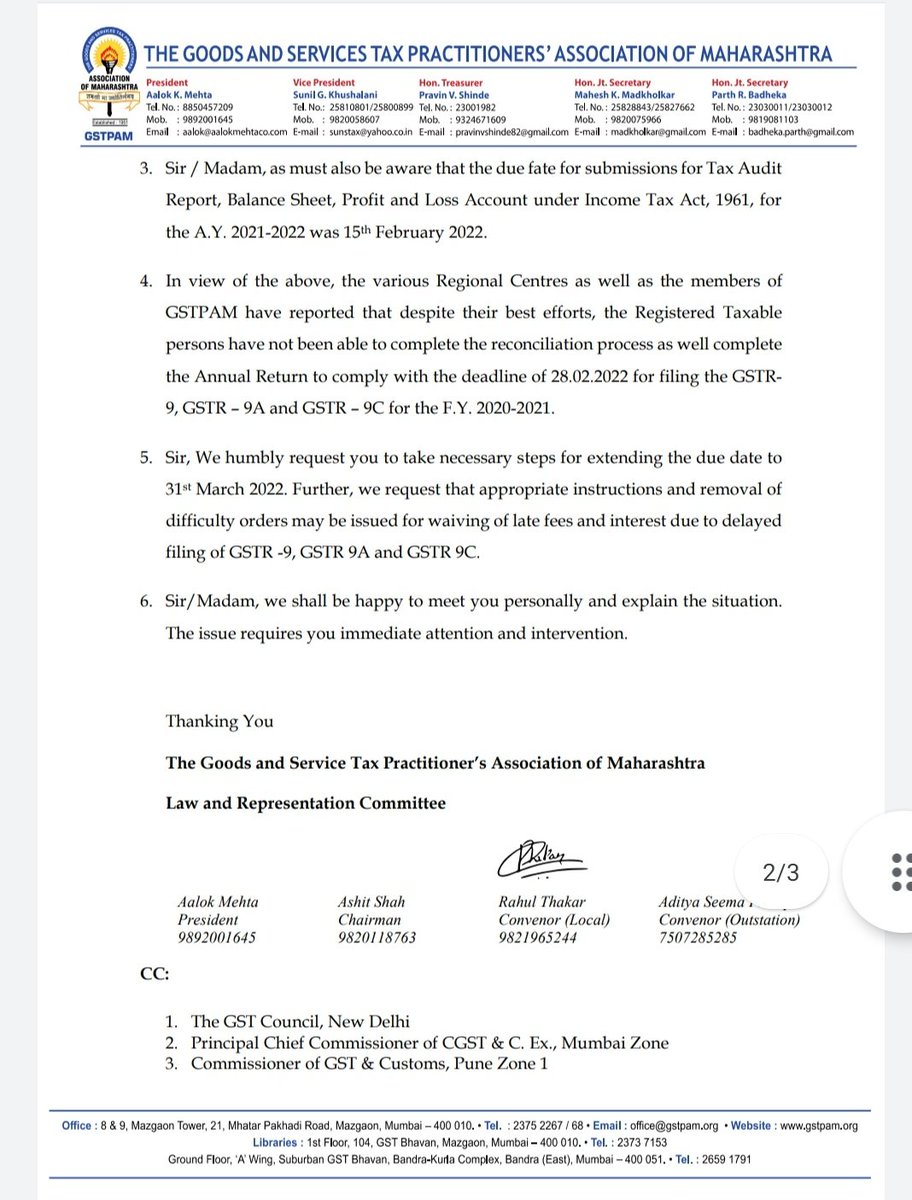

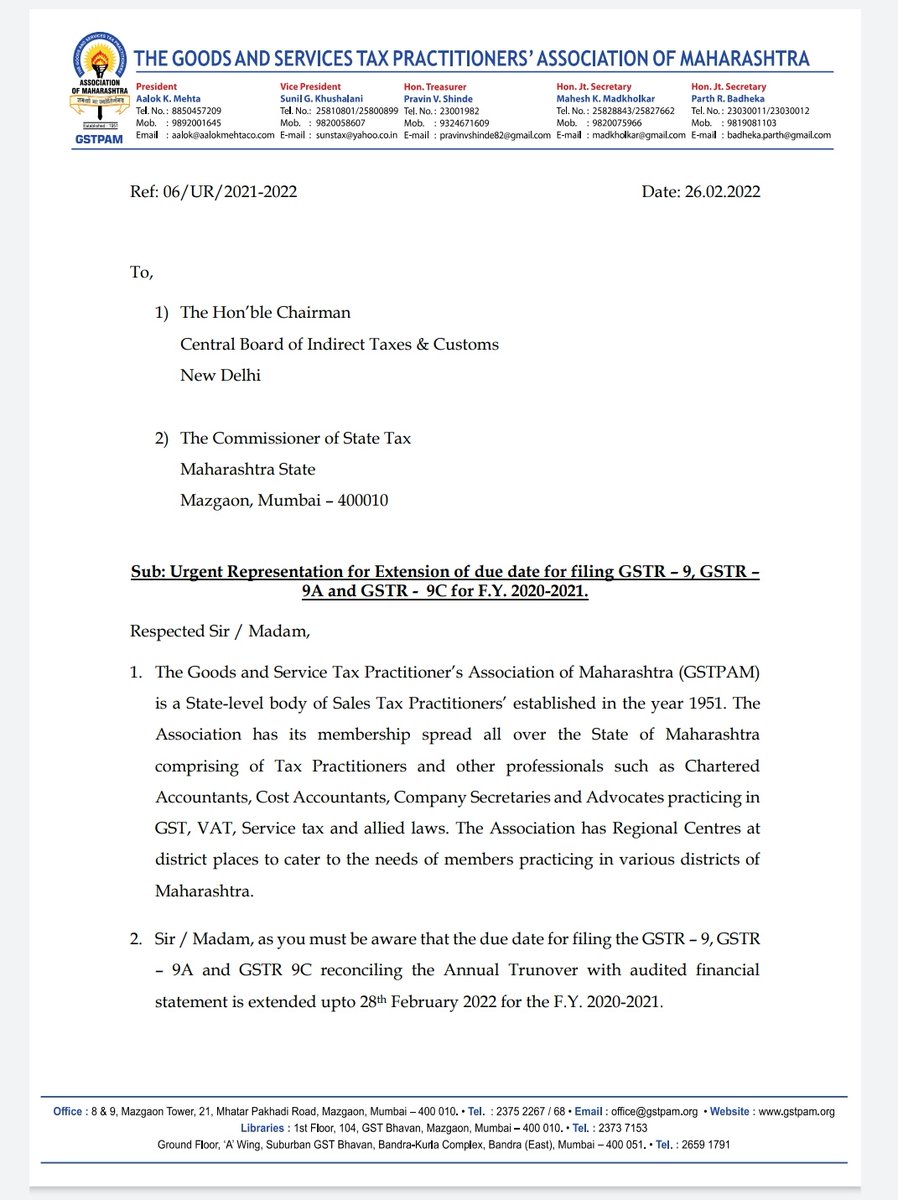

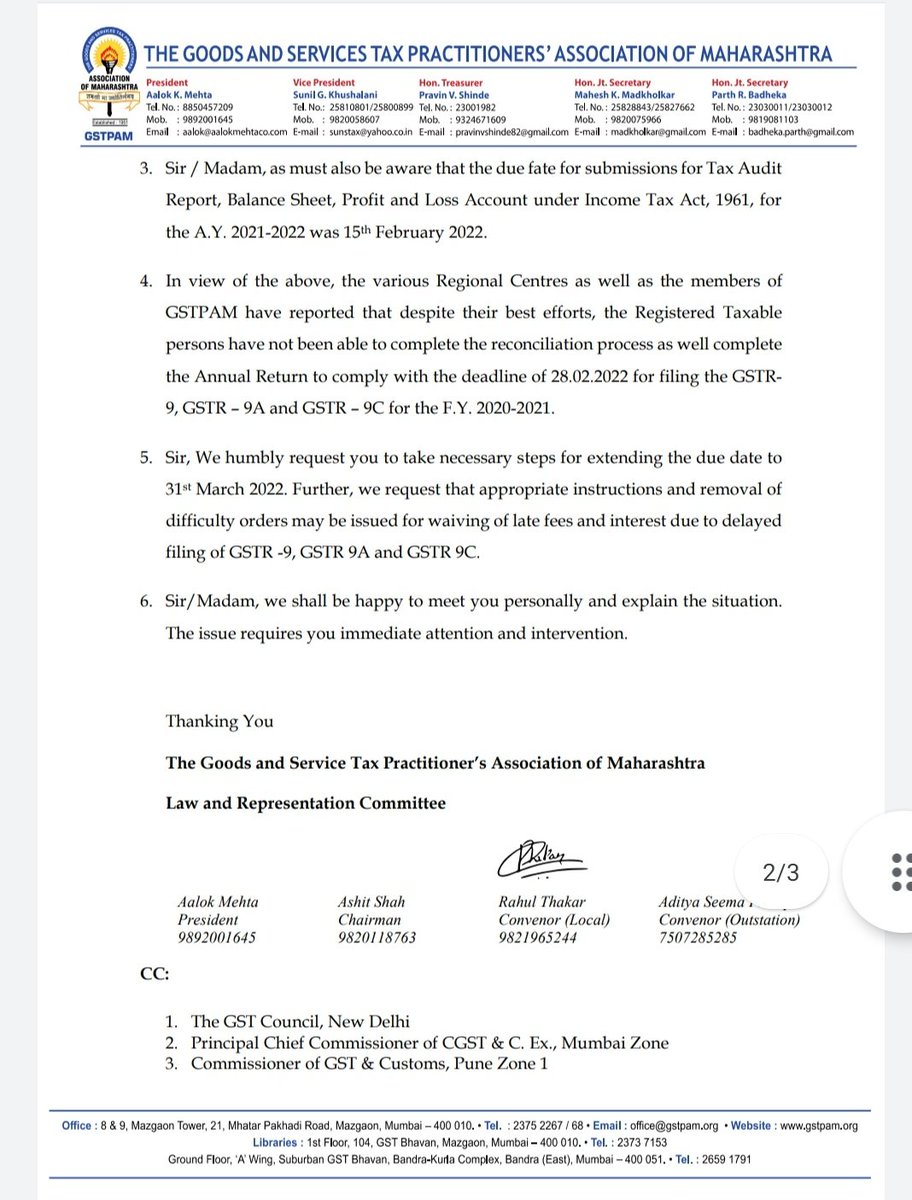

The due date to comply with Annual Compliance under GST Law should be extended from 28/02/22 to further at least a month considering the difficulties faced by Trade and Industry Representation by #GSTPAM #EasyGST4U

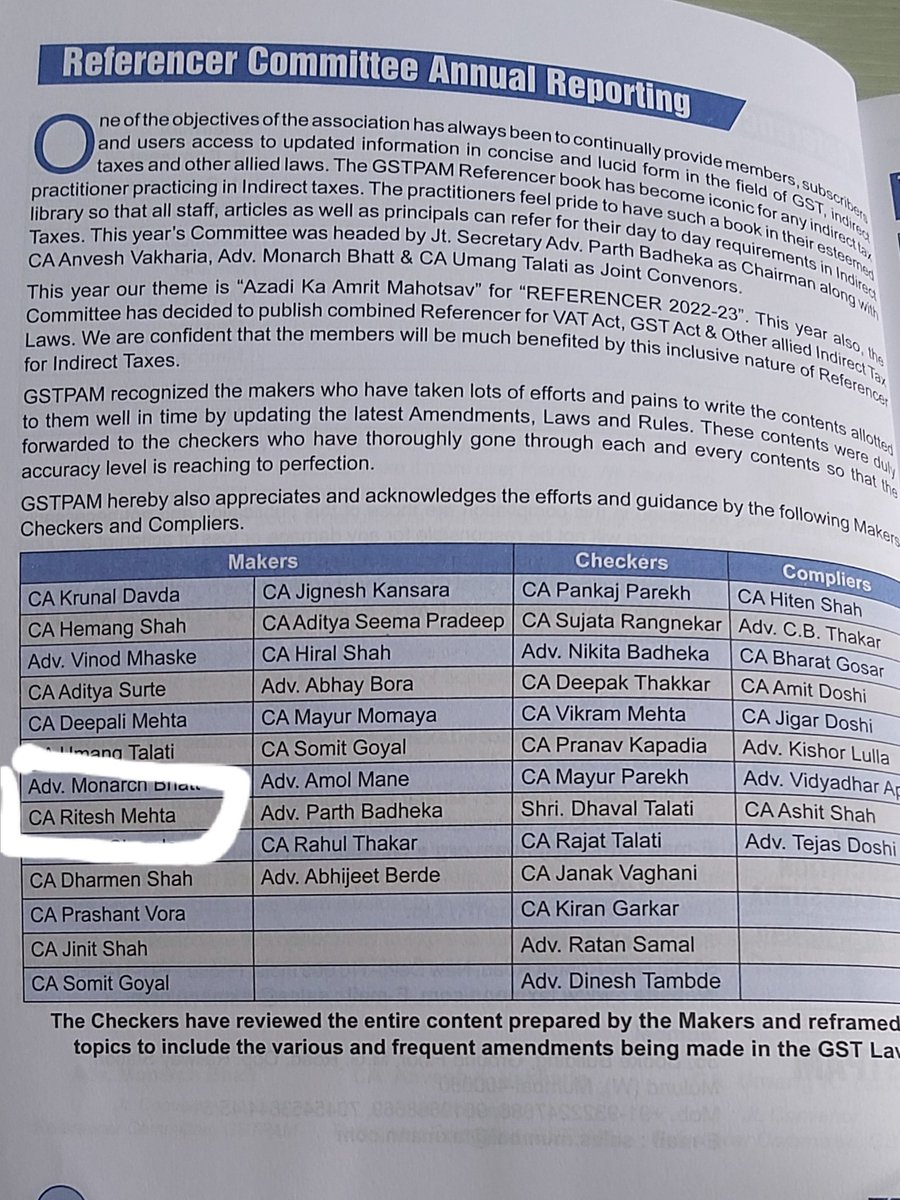

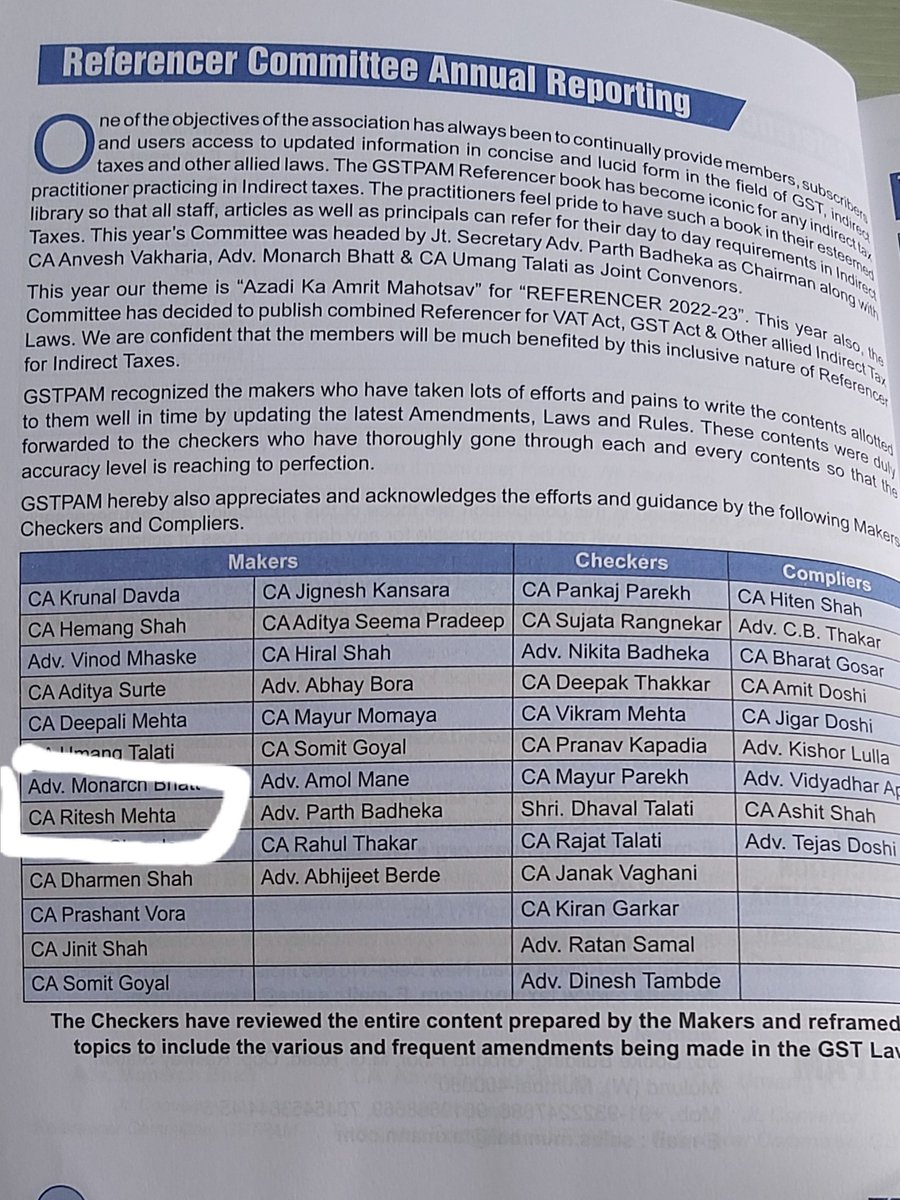

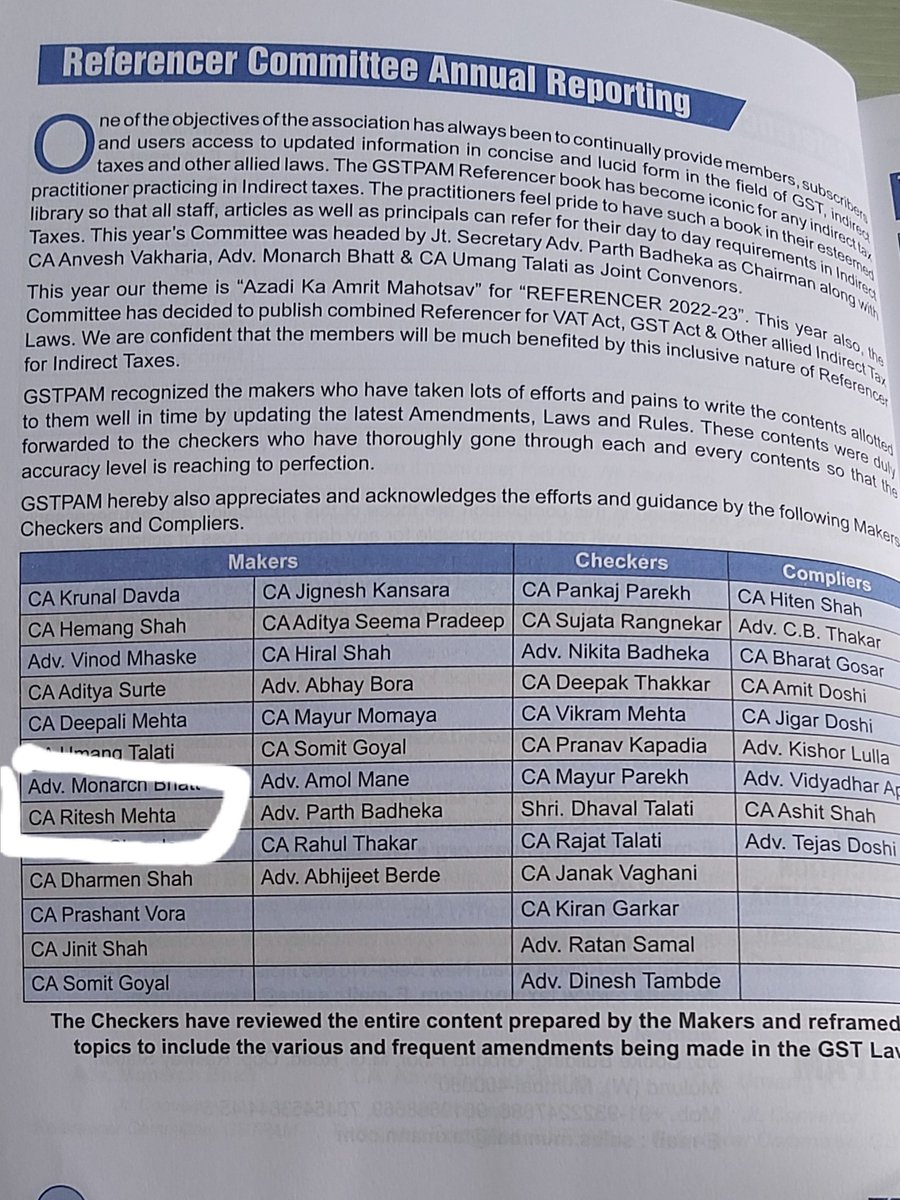

Happy to Contribute to the Profession by being one of the contributory to this all inclusive and most referred #GST referencer 2022-23 released by #GSTPAM, Mumbai. #gstcouncilmeeting

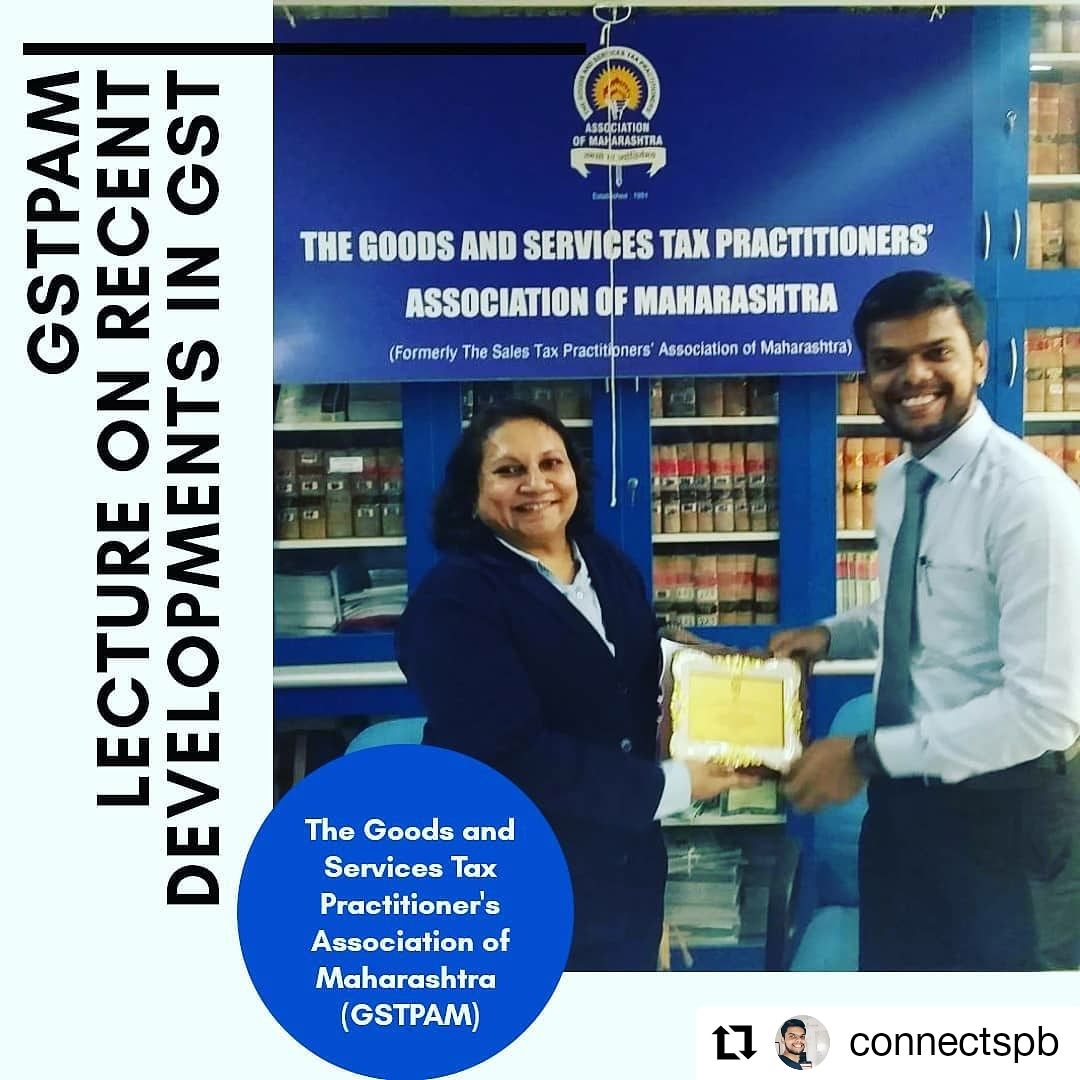

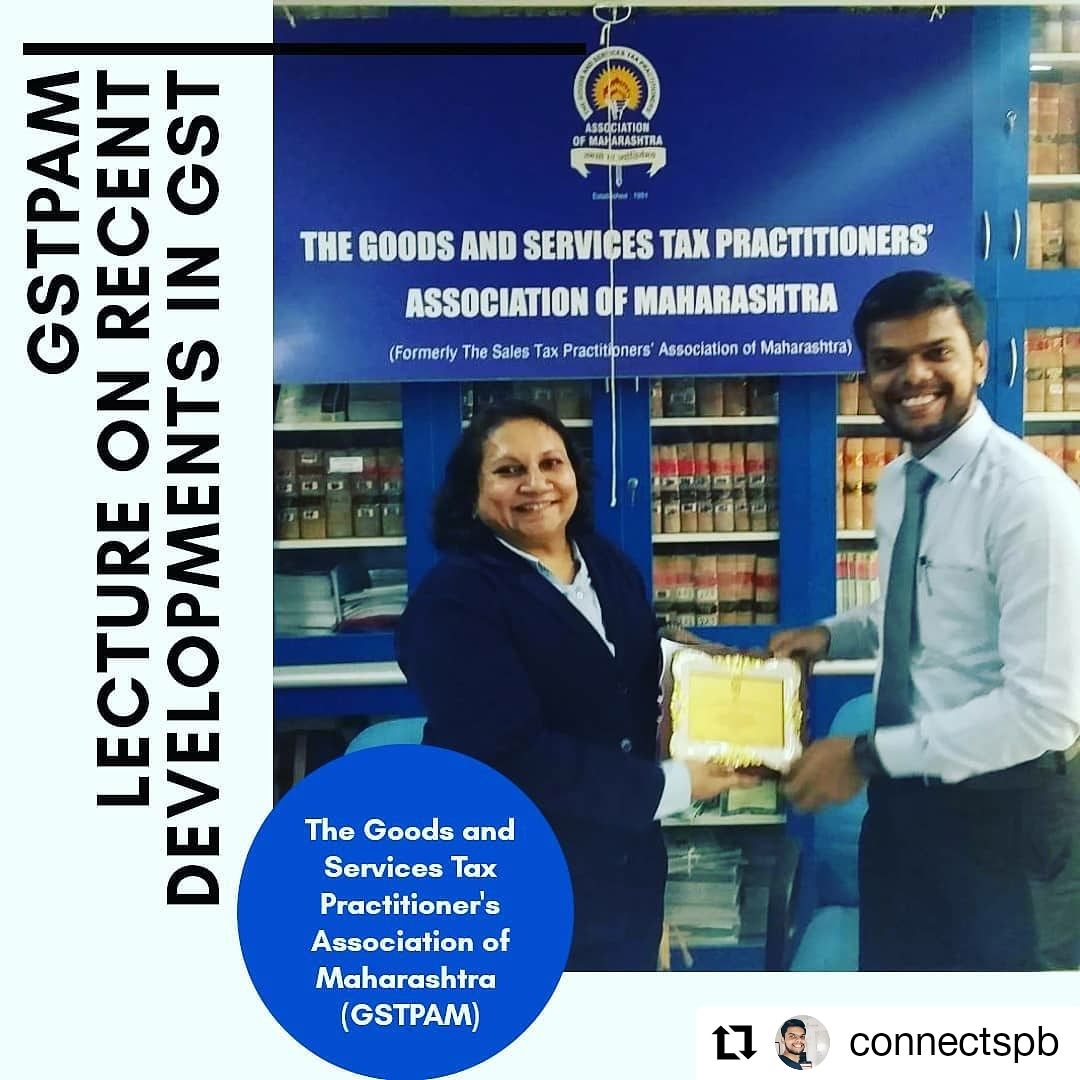

GST... Passion of subject and its knowledge sharing gives me satisfaction. Delivered lecture on ITC and Special Circumentaces at GSTPAM Mumbai. Thanks to GSTPAM for their love and affection. #gstpam #GST

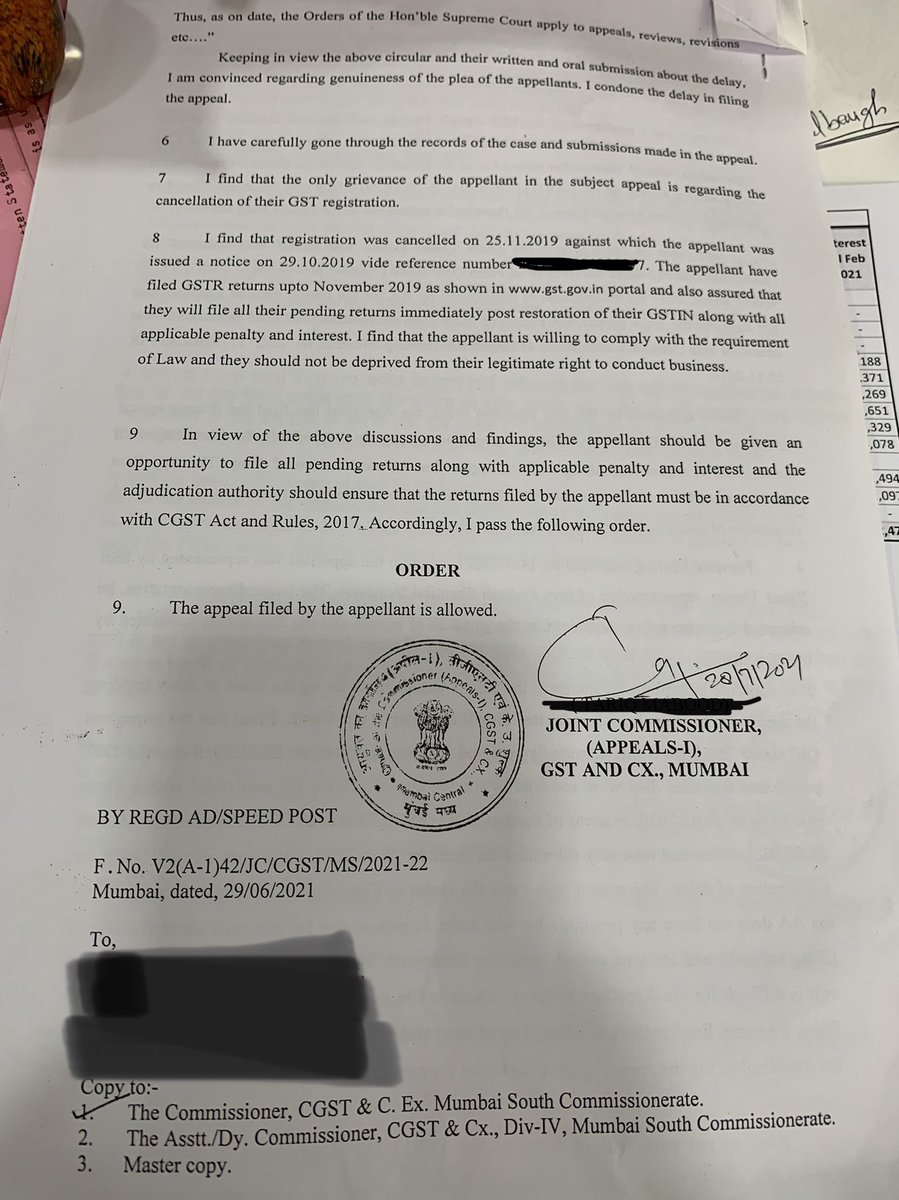

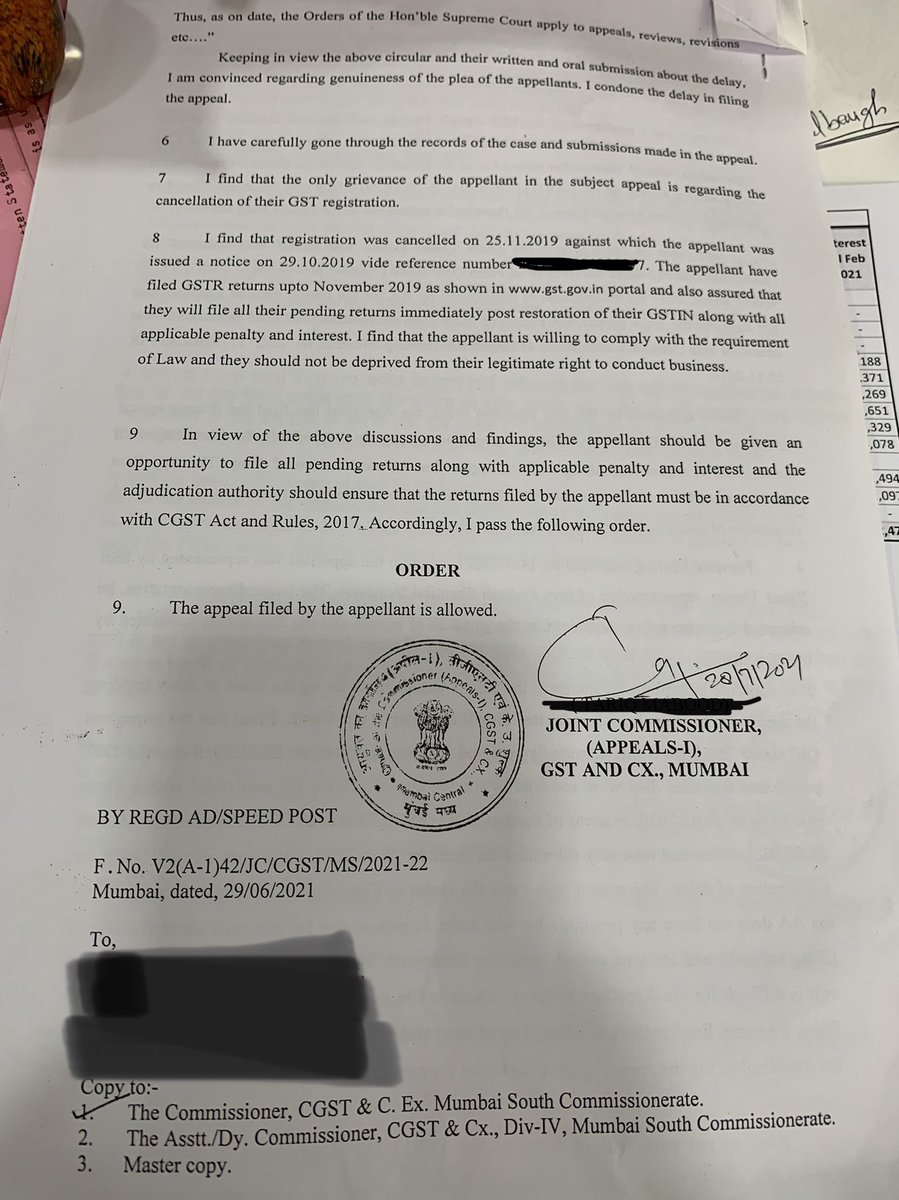

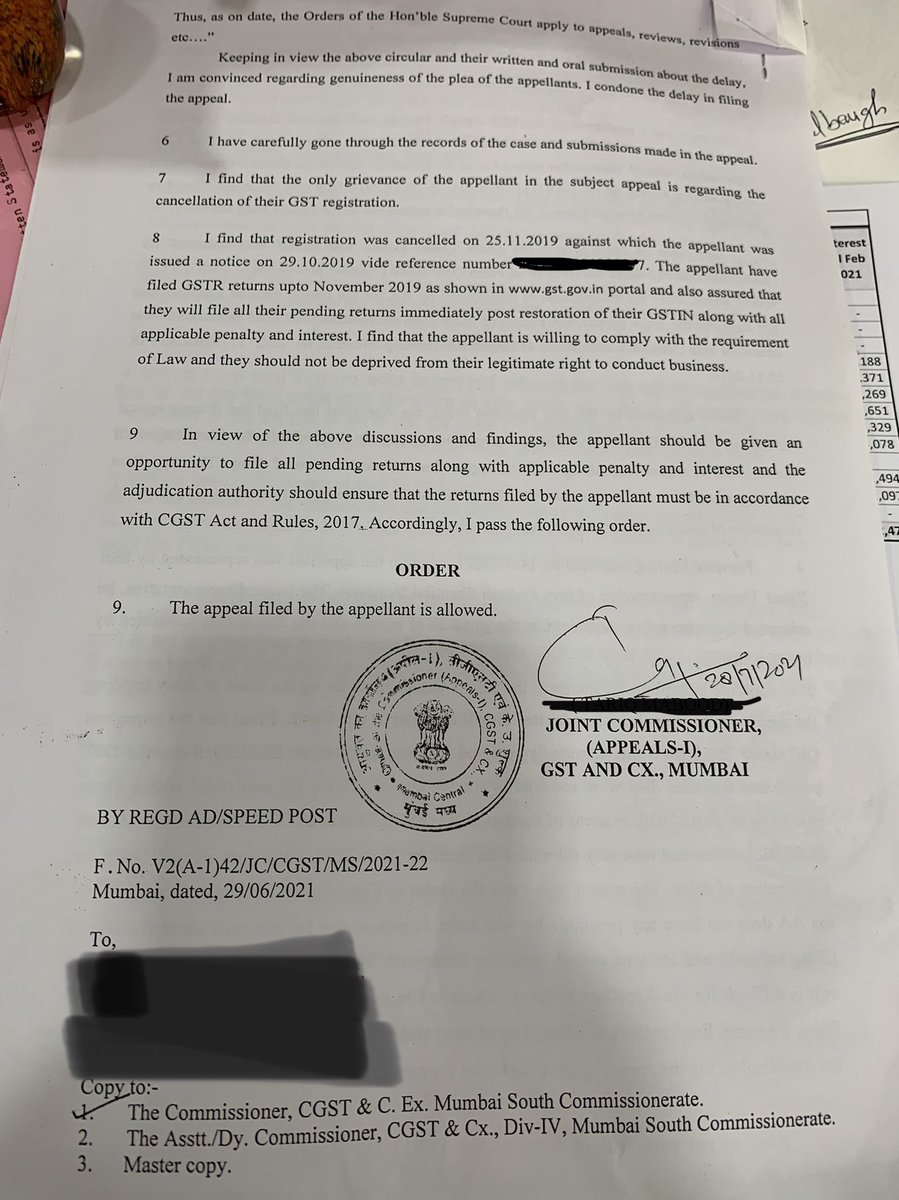

@cbic_india @FinMinIndia This is frustrating. A tax payer is given deadline to file pending returns by 31st Aug 21 to avail rationalised late fee benefit. Despite an appeal order passed on 28.07.2021 for allowing restoration of RC, till date it is not active on portal. #gstpam

It’s an honour to be felicitated by Goods and Service Tax Practitioner Association of Maharashtra (GSTPAM) and Mithibai College. #GSTPAM #GST #Session #Coaching #Training #Mithibai #Students

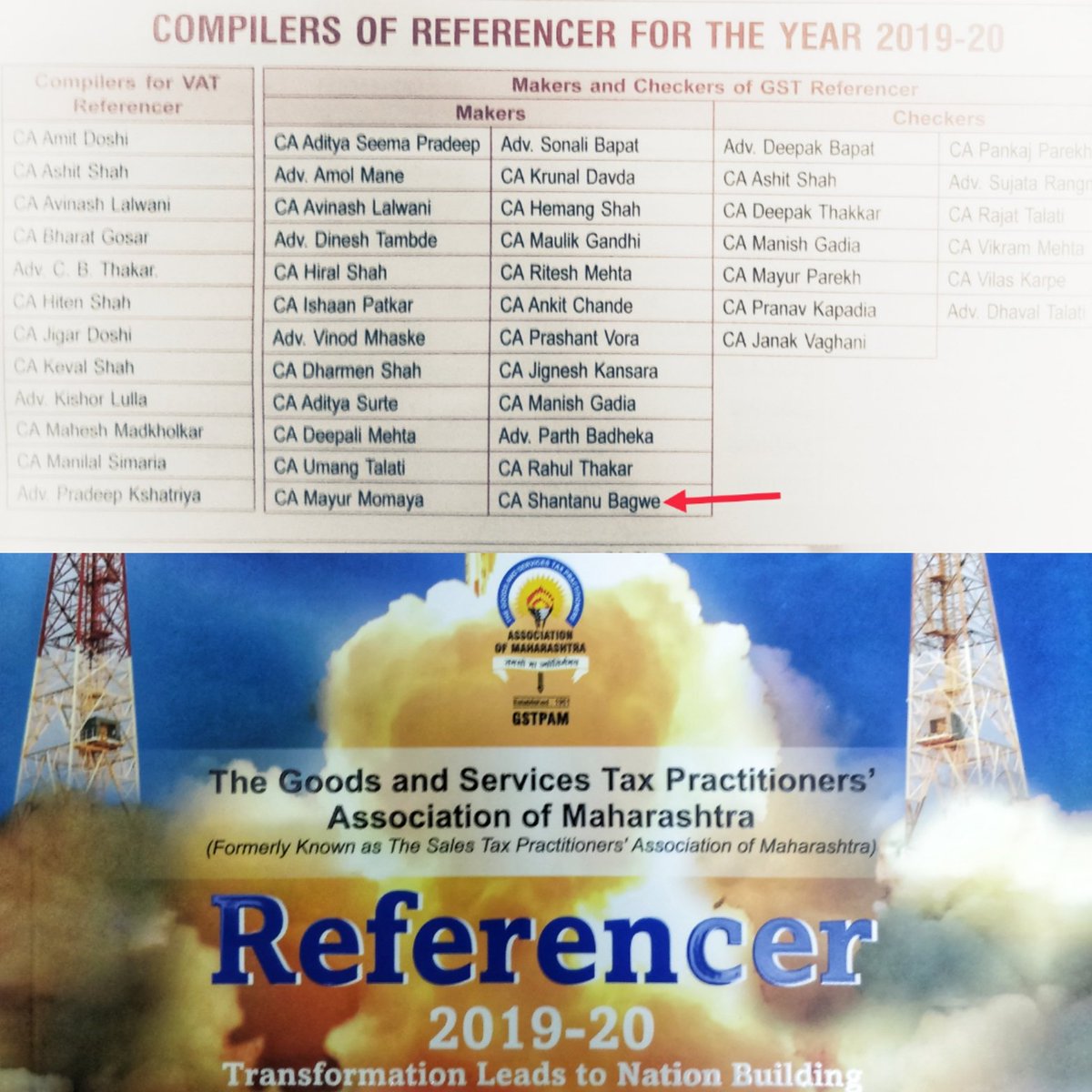

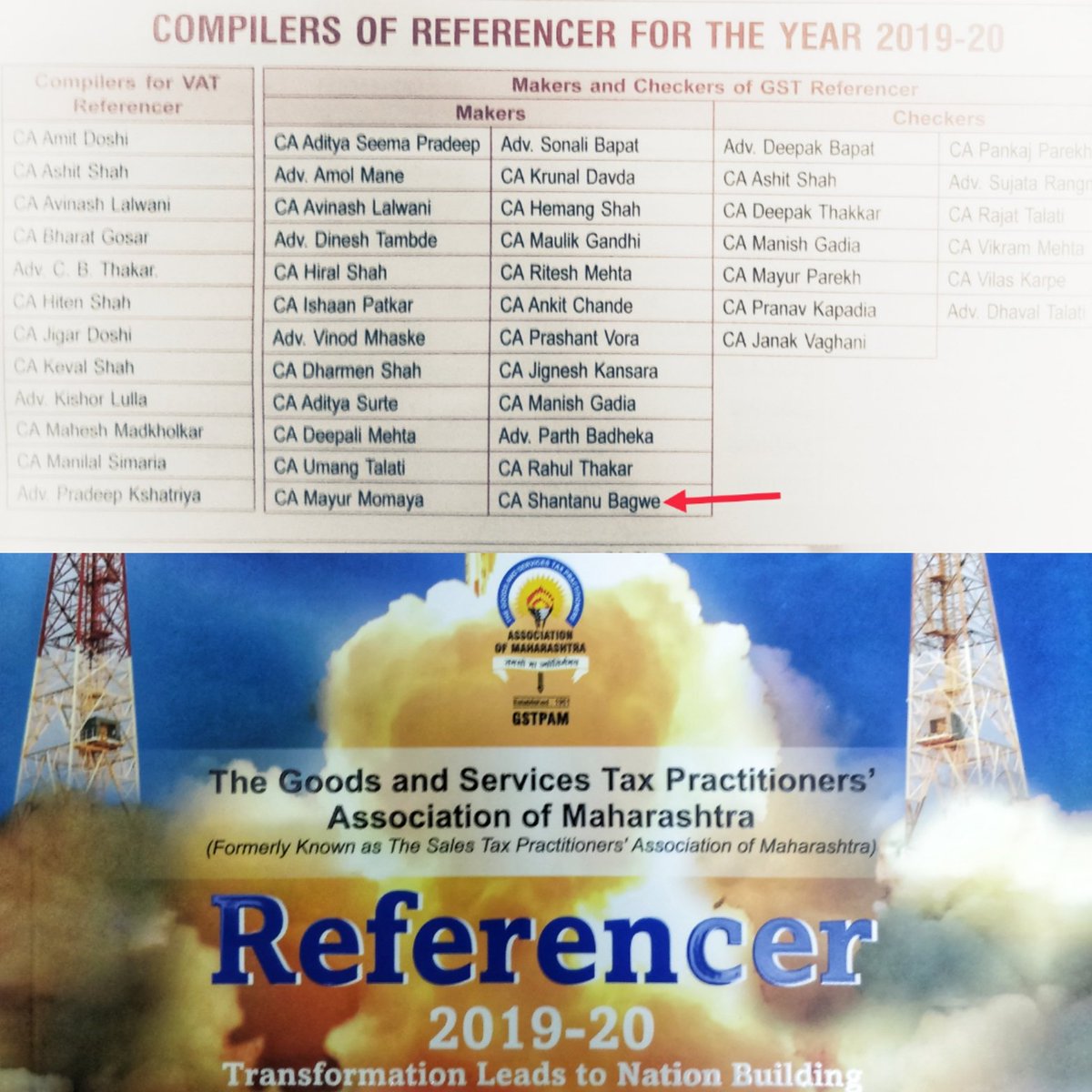

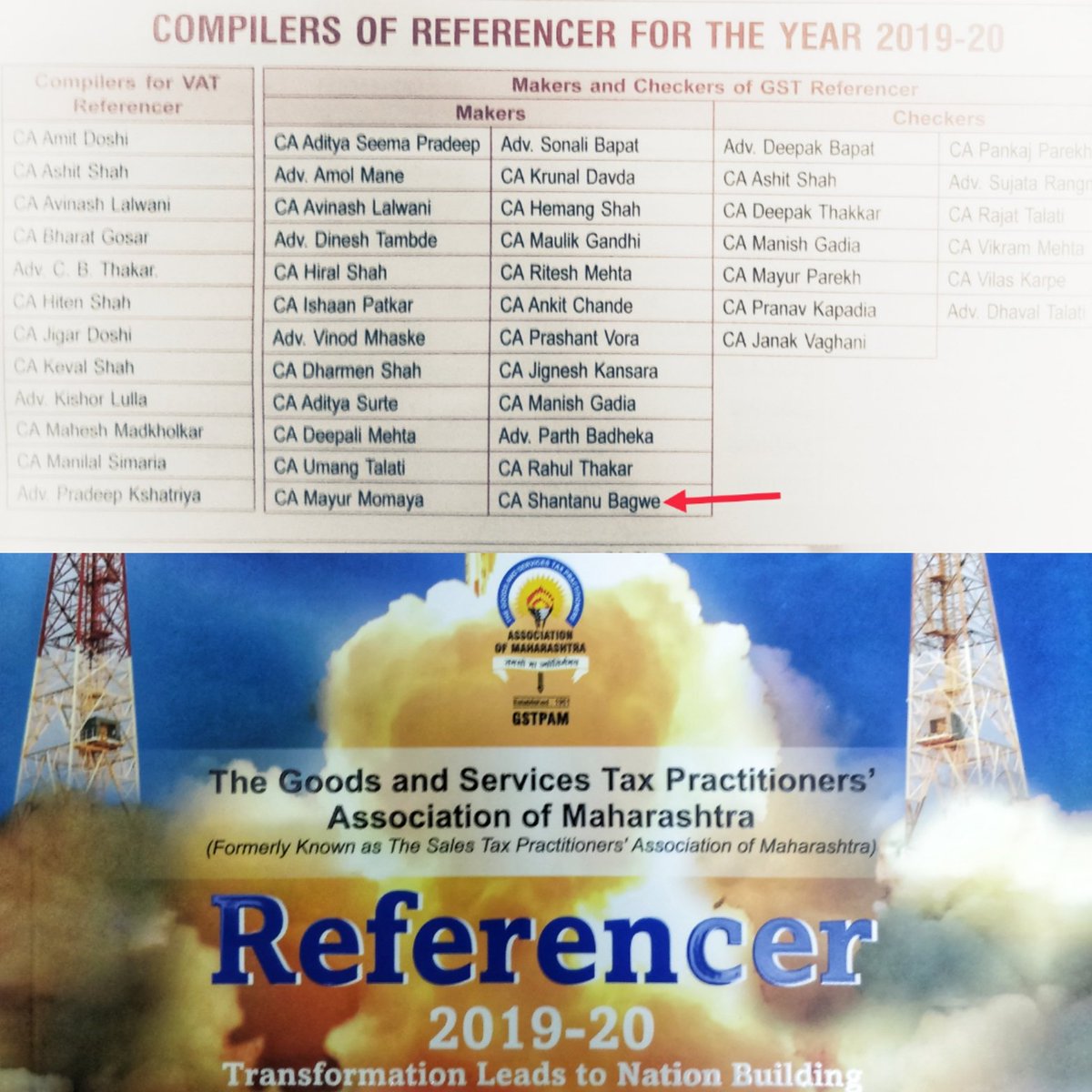

Glad to contribute to "The GST Referencer 2019-20" published by The Goods and Service Tax Practitioner's Association of Maharashtra. I hope this publication with concise summaries, flow charts, etc shall be of help to Tax Practitioners, Consultants, etc. #GST #GSTPAM #Referencer

Spoke on recent developments in GST at 34th Batch of Coaching Class organized by GSTPAM. I feel it's a wonderful initiative which is efficiently implemented under the leadership of @dineshtambde9 Adv Dinesh Tambde. #GST #GSTPAM #Training #Coaching #Class #Students #Developments

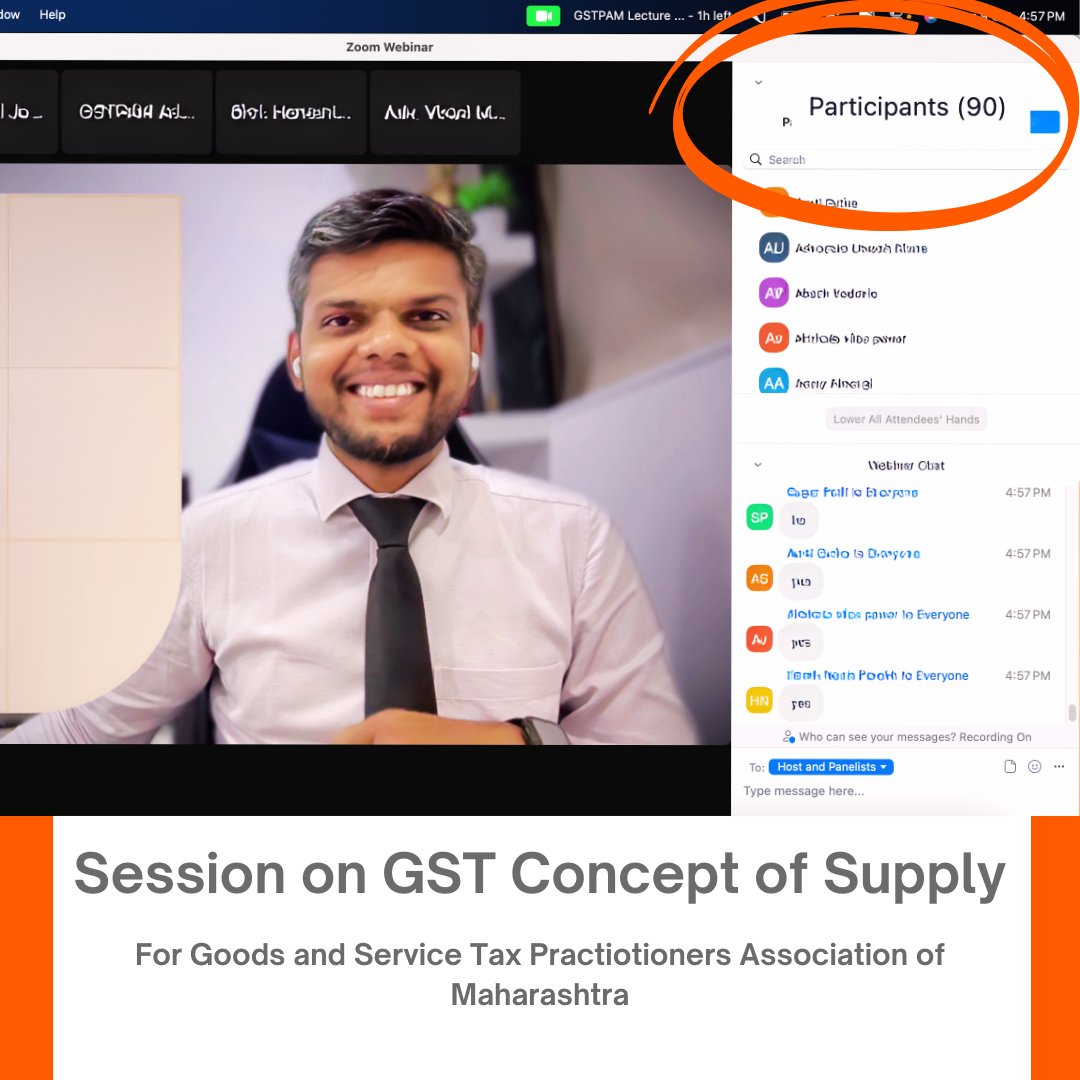

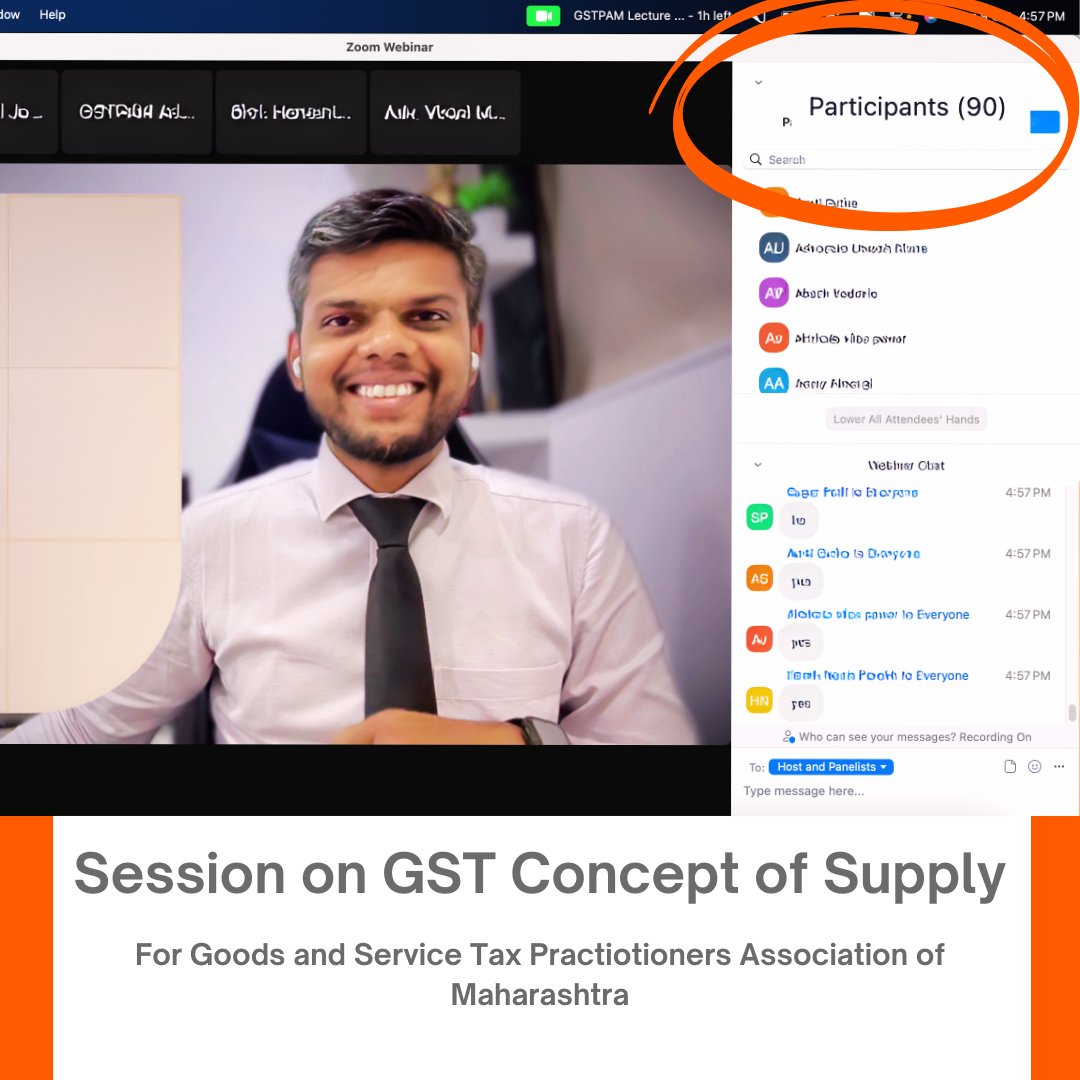

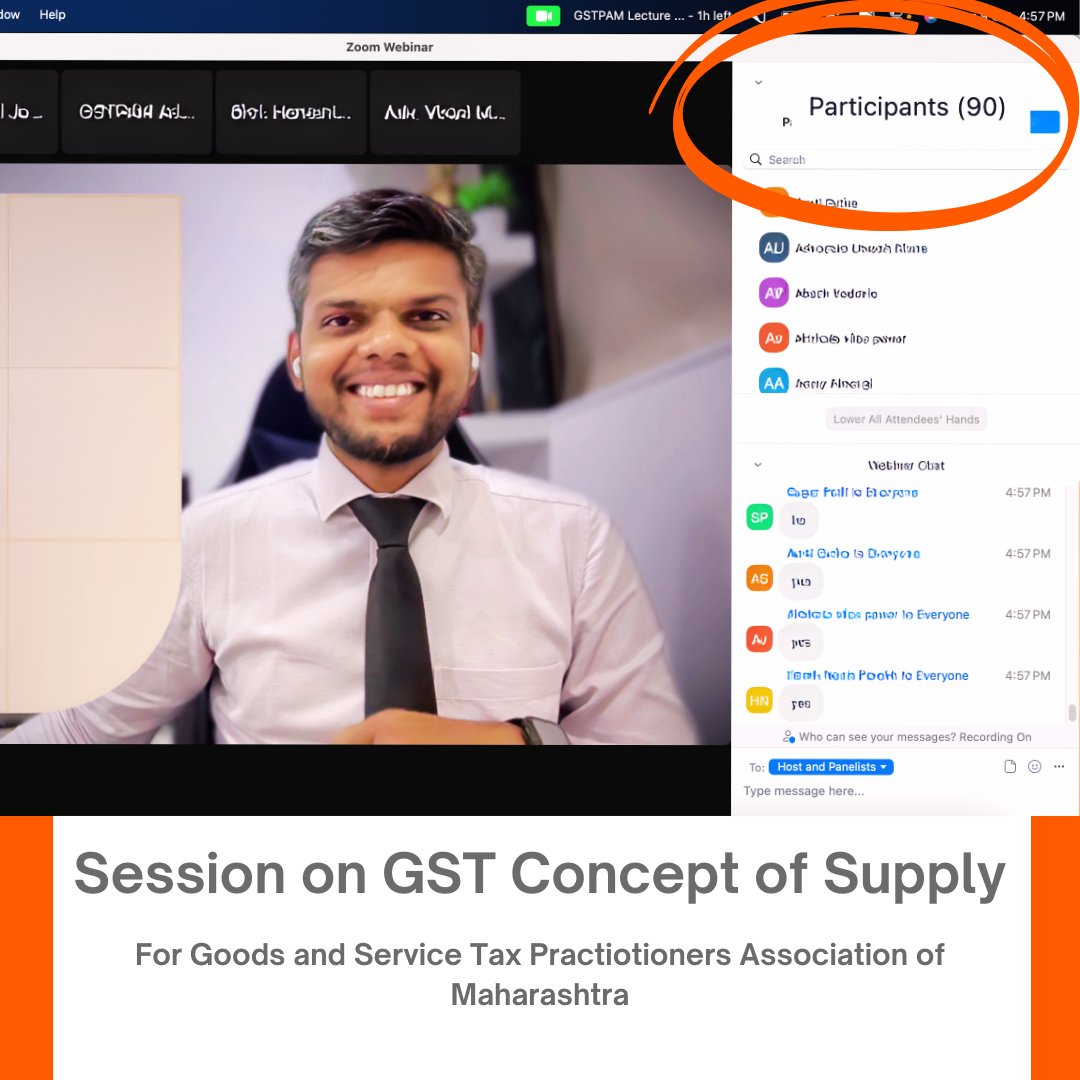

Honored to be a speaker at yesterday's #GSTPAM session on GST concept of supply, discussing vital aspects with over 80 participants. Appreciating the interactive session, a big thanks to all who engaged. More to come! #GSTConceptOfSupply #Finance #KnowledgeSharing #Taxation

Honoured to share this moment of recognition! Grateful to The Goods and Services Tax Practitioners’ Association of Maharashtra (GSTPAM) for presenting me with this award. #GSTPAM #SpeakerRecognition #FinanceCommunity #KnowledgeSharing #TaxLeadership #ProfessionalMilestones

Goa, GST, and Great Conversations! Presented a Paper and Spoke at the 49th RRC of #GSTPAM at Goa. Always good to step out of the office and into forums that spark thinking. #TaxLeadership #GSTIndia #TaxExperts #GSTUpdates #TaxReforms #GST #RRC #Goa #ParkRegis

T-1: today got elected to GSTPAM MCM for second term-without election😉-COVID played the most important role in avoiding elections🙏-ppl will get gud nite’s sleep 👻tonite after days of politics😝-also today i drove my fastest to baroda and back🤘🏻🏎🤘🏻#gstpam

Know More Here: bit.ly/3p35UQq (3/3) #TaxmannUpdates #TaxmannIndia #GSTPAM #GSTUpdate #GSTAnnualReturn #ResearchAtTheSpeedOfThought

#GSTPAM has organised Webinar on "#GST impact on Tours & Travel Industry" Speaker: CA Manish Gadia 05th June2018 4.00 to 5.30 pm Link for Registration attendee.gotowebinar.com/register/60461…

Read pt no 4 for your concern, this @gstpam works as a bridge between government and taxpayers In a way this representation to government by #GSTPAM is for taxpayers at large and not a selfish n baseless desire. You are free to move to next years compliance, whose stopping you!

Daily Hack Notices: #gstpam, #indianaerospaceandengineering, #akobdc, #acumengroup, #lasen, #tumenypay, #gns, #scania, #archlou, #aneticaid, #tcpm, #drapregistration, #khontharot, #maesripraifarm, #wo... hacknotice.com/recent-hack-no…

Honoured to share this moment of recognition! Grateful to The Goods and Services Tax Practitioners’ Association of Maharashtra (GSTPAM) for presenting me with this award. #GSTPAM #SpeakerRecognition #FinanceCommunity #KnowledgeSharing #TaxLeadership #ProfessionalMilestones

Goa, GST, and Great Conversations! Presented a Paper and Spoke at the 49th RRC of #GSTPAM at Goa. Always good to step out of the office and into forums that spark thinking. #TaxLeadership #GSTIndia #TaxExperts #GSTUpdates #TaxReforms #GST #RRC #Goa #ParkRegis

Daily Hack Notices: #gstpam, #indianaerospaceandengineering, #akobdc, #acumengroup, #lasen, #tumenypay, #gns, #scania, #archlou, #aneticaid, #tcpm, #drapregistration, #khontharot, #maesripraifarm, #wo... hacknotice.com/recent-hack-no…

GST... Passion of subject and its knowledge sharing gives me satisfaction. Delivered lecture on ITC and Special Circumentaces at GSTPAM Mumbai. Thanks to GSTPAM for their love and affection. #gstpam #GST

Honored to be a speaker at yesterday's #GSTPAM session on GST concept of supply, discussing vital aspects with over 80 participants. Appreciating the interactive session, a big thanks to all who engaged. More to come! #GSTConceptOfSupply #Finance #KnowledgeSharing #Taxation

Happy to Contribute to the Profession by being one of the contributory to this all inclusive and most referred #GST referencer 2022-23 released by #GSTPAM, Mumbai. #gstcouncilmeeting

It’s an honour to be felicitated by Goods and Service Tax Practitioner Association of Maharashtra (GSTPAM) and Mithibai College. #GSTPAM #GST #Session #Coaching #Training #Mithibai #Students

Read pt no 4 for your concern, this @gstpam works as a bridge between government and taxpayers In a way this representation to government by #GSTPAM is for taxpayers at large and not a selfish n baseless desire. You are free to move to next years compliance, whose stopping you!

The due date to comply with Annual Compliance under GST Law should be extended from 28/02/22 to further at least a month considering the difficulties faced by Trade and Industry Representation by #GSTPAM #EasyGST4U

@cbic_india @nsitharamanoffc common answer by all officers is that there is 90 days period to review Appeal orders after that RC will be restored. There is a need for major overhaul in CGST Dept procedures #gstpam. States are reactivating GST numbers in one day. Buck up Centre

@cbic_india @FinMinIndia This is frustrating. A tax payer is given deadline to file pending returns by 31st Aug 21 to avail rationalised late fee benefit. Despite an appeal order passed on 28.07.2021 for allowing restoration of RC, till date it is not active on portal. #gstpam

Know More Here: bit.ly/3p35UQq (3/3) #TaxmannUpdates #TaxmannIndia #GSTPAM #GSTUpdate #GSTAnnualReturn #ResearchAtTheSpeedOfThought

T-1: today got elected to GSTPAM MCM for second term-without election😉-COVID played the most important role in avoiding elections🙏-ppl will get gud nite’s sleep 👻tonite after days of politics😝-also today i drove my fastest to baroda and back🤘🏻🏎🤘🏻#gstpam

Spoke on recent developments in GST at 34th Batch of Coaching Class organized by GSTPAM. I feel it's a wonderful initiative which is efficiently implemented under the leadership of @dineshtambde9 Adv Dinesh Tambde. #GST #GSTPAM #Training #Coaching #Class #Students #Developments

Representation made by #GSTPAM to the Union FM @nsitharaman and @GST_Council for clarification on the contentious issue of due date of claiming ITC for F.Y. 2018-19 and extension of the same in view of recent litigation. #GST

Glad to contribute to "The GST Referencer 2019-20" published by The Goods and Service Tax Practitioner's Association of Maharashtra. I hope this publication with concise summaries, flow charts, etc shall be of help to Tax Practitioners, Consultants, etc. #GST #GSTPAM #Referencer

#GSTPAM has organised Webinar on "#GST impact on Tours & Travel Industry" Speaker: CA Manish Gadia 05th June2018 4.00 to 5.30 pm Link for Registration attendee.gotowebinar.com/register/60461…

GST... Passion of subject and its knowledge sharing gives me satisfaction. Delivered lecture on ITC and Special Circumentaces at GSTPAM Mumbai. Thanks to GSTPAM for their love and affection. #gstpam #GST

Representation made by #GSTPAM to the Union FM @nsitharaman and @GST_Council for clarification on the contentious issue of due date of claiming ITC for F.Y. 2018-19 and extension of the same in view of recent litigation. #GST

Spoke on recent developments in GST at 34th Batch of Coaching Class organized by GSTPAM. I feel it's a wonderful initiative which is efficiently implemented under the leadership of @dineshtambde9 Adv Dinesh Tambde. #GST #GSTPAM #Training #Coaching #Class #Students #Developments

The due date to comply with Annual Compliance under GST Law should be extended from 28/02/22 to further at least a month considering the difficulties faced by Trade and Industry Representation by #GSTPAM #EasyGST4U

Happy to Contribute to the Profession by being one of the contributory to this all inclusive and most referred #GST referencer 2022-23 released by #GSTPAM, Mumbai. #gstcouncilmeeting

It’s an honour to be felicitated by Goods and Service Tax Practitioner Association of Maharashtra (GSTPAM) and Mithibai College. #GSTPAM #GST #Session #Coaching #Training #Mithibai #Students

Glad to contribute to "The GST Referencer 2019-20" published by The Goods and Service Tax Practitioner's Association of Maharashtra. I hope this publication with concise summaries, flow charts, etc shall be of help to Tax Practitioners, Consultants, etc. #GST #GSTPAM #Referencer

Honoured to share this moment of recognition! Grateful to The Goods and Services Tax Practitioners’ Association of Maharashtra (GSTPAM) for presenting me with this award. #GSTPAM #SpeakerRecognition #FinanceCommunity #KnowledgeSharing #TaxLeadership #ProfessionalMilestones

Goa, GST, and Great Conversations! Presented a Paper and Spoke at the 49th RRC of #GSTPAM at Goa. Always good to step out of the office and into forums that spark thinking. #TaxLeadership #GSTIndia #TaxExperts #GSTUpdates #TaxReforms #GST #RRC #Goa #ParkRegis

Honored to be a speaker at yesterday's #GSTPAM session on GST concept of supply, discussing vital aspects with over 80 participants. Appreciating the interactive session, a big thanks to all who engaged. More to come! #GSTConceptOfSupply #Finance #KnowledgeSharing #Taxation

@cbic_india @FinMinIndia This is frustrating. A tax payer is given deadline to file pending returns by 31st Aug 21 to avail rationalised late fee benefit. Despite an appeal order passed on 28.07.2021 for allowing restoration of RC, till date it is not active on portal. #gstpam

Something went wrong.

Something went wrong.

United States Trends

- 1. Cheney 39.4K posts

- 2. Nano Banana Pro 14.2K posts

- 3. #AcousticPianoSnowGlobe 1,932 posts

- 4. First Take 42.9K posts

- 5. #NXXT_NEWS N/A

- 6. #TSTheErasTour 1,582 posts

- 7. Cam Newton 2,072 posts

- 8. SEDITIOUS BEHAVIOR 10.8K posts

- 9. FINAL DRAFT FINAL LOVE 344K posts

- 10. Trump and Vance 28.3K posts

- 11. #LoveDesignFinalEP 314K posts

- 12. Stephen A 36K posts

- 13. Bush 50.2K posts

- 14. Husqvarna 1,012 posts

- 15. Godzilla 21.6K posts

- 16. Stuart Scott 1,750 posts

- 17. Nnamdi Kanu 170K posts

- 18. Sedition 82.6K posts

- 19. Haymitch 17K posts

- 20. #WeekndTourLeaks 1,036 posts

![GK2627's profile picture. C.A. , LLB-[Gen]

Professional, Writer, Entrepreneur, National GST Expert as recognised by Indirect Tax Committee, ICAI](https://pbs.twimg.com/profile_images/1708469670305808385/F0hRXhkg.jpg)