#imfblog kết quả tìm kiếm

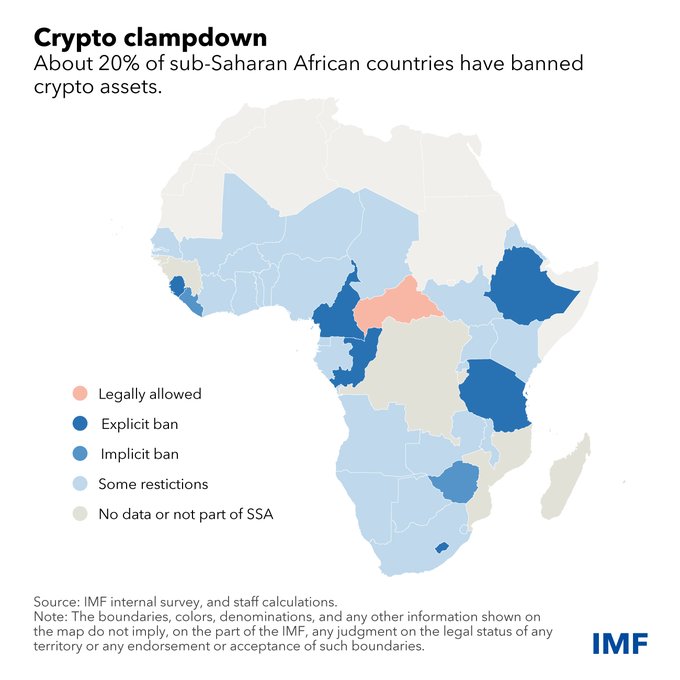

RT @IMFNews The collapse of crypto exchange FTX is prompting calls for greater regulation of the crypto industry. Here’s what countries in sub-Saharan Africa are doing. bit.ly/3UZPQQ6 #IMFBlog

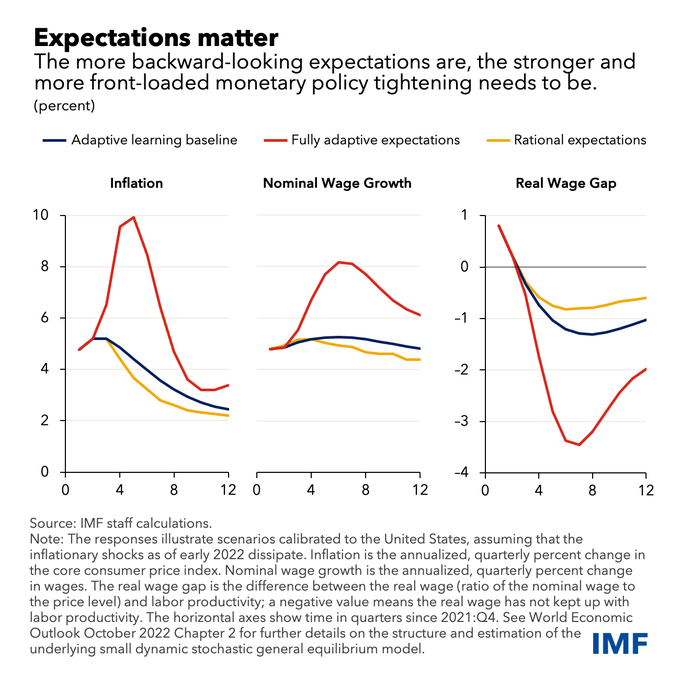

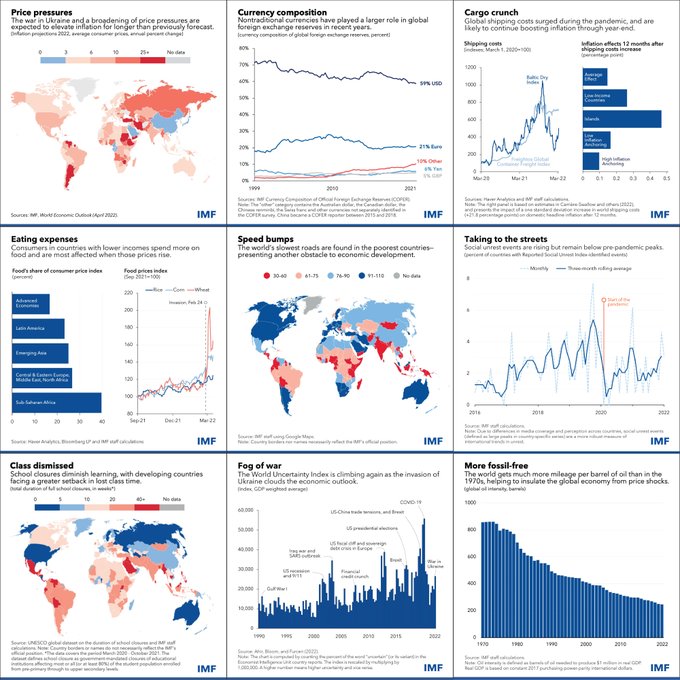

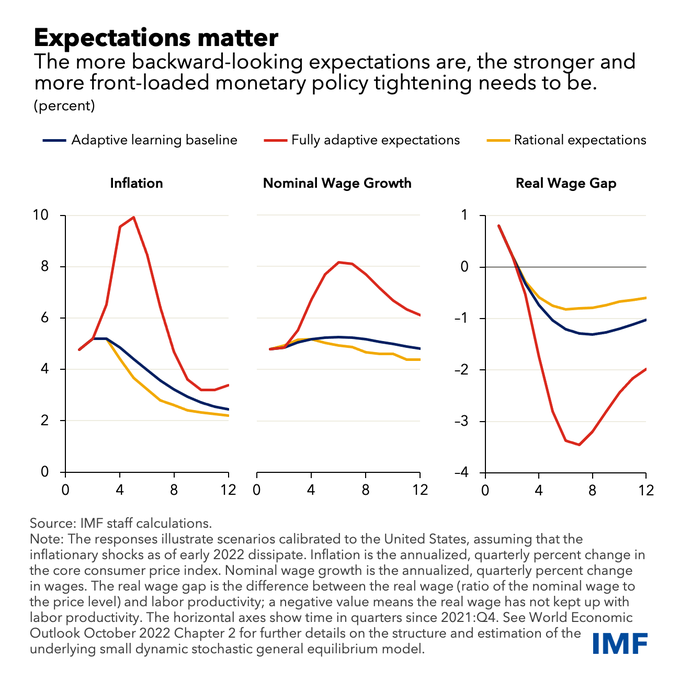

RT @IMFNews The threat of inflation leading to faster wage growth, and even more rapid inflation, appears to be limited—so far. See our new #IMFBlog for what the latest IMF research says about the risks. bit.ly/3e5F2jw

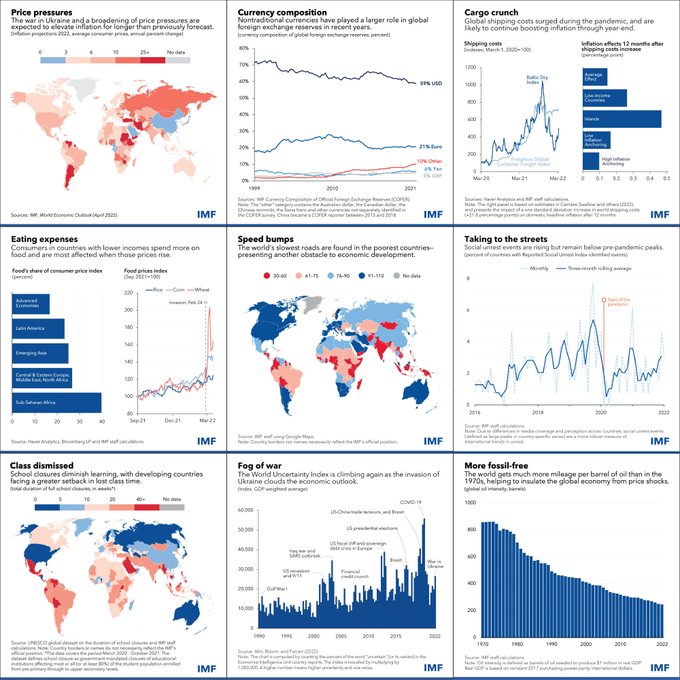

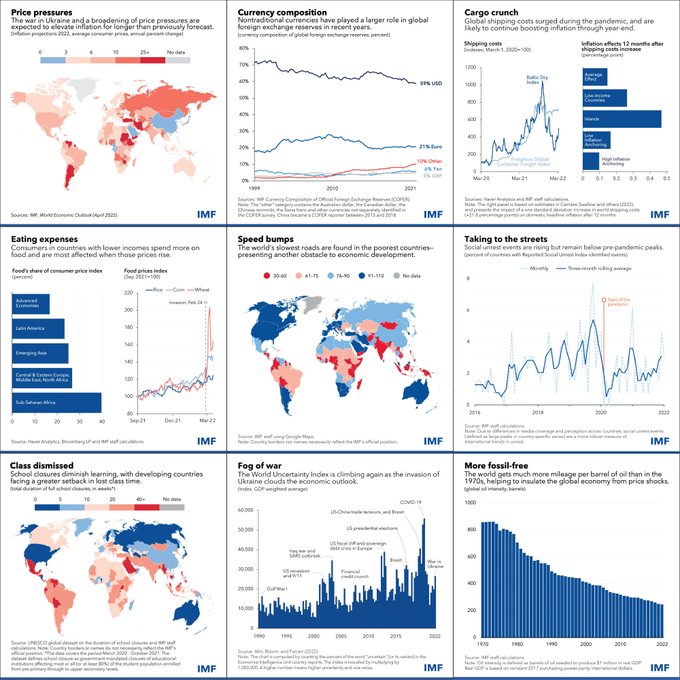

RT @IMFNews From Brexit and US-China trade tensions to the pandemic and war, successive shocks have kept uncertainty high. See our latest chart of the week blog for a new way to track the trends. bit.ly/3RbsLJ7 #IMFBlog

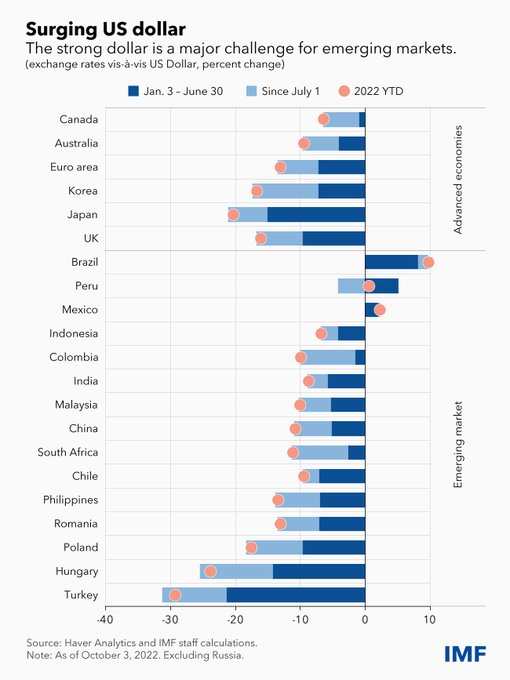

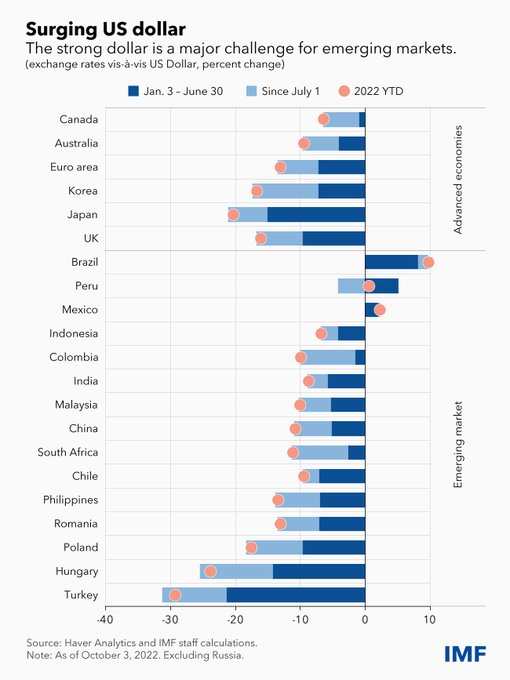

RT @IMFNews The dollar is now at its strongest since the early 2000s. Chief Economist @pogourinchas’ latest #IMFBlog explains why that matters. bit.ly/3yto7OQ #WEO

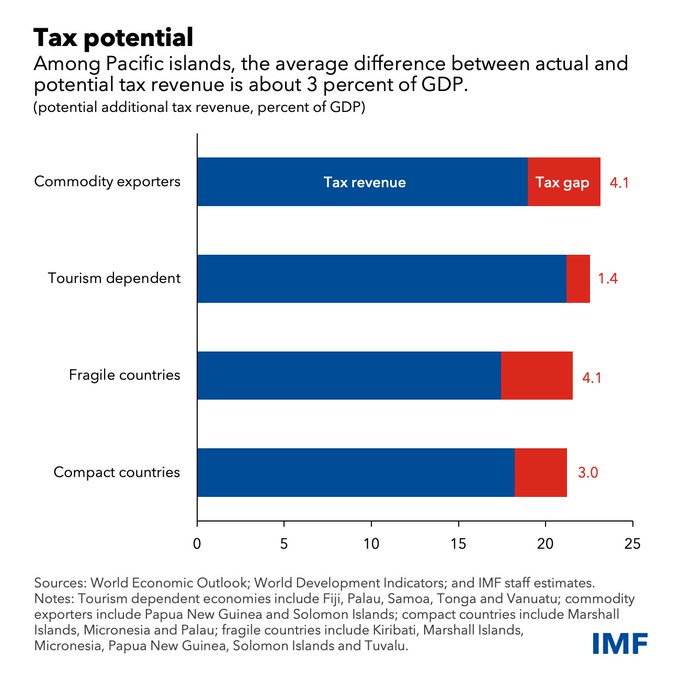

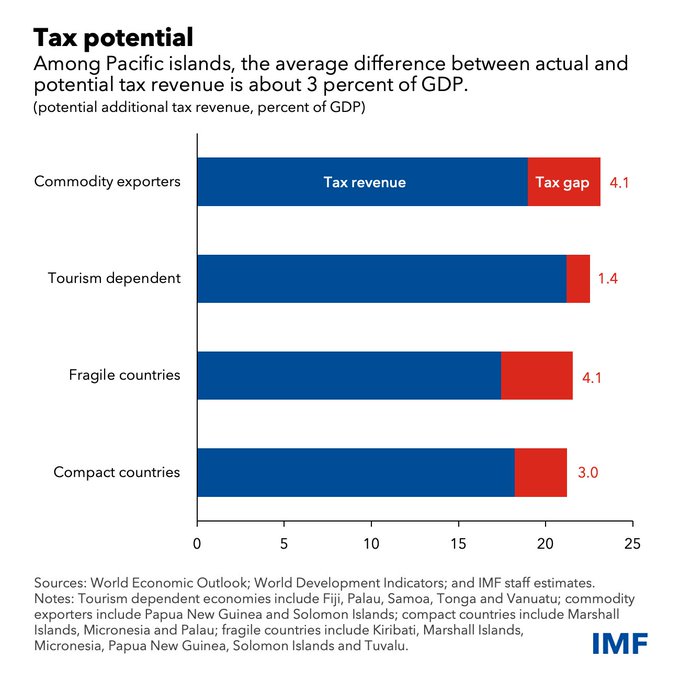

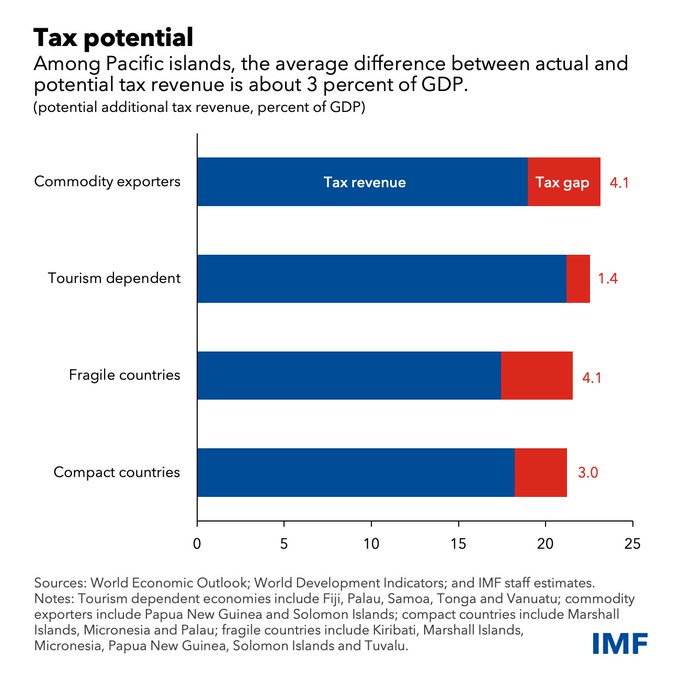

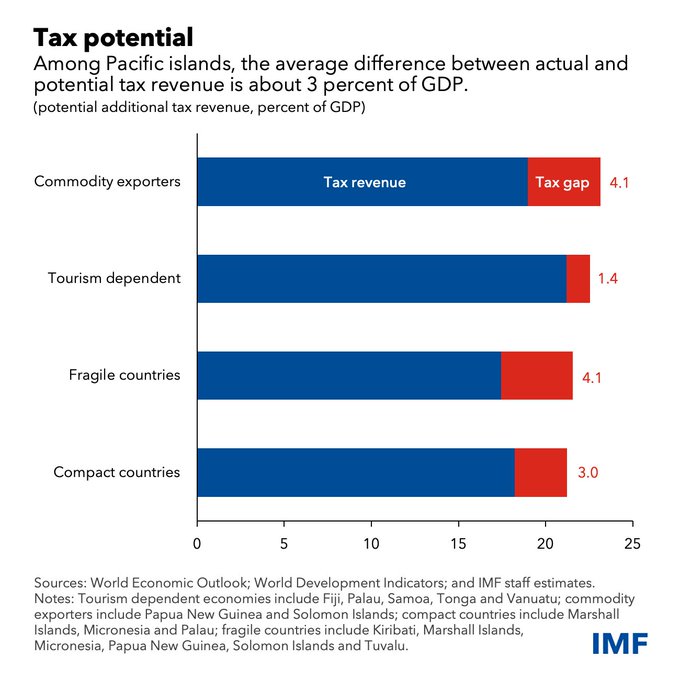

RT @IMFNews Pacific island countries have untapped tax potential, and raising more revenue could help pay for vital climate and social-development spending. See our latest blog for more. bit.ly/3yUmjOU #IMFBlog

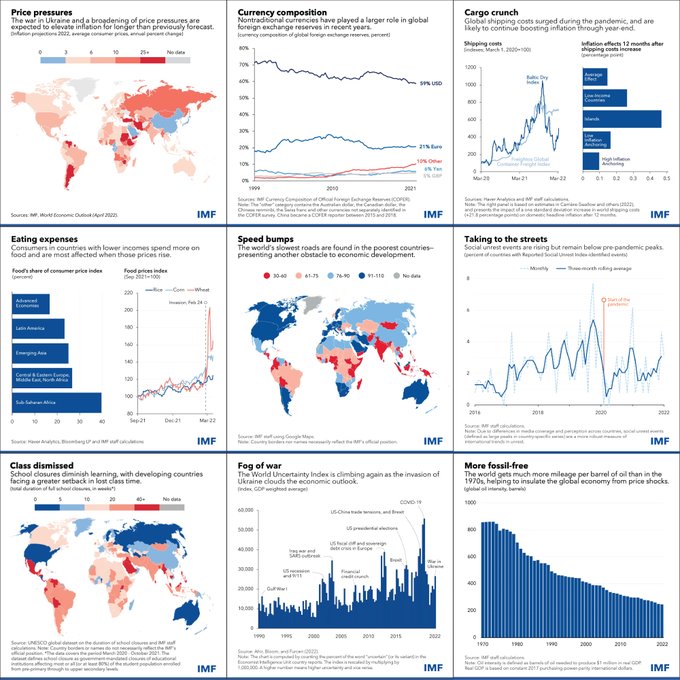

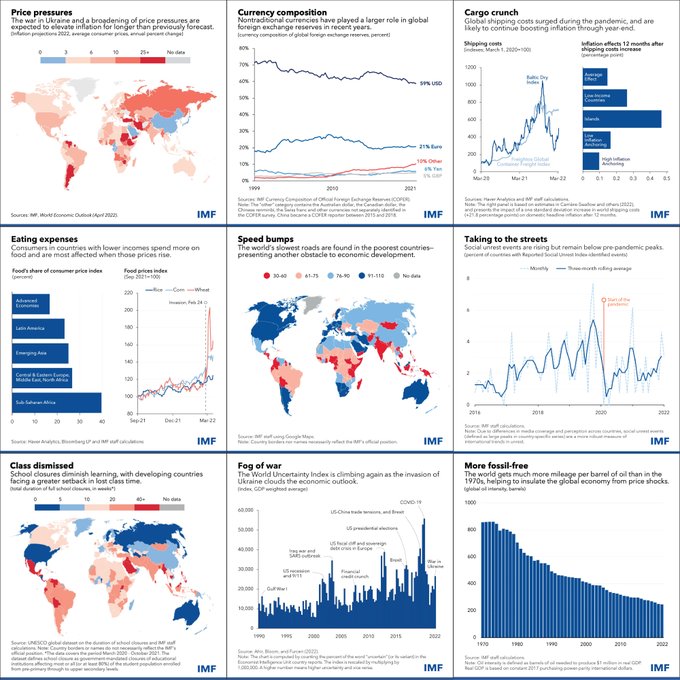

RT @IMFNews A picture is worth a thousand words. See #IMFBlog for our recent Chart of the Week posts that visualize what’s happening in the global economy. bit.ly/3wDjpgw

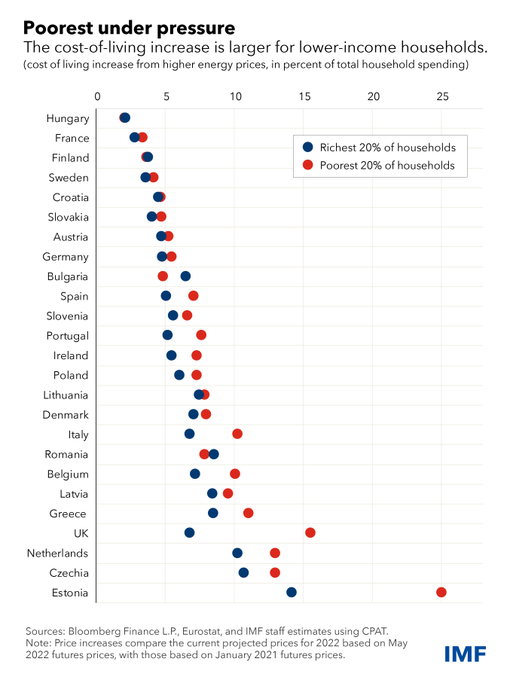

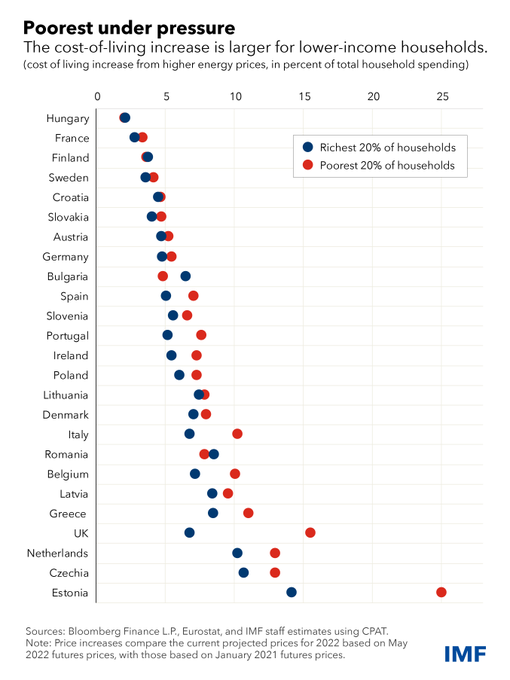

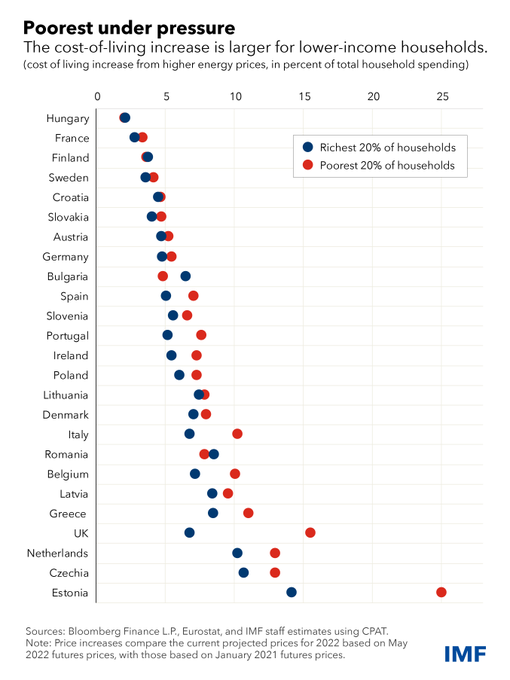

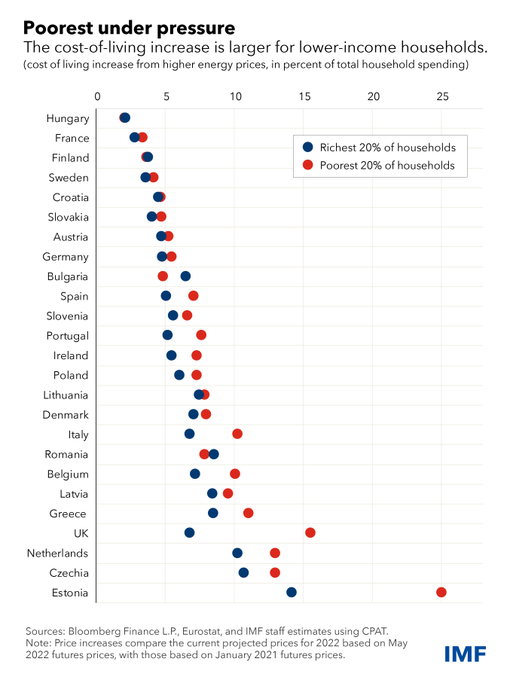

RT @IMFNews In the United Kingdom, living costs for the poorest 20% of households are set to rise by about twice as much as those for the wealthiest because of higher energy bills. Read #IMFBlog. bit.ly/3SoC09m

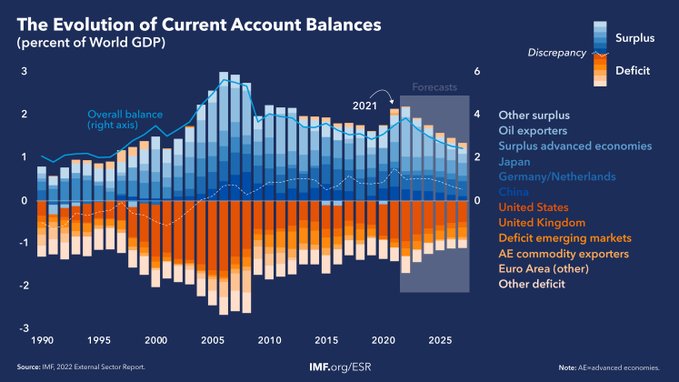

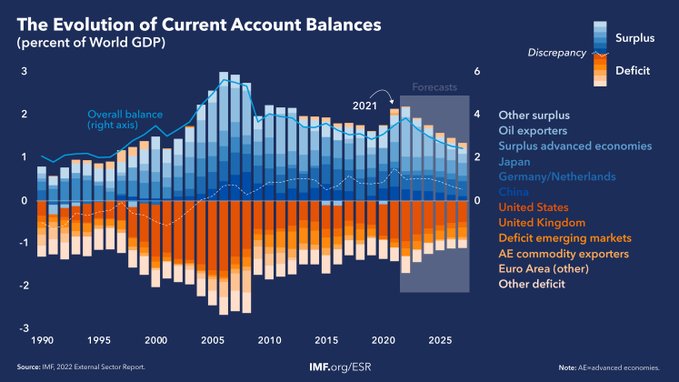

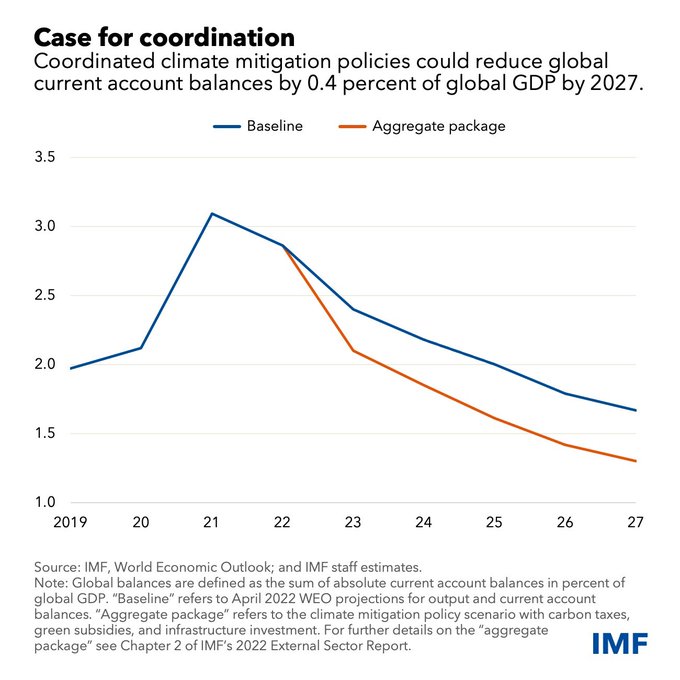

RT @IMFNews Global current account balances—the overall size of deficits and surpluses across countries—are widening for a second straight year, according to our latest External Sector Report. #ESR #IMFBlog bit.ly/3zW5Bzu

RT @IMFNews In the United Kingdom, living costs for the poorest 20% of households are set to rise by about twice as much as those for the wealthiest because of higher energy bills. Read #IMFBlog. bit.ly/3SoC09m

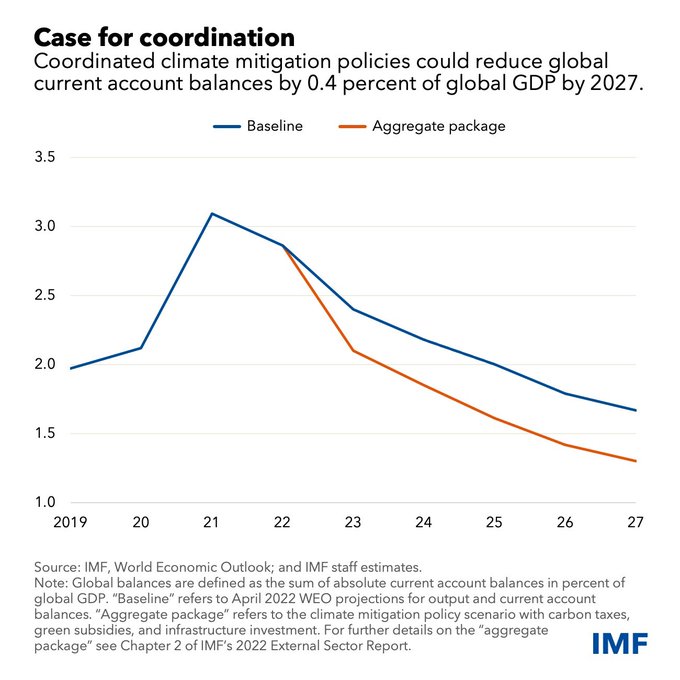

RT @IMFNews A mix of policies to mitigate climate change—carbon taxes, green subsidies, and infrastructure investment—could reduce global current account balances by a quarter by 2027. Read more here. #IMFBlog. bit.ly/3SRg8DD58

Asia's manufacturing sector is near global benchmarks, limiting further productivity gains. However, its services sector lags behind, offering significant room for growth and productivity improvement by catching up with global leaders. #IMFBlog

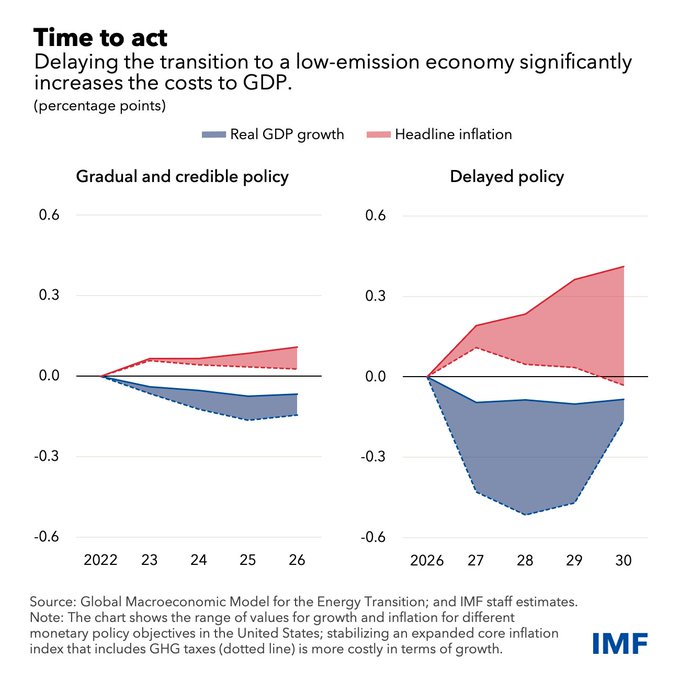

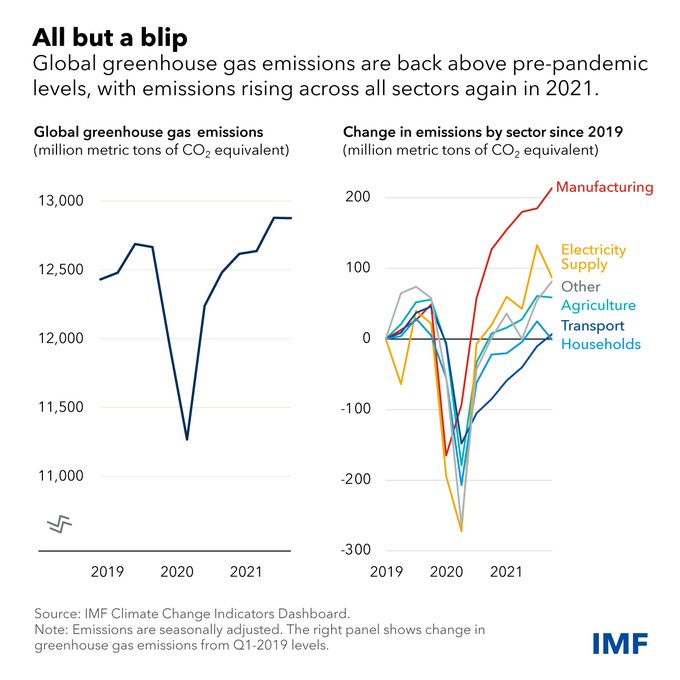

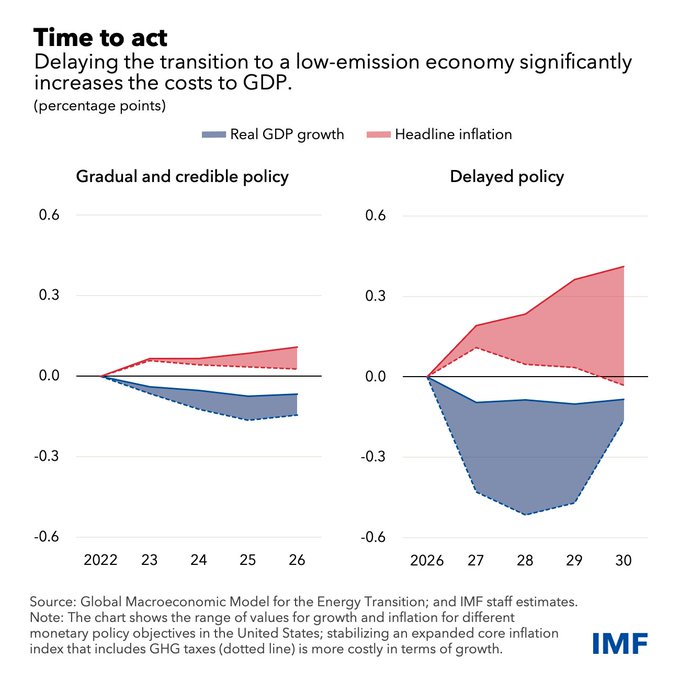

RT @IMFNews The longer we wait, the worse the trade-off. That’s the conclusion of our latest research on the economic costs of delaying the world’s transition to low carbon emissions. #IMFBlog bit.ly/3CyJh07

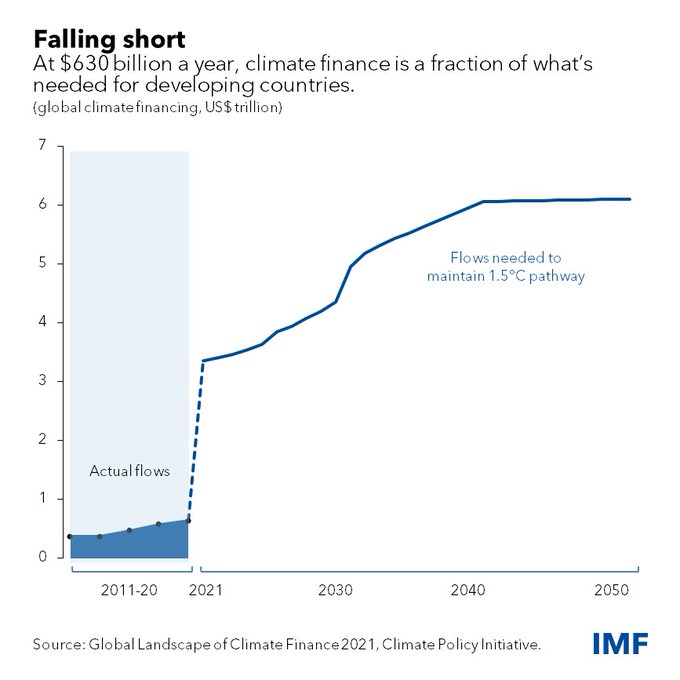

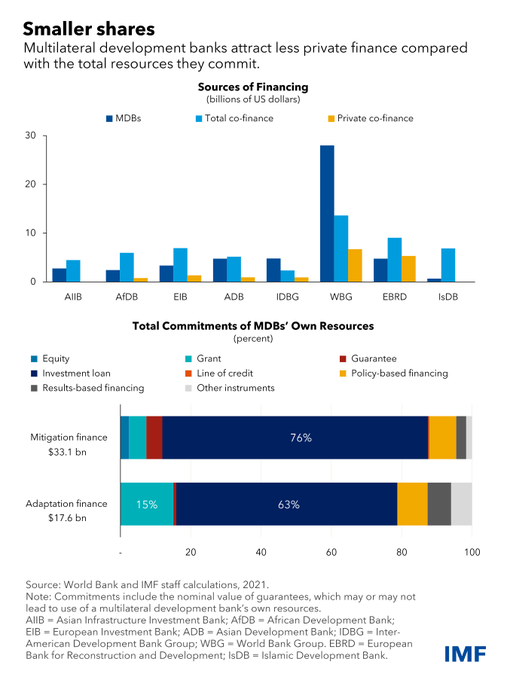

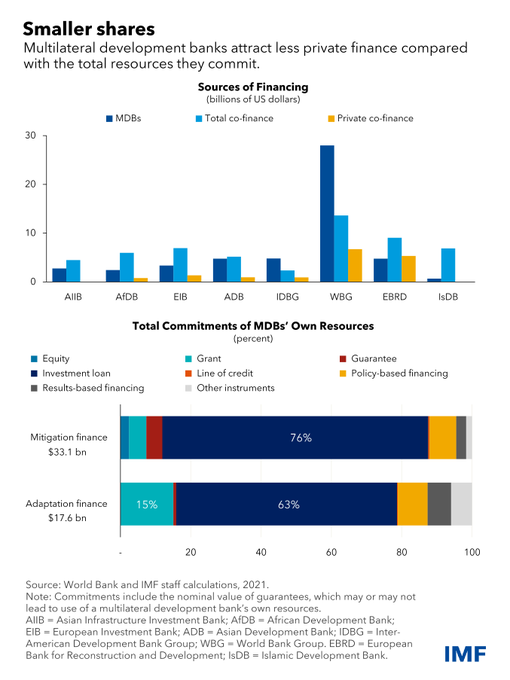

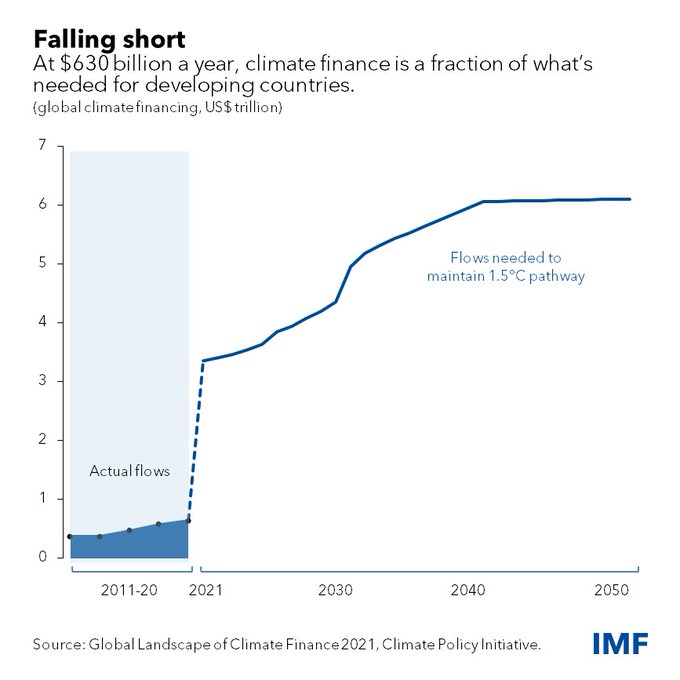

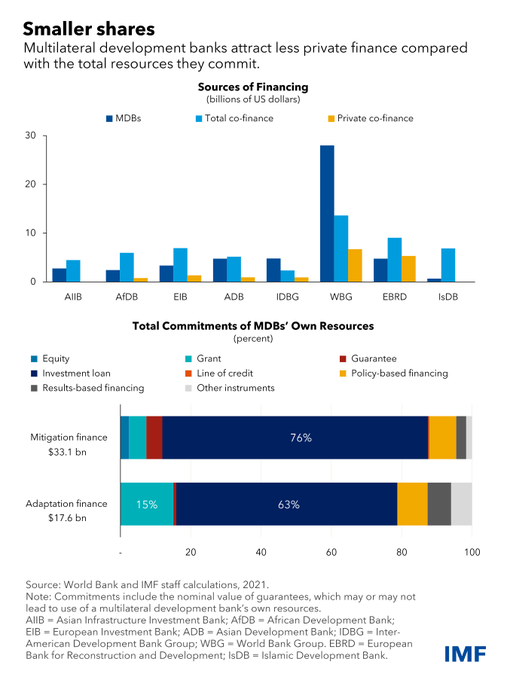

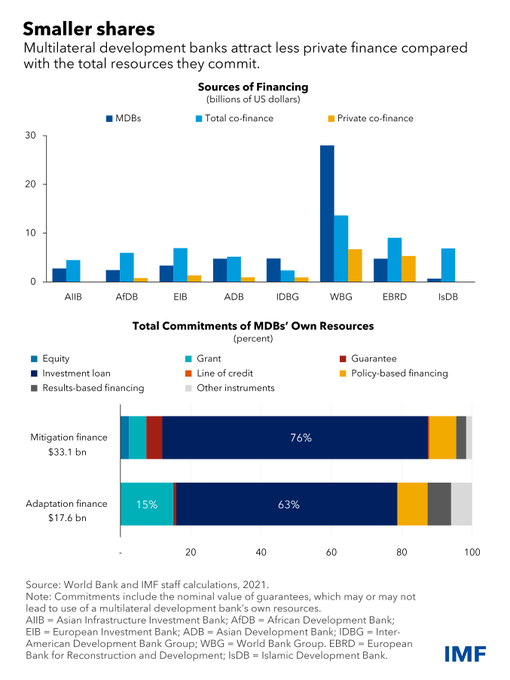

RT @IMFNews The public sector must play a major role in boosting private climate finance, and risks shared by both sides would help direct a greater part of the world’s financial assets to climate projects. bit.ly/3c22xZH #IMFBlog

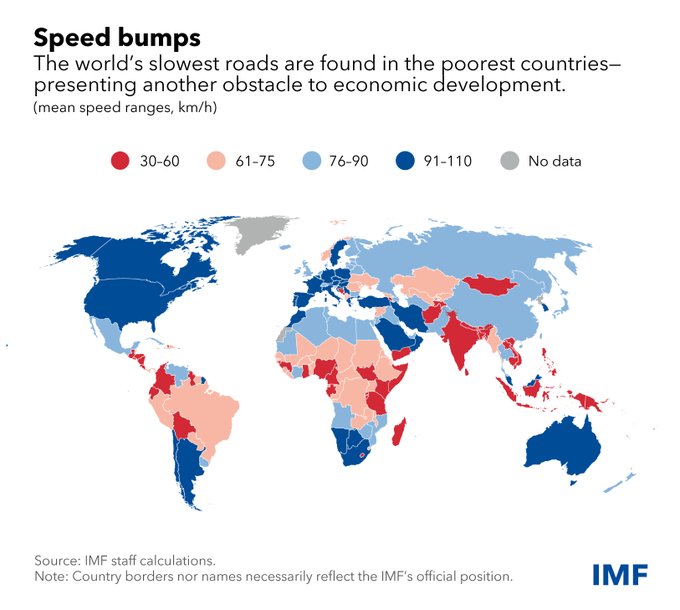

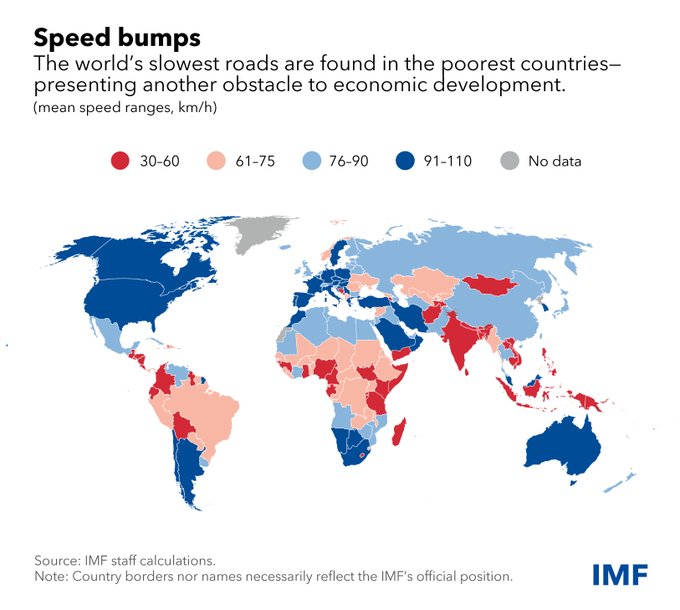

RT @IMFNews Where are the world’s fastest roads? A new IMF measure of road quality across 162 countries uses data from Google Maps. Read the #IMFBlog. bit.ly/3NUjVgw

As the world struggles to restrict global warming to 1.5 DC & parts of Asia, Europe & the US swelter in extreme heat, subsidies for oil, coal & natural gas are costing the equivalent of 7.1% of global GDP. It is more than govt spend on education & 2/3 on healthcare. #IMFBlog

Global commitments to cut carbon dioxide and other greenhouse gases would reduce emissions by just 11% from 1990 levels by the end of this decade. However, the cuts of 25-50% needed to limit global warming to 1.5 degrees to 2 degrees Celsius. #IMFBlog #COP28

RT @IMFNews Climate policies and finance are complementary because better policies attract private investment, which in turn helps meet policy objectives in emerging and developing economies. Check out our #IMFBlog for more details: bit ..

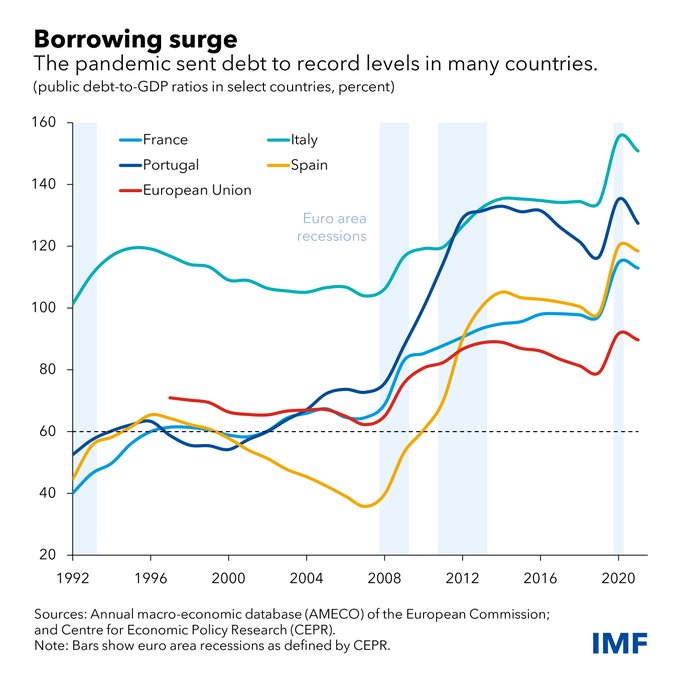

RT @IMFNews Given fiscal policy’s key role to help countries face debt vulnerabilities and future challenges, the call to reform Europe’s fiscal rules resonates like never before. See IMF's latest research for our plan. #IMFBlog: bit.ly ..

Higher debt costs worsen the vulnerability of economies with heavy external debt burdens.15% of low-income countries are in debt distress & additional45% are at high risk of debt distress.25% among emerging economies are at high risk,facing default-like borrowing spreads #IMFBlog

RT @IMFNews The threat of inflation leading to faster wage growth, and even more rapid inflation, appears to be limited—so far. See our new #IMFBlog for what the latest IMF research says about the risks. bit.ly/3e5F2jw

RT @IMFNews The collapse of crypto exchange FTX is prompting calls for greater regulation of the crypto industry. Here’s what countries in sub-Saharan Africa are doing. bit.ly/3UZPQQ6 #IMFBlog

RT @IMFNews From Brexit and US-China trade tensions to the pandemic and war, successive shocks have kept uncertainty high. See our latest chart of the week blog for a new way to track the trends. bit.ly/3RbsLJ7 #IMFBlog

RT @IMFNews The collapse of crypto exchange FTX is prompting calls for greater regulation of the crypto industry. Here’s what countries in sub-Saharan Africa are doing. bit.ly/3UZPQQ6 #IMFBlog

RT @IMFNews The dollar is now at its strongest since the early 2000s. Chief Economist @pogourinchas’ latest #IMFBlog explains why that matters. bit.ly/3yto7OQ #WEO

RT @IMFNews Pacific island countries have untapped tax potential, and raising more revenue could help pay for vital climate and social-development spending. See our latest blog for more. bit.ly/3yUmjOU #IMFBlog

RT @IMFNews Pacific island countries have untapped tax potential, and raising more revenue could help pay for vital climate and social-development spending. See our latest blog for more. bit.ly/3yUmjOU #IMFBlog

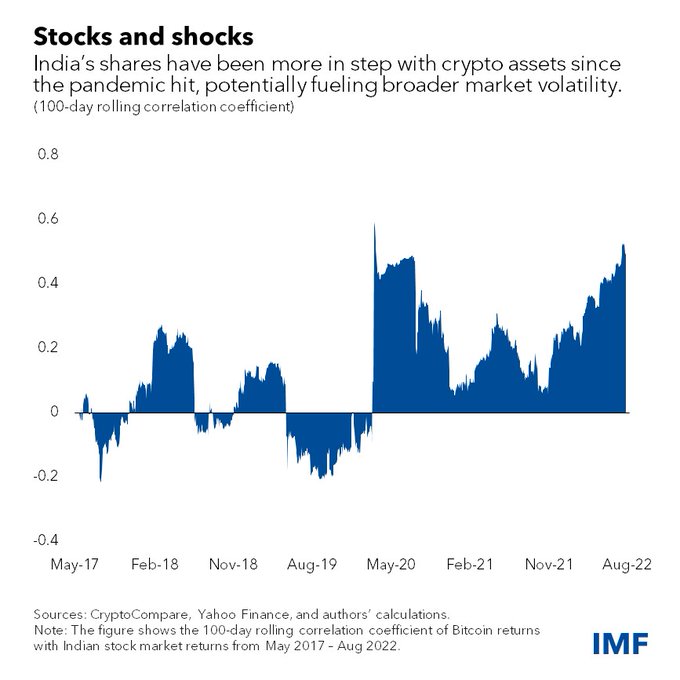

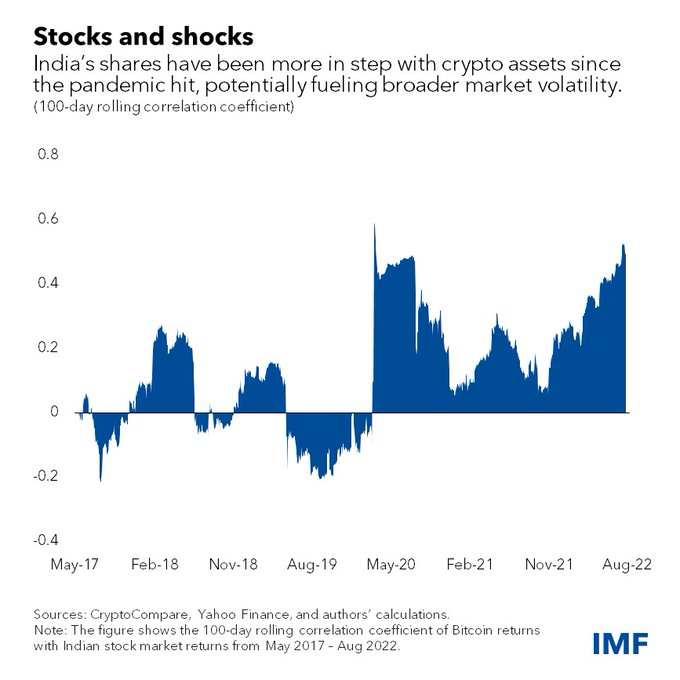

RT @IMFNews Asia’s stock markets are moving more in sync with crypto prices, highlighting the need for regulators to better safeguard financial stability. See our latest #IMFBlog for more. bit.ly/3Adoqgz

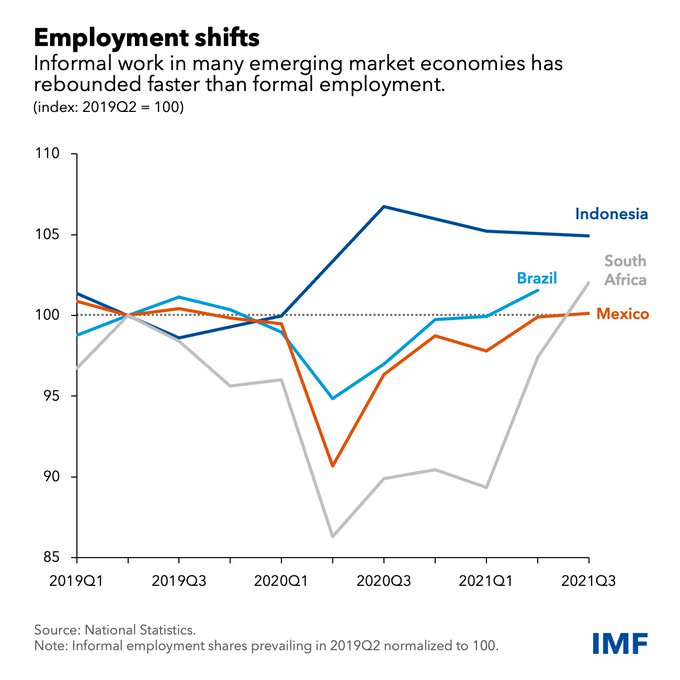

RT @IMFNews Informal employment has rebounded much more than formal work in G20 emerging economies including Brazil, Indonesia, Mexico, and South Africa since the depths of the pandemic. See #IMFBlog for more on how labor markets are changi ..

RT @IMFNews Inflation often comes down to how people expect prices to rise in the future. We find that the more backward-looking people’s expectations are, the higher interest rates have to rise. #IMFBlog bit.ly/3e5F2jw

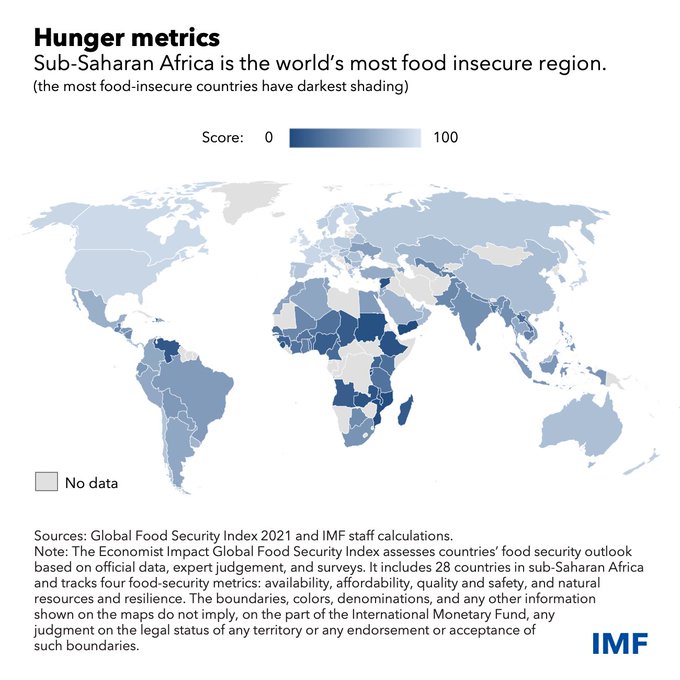

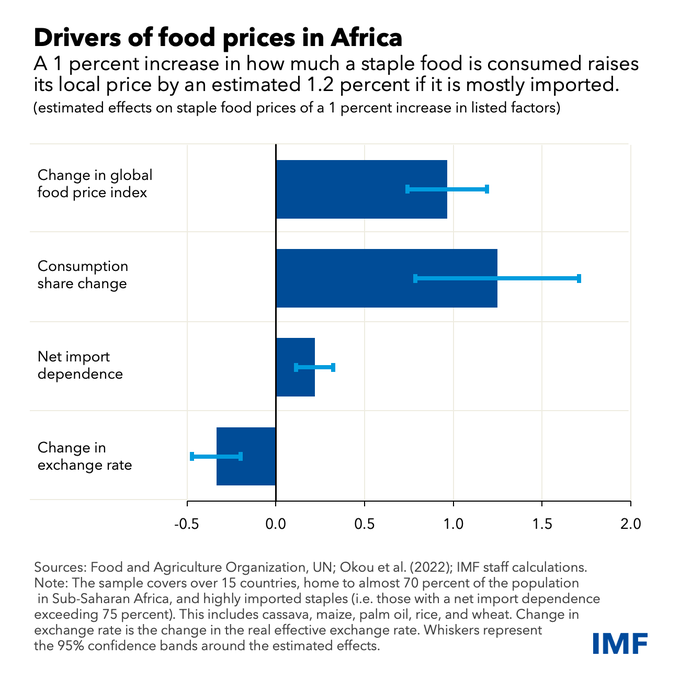

RT @IMFNews Extreme weather could push surging food prices even higher. Here’s how sub-Saharan Africa, the world’s most food insecure region, can adapt. bit.ly/3BIQMkJ #IMFBlog

RT @IMFNews Global current account balances—the overall size of deficits and surpluses across countries—are widening for a second straight year, according to our latest External Sector Report. #ESR #IMFBlog bit.ly/3zW5Bzu

RT @IMFNews A picture is worth a thousand words. See #IMFBlog for our recent Chart of the Week posts that visualize what’s happening in the global economy. bit.ly/3wDjpgw

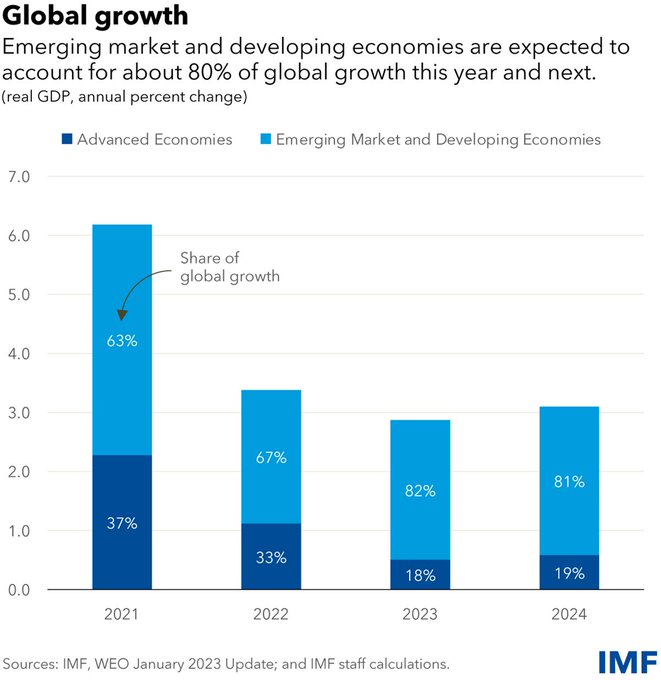

RT @IMFNews This could be another challenging year for the global economy, but it could be a turning point—with inflation moderating and growth accelerating. We project 2.9% growth this year. bit.ly/3YToQ6P #IMFBlog

RT @IMFNews This could be another challenging year for the global economy, but it could be a turning point—with inflation moderating and growth accelerating. We project 2.9% growth this year. bit.ly/3YToQ6P #IMFBlog

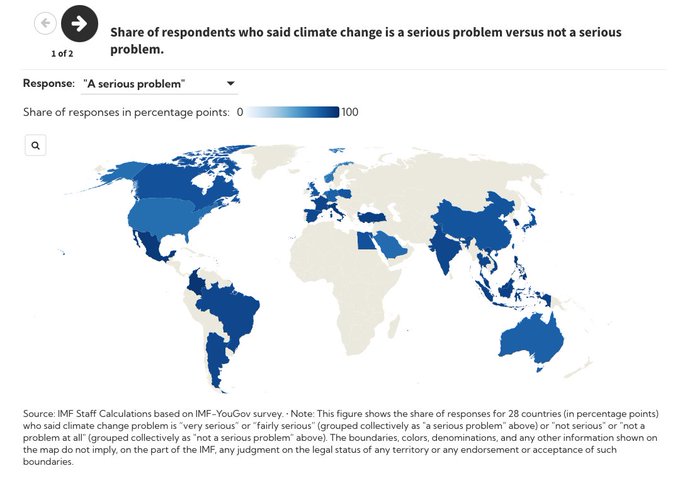

RT @IMFNews Our new survey of global attitudes about fighting climate change shows that effective communication and building awareness of the best policy options matter most. Learn more here on #IMFBlog: bit.ly/3x9303d

RT @IMFNews Inflation often comes down to how people expect prices to rise in the future. We find that the more backward-looking people’s expectations are, the higher interest rates have to rise. #IMFBlog bit.ly/3e5F2jw

RT @IMFNews Climate policies and finance are complementary because better policies attract private investment, which in turn helps meet policy objectives in emerging and developing economies. Check out our #IMFBlog for more details: bit ..

RT @IMFNews The IMF’s Climate Change Indicators Dashboard provides the breakdown on global greenhouse emission trends. See #IMFBlog for more. bit.ly/3a5utuF

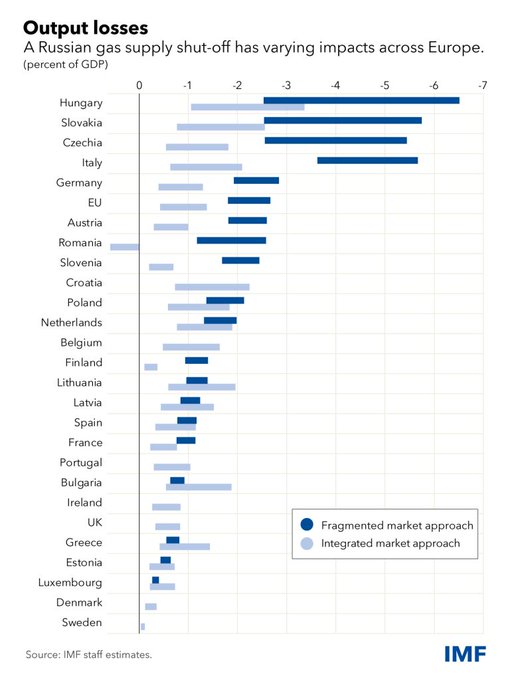

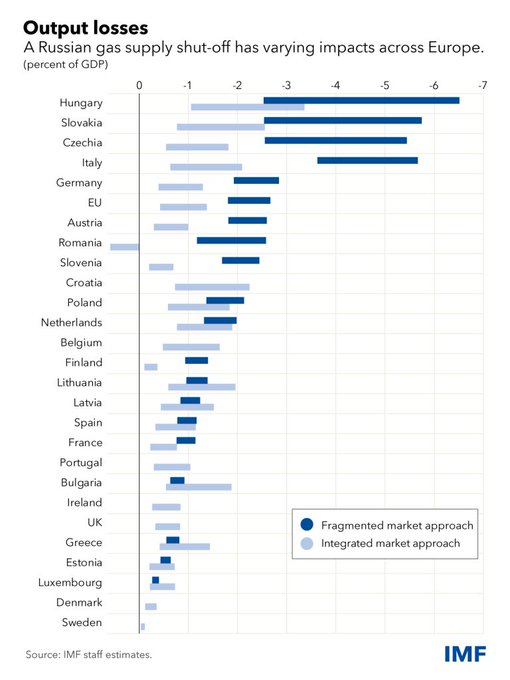

RT @IMFNews A Russian natural gas cutoff could hit Central and Eastern Europe countries hardest, with a risk of economic contractions of up to 6%. See #IMFBlog for more. bit.ly/3yPEpRh

RT @IMFNews A picture is worth a thousand words. See #IMFBlog for our recent Chart of the Week posts that visualize what’s happening in the global economy. bit.ly/3wDjpgw

RT @IMFNews The longer we wait, the worse the trade-off. That’s the conclusion of our latest research on the economic costs of delaying the world’s transition to low carbon emissions. #IMFBlog bit.ly/3CyJh07

RT @IMFNews The public sector must play a major role in boosting private climate finance, and risks shared by both sides would help direct a greater part of the world’s financial assets to climate projects. bit.ly/3c22xZH #IMFBlog

RT @IMFNews Climate policies and finance are complementary because better policies attract private investment, which in turn helps meet policy objectives in emerging and developing economies. Check out our #IMFBlog for more details: bit ..

RT @IMFNews A mix of policies to mitigate climate change—carbon taxes, green subsidies, and infrastructure investment—could reduce global current account balances by a quarter by 2027. Read more here. #IMFBlog. bit.ly/3SRg8DD58

RT @IMFNews In the United Kingdom, living costs for the poorest 20% of households are set to rise by about twice as much as those for the wealthiest because of higher energy bills. Read #IMFBlog. bit.ly/3SoC09m

RT @IMFNews How could a Russian natural gas cutoff weigh on Europe’s economies? #IMFBlog rounds up three new staff research papers examining this question: bit.ly/3yPEpRh

RT @IMFNews Asia’s stock markets are moving more in sync with crypto prices, highlighting the need for regulators to better safeguard financial stability. See our latest #IMFBlog for more. bit.ly/3Adoqgz

RT @IMFNews Staple food prices in sub-Saharan Africa surged by an average 23.9% in 2020-22—the most since the 2008 global financial crisis. Our #IMFBlog looks at the drivers of food prices. bit.ly/3EKEpqh

RT @IMFNews A picture is worth a thousand words. See #IMFBlog for our recent Chart of the Week posts that visualize what’s happening in the global economy. bit.ly/3wDjpgw

RT @IMFNews In the United Kingdom, living costs for the poorest 20% of households are set to rise by about twice as much as those for the wealthiest because of higher energy bills. Read #IMFBlog. bit.ly/3SoC09m

RT @IMFNews Pacific island countries have untapped tax potential, and raising more revenue could help pay for vital climate and social-development spending. See our latest blog for more. bit.ly/3yUmjOU #IMFBlog

RT @IMFNews Global debt fell by 10 percentage points in 2021 to 247% of GDP. Find out why in our new #IMFBlog ➡️bit.ly/3iWT0pS

RT @IMFNews Where are the world’s fastest roads? A new IMF measure of road quality across 162 countries uses data from Google Maps. Read the #IMFBlog. bit.ly/3NUjVgw

RT @IMFNews A picture is worth a thousand words. See #IMFBlog for our recent Chart of the Week posts that visualize what’s happening in the global economy. bit.ly/3wDjpgw

RT @IMFNews Climate policies and finance are complementary because better policies attract private investment, which in turn helps meet policy objectives in emerging and developing economies. Check out our #IMFBlog for more details: bit ..

RT @IMFNews Pacific island countries have untapped tax potential, and raising more revenue could help pay for vital climate and social-development spending. See our latest blog for more. bit.ly/3yUmjOU #IMFBlog

RT @IMFNews Asia’s stock markets are moving more in sync with crypto prices, highlighting the need for regulators to better safeguard financial stability. See our latest #IMFBlog for more. bit.ly/3Adoqgz

RT @IMFNews Informal employment has rebounded much more than formal work in G20 emerging economies including Brazil, Indonesia, Mexico, and South Africa since the depths of the pandemic. See #IMFBlog for more on how labor markets are changi ..

RT @IMFNews A Russian natural gas cutoff could hit Central and Eastern Europe countries hardest, with a risk of economic contractions of up to 6%. See #IMFBlog for more. bit.ly/3yPEpRh

Something went wrong.

Something went wrong.

United States Trends

- 1. #GrandEgyptianMuseum 26.1K posts

- 2. #GEM𓅓 7,226 posts

- 3. #Talus_Labs 1,023 posts

- 4. #capcutlovers N/A

- 5. Game 7 76.3K posts

- 6. Happy New Month 184K posts

- 7. jungkook 811K posts

- 8. Nigeria 428K posts

- 9. Kawhi 8,484 posts

- 10. vmin 4,877 posts

- 11. GenG 11.8K posts

- 12. Ja Morant 5,938 posts

- 13. #RUNSEOKJIN_epTOUR_ENCORE 355K posts

- 14. Barger 6,176 posts

- 15. Glasnow 6,891 posts

- 16. Shirley Temple N/A

- 17. Tinubu 47K posts

- 18. Justin Dean 2,710 posts

- 19. Halloween 2025 193K posts

- 20. Rojas 11.5K posts