#isgindex search results

Economic concerns are slowing demand for IT and business services in the Americas, as enterprises delay spending on non-critical projects, according to the Q4 #ISGIndex. Enterprises are looking to cost optimization to fund ongoing #digitaltransformation. bit.ly/3XA6Ai8

ACV of the combined global #IT and business services market was $23Bin Q3. The 3% decline was smaller than the previous four quarters, suggesting the market may soon turn upwards. Here is the full Q323 #ISGIndex webcast: bit.ly/48U3VGg

The EMEA #ISGIndex shows ACV for the combined market (both managed services and XaaS) at US $7.2 billion for 4Q22, down 1% from the prior year, the first time since the third quarter of 2019 the region did not register year-over-year growth: bit.ly/3R1t3Tb

📅 Don't miss the 3Q25 ISG Index this Thursday, Oct. 9th. Get the latest market data & intelligence on the health & growth of technology industry. Register ➡️ bit.ly/4h0GjUX #ISGIndex #marketintelligence #technologyindustry

The EMEA #ISGIndex shows ACV for the combined market (both managed services and XaaS) at US $7.2 billion for 4Q22, down 1 percent from the prior year, the first time since the third quarter of 2019 the region did not register year-over-year growth. bit.ly/3ZIpsgp

Join the 2Q23 #ISGIndex webcast on July 13. Leveraging unprecedented data assets and a practitioner-led view into the IT and business services industry, the Index provides the most up-to-date view into demand, pricing, talent and provider landscapes. bit.ly/3Xyr9fZ

The IT and business services industry made up all the ground it lost to economic uncertainty over the past 27 months in Q3, the global #ISGIndex finds. #ManagedServices reached a new quarterly high and as-a-service continues its remarkable turnaround. dy.si/s6xi9

Demand for #cloud services continued its upward trajectory in a complete turnaround from 2023, data from the #ISGIndex show. Q4 ACV for the combined global IT and business services market was a record $28.2 billion, up 20 percent versus the prior year. dy.si/qwc7VL3

The Americas #ISGIndex finds IT and business services demand rose 10 percent in Q2, to $12.1 billion, the region’s first quarterly double-digit increase since Q2 2022. #ManagedServices demand remains sluggish with discretionary spending under pressure. dy.si/HqhsQ

The Americas #ISGIndex finds IT and business services demand rose 10 percent in Q2, to $12.1 billion, the region’s first quarterly double-digit increase since Q2 2022. #ManagedServices demand remains sluggish with discretionary spending under pressure. dy.si/jWCZxd

Demand for IT and business services in the Americas fell sharply in Q2, reflecting softness in the banking, financial services and insurance sector and slackening demand for #cloud-based services overall, according to the latest Americas #ISGIndex. bit.ly/3DfUVwG

Data from the EMEA #ISGIndex finds the European IT and business services market had a record Q3 after several quarters of slow growth. ISG says this signals the start of a period of accelerated growth, despite continued weak spending in the BFSI sector. dy.si/Fe9HSg2

The Americas #ISGIndex shows Q3 ACV for the combined IT and business services market rose 7 percent, to $13.2 billion, the region’s highest quarterly mark since a record first quarter of 2022. Q3 growth, overall, was driven by XaaS spending. dy.si/7teSHg2

The Americas #ISGIndex finds IT and business services demand rose 10 percent in Q2, to $12.1 billion, the region’s first quarterly double-digit increase since Q2 2022. #ManagedServices demand remains sluggish with discretionary spending under pressure. dy.si/FpQXQ

The Americas #ISGIndex finds IT and business services demand rose 10 percent in Q2, to $12.1 billion, the region’s first quarterly double-digit increase since Q2 2022. #ManagedServices demand remains sluggish with discretionary spending under pressure. dy.si/5sTbP

The Americas #ISGIndex shows Q1 ACV for the combined IT and business services market was $12.1 billion, down 3 percent from a year ago. The rate of decline in Q1 slowed compared with the average 5.4 percent decline over the last five quarters. dy.si/fS3uDa

The Q2 2024 #ISGIndex reports IT and business services industry revenue growth slowed to just over 1 percent, compared with just over 3 percent growth in Q2 2023. Provider margin growth declined for the second quarter in a row, resulting in slower hiring. dy.si/q7gh5

Demand for #cloud services continued its upward trajectory in a complete turnaround from 2023, data from the #ISGIndex show. Q4 ACV for the combined global IT and business services market was a record $28.2 billion, up 20 percent versus the prior year. dy.si/hqd14b

The IT and business services industry made up all the ground it lost to economic uncertainty over the past 27 months in Q3, the global #ISGIndex finds. #ManagedServices reached a new quarterly high and as-a-service continues its remarkable turnaround. dy.si/H7rMGD

Big-four accounting firms are buying up third-party technology services firms to fill critical skill gaps and chase high-margin consulting revenue. @CIODive cites #ISGIndex data that predicts 5% growth in the #managedservices market in 2023. bit.ly/422HIRX

Catch the replay of our #3Q25 Global ISG Index™ for the latest market data and intelligence on the health & growth of the technology industry. ▶️ Watch the full replay here: bit.ly/4hdTbY2 #ISGIndex #marketintelligence

📅 Don't miss the 3Q25 ISG Index this Thursday, Oct. 9th. Get the latest market data & intelligence on the health & growth of technology industry. Register ➡️ bit.ly/4h0GjUX #ISGIndex #marketintelligence #technologyindustry

We have recognized as a Top 15 Sourcing Standout in the 2Q 2025 Global ISG Index™ across the Global market as well as in the Americas and EMEA regions, showcasing our continued excellence in #digitaltransformation and AI-powered solutions. #ISGIndex #Top15 #Mastek

📅❗Don't miss the #2Q25 ISG Index this Thursday July 10. Tune in at 9 AM ET for our analysis of the latest market data & intelligence on the health and growth of technology industry. Register here➡️ bit.ly/4nR0h7I.. #ISGIndex #marketintelligence

📆 You're invited! 📆 Join us for the #2Q25 webcast from the authoritative source for market intel on the enterprise tech sector. Don't miss this critical view into current market trends & future projections. Register➡️ isgsmarttalk.isg-one.com/2Q25?utm_sourc… ⬅️ #ISGIndex #marketintelligence

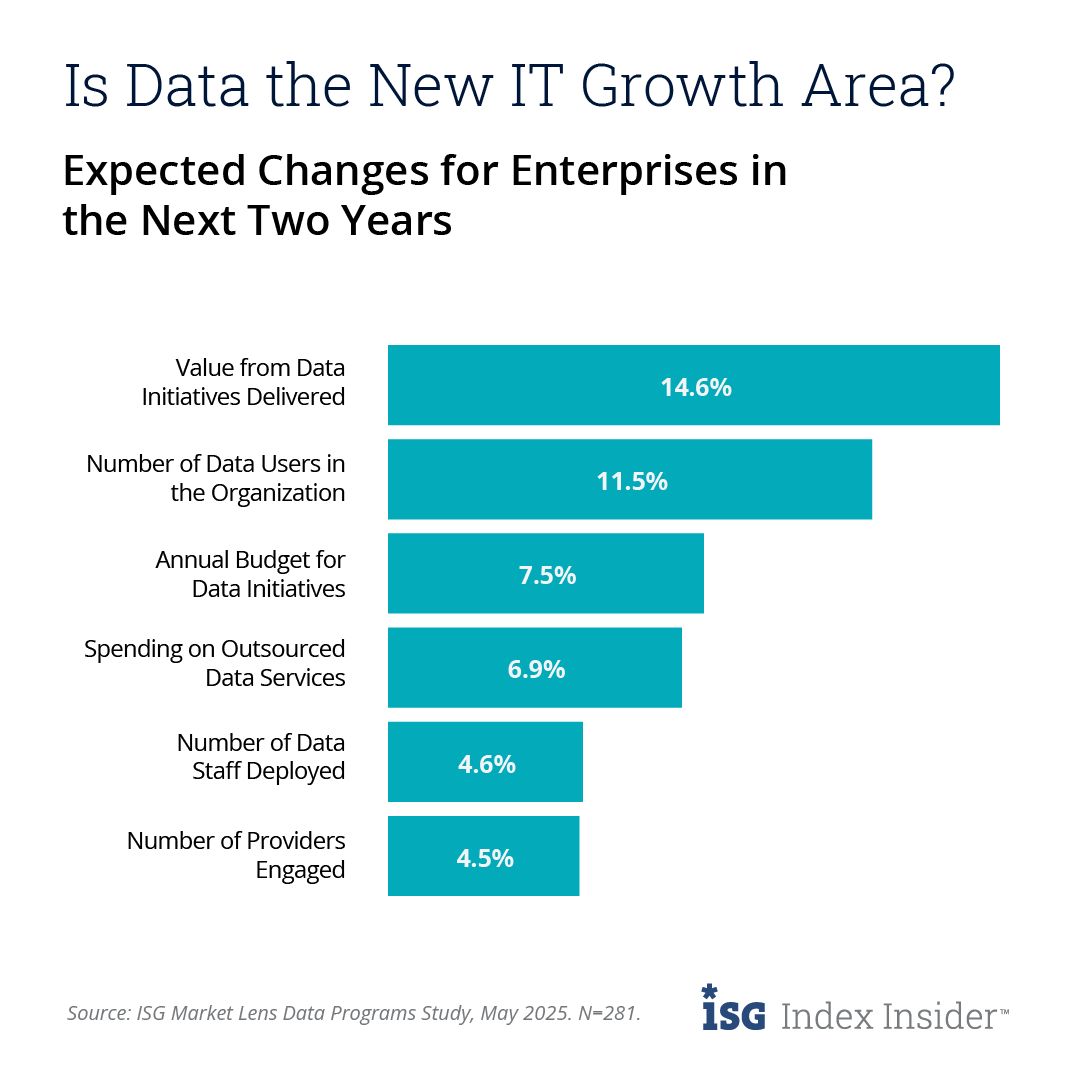

📊 IT spending patterns are evolving! AI and applications are leading the charge, but what’s really driving decisions: the applications themselves, or the data powering them? Read more ➡️ bit.ly/3SMrMAW #ISGIndexInsider #ISGIndex #ITSpending

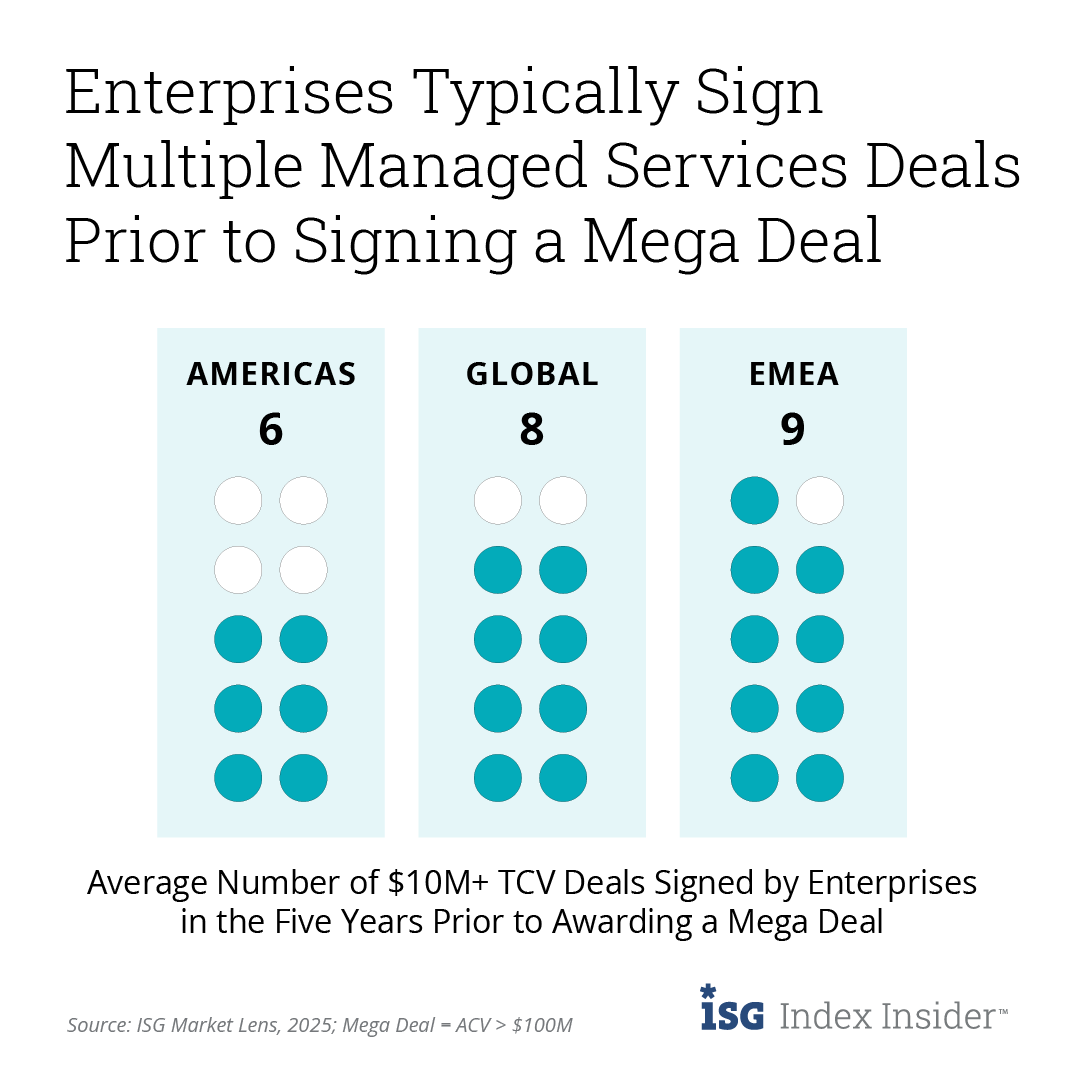

🚨 Mega deals don’t just happen. They’re shaped! ISG research shows that enterprises typically sign an average of 8 managed services deals in the 5 years leading up to a mega deal! 🤝Learn why in the latest #ISGIndexInsider ➡️ bit.ly/4kpai9k #ISGIndex #Outsourcing

ISG Research indicates that ~60% of #GCCs plan on increasing or continuing the use of IT services over the next 2 years. On the 1Q25 #ISGIndex call, ISG’s Namratha Dharshan explained the dynamics of the GCC and IT services market. Catch the replay here: lnkd.in/exxurYxA

The rapid rise of #GCCs has been seen as a threat to the IT & BPO services industry. But our research idisagrees. In the 1Q25 #ISGIndex call, Namratha Dharshan explained that GCCs and #ITservices providers will continue to collaborate⬇️ Replay: lnkd.in/eYWz3nYv

#AgenticAI is dominating the conversation in the business software market. In the 1Q25 #ISGIndex call, Stanton Jones explained that despite its massive potential, the real transformation won’t happen overnight. Catch the full replay here for more: lnkd.in/esKxnxdw

🔎 Let's take a look at the impact of AI on the market. We're seeing AI in nearly every sourcing conversation - pushing for 20-30% savings in ITO and BPO deals. Watch this clip, or catch the full replay of the #ISGIndex here➡️ lnkd.in/esKxnxdw #AIimpact #aiandsourcing

How are tariffs impacting the industry? Increased caution and pressure on discretionary spend is just the start. Get insights from ISG's Steven Hall in this clip, or watch the full replay of the #ISGIndex here: lnkd.in/eim5m3PG #1Q25 #ISGIndex #tariffs

Why are enterprises investing in building #GCCs? And what specific business objectives do they hope to address with this delivery model? ISG's Alex Bakker breaks it down in this extract from the #1Q25 #ISGIndex call⬇️ Don’t miss the full replay here: youtube.com/watch?v=MHkRKu…

Missed the #1Q25 #ISGIndex call? No problem - we've got you covered. Catch the replay for our take on what's ahead this quarter, plus how the tariff changes will affect your business. Watch the full call here ➡️ bit.ly/3GgfjCm ⬅️

Demand for #cloud services continued its upward trajectory in a complete turnaround from 2023, data from the #ISGIndex show. Q4 ACV for the combined global IT and business services market was a record $28.2 billion, up 20 percent versus the prior year. dy.si/VfyUeP

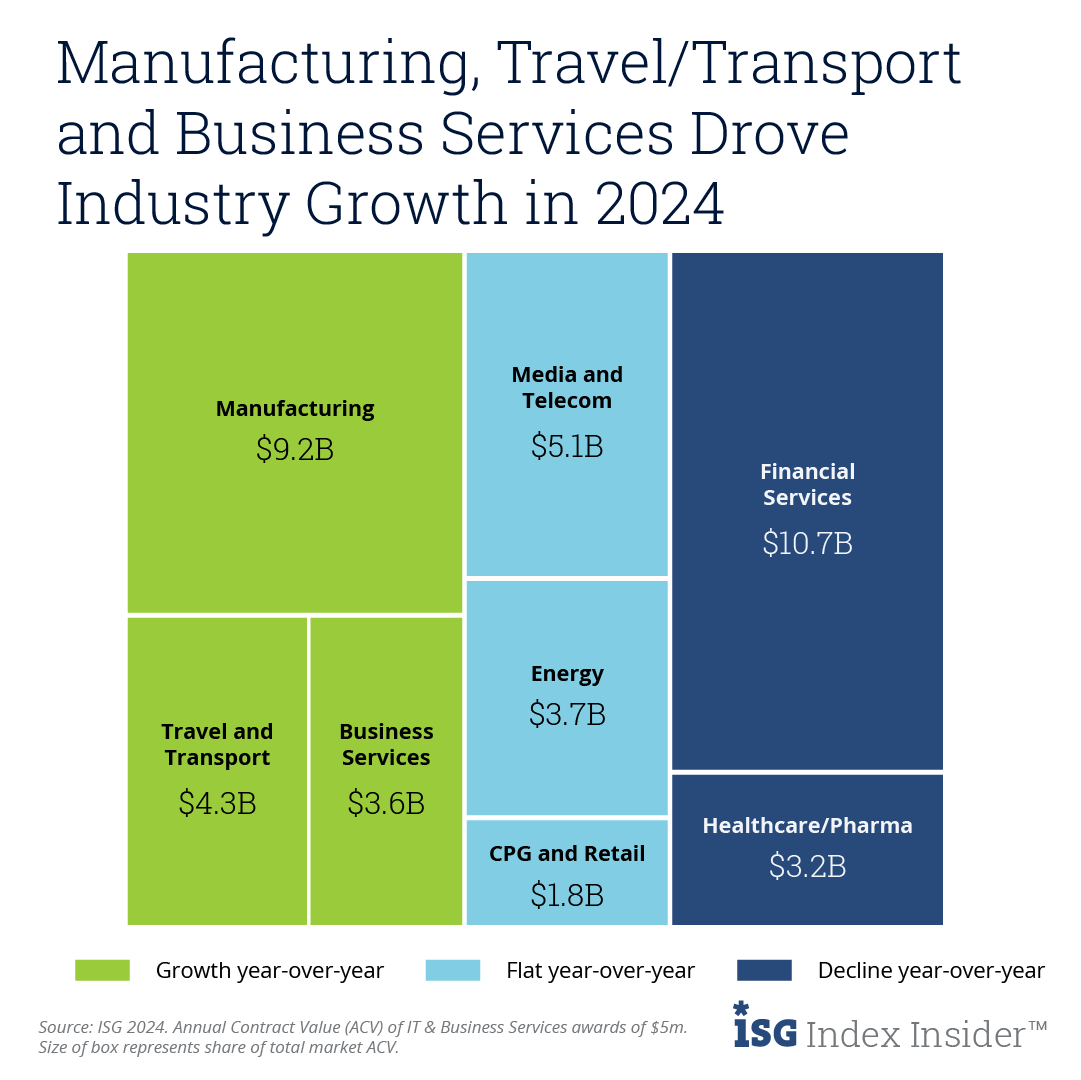

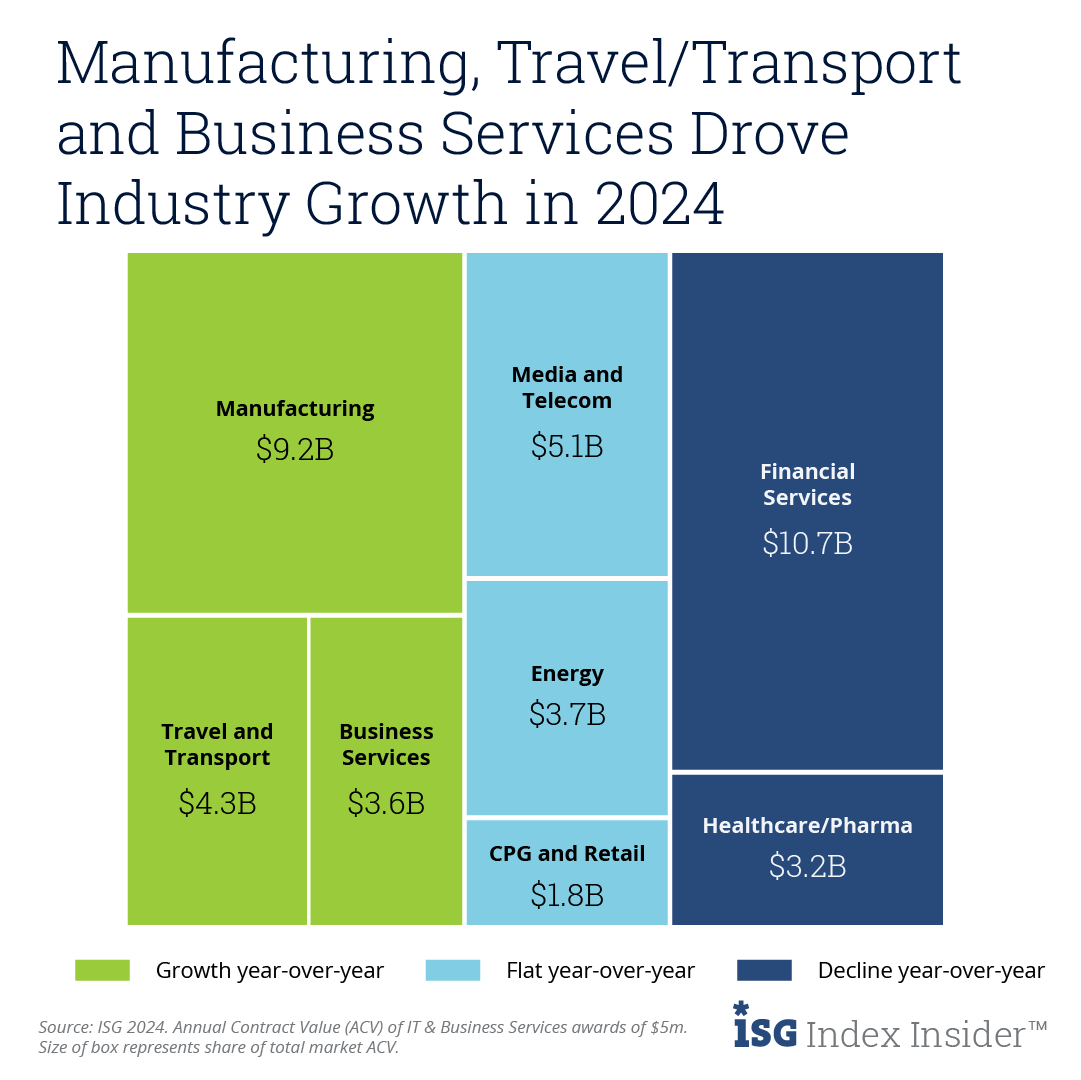

In 2024, Manufacturing, Business Services, Travel & Transport drove growth in the IT and business services industry. Can this momentum indicate what's on the horizon for demand in 2025? 📈 Full article ➡️ bit.ly/3CKOUv8 #ISGIndex #ISGIndexInsider

The Americas #ISGIndex finds Q4 ACV for the combined IT and business services market climbed 21 percent, as companies sign large managed services contracts to reaccelerate #digitaltransformations and spend more on #cloud services to further #AI ambitions. dy.si/sYRyNn2

Data from the Q4 Asia Pacific #ISGIndex says the IT and business services market was fueled by double-digit #cloud and #managedservices growth, driven in part by demand for #AI. ACV for managed services exceeded US $1 billion in three quarters last year. dy.si/RTJPP

The Americas #ISGIndex finds Q4 ACV for the combined IT and business services market climbed 21 percent, as companies sign large managed services contracts to reaccelerate #digitaltransformations and spend more on #cloud services to further #AI ambitions. dy.si/PJ1NU

The global market for IT and business services is on the rebound, thanks to a new wave of #cloud spending to support #AI adoption. This article by ISG's Steve Hall discusses the complete turnaround in cloud services demand revealed by Q4 2024 #ISGIndex. dy.si/7CpFA

Economic concerns are slowing demand for IT and business services in the Americas, as enterprises delay spending on non-critical projects, according to the Q4 #ISGIndex. Enterprises are looking to cost optimization to fund ongoing #digitaltransformation. bit.ly/3XA6Ai8

Big-four accounting firms are buying up third-party technology services firms to fill critical skill gaps and chase high-margin consulting revenue. @CIODive cites #ISGIndex data that predicts 5% growth in the #managedservices market in 2023. bit.ly/422HIRX

The EMEA #ISGIndex shows ACV for the combined market (both managed services and XaaS) at US $7.2 billion for 4Q22, down 1 percent from the prior year, the first time since the third quarter of 2019 the region did not register year-over-year growth. bit.ly/3ZIpsgp

The Americas #ISGIndex finds IT and business services demand rose 10 percent in Q2, to $12.1 billion, the region’s first quarterly double-digit increase since Q2 2022. #ManagedServices demand remains sluggish with discretionary spending under pressure. dy.si/FpQXQ

The Americas #ISGIndex finds IT and business services demand rose 10 percent in Q2, to $12.1 billion, the region’s first quarterly double-digit increase since Q2 2022. #ManagedServices demand remains sluggish with discretionary spending under pressure. dy.si/5sTbP

The Americas #ISGIndex finds IT and business services demand rose 10 percent in Q2, to $12.1 billion, the region’s first quarterly double-digit increase since Q2 2022. #ManagedServices demand remains sluggish with discretionary spending under pressure. dy.si/HqhsQ

Missed the #1Q25 #ISGIndex call? No problem - we've got you covered. Catch the replay for our take on what's ahead this quarter, plus how the tariff changes will affect your business. Watch the full call here ➡️ bit.ly/3GgfjCm ⬅️

Demand for #cloud services continued its upward trajectory in a complete turnaround from 2023, data from the #ISGIndex show. Q4 ACV for the combined global IT and business services market was a record $28.2 billion, up 20 percent versus the prior year. dy.si/qwc7VL3

The IT and business services industry made up all the ground it lost to economic uncertainty over the past 27 months in Q3, the global #ISGIndex finds. #ManagedServices reached a new quarterly high and as-a-service continues its remarkable turnaround. dy.si/s6xi9

ACV of the combined global #IT and business services market was $23Bin Q3. The 3% decline was smaller than the previous four quarters, suggesting the market may soon turn upwards. Here is the full Q323 #ISGIndex webcast: bit.ly/48U3VGg

The Americas #ISGIndex finds IT and business services demand rose 10 percent in Q2, to $12.1 billion, the region’s first quarterly double-digit increase since Q2 2022. #ManagedServices demand remains sluggish with discretionary spending under pressure. dy.si/jWCZxd

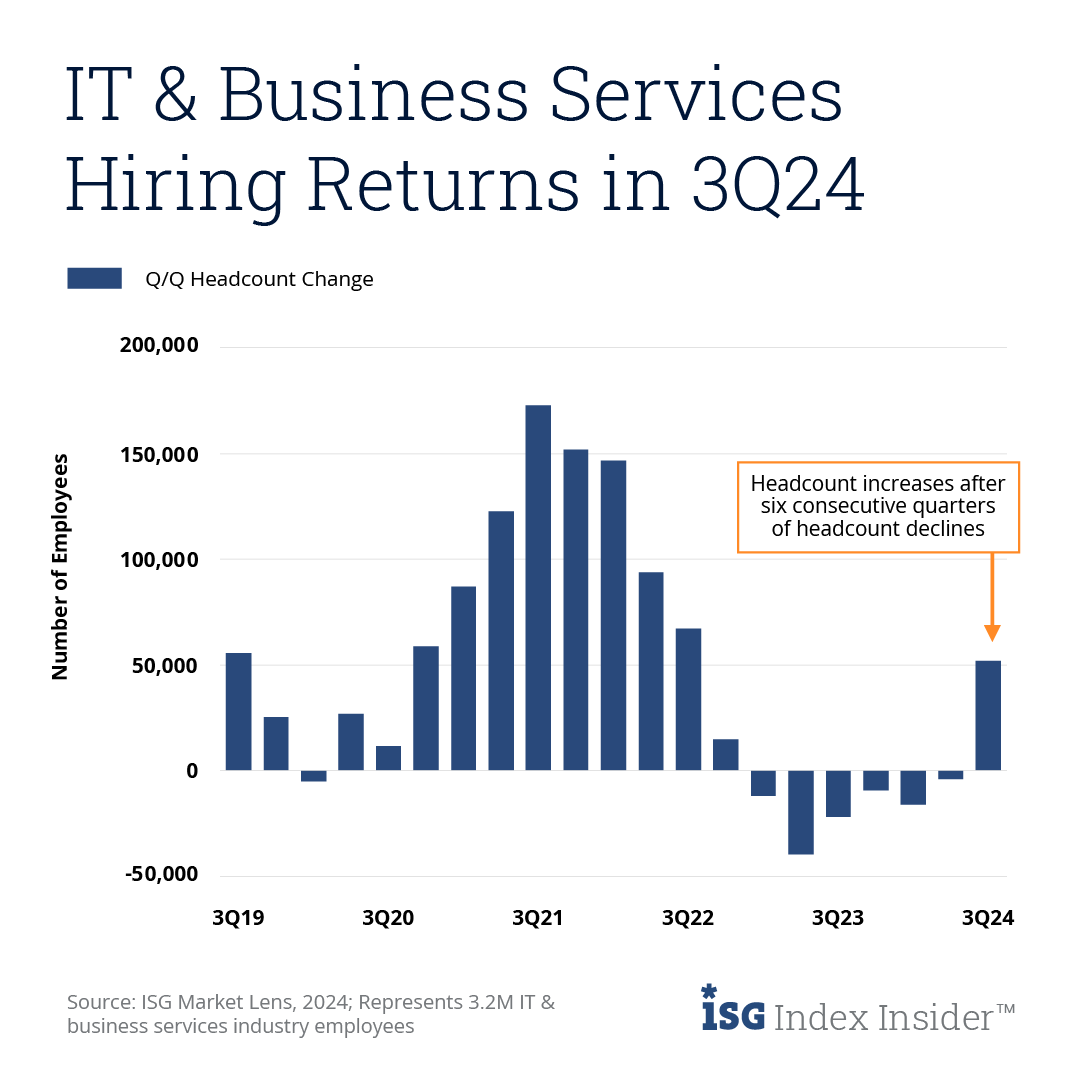

After six straight quarters of decline, employee headcount increased in the IT and business services industry in 3Q24. Is this a telltale sign of burgeoning demand? 🚀 Read the full #ISGIndexInsider article to find out more👉 bit.ly/4hI9SKW #ISGIndex

The Americas #ISGIndex shows Q1 ACV for the combined IT and business services market was $12.1 billion, down 3 percent from a year ago. The rate of decline in Q1 slowed compared with the average 5.4 percent decline over the last five quarters. dy.si/fS3uDa

#pressrelease: cutt.ly/w5BqZ22 We are pleased to announce that Birlasoft has been named a Top 15 Sourcing Standout by ISG (Information Services Group) in accordance with the 1Q 2023 Global ISG Index™. #isgindex #excellence #analystrelations #sourcing @PaulLReynolds

The Q2 2024 #ISGIndex reports IT and business services industry revenue growth slowed to just over 1 percent, compared with just over 3 percent growth in Q2 2023. Provider margin growth declined for the second quarter in a row, resulting in slower hiring. dy.si/q7gh5

In 2024, Manufacturing, Business Services, Travel & Transport drove growth in the IT and business services industry. Can this momentum indicate what's on the horizon for demand in 2025? 📈 Full article ➡️ bit.ly/3CKOUv8 #ISGIndex #ISGIndexInsider

Data from the EMEA #ISGIndex finds the European IT and business services market had a record Q3 after several quarters of slow growth. ISG says this signals the start of a period of accelerated growth, despite continued weak spending in the BFSI sector. dy.si/Fe9HSg2

The Americas #ISGIndex finds IT and business services demand rose 10 percent in Q2, to $12.1 billion, the region’s first quarterly double-digit increase since Q2 2022. #ManagedServices demand remains sluggish with discretionary spending under pressure. dy.si/dfdyUg2

Estamos emocionados de compartir que Rackspace Technology ha sido reconocida por 8° trimestre consecutivo en la tabla de líderes de ISG en la categoría "Breakthrough 15" a nivel mundial: bit.ly/40Eqg65 #ISGIndex #CloudProvider #RackspaceTechnologyLATAM #Multicloud

The Americas #ISGIndex shows Q3 ACV for the combined IT and business services market rose 7 percent, to $13.2 billion, the region’s highest quarterly mark since a record first quarter of 2022. Q3 growth, overall, was driven by XaaS spending. dy.si/7teSHg2

Something went wrong.

Something went wrong.

United States Trends

- 1. Iowa 24.5K posts

- 2. Dante Moore 2,221 posts

- 3. Penn State 24.7K posts

- 4. Indiana 40.6K posts

- 5. Mendoza 21.9K posts

- 6. Heisman 10.2K posts

- 7. Gus Johnson 7,587 posts

- 8. #UFCVegas111 7,233 posts

- 9. Mizzou 4,616 posts

- 10. Sayin 70.7K posts

- 11. Atticus Sappington N/A

- 12. Sounders N/A

- 13. #iufb 4,594 posts

- 14. Cam Coleman N/A

- 15. #kufball N/A

- 16. Fran Brown N/A

- 17. #GoDucks 2,021 posts

- 18. Preston Howard N/A

- 19. UConn 3,920 posts

- 20. Barcelos 1,058 posts