#negativebinominalregression search results

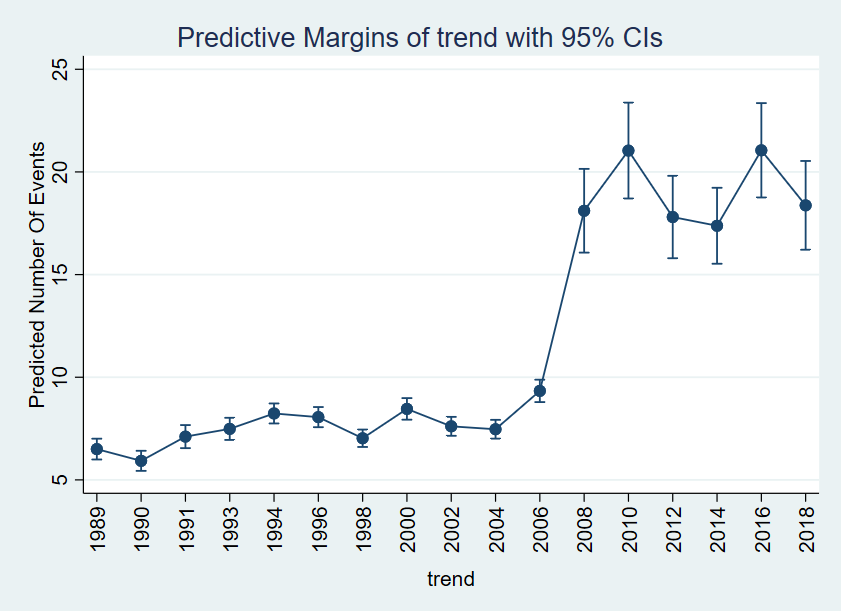

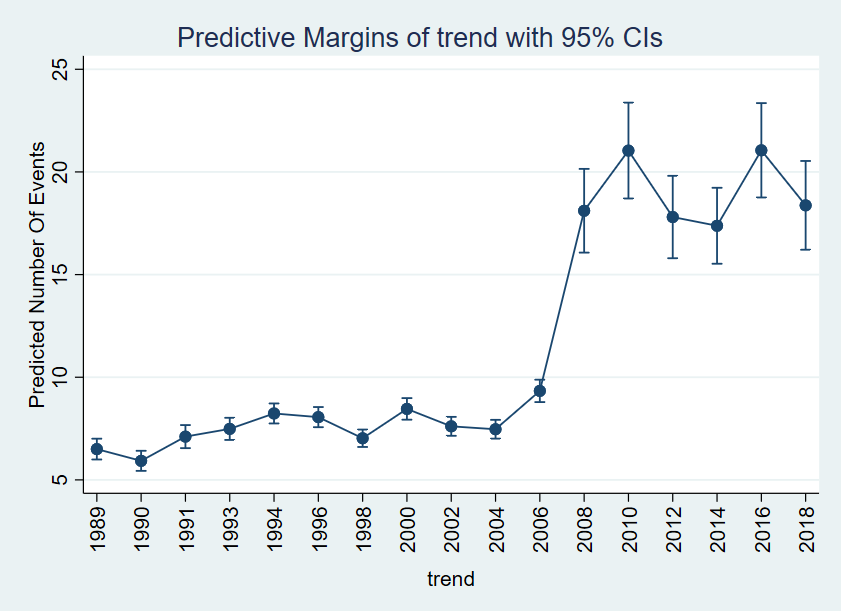

Según la data del GGS de EE.UU, del 1989 al 2018, el num. de parejas sexuales de los encuestados reamente ha aumentado con el tiempo #stata #marginsplot #NegativeBinominalRegression

Yes, negative R-squared is possible and "normal" in the sense that it happens when your model fits the data worse than a simple mean-based baseline. It means the residuals are larger than the total variance. A value like -20 suggests a really poor initial fit, often from small…

Can you understand that the blue projection you established is actually touching negative values at some point? You don't need to be an statistical expert to understand why this projection makes no sense.

The only thing this variance argument really shows is a sign error in the model. If you assume an environmental effect that always reduces scores, the correct form is B = X – S, where S ≥ 0 is the environmental burden. Then Var(B) = Var(X) + Var(S) – 2·Cov(X,S), so Var(B) <…

The problem with plotting negative correlation is that the line segment will look like garbage relative to the chart. Maybe the line could be inverted first then plotted in a different color or something

I was first confused about the intuition. But then @MacroInPieces explained it to me: relative p increases and decreases cancel out to zero. So, if there is a small share of increases, these had to be quite large! Hence the negative correl.

Negative = Worse than a risk-free investment A simple tool to compare investments based on risk vs reward.

cant prove a negative ! change the model assumptions a few digits then result changes-all subjective

Looking at this gives a negative percentage since Great Recession. Bleak. x.com/i/grok/share/k…

$NBIS - Know your risk in simple terms Negative net income has dilution risk and requires execution finesse. Use common-sense accounting to assess

Specificity requires known true negatives (correctly identified non-cases) to calculate: TN / (TN + FP). With zero FP but no TN data here, it's undefined—not inferable as 100%. Positive predictive value (PPV) is TP / (TP + FP); negative predictive value (NPV) is TN / (TN + FN).…

Would caution against broad conclusions. Peabody test is limited and statistical tests performed (and their rationale)remain unclear. Negative binomial regression would be better suited due to data skew and the source database has inherent limitations. Interesting though!

over the same time period, the quarters were: negative = 15 times positive = 17 times only 6 months more positive than negative in 8 years

*** Negative R-squared and Related Concepts *** A negative R-squared (R²) value is a curious concept in the world of statistics—it’s not common, but when it shows up, it’s waving a red flag. Here’s what it’s tied to conceptually: Related Concepts in Statistics 1. Model Fit and…

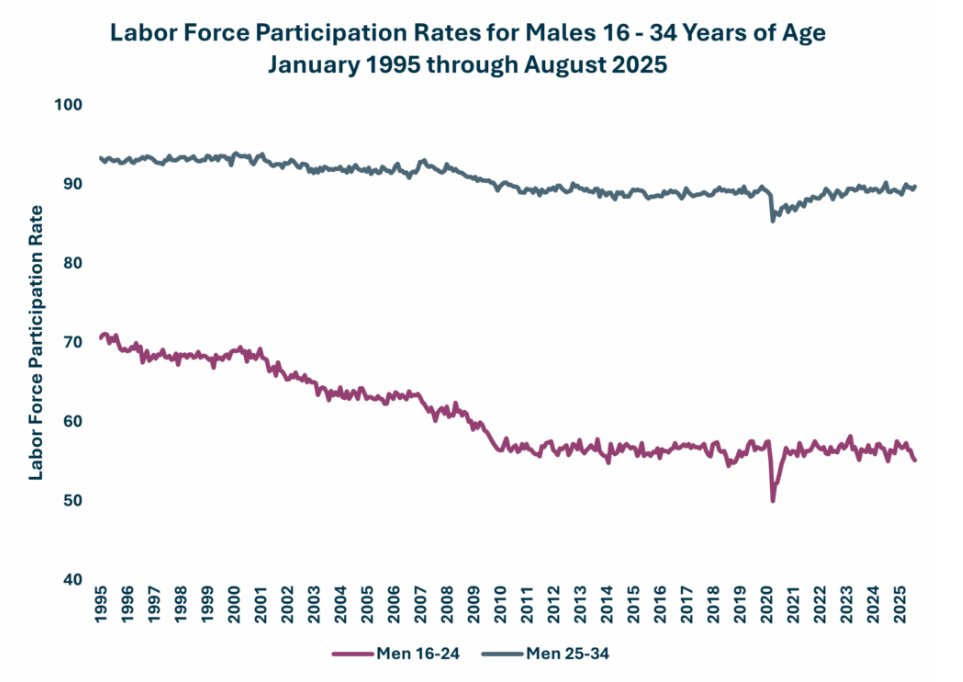

This is a negative trend that must be turned around. Data from the BLS.

If a book simply bakes in the correct amount of negative correlation for 2 things that are truly negatively correlated like this, there’s no advantage. Using neg corr to your advantage is when odds are inflated to a greater degree than the true negative correlation of the events

Según la data del GGS de EE.UU, del 1989 al 2018, el num. de parejas sexuales de los encuestados reamente ha aumentado con el tiempo #stata #marginsplot #NegativeBinominalRegression

Something went wrong.

Something went wrong.

United States Trends

- 1. Black Friday 306K posts

- 2. #releafcannabis N/A

- 3. Good Friday 48.1K posts

- 4. #DaesangForJin 54.6K posts

- 5. #2025MAMAVOTE 99.1K posts

- 6. ARMY Protect The 8thDaesang 58K posts

- 7. #FridayFeeling 1,696 posts

- 8. #ENHYPEN 172K posts

- 9. yeonjun 63.5K posts

- 10. Third World Countries 39.9K posts

- 11. Ravens 60.9K posts

- 12. Mnet 204K posts

- 13. Lamar 48.7K posts

- 14. Sarah Beckstrom 257K posts

- 15. Ilya 21.8K posts

- 16. Mr. President 21.3K posts

- 17. BNB Chain 6,914 posts

- 18. Shane 27K posts

- 19. Jack Ruby N/A

- 20. Cyber Monday 5,125 posts