#pittiengineering kết quả tìm kiếm

*Today's bulk /block deals* #GujaratFluorochem #Voltamp #PittiEngineering #ShringarHouse #MOSUtility #DevAccelerator #ChandanHealthcare #EkanshConcepts #ArunisAbode #KarbonsteelEngineering #SilverlineTech #NimbusProjects #SawaliyaFood #SampreNutrition #NilachalCarbo

Investors Presentation Q1FY24 Pitti Engineering 📢Follow for More Investors Presentation #InvestorPresentation #Pittiengineering #Q1FY24

Pitti Engineering : 1006 On 17.09.2025 SBI Mutual Fund ACQUIRED 2.8508% stake (10,73,424 shares) from the open market. SBI MF stake increased ⬆️to 6.0106% from 3.1598% earlier. Keep on Radar. #pittiengineering

#pittiengineering Why Pitti Engineering fell more than 10% today now recovering slowly. No news found bought today for short term

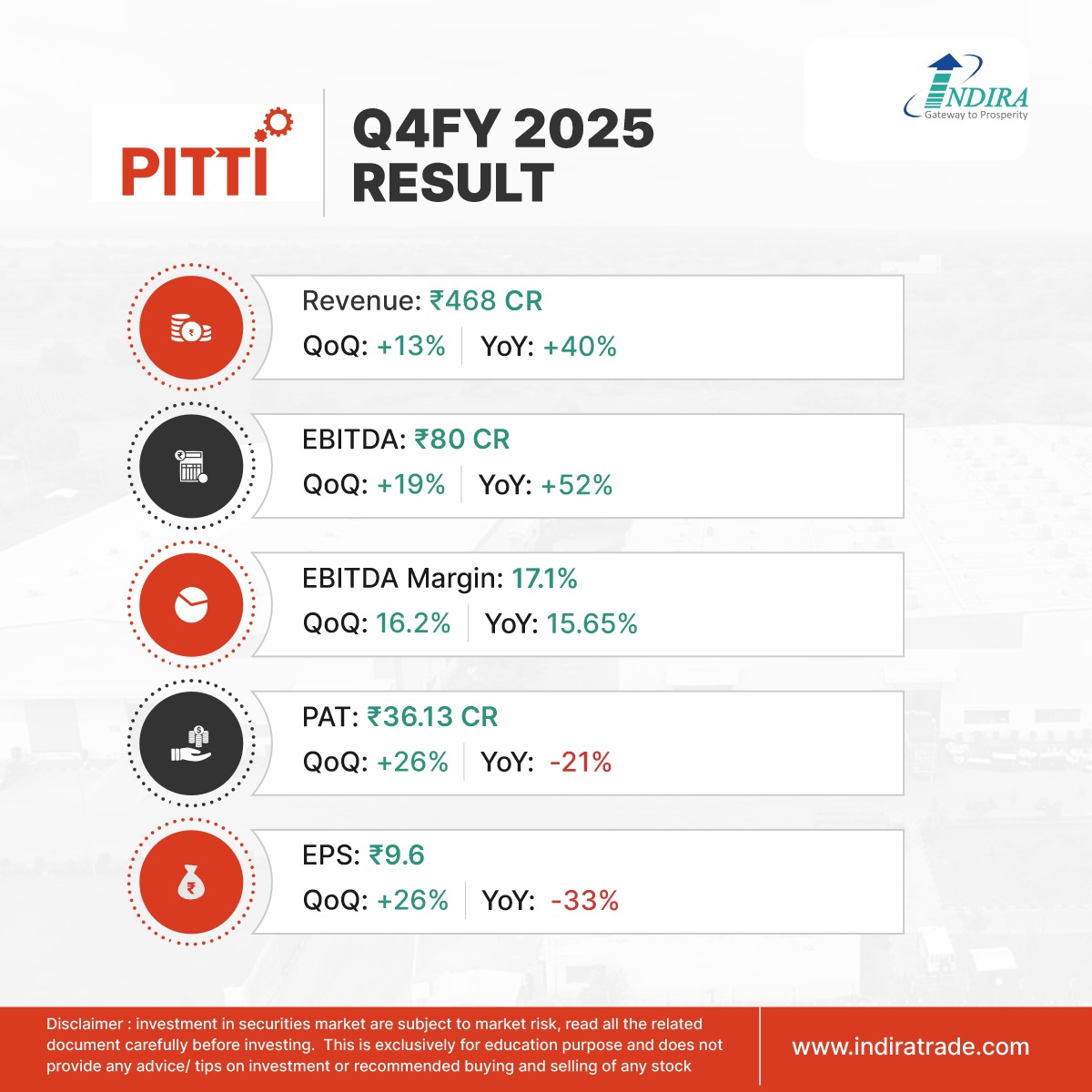

⚙️ Pitti Engineering Q4FY25 Performance Snapshot! 📈 Revenue rises 40% YoY 💼 EBITDA up 52% YoY 📉 PAT and EPS see some pressure YoY 📊 EPS at ₹9.6 Mixed bag for Pitti this quarter, with top-line growth but margin pressure on bottom-line. #PittiEngineering #Q4Results…

Key Summary from Pitti Engineering Ltd. Q1FY24 Concall Follow 📢, Retweet ♻️ and Share 🔗 for More Concall Summary #pittiEngineering #pitti #Concall #Q1FY24 #TrendingNow #StocksInFocus #StockMarket #stockmarketnews #stockstowatch

Stock: Pitti Engineering Pitti Engineering raising of Rs 359.99 crore through QIP #PittiEngineering #PriceAction #stocks #stockstowatch #trading #StockMarketNews #Marketbuzz #Result #Q4results #hiddengem #multibagger

Mcap - 2300 Cr Management expects to make cos debt-free by FY26 Expected 1,700 Cr of revenue in FY25 Consolidated basis and 17% EBITDA Margin, around 290-295 Cr #stockmarkets #StocksInFocus #PittiEngineering

#PittiEngineering Insidebar Breakout - @nakulvibhor @drprashantmish6 @caniravkaria #BelieveInTechnoFunda #StocksToWatch #StocksToBuy #Investing #Investments

*Today's bulk / block deals* #DBRealty #AwficSpace #PittiEngineering #UPL #Pakka #Sarveshwarfoods #C2CAdvancedSystems #NectarLife #EmamiRealty #NisusFinance #IndoNational #VaishaliPharma #AceSoftware #HiltonMetal #RajputanaBiodiesel #PadamCotton #TitanIntech #GGEngineering

🚨Pitti Engineering: 👉Q1 Results 🟢Revenue & Profit -Up⬆️ (YoY) #PittiEngineering #Q1Results #Q1FY26Results #StocksInFocus #stockmarketsindia #stockstowatch #StockMarketUpdate

Pitti Engineering quarterly results ending 31-Dec-2024 - Revenue at 421Cr vs 296.92Cr PBT at 38.66Cr vs 19.27Cr PAT at 28.76Cr vs 13.32Cr EBITDA at 66.95Cr vs 44.09Cr EBITDA Margin at 16.13% vs 15.01% EPS at 7.64 vs 4.16 #PITTIENG #PittiEngineering

Pitti Engineering : Good Set Of Results : 👍 Standalone & Consolidated : (₹ in Lacs)-Mar’25 Overall 👍 YOY Mar25 vs Mar24👍 EPS YOY 👍 QOQ Mar25 vs Dec24👎 EPS QOQ 👎 Q4 Mar25 vs Mar24👍 EPS Q4👍 Sales ⬆️ #finresults #pittiengineering #pittiengg #pittiimmagine

Pitti Engineering reported strong sequential and annual growth in operating and operating profit. However, net profit declined sharply sequentially due to non-operating items (higher other income last quarter), though it remained higher year-on-year. #PittiEngineering #PittiEng

#Pittiengineering Sharp Movement Price move 400>>>>550 Approx return -40%

#PittiEngineering #Chart Check #trending #chartpatterns on my.soctr.in/x & "follow" @MySoctr #nifty #nifty50 #investing #breakoutstocks #StocksInFocus #StocksToWatch #stocks #StocksToBuy #StocksToTrade #breakoutstock #stockmarketindia #StockMarket #trading…

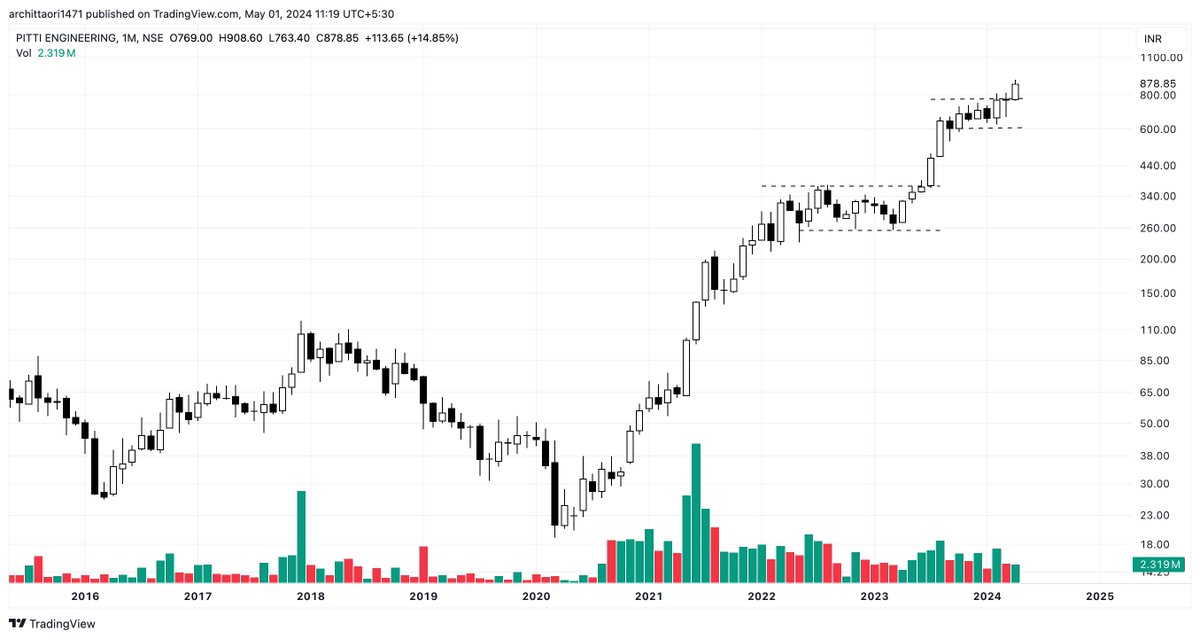

#PittiEngineering - Monthly Charts are a great way to cut the noise & ride the trend We usually follow the monthly charts & their levels

@iamabhinendra sir, you insights regarding stocks are really good....i want to know #pittiengineering is very good company but currently structure is not good...can you share your views... Thanks

Pitti Engineering Ltd Concall for Q2FY26 #Pittiengineering #Pittienginee... youtu.be/F-K9A1MTC-4?si… via @YouTube #pittiengineering #StockMarket #StockMarketIndia #NiftyMidcap100 #NIFTYSMALLCAP100 #Nifty #Q2Results #Q2FY26

youtube.com

YouTube

Pitti Engineering Ltd Concall for Q2FY26 #Pittiengineering #Pittien...

#PittiEngineering Q2 CONS NET PROFIT: ₹401M vs ₹380M YoY ✅ Q2 REVENUE: ₹4.77B vs ₹4.3B YoY ✅ Q2 EBITDA: ₹777M vs ₹661M YoY ✅ Q2 EBITDA MARGIN: 16.26% vs 15.39% YoY #Q2Results #StockMarket #Investing #Finance #Business #Earnings #MarketUpdate #CorporateResults

🚀 Stock Alert:Senores Pharmaceutic Entry: 820-825 Stop Loss: 800 Targets: 850 #Trading #PittiEngineering #SwingTrade #StocksToWatch #TechnicalAnalysis #NSE #BSE Views are personal & for education only. Not investment Recommendation

🚀 Stock Alert: Pitti Engineering 🎯 Entry: ₹960 🛑 Stop Loss: ₹940 🎯 Target: ₹990 #StockMarket #Trading #PittiEngineering #SwingTrade #StocksToWatch #TechnicalAnalysis #NSE #BSE Views are personal & for education only. Not investment Recommendation

Pitti Engineering : 1006 On 17.09.2025 SBI Mutual Fund ACQUIRED 2.8508% stake (10,73,424 shares) from the open market. SBI MF stake increased ⬆️to 6.0106% from 3.1598% earlier. Keep on Radar. #pittiengineering

📉 Bulk Deal Alert Motilal Oswal Mutual Fund offloads 1 crore shares of Pitti Engineering worth ₹102 crore via a bulk deal. #PittiEngineering #MotilalOswal #BulkDeal #StockMarket

Why #GujaratFluorochem, #PittiEngineering, #Dreamfolks, #LodhaDevelopers, #CochinShipyard, #ONGC, #CohanceLifesciences, #AdaniEnterprises, #TVSMotor, #ThomasCook, #Hyundai and #Biocon will be in focus on Thursday. trib.al/ocMDBf0

*Today's bulk /block deals* #GujaratFluorochem #Voltamp #PittiEngineering #ShringarHouse #MOSUtility #DevAccelerator #ChandanHealthcare #EkanshConcepts #ArunisAbode #KarbonsteelEngineering #SilverlineTech #NimbusProjects #SawaliyaFood #SampreNutrition #NilachalCarbo

76.🚨 Corporate Action Alert! 📌 Pitti Engineering Ltd (513519 - PITTIENG) 💸 Final Dividend: ₹1.50 per share 📅 Ex-Date: 19 Sep 2025 🗓️ Record Date: 19 Sep 2025 ⛔ No-Delivery Period: 16 – 19 Sep 2025 #DividendUpdate #PittiEngineering #CorporateActions #StockAlert 💹📢

🚨 Pitti Engineering Tax Update 🔹 Won favorable order from CIT (Appeals), Hyderabad 🔹 Disputed tax demand of ₹9.23 Cr (FY18) quashed 🔹 Removes legacy overhang & provides clarity 🔹 Positive for financials & sentiment #PittiEngineering #TaxRelief #FlashStox

Pitti Engineering CIT(A) Hyderabad deleted ₹923.08 lakh income-tax addition for AY2017-18; order dated 19 Aug 2025. #PittiEngineering #Investor #niftycrash #OptionsTreding #Investing #BREAKING #Nifty #StockMarketUpdate

#3 #PittiEngineering · Manufactures electrical laminations, stator frames, rotor assemblies · Key supplier to transformer and rotating machinery makers · Manufacturing units in Telangana; strong export business (US & Europe) · PE: 27.7 | FY25 revenue: +34.8% YoY | Net profit: Rs…

Deven Choksey sees 20% UPSIDE in #PittiEngineering - Strong long-term outlook on the backdrop of capacity expansion and robust volume growth

Pitti Engineering Q1 FY26 revenue rises 17% to Rs 457cr as Rs 150cr capacity expansion gains momentum business-news-today.com/pitti-engineer… #PittiEngineering #Manufacturing #Earnings #CapacityExpansion #IndustrialGrowth #IndiaSteel #BusinessNews #StockMarket #Investing #MarketUpdates #Finance…

Pitti Engineering Q1 FY26: Revenue Rs.457Cr (+17%), Rs.150Cr capex approved for capacity expansion over 18 months. #PittiEngineering #Investor #niftycrash #OptionsTreding #Investing #BREAKING #Nifty #StockMarketUpdate

🚨Pitti Engineering: 👉Q1 Results 🟢Revenue & Profit -Up⬆️ (YoY) #PittiEngineering #Q1Results #Q1FY26Results #StocksInFocus #stockmarketsindia #stockstowatch #StockMarketUpdate

#PittiEngineering Q1 Results 📊 ✅ Net Profit rises to ₹229 Cr vs ₹194 Cr (YoY) ✅ Revenue grows to ₹457 Cr vs ₹391 Cr (YoY) ✅ EBITDA jumps to ₹75.3 Cr vs ₹58 Cr (YoY) ✅ EBITDA Margin improves to 16.50% vs 14.82% (YoY) #Earnings #Q1Results #StockMarket #Investing…

Pitti Engineering investing ₹150 Cr for expansion! 🚀 Boosting capacity in sheet metal, machining & foundry for future growth. Stock at 880.1 ▼ -4.3%. Click here for details: marketsetup.in/news/07082025/… #PittiEngineering #Growth #India #Stocks

PITTI ENGINEERING: Q1FY26 Results 🚀 👉 Net Profit: ₹229M 🟢 vs ₹194M (YoY) 👉 Revenue: ₹4.57B 🟢 vs ₹3.91B (YoY) 👉 EBITDA: ₹753M 🟢 vs ₹580M (YoY) 👉 EBITDA Margin: 16.50% 🟢 vs 14.82% (YoY) 📌 Strong operating performance across all fronts. #PittiEngineering…

Investors Presentation Q1FY24 Pitti Engineering 📢Follow for More Investors Presentation #InvestorPresentation #Pittiengineering #Q1FY24

#PittiEngineering CMP : 229 ➡️Support is at 194 WCB ➡️ Company is going for expansion ➡️ Capital good sector is raising ➡️ Make in India 🎯My view : 276,340,440

Try to identify the company 🤔 🌟Capital good sector,I am liking this sector now,last week we picked #Elecon from same sector 🌟Company PE is around 15,where as industry PE is 67 🌟 Breakout & Retest are done on weekly chart 📉 🌟 I am expecting 50-100% potential upside from CMP

*Today's bulk /block deals* #GujaratFluorochem #Voltamp #PittiEngineering #ShringarHouse #MOSUtility #DevAccelerator #ChandanHealthcare #EkanshConcepts #ArunisAbode #KarbonsteelEngineering #SilverlineTech #NimbusProjects #SawaliyaFood #SampreNutrition #NilachalCarbo

#PITTIENG #PittiEngineering Setting up for another breakout Breakout Above 345 Resistance 375/400 Support 310 #nifty #stockstowatch #stocksinfocus #trading #investing #swingtrading #trending #KJCapital #stockmarketindia #stocks #equity #automotive #ancillary

#PittiEngineering I am loving it now.

#PittiEngineering is India's largest manufacturer of electrical steel laminates. Big Capex ongoing.

#PittiEngineering HNS Continuation Pattern Followed by Rectangle Pattern Good Volumes Breakout Above 345

#PittiEngineering IT CAN FLY TOMORROW 🚀🚀🚀 FOR #SwingTrading PURPOSE!!! #trading #Nifty #Nifty50 #niftyOptionS #niftyfinservice #banknifty #sensex #jackpot

Something went wrong.

Something went wrong.

United States Trends

- 1. #StrangerThings5 250K posts

- 2. Thanksgiving 676K posts

- 3. BYERS 57.1K posts

- 4. robin 92.6K posts

- 5. Reed Sheppard 5,936 posts

- 6. Afghan 288K posts

- 7. holly 64.6K posts

- 8. Podz 4,520 posts

- 9. Dustin 89.9K posts

- 10. Vecna 59K posts

- 11. National Guard 663K posts

- 12. Jonathan 75.3K posts

- 13. hopper 16K posts

- 14. Erica 17.6K posts

- 15. Lucas 83.4K posts

- 16. Nancy 68.6K posts

- 17. Gonzaga 8,519 posts

- 18. Joyce 32.2K posts

- 19. noah schnapp 8,991 posts

- 20. Tini 9,616 posts