#privateequity 검색 결과

Operations are central to our DNA. Watch Adrian Letts share how our operational expertise complements investments within our #privateequity business in the video below.

🤔 Why do 70% of fund launches stall? Compliance traps in Reg D filings. Poplar Equity Group simplifies the process, freeing you to focus on growth. What's your biggest filing hurdle? 💼⚖️ #FundFormation #RegD #PrivateEquity

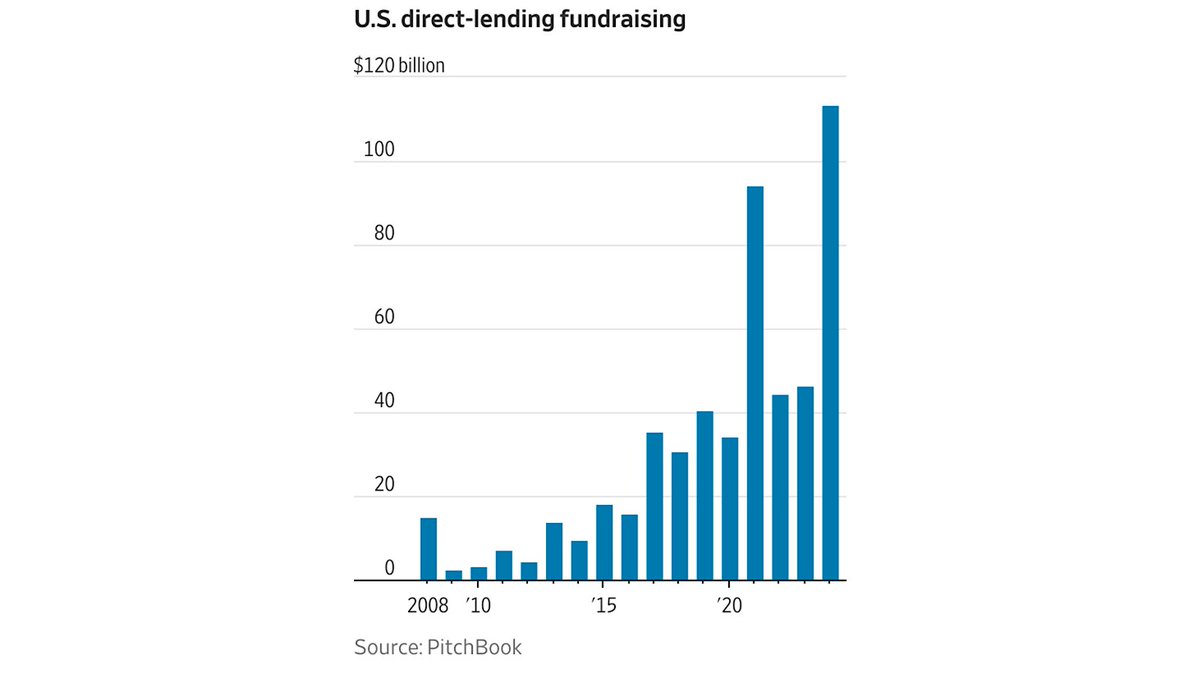

For LPs eyeing private credit: The M&A “recovery” isn’t here yet. Deal volumes are down 24% YoY. via @lcdnews @PitchBook #privateequity #deals #manda #investor

𝐌&𝐀 𝐂𝐫𝐞𝐝𝐢𝐭 𝐁𝐥𝐢𝐭𝐳? M&A deal pipeline jumps to $472 bn in August—the highest since Apr ’19. Up from $288 bn in June; UNP alone drove 48% of the $184 bn gain. Next 8 mths IG-funded supply at $132 bn vs. $121 bn prior. Big credit wave incoming! #Deal #fixedincome…

What a day at 𝐇𝐏𝐄 𝐄𝐮𝐫𝐨𝐩𝐞 𝟐𝟎𝟐𝟓! Thank you to all attendees, speakers and our excellent McDermott team for making this event such a success! See you at HPE NYC next month! #HPEEurope2025 #Healthcare #PrivateEquity #Investment

📉 PE exits keep sliding since the Fed’s 2022 hikes—exit/investment ratio now flirting with 0.3x. 📊 Median buyout EV/EBITDA still ~12x. Translation: buyers still paying up, sellers stuck in the waiting room. #PrivateEquity #Valuations #Exit #fees #LP #Fund #investor @ilpaorg…

Stuck Private-Equity Deals Saddle Investors With Endless Fees An exit drought has left some $668 billion sitting in funds a decade or more old, racking up costs - WSJ wsj.com/articles/stuck… #exit #privateequity #credit #privatedebt #LP #Fund #investor #merger m&a #deals

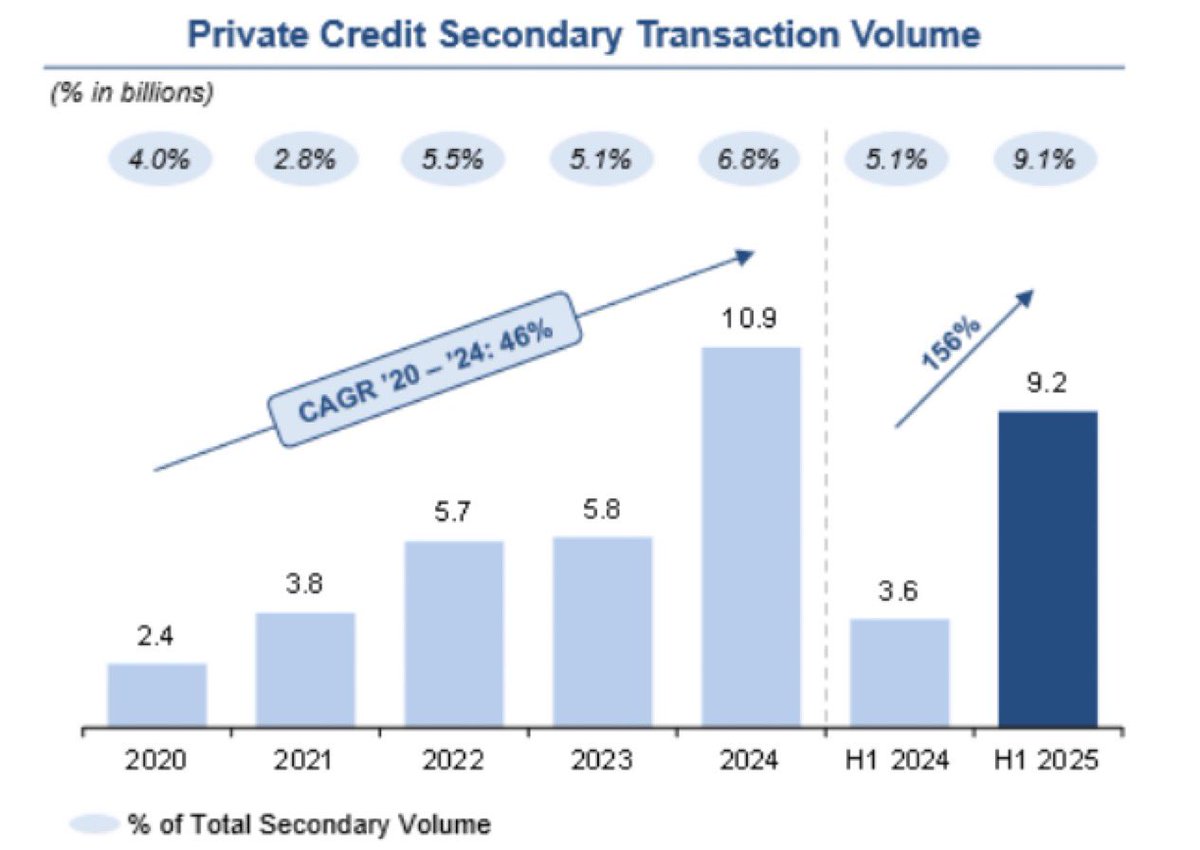

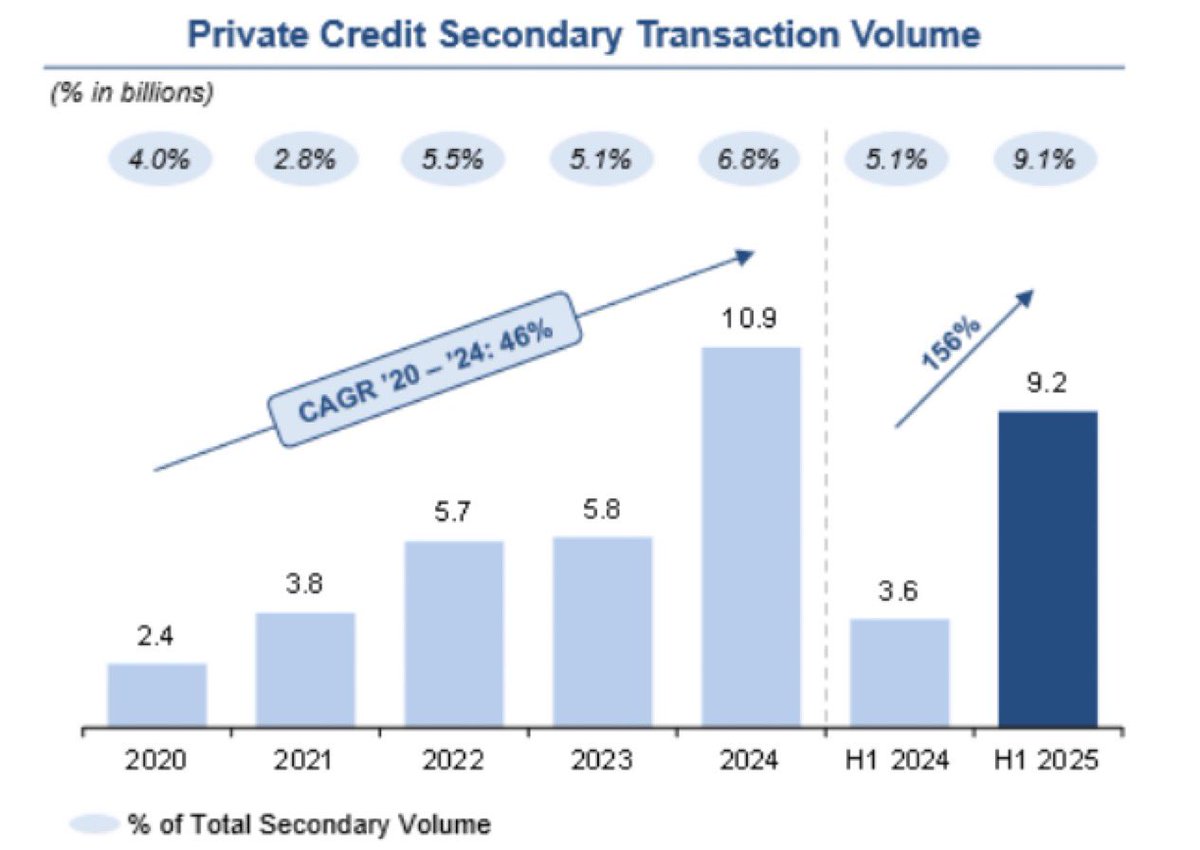

📈 Private credit liquidity isn’t creeping up — it’s exploding. +46% CAGR since 2020. +156% YoY in H1. From niche to necessity, the secondary market is where the action is. Ignore it at your own risk. 💥 #PrivateCredit #privateequity #lp #fund #investor ht @junkbondinvest

𝐅𝐫𝐨𝐦 𝐒𝐭𝐮𝐜𝐤 𝐭𝐨 𝐅𝐮𝐧𝐝𝐞𝐝: ~45% of buyout holdings are breaching leverage caps. Hybrid capital & secondaries are stepping in to unlock liquidity, extend holds & keep dividends flowing. Flexibility is the new alpha. bloomberg.com/news/articles/… #PrivateEquity #Credit #lp…

💰 Dry powder remains the elephant in the room. ~$700bn+ of buyout capital is sitting on the sidelines. That’s nearly 3x the 2015 level. Deployment pressure is real. #exit #PrivateEquity #lbo #lp #fund #PE #investor #credit

📉 PE exits keep sliding since the Fed’s 2022 hikes—exit/investment ratio now flirting with 0.3x. 📊 Median buyout EV/EBITDA still ~12x. Translation: buyers still paying up, sellers stuck in the waiting room. #PrivateEquity #Valuations #Exit #fees #LP #Fund #investor @ilpaorg…

"My mother had Alzheimer’s. I watched her slip away in the fragile care system" statnews.com/2025/10/10/alz… via @statnews #Alzheimers #dementia #PrivateEquity #LongTermCare

What are the other ways your financial advisor is failing you? 5 Things your Financial Advisor Won't Tell You - tickertapeinvestments.com/5-things-your-… #privateequity #preipo #bitcoin #crypto

Even animal care under attack from #PrivateEquity, Conglomerates, #F1visa #CPT/#OPT, #H1B @StephenM @howardlutnick @SecretaryLCD @Sec_Noem @realDonaldTrump? (thread) getpocket.com/explore/item/w…

NEW: After #PrivateEquity acquisition, hospitals saw an increase in emergency department mortality and patient transfers to other hospitals. The researchers say this was likely caused by reduced staffing and salary expenditures. bit.ly/3KafMZ7

“We are honored to have collaborated with Arlington Capital Partners on this significant growth investment in CBSET,” said #PrivateEquity Vice Chair and Partner Eric Grossman, who co-led DLA Piper’s deal team. Read our press release: spr.ly/6011AoONf

“We were excited to work with Artistic Milliners on this strategic matter, showcasing the breadth of our cross-border experience,” said deal lead Michael J. McGuinness. Read our press release: spr.ly/6017AqGIW #MergersAndAcquisitions #CorporateLaw #PrivateEquity

A&M Tax is pleased to welcome Dhara Mehta as a Senior Director with the #IndirectTax practice in #India. With 13+ years of experience, she specialises in consulting across insurance, banking, #privateequity, and leasing sectors. Learn more: okt.to/6cO3pd #AMon #AsiaTax

📊 EY-Parthenon 2025 Özel Sermaye Fonları Raporu yayımlandı! İşletme sermayesi ve likidite stratejileri; özel sermaye (PE) yatırım döngüsünün her aşamasında kritik rol oynuyor. Detaylar için: ow.ly/S9gE50X0coY #EYParthenon #PrivateEquity #ShapeTheFutureWithConfidence

“The one challenge if you remove #PrivateEquity from #Healthcare is, who’s paying for all of this?” — @danturrentine on #TheGroupChat 👥💬

🚨 Harvard study: ER deaths ↑ after private equity takeovers. AAEM has long warned corporatization risks patient care + physician independence—now the data proves it.🔗 Read more: bit.ly/46laxOH #EmergencyMedicine #HealthcarePolicy #PrivateEquity #PhysicianAdvocacy

Waat lève 100 millions d’euros auprès de Bpifrance et d’un fonds de DWS. Avec cette opération, l’opérateur français de bornes de recharge pour véhicules électriques entend accélérer son développement en Europe. #PrivateEquity agefi.fr/private-equity…

Good Morning, #college students and professors, Did you know that the online course management platform Canvas is owned by a #PrivateEquity firm? Sure makes you wonder what they care about more, your education or their profits. I'm tired of the financial sector ruining the…

The similarities to 2008 keep piling up! #PrivateEquity #PrivateCredit 📉 ☠️ x.com/kshaughnessy2/…

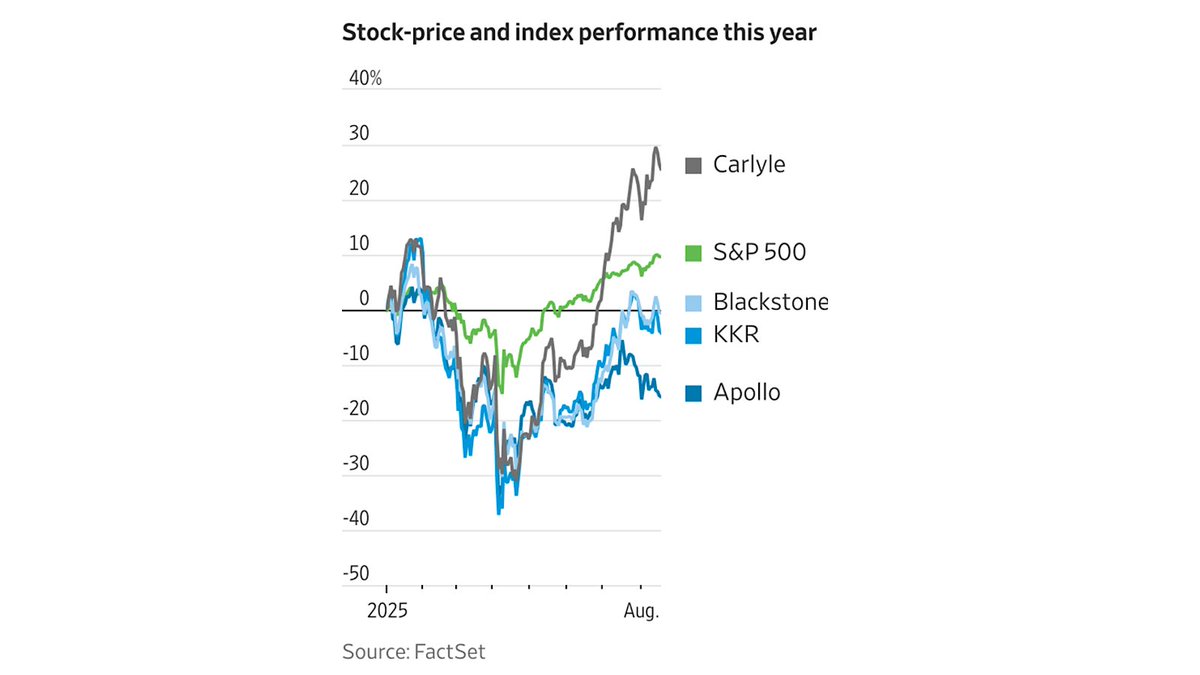

The First Cracks Appeared Years Ago (the media just ignored them until they couldn't ) ".. the first cracks are also starting to appear. Investors have started selling off shares in some of the world’s largest money managers on fears that their vast holdings of “private…

New investment Deal Only 3 months to take your shares Roi : +70% Read this instagram.com/reel/DPsmCBpDJ… #venturecapital #businessangel #privateequity

instagram.com

Josué HOMESPUN (@iamhomespun) • Instagram reel

Josué HOMESPUN (@iamhomespun) • Instagram reel

Private capital can shape the future by backing bold ideas before the world recognizes them.” – Josh Lerner, Harvard 💼 At VaultStreet Advisors, we fuel bold visions with smart investments. 🌍 Learn more: vaultstreet.in 📞 +91 91379 69859 #PrivateEquity #VentureCapital

‘Private equity overcomes California hurdle to expansion in US legal market’ - a look at what California's recent decision to allow Private Equity ownership might mean to law firms #lawfirmstrategy #privateequity #nonlawyers #lawfirmownership rws01.com/2025/10/12/pri…

🚨 Did Tastytrade lose its flavor? 🍽️ Once driven by passionate founders, now it's interns running the show! Discover the shift from thriving traders to a Private Equity powerhouse. #Tastytrade #PrivateEquity #FinanceInsights

There's a record amount of liquid capital sitting on the sidelines in the U.S. . thesirlancelotgroup.com #privateequity #wealthmanagement #investing #liquidity #cash #realestateinvesting #privatelending

Infrastructure, Impact, and Investor Opportunity theglobalstructurenetwork.com/f/infrastructu… #lifescience #privateequity #venturecapital #assetmanagement #selfcare #consumerhealth #health #lifestyle #luxury #consumers #FinanceProsperity #MedicineSafety #NutritionSecurity #MedSafetyWeek

🚀 Struggling with private equity value creation? Discover actionable steps for success and unlock your business potential! Share your tips below. #PrivateEquity #BusinessValue #SuccessTips 💡 Link in the reply.

Liquidity events are complex. We help you navigate tax, estate & investment decisions to preserve wealth. #LiquidityPlanning #PrivateEquity #UHNW 👉 raymondjames.com/lamingtonpriva…

#troutmanpepperlocke advised Genesis Park, a Houston-based private investment firm, in its investment in Perfect Feast. #privateequity #investment Learn more: troutman.com/insights/genes…

#PrivateEquity A new trend is emerging in India's venture capital scene as several senior general partners (GPs) are leaving major firms to start their own funds. This shift is driven by a desire for more autonomy and the challenges of delivering high returns from increasingly…

#Privateequity companies have quickly expanded into ownership of #PACE organizations in recent years, and with that growth comes the potential for harm, according to the Private Equity Stakeholder Project, which released its PACE Investment Tracker. tinyurl.com/39zhsmd3

What are the other ways your financial advisor is failing you? 5 Things your Financial Advisor Won't Tell You - tickertapeinvestments.com/5-things-your-… #privateequity #preipo #bitcoin #crypto

🤔 Why do 70% of fund launches stall? Compliance traps in Reg D filings. Poplar Equity Group simplifies the process, freeing you to focus on growth. What's your biggest filing hurdle? 💼⚖️ #FundFormation #RegD #PrivateEquity

PE-owned GI practices raise prices and spending, but quality stays the same. More colonoscopies performed, access increases. gastroendonews.com/a/GTEBAA/t #Gastroenterology #PrivateEquity #HealthcareCosts

📈 Private credit liquidity isn’t creeping up — it’s exploding. +46% CAGR since 2020. +156% YoY in H1. From niche to necessity, the secondary market is where the action is. Ignore it at your own risk. 💥 #PrivateCredit #privateequity #lp #fund #investor ht @junkbondinvest

𝐅𝐫𝐨𝐦 𝐒𝐭𝐮𝐜𝐤 𝐭𝐨 𝐅𝐮𝐧𝐝𝐞𝐝: ~45% of buyout holdings are breaching leverage caps. Hybrid capital & secondaries are stepping in to unlock liquidity, extend holds & keep dividends flowing. Flexibility is the new alpha. bloomberg.com/news/articles/… #PrivateEquity #Credit #lp…

360 ONE Asset has returned $2.1 billion through exits and is now launching new PE-VC and pre-IPO funds, targeting sectors such as financial services, healthcare, & tech. Join our WhatsApp channel: whatsapp.com/channel/0029Vb… #PrivateEquity #VentureCapital #360ONEAsset #Fundraising

A&M Tax is pleased to welcome Dhara Mehta as a Senior Director with the #IndirectTax practice in #India. With 13+ years of experience, she specialises in consulting across insurance, banking, #privateequity, and leasing sectors. Learn more: okt.to/6cO3pd #AMon #AsiaTax

📍 We will be attending IPEM Paris, the leading global event for #PrivateEquity, where industry leaders from 50 countries will convene to create opportunities, explore partnerships and analyse tendences that will shape the future of private equity. #IPEM2025 #FOCO

David beats Goliath: Small buyout funds lead PE performance pitchbook.com/news/articles/… via @PitchBook #PrivateEquity

𝐅𝐫𝐨𝐦 𝐒𝐭𝐮𝐜𝐤 𝐭𝐨 𝐅𝐮𝐧𝐝𝐞𝐝: ~45% of buyout holdings are breaching leverage caps. Hybrid capital & secondaries are stepping in to unlock liquidity, extend holds & keep dividends flowing. Flexibility is the new alpha. bloomberg.com/news/articles/… #PrivateEquity #Credit #lp…

Private equity firms finally scored a spot in our 401(k)s, but their stocks can’t keep up with the broader market. High leverage, rising debt costs and fee pressure are crimping returns. Can steady fee income and long-term performance potential turn the tide? #PrivateEquity…

Slipping caviar into a tuna sandwich; private equity is your portfolio’s daredevil—strapped in for wild returns, but you’ve got to love the liquidity loop-de-loops. RIA: Super-size fee du jour 🔻 Super-size fee du jour: your friendly RIA’s pocket-sized solution via alt-assets…

📌📌🚨🚨Scoop alert from Rome~ Brothers Menon of @dorfketal are closing in on their biggest buyout ever. @BainCapital specialist chem company #Italmatch. Big breaking only on @EconomicTimes #privateequity economictimes.indiatimes.com/industry/indl-…

📣 Le nouveau numéro de 𝘊𝘰𝘳𝘱𝘰𝘳𝘢𝘵𝘦 𝘍𝘪𝘯𝘢𝘯𝘤𝘦 vient de sortir. 🔗 À découvrir sur lenouveleconomiste.fr #buildup #privateequity #IAvsVC #serialCEO #bourse #management #RSE

Even animal care under attack from #PrivateEquity, Conglomerates, #F1visa #CPT/#OPT, #H1B @StephenM @howardlutnick @SecretaryLCD @Sec_Noem @realDonaldTrump? (thread) getpocket.com/explore/item/w…

Akin #investmentmanagement partner Dennis Pereira speaks with @Bloomberg about growing concerns among #institutionalinvestors, including less access to fee-free investment opportunities like co-investments, as #PrivateEquity funds court retail investors as a source for new…

NEW: After #PrivateEquity acquisition, hospitals saw an increase in emergency department mortality and patient transfers to other hospitals. The researchers say this was likely caused by reduced staffing and salary expenditures. bit.ly/3KafMZ7

For LPs eyeing private credit: The M&A “recovery” isn’t here yet. Deal volumes are down 24% YoY. via @lcdnews @PitchBook #privateequity #deals #manda #investor

𝐌&𝐀 𝐂𝐫𝐞𝐝𝐢𝐭 𝐁𝐥𝐢𝐭𝐳? M&A deal pipeline jumps to $472 bn in August—the highest since Apr ’19. Up from $288 bn in June; UNP alone drove 48% of the $184 bn gain. Next 8 mths IG-funded supply at $132 bn vs. $121 bn prior. Big credit wave incoming! #Deal #fixedincome…

Ieri a Londra si è tenuta la conferenza promossa da AIFI ed EY per rafforzare il dialogo tra stakeholder del #PrivateEquity, con un focus su trend emergenti e collaborazioni LP-GP. Forte presenza internazionale ➡️ cresce l’interesse per il #PrivateCapital italiano.

Something went wrong.

Something went wrong.

United States Trends

- 1. Auburn 46.1K posts

- 2. At GiveRep N/A

- 3. Brewers 65.5K posts

- 4. Cubs 56.7K posts

- 5. #SEVENTEEN_NEW_IN_TACOMA 33.3K posts

- 6. Georgia 68.4K posts

- 7. Gilligan's Island 4,836 posts

- 8. Utah 25.5K posts

- 9. #byucpl N/A

- 10. MACROHARD 4,375 posts

- 11. Arizona 42K posts

- 12. Kirby 24.3K posts

- 13. Wordle 1,576 X N/A

- 14. #AcexRedbull 4,268 posts

- 15. Michigan 63.2K posts

- 16. Boots 51.1K posts

- 17. #Toonami 2,993 posts

- 18. #BYUFootball 1,020 posts

- 19. mingyu 91.2K posts

- 20. Hugh Freeze 3,281 posts