#programpreview search results

📢 #ProgramPreview, Sunday Edition 'What moves stock prices?' might be the most researched question in finance. New techniques deliver new and perhaps unexpected answers. Everyone interested in #assetpricing #machinelearning #bigdata and #investing should tune in! #EconTwitter

📢 #ProgramPreview #ML is about finding data features that predict an outcome. If data features are firm characteristics and stock returns are the outcome you get.. fundamental analysis. Potential disruption is huge, no wonder more than one paper is looking into it. #EconTwitter

📢 #ProgramPreview, informed edition We all learn that 'sharing is caring' though we wouldn't necessarily associate the phrase with financial markets. But maybe we should? Anyone interested in #disclosure and #informed #trading should tune in! #EconTwitter

📢 #ProgramPreview, high frequency edition In physics, as you go to smaller and smaller scales, strange things start to happen. It's the same thing with trading at higher and higher frequencies.. Anyone interested in #market #microstructure and #HFT should tune in! #EconTwitter

📢 #ProgramPreview, poster edition A picture is worth a 1000 words and a poster is worth even more. It is a great way to get to know several projects quickly. Follow-up with authors included! Anyone interested in #ML, #bigdata and #microstructure should tune in! #EconTwitter

📢 #ProgramPreview, app edition It is the norm today to access all kinds of information on your phone. And it actually might be a good idea to access your bank's app before your Saturday shopping. Anyone interested in #consumers, #household #finance and #FinTech should tune in!

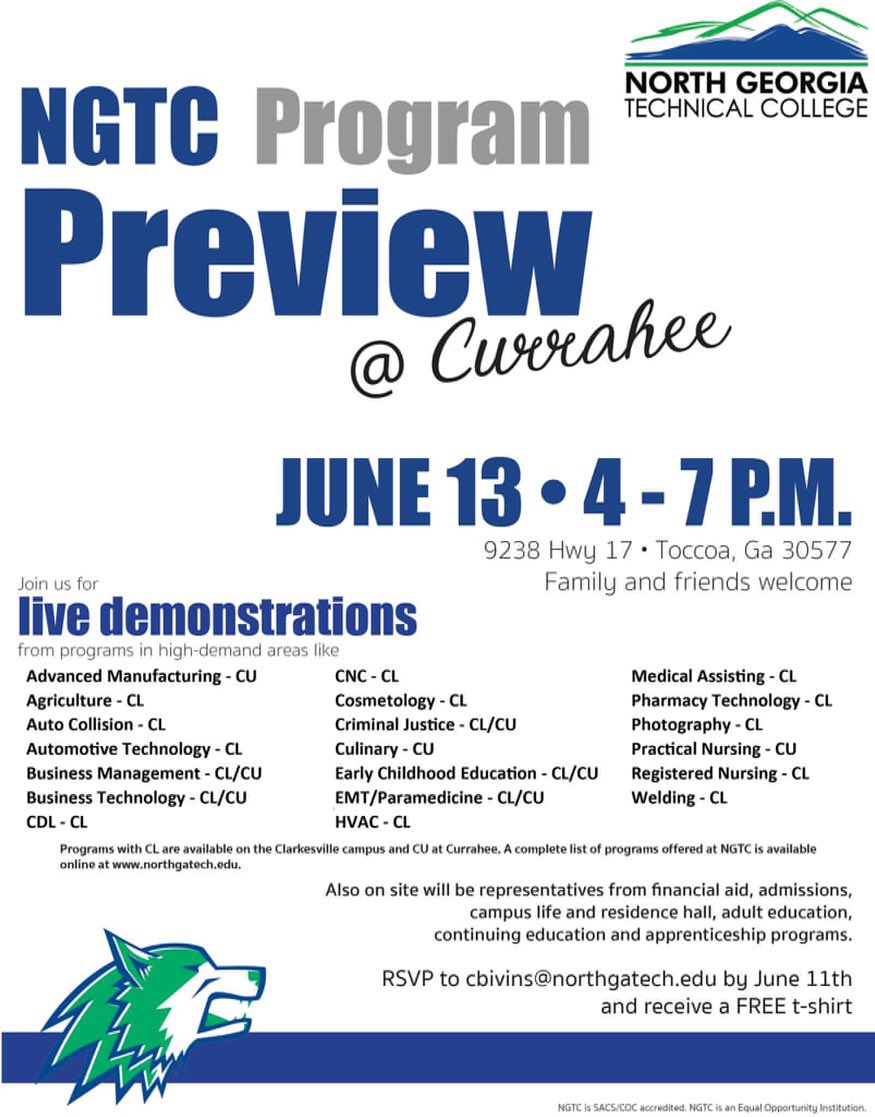

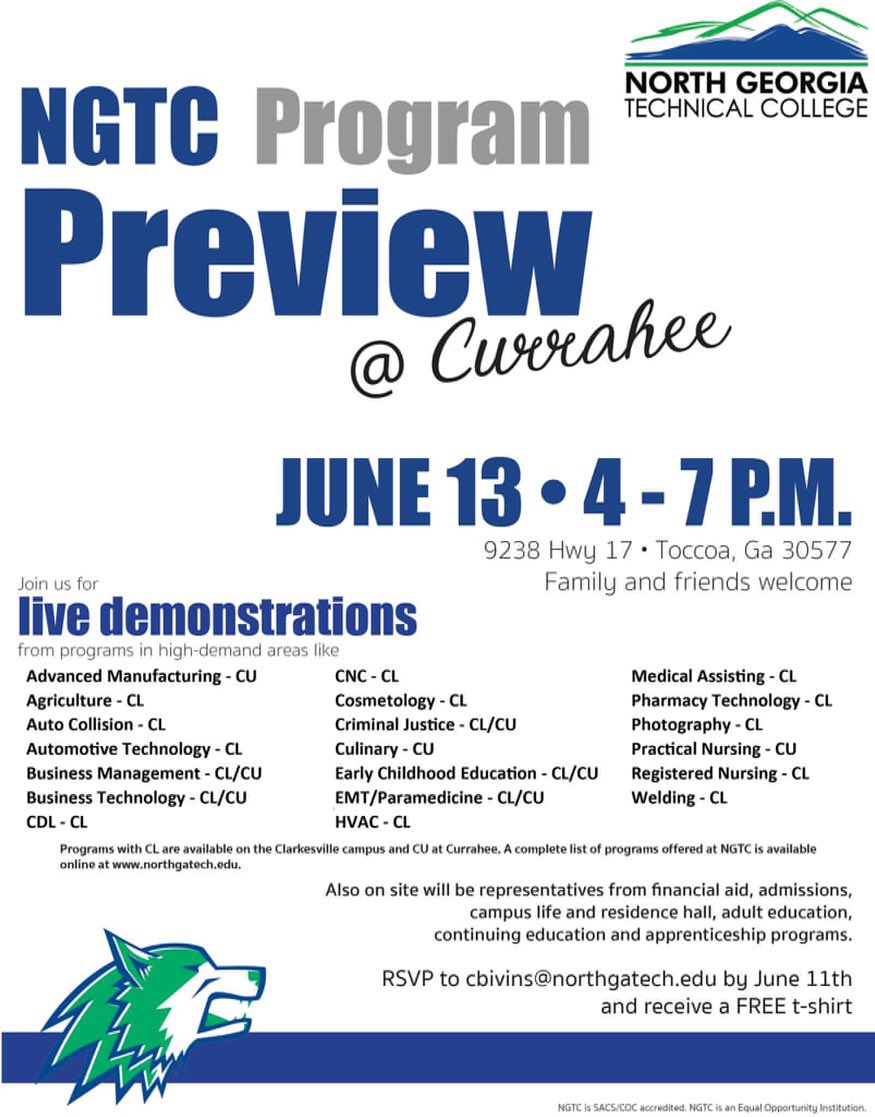

ASK YOUR Questions! NGTC Currahee Campus 9238 Hwy 17 Toccoa, GA 30577 #ngtc #programpreview #education #technical #careers #advisors

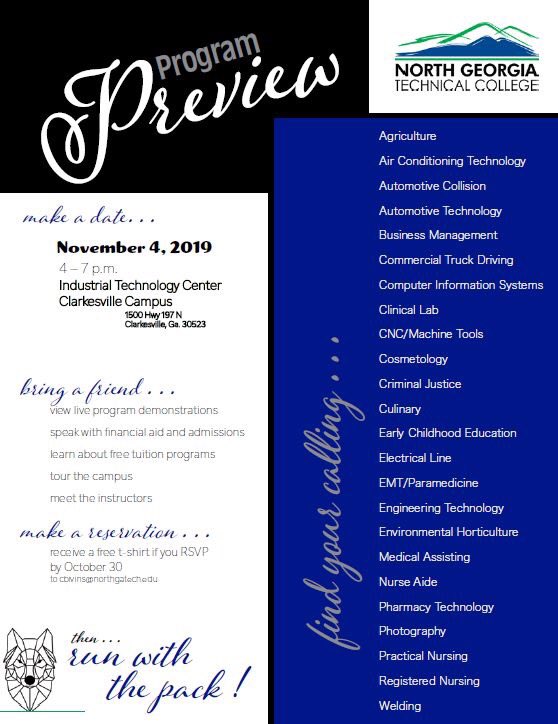

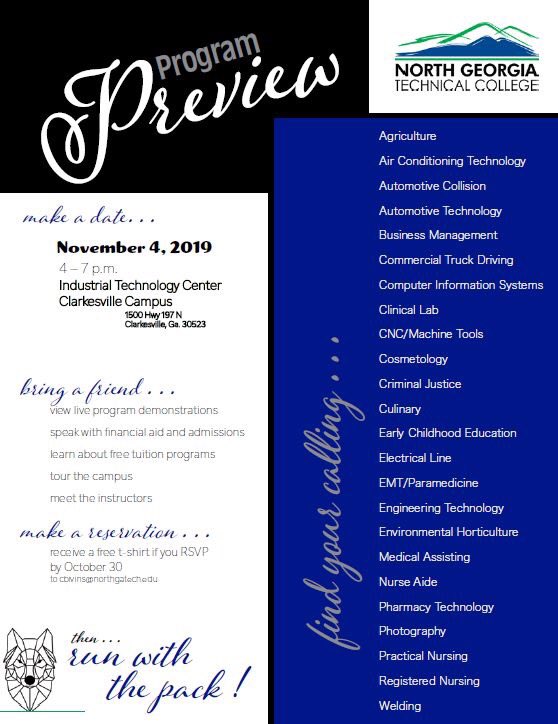

Your Future begins w/ North Georgia Technical College! Monday, November 4 @ 4pm - 7pm #ngtc #tcsg #programpreview #education #careers #future

📢 #ProgramPreview, orderly edition Market, limit, stop, GTC... are just some ways of achieving the seemingly simple goal of buying or selling a stock. Why do we need so many? Anyone interested in #market #microstructure, #trading and #execution should tune in! #EconTwitter

📢 #ProgramPreview retail edition Capital market participation is one of the levers to reduce inequality. It can also seem daunting. Can we provide customized advice on a mass scale? Anyone interested in #FinTech #roboadvising and #retail #investors should tune in! #EconTwitter

📢 #ProgramPreview, midday Edition Near-zero interest rates have probably been around long enough to shift reference points. So how do ordinary people respond, given their biases? Anyone interested in #behavior #saving #interest #rates and #ZLB should tune in! #EconTwitter

📢 #ProgramPreview, sparse edition The 300+ factors that arguably predict returns are a diverse bunch but have one thing in common - they're meant to work for all stocks. But does one size fit all? Anyone interested in #ML, #bigdata and #prediction should tune in! #EconTwitter

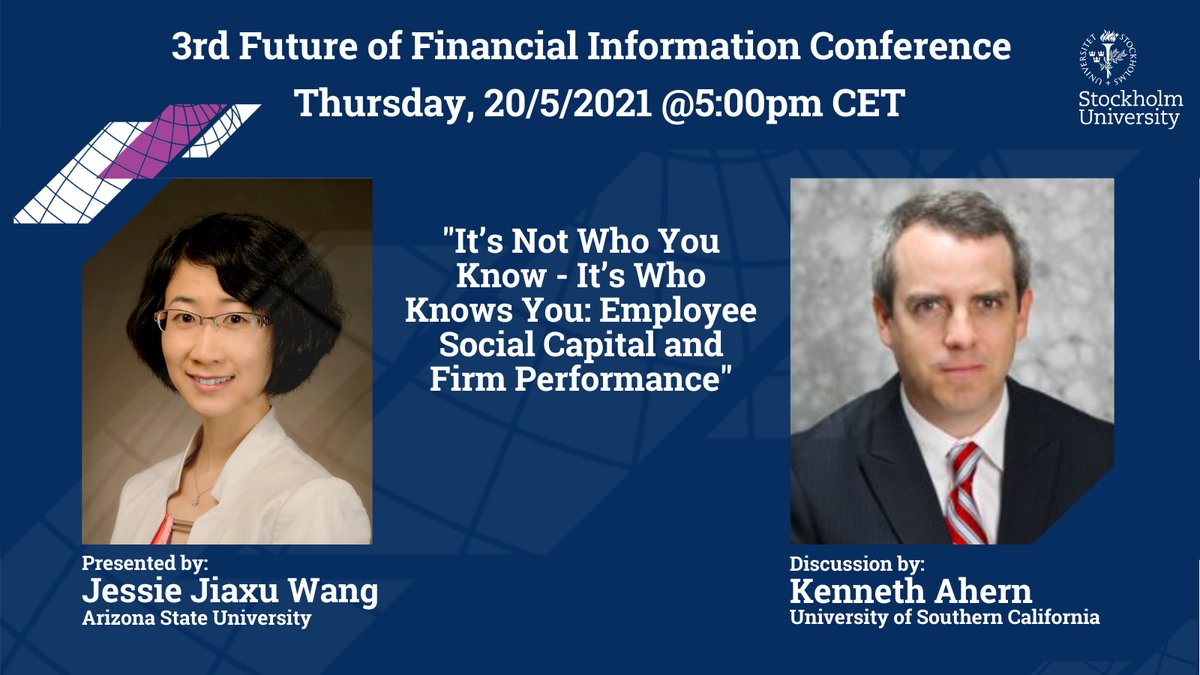

📢 #ProgramPreview, May the 4th be with you! Edition Popular employees improve firm performance. Sounds obvious? Maybe, since you're viewing this on Twitter. Still worth learning about the details! Anyone interested in #networks and #social #finance should tune in! #EconTwitter

📢 #ProgramPreview, Theory Edition Feedback loops between managers can be truly mind-bending. They are also important to understanding information flows and we should be thankful to those up to the challenge. Anyone interested in #disclosure should tune in! #EconTwitter

📢 #ProgramPreview, anomalous edition Are anomalies due to risk or mispricing? The question is simple but the answer has proven anything but. Maybe changing our idea of time could help? Anyone interested in #asset #pricing, #anomalies and #investing should tune in! #EconTwitter

📢 #ProgramPreview, dealer edition Bond markets rival equities for size and yet remain under-researched. Which is a shame, because trading and so information flows work quite differently there. Anyone interested in #corporate #bonds and #networks should tune in! #EconTwitter

📢 #ProgramPreview, sentimental edition Foreign animal spirits are different from domestic. Especially the exotic ones. No, we did not pull this from a veterinary conference. Anyone interested in #asset #pricing, #investor #sentiment and #behavioral should tune in! #EconTwitter

📢 #ProgramPreview, GMT- Edition Before automated credit scoring, consumer lending was a personal affair. Ironically, could this be coming back as consumers' lives move online? And will consumers benefit? Everyone interested in #fintech, #lending and #privacy should tune in!

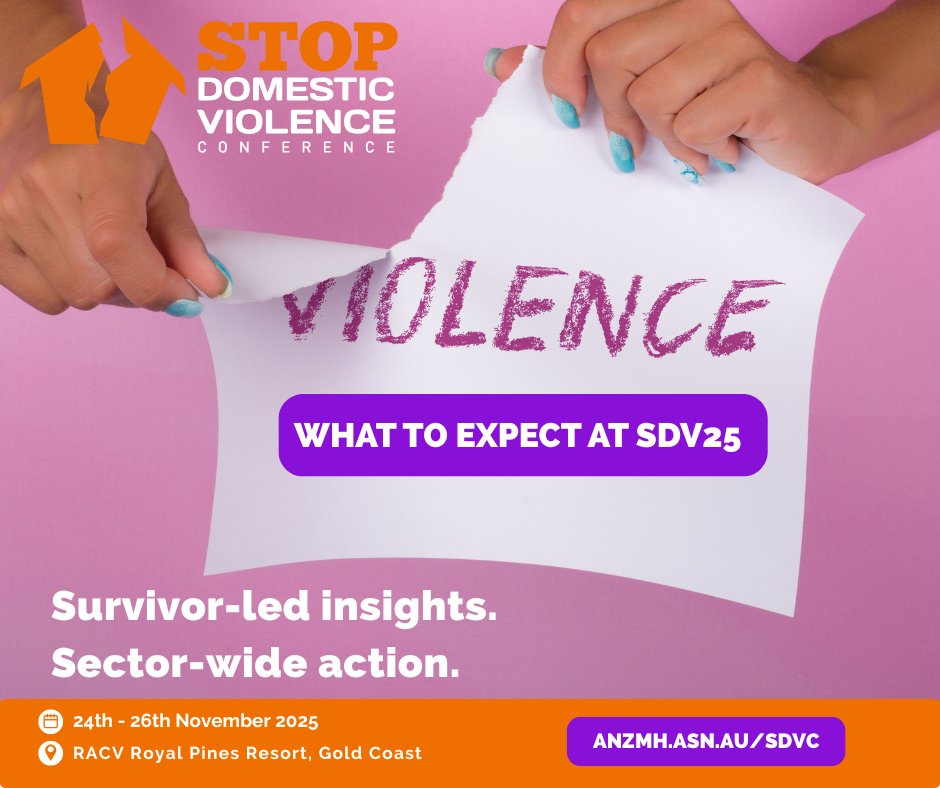

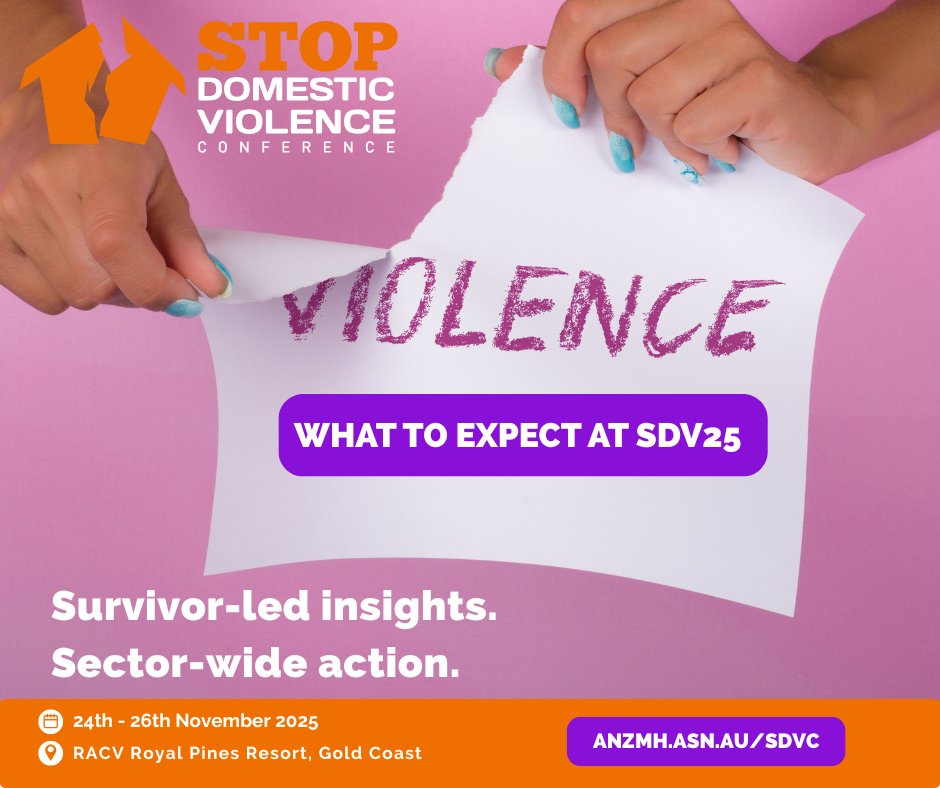

💡 The SDV25 program is nearly here… More than a conference, this is a space to collaborate, reflect, and act. 📍 Gold Coast | 24–26 November Stay informed: hubs.li/Q03v-K2V0 #SDV25 #DomesticViolenceConference #ProgramPreview #SupportSurvivors #SectorLeadership

We're gearing up for a busy year at Catalyst! Hear from our VP of Programs & Initiatives Aline Racic about what you can look forward to in the coming weeks and months ▶️ bit.ly/CatalystSD2024 #programpreview #2024Calendar #philanthropy #sandiegoevents

youtube.com

YouTube

2024 Program Preview

🔍 Dive into the Clean Tech CEO Crash experience! From refining your business plan to interactive sessions, this program is designed to accelerate your journey. Get ready to innovate, connect, and thrive! 🚀🌱 #CleanTechInnovation #ProgramPreview

That concludes our #ProgramPreview series - it's all #LiveView from now on, starting with these two blockbuster sessions: #1A: (Un)informed trading #1B: New answers to an old question Hurry up if you still want to join, kick-off is 2:45pm Stockholm time! futfin.info/conference/

📢 #ProgramPreview, closing edition There are 6.5 hours, or 390 minutes, available for trading at the NYSE. Yet 7% of daily volume is squeezed into the last 5. Why is that and what are the consequences? Anyone interested in #market #microstructure should tune in! #EconTwitter

📢 #ProgramPreview, biased edition Biases embedded into AI algorithms are becoming an increasing concern to regulators. Turns out it could be in the best interest of the users to avoid them too. Anyone interested in #FinTech #AI #retail and #lending should tune in! #EconTwitter

📢 #ProgramPreview, poster edition A picture is worth a 1000 words and a poster is worth even more. It is a great way to get to know several projects quickly. Follow-up with authors included! Anyone interested in #ML, #bigdata and #microstructure should tune in! #EconTwitter

📢 #ProgramPreview, sparse edition The 300+ factors that arguably predict returns are a diverse bunch but have one thing in common - they're meant to work for all stocks. But does one size fit all? Anyone interested in #ML, #bigdata and #prediction should tune in! #EconTwitter

📢 #ProgramPreview, app edition It is the norm today to access all kinds of information on your phone. And it actually might be a good idea to access your bank's app before your Saturday shopping. Anyone interested in #consumers, #household #finance and #FinTech should tune in!

📢 #ProgramPreview, sentimental edition Foreign animal spirits are different from domestic. Especially the exotic ones. No, we did not pull this from a veterinary conference. Anyone interested in #asset #pricing, #investor #sentiment and #behavioral should tune in! #EconTwitter

📢 #ProgramPreview, dealer edition Bond markets rival equities for size and yet remain under-researched. Which is a shame, because trading and so information flows work quite differently there. Anyone interested in #corporate #bonds and #networks should tune in! #EconTwitter

📢 #ProgramPreview, anomalous edition Are anomalies due to risk or mispricing? The question is simple but the answer has proven anything but. Maybe changing our idea of time could help? Anyone interested in #asset #pricing, #anomalies and #investing should tune in! #EconTwitter

📢 #ProgramPreview, orderly edition Market, limit, stop, GTC... are just some ways of achieving the seemingly simple goal of buying or selling a stock. Why do we need so many? Anyone interested in #market #microstructure, #trading and #execution should tune in! #EconTwitter

📢 #ProgramPreview, informed edition We all learn that 'sharing is caring' though we wouldn't necessarily associate the phrase with financial markets. But maybe we should? Anyone interested in #disclosure and #informed #trading should tune in! #EconTwitter

📢 #ProgramPreview retail edition Capital market participation is one of the levers to reduce inequality. It can also seem daunting. Can we provide customized advice on a mass scale? Anyone interested in #FinTech #roboadvising and #retail #investors should tune in! #EconTwitter

📢 #ProgramPreview, high frequency edition In physics, as you go to smaller and smaller scales, strange things start to happen. It's the same thing with trading at higher and higher frequencies.. Anyone interested in #market #microstructure and #HFT should tune in! #EconTwitter

📢 #ProgramPreview #ML is about finding data features that predict an outcome. If data features are firm characteristics and stock returns are the outcome you get.. fundamental analysis. Potential disruption is huge, no wonder more than one paper is looking into it. #EconTwitter

📢 #ProgramPreview, International Edition In the recent @RevOfFinStudies article on perspectives in asset pricing, beliefs, intermediaries and international finance play a prominent role. This paper has all three. Anyone interested in #asset #pricing should tune in! #EconTwitter

📢 #ProgramPreview, Theory Edition Feedback loops between managers can be truly mind-bending. They are also important to understanding information flows and we should be thankful to those up to the challenge. Anyone interested in #disclosure should tune in! #EconTwitter

📢 #ProgramPreview, Sunday Edition 'What moves stock prices?' might be the most researched question in finance. New techniques deliver new and perhaps unexpected answers. Everyone interested in #assetpricing #machinelearning #bigdata and #investing should tune in! #EconTwitter

📢 #ProgramPreview #ML is about finding data features that predict an outcome. If data features are firm characteristics and stock returns are the outcome you get.. fundamental analysis. Potential disruption is huge, no wonder more than one paper is looking into it. #EconTwitter

Your Future begins w/ North Georgia Technical College! Monday, November 4 @ 4pm - 7pm #ngtc #tcsg #programpreview #education #careers #future

📢 #ProgramPreview, informed edition We all learn that 'sharing is caring' though we wouldn't necessarily associate the phrase with financial markets. But maybe we should? Anyone interested in #disclosure and #informed #trading should tune in! #EconTwitter

📢 #ProgramPreview, high frequency edition In physics, as you go to smaller and smaller scales, strange things start to happen. It's the same thing with trading at higher and higher frequencies.. Anyone interested in #market #microstructure and #HFT should tune in! #EconTwitter

ASK YOUR Questions! NGTC Currahee Campus 9238 Hwy 17 Toccoa, GA 30577 #ngtc #programpreview #education #technical #careers #advisors

🔍 Dive into the Clean Tech CEO Crash experience! From refining your business plan to interactive sessions, this program is designed to accelerate your journey. Get ready to innovate, connect, and thrive! 🚀🌱 #CleanTechInnovation #ProgramPreview

📢 #ProgramPreview, poster edition A picture is worth a 1000 words and a poster is worth even more. It is a great way to get to know several projects quickly. Follow-up with authors included! Anyone interested in #ML, #bigdata and #microstructure should tune in! #EconTwitter

Join us on March 31 for a FREE Web Design program preview. Learn about the program's benefits and features, schedule, fees and more. Register now! ow.ly/UckV50ySCmh #McMasterContEd #ProgramPreview #WebDesign

Risk Management happens everywhere! Join us on April 7 for a free program preview to discover the benefits and features, career outcomes, and more of our Risk Management program. Register today! ow.ly/1zo450yYs0L #McMasterContEd #ProgramPreview #RiskManagement #Risk

📢 #ProgramPreview, orderly edition Market, limit, stop, GTC... are just some ways of achieving the seemingly simple goal of buying or selling a stock. Why do we need so many? Anyone interested in #market #microstructure, #trading and #execution should tune in! #EconTwitter

📢 #ProgramPreview retail edition Capital market participation is one of the levers to reduce inequality. It can also seem daunting. Can we provide customized advice on a mass scale? Anyone interested in #FinTech #roboadvising and #retail #investors should tune in! #EconTwitter

📢 #ProgramPreview, midday Edition Near-zero interest rates have probably been around long enough to shift reference points. So how do ordinary people respond, given their biases? Anyone interested in #behavior #saving #interest #rates and #ZLB should tune in! #EconTwitter

📢 #ProgramPreview, GMT+ Edition Before automated credit scoring, consumer lending was a personal affair. Ironically, could this be coming back as consumers' lives move online? And will consumers benefit? Everyone interested in #fintech, #lending and #privacy should tune in!

📢 #ProgramPreview, app edition It is the norm today to access all kinds of information on your phone. And it actually might be a good idea to access your bank's app before your Saturday shopping. Anyone interested in #consumers, #household #finance and #FinTech should tune in!

📢 #ProgramPreview Western Edition Judging by how closely watched they are, FOMC announcements, like the one we had this week, are extremely informative. Or are they? Everyone interested in #fomc, #monetary #policy and #information should tune in!

📢 #ProgramPreview, sentimental edition Foreign animal spirits are different from domestic. Especially the exotic ones. No, we did not pull this from a veterinary conference. Anyone interested in #asset #pricing, #investor #sentiment and #behavioral should tune in! #EconTwitter

💡 The SDV25 program is nearly here… More than a conference, this is a space to collaborate, reflect, and act. 📍 Gold Coast | 24–26 November Stay informed: hubs.li/Q03v-K2V0 #SDV25 #DomesticViolenceConference #ProgramPreview #SupportSurvivors #SectorLeadership

Something went wrong.

Something went wrong.

United States Trends

- 1. Araujo 187K posts

- 2. Chelsea 653K posts

- 3. Barca 261K posts

- 4. Estevao 269K posts

- 5. Barcelona 466K posts

- 6. Wizards 5,934 posts

- 7. Yamal 204K posts

- 8. Ferran 78.9K posts

- 9. Hazel 9,501 posts

- 10. Oklahoma State 4,958 posts

- 11. Godzilla 26.3K posts

- 12. Eric Morris 3,364 posts

- 13. Skippy 5,304 posts

- 14. Leftover 6,508 posts

- 15. Witkoff 64.7K posts

- 16. Bishop Boswell N/A

- 17. Cucurella 105K posts

- 18. Raising Arizona 1,926 posts

- 19. Rashford 24.5K posts

- 20. Cooks 12.4K posts