#pythonquantsconf résultats de recherche

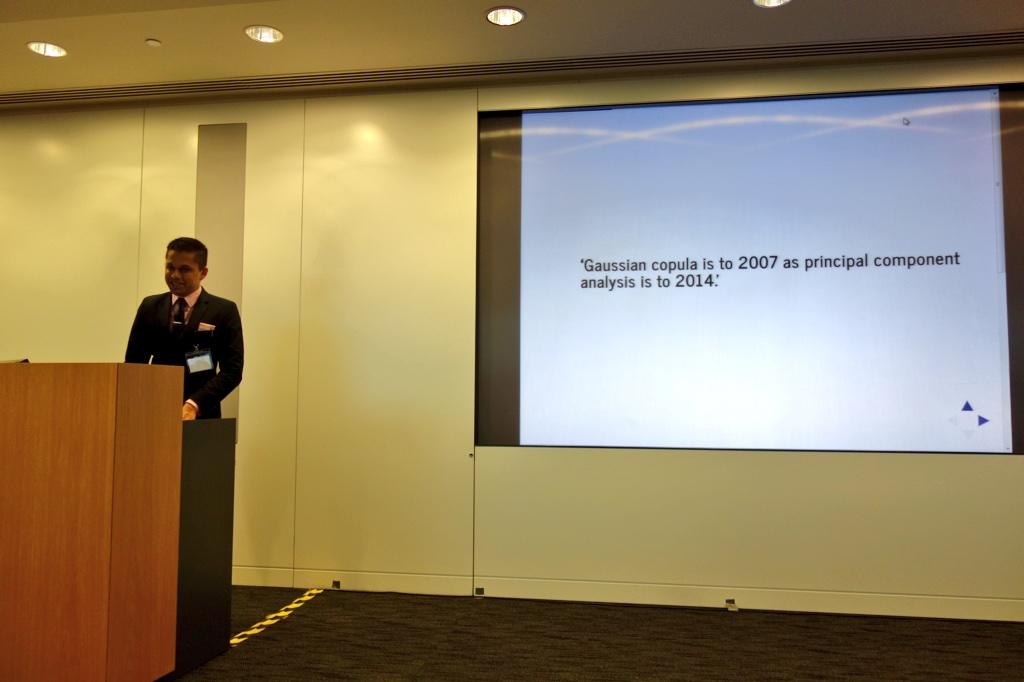

Gaussian copula is to 2007 as principal component analysis is to 2014! - James Powell #PythonQuantsConf

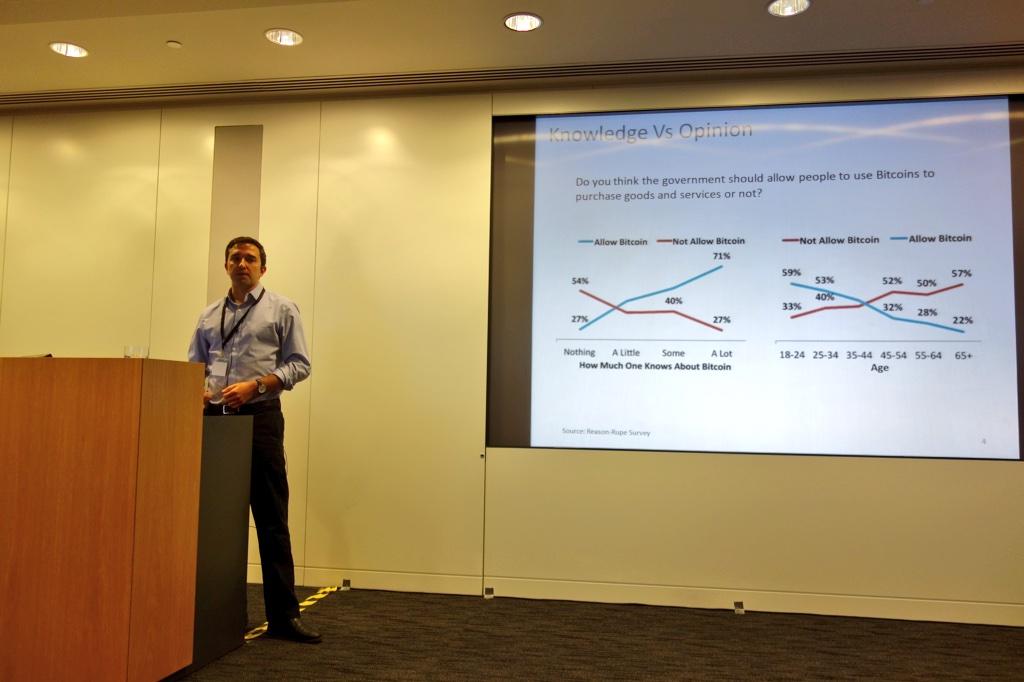

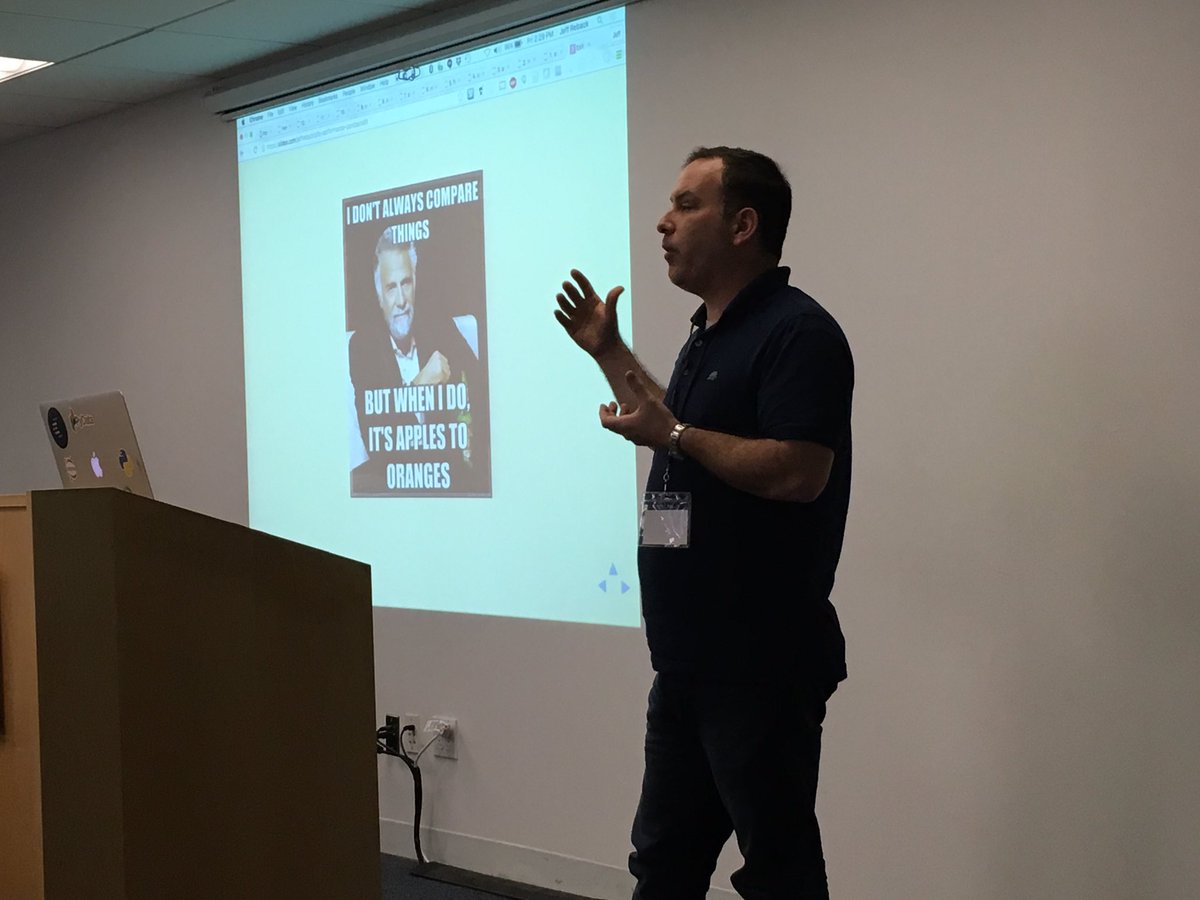

Delaney Mackenzie @thestreetquant about Dos and Don'ts in #machinelearning for #finance #PythonQuantsConf #Python

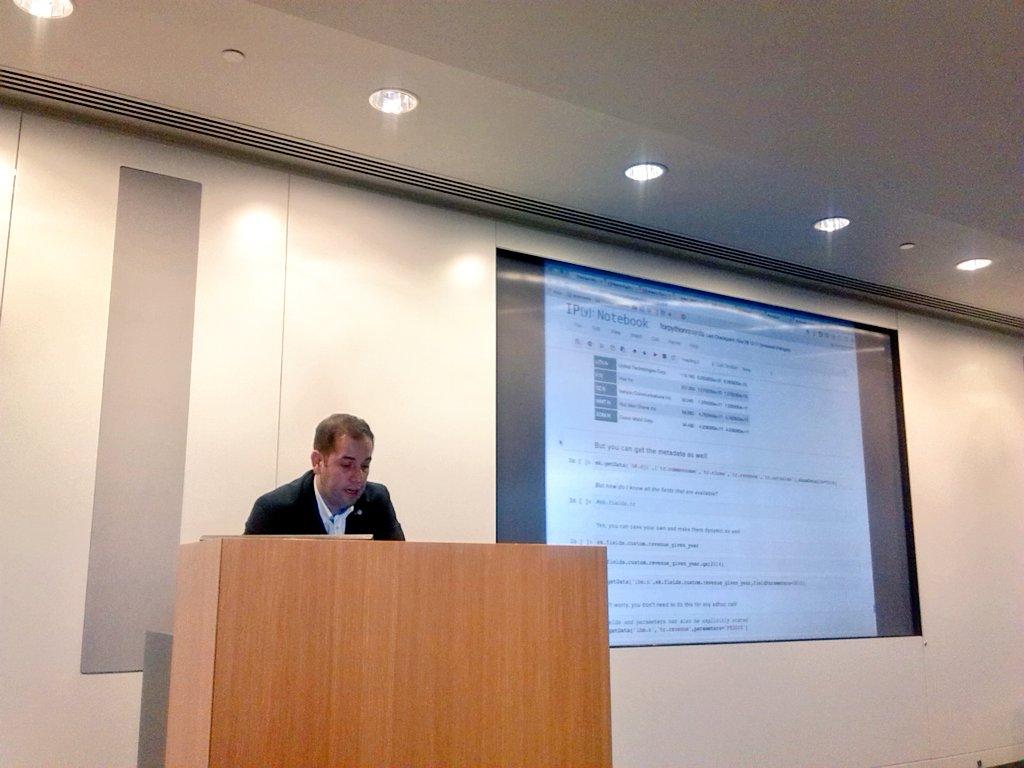

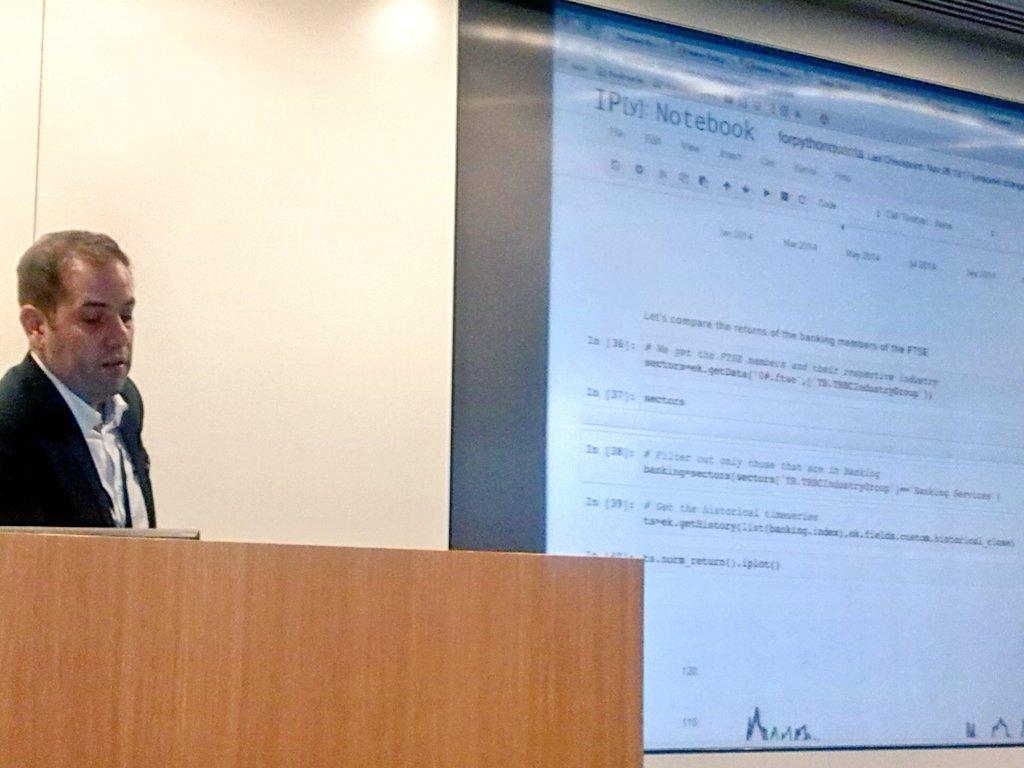

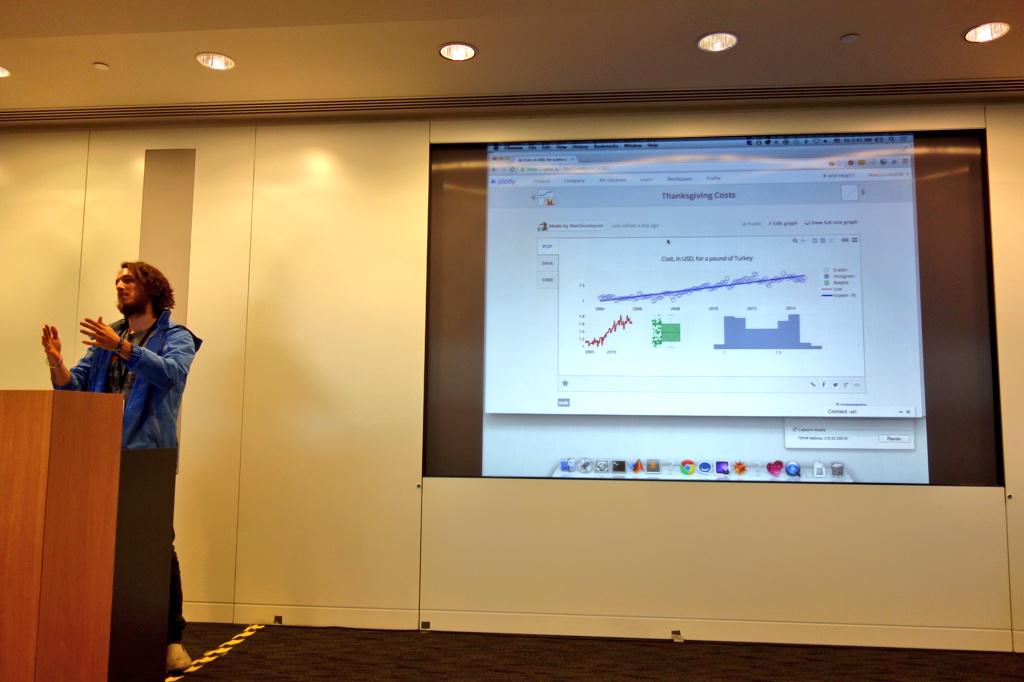

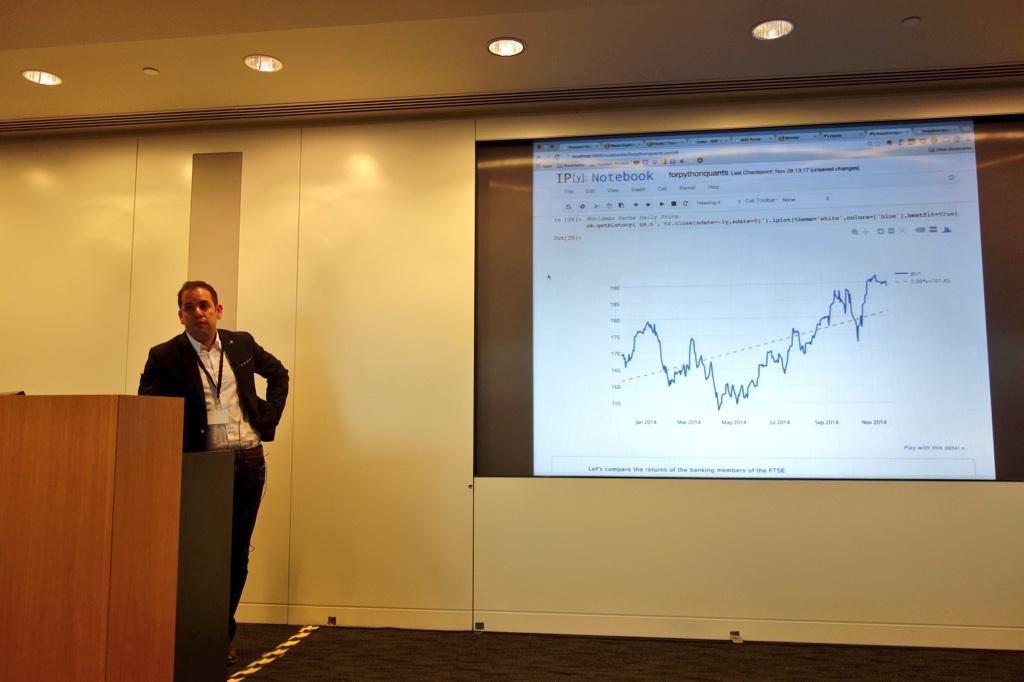

using Reuters Python API to get mkt data - Jorge Santos - looks quite easy to use! #PythonQuantsConf

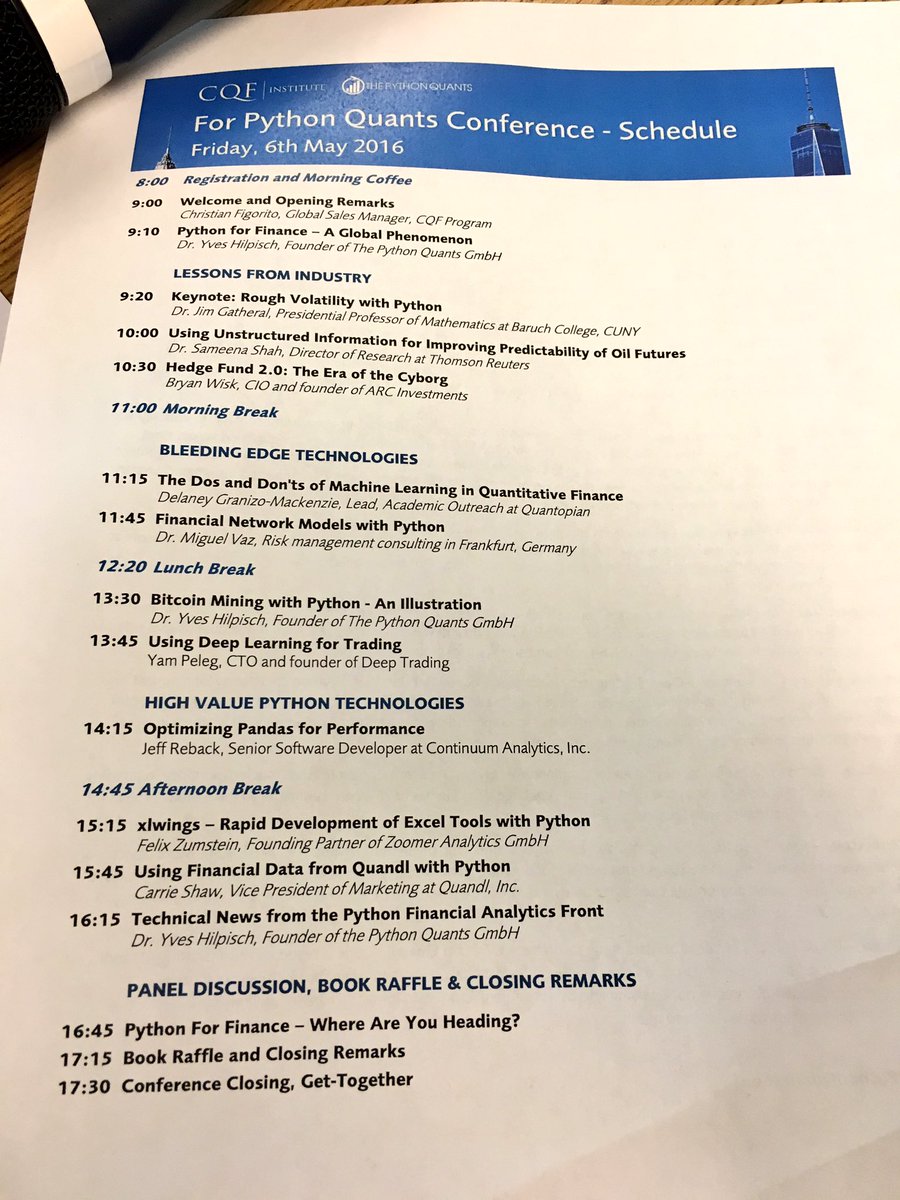

FIVE Confirmed Speakers for #PythonQuantsConf in #NewYork / May 6th 2016 / Early Bird Tickets ON SALE NOW! - fpq.io

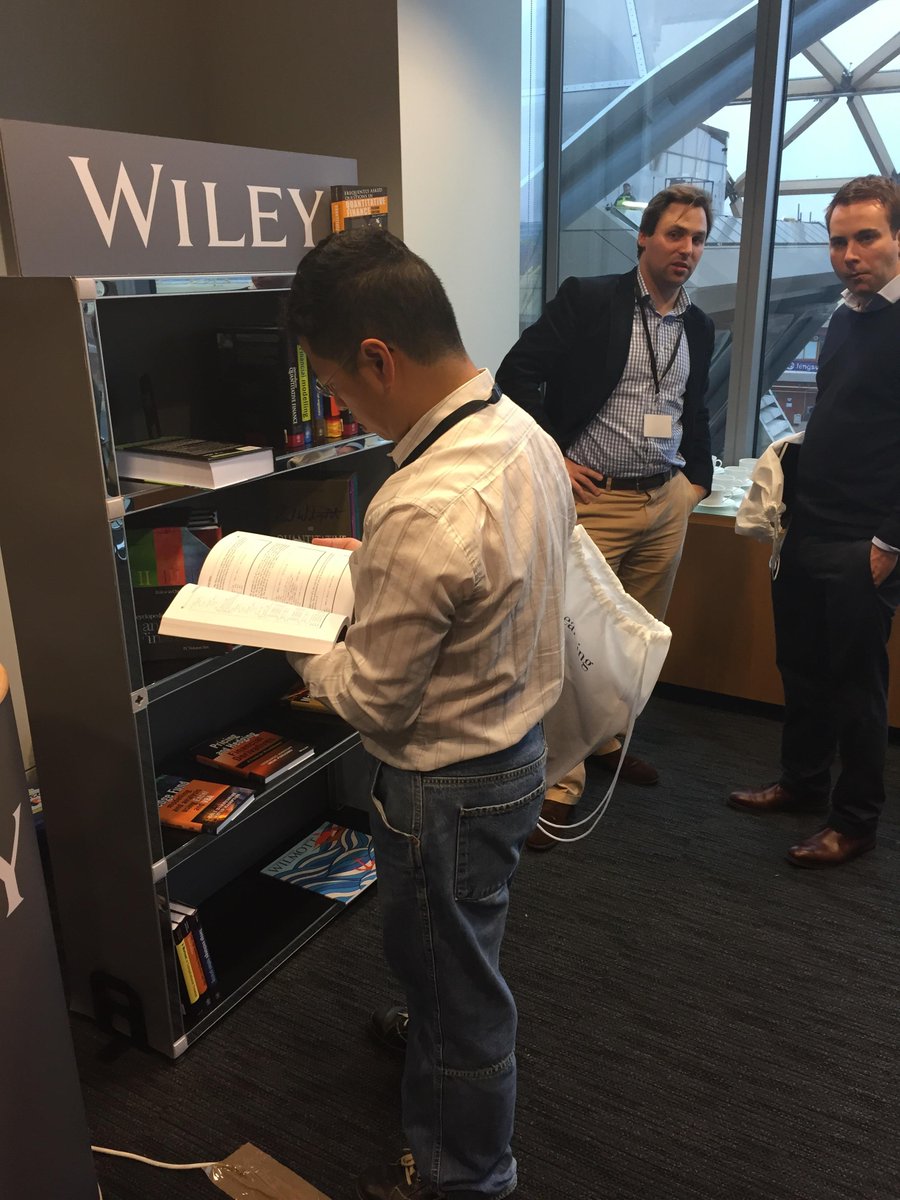

CQF Institute director Dr. Randeep Gug welcomes everyone to this year's #PythonQuantsConf in London. #python

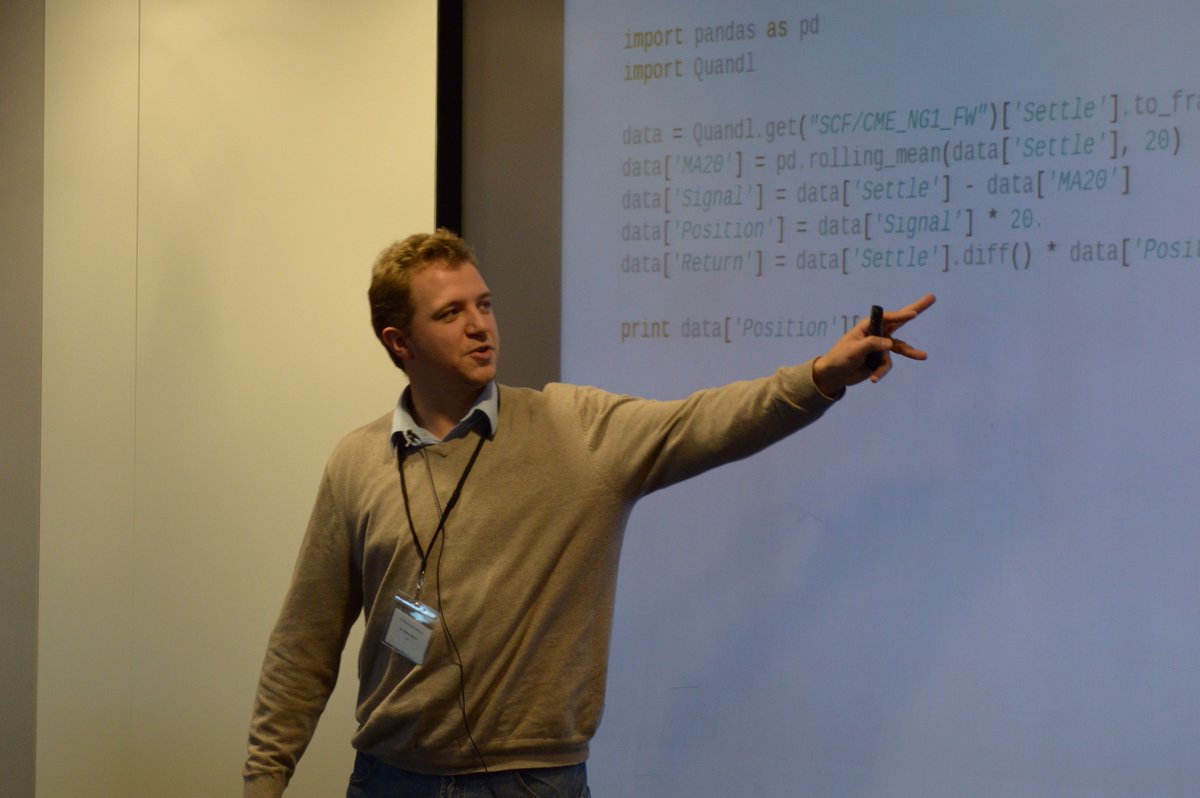

Gist for today's intro bootcamp at #PythonQuantsConf in #London gist.github.com/yhilpisch/dfae…

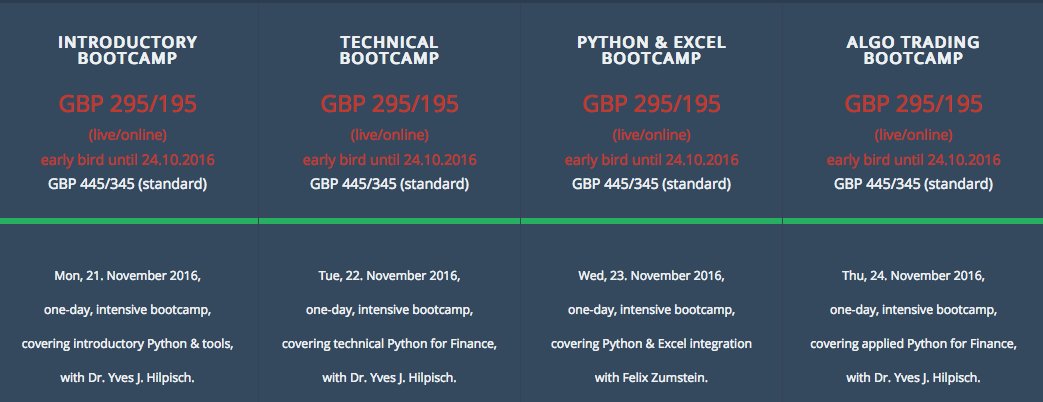

5 Days left for Early Bird Tickets #PythonQuantsConf in Nov in #LDN | #Python #Finance #algotrading #excel | fpq.io

#PythonQuantsConf Nov #London | combine early bird w/ TWITTER_10 for add. 10% discount | #Python @CQFInstitute | fpq.io

Early bird tickets available for #PythonQuantsConf #Python #QuantFinance #London in November | fpq.io

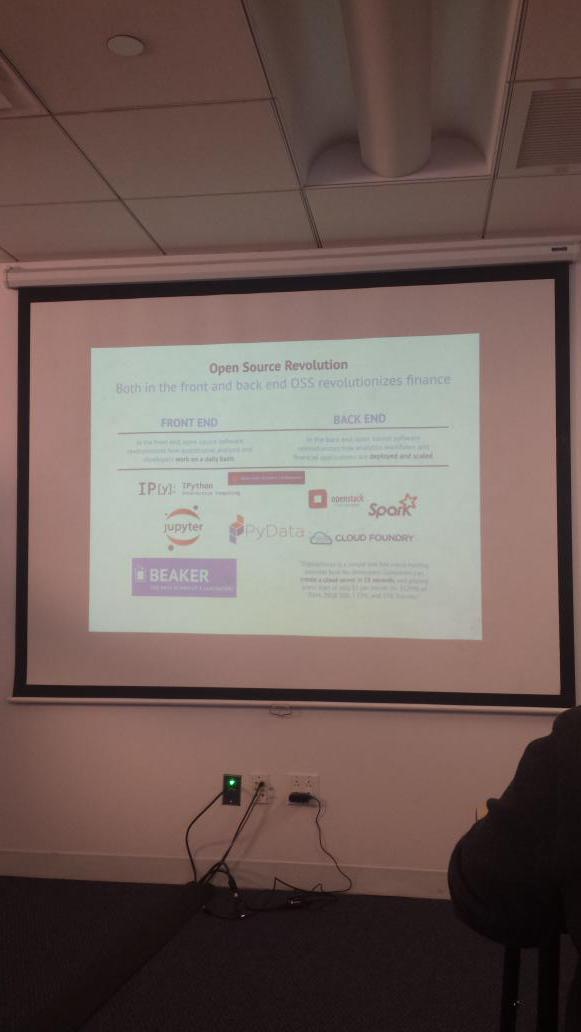

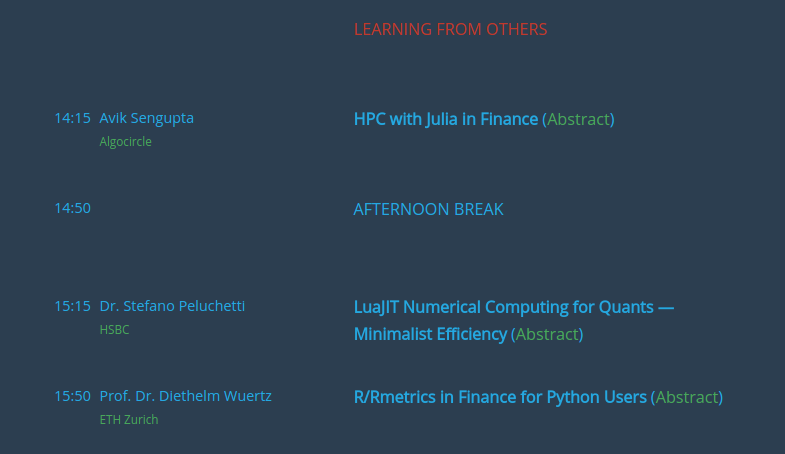

Slides & @ProjectJupyter notebooks from #PythonQuantsConf in NYC now available fpq.io/#schedule #Python #Finance @CQFInstitute

Slides & @ProjectJupyter notebooks from #PythonQuantsConf last week now available fpq.io/#schedule #Python #Finance @CQFInstitute

Thanks to @OReillyMedia for sponsoring #PythonQuantsConf in #NewYork today. #Python #Finance @CQFInstitute

Delaney Mackenzie @thestreetquant about Dos and Don'ts in #machinelearning for #finance #PythonQuantsConf #Python

.@thestreetquant to present "The Dos and Don'ts of Machine Learning in Quant Finance" at #PythonQuantsConf today! fpq.io

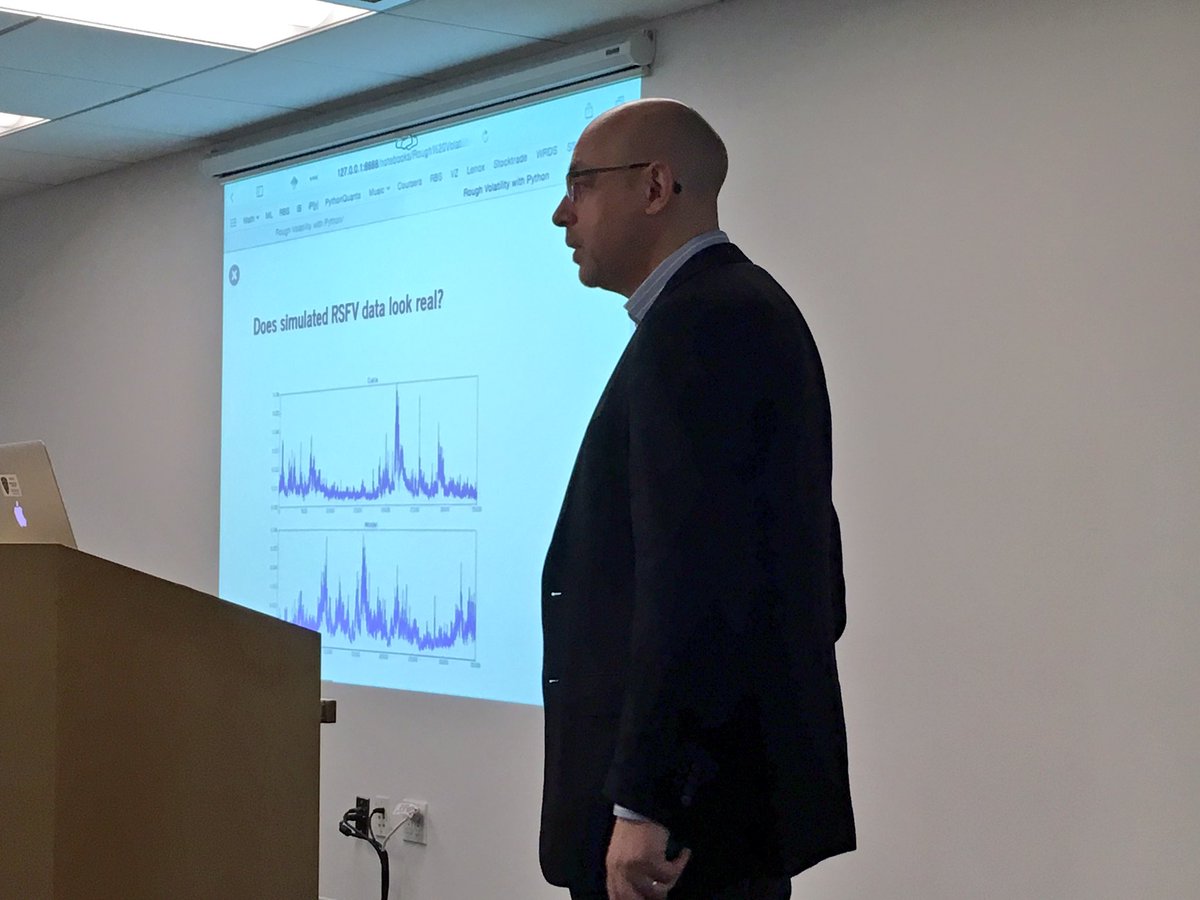

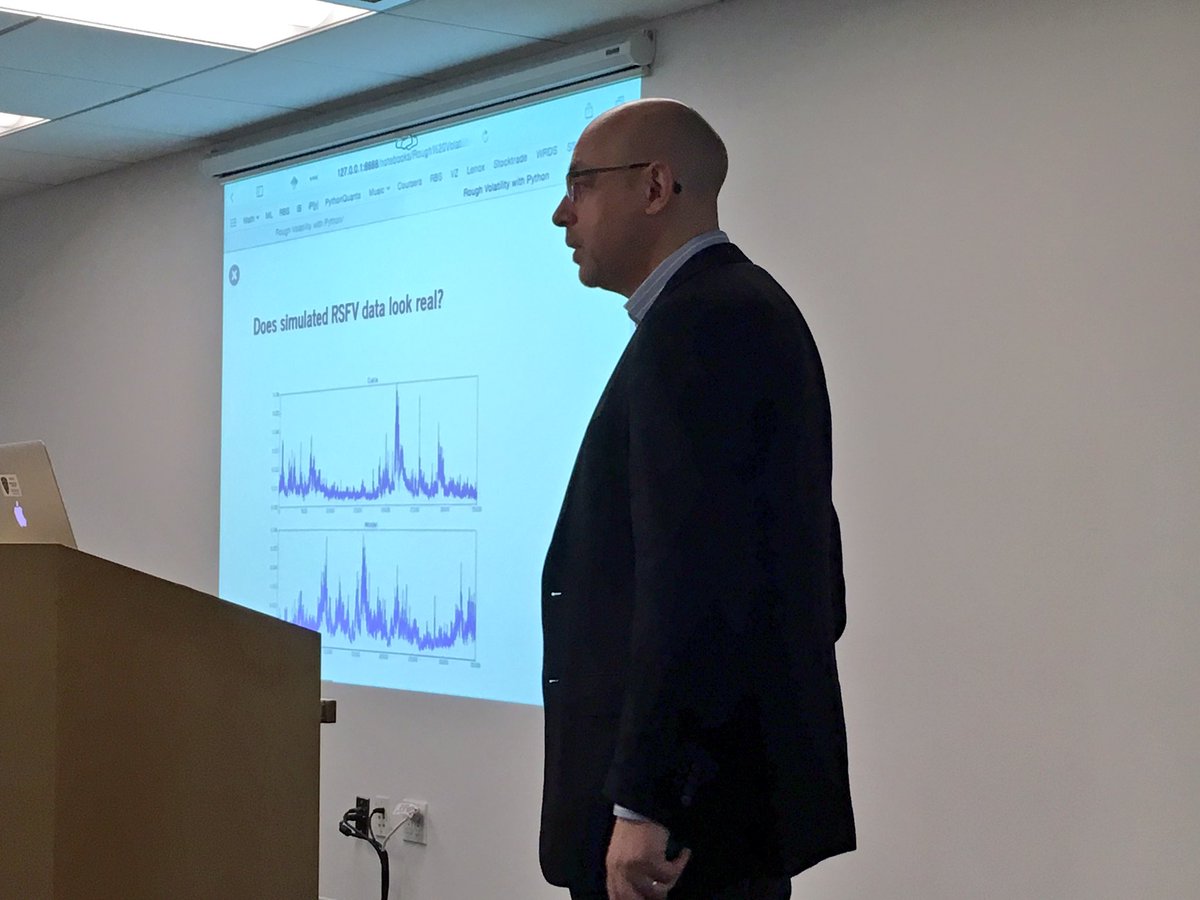

#PythonQuantsConf kicked off with keynote by Jim Gatheral about Rough #Volatility w/ #Python. @CQFInstitute

#PythonQuantsConf in #NewYork - 6 May 2016 / LAST DAY TO BUY YOUR LIVE AND ONLINE TICKETS - fpq.io

1 day until #PythonQuantsConf in #NewYork. Still time left to book your (online) ticket. #Python #Bitcoin #Finance foq.io

On my way to #NewYork for #PythonQuantsConf fpq.io | Still time to book your tickets | #python #quantfinance

#PythonQuantsConf series starts on Monday. Still time to register (use TPQ_10 for 10% disc). tpq.io | #python #quantfinance

Delaney Mackenzie @thestreetquant about Dos and Don'ts in #machinelearning for #finance #PythonQuantsConf #Python

#PythonQuantsConf - 27th Nov, London. #PythonQuantTechnologies Talks / Buy your tickets now! ow.ly/UbQvd

Gaussian copula is to 2007 as principal component analysis is to 2014! - James Powell #PythonQuantsConf

#PythonQuantsConf kicked off with keynote by Jim Gatheral about Rough #Volatility w/ #Python. @CQFInstitute

Thanks to @OReillyMedia for sponsoring #PythonQuantsConf in #NewYork today. #Python #Finance @CQFInstitute

Something went wrong.

Something went wrong.

United States Trends

- 1. Liverpool 175K posts

- 2. Derek Shelton N/A

- 3. Slot 107K posts

- 4. Delap 22K posts

- 5. $META 34.2K posts

- 6. Jennifer Welch 17.7K posts

- 7. Sonya Massey 19.9K posts

- 8. Magic 328K posts

- 9. Boasberg 16.7K posts

- 10. Gittens 27.7K posts

- 11. Crystal Palace 56.8K posts

- 12. Pierre Robert 2,728 posts

- 13. Powell 72.8K posts

- 14. Metchie 4,301 posts

- 15. Jeff Landry 2,915 posts

- 16. Arctic Frost 54K posts

- 17. Watergate 12.9K posts

- 18. Welcome to Philly N/A

- 19. #CarabaoCup 29.1K posts

- 20. Woodward 8,564 posts