#sandhartech search results

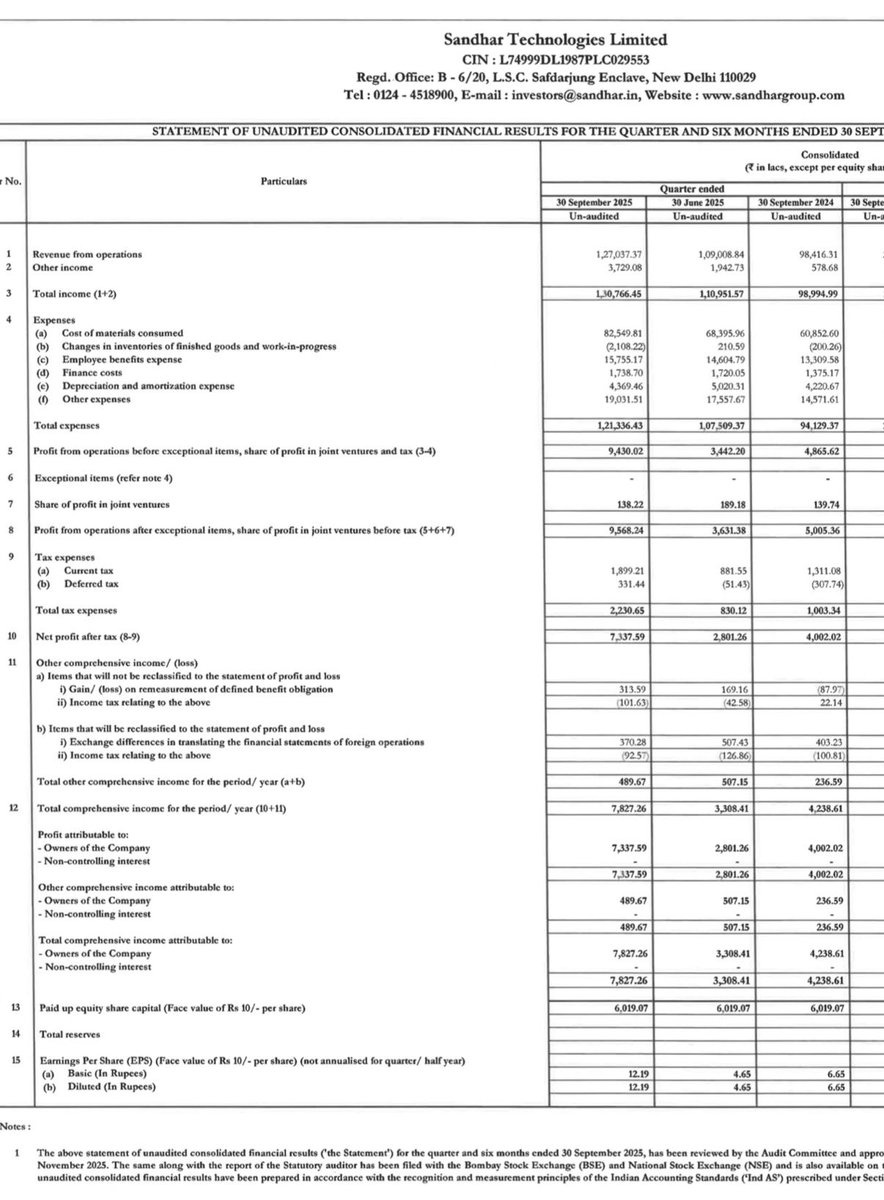

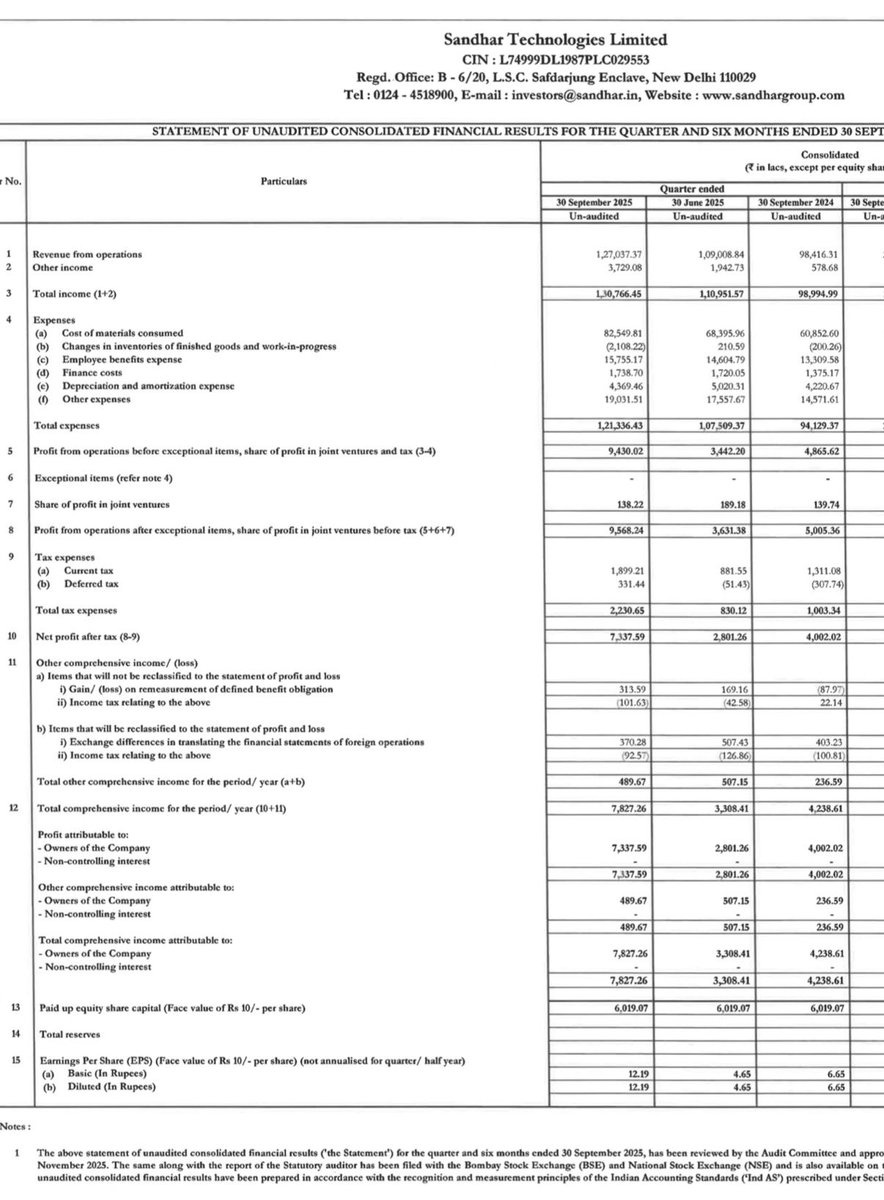

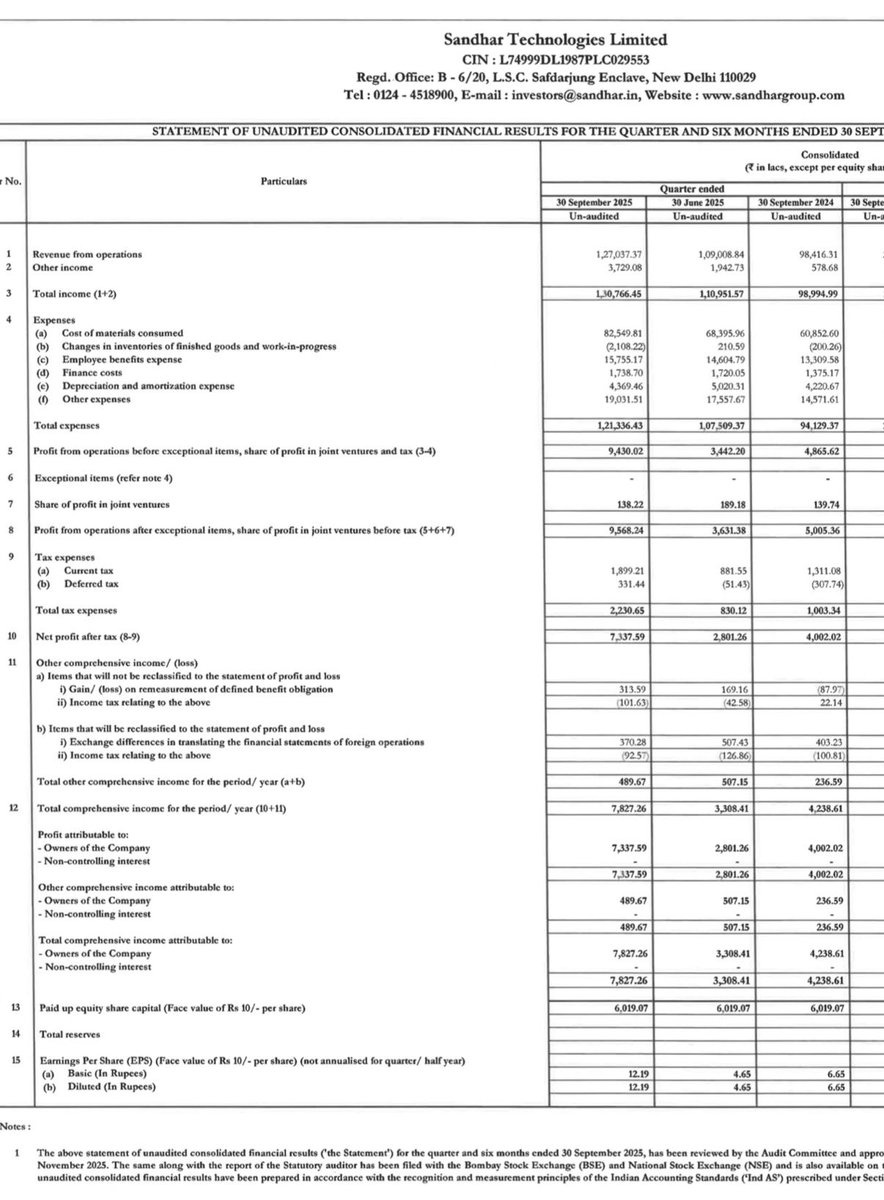

#SANDHAR #SANDHARTECH Sandhar Technologies Q2 result 🔥🔥🔥 - Revenue: ~1,269 (YoY +28% from ~990, QoQ +14% from 1,110) - EBITDA: 118 (YoY +19% from 99, QoQ +16% from 102, margin 9.3% vs 10% YoY) - Net Profit: 73.4 (YoY +84% from 40, QoQ +162% from 28)

#SandharTech Result -YoY ↑ #StockMarket #StockMarketindia #sharemarket #Adani #TataGroup #RVNL #IRFC #VEDL #StocksInFocus #AdaniGroup #Nifty #nifty50 #IpoAlert #StockToWatch #Finnifty #FII

#NSE #SandharTech looks great buy at the current levels. Entered at 295.60 lvls and expecting a tgt of 348.5

#SandharTech❤️🔥 👉• Can Easily Give 30-50% Returns 🚀 👉• ATH Cup Pattern Breakout 🔥 👉Target ~ 685 / 772 (Ultimate Target 900) 👉 SL ~ 538 **Company is in the business of manufacturing and assembling of automotive components in India 📊

#SandharTech CMP 540 ~Auto ancillary 🎯Highly undervalued #StockToWatch #SwingTrading

Top 3 strong techno funda stocks for coming days 🔥 15 to 20% upside possible ✅ 1. #SandharTech CMP 515 ~Auto ancillary 🎯Highly undervalued 2. #Fiemindustries CMP 2090~Auto ancillary 🎯 Undervalued in auto sector 🎯Ready for previous high

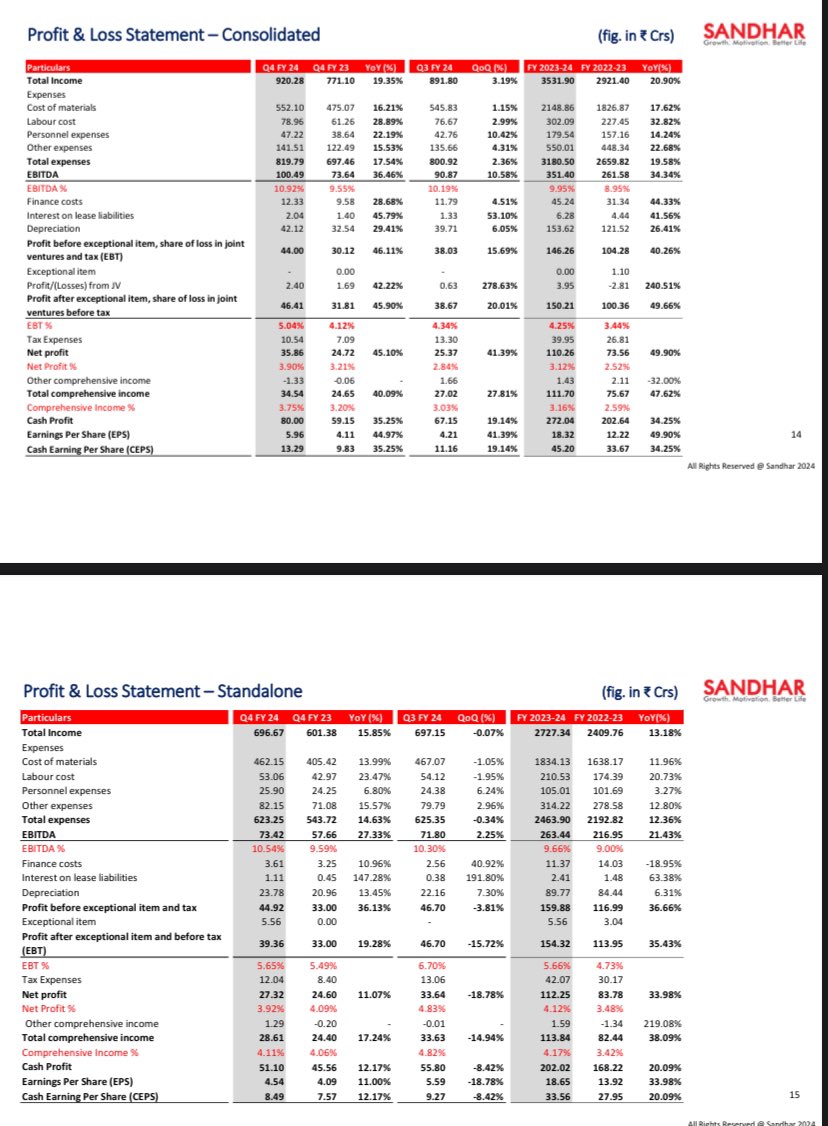

Sandhar Tech : (YOY) Posted Decent 👌Results✅ Net profit ⬆️ 45.3% at ₹35.9 cr vs ₹24.7 cr✅ Revenue ⬆️ 20% at ₹917.8 cr vs ₹765 cr✅ EBITDA ⬆️ 45.2% at ₹98 cr vs ₹67.5 cr✅ Margin ⬆️ 10.7% vs 8.8%✅ EPS ⬆️ 18.32 vs 12.22 ✅ #sandhartech

#Sandhar Technologies #SandharTech Good #Q2_FY26 results 👇🏻 👉🏻 Revenue: ₹1270 cr vs ₹984 cr ⬆️ 29% YoY, vs ₹1090 cr ⬆️ 16% QoQ 👉🏻 Other Income: ₹37 cr vs ₹6cr(YoY) 👉🏻 PBT: ₹94 cr vs ₹49 cr ⬆️ 92% YoY, vs ₹34 cr ⬆️ 176% QoQ 👉🏻 PAT: ₹73 cr vs ₹40 cr ⬆️ 83% YoY, vs…

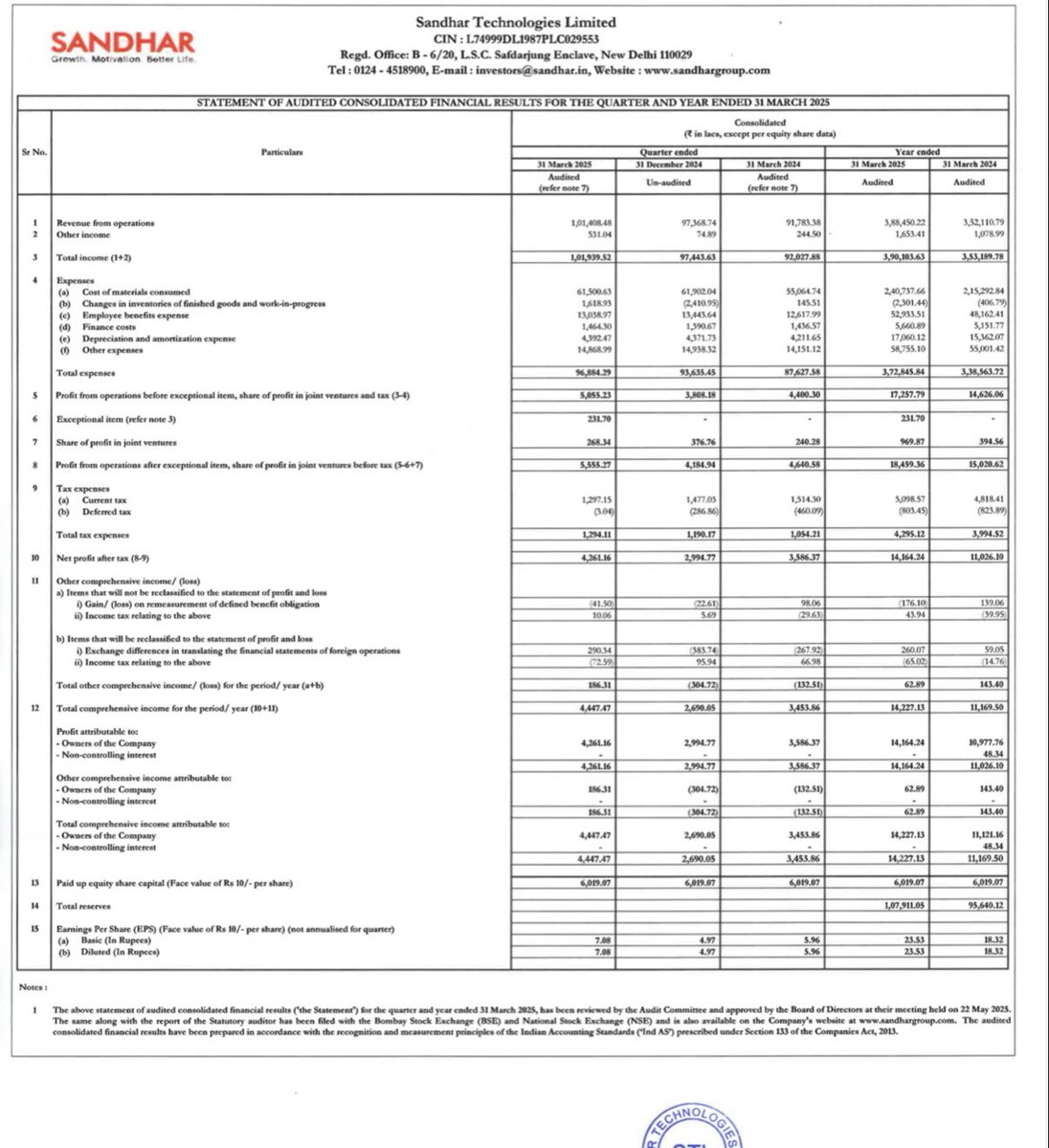

#SANDHARTECH Sandhar Technologies Ltd Q4 Results Good numbers Revenue 1014 cr vs 917 cr up by 10.5% YoY & up by 4.15% QoQ PAT 42.61 cr vs 35.86 cr up by 18.8% YoY & up by 42.3% QoQ Dividend: ₹3.50 Exceptional Gain: ₹2.32 Cr (impairment reversal) OCF (FY25): ₹246.97 Cr vs…

🚨#SandharTech Q3FY25 concall insights: 👉Management remains optimistic about achieving a revenue target of ₹4,500 Cr for FY25-26, with EBITDA margin projections between 10.50% to 10.95%. 👉PAT margins at 4% in Q3FY25 (1/n)

Gabriel India: Investor presentation lists the capex plans for 2023. Market Cap: 3300 Cr PE: 23.3 ROCE: 22 % #gabriel #sswl #sandhartech #pricol #autoancillaries #StocksInFocus #stockstowatch #NiftyBank #IndependenceDay2023 #IndependenceDay

#SandharTech good price volume action yesterday. In a good sector. Decent valuations. Disc - not invested

#SandharTech @Ramesh_views bhai suggested at 455, did 674+ -> almost 50% in 6 months Cmp 670, support 610 which was last cup and handle breakout. Upside 755/810/890/985/1075/1190++ Fresh view above 1200 Keep strict SL #ShareView for educational purposes only #StockMarket

#sandhartech Good move after results here This one has tested patience Hoping for a big move #stocks

Sandhar Technologies Ltd Q4 FY25 Results:- Revenue 1014 cr vs 917 cr up by 10.5% YoY & up by 4.15% QoQ PAT 42.61 cr vs 35.86 cr up by 18.8% YoY & up by 42.3% QoQ Higher Other Income this Q4 This Q4 Exceptional gain of 2.31 cr #sandhartech #Nifty50 #Q4Results #Q4FY25 #Nifty

🚗 Sandhar Technologies delivered solid Q2FY26 performance! 📈 Revenue: ₹1,153 Cr (+33% YoY) | EBITDA margin: 10.4% Expanding ADC & CFD plants in Pune & South India. Focus on EV components, safety systems & exports to sustain double-digit growth 🌍 #SandharTech #AutoAncillary

#Sandhar Technologies #SandharTech Good #Q2_FY26 results 👇🏻 👉🏻 Revenue: ₹1270 cr vs ₹984 cr ⬆️ 29% YoY, vs ₹1090 cr ⬆️ 16% QoQ 👉🏻 Other Income: ₹37 cr vs ₹6cr(YoY) 👉🏻 PBT: ₹94 cr vs ₹49 cr ⬆️ 92% YoY, vs ₹34 cr ⬆️ 176% QoQ 👉🏻 PAT: ₹73 cr vs ₹40 cr ⬆️ 83% YoY, vs…

#SANDHAR #SANDHARTECH Sandhar Technologies Q2 result 🔥🔥🔥 - Revenue: ~1,269 (YoY +28% from ~990, QoQ +14% from 1,110) - EBITDA: 118 (YoY +19% from 99, QoQ +16% from 102, margin 9.3% vs 10% YoY) - Net Profit: 73.4 (YoY +84% from 40, QoQ +162% from 28)

Sandhar to Maine kaha tha 😂😂😂 Played out well :) Congratulations to all those holding Superb results ❤️❤️❤️ No reco #Sandhar #SandharTech

#SandharTech CMP 540 ~Auto ancillary 🎯Highly undervalued #StockToWatch #SwingTrading

Top 3 strong techno funda stocks for coming days 🔥 15 to 20% upside possible ✅ 1. #SandharTech CMP 515 ~Auto ancillary 🎯Highly undervalued 2. #Fiemindustries CMP 2090~Auto ancillary 🎯 Undervalued in auto sector 🎯Ready for previous high

Top 3 strong techno funda stocks for coming days 🔥 15 to 20% upside possible ✅ 1. #SandharTech CMP 515 ~Auto ancillary 🎯Highly undervalued 2. #Fiemindustries CMP 2090~Auto ancillary 🎯 Undervalued in auto sector 🎯Ready for previous high

Sandhar 550 now & lots of posts… now 😄😄😄 No reco & biased #Sandhar #SandharTech

Sandhar that’s the tweet, That’s the sweet tweet :) No FOMO pls 🤞 No reco too #Sandhar #SandharTech

Sandhar tech 4% up 🔥🔥 It is highly undervalued 😊 #Sandhartech

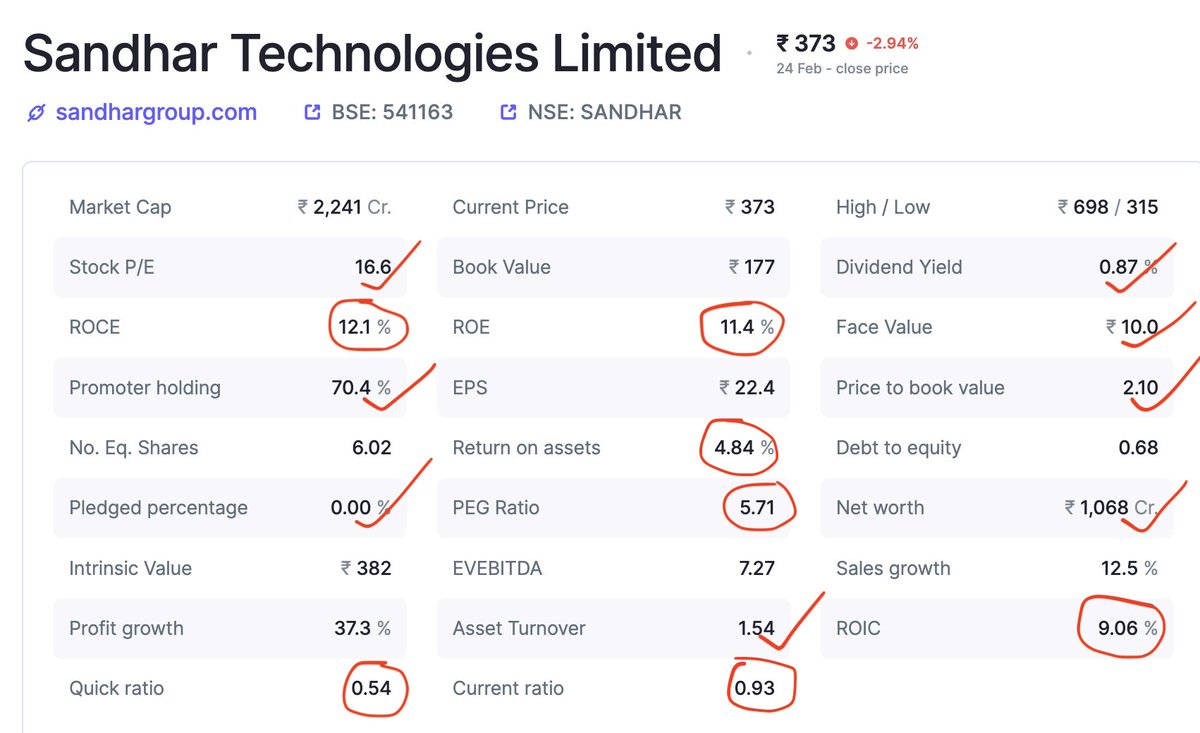

1. Sandhar tech is manufacturing a Automotive locking system, vision system, helmets , fuel pumps & filters. CMP 527 Stock pe :: 22.9 (undervalued) Industry PE :: 29.7 EPS::23.4 September quarter result can be ATH ❤️ Inverted head & should breakout on daily chart #Sandhartech

1. Sandhar tech is manufacturing a Automotive locking system, vision system, helmets , fuel pumps & filters. CMP 527 Stock pe :: 22.9 (undervalued) Industry PE :: 29.7 EPS::23.4 September quarter result can be ATH ❤️ Inverted head & should breakout on daily chart #Sandhartech

Finally played out well. Hope it sustains & results turn out to be good for Sandhar too :) Kabhi kabhi hum bhi technical kar lete hai 😅😅😅 No reco. Waiting for results #Sandhar #SandharTech

Sandhar that’s the tweet, That’s the sweet tweet :) No FOMO pls 🤞 No reco too #Sandhar #SandharTech

Bought #SANDHARTECH at 507... Good volume accumulation and favourite auto sector

#SandharTech good price volume action yesterday. In a good sector. Decent valuations. Disc - not invested

Sandhar that’s the tweet, That’s the sweet tweet :) No FOMO pls 🤞 No reco too #Sandhar #SandharTech

60. 🚨 Corporate Action Alert! 📌 #SandharTech (541163) 💰 Final Dividend: Rs. 3.5000 📅 Ex-Date: 12-Sep-2025 🗓 Record Date: 12-Sep-2025 ⛔ No-Delivery Period: 10–12 Sep 2025 #Dividend #CorporateActions #StockMarket #Investing #BSE

Sandhar Tech Narender K. Dogra ceased as VP Finance on Aug 31, 2025; appointed Advisor from Sep 1, 2025; delay explained #SandharTech #Investor #niftycrash #OptionsTreding #Investing #BREAKING #Nifty #StockMarketUpdate

1. Sandhar tech is manufacturing a Automotive locking system, vision system, helmets , fuel pumps & filters. CMP 527 Stock pe :: 22.9 (undervalued) Industry PE :: 29.7 EPS::23.4 September quarter result can be ATH ❤️ Inverted head & should breakout on daily chart #Sandhartech

#SandharTech CMP 540 ~Auto ancillary 🎯Highly undervalued #StockToWatch #SwingTrading

Top 3 strong techno funda stocks for coming days 🔥 15 to 20% upside possible ✅ 1. #SandharTech CMP 515 ~Auto ancillary 🎯Highly undervalued 2. #Fiemindustries CMP 2090~Auto ancillary 🎯 Undervalued in auto sector 🎯Ready for previous high

#SandharTech Result -YoY ↑ #StockMarket #StockMarketindia #sharemarket #Adani #TataGroup #RVNL #IRFC #VEDL #StocksInFocus #AdaniGroup #Nifty #nifty50 #IpoAlert #StockToWatch #Finnifty #FII

#SANDHAR #SANDHARTECH Sandhar Technologies Q2 result 🔥🔥🔥 - Revenue: ~1,269 (YoY +28% from ~990, QoQ +14% from 1,110) - EBITDA: 118 (YoY +19% from 99, QoQ +16% from 102, margin 9.3% vs 10% YoY) - Net Profit: 73.4 (YoY +84% from 40, QoQ +162% from 28)

#SandharTech❤️🔥 👉• Can Easily Give 30-50% Returns 🚀 👉• ATH Cup Pattern Breakout 🔥 👉Target ~ 685 / 772 (Ultimate Target 900) 👉 SL ~ 538 **Company is in the business of manufacturing and assembling of automotive components in India 📊

#NSE #SandharTech looks great buy at the current levels. Entered at 295.60 lvls and expecting a tgt of 348.5

#SandharTech @Ramesh_views bhai suggested at 455, did 674+ -> almost 50% in 6 months Cmp 670, support 610 which was last cup and handle breakout. Upside 755/810/890/985/1075/1190++ Fresh view above 1200 Keep strict SL #ShareView for educational purposes only #StockMarket

Gabriel India: Investor presentation lists the capex plans for 2023. Market Cap: 3300 Cr PE: 23.3 ROCE: 22 % #gabriel #sswl #sandhartech #pricol #autoancillaries #StocksInFocus #stockstowatch #NiftyBank #IndependenceDay2023 #IndependenceDay

Sandhar Technologies Ltd Q4 FY25 Results:- Revenue 1014 cr vs 917 cr up by 10.5% YoY & up by 4.15% QoQ PAT 42.61 cr vs 35.86 cr up by 18.8% YoY & up by 42.3% QoQ Higher Other Income this Q4 This Q4 Exceptional gain of 2.31 cr #sandhartech #Nifty50 #Q4Results #Q4FY25 #Nifty

Something went wrong.

Something went wrong.

United States Trends

- 1. Sonny Gray 6,587 posts

- 2. Dick Fitts N/A

- 3. Red Sox 6,682 posts

- 4. #yummymeets N/A

- 5. Godzilla 19.4K posts

- 6. National Treasure 4,900 posts

- 7. Clarke 6,163 posts

- 8. Rush Hour 4 4,060 posts

- 9. Gone in 60 1,731 posts

- 10. Raising Arizona N/A

- 11. #GMMTV2026 4.25M posts

- 12. Happy Thanksgiving 20.6K posts

- 13. Giolito N/A

- 14. Lord of War 1,244 posts

- 15. NextNRG Inc N/A

- 16. Thankful 50K posts

- 17. Academic All-District N/A

- 18. Chuck and Nancy 4,147 posts

- 19. Breslow N/A

- 20. Chaim 1,122 posts