#spdrliquidity search results

#SPDRLiquidity Power of the SuperIndex®️ Is there a solution NOW to the problem of MARKET DOWNTURNS? How to mitigate risk but maintain performance ? With Amazing liquidity? And a track record of success? This is the world’s first true Super Index!

How does understanding the “plumbing” 🚰 of the #ETF market disprove claims that it will cause the next downturn? @Dougielarge of @VirtuFinancial explains: bit.ly/39pe122 #SPDRLiquidity

Q: Is famed investor Michael Burry right about the “dangers” ⚠️ of #ETFs? A: @Dougielarge of @VirtuFinancial has no problem saying it: “He’s wrong” 🙅♂️. More on that ⬇️. For additional liquidity insights and videos: bit.ly/39pe122 #SPDRLiquidity

We asked ”what liquidity event could happen in 2020 that institutional investors may not be prepared for?” Then it happened. Watch our full State of Liquidity series for #liquidity insights from industry experts: bit.ly/39pe122 #SPDRLiquidity

“He’s wrong.” @Dougielarge from @Virtufinancial dismisses Michael Burry’s claim that ETFs are dangerous. Watch the full video, as Doug Cifu mic drops here: bit.ly/38mgjP3 #SPDRLiquidity

Michael Burry has argued #ETFs are a bubble, that have inflated pricing and can trigger the next downturn. Does our panel of experts from @goldmansachs, @virtufinancial, @Citi and State Street agree? ⚠️ Spoiler alert: NO. Find out why: bit.ly/39pe122 #SPDRLiquidity

Are market makers the unsung heroes of liquidity? 🦸♂️🦸♀️ @Dougielarge of @VirtuFinancial thinks so. Watch the full video 📺 to find out why: bit.ly/38mgjP3 #SPDRLiquidity

Institutional investors are tuning in to our new video series for insights from industry experts @LloydBlankfein, @Dougielarge, Carey Lathrop and our own Gunjan Chauhan. Watch the first 3 videos in our 6-part State of Liquidity series: bit.ly/2UEj75a #SPDRLiquidity

How does today’s fragmented marketplace impact the market’s capabilities, in good times 👍 and bad 👎? Watch as our panel of industry experts explain 👇. For other videos in our liquidity series: bit.ly/39pe122 #SPDRLiquidity

In a global economy rife with challenges like coronavirus and geopolitical tensions, investors need to know all they can about #liquidity 🧠💧. Watch our 6-part video series for insights from experts like @LloydBlankfein: bit.ly/3dSf5iu #SPDRLiquidity

“Sentiment can shift radically; liquidity can be abundant one minute and zero the next.” –@lloydblankfein Learn more about the state of liquidity: bit.ly/39pe122 #SPDRLiquidity

How are tech advancements such as AI trading 📺 impacting an already-fragmented market? Watch @Dougielarge of @VirtuFinancial and our panel of industry experts discuss. #SPDRLiquidity

The market doesn’t wait until 4PM 🕓 to make moves, why should you? Check out the benefits of #ETF #liquidity: bit.ly/2LvZzLT #SPDRLiquidity #ItsLiquidityTime

Are you ready for anything the market may throw at you? Check out our new State of Liquidity video series, produced with @Bloomberg, for data, insights, and expert opinions: bit.ly/2UEj75a #SPDRLiquidity

.@Dougielarge argues that Michael Burry is wrong in claiming ETFs are a bubble. The rest of our panel of experts agree. Find out why below, and watch more of their discussion on the state of liquidity here: bit.ly/39pe122 #SPDRLiquidity

.@AlexisGlick asks: “Should market makers be compensated by ETF providers?” @Dougielarge: “Yes.” Watch below to find out why, and watch our full State of Liquidity series for more insights from our panel of industry experts: bit.ly/39pe122 #SPDRLiquidity

What does @Dougielarge mean when he says, “not all ETFs are created equal”? 🤔 Find out at [4:10] below—and watch the full State of Liquidity video series here: bit.ly/39pe122 #SPDRLiquidity

#MutualFunds can only trade at the end of the day, meaning they have to wait for the green light. ETFs can trade all day. Learn how ETFs can help get you in the investing fast lane: bit.ly/2LvZzLT #SPDRLiquidity #ItsLiquidityTime

Markets can go from 0 ⏩ 100 real quick. Can your portfolio get up to speed when you need it to? Find out how #ETF #liquidity can help: bit.ly/2LvZzLT #SPDRLiquidity #ItsLiquidityTime

#MutualFunds can only trade at the end of the day, meaning they have to wait for the green light. ETFs can trade all day. Learn how ETFs can help get you in the investing fast lane: bit.ly/2LvZzLT #SPDRLiquidity #ItsLiquidityTime

The market doesn’t wait until 4PM 🕓 to make moves, why should you? Check out the benefits of #ETF #liquidity: bit.ly/2LvZzLT #SPDRLiquidity #ItsLiquidityTime

Markets can go from 0 ⏩ 100 real quick. Can your portfolio get up to speed when you need it to? Find out how #ETF #liquidity can help: bit.ly/2LvZzLT #SPDRLiquidity #ItsLiquidityTime

.@Dougielarge argues that Michael Burry is wrong in claiming ETFs are a bubble. The rest of our panel of experts agree. Find out why below, and watch more of their discussion on the state of liquidity here: bit.ly/39pe122 #SPDRLiquidity

.@AlexisGlick asks: “Should market makers be compensated by ETF providers?” @Dougielarge: “Yes.” Watch below to find out why, and watch our full State of Liquidity series for more insights from our panel of industry experts: bit.ly/39pe122 #SPDRLiquidity

What does @Dougielarge mean when he says, “not all ETFs are created equal”? 🤔 Find out at [4:10] below—and watch the full State of Liquidity video series here: bit.ly/39pe122 #SPDRLiquidity

How are tech advancements such as AI trading 📺 impacting an already-fragmented market? Watch @Dougielarge of @VirtuFinancial and our panel of industry experts discuss. #SPDRLiquidity

“Sentiment can shift radically; liquidity can be abundant one minute and zero the next.” –@lloydblankfein Learn more about the state of liquidity: bit.ly/39pe122 #SPDRLiquidity

We asked ”what liquidity event could happen in 2020 that institutional investors may not be prepared for?” Then it happened. Watch our full State of Liquidity series for #liquidity insights from industry experts: bit.ly/39pe122 #SPDRLiquidity

Michael Burry has argued #ETFs are a bubble, that have inflated pricing and can trigger the next downturn. Does our panel of experts from @goldmansachs, @virtufinancial, @Citi and State Street agree? ⚠️ Spoiler alert: NO. Find out why: bit.ly/39pe122 #SPDRLiquidity

How does understanding the “plumbing” 🚰 of the #ETF market disprove claims that it will cause the next downturn? @Dougielarge of @VirtuFinancial explains: bit.ly/39pe122 #SPDRLiquidity

In a global economy rife with challenges like coronavirus and geopolitical tensions, investors need to know all they can about #liquidity 🧠💧. Watch our 6-part video series for insights from experts like @LloydBlankfein: bit.ly/3dSf5iu #SPDRLiquidity

How does today’s fragmented marketplace impact the market’s capabilities, in good times 👍 and bad 👎? Watch as our panel of industry experts explain 👇. For other videos in our liquidity series: bit.ly/39pe122 #SPDRLiquidity

Q: Is famed investor Michael Burry right about the “dangers” ⚠️ of #ETFs? A: @Dougielarge of @VirtuFinancial has no problem saying it: “He’s wrong” 🙅♂️. More on that ⬇️. For additional liquidity insights and videos: bit.ly/39pe122 #SPDRLiquidity

“He’s wrong.” @Dougielarge from @Virtufinancial dismisses Michael Burry’s claim that ETFs are dangerous. Watch the full video, as Doug Cifu mic drops here: bit.ly/38mgjP3 #SPDRLiquidity

Are you ready for anything the market may throw at you? Check out our new State of Liquidity video series, produced with @Bloomberg, for data, insights, and expert opinions: bit.ly/2UEj75a #SPDRLiquidity

Are market makers the unsung heroes of liquidity? 🦸♂️🦸♀️ @Dougielarge of @VirtuFinancial thinks so. Watch the full video 📺 to find out why: bit.ly/38mgjP3 #SPDRLiquidity

Institutional investors are tuning in to our new video series for insights from industry experts @LloydBlankfein, @Dougielarge, Carey Lathrop and our own Gunjan Chauhan. Watch the first 3 videos in our 6-part State of Liquidity series: bit.ly/2UEj75a #SPDRLiquidity

Q: Who helps create #liquidity 💧 and drive innovation 💡 in the marketplace? A: bit.ly/38mgjP3 #SPDRLiquidity

Should market makers be compensated by #ETF providers 💰? @Dougielarge: “Yes.” Learn why ⬇️ and to view other episodes in our State of Liquidity video series: bit.ly/38mgjP3 #SPDRLiquidity

👋👋👋 #SchwabIMPACT 2019 advisors! We’re here dropping knowledge about total cost of ownership—and, of course, giving out swag! Make sure you stop by booth #1113. #TradingCostsMatter #SPDRLiquidity

#SchwabIMPACT attendees: Visit us at booth #1113, to grab an insulated mug and bottle of water. Drink up all the liquidity info you need to make smarter decisions and lower your total cost of ownership. #TradingCostsMatter #SPDRLiquidity

All of the above! Learn how expense ratio, bid/ask spread, trading costs AND commissions (yes, they do still exist) impact total cost of ownership: bit.ly/2ucHfCD #KnowTheTotalCost #SPDRLiquidity

All of the above! Expense ratio, commissions, and bid/ask spread are important parts of the TCO equation. Don’t let them or Sasquatch creep up on you. Learn more about total cost of ownership: bit.ly/2SKzEoO #KnowTheTotalCost #SPDRLiquidity

We’re looking forward to seeing you at #SchwabIMPACT! Stop by booth #1113 for some swag and info on how liquidity due diligence can lower your total cost of ownership. #TradingCostsMatter #SPDRLiquidity

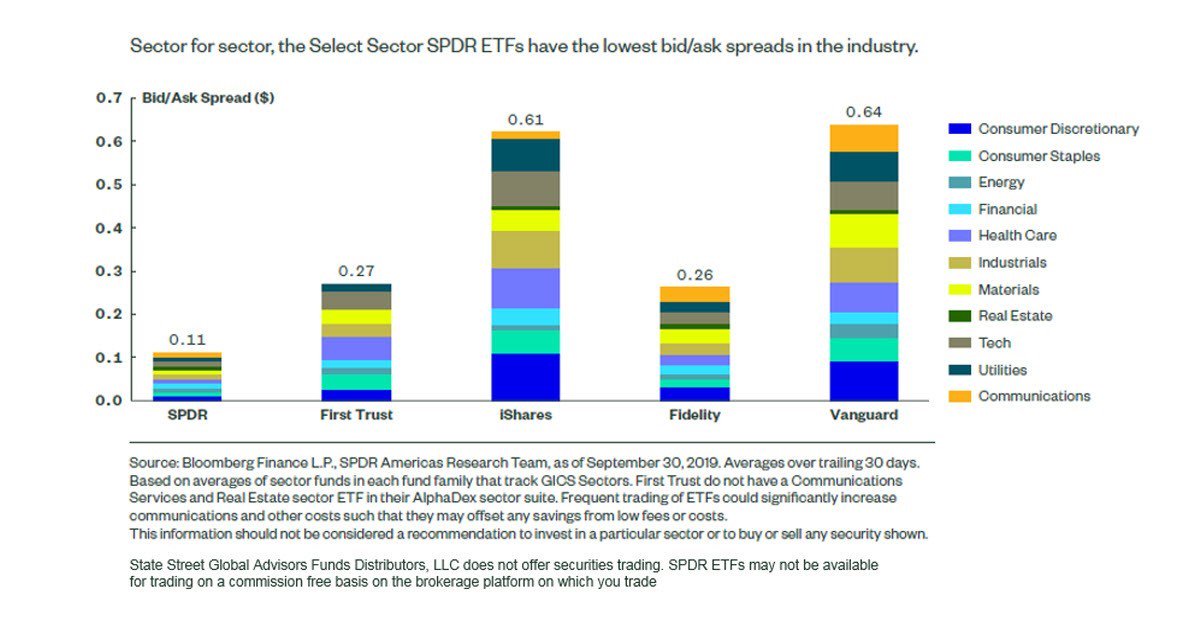

Sector for sector, the Select Sector SPDR ETFs have the lowest bid/ask spread in the industry. So $0 commission trading* + Lowest bid/ask spread = lower total cost of ownership and happy investors: bit.ly/2NwpXWD #SPDRLiquidity #winning *on select 3rd party platforms

If you said “All of the above,” then you’re seeing the bigger picture! Learn why it’s important to #KnowTheTotalCost: bit.ly/2SKzEoO #SPDRLiquidity

Don’t make a “snap” judgment. Look at the bigger picture. Trading costs like bid-ask spreads don’t have to be unidentified flying objects that creep behind you. Learn more: bit.ly/2SKzEoO #KnowTheTotalCost #SPDRLiquidity

#SPDRLiquidity Power of the SuperIndex®️ Is there a solution NOW to the problem of MARKET DOWNTURNS? How to mitigate risk but maintain performance ? With Amazing liquidity? And a track record of success? This is the world’s first true Super Index!

Something went wrong.

Something went wrong.

United States Trends

- 1. #BaddiesUSA 63.9K posts

- 2. TOP CALL 3,575 posts

- 3. #centralwOrldXmasXFreenBecky 422K posts

- 4. SAROCHA REBECCA DISNEY AT CTW 439K posts

- 5. AI Alert 1,186 posts

- 6. Rams 29.8K posts

- 7. #LAShortnSweet 23.1K posts

- 8. Market Focus 2,415 posts

- 9. #LingOrmDiorAmbassador 224K posts

- 10. Token Signal 1,619 posts

- 11. Check Analyze N/A

- 12. Scotty 10.3K posts

- 13. Chip Kelly 8,987 posts

- 14. sabrina 64.4K posts

- 15. #ITWelcomeToDerry 16.8K posts

- 16. Vin Diesel 1,478 posts

- 17. Raiders 68.1K posts

- 18. Ahna 7,646 posts

- 19. DOGE 175K posts

- 20. Stacey 24.1K posts