#suptech search results

Our CEO Carmelle Cadet joins global leaders reimagining how regulators supervise in the digital era. Modern supervision isn’t about control, it’s about clarity, trust, and real-time insight. Discover how regulators are modernizing with EMTECH hubs.li/Q03QMw_g0 #SupTech

We built technology to make supervision smarter. But in doing so, are we reshaping the very foundations of trust and oversight? Join Swiss Financial Market Supervisory Authority FINMA, Marlene Amstad at #SFF2025 as she explores how #SupTech is transforming financial supervision…

“A sandbox isn’t an innovation hub — it’s where innovators come for a regulatory verdict: yes or no.” — Kwame Oppong, Bank of Ghana 🇬🇭 Discover how regulatory sandboxes bridge innovation & compliance 👇 hubs.li/Q03P-x6K0 #RegTech #SupTech #VASPFrameworks #DigitalAssets

🌟 #ENTERTECH, özel destek programı SUPTECH ile seçkin girişimlere ihtiyaca yönelik terzi usulü kurgulanmış ayni destekler sunuyor. 2023 yılında Biyopol ve Team V Games firmalarımız #SUPTECH ile ivmelendi. Hedefe beraber yürüyoruz!

Smart supervision comes to the #Pacific. A new #SupTech blueprint will now empower central banks to drive real-time insights, boost inclusion, & protect consumers across the islands. Smarter regulation starts here. Find the details here: tinyurl.com/yzrk6cx6 #SupTech…

The BIS Innovation Hub organised its SupTech & AI Symposium from 1-3 October at Basel, Switzerland, welcoming over 100 participants from 30 regulatory bodies, including Rami Lahouar from the Financial Analysis and Innovation department, who represented the QFCRA. #QFCRA #SupTech

#Domains for Sale AMLSupervision.com AMLSupervisor.com #RegTech #SupTech #AML #AMLSupervision #Blockchain #Compliance #KYC #FinancialCrime #FinTech #DigitalAssets #Supervision #DomainNames #LegalTech #Finance #Banking #Monitor #AiAML #Crypto #ComplianceTech

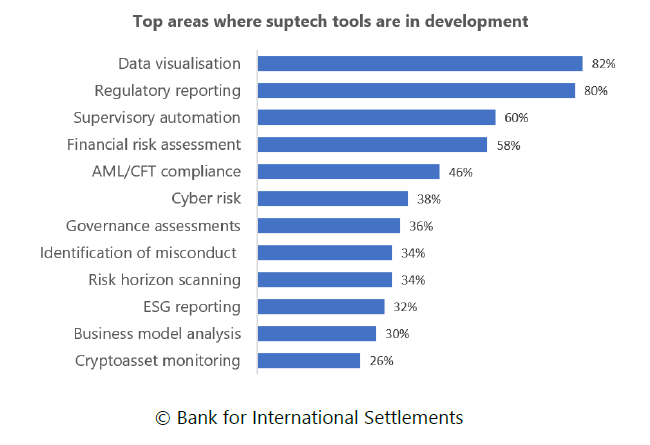

How can we boost adoption of new technology to supervise financial institutions? A new FSI Brief discusses how we can build a more vibrant #Suptech ecosystem & enhance collaboration between authorities & firms #FinancialStabilityInstitute #BISInnovationHub bis.org/fsi/fsibriefs2…

📜 2nd Theme of 9th Doha Islamic Finance Conference, Titled: (#RegTech and #SupTech in Islamic Finance) 🗓 14/03/2023 at Sheraton Doha (Al-Majlis Hall). 👉 Register Here forms.office.com/r/3ZxbHj11ki #Metaverse #META #Crypto #nfts #Doha #digital #Finance #FinTechs #event

Why are regulators buried in spreadsheets? #SupTech and #RegTech are changing the game. Today, they automate data, speed up compliance, & reduce errors. The shift is happening now in Rwanda, the Philippines, & beyond. Will your regulator leap forward? #FinTech #AI…

Financial authorities are focusing their #Suptech efforts on data visualisation and regulatory reporting, with rapidly growing interest in cyber, ESG and cryptoasset monitoring #FinancialStabilityInstitute #BISInnovationHub bis.org/fsi/fsibriefs2…

#SupTech can process risks in real time. Yet, weak, inconsistent data can make the best tools ineffective. Should regulators fix data systems first, or leap ahead with advanced SupTech? Read our blog tinyurl.com/423jcyn3 & share your perspective in comments. #RegTech…

Supervisory authorities with a #Suptech strategy are more likely to have suptech tools that are critical to their supervisory processes #FinancialStabilityInstitute bis.org/fsi/publ/insig…

#Suptech tools can process vast amounts of structured and #unstructureddata bit.ly/3WOb0SZ #Finance #FinancialTech #TechPR #Technology #DigitalTransformation #AI #Startup

How #suptech is playing a role in helping #regulators promote #financialinclusion and keep up with rapid #techinnovations. bit.ly/3WOb0SZ #Finance #FinancialTech #TechPR #Technology #DigitalTransformation #AI #Startup

💼 IRIS Business Services Ltd | Mar 2025 Results Out #IRISBusinessServices #RegTech #SupTech #FinTech #Earnings Mixed Performance 😐 📊 Key Metrics Revenue (REV): 📅 Mar 2025: ₹34.64 Cr 📅 Dec 2024: ₹32.83 Cr 📅 Mar 2024: ₹30.35 Cr 📉 ⬆️5.51% QoQ, ⬆️14.13% YoY Profit…

🙏Thank you to all participants & instructors of 6th Advanced Training week @EU_SDFA focusing on #AI & #ML for #Suptech. 🌟Participants engaged in intensive, cross-functional team activities focusing on problem-solving & prototyping innovative solutions 👉bit.ly/3xoUi4o

Last week we launched the BIS Toronto Innovation Centre in collaboration with the @bankofcanada. The Centre’s initial focus will be on next-generation financial market infrastructures, #Suptech and #OpenFinance bis.org/about/bisih/lo…

🌟This week we welcome 36 participants at the 6th Advanced Training Week on #AI & #ML for #Suptech. Our participants will dive into intensive, cross-functional team activities, focusing on problem-solving and prototyping innovative solutions. 👉 bit.ly/3VChiq8

Regulators still depend on spreadsheets & emails for supervision. #SupTech only works with strong data foundations. Find out how your organization can strengthen its data foundations for SupTech in our new blog: tinyurl.com/4vpnd3da #FinTech #DataFoundations…

#SupTech can process risks in real time. Yet, weak, inconsistent data can make the best tools ineffective. Should regulators fix data systems first, or leap ahead with advanced SupTech? Read our blog tinyurl.com/423jcyn3 & share your perspective in comments. #RegTech…

#Domains for Sale AMLSupervision.com AMLSupervisor.com #RegTech #SupTech #AML #AMLSupervision #Blockchain #Compliance #KYC #FinancialCrime #FinTech #DigitalAssets #Supervision #DomainNames #LegalTech #Finance #Banking #Monitor #AiAML #Crypto #ComplianceTech

Why are regulators buried in spreadsheets? #SupTech and #RegTech are changing the game. Today, they automate data, speed up compliance, & reduce errors. The shift is happening now in Rwanda, the Philippines, & beyond. Will your regulator leap forward? #FinTech #AI…

Smart supervision comes to the #Pacific. A new #SupTech blueprint will now empower central banks to drive real-time insights, boost inclusion, & protect consumers across the islands. Smarter regulation starts here. Find the details here: tinyurl.com/yzrk6cx6 #SupTech…

October personal and professional update. #InsurTech #FinTech #SupTech linkedin.com/posts/andresle…

Personal news. I have joined the Tallinn Business Incubator. This is a step to sharpen focus, speak more with customers, and scale what already works. #InsurTech #FinTech #SupTech linkedin.com/posts/andresle…

Our CEO Carmelle Cadet joins global leaders reimagining how regulators supervise in the digital era. Modern supervision isn’t about control, it’s about clarity, trust, and real-time insight. Discover how regulators are modernizing with EMTECH hubs.li/Q03QMw_g0 #SupTech

We built technology to make supervision smarter. But in doing so, are we reshaping the very foundations of trust and oversight? Join Swiss Financial Market Supervisory Authority FINMA, Marlene Amstad at #SFF2025 as she explores how #SupTech is transforming financial supervision…

“A sandbox isn’t an innovation hub — it’s where innovators come for a regulatory verdict: yes or no.” — Kwame Oppong, Bank of Ghana 🇬🇭 Discover how regulatory sandboxes bridge innovation & compliance 👇 hubs.li/Q03P-x6K0 #RegTech #SupTech #VASPFrameworks #DigitalAssets

AFI members joined a Regional Training on Leveraging Digital Technology for Enhanced Consumer Protection, hosted by @CentralBankRw Participants explored how #SupTech, #RegTech & digital tools can boost consumer protection while keeping innovation strong. bit.ly/4qb0wvm

youtube.com

YouTube

Keeping Digital Consumers Safe in a Rapidly Evolving Market

What if financial regulators used AI and data analytics instead of endless paperwork? Discover how SupTech is changing financial oversight in Canada and beyond. Read more here: aifinancial.ca/aif-news-bites… #Finance #AI #SupTech #Innovation #Canada

Innovation meets insight at @GffFintechfest! #IRIS is proud to be part of global conversations on how structured data, iXBRL & AI-powered #SupTech are transforming #compliance & digital supervision. #FintechLeadership #RegTech #FutureOfFinance #IRISBusiness

Bank of #Uganda has launched a supervisory technology (‘#SupTech’) initiative as the authority looks to ‘modernise financial sector supervision’ globalgovernmentfintech.com/bank-of-uganda… @BOU_Official @ProfNuwagaba #AI #technology

#PensionFund #Regulators: The future is digital. #SupTech empowers oversight with: ✅ Structured reporting (#XBRL, CSV) ✅ Automated validations ✅ Real-time dashboards ✅ Predictive risk monitoring See how platforms like #iFile transform supervision 👉 bit.ly/42uhACu

#FinTech #SupTech - Prioritization of SupTech Use Cases under Digital Assets . #Blockchain Source - Cambridge SupTech Lab

We’re exhibiting at the SDMX Global Conference 2025! 📅 Sept 29–Oct 1 | Rome, Italy Come visit us at our booth and discover our SupTech solutions. ➡️ Learn more: eu1.hubs.ly/H0n1M200 #SDMX2025 #SupTech

Exactly a year ago, I announced here that I was leaving EIOPA. How has it been since then? Time for another interview with myself. #InsurTech #FinTech #SupTech #insurance linkedin.com/posts/andresle…

Discover Regnology Metadata Modeller, a powerful collaborative tool for metadata modelling and taxonomy management, transforming complex financial and non-financial regulations into precise, traceable and standardized data concepts. #suptech 🔗 eu1.hubs.ly/H0mWcpR0

Our CEO Carmelle Cadet joins global leaders reimagining how regulators supervise in the digital era. Modern supervision isn’t about control, it’s about clarity, trust, and real-time insight. Discover how regulators are modernizing with EMTECH hubs.li/Q03QMw_g0 #SupTech

Innovation meets insight at @GffFintechfest! #IRIS is proud to be part of global conversations on how structured data, iXBRL & AI-powered #SupTech are transforming #compliance & digital supervision. #FintechLeadership #RegTech #FutureOfFinance #IRISBusiness

#PensionFund #Regulators: The future is digital. #SupTech empowers oversight with: ✅ Structured reporting (#XBRL, CSV) ✅ Automated validations ✅ Real-time dashboards ✅ Predictive risk monitoring See how platforms like #iFile transform supervision 👉 bit.ly/42uhACu

The BIS Innovation Hub organised its SupTech & AI Symposium from 1-3 October at Basel, Switzerland, welcoming over 100 participants from 30 regulatory bodies, including Rami Lahouar from the Financial Analysis and Innovation department, who represented the QFCRA. #QFCRA #SupTech

We built technology to make supervision smarter. But in doing so, are we reshaping the very foundations of trust and oversight? Join Swiss Financial Market Supervisory Authority FINMA, Marlene Amstad at #SFF2025 as she explores how #SupTech is transforming financial supervision…

📜 2nd Theme of 9th Doha Islamic Finance Conference, Titled: (#RegTech and #SupTech in Islamic Finance) 🗓 14/03/2023 at Sheraton Doha (Al-Majlis Hall). 👉 Register Here forms.office.com/r/3ZxbHj11ki #Metaverse #META #Crypto #nfts #Doha #digital #Finance #FinTechs #event

CALLING #SUPTECH VENDORS – submit your expression of interest in the @CambridgeAltFin’s @CamSupTechLab competitions to prototype suptech apps to advance financial #ConsumerProtection supervision in LMICs. Deadline COP 9 March 2023 More at loom.ly/82o2g-M

#Suptech tools can process vast amounts of structured and #unstructureddata bit.ly/3WOb0SZ #Finance #FinancialTech #TechPR #Technology #DigitalTransformation #AI #Startup

🙏Thank you to all participants & instructors of 6th Advanced Training week @EU_SDFA focusing on #AI & #ML for #Suptech. 🌟Participants engaged in intensive, cross-functional team activities focusing on problem-solving & prototyping innovative solutions 👉bit.ly/3xoUi4o

🌎 How can #crossborder collaboration drive the future of #SupTech? On 12 Dec join experts from @EU_SDFA for a discussion on overcoming challenges and driving innovation at #SupTech Week hosted by @CamSupTechLab, @CambridgeAltFin, @wef Tune in 📲 bit.ly/4f0PySl

🌟Yesterday, we welcomed 32 supervisors to our 2nd Advanced Training Week @EU_SDFA. This week is dedicated to the real-world applications and limitations of #AI and #ML for #SupTech and to promote a more efficient and informed supervisory landscape. 👉bit.ly/42N7JGT

Inviting Industry Participation for IFSCA's Core SupTech Solution. For more details please click here at ifsca.gov.in/home/TenderList #SupTech #FinTech #RegTech #FinancialTechnology #Regulation #Supervision #RBS

¿Sabías que el @BancoDeEspana utiliza #InteligenciaArtificial para ayudar en la #supervisión de los bancos? ¿Te interesa saber más sobre #Suptech? bde.es/wbe/es/noticia… #bdeBlog #IA

🚀#SupTech is the focus in the 1st Adv Training Week! @EU_SDFA welcomed 34 participants from the #NCAs. The program bridges theory & hands-on practice, equipping participants with Machine Learning & #digital product design skills. 👉bit.ly/417V1mO

🙌 We’re gearing up for the third cycle of activities at the @EU_SDFA ! Soon, we’ll be opening our doors to welcome participants from #NCAs for the next cycle of Foundational Training Weeks focused on key #digital finance topics and #SupTech tools. 👉 bit.ly/3Z6Uot4

🌟This week we welcome 36 participants at the 6th Advanced Training Week on #AI & #ML for #Suptech. Our participants will dive into intensive, cross-functional team activities, focusing on problem-solving and prototyping innovative solutions. 👉 bit.ly/3VChiq8

EU financial markets regulator to ‘scale up #data capabilities’ globalgovernmentfintech.com/eu-financial-m… @ESMAComms @EBA_News #AI #SupTech #RegTech #MachineLearning #finance

Did you know that the @BancoDeEspana uses #AI to help supervise banks? Would you like to find out more about #suptech? #bdeResearch #bdeBlog bde.es/wbe/es/noticia…

We’re excited to announce 📢 — @vineet_kandoi is now the CFO of @XBRL_IRIS (effective Aug 14, 2025)! 🚀With his sharp financial acumen & vision, Vineet will lead us into the next chapter of growth in #SupTech & #RegTech. 👏 Join us in congratulating him! #CFO #TeamIRIS

Bank of #Uganda has launched a supervisory technology (‘#SupTech’) initiative as the authority looks to ‘modernise financial sector supervision’ globalgovernmentfintech.com/bank-of-uganda… @BOU_Official @ProfNuwagaba #AI #technology

Something went wrong.

Something went wrong.

United States Trends

- 1. #River 5,836 posts

- 2. Jokic 27.8K posts

- 3. Lakers 53K posts

- 4. Namjoon 62.8K posts

- 5. #ReasonableDoubtHulu N/A

- 6. Rejoice in the Lord 1,154 posts

- 7. #AEWDynamite 51.5K posts

- 8. #PieMeACoffee 4,251 posts

- 9. #Pieverse 4,339 posts

- 10. Clippers 15.2K posts

- 11. Shai 16.7K posts

- 12. Simon Nemec 2,363 posts

- 13. Thunder 41K posts

- 14. Mikey 73.5K posts

- 15. Visi 7,723 posts

- 16. Ty Lue 1,270 posts

- 17. Rory 8,444 posts

- 18. Steph 31.8K posts

- 19. Valve 62.2K posts

- 20. Markstrom 1,320 posts