#sectorupdate 搜尋結果

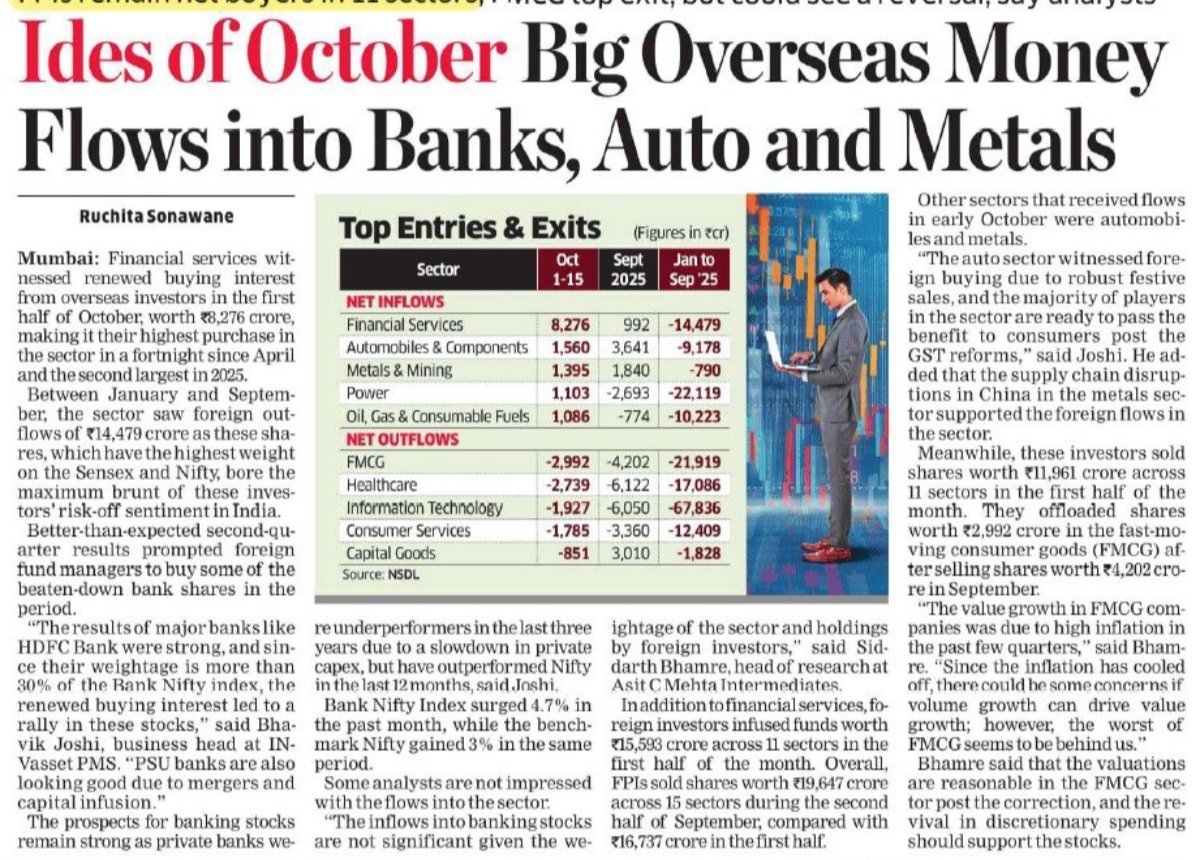

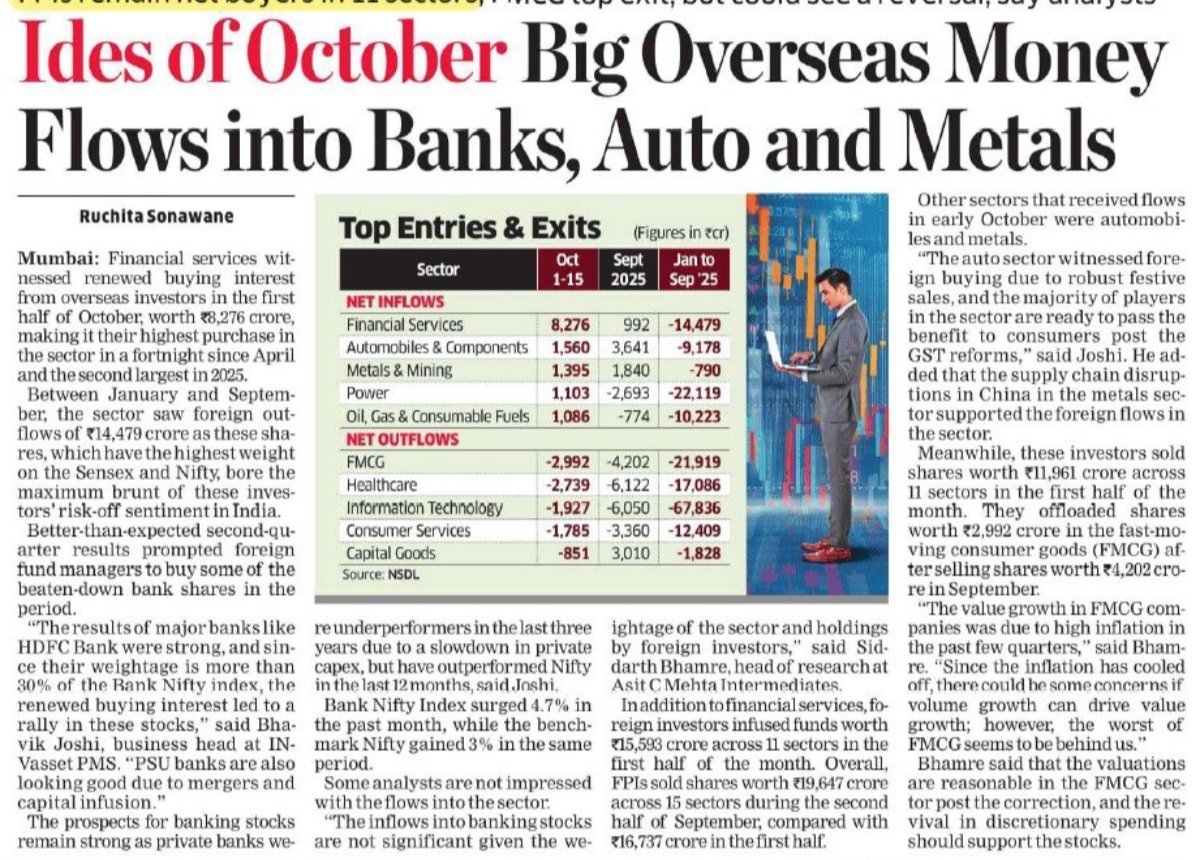

MF/FII Action in October month ( 1-15) 🔥🔥🔥 ♦️New favourite sector 1️⃣BANK 2️⃣ Automotive & Auto ancillary 3️⃣ Metal & Mining ♦️ EXIT sector 1️⃣FMCG 2️⃣ Healthcare 3️⃣IT #Sectorupdate

Weekly NGX Sector Snapshot (July 18–25, 2025): The market rallied for a 9th straight week as ASI hit 134,452.93 pts and market cap soared to ₦85.05 trillion. #nigeriafirst #StockMarketNews #sectorupdate #investinlagos #FinanceNews #stocks

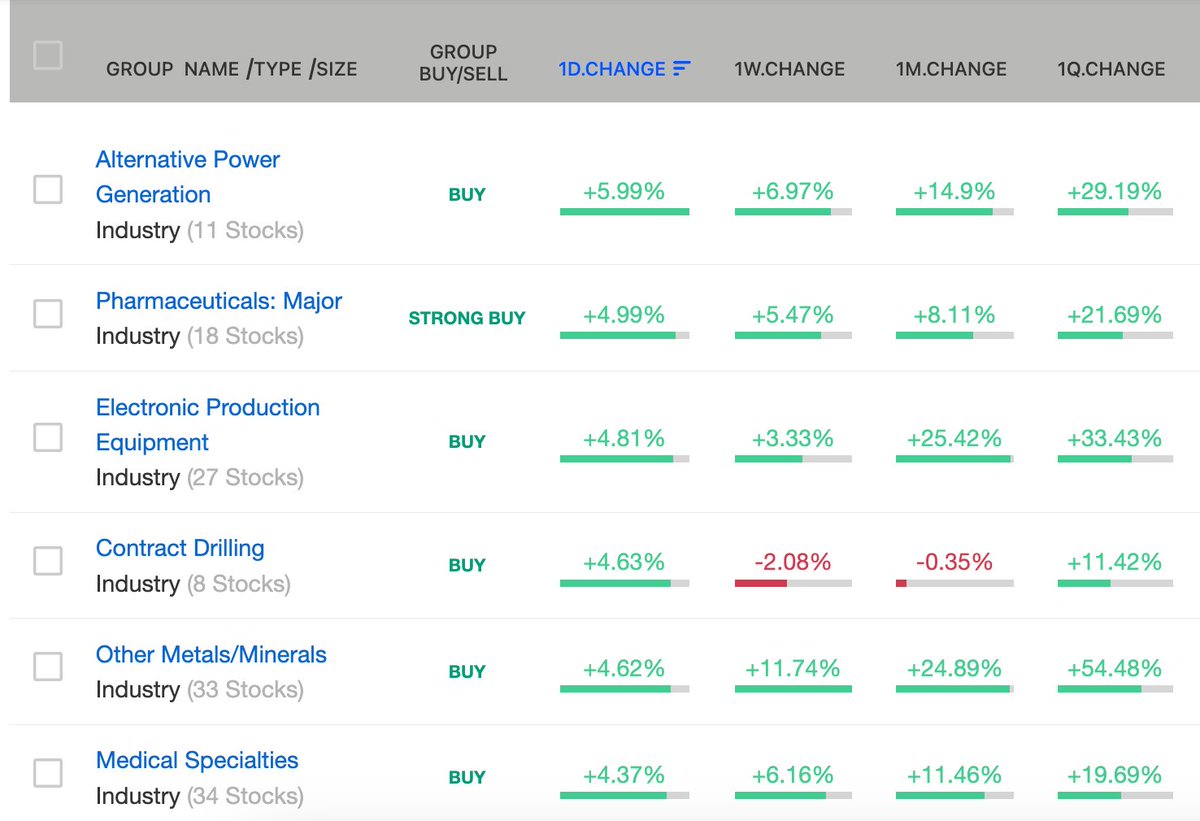

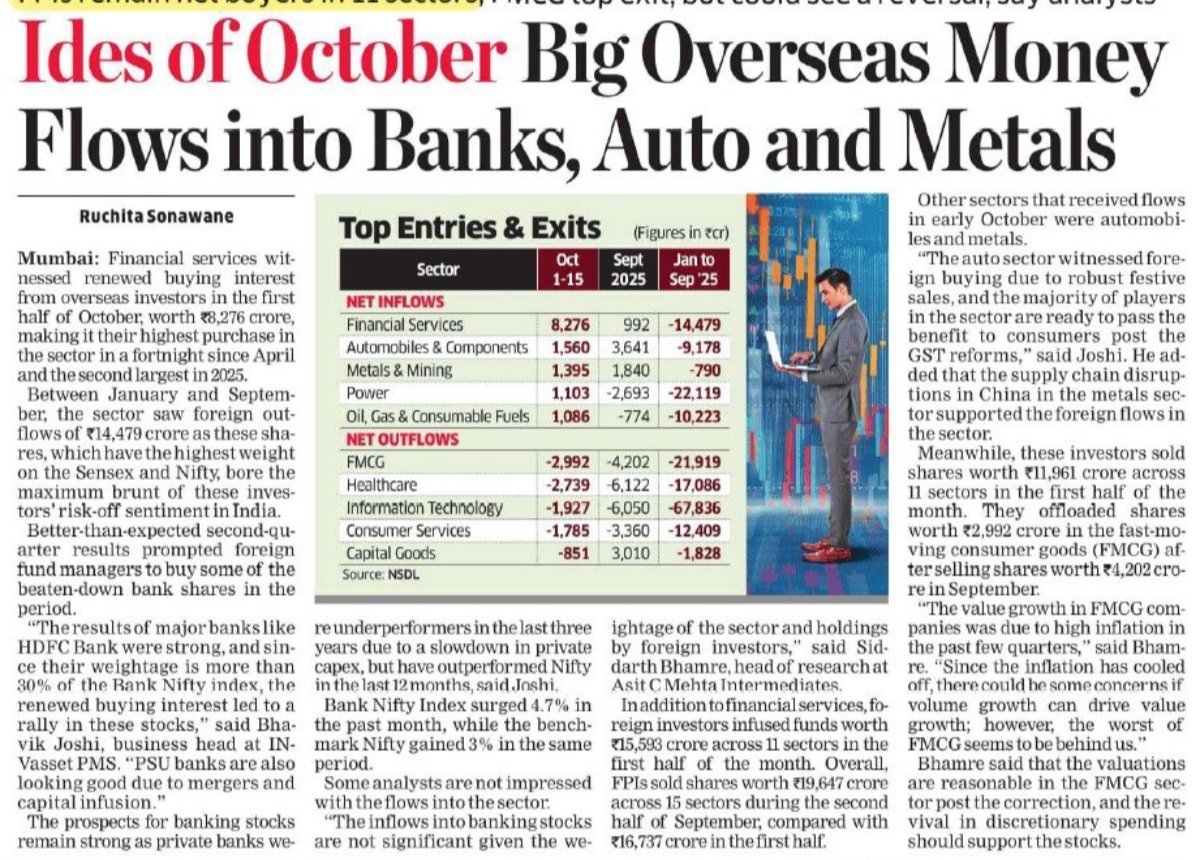

October Sector watch for day 1. #SectorUpdate #IndustryTrends #MarketSectors #StockSignals #TechnicalAnalysis #GrowthStocks #MomentumStocks #StocksToWatch #InvestingInsights #MarketTrends

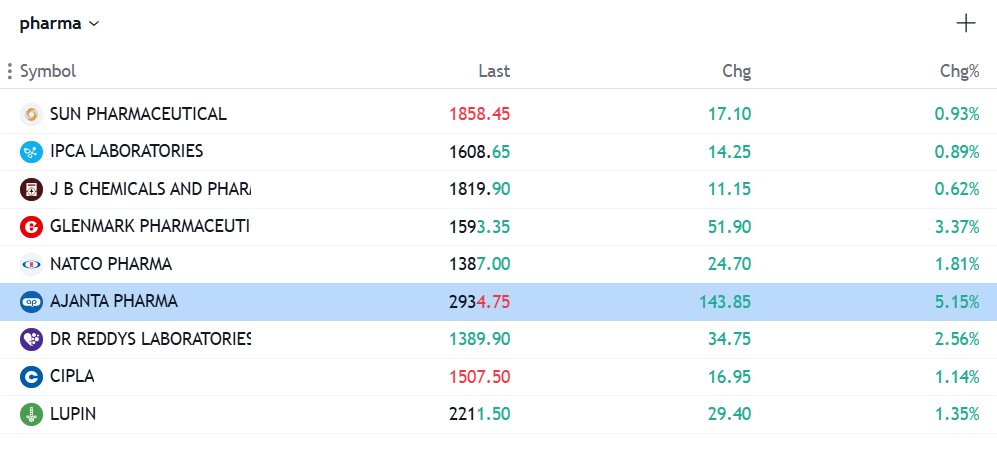

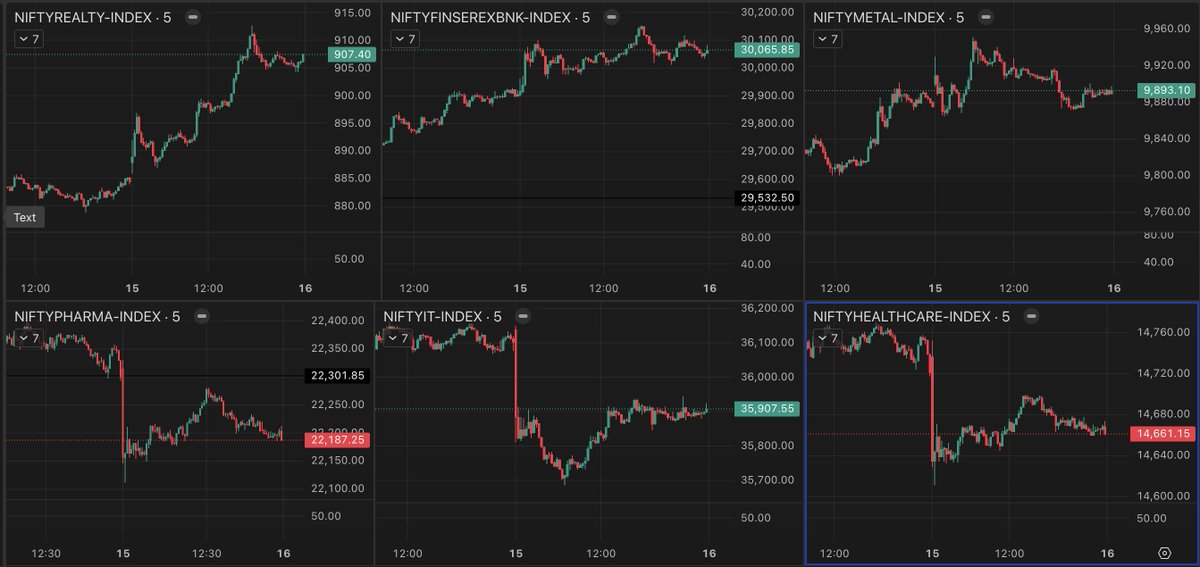

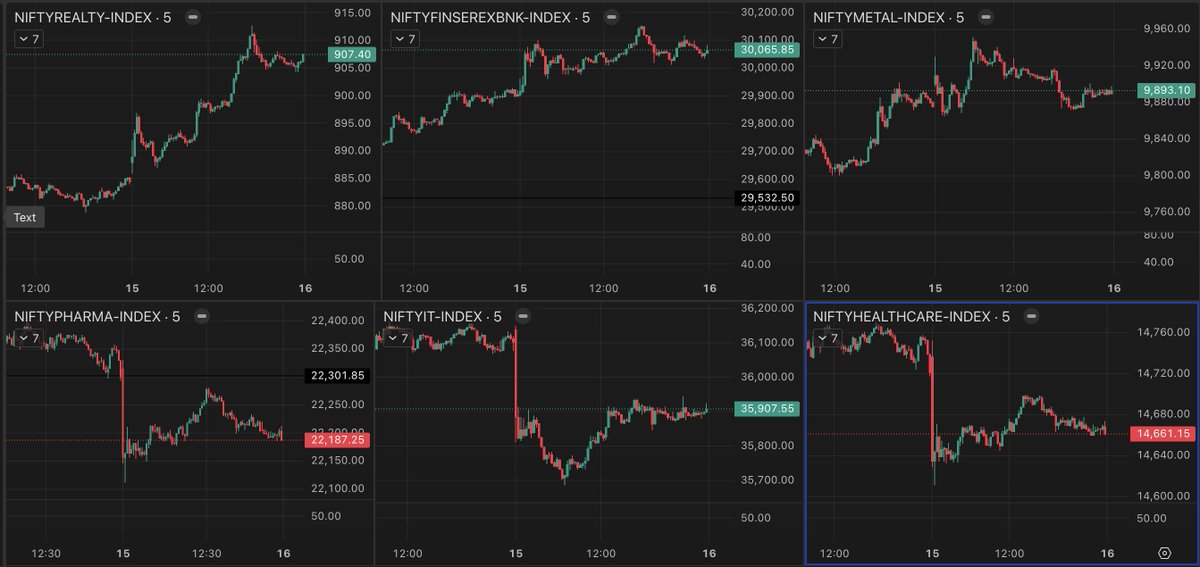

📊 Sector Snapshot – 15th Sept 2025 ✅ Realty & Financial Services extended gains, showing steady strength. ❌ Pharma & Healthcare slipped, facing selling pressure. ❌ IT saw volatility, recovering after an intraday dip. #Nifty #StockMarketIndia #SectorUpdate

📊 Nifty Sector Advance-Decline Today 🔼 Top gainers (Advances): PSU Bank: 100% Oil & Gas: 73% Realty: 70% 🔽 Weakest (Declines): Media: 70% Chemicals: 70% Consumer Durables: 60% Overall: Mixed performance across sectors. #Nifty #StockMarket #SectorUpdate

*#SectorUpdate* As an implementing partner of Creative Uganda Revolving Fund (CURF),* we were tasked by the Ministry of Gender, Labor, and Social Development to mobilize Creatives for workshops across 5 regions: Masaka, Mbarara, Mbale, Mukono, and Lira.

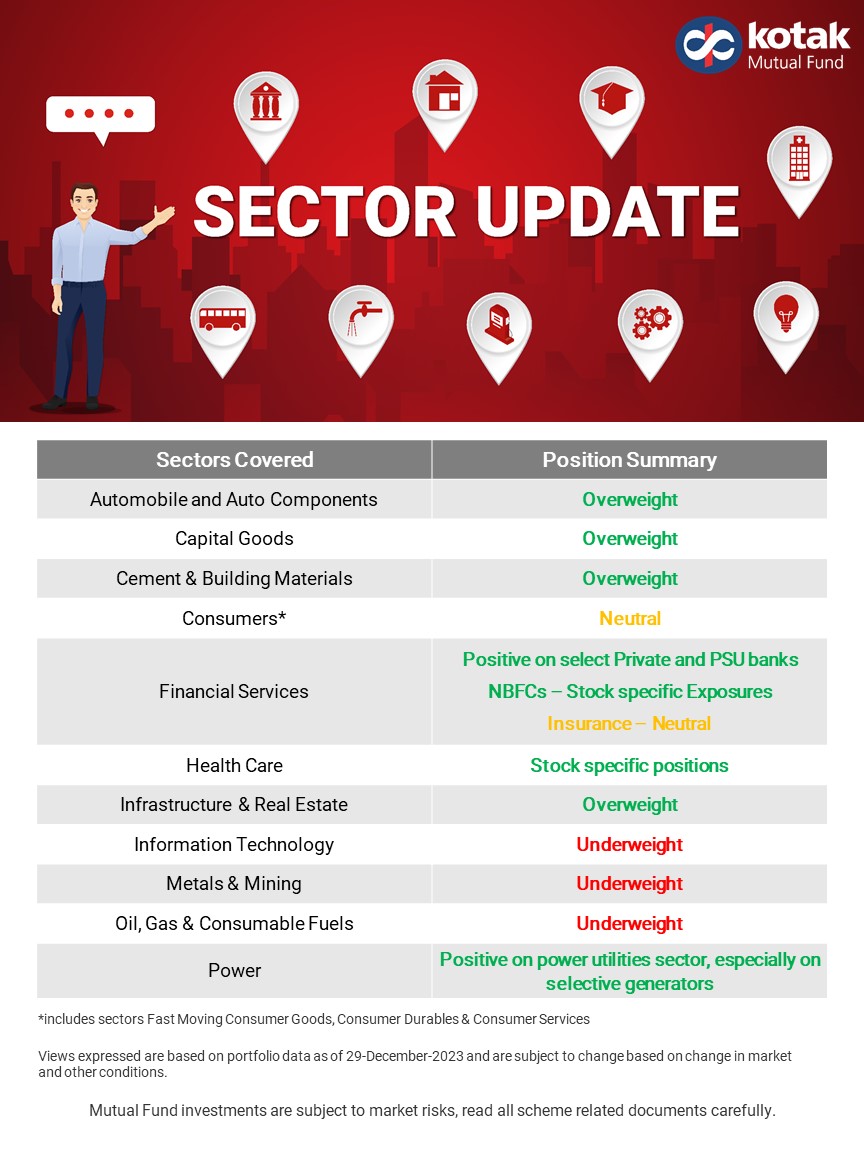

Here are some interesting trends to watch in the technology sector. For more such insights, watch our monthly market outlook: info.kotakmf.com/3TdFVHN or download the presentation: info.kotakmf.com/MMU_Mar #TechnologySector #Growth #Sectorupdate

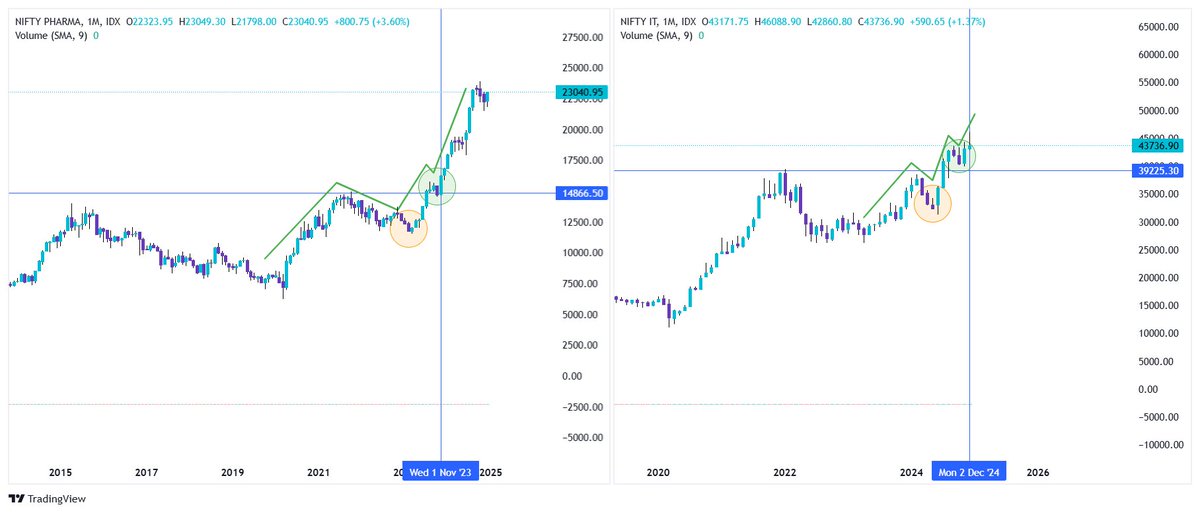

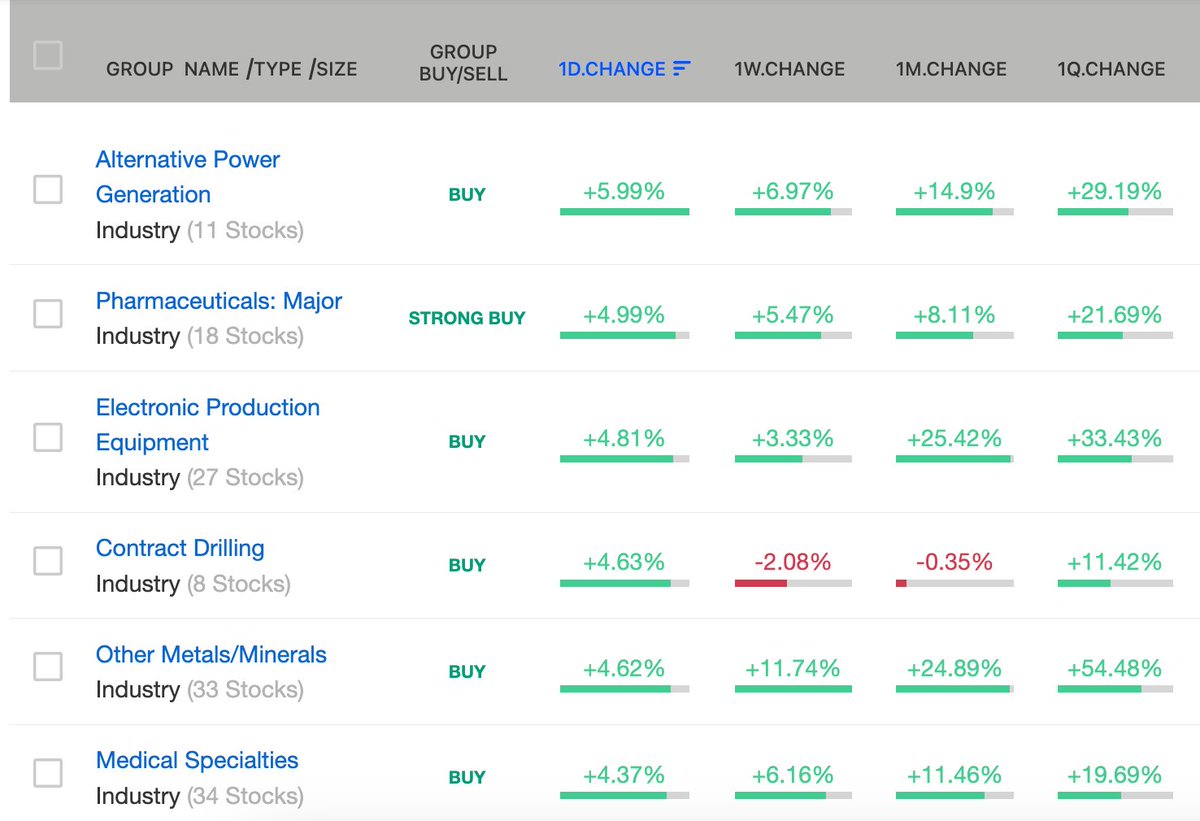

Do you Find any similarity? Is Nifty IT going to be the next targeted sector? #NiftyIT #NiftyPharma #SectorUpdate #MarketUpdate

🏗️ CNX Realty Index (CMP ₹945) 📈 Two targets ₹920 and ₹950 have been successfully hit — with a high of ₹974 today. Still strong as long as it holds ₹850+ on a closing basis for momentum to sustain. Next levels to watch: ₹1000 / ₹1050 🚀 #CNXRealty #SectorUpdate…

🏗️ CNX Realty Index (CMP ₹872) 📈 Above ₹885 can head towards ₹920 / ₹950 / ₹1000 / ₹1050 🚀 ⚙️ Needs to hold ₹850+ on a closing basis for momentum to sustain. #CNXRealty #SectorUpdate #NiftyRealty #StockMarket #Trading #Breakout

📢 Indian Banking Sector Update (Jan 2025): Weak credit growth, shifting trends, and insights into the post-rate-hike cycle. Let’s dive into the key takeaways! 💹 #IndianBanking #SectorUpdate

Media, metals, realty, and banks led the charge, with significant gains. Auto, IT, and pharma followed suit, while FMCG lagged behind. (7/9) #SectorUpdate

4/ 📈 Broader Markets Mixed, But Tone Turns Optimistic 🔹 Midcap & Smallcap ended modestly higher 🔹 Sector Outperformers: Media +0.99% IT +0.87% Pharma +0.75% 🔻 Realty & Oil & Gas saw minor declines #NiftyMidcap #SmallCap #SectorUpdate

Pharma rallied while Media and Realty sectors faced the heat. Mixed momentum defined the week! (3/8) #SectorUpdate #ShareMarketWeekly

🔍 What Moved the Market? PSU Bank, Oil & Gas, and Media sectors led the market this week, showing strong growth momentum. (3/8) #SectorUpdate #MarketTrends

*#SectorUpdate* As an implementing partner of Creative Uganda Revolving Fund (CURF),* we were tasked by the Ministry of Gender, Labor, and Social Development to mobilize Creatives for workshops across 5 regions: Masaka, Mbarara, Mbale, Mukono, and Lira.

🏗️ CNX Realty Index (CMP ₹945) 📈 Two targets ₹920 and ₹950 have been successfully hit — with a high of ₹974 today. Still strong as long as it holds ₹850+ on a closing basis for momentum to sustain. Next levels to watch: ₹1000 / ₹1050 🚀 #CNXRealty #SectorUpdate…

🏗️ CNX Realty Index (CMP ₹872) 📈 Above ₹885 can head towards ₹920 / ₹950 / ₹1000 / ₹1050 🚀 ⚙️ Needs to hold ₹850+ on a closing basis for momentum to sustain. #CNXRealty #SectorUpdate #NiftyRealty #StockMarket #Trading #Breakout

🔝 1️⃣ Banks — strength in PSU & private majors led rebound 2️⃣ Financial Services — steady FII buying boosted momentum 🔻 1️⃣ Metals — pressure from global commodity weakness 2️⃣ Realty — profit booking after recent rally Money rotating towards defensives #SectorUpdate #MarketLive

📉 Previous Session Recap • Nifty fell 0.6% to 25,722.1 • Media (-1.3%) & Metal (-1.1%) dragged • 11 of 12 sectors ended red, PSU Banks (+1.6%) gained • Top gainers: BEL (+4%), Eicher (+1.7%) • Losers: Zomato (-3.5%), Max Health (-2.6%) #Nifty #SectorUpdate

MF/FII Action in October month ( 1-15) 🔥🔥🔥 ♦️New favourite sector 1️⃣BANK 2️⃣ Automotive & Auto ancillary 3️⃣ Metal & Mining ♦️ EXIT sector 1️⃣FMCG 2️⃣ Healthcare 3️⃣IT #Sectorupdate

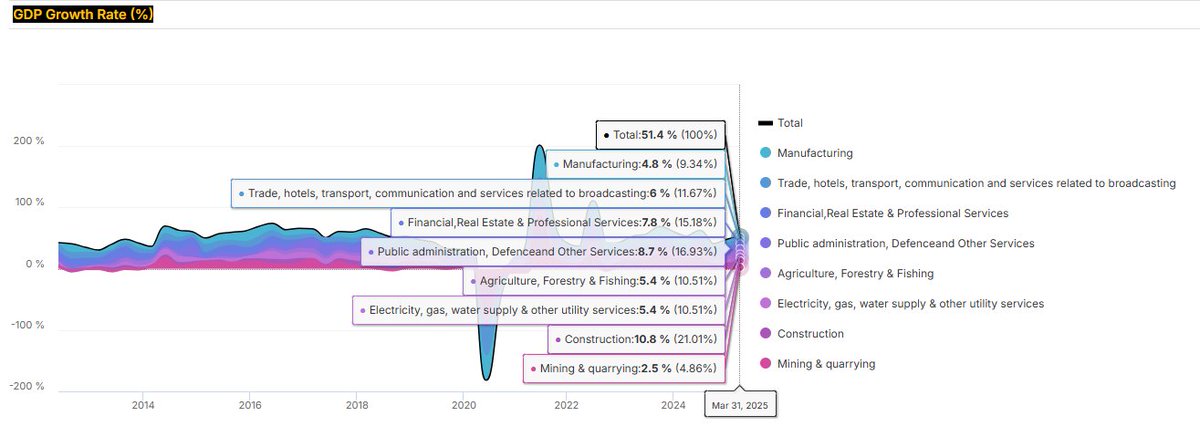

Weak energy output may weigh on refinery, oil, and gas-linked stocks, while steady infrastructure demand could support cement and steel plays. #Investing #SectorUpdate #Commodities

📈 Sector Check (Mid-Morning) Nifty Bank: +0.74% 🔼 Financial Services: +0.44% IT: -0.63% (Mixed post HCLTech results) Infra & Energy: +0.5–1% (Policy-led momentum) Auto: -0.22% (Tata Motors in focus) #SectorUpdate #StocksToWatch

Sector Snapshot 🔻 Decliners: FMCG, IT, Metals, Defence, Oil & Gas 🟢 Gainers: PSU Banks, Financials, Media Capital Market Index led gains (+2.55%) #SectorUpdate #trading

#SectorUpdate | Discretionary & Consumer Space (Q2FY26 Preview) 🏨 Hotels: Slight moderation in RevPAR; strong 16% YoY revenue growth on room additions. 👗 Value Retail: V2 Retail & Trent-Zudio to sustain strong momentum. 🍔 QSRs: Soft quarter; 17% YoY growth driven by new…

📈 Sector check: Metals lead the rally — up +2.25%, with HINDZINC +3.8%, JSWSTEEL +2%, NMDC +3.1% stealing the show. Pharma & PSE also shining. Only Auto showing red. #Nifty #Stocks #SectorUpdate

Sectoral Indices; Auto, Energy, IT, Metal, Pharma, PSU Bank, Realty, FMCG... #Nifty #StockMarket #SectorUpdate #EquityMarkets #Trading #MarketBuzz #A3RT @arbindtiwariT

MF/FII Action in October month ( 1-15) 🔥🔥🔥 ♦️New favourite sector 1️⃣BANK 2️⃣ Automotive & Auto ancillary 3️⃣ Metal & Mining ♦️ EXIT sector 1️⃣FMCG 2️⃣ Healthcare 3️⃣IT #Sectorupdate

October Sector watch for day 1. #SectorUpdate #IndustryTrends #MarketSectors #StockSignals #TechnicalAnalysis #GrowthStocks #MomentumStocks #StocksToWatch #InvestingInsights #MarketTrends

Nifty Energy index testing resistance since last month. Looks like breakout is imminent. Keep energy & power stocks on radar. #StockMarket #SectorUpdate #Index #Nifty #EnergyStocks

📢 Indian Banking Sector Update (Jan 2025): Weak credit growth, shifting trends, and insights into the post-rate-hike cycle. Let’s dive into the key takeaways! 💹 #IndianBanking #SectorUpdate

4/ 📈 Broader Markets Mixed, But Tone Turns Optimistic 🔹 Midcap & Smallcap ended modestly higher 🔹 Sector Outperformers: Media +0.99% IT +0.87% Pharma +0.75% 🔻 Realty & Oil & Gas saw minor declines #NiftyMidcap #SmallCap #SectorUpdate

Tweet 4: 📊 सेक्टरल परफॉर्मेंस मिला-जुला रहा — 🔼 Nifty Realty +1.09% सबसे आगे Oil & Gas, Pharma, Consumer Durables और Auto भी हरे निशान में। 🔻 FMCG, PSU Bank, Media, Metal और IT सेक्टर में गिरावट। #NiftyToday #SectorUpdate

Do you Find any similarity? Is Nifty IT going to be the next targeted sector? #NiftyIT #NiftyPharma #SectorUpdate #MarketUpdate

Pharma rallied while Media and Realty sectors faced the heat. Mixed momentum defined the week! (3/8) #SectorUpdate #ShareMarketWeekly

🔍 What Moved the Market? PSU Bank, Oil & Gas, and Media sectors led the market this week, showing strong growth momentum. (3/8) #SectorUpdate #MarketTrends

6️⃣ Sectors in Spotlight : 🚀Top = Energy (Adani Green + Adani Power) 😢Weak = Financial/IT (H-1B ne band baja di) Energy sector = “Adani is Back” season. IT = “Trump ka tweet = portfolio wipeout” moment. #SectorUpdate #AdaniVsIT

📊 Sectoral & Broader Market Snapshot: Smallcaps dropped over 1% even as midcaps clung to mild gains. Volatility picked up as traders awaited clarity from earnings and global cues. (4/7) #Midcaps #Smallcaps #SectorUpdate

Media, metals, realty, and banks led the charge, with significant gains. Auto, IT, and pharma followed suit, while FMCG lagged behind. (7/9) #SectorUpdate

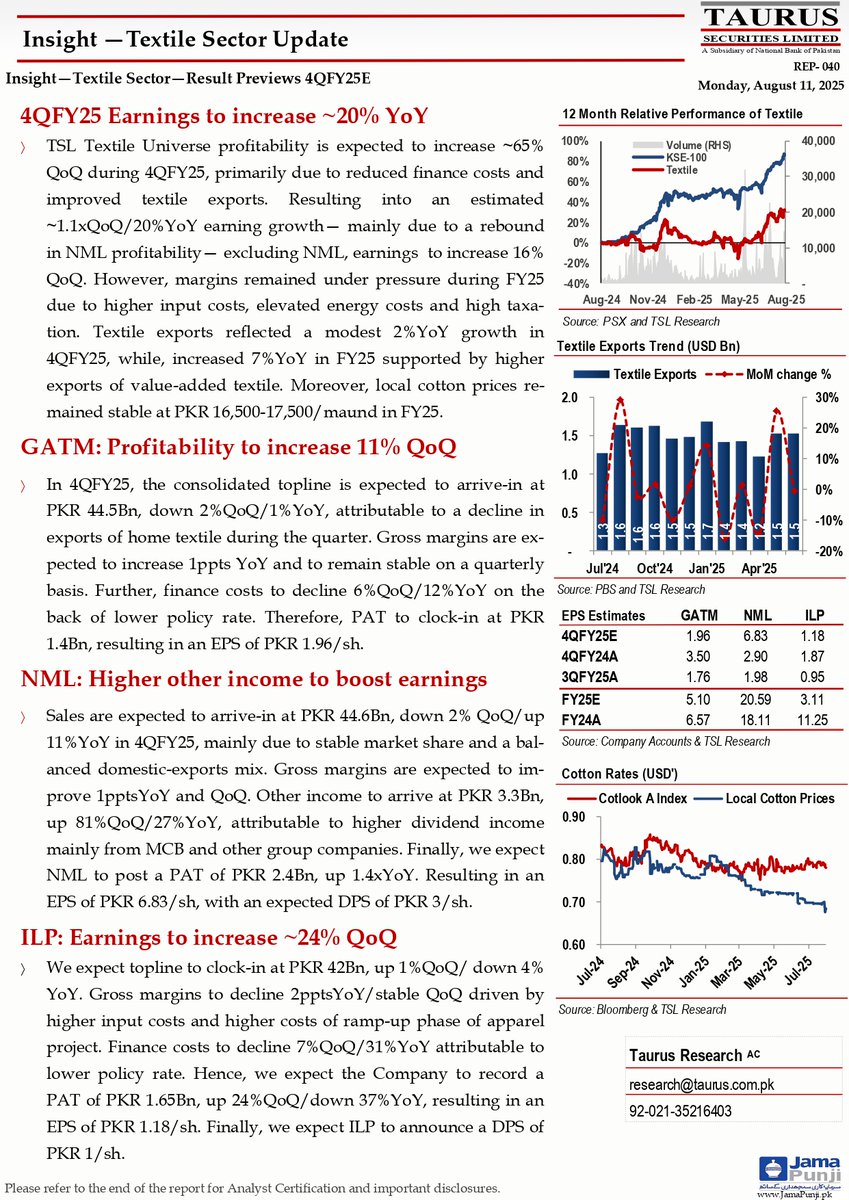

Insight—Textile Sector—Result Previews 4QFY25E Link: shorturl.at/3oVz7 #TextileSector #SectorUpdate #4QFY25 #Earnings #TextileExports #GATM #NML #ILP #PSX

Discover the latest insights shaping various sectors in our sector update report! 📊 Explore key trends, challenges, and opportunities, providing a comprehensive overview. Dive into a detailed report by clicking here: bit.ly/3umk9bS #SectorUpdate #IndustryInsights

📊 Sector Snapshot – 15th Sept 2025 ✅ Realty & Financial Services extended gains, showing steady strength. ❌ Pharma & Healthcare slipped, facing selling pressure. ❌ IT saw volatility, recovering after an intraday dip. #Nifty #StockMarketIndia #SectorUpdate

Defence full on Fire HAL 🔥 BDL 🔥 Cochin 🔥 GRSE 🔥 Mazdock 🔥 Data patterns 🔥 Apollo Micro 🔥 #Defence #StockMarket #SectorUpdate x.com/Asset_Architec…

Defence index is worth tracking right now. Stocks to keep on radar 👇🏻👇🏻 HAL 4600 BHEL 239 BEL 336 APOLLO MICRO 134 MAZDOCK 3018 COCHINSHIP 1582 GRSE 1906 DATA PATTERN 2480 #DefenceStocks #Swingtrade #Stockmarket #MarketUpdate

Something went wrong.

Something went wrong.

United States Trends

- 1. LeBron 62.8K posts

- 2. #DWTS 50.5K posts

- 3. #LakeShow 2,927 posts

- 4. Whitney 15.1K posts

- 5. Keyonte George 1,658 posts

- 6. Reaves 5,519 posts

- 7. Elaine 17.1K posts

- 8. Taylor Ward 3,236 posts

- 9. Grayson 6,603 posts

- 10. Orioles 6,399 posts

- 11. Dylan 24.3K posts

- 12. Celebrini 2,994 posts

- 13. Peggy 16.5K posts

- 14. #WWENXT 16.1K posts

- 15. Jazz 24.2K posts

- 16. #TheFutureIsTeal 1,215 posts

- 17. Winthrop 2,422 posts

- 18. Tatum 14.5K posts

- 19. Connor Bedard 4,041 posts

- 20. Haiti 53K posts