#stacksource результаты поиска

Wishing you a fantastic 4th of July filled with joy, festivities, and the spirit of freedom. Enjoy the celebrations and have a memorable day! 🇺🇸🗽 #IndependenceDay #4thofJuly #StackSource #USA

Join us in welcoming our newest Director, Joe Hepp! Joe comes to StackSource with over 20 years of commercial real estate experience in originating, underwriting, and structuring commercial real estate debt and equity for all property types. #StackSource #Welcome #Florida #CRE

We're excited to welcome Stephen Lindsley as our latest Associate Capital Advisor, based in San Francisco, California. With experience as a "big box" banker, Stephen is dedicated to solving credit and capital needs for clients at StackSource. #StackSource #Welcome #SanFrancisco

CLOSED! 🎉 $1.6M financing for the acquisition of a 100% occupied multifamily located in Des Moines, IA. Director Chris Peters arranged the deal with a 5-year fixed rate at 5.95% and a 25-year amortization. Check out the full details at hubs.la/Q01Nf5RN0 #StackSource

CLOSED! 🎉 $1.8M financing for the new development of a RV park located in Sweetwater, TN. Associate Director Jaideep Chadha arranged the deal where the lender funded 100% of the development cost and interest reserve. Learn more at hubs.la/Q01M3bV-0 #StackSource #CRE

It's important to work with the right lender when it comes to commercial finance, and there are seven red flags to look out for when identifying a bad lender. Huber Bongolan & Avery Ngo dive into what those red flags are. Read it at hubs.la/Q01LLpYg0 #Blog #StackSource

Private equity firms provide financing options to real estate developers and investors through equity investments or debt financing, and can be tailored to meet specific needs due to access to large pools of capital. Learn more at hubs.la/Q01M8mLZ0 #StackSource #Equity

CLOSED! 🎉 $13.2 Million financing for the redevelopment of an office property in Dallas, Texas. Senior Directors Beth Mercante and Zach Wagner arranged the debt for the 180,000 sq. ft. property. Read the full details at hubs.la/Q01MJHkG0 #StackSource #Texas #Dallas

CLOSED! 🎉 $630K financing for the refinance of a rental portfolio located in Troy, NY. Director of Inbound Originations Chris Peters arranged the deal with a 30-year amortization and no prepay penalty. Read the details at hubs.la/Q01KTMzb0 #StackSource #CRE #NewYork

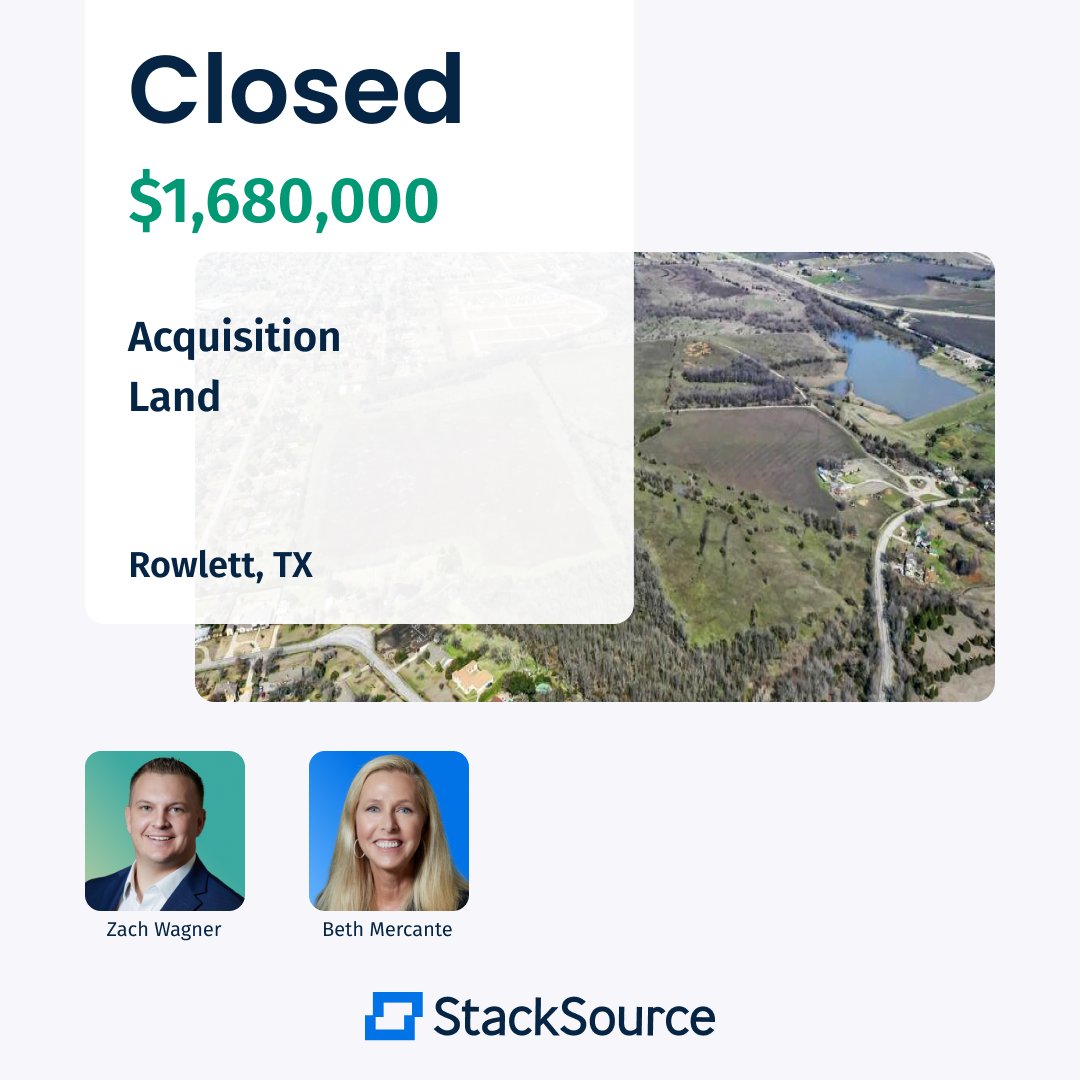

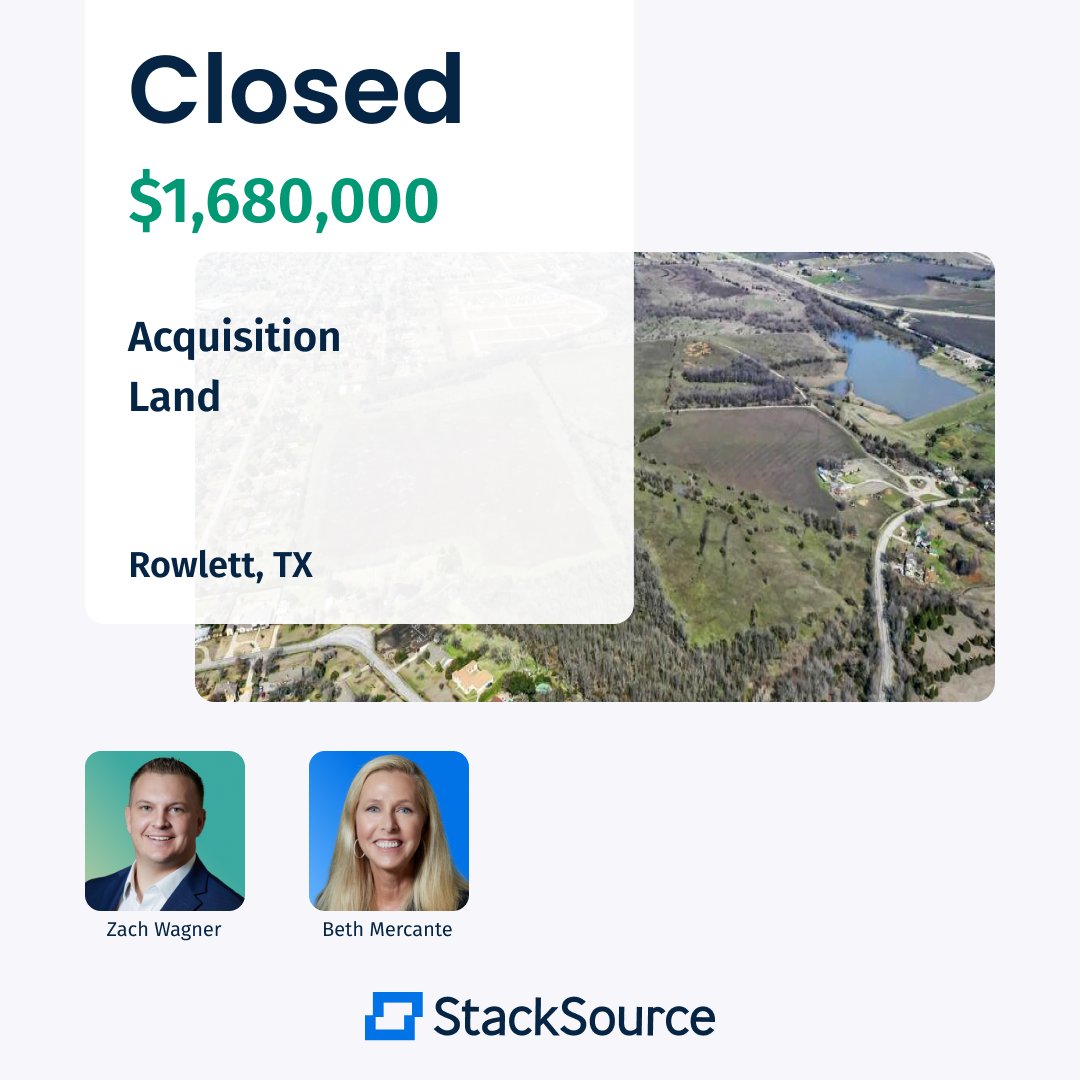

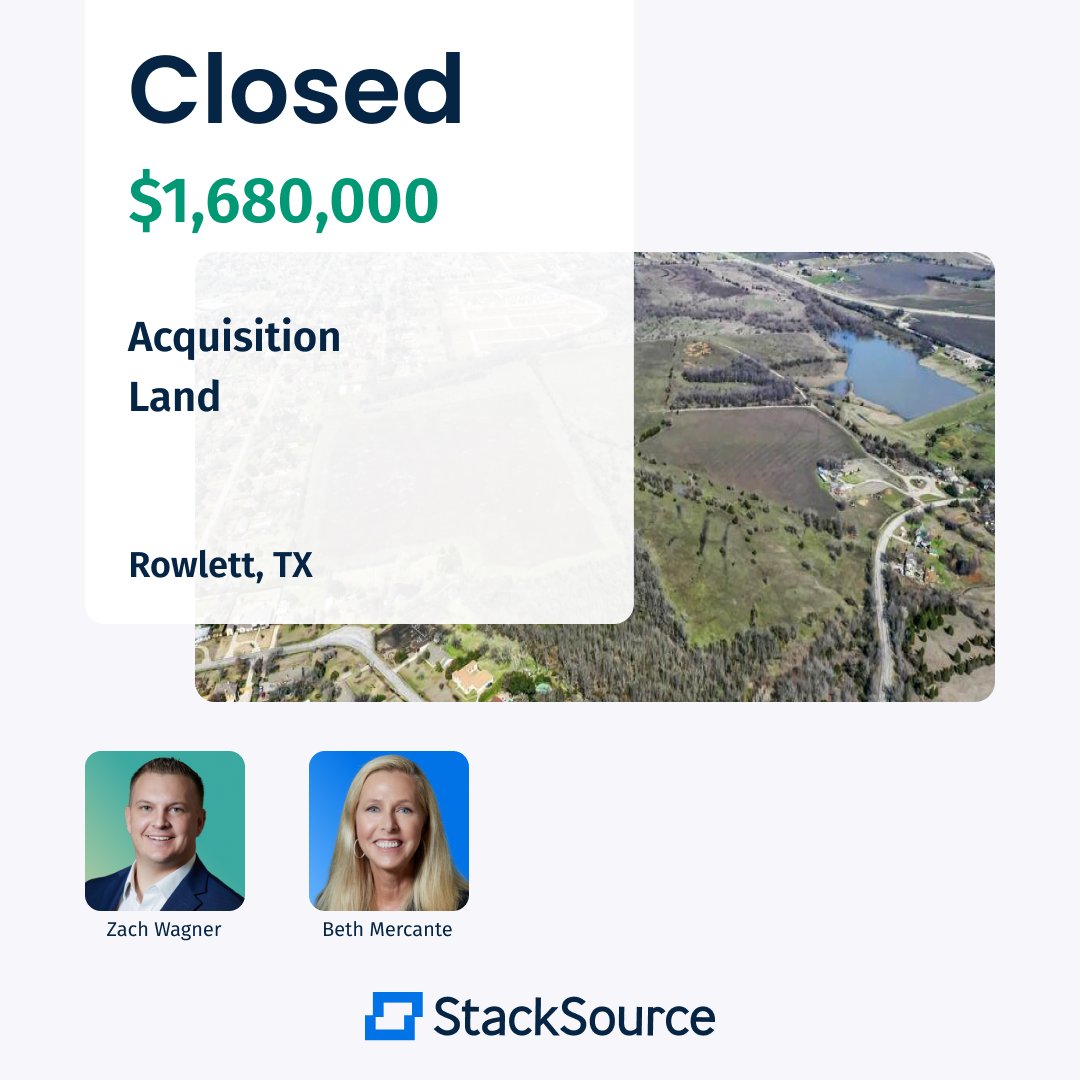

CLOSED! 🎉 $1.7 Million financing for the acquisition of vacant land located in Rowlett, Texas. Senior Directors Beth Mercante and Zach Wagner arranged the senior debt in just 3 weeks. Check out the full details here: hubs.la/Q01Lx5sN0 #StackSource #CRE #Texas #Land

Don’t forget to join us tonight at 6 p.m. ET! CEO Tim Milazzo and Director Huber Bongolan will talk through the current state of the commercial real estate capital markets, providing a March recap. Register to attend: hubs.la/Q01K7-7s0 #LinkedinLive #StackSource #CRE

Don’t forget to join us tonight at 6 p.m. ET! Register to attend or view the recording after the event ends: hubs.la/Q01SvmY80 #LinkedinLive #StackSource #CapitalMarkets #CRE

Our next Linkedin Live event is on June 6 at 6 p.m. ET. CEO Tim Milazzo and Director Chris Peters will discuss the current state of the commercial real estate capital markets, providing a May recap. Register now: hubs.la/Q01RQzcg0 #LinkedinLive #StackSource #CRE #Webinar

Join us for our next Linkedin Live event on May 2 at 6 p.m. ET. Directors Huber Bongolan and Chris Peters will talk through the current state of the CRE capital markets, providing an April recap. Register now: hubs.la/Q01MHf120 #LinkedinLive #StackSource #Webinar #CRE

CLOSED! 🎉 $608K financing for the acquisition of a multifamily located in Trenton, OH. Associate Director Jaideep Chadha arranged the deal in less than 30 days with a 5-year fixed rate. Check out the full details at hubs.la/Q01Lp6FX0 #StackSource #CRE #Ohio #Closed

SBA loan programs like 504 and 7(a) offer financing for small business commercial real estate with low down payments and competitive interest rates for up to 90% of project costs. Learn more about SBA Loans at hubs.la/Q01KpKg50 #SBALoans #CRE #StackSource

In our latest blog, CEO Tim Milazzo talks about the complex process of real estate development and the importance of a strong track record for developers to secure funding from lenders and investors. Read it at hubs.la/Q01KCSjY0 #Blog #CRE #StackSource #Construction

What's the best way to underwrite non-credit grade commercial tenants? Co-founder Marissa Limsiaco answers this complex question in a guest blog post published at StackSource. Click here to read more: stacksource.com/blog/underwrit… #commercialtenants #OtsoCorp #StackSource

As a Capital Markets Associate, Michael Nasca has seen firsthand the effects of risky lending practices in the banking industry. In his latest blog post, he delves into the collapse of Silicon Valley Bank. Read it at hubs.la/Q01L0cQp0 #SVB #StackSource #Blog #Risk

Wishing you a fantastic 4th of July filled with joy, festivities, and the spirit of freedom. Enjoy the celebrations and have a memorable day! 🇺🇸🗽 #IndependenceDay #4thofJuly #StackSource #USA

Don’t forget to join us tonight at 6 p.m. ET! Register to attend or view the recording after the event ends: hubs.la/Q01SvmY80 #LinkedinLive #StackSource #CapitalMarkets #CRE

Our next Linkedin Live event is on June 6 at 6 p.m. ET. CEO Tim Milazzo and Director Chris Peters will discuss the current state of the commercial real estate capital markets, providing a May recap. Register now: hubs.la/Q01RQzcg0 #LinkedinLive #StackSource #CRE #Webinar

CLOSED! 🎉 $1.6M financing for the acquisition of a 100% occupied multifamily located in Des Moines, IA. Director Chris Peters arranged the deal with a 5-year fixed rate at 5.95% and a 25-year amortization. Check out the full details at hubs.la/Q01Nf5RN0 #StackSource

CLOSED! 🎉 $13.2 Million financing for the redevelopment of an office property in Dallas, Texas. Senior Directors Beth Mercante and Zach Wagner arranged the debt for the 180,000 sq. ft. property. Read the full details at hubs.la/Q01MJHkG0 #StackSource #Texas #Dallas

Join us for our next Linkedin Live event on May 2 at 6 p.m. ET. Directors Huber Bongolan and Chris Peters will talk through the current state of the CRE capital markets, providing an April recap. Register now: hubs.la/Q01MHf120 #LinkedinLive #StackSource #Webinar #CRE

Join us in welcoming our newest Director, Joe Hepp! Joe comes to StackSource with over 20 years of commercial real estate experience in originating, underwriting, and structuring commercial real estate debt and equity for all property types. #StackSource #Welcome #Florida #CRE

Private equity firms provide financing options to real estate developers and investors through equity investments or debt financing, and can be tailored to meet specific needs due to access to large pools of capital. Learn more at hubs.la/Q01M8mLZ0 #StackSource #Equity

CLOSED! 🎉 $1.8M financing for the new development of a RV park located in Sweetwater, TN. Associate Director Jaideep Chadha arranged the deal where the lender funded 100% of the development cost and interest reserve. Learn more at hubs.la/Q01M3bV-0 #StackSource #CRE

We're excited to welcome Stephen Lindsley as our latest Associate Capital Advisor, based in San Francisco, California. With experience as a "big box" banker, Stephen is dedicated to solving credit and capital needs for clients at StackSource. #StackSource #Welcome #SanFrancisco

It's important to work with the right lender when it comes to commercial finance, and there are seven red flags to look out for when identifying a bad lender. Huber Bongolan & Avery Ngo dive into what those red flags are. Read it at hubs.la/Q01LLpYg0 #Blog #StackSource

CLOSED! 🎉 $1.7 Million financing for the acquisition of vacant land located in Rowlett, Texas. Senior Directors Beth Mercante and Zach Wagner arranged the senior debt in just 3 weeks. Check out the full details here: hubs.la/Q01Lx5sN0 #StackSource #CRE #Texas #Land

CLOSED! 🎉 $608K financing for the acquisition of a multifamily located in Trenton, OH. Associate Director Jaideep Chadha arranged the deal in less than 30 days with a 5-year fixed rate. Check out the full details at hubs.la/Q01Lp6FX0 #StackSource #CRE #Ohio #Closed

The USDA is a government program that provides non-recourse loans to qualified borrowers to increasing affordable rental housing & supporting economic development in eligible rural areas and towns. Learn more about USDA Loans at hubs.la/Q01LdjqX0. #StackSource #USDA #CRE

As a Capital Markets Associate, Michael Nasca has seen firsthand the effects of risky lending practices in the banking industry. In his latest blog post, he delves into the collapse of Silicon Valley Bank. Read it at hubs.la/Q01L0cQp0 #SVB #StackSource #Blog #Risk

CLOSED! 🎉 $630K financing for the refinance of a rental portfolio located in Troy, NY. Director of Inbound Originations Chris Peters arranged the deal with a 30-year amortization and no prepay penalty. Read the details at hubs.la/Q01KTMzb0 #StackSource #CRE #NewYork

In our latest blog, CEO Tim Milazzo talks about the complex process of real estate development and the importance of a strong track record for developers to secure funding from lenders and investors. Read it at hubs.la/Q01KCSjY0 #Blog #CRE #StackSource #Construction

SBA loan programs like 504 and 7(a) offer financing for small business commercial real estate with low down payments and competitive interest rates for up to 90% of project costs. Learn more about SBA Loans at hubs.la/Q01KpKg50 #SBALoans #CRE #StackSource

Don’t forget to join us tonight at 6 p.m. ET! CEO Tim Milazzo and Director Huber Bongolan will talk through the current state of the commercial real estate capital markets, providing a March recap. Register to attend: hubs.la/Q01K7-7s0 #LinkedinLive #StackSource #CRE

CLOSED! 🎉 $2.7 Million financing for the acquisition of a rental portfolio located in East Point, GA. Associate Director Andrew Bouton arranged the deal with an 80% LTC & 24 month term. Check out the details here: hubs.la/Q01JKrkQ0 #StackSource #CRE #Atlanta #Closed

Wishing you a fantastic 4th of July filled with joy, festivities, and the spirit of freedom. Enjoy the celebrations and have a memorable day! 🇺🇸🗽 #IndependenceDay #4thofJuly #StackSource #USA

Join us in welcoming our newest Director, Joe Hepp! Joe comes to StackSource with over 20 years of commercial real estate experience in originating, underwriting, and structuring commercial real estate debt and equity for all property types. #StackSource #Welcome #Florida #CRE

We're excited to welcome Stephen Lindsley as our latest Associate Capital Advisor, based in San Francisco, California. With experience as a "big box" banker, Stephen is dedicated to solving credit and capital needs for clients at StackSource. #StackSource #Welcome #SanFrancisco

CLOSED! 🎉 $1.6M financing for the acquisition of a 100% occupied multifamily located in Des Moines, IA. Director Chris Peters arranged the deal with a 5-year fixed rate at 5.95% and a 25-year amortization. Check out the full details at hubs.la/Q01Nf5RN0 #StackSource

CLOSED! 🎉 $13.2 Million financing for the redevelopment of an office property in Dallas, Texas. Senior Directors Beth Mercante and Zach Wagner arranged the debt for the 180,000 sq. ft. property. Read the full details at hubs.la/Q01MJHkG0 #StackSource #Texas #Dallas

CLOSED! 🎉 $1.7 Million financing for the acquisition of vacant land located in Rowlett, Texas. Senior Directors Beth Mercante and Zach Wagner arranged the senior debt in just 3 weeks. Check out the full details here: hubs.la/Q01Lx5sN0 #StackSource #CRE #Texas #Land

Don’t forget to join us tonight at 6 p.m. ET! CEO Tim Milazzo and Director Huber Bongolan will talk through the current state of the commercial real estate capital markets, providing a March recap. Register to attend: hubs.la/Q01K7-7s0 #LinkedinLive #StackSource #CRE

CLOSED! 🎉 $630K financing for the refinance of a rental portfolio located in Troy, NY. Director of Inbound Originations Chris Peters arranged the deal with a 30-year amortization and no prepay penalty. Read the details at hubs.la/Q01KTMzb0 #StackSource #CRE #NewYork

What's the best way to underwrite non-credit grade commercial tenants? Co-founder Marissa Limsiaco answers this complex question in a guest blog post published at StackSource. Click here to read more: stacksource.com/blog/underwrit… #commercialtenants #OtsoCorp #StackSource

Don’t forget to join us tonight at 6 p.m. ET! Register to attend or view the recording after the event ends: hubs.la/Q01SvmY80 #LinkedinLive #StackSource #CapitalMarkets #CRE

CLOSED! 🎉 $1.8M financing for the new development of a RV park located in Sweetwater, TN. Associate Director Jaideep Chadha arranged the deal where the lender funded 100% of the development cost and interest reserve. Learn more at hubs.la/Q01M3bV-0 #StackSource #CRE

Private equity firms provide financing options to real estate developers and investors through equity investments or debt financing, and can be tailored to meet specific needs due to access to large pools of capital. Learn more at hubs.la/Q01M8mLZ0 #StackSource #Equity

It's important to work with the right lender when it comes to commercial finance, and there are seven red flags to look out for when identifying a bad lender. Huber Bongolan & Avery Ngo dive into what those red flags are. Read it at hubs.la/Q01LLpYg0 #Blog #StackSource

Our next Linkedin Live event is on June 6 at 6 p.m. ET. CEO Tim Milazzo and Director Chris Peters will discuss the current state of the commercial real estate capital markets, providing a May recap. Register now: hubs.la/Q01RQzcg0 #LinkedinLive #StackSource #CRE #Webinar

Join us for our next Linkedin Live event on May 2 at 6 p.m. ET. Directors Huber Bongolan and Chris Peters will talk through the current state of the CRE capital markets, providing an April recap. Register now: hubs.la/Q01MHf120 #LinkedinLive #StackSource #Webinar #CRE

CLOSED! 🎉 $608K financing for the acquisition of a multifamily located in Trenton, OH. Associate Director Jaideep Chadha arranged the deal in less than 30 days with a 5-year fixed rate. Check out the full details at hubs.la/Q01Lp6FX0 #StackSource #CRE #Ohio #Closed

In our latest blog, CEO Tim Milazzo talks about the complex process of real estate development and the importance of a strong track record for developers to secure funding from lenders and investors. Read it at hubs.la/Q01KCSjY0 #Blog #CRE #StackSource #Construction

SBA loan programs like 504 and 7(a) offer financing for small business commercial real estate with low down payments and competitive interest rates for up to 90% of project costs. Learn more about SBA Loans at hubs.la/Q01KpKg50 #SBALoans #CRE #StackSource

The USDA is a government program that provides non-recourse loans to qualified borrowers to increasing affordable rental housing & supporting economic development in eligible rural areas and towns. Learn more about USDA Loans at hubs.la/Q01LdjqX0. #StackSource #USDA #CRE

As a Capital Markets Associate, Michael Nasca has seen firsthand the effects of risky lending practices in the banking industry. In his latest blog post, he delves into the collapse of Silicon Valley Bank. Read it at hubs.la/Q01L0cQp0 #SVB #StackSource #Blog #Risk

Something went wrong.

Something went wrong.

United States Trends

- 1. Columbus 149K posts

- 2. President Trump 1.07M posts

- 3. Middle East 249K posts

- 4. Brian Callahan 7,939 posts

- 5. #IndigenousPeoplesDay 10.6K posts

- 6. Titans 38.8K posts

- 7. Vrabel 6,968 posts

- 8. Thanksgiving 54.4K posts

- 9. Macron 209K posts

- 10. Seth 47.9K posts

- 11. Marc 48.7K posts

- 12. #WWERaw 53.7K posts

- 13. Cape Verde 7,662 posts

- 14. Darius Smith 3,698 posts

- 15. HAZBINTOOZ 4,584 posts

- 16. Apple TV 5,307 posts

- 17. Shildt 2,637 posts

- 18. Egypt 255K posts

- 19. #Isles 1,185 posts

- 20. Flip 53.2K posts