#udpl search results

United Distributors Pakistan Limited Brief Company Overview 27-01-2023 #psx #fnel #udpl #stockexchange

United Distributors Pakistan Limited has entered into a non-compete arrangement with FMC Corporation, under which the US-based firm has paid UDPL $6 million as consideration. brecorder.com/news/40384131/… #UDPL #fertiliser #brecordernews

MoD today signed a contract with Ultra Dimensions Pvt. Ltd. (#UDPL), Vishakhapatnam for modernization of Naval Aircraft Yards (NAYs) at Goa & Kochi, at a cost of approx. Rs 470 cr. The NAYs undertake servicing/repairs of Naval Aircraft, Aero Engines, Rotables and Test Equipment

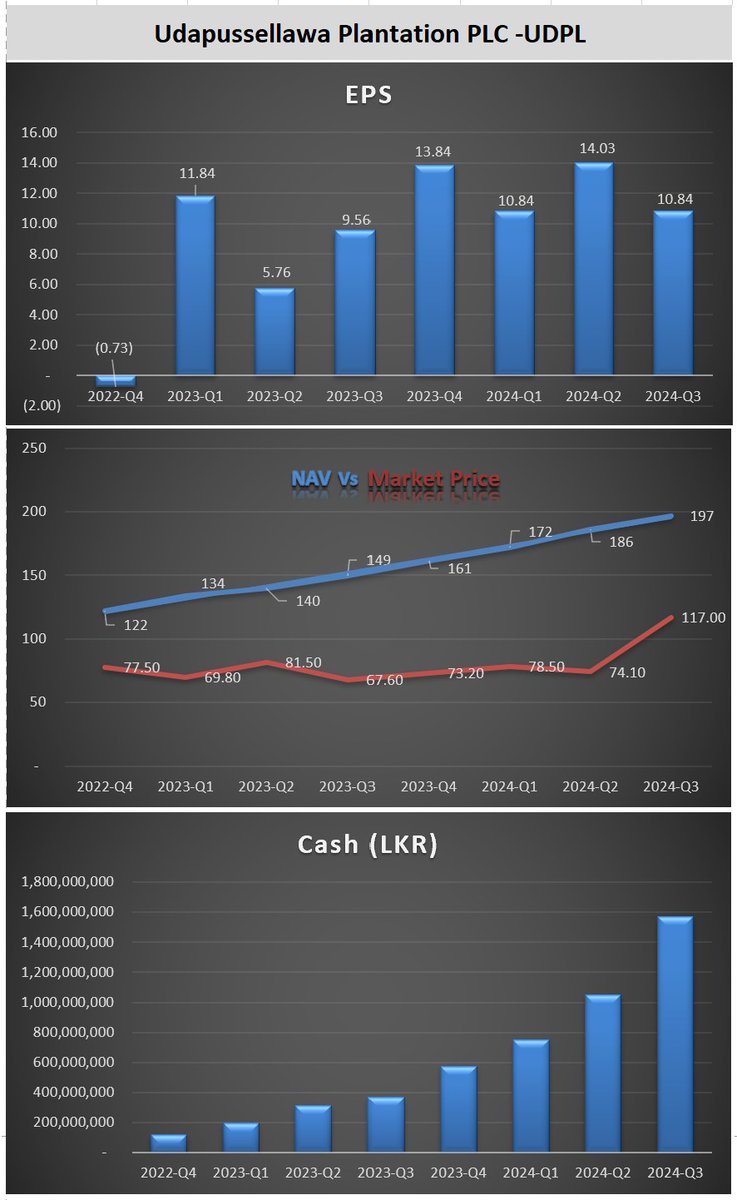

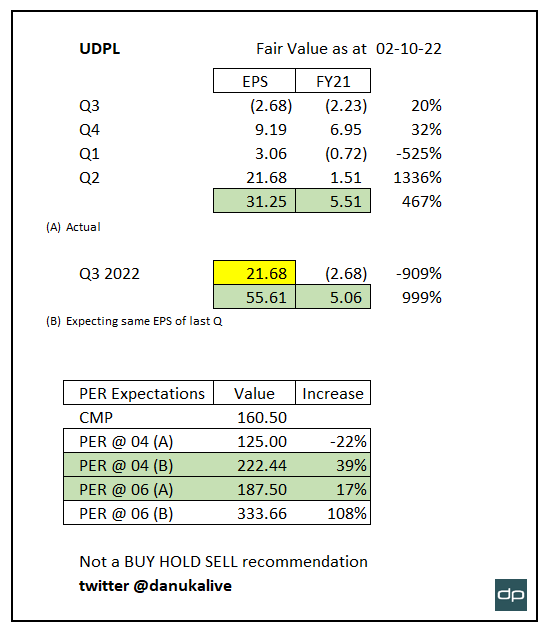

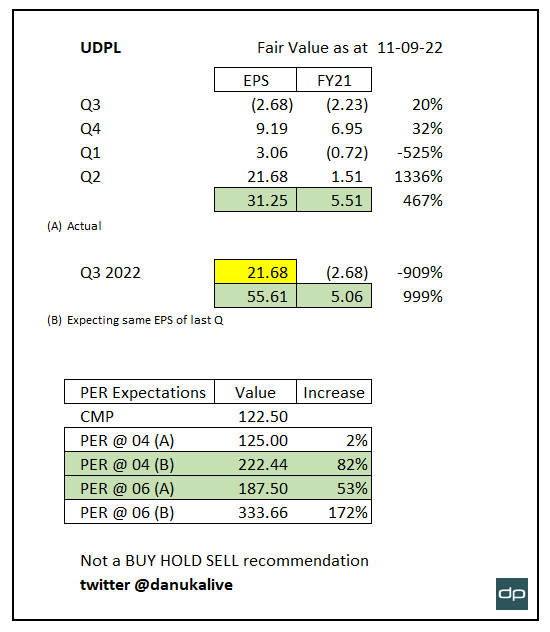

#UDPL fair value calculation based on financials. Recorded impressive EPS during last Q. if able to maintain the same EPS levels, price can be appreciate to 187-222 range by considering PER 6 and forecasted EPS @ PER 4

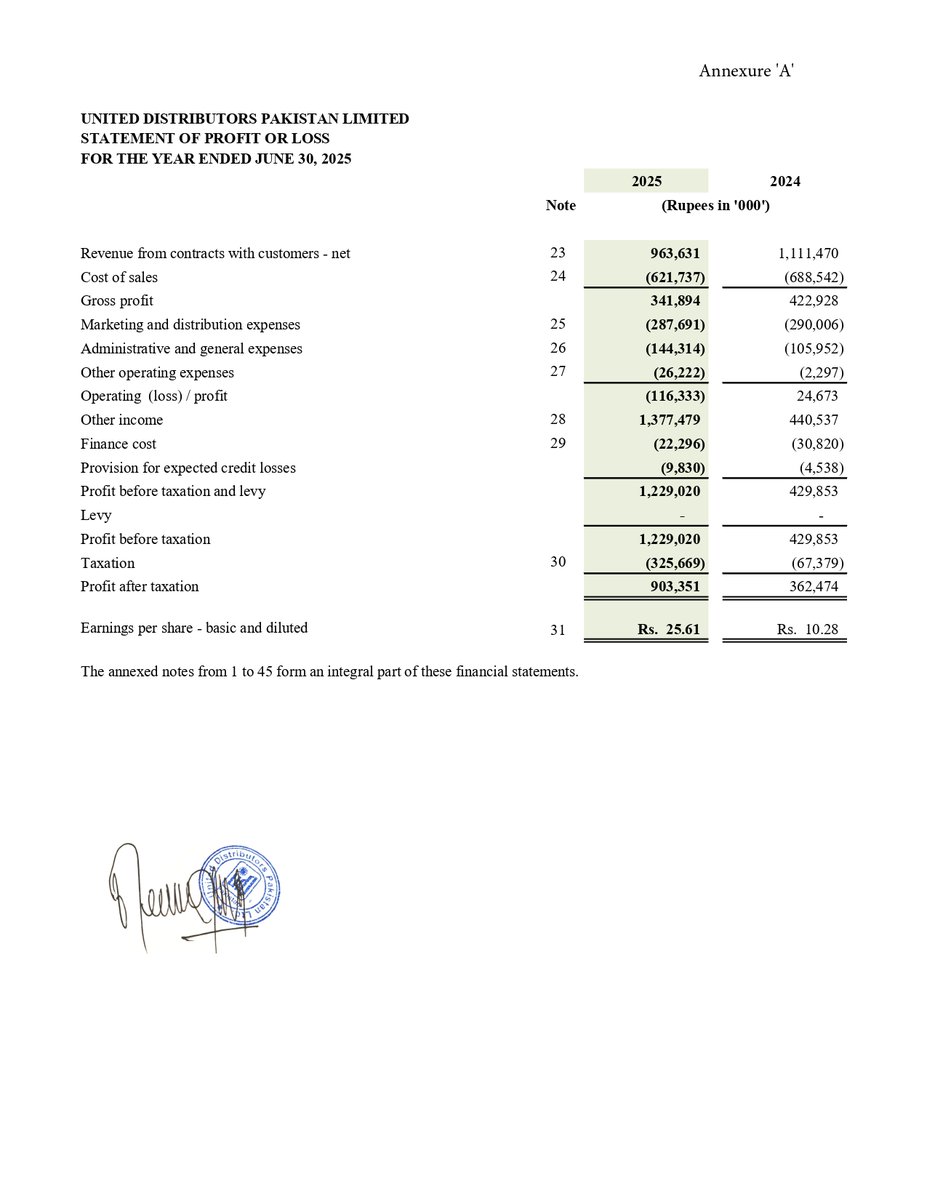

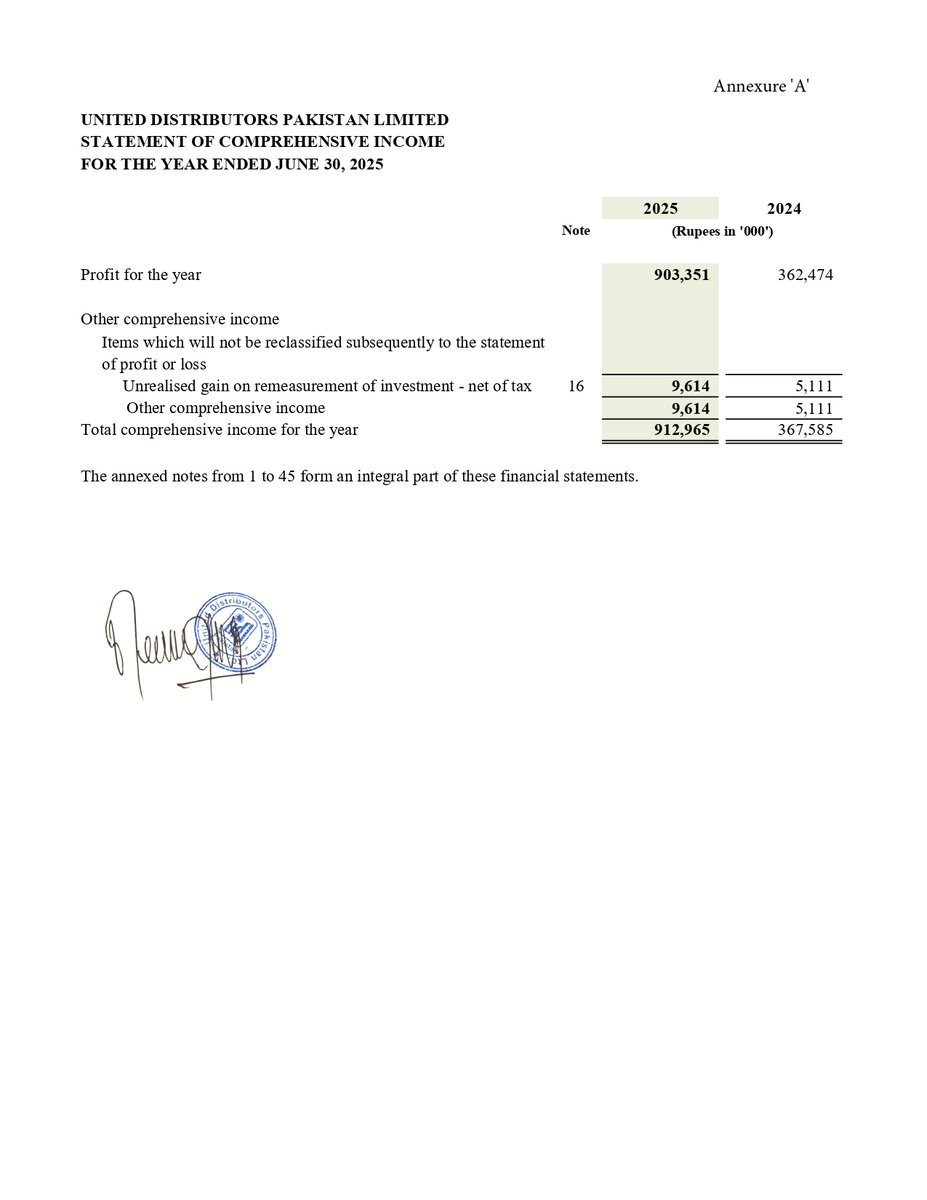

UDPL's FY25 profit isn't what it seems. Ignore the headline #EPS. The core distribution business posted an operating loss. The entire profit came from one-off investment gains. #UDPL #Earnings #PSX 🔗dps.psx.com.pk/download/docum…

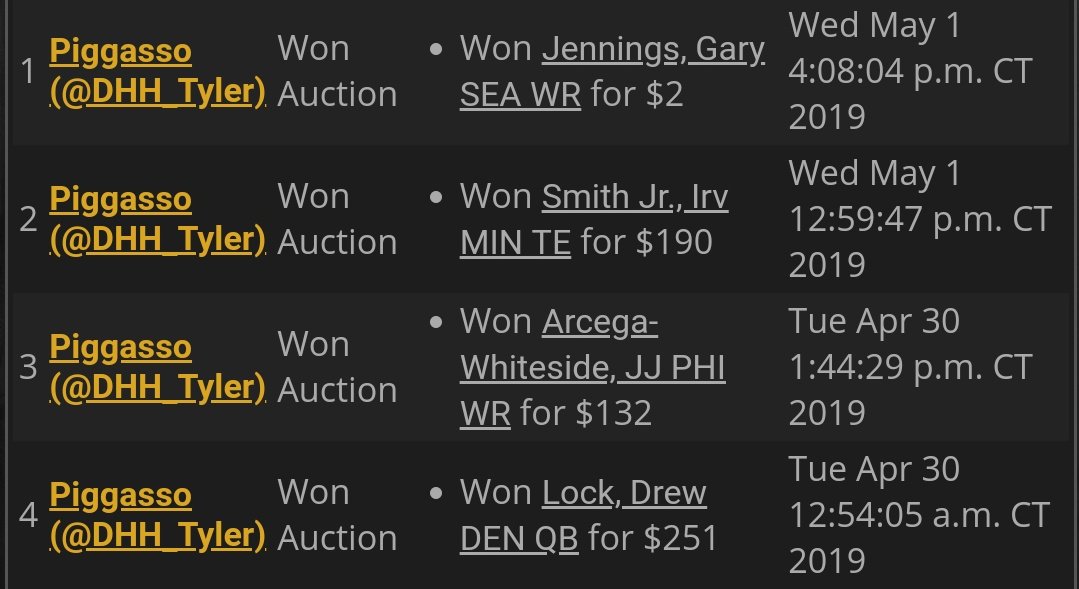

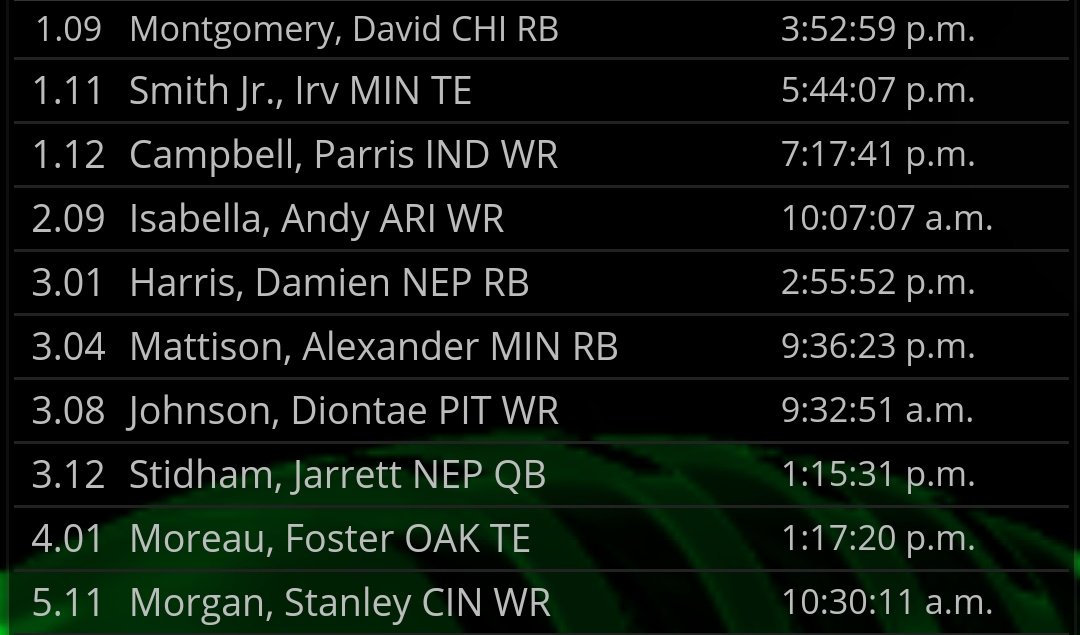

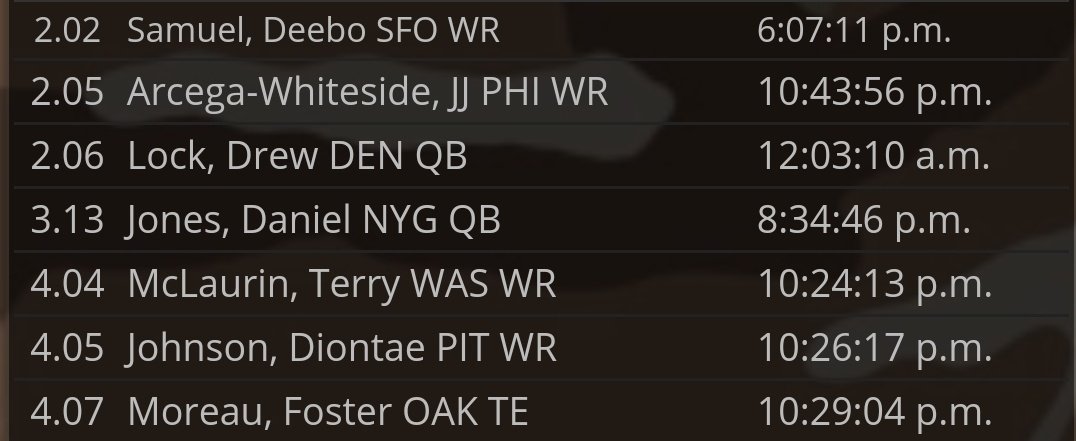

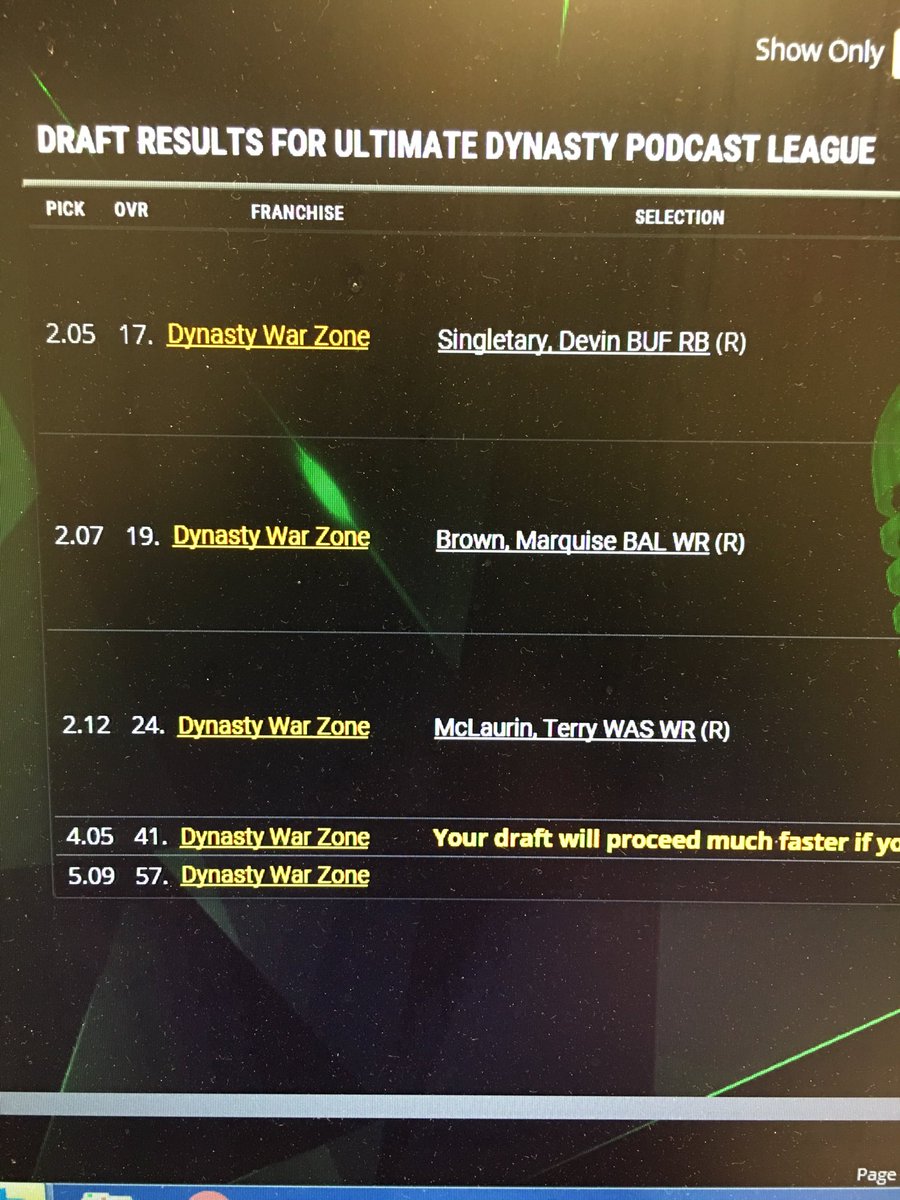

For those wondering how #UDPL is going... here are the standings with 2 weeks left. @DFF_Shane @Rotobahn @DynastyRich @DFFMemphis @DynastyOuthouse @_PeteLaw @TheFFdynasty @DaFantasyFather @DTC_IzzyE @FF_TravisM @DynastyPrice

#UDPL fair value calculation based on financials. Revenue +79% GP +562+ NP +1336%. Positioned at PER . by forecasting same EPS, price can easily appreciate to 187 and then 222 which is more than 50% from CMP. Good time to collect and wait for next Q financial results to realize

📢 Dividend Alert: #UDPL (UDL Pakistan) Announces Massive Special Interim Cash Dividend UDL Pakistan’s Board of Directors has declared a special interim cash dividend of Rs. 30/- per share (300%) for the year ending June 30, 2025 This is in addition to the earlier interim…

My draft in #UDPL has been 🔥🔥 1.06 - Akers 1.08 - Swift 1.10 - Jeudy (huge need) Follow the rest. www55.myfantasyleague.com/2020/home/4597…

Lost to @DaFantasyFather in the #UDPL championship last year.... he sneaks into playoffs and has a 40 point lead early.... if he boots me....

The fellas are back, well most of them. @DHH_Tim is out, so @DaFantasyFather and @DHH_Tyler are joined by @TheFFdynasty own @JayWaynesWorld to go over the #UDPL (Ultimate Dynasty Podcasters League) rookie draft. dynastyhappyhour.podbean.com/e/ep-127-udpl-…

Through 3 rounds of the #UDPL rookie draft. I traded for TJ Hockenson, who’s not shown. I sent Fant and 2.08 for Hock and 4.04 during round one. First Hock share in TE Premium.

#CCP Penalizes #UDPL and #IBL for Anti-Competitive Agreement in #Pharmaceutical Sector thepublictribune.com/ccp-penalizes-…

thepublictribune.com

CCP Penalizes UDPL and IBL for Anti-Competitive Agreement in Pharmaceutical Sector - The Public...

ISLAMABAD — The Competition Commission of Pakistan (CCP) has imposed a total penalty of Rs. 42 million on United Distributors Pakistan Limited (UDPL) and International Brands (Private) Limited (IBL)...

Today, #UDPL has announced Rs.17/- DPS for September quarter 2025. This is third dividend since July (total dividend Rs.48.25) which makes it lucrative. @MeherJazibAli @SaeedNasha44198 @pkalphachase

UDPL's FY25 profit isn't what it seems. Ignore the headline #EPS. The core distribution business posted an operating loss. The entire profit came from one-off investment gains. #UDPL #Earnings #PSX 🔗dps.psx.com.pk/download/docum…

United Distributors Pakistan Limited has entered into a non-compete arrangement with FMC Corporation, under which the US-based firm has paid UDPL $6 million as consideration. brecorder.com/news/40384131/… #UDPL #fertiliser #brecordernews

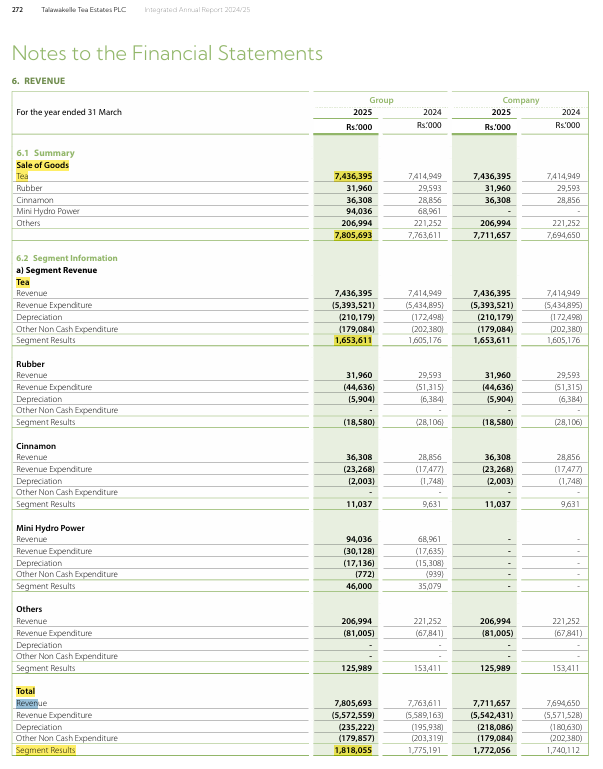

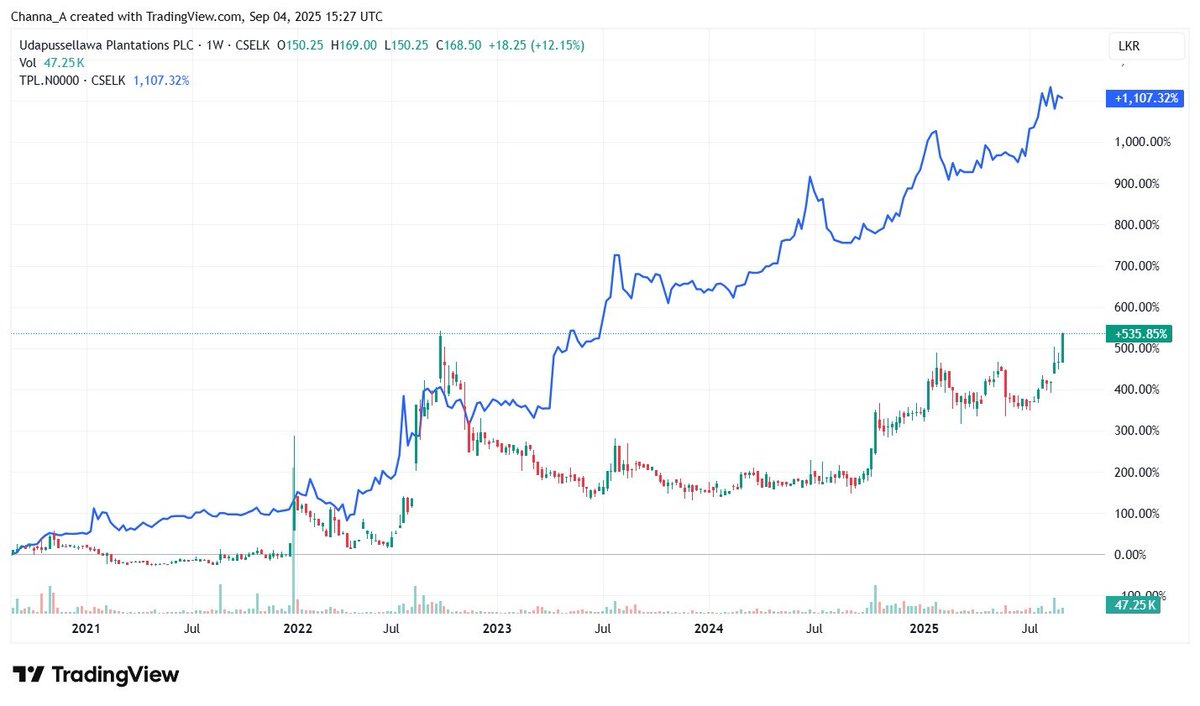

FY25 #TPL: 95% of revenue and 91% of GP was from tea FY25 #UDPL: 97% of revenue and 95% of GP was from tea #CSE #lka

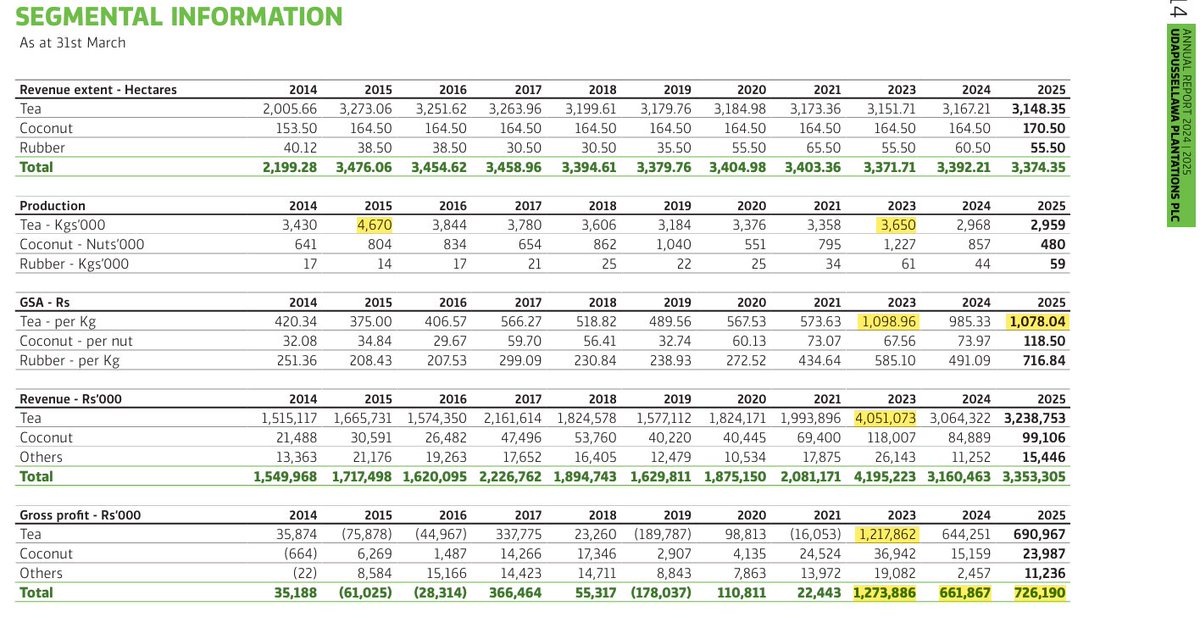

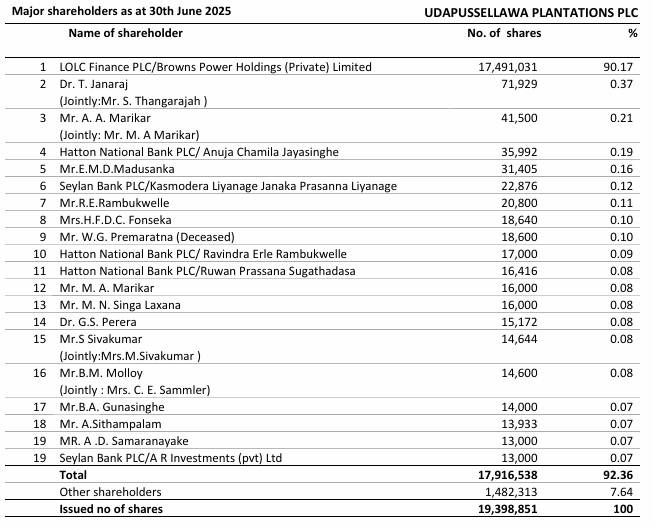

#BIL acquired control of #UDPL (and #HAPU) from Finlays in Dec 2021 UDPL had a banner year in FY23, benefiting from surge in tea prices to record highs and a recovery in crop Only 13k shares were needed to enter top 20 shareholders of illiquid company as at June 2025 #CSE #lka

#UDPL's recurring TTM PER is 6.1x at Rs168 But what is ‘fair’ PER for volatile plantation sector? Pure tea plays should also trade at discount to multi-crop estates How does UDPL compare with high dividend paying tea play #TPL, which is on TTM PER of 5.9x at Rs160? #CSE #lka

#UDPL valuations should be adjusted for non-recurring gain on bargain purchase of #TSML in 1Q26 ➡️ UDPL's 1Q26 net profit of Rs678 mn included negative goodwill of Rs515 mn • EBIT -19% YoY Excluding same, UDPL's recurring TTM EPS is Rs28 vs reported TTM EPS of Rs54 #CSE #lka

📢 Dividend Alert: #UDPL (UDL Pakistan) Announces Massive Special Interim Cash Dividend UDL Pakistan’s Board of Directors has declared a special interim cash dividend of Rs. 30/- per share (300%) for the year ending June 30, 2025 This is in addition to the earlier interim…

#CCP Penalizes #UDPL and #IBL for Anti-Competitive Agreement in #Pharmaceutical Sector thepublictribune.com/ccp-penalizes-…

thepublictribune.com

CCP Penalizes UDPL and IBL for Anti-Competitive Agreement in Pharmaceutical Sector - The Public...

ISLAMABAD — The Competition Commission of Pakistan (CCP) has imposed a total penalty of Rs. 42 million on United Distributors Pakistan Limited (UDPL) and International Brands (Private) Limited (IBL)...

Need a better peer group to compare #SOY's TTM PERs - and need market cap weighted average Plantations #UDPL and #KOTA are poor proxies - and #RWSL is not a good benchmark either ➡️ Shows difficulty of relative valuation ➡️ Forward earnings and cashflows matter more #CSE #lka

#CSE #lka trivia question: When did #UDPL last pay a dividend? 🧐 #LOLC acquired control of UDPL from Finlays in Dec 2021, but even long before that, dividends were unheard of at UDPL Illiquid share up ~5x over past five years, but lagged tea star #TPL due to lack of dividends

Based on TTM PERs, pure tea plays #TPL and #UDPL are cheaper than #KVAL on TTM PERs of 3.7x and 2.5x respectively But KVAL's Mabroc tea brand ownership merits premium TPL has stronger B/S and better dividend record than UDPL Wage hike will affect forward EPS for all #CSE #lka

The Canaweek⚽️ 21/02🇸🇮 @FCKoper - Mura 23/02🇧🇬 @botev_plovdiv - Etar 24/02🏴 Blackburn - @NorwichCityFC 24/02🇫🇷 Lorient - @FCNantes 24/02🇧🇪 @stvv - Westerlo 25/02🇮🇹 @ModenaOfficial - Spezia 25/02🇪🇸 @UDLP_Oficial - Osasuna #FCNantes #UDPL #NCFC #STVV

Something went wrong.

Something went wrong.

United States Trends

- 1. Thanksgiving 406K posts

- 2. Golesh 2,720 posts

- 3. Two National Guard 1,876 posts

- 4. Camp Haven 7,578 posts

- 5. Fani Willis 18.2K posts

- 6. #WipersDayGiveaway N/A

- 7. Pizza 49.4K posts

- 8. Denzel 3,644 posts

- 9. Trumplican 3,521 posts

- 10. NextNRG Inc 1,300 posts

- 11. Khabib 7,493 posts

- 12. Hong Kong 89K posts

- 13. Tom Hardy 1,881 posts

- 14. Wine 40.6K posts

- 15. Mendy 5,535 posts

- 16. Stranger Things 171K posts

- 17. Bayern 144K posts

- 18. Africans 27.8K posts

- 19. Idris 8,091 posts

- 20. Breyers 2,726 posts