#vatreform search results

Let the states control their VAT. There’s no point benefitting from the proceeds of what you forbid. #VATReform 💳

Definitive system of reduced VAT rates – Too much freedom? New IBFD White Paper link.ibfd.org/2Fw0rzR #VATreform

The expected VAT reform would be much welcomed by the business community – Deloitte 3news.com/business/the-e… #VATReform #BusinessCommunity #ValueAddedTax

A great week of learning and knowledge exchange with the participants of the #mozmod retreat. This year they are producing policy briefs about #CashTransfer, #VATreform, and #UcranianWarImpacts. Studies with high relevance for policymaking. @UNUWIDER @ilolusaka @InclusiveMoz

A beautiful old Bill Tidy MBE original, that's still just as pertinent today! Robbed at umbrella point!! #pubs #hospitality #vatreform

Estonia has blocked an EU VAT reform that aimed to impose new liabilities on short-term rental services such as Airbnb and passenger transport services like Bolt. 🇪🇺🏠🚗 #Estonia #EU #VATReform #Airbnb #Bolt #TechNews

Big news for Kenyan small businesses! The Finance Bill 2024 aims to ease #VAT burdens by raising the registration threshold from Ksh 5M to Ksh 8M annual turnover. This move could lighten administrative loads, fostering growth. #FinanceBill2024 #VATReform #KenyaBusiness #TaxRelief

Cross-border #VAT loopholes for businesses won’t be around much longer. #VATreform. Read more here: European VAT Reform Targets Cross-Border E-Commerce - Radius ow.ly/ojEg30iDkRv

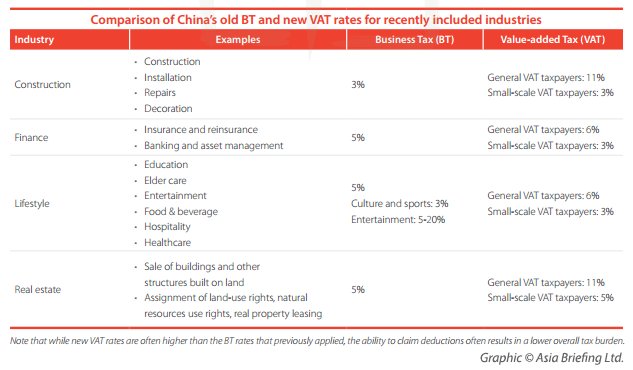

This year, China expanded its VAT system to include more service sectors. Learn more in our new mag: bit.ly/CBNov2016 #VATreform

#VATReform for B2C Distance Selling and #ECommerce in 2021 : Luxembourg plans to open its one-stop VAT registration portal on October 1st. For more information, please click here 👉 EN : bit.ly/34RsEdL FR : bit.ly/3eCRhPH

This year, China expanded its VAT system to include more service sectors. Learn more in our new mag: bit.ly/CBNov2016 #VATreform

Can Croatia boost its fintech boom with VAT cuts for green tech to combat 4.1% inflation? Read my article for insights! [luka.guru/xpz8] #CroatiaFintech #GreenFintech #VATReform #InflationFight #FDI #SustainableFinance #EUEconomy #ZagrebHub #GreenDeal

In 2004 Glynn and I spoke how we want to change our city’s reputation as a culinary desert. We’ve done that and that gave so many more entrepreneurs the confidence to join our hospitality scene. It’s a shame that independent operators are being taxed out of existence. #vatreform

🔴LIVE: we start Day 2 of our #EESCplenary. Tune in for: 📢debate on priorities of @ro2019eu with Romanian PM Viorica Dăncilă at 9.30 Votes on 📌#VATreform 📌#DeepeningEMU 📌#MinimumIncome 🧐All info & agenda europa.eu/!rC63hC 📺Web stream europa.eu/!Fq77xK

Big News: Major VAT Changes! 📢 This reform focuses on mandatory digital reporting, expanding VAT obligations for online platforms, and simplifying registration. 🌍💼 Read more: eu1.hubs.ly/H0dHt920 #VATReform #DigitalEconomy #EUUpdate #1stopVAT

🏛️ @Historic_Houses report shows VAT rebate scheme changes could boost heritage sector, improving access & economic benefits. Read more: ow.ly/nG3r50UZgOL #Heritage #VATreform

A terrible loss for Birmingham Hospitality family, Glynn and the Purnells team were instrumental in changing the world’s opinion of our city’s food scene. But sadly one of many great restaurants that we’ve lost and I fear many more to follow. We need fairer terms #vatreform

Very sad news to bring you this morning about the closure of @purnellsrest Glynn Purnell, the chef behind Michelin-starred restaurant Purnell’s, has announced that his establishment closed its doors for the final time on Saturday 12 October. The news marks the end of an era for…

Italy is dropping VAT on art sales from 22% to just 5%, making it the lowest rate in the EU. 🎨🇮🇹 #ArtMarket #VATReform theartnewspaper.com/2025/06/23/ita…

Wike dey squeeze their neck lift, right and center.. one man wey be crowd 😂 #Nigeria #IPOB #VATReform

The expected VAT reform would be much welcomed by the business community – Deloitte 3news.com/business/the-e… #VATReform #BusinessCommunity #ValueAddedTax

7/ Fairer. Smarter. Real-world tax policy. Not slogans. Not spreadsheets. 8/ If you think this makes sense, share it. Let us push for reform that helps people. #VATReform #EnergyJustice #TaxFairness #LegacyDriven

UK VAT-free silver would unleash retail demand, safety, and legacy investing, there is no reason the UK Government should charge VAT on investment #XAG. Make silver the people’s metal, sterling pound. #Silver #VATReform #LegacyWealth #Breakout

Silver $46.25 Third test of $50 incoming. 1980: Hunt Bros squeeze. 2011: QE rally. 2025: The story going forward a break $50 and it is $200+ minimum. Purpleline: #Silver #VATReform #LegacyWealth #Breakout 👇

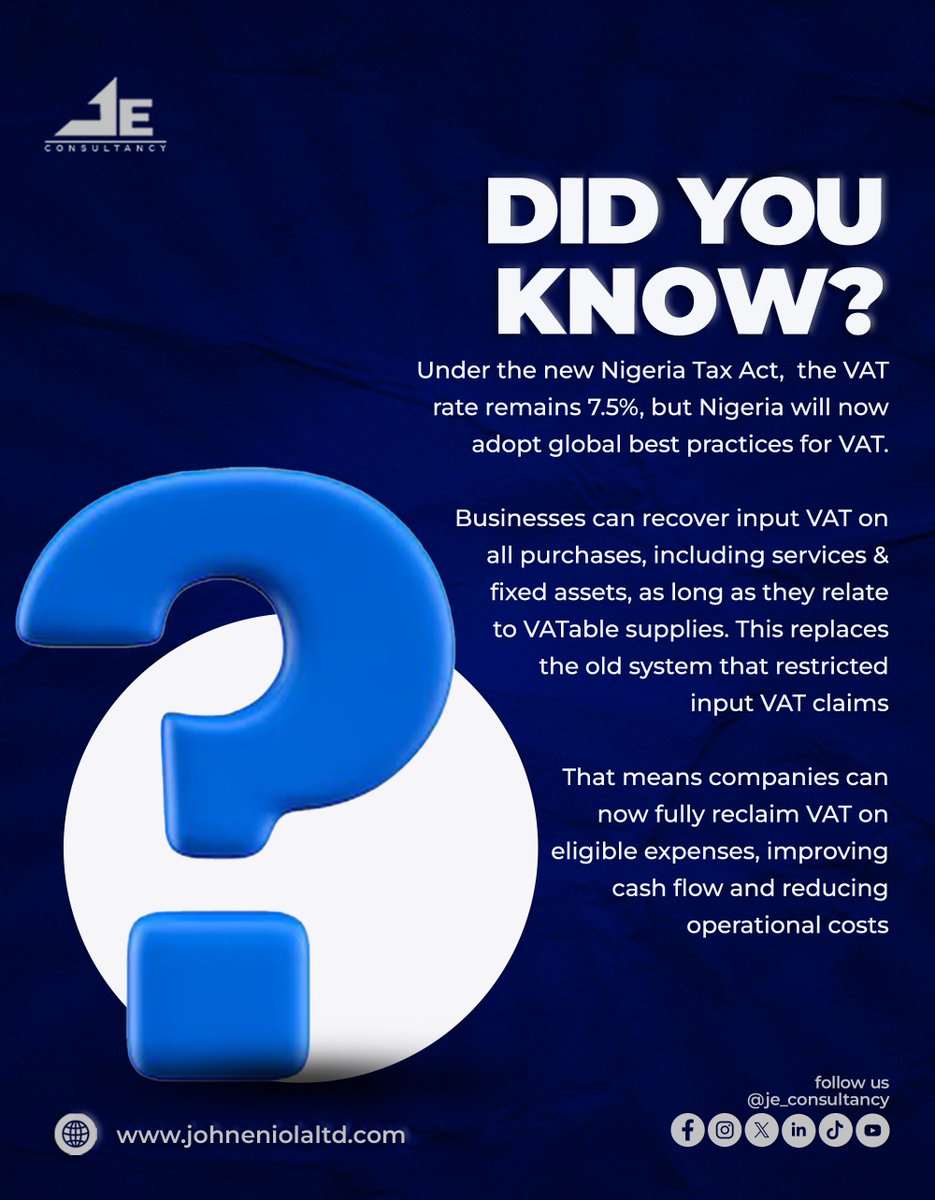

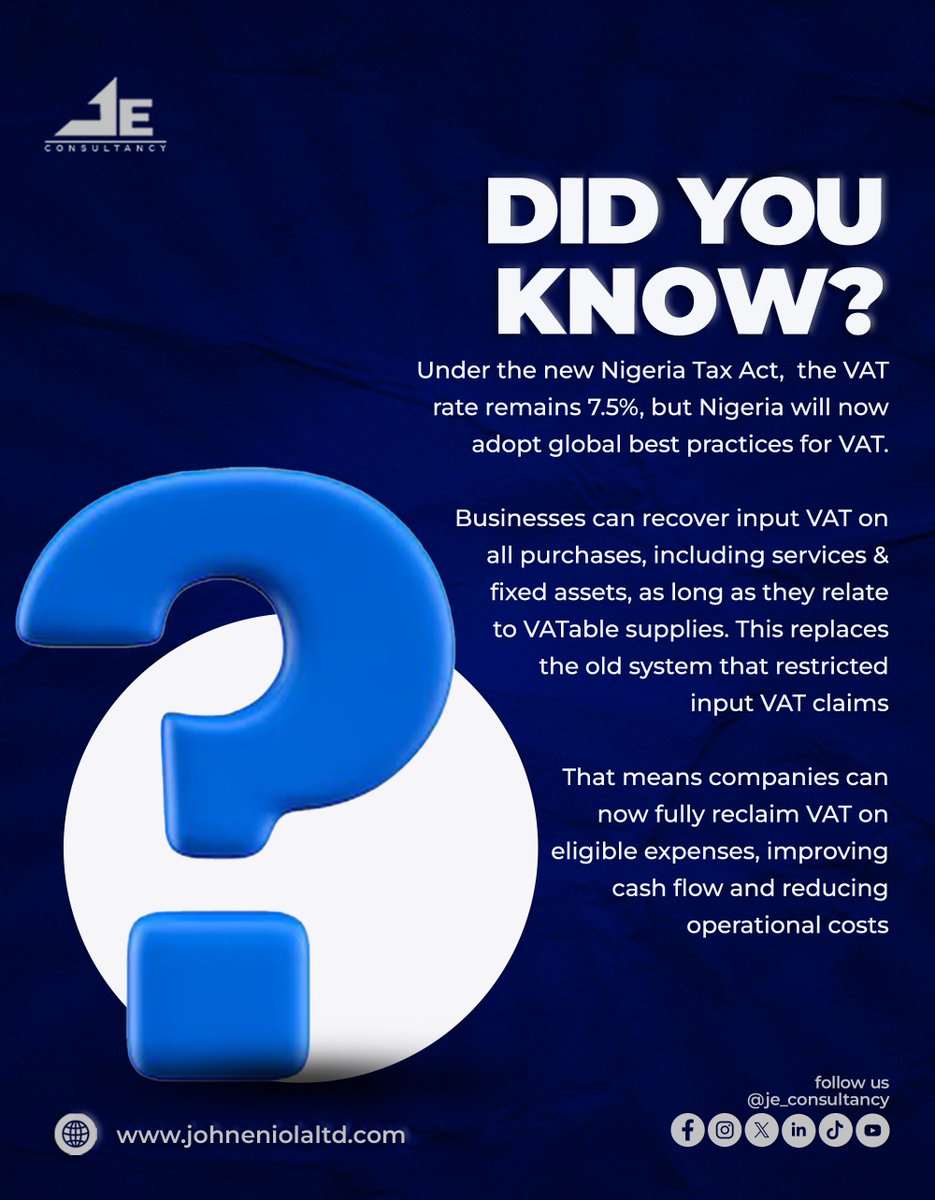

Did you know? 🇳🇬 Nigeria’s new Tax Act allows businesses to recover input VAT on all purchases — including services & fixed assets — if related to vatable supplies. Aligning with global best practices. 💼📊 #NigeriaTax #VATReform #BusinessNigeria #TaxTips

Can Croatia boost its fintech boom with VAT cuts for green tech to combat 4.1% inflation? Read my article for insights! [luka.guru/xpz8] #CroatiaFintech #GreenFintech #VATReform #InflationFight #FDI #SustainableFinance #EUEconomy #ZagrebHub #GreenDeal

The St. Lucia Chamber of Commerce has welcomed recent VAT reforms, calling them “long overdue” and a boost for business and consumers alike. #VATReform #StLuciaBusiness thevoiceslu.com/2025/08/chambe…

thevoiceslu.com

Chamber Welcomes VAT Reforms, Signals Relief for Consumers - The Voice St. Lucia News

The St. Lucia Chamber of Commerce, Industry and Agriculture has welcomed the Government’s recent adjustments to the Value Added Tax …

Expanding VAT coverage to digital services, e-commerce, and informal sectors can increase revenue mobilization while maintaining reduced rates for essential goods to protect low-income households .#VATReform #Broadening

Senators, @senatePH instead of removing the 12% VAT, please keep it for the wealthy and set 0% for people in need. Kindly note: removing this entirely also cuts our budget for schools, hospitals, and infrastructure. 🇵🇭💡 #PHSenate #VATReform #ProtectPublicServices #ProPoorPolicy

The UK is considering lowering the VAT registration threshold from £90,000 to bring more small businesses under the VAT net without raising rates. tax.news/vat-reform-thr… #VATReform #UKTax

tax.news

Tax.News - UK VAT Reform 2025: Threshold Reduction and Simplification Drive Tax System Efficiency

Explore the latest UK VAT reform proposals focusing on lowering the VAT registration threshold and improving legal clarity to simplify compliance for small businesses and multinationals alike.

Italy is dropping VAT on art sales from 22% to just 5%, making it the lowest rate in the EU. 🎨🇮🇹 #ArtMarket #VATReform theartnewspaper.com/2025/06/23/ita…

KRA targets VAT as top revenue source Kenya Revenue Authority plans to overhaul VAT collection through a digital system aimed at curbing evasion & boosting revenue. 🔗 newsly.co.ke/kra-targets-va… #KRA #VATReform #TaxJusticeKE #KenyaEconomy #DigitalTaxation

newsly.co.ke

KRA Targets VAT as Top Revenue Source Through Digital Overhaul

... an authoritative Kenyan digital news and media site.

Reforming Egypt’s VAT system provides the advantage of boosting the government’s ability to fund national development projects and improve public services. #VATReform #PublicServices

The implementation of VAT reforms in Egypt has contributed to improved public service delivery, ensuring better healthcare, education, and infrastructure for citizens. #VATReform #PublicServices

Despite efforts to increase the national tax-to-GDP ratio 10pc this year, the large informal market remains a formidable adversary. #TaxCollection #TaxJustice #VATReform #CustomsEnforcement Read more - ow.ly/MMn950VSgWK

Bangladesh’s VAT system has been reformed multiple times to broaden its base, reduce exemptions, and increase collection, although challenges remain in effective implementation. #VATReform #TaxBaseExpansion

The federal government's annual expenditure of 1.2 trillion Br painted a picture against the backdrop of its current revenue collections. #TaxCollection #TaxJustice #VATReform #CustomsEnforcement Read more - ow.ly/8U3f50VQKnk

OPINION: If VAT will be collected based on where goods are consumed — not supplied, this long-demand change could benefit heavily on populated, high-consumption states. True or False? 🧐🤔 #VATReform #NigeriaTax #FiscalFederalism

“VAT will now be collected based on where goods are consumed—not supplied.” This long-demanded change could benefit heavily populated, high-consumption states. #VATReform #NigeriaTax #FiscalFederalism bit.ly/3GJNyCI

premiumtimesng.com

UPDATED: Senate passes tax reform bills

The Senate President, Godswill Akpabio, announced passage of the bills after a majority of the senators supported them.

#NigeriaTaxReform'25 For the 1st time ever, Nigerian businesses can claim input VAT on assets and services. #VATReform #Nigeria

Definitive system of reduced VAT rates – Too much freedom? New IBFD White Paper link.ibfd.org/2Fw0rzR #VATreform

#VATReform Ekiti continues to "shame" us trying to overtake BH & Terrorism infested states? That is one state led by another too much sense PhD holder. According to my late mum "Ọtọ́ ní Ọgbọ́n ìwé, oto ni ọgbọ́n orí" Asiwaju no get PhD o Make I nor just talk... 🙄🙄

Did you know? 🇳🇬 Nigeria’s new Tax Act allows businesses to recover input VAT on all purchases — including services & fixed assets — if related to vatable supplies. Aligning with global best practices. 💼📊 #NigeriaTax #VATReform #BusinessNigeria #TaxTips

Big news for Kenyan small businesses! The Finance Bill 2024 aims to ease #VAT burdens by raising the registration threshold from Ksh 5M to Ksh 8M annual turnover. This move could lighten administrative loads, fostering growth. #FinanceBill2024 #VATReform #KenyaBusiness #TaxRelief

Let the states control their VAT. There’s no point benefitting from the proceeds of what you forbid. #VATReform 💳

Belgium's art market braces for impact as EU 'rates directive' mandates #VAT increase from 6% to 21% by 2025, ending special regimes. Neighboring France and Luxembourg opt for lower rates, posing challenges for Belgian galleries, artists, and collectors. #BelgianArt #VATreform

A great week of learning and knowledge exchange with the participants of the #mozmod retreat. This year they are producing policy briefs about #CashTransfer, #VATreform, and #UcranianWarImpacts. Studies with high relevance for policymaking. @UNUWIDER @ilolusaka @InclusiveMoz

📰 VAT Reform: Evolution, Not Revolution #VATReform #TaxReform #UKTax #SME #VATSimplification #InternationalTax #PolicyChange #TaxPolicy #CharteredAccountants #TaxAdvisors #AccountantsinLondon #UnitedKingdom #uk

A beautiful old Bill Tidy MBE original, that's still just as pertinent today! Robbed at umbrella point!! #pubs #hospitality #vatreform

⚖️ VAT reforms: Big growth potential, but political hurdles are immense. Timing & bold messaging are crucial, says David Gauke. #VATReform #TaxReform #FiscalPolicy #PublicFinance #Economy #Politics #Treasury #EconomicGrowth #PoliticalChallenges #UnitedKingdom #uk

The VAT base is too narrow, and the UK is falling behind in digital tax solutions. 📉 Big change is needed—modernisation & fairness are the way forward! 🚀 #VATreform #UKeconomy #taxation #fiscalpolicy #accountingservices #taxadvice #ukbusiness #AccountantsinLondon #uk

Simplifying VAT compliance & supporting not-for-profits are crucial to unlocking 20% growth capital for small businesses. Discover how VAT reforms could reshape UK entrepreneurship! #VATReform #SMEs #SMEGrowth #UKBusiness #UKEconomy #TaxReform #Entrepreneurship

OPINION: If VAT will be collected based on where goods are consumed — not supplied, this long-demand change could benefit heavily on populated, high-consumption states. True or False? 🧐🤔 #VATReform #NigeriaTax #FiscalFederalism

Estonia has blocked an EU VAT reform that aimed to impose new liabilities on short-term rental services such as Airbnb and passenger transport services like Bolt. 🇪🇺🏠🚗 #Estonia #EU #VATReform #Airbnb #Bolt #TechNews

🚨 The EU officially approves ViDA to modernize VAT! 🔹 Digital VAT reporting by 2030 🔹 Online platforms must collect & pay VAT 🔹 Enhanced OSS for easier cross-border compliance New rules take effect 20 days after publication! #ViDA #VATReform #EURegulations #TaxCompliance

#VATReform for B2C Distance Selling and #ECommerce in 2021 : Luxembourg plans to open its one-stop VAT registration portal on October 1st. For more information, please click here 👉 EN : bit.ly/34RsEdL FR : bit.ly/3eCRhPH

AGI President's Call: Fix VAT Before Tax Cuts! Dr. Yaw Osei Adutwum urges the government to prioritize VAT reform for long-term growth. 💡 #VATReform #Ghana #EconomicGrowth #AgiosErotas Full details here: anuanommedia.com/agi-president-…

Leading enterprises #LongStay #Apartment gets invested constantly, benefits from #VATreform e.meadin.com/e/128595_1.sht…

Big News: Major VAT Changes! 📢 This reform focuses on mandatory digital reporting, expanding VAT obligations for online platforms, and simplifying registration. 🌍💼 Read more: eu1.hubs.ly/H0dHt920 #VATReform #DigitalEconomy #EUUpdate #1stopVAT

Something went wrong.

Something went wrong.

United States Trends

- 1. #AskFFT N/A

- 2. Good Sunday 77.6K posts

- 3. Klay 35.7K posts

- 4. Raora 3,287 posts

- 5. #sundayvibes 6,549 posts

- 6. Full PPR N/A

- 7. Ja Morant 16.7K posts

- 8. Cornbread 1,550 posts

- 9. #FelizCumpleañosNico 6,230 posts

- 10. #AskBetr N/A

- 11. McLaren 145K posts

- 12. Michael Wilson N/A

- 13. Tuten 1,407 posts

- 14. Sunday Funday 3,128 posts

- 15. Leeds 15.9K posts

- 16. Kamara 1,629 posts

- 17. Beirut 11.9K posts

- 18. Fritos N/A

- 19. #FelizCumpleañosPresidente 5,026 posts

- 20. Pick 2 18.3K posts