#vixanalysis search results

$VIX Downturn: Black Swan Needed to Stop the Momentum? #VIXAnalysis #MarketTrends #StockMarket #Trading #Investment #Finance #BlackSwan #MarketUpdate #Volatility #EconomicNews

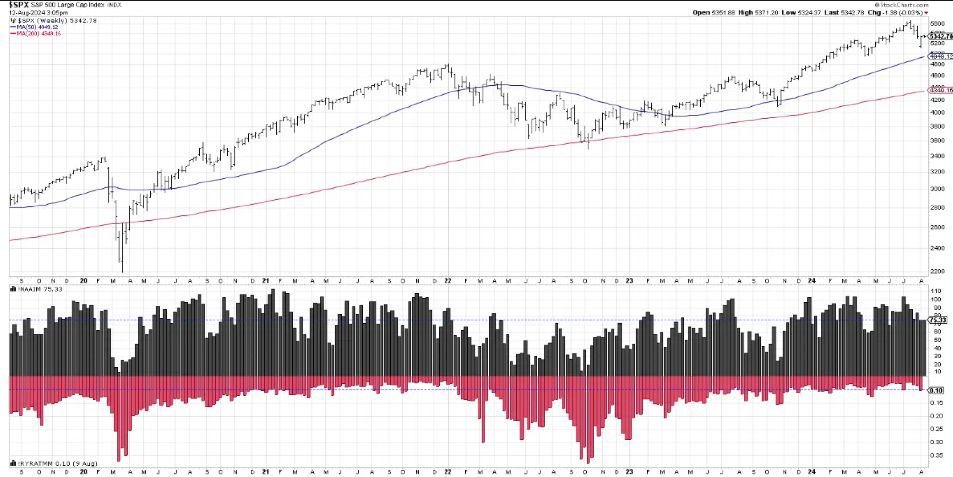

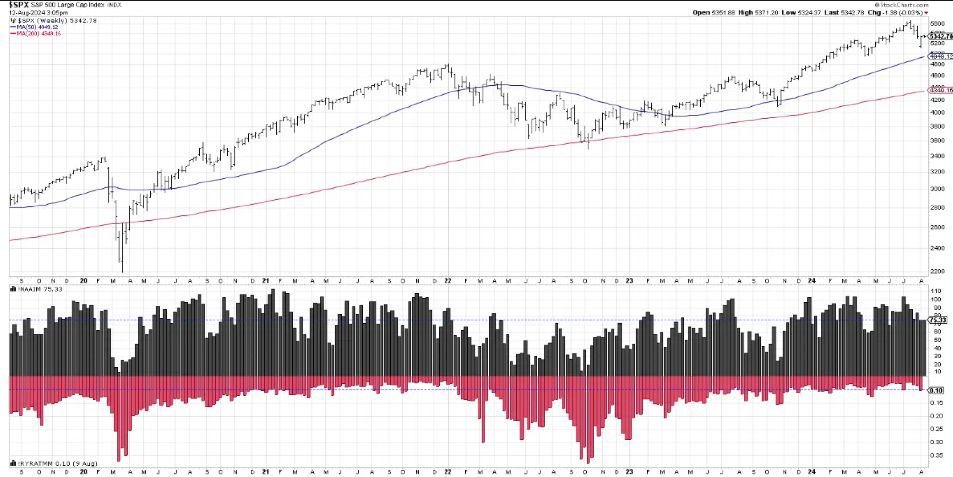

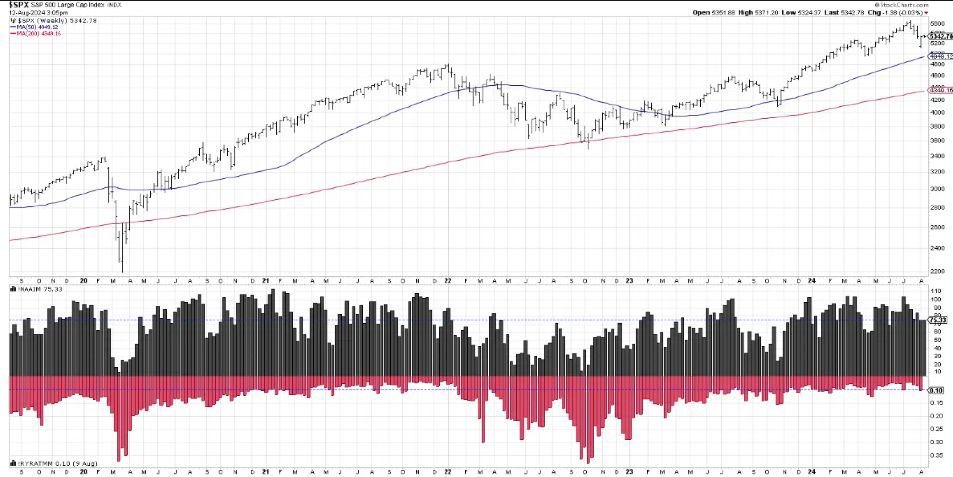

The NAAIM Exposure Index just went on a wild ride! Five weeks ago, it was above 100%. Now, it’s down to around 75%. Money managers are definitely hitting the brakes and getting more cautious. Is a deeper market correction on the horizon? #MarketVolatility #VIXAnalysis

The NAAIM Exposure Index just went on a wild ride! Five weeks ago, it was above 100%. Now, it’s down to around 75%. Money managers are definitely hitting the brakes and getting more cautious. Is a deeper market correction on the horizon? #MarketVolatility #VIXAnalysis

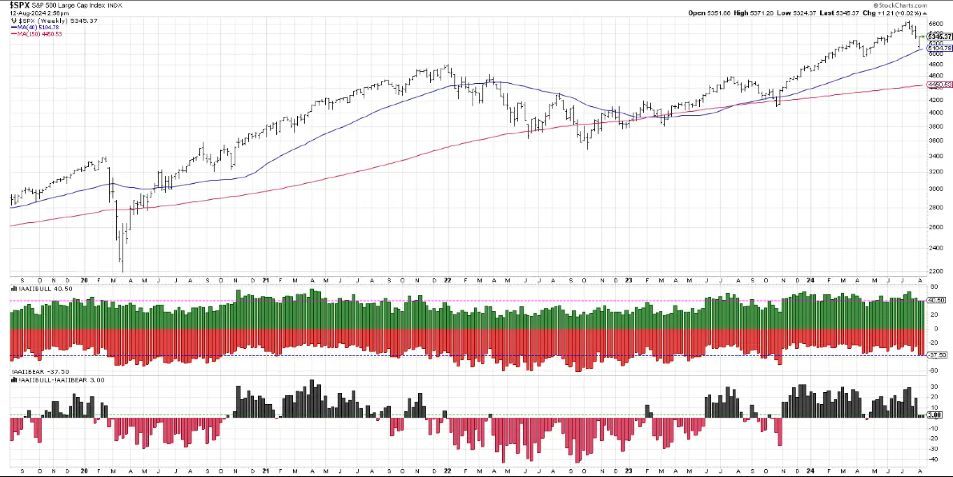

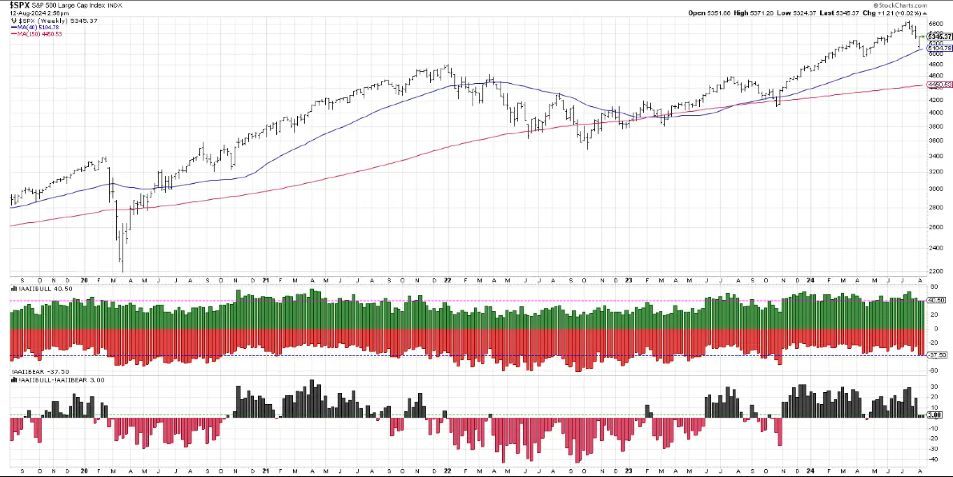

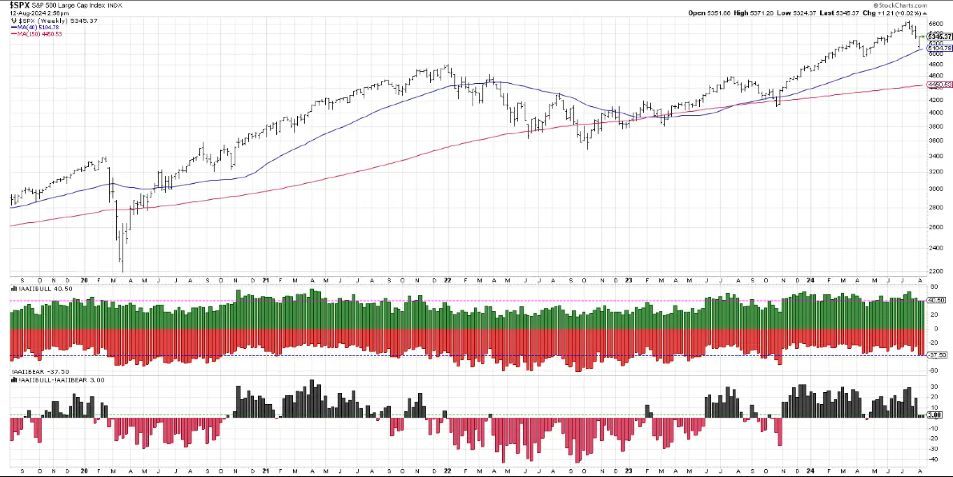

Checking out the AAII survey lately? Recently, the bullish reading dropped from 52% to around 40%, and bearish sentiment increased from 22% to 38%. Perhaps the crowd is accepting the idea of a not-so-soft landing?... #MarketVolatility #VIXAnalysis #FearGauge #RiskManagement

Over the last 3 hours, VIX fluctuated between 16.010 and 16.430, showing a percent change of -2.38% to 2.30%. Choppiness index indicates increased volatility, while momentum is slightly negative. #VIXanalysis #30minData

S&P 500 crash deepens with a historic intraday reversal. VIX above 52, bonds selling off—insights inside: medium.com/decoding-marke… #SP500Crash #MarketVolatility #VIXAnalysis #FinancialModels #Investing

medium.com

S&P 500 Crash Deepens with Historic Intraday Reversal: VIX Soars Above 52

The S&P 500 crash deepens with a historic intraday reversal as the VIX soars above 52

(Bridge) The VIX reveals the mood, the market's heartbeat, It captures the essence, the market's heat. From greed to despair, it reflects the emotion, Oh, the VIX volatility, it's quite the devotion. #MarketEmotion #VIXAnalysis

#VIXAnalysis: 2023 saw a notable drop in the Volatility Index compared to 2022 📉. The daily closing high for the $VIX on March 13th, 2023 (26.52) was influenced by a brief panic in the US regional bank sector. 📈 What's catching our eye? Post-VIX spikes often signal an…

$VIX Downturn: Black Swan Needed to Stop the Momentum? #VIXAnalysis #MarketTrends #StockMarket #Trading #Investment #Finance #BlackSwan #MarketUpdate #Volatility #EconomicNews

S&P 500 crash deepens with a historic intraday reversal. VIX above 52, bonds selling off—insights inside: medium.com/decoding-marke… #SP500Crash #MarketVolatility #VIXAnalysis #FinancialModels #Investing

medium.com

S&P 500 Crash Deepens with Historic Intraday Reversal: VIX Soars Above 52

The S&P 500 crash deepens with a historic intraday reversal as the VIX soars above 52

Over the last 3 hours, VIX fluctuated between 16.010 and 16.430, showing a percent change of -2.38% to 2.30%. Choppiness index indicates increased volatility, while momentum is slightly negative. #VIXanalysis #30minData

The NAAIM Exposure Index just went on a wild ride! Five weeks ago, it was above 100%. Now, it’s down to around 75%. Money managers are definitely hitting the brakes and getting more cautious. Is a deeper market correction on the horizon? #MarketVolatility #VIXAnalysis

The NAAIM Exposure Index just went on a wild ride! Five weeks ago, it was above 100%. Now, it’s down to around 75%. Money managers are definitely hitting the brakes and getting more cautious. Is a deeper market correction on the horizon? #MarketVolatility #VIXAnalysis

Checking out the AAII survey lately? Recently, the bullish reading dropped from 52% to around 40%, and bearish sentiment increased from 22% to 38%. Perhaps the crowd is accepting the idea of a not-so-soft landing?... #MarketVolatility #VIXAnalysis #FearGauge #RiskManagement

#VIXAnalysis: 2023 saw a notable drop in the Volatility Index compared to 2022 📉. The daily closing high for the $VIX on March 13th, 2023 (26.52) was influenced by a brief panic in the US regional bank sector. 📈 What's catching our eye? Post-VIX spikes often signal an…

(Bridge) The VIX reveals the mood, the market's heartbeat, It captures the essence, the market's heat. From greed to despair, it reflects the emotion, Oh, the VIX volatility, it's quite the devotion. #MarketEmotion #VIXAnalysis

Checking out the AAII survey lately? Recently, the bullish reading dropped from 52% to around 40%, and bearish sentiment increased from 22% to 38%. Perhaps the crowd is accepting the idea of a not-so-soft landing?... #MarketVolatility #VIXAnalysis #FearGauge #RiskManagement

The NAAIM Exposure Index just went on a wild ride! Five weeks ago, it was above 100%. Now, it’s down to around 75%. Money managers are definitely hitting the brakes and getting more cautious. Is a deeper market correction on the horizon? #MarketVolatility #VIXAnalysis

The NAAIM Exposure Index just went on a wild ride! Five weeks ago, it was above 100%. Now, it’s down to around 75%. Money managers are definitely hitting the brakes and getting more cautious. Is a deeper market correction on the horizon? #MarketVolatility #VIXAnalysis

Something went wrong.

Something went wrong.

United States Trends

- 1. #BaddiesUSA 34.8K posts

- 2. Rams 23.7K posts

- 3. Cowboys 91.6K posts

- 4. Eagles 131K posts

- 5. Stafford 10.7K posts

- 6. Bucs 10.6K posts

- 7. Baker 18.7K posts

- 8. Scotty 7,466 posts

- 9. #RHOP 8,641 posts

- 10. Raiders 58.2K posts

- 11. Stacey 28.6K posts

- 12. Teddy Bridgewater N/A

- 13. Chip Kelly 4,366 posts

- 14. Todd Bowles 1,413 posts

- 15. Pickens 29.3K posts

- 16. #ITWelcomeToDerry 9,345 posts

- 17. Browns 104K posts

- 18. Shedeur 119K posts

- 19. Nimmo 19.4K posts

- 20. Ahna 4,302 posts