#volatilitytrading search results

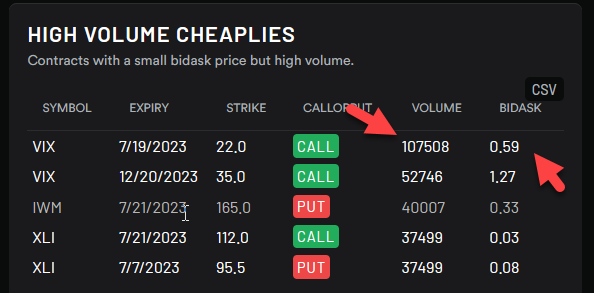

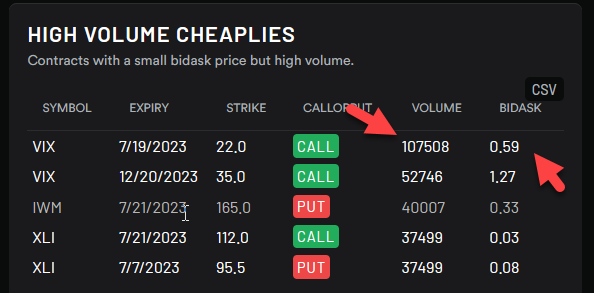

Daily $VIX 6/22/2023 makes a new low, mega action in the VIX 7/19 22's Calls, current Implied Volatility (IV) a whopping 172%, pt 2 is next #VolatilityTrading

Volatility in digital assets can be intimidating, but it's also fertile ground for strategic trades. Embrace the ups and downs. #VolatilityTrading #EmbraceChange

📈 Essential Volatility Trading tools to empower you on your trading journey! 🌐✨ Essential Tools: 1️⃣ VIX 2️⃣ Bollinger Bands 3️⃣ Implied vs. Historical Volatility 🎥 Dive into the strategy! bit.ly/4aEiE9j 🚀 #VolatilityTrading #TradingStrategies

Straddle Strangle Swaps can be powerful tools for profit in volatile markets. 📈 #StraddleStrangle #VolatilityTrading

As #USElection2024 heats up, investors turn to #VolatilityTrading. Using complex derivatives, they're betting on market swings rather than outcomes. The #SP500 could see a 2.8% move post-election w/ the VIX in focus. A new era of election trading strategy. #ElectionTrading

⚖️ How to Use: Low Volatility: ATR(14) < 50 pips → Tighten stops, scale into positions. High Volatility: ATR(14) > 100 pips → Wider stops, trailing SL. Example: If EUR/USD ATR drops below 60, switch to scalping. #VolatilityTrading #ATRStrategy

Volatility is the heartbeat of opportunity! Unpack the drivers behind market volatility — economic data, geopolitical events, and sentiment shifts. Embrace the volatility, but tread carefully! 📉📈 #VolatilityTrading #MarketOpportunities @RayDalio

🗣️ Investing Russian Roulette - An Ergodicity Masterclass 🎧 @JasonCBuck from @MutinyFunds joins @RodGordilloP & @GestaltU to discuss #ergodicity, understanding the emotion behind #portfolioconstruction, #volatilitytrading & more.

#OptionsTrading #CryptoOptions #VolatilityTrading #GoldCondorCapital #BTCOptions #RiskManagement #MakeVolatilityGreatAgain #ThetaGang #VegaControl #TradingStrategy

Don't Get Wrecked! Protect Your Trades From Market Chaos! #VolatilityTrading #RiskManagement #PositionSizing #FinancialMarkets #TradingStrategies #ProtectYourTrades #MarketAnalysis #TradingTips #InvestmentStrategy #StockMarket

Real traders don’t pray for green candles, they train their code to hunt volatility. #CryptoMarkets #VolatilityTrading #DeFiEdge

Don’t worship volatility master it. Build rules that survive chaos. #VolatilityTrading #CryptoWarrior #AlgoRules

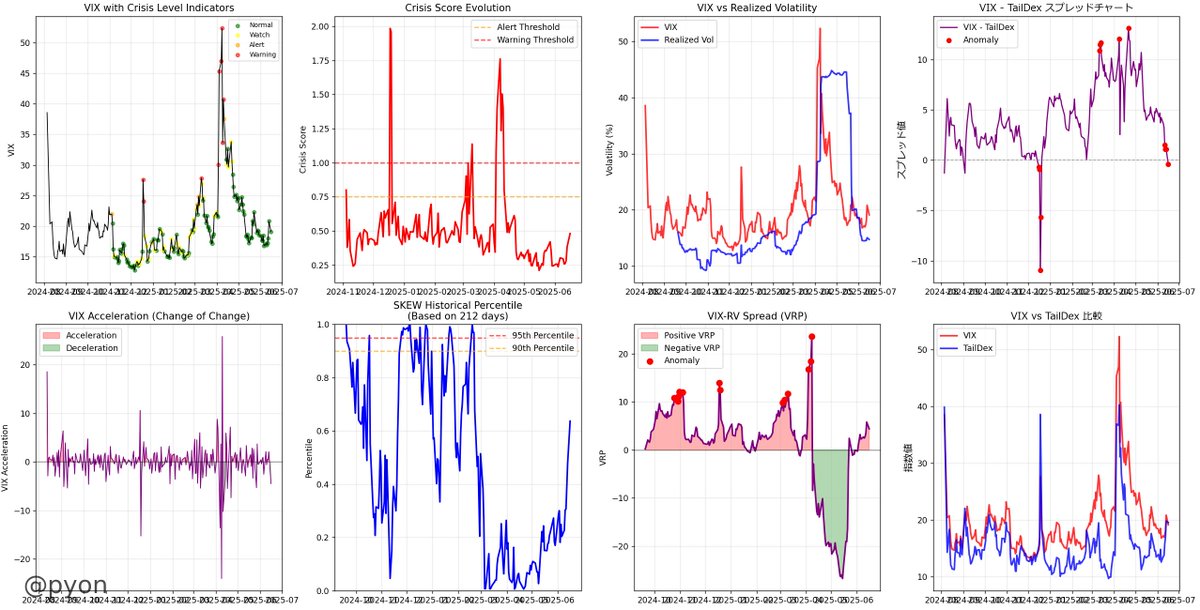

🔥 Built a tool to track and compare implied volatility / skew across chain and indices Check it out here: [tradingalgo.in] #OptionsTrading #VolatilityTrading #NIFTY #skew

![Souvik131's tweet image. 🔥 Built a tool to track and compare implied volatility / skew across chain and indices

Check it out here: [tradingalgo.in]

#OptionsTrading #VolatilityTrading #NIFTY #skew](https://pbs.twimg.com/media/GslO6IqXoAEHL1M.jpg)

📊 Dan Passarelli dives into volatility and how it can give you an edge in options trading. Learn how to read historical vs. implied volatility charts and factor in events like earnings! 🚀 #VolatilityTrading #OptionsStrategy #TradeSmart

Volatile Stocks: Small Capital, Big Moves Trading Strategy #VolatilityTrading #StockMarket #TradingStrategy #RiskManagement #DayTrading #SmallCapStocks #Investing #ProfitTargets #StopLoss #FinancialFreedom

📢 LIVE Trade Signal – TIDAL VexAlpha™ 📢 This was the real trade signal to the TIDAL Prime community on August 2, 2024—the one that nailed a 12%+ one-day gain on $VXZ (and $VIXM was up 20%!). ⚡ See the real-time trade signal here: tinyurl.com/mvy2pdh2 #VolatilityTrading…

Trade with confidence using Bollinger Bands! 📉📊 These volatility bands help identify overbought or oversold conditions, signaling potential entry and exit points. #BollingerBands #VolatilityTrading #Aquacity

Heston solves this with 4 critical parameters: κ (kappa): Mean reversion speed θ (theta): Long-run variance target σ_v (sigma): Volatility-of-volatility ρ (rho): Spot-vol correlation For equities, ρ typically ranges -0.6 to -0.8 (negative correlation). #VolatilityTrading

I use average daily range (ADR) to quickly identify stocks that are "in play". If it barely moves, it's not worth your time. Look for names with above average volatility! #DayTrading #SwingTrading #VolatilityTrading Educational content only.

Secret #1: The edge isn't signal complexity When realized vol spikes 5% → 15%, positions automatically cut 66%. No discretion. No genius. Just systematic deleveraging. Position Scalar = Target Vol / Realized Vol #RiskManagement #VolatilityTrading

Don’t worship volatility master it. Build rules that survive chaos. #VolatilityTrading #CryptoWarrior #AlgoRules

Real traders don’t pray for green candles, they train their code to hunt volatility. #CryptoMarkets #VolatilityTrading #DeFiEdge

MasterQuant helps traders navigate volatility with AI-powered strategies that adjust in real time Turn every market movement into opportunity 👉 masterquant.com #VolatilityTrading #AITrading #MarketInsights #DataDriven #MasterQuant

Daily $VIX 6/22/2023 makes a new low, mega action in the VIX 7/19 22's Calls, current Implied Volatility (IV) a whopping 172%, pt 2 is next #VolatilityTrading

Volatility in digital assets can be intimidating, but it's also fertile ground for strategic trades. Embrace the ups and downs. #VolatilityTrading #EmbraceChange

$BTC Bitcoin on the 4hr chart has started a squeeze (shaded area). This means that volatility has built up & a violent breakout to the upside or downside is imminent very soon. If you have the indicator it means watch for the signal coming up to dictate trend #VolatilityTrading

Nice flat Bollinger range on the #Bitcoin market. Keep the 18-25k range by Friday morning expiration, and my options will pay handsomely. #volatilitytrading $BTC

1 month chart of $AAPL showing the predictable run-up before their earnings call next week. #volatilitytrading #aapl #StockTrading

#OptionsTrading #CryptoOptions #VolatilityTrading #GoldCondorCapital #BTCOptions #RiskManagement #MakeVolatilityGreatAgain #ThetaGang #VegaControl #TradingStrategy

Last year we met the master of #volatilitytrading in mumbai and dropped all the ideas Of delta management in intraday trading! @mdave1

Here comes BankNifty IV nearly at last 1 year high at 47.79%, against 48.27% seen on 22nd May 2019. last 2000 period ~ 5 1/2 years, IV went high of 60% too. So plan your trades taking vol in perspective #volatilitytrading #OptionsTrading

⚖️ How to Use: Low Volatility: ATR(14) < 50 pips → Tighten stops, scale into positions. High Volatility: ATR(14) > 100 pips → Wider stops, trailing SL. Example: If EUR/USD ATR drops below 60, switch to scalping. #VolatilityTrading #ATRStrategy

Excited to be building a business that fosters a culture of excellence, generosity, and passion. Blessed to have a partner that believes in me, and clients that trust in our abilities to navigate the financial markets. #volatilitytrading #vix #uvxy #battletested #malataicapital

Volatility is the heartbeat of opportunity! Unpack the drivers behind market volatility — economic data, geopolitical events, and sentiment shifts. Embrace the volatility, but tread carefully! 📉📈 #VolatilityTrading #MarketOpportunities @RayDalio

As #USElection2024 heats up, investors turn to #VolatilityTrading. Using complex derivatives, they're betting on market swings rather than outcomes. The #SP500 could see a 2.8% move post-election w/ the VIX in focus. A new era of election trading strategy. #ElectionTrading

Group Coaching: how will IV affect this position? #tradingvol #volatilitytrading #stockmarket #optionseducation #mtmquiz

🔥 Built a tool to track and compare implied volatility / skew across chain and indices Check it out here: [tradingalgo.in] #OptionsTrading #VolatilityTrading #NIFTY #skew

![Souvik131's tweet image. 🔥 Built a tool to track and compare implied volatility / skew across chain and indices

Check it out here: [tradingalgo.in]

#OptionsTrading #VolatilityTrading #NIFTY #skew](https://pbs.twimg.com/media/GslO6IqXoAEHL1M.jpg)

Something went wrong.

Something went wrong.

United States Trends

- 1. Steph 51.7K posts

- 2. Wemby 24.3K posts

- 3. Spurs 26.7K posts

- 4. Draymond 9,210 posts

- 5. Clemson 10.8K posts

- 6. Louisville 10.6K posts

- 7. #SmackDown 48K posts

- 8. Zack Ryder 14.6K posts

- 9. Aaron Fox 1,668 posts

- 10. #DubNation 1,807 posts

- 11. Dabo 1,932 posts

- 12. Harden 11.9K posts

- 13. Brohm 1,533 posts

- 14. Landry Shamet 5,462 posts

- 15. #OPLive 2,437 posts

- 16. Marjorie Taylor Greene 39.8K posts

- 17. Matt Cardona 2,692 posts

- 18. Miller Moss N/A

- 19. UCLA 7,996 posts

- 20. #CLAWMARK3D 37.3K posts