#weguideyoudecide search results

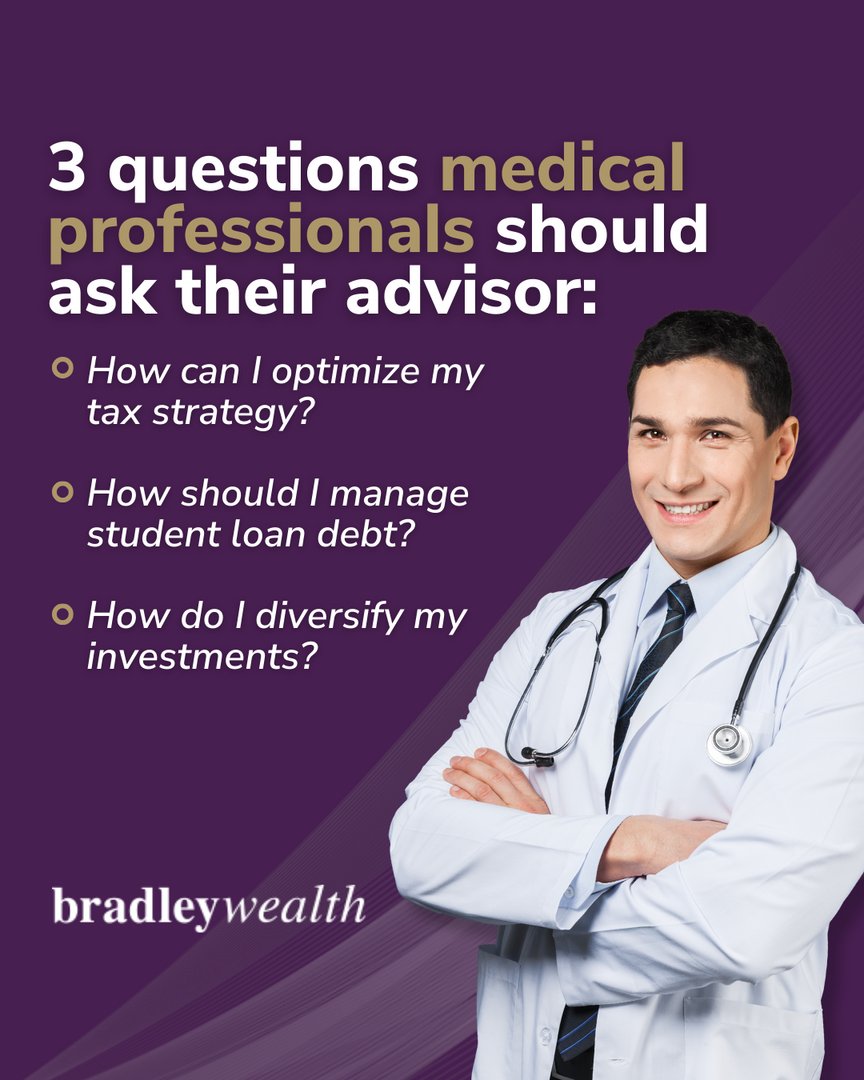

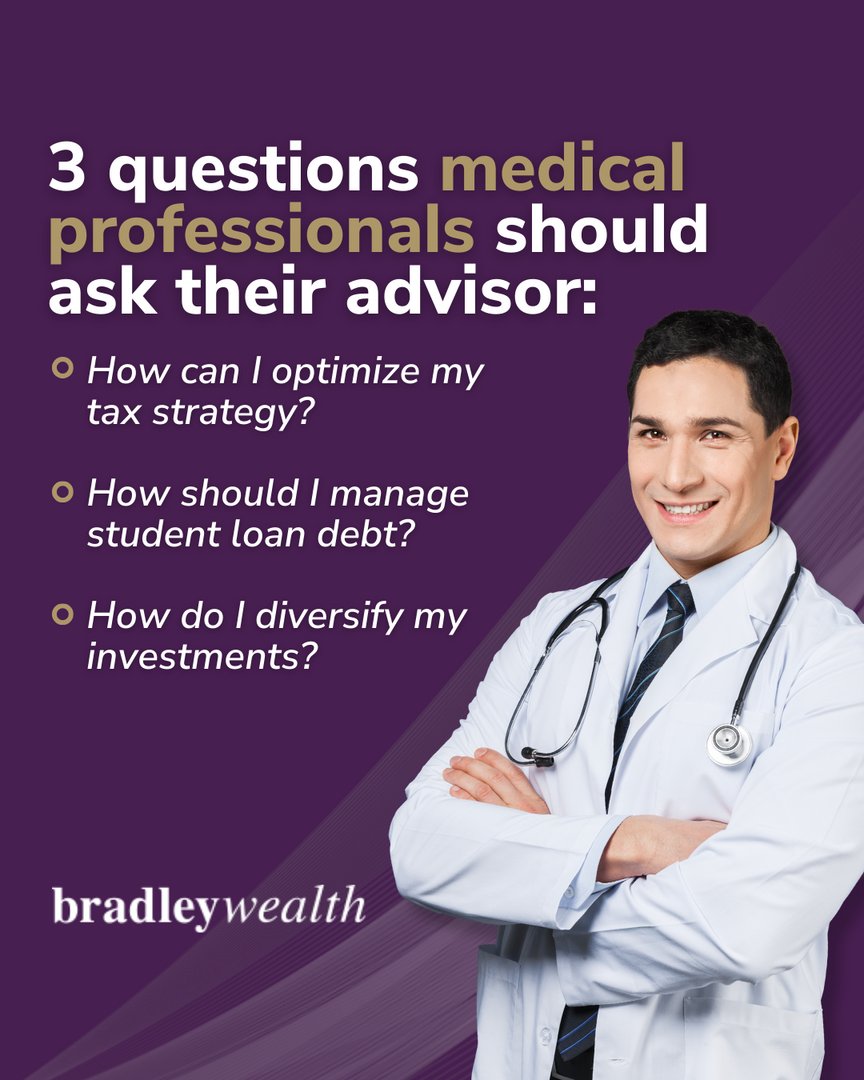

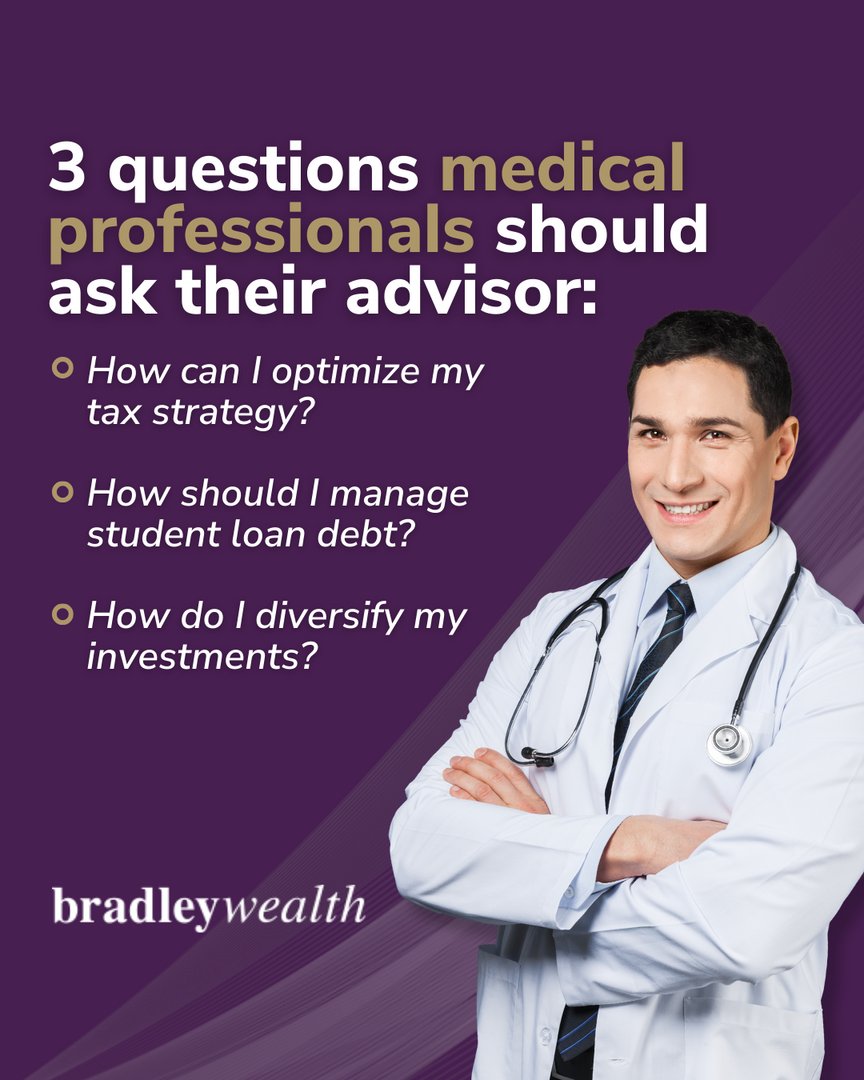

Medical professionals, your financial well-being deserves careful consideration. Our team understands the nuances of your unique career path. Together, we can craft a tailored plan for long-term that aligns with your goals. #WeGuideYouDecide #DoWealthDifferently

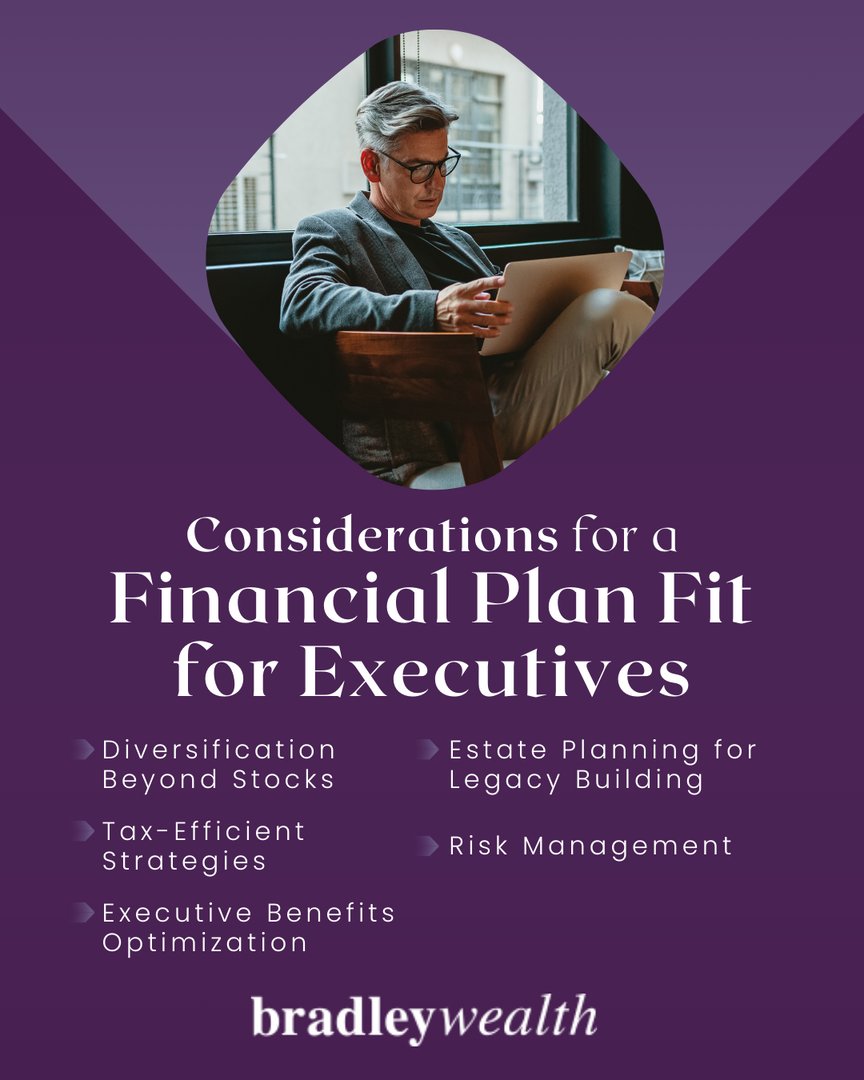

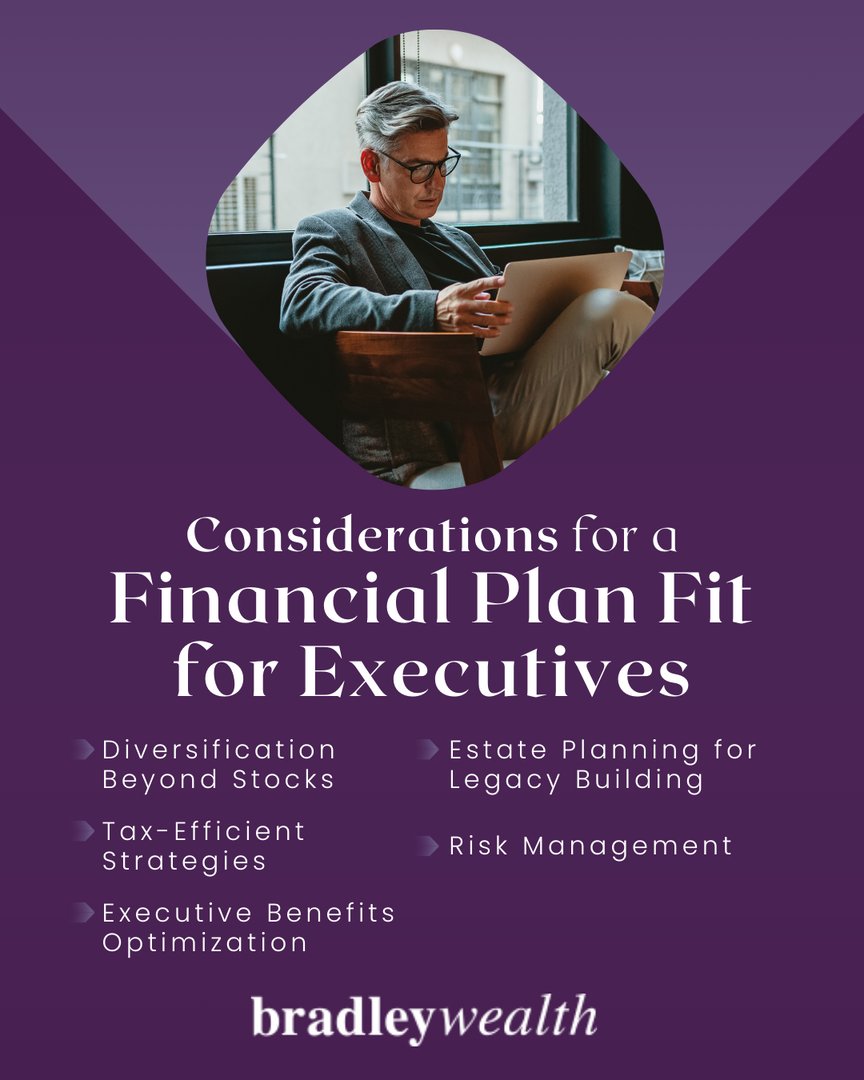

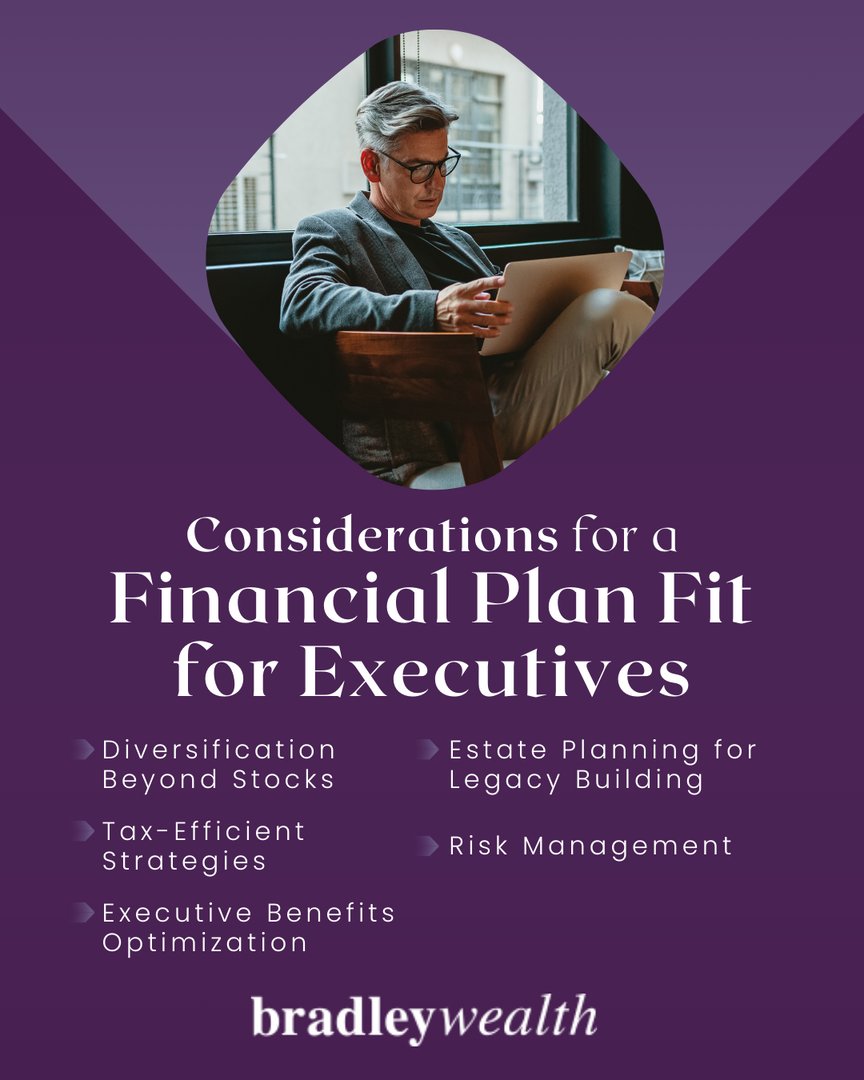

For executives, a tailored financial plan is paramount in working towards a prosperous future. These key considerations form the foundation of a comprehensive financial strategy designed to align with your unique professional trajectory. #LiveLifeByDesign #WeGuideYouDecide

Need help understanding your options? Let's have a conversation. #WeGuideYouDecide #StartYourJourney

We're here to help you stay on the right course, no matter the conditions ahead. #WeGuideYouDecide #NewEraAdvisor

Investing doesn’t have to be complicated. Let’s deconstruct and learn together. #ReturnOnLife #WeGuideYouDecide

Embracing solo retirement? Let's focus on what matters most: your health, finances, and housing. Let's work together to craft a plan. #LifeOfSignificance #WeGuideYouDecide

Ladies, make your money work harder by investing more. It’s a powerful step that can help close the wealth gap and achieve your goals. #ClientCentricApproach #WeGuideYouDecide

Weddings, home-buying, babies, and sometimes...divorce. These aren't just life events, they are money events too. Leverage us for insights and conversation. #WeGuideYouDecide #TrustedAdvisor

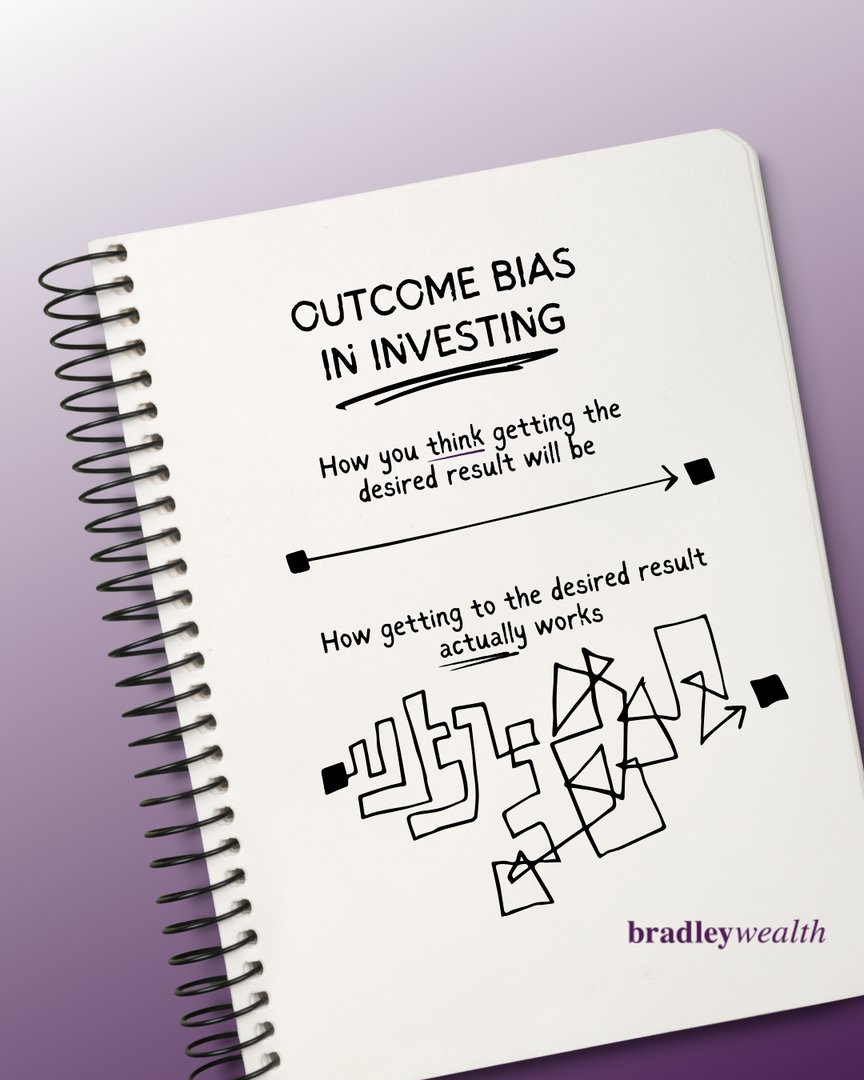

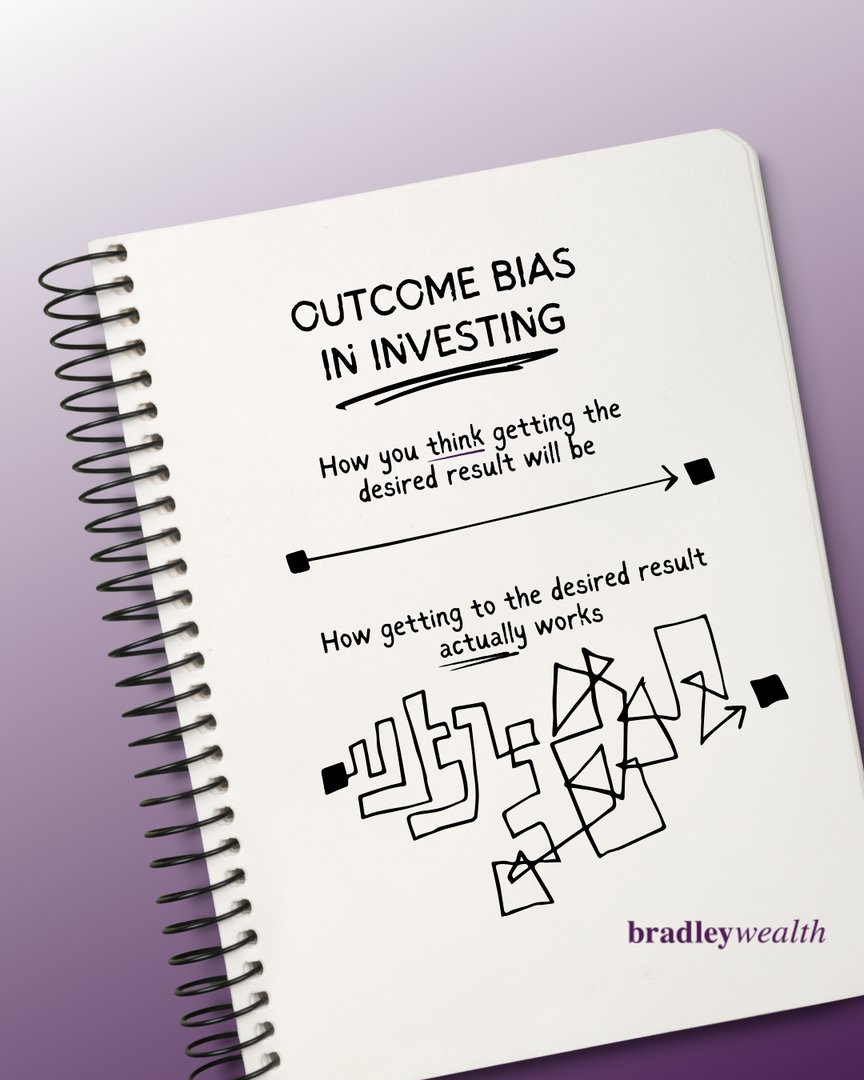

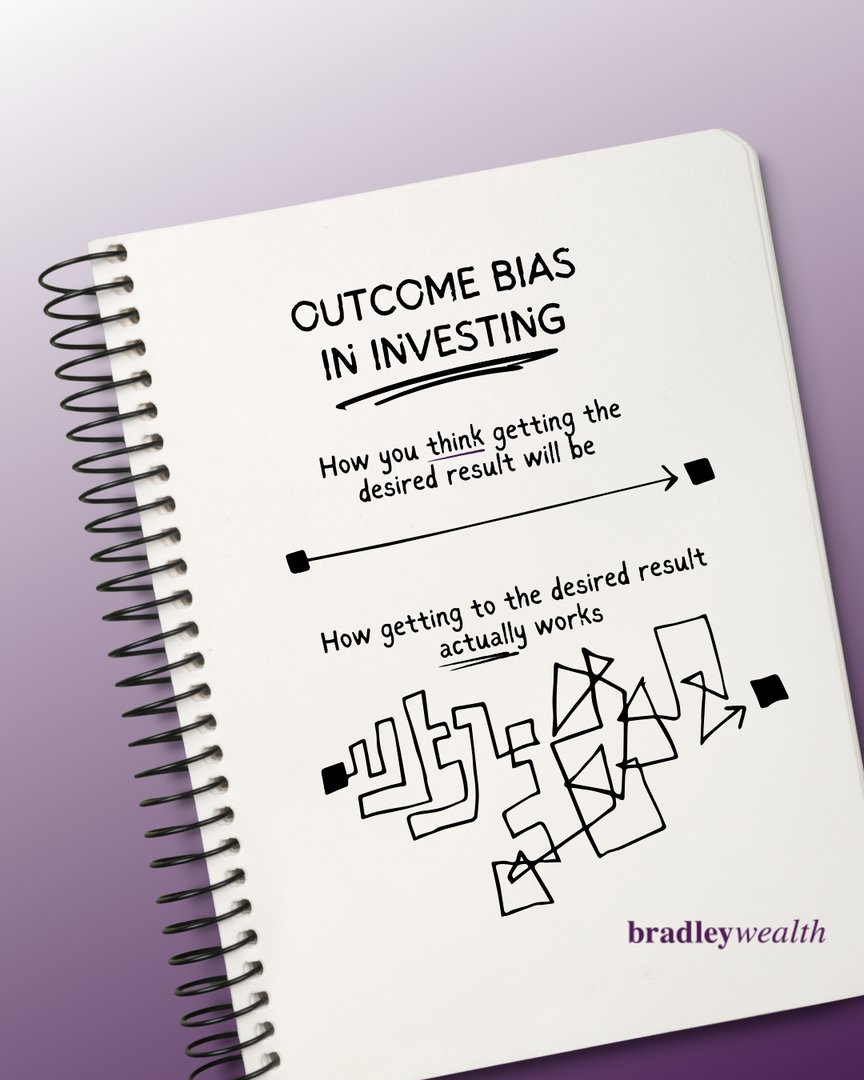

Outcome bias is making a decision based on the outcome of previous events, without regard to how the past events developed. Successful investing isn't just about the results, but the rationale behind your decisions. #WeGuideYouDecide #DoWealthDifferently

As you celebrate your end-of-year bonus, don't forget to factor in taxes. Being mindful of the potential financial implications can help ensure you make the most of this well-deserved reward. #ClientCentricApproach #WeGuideYouDecide

Don't stress if finance feels like a foreign language. We understand that money matters can be complex and confusing. We're here to provide clarity and support every step of the way. Your financial confidence is our mission. #WeGuideYouDecide #TrustedAdvisor

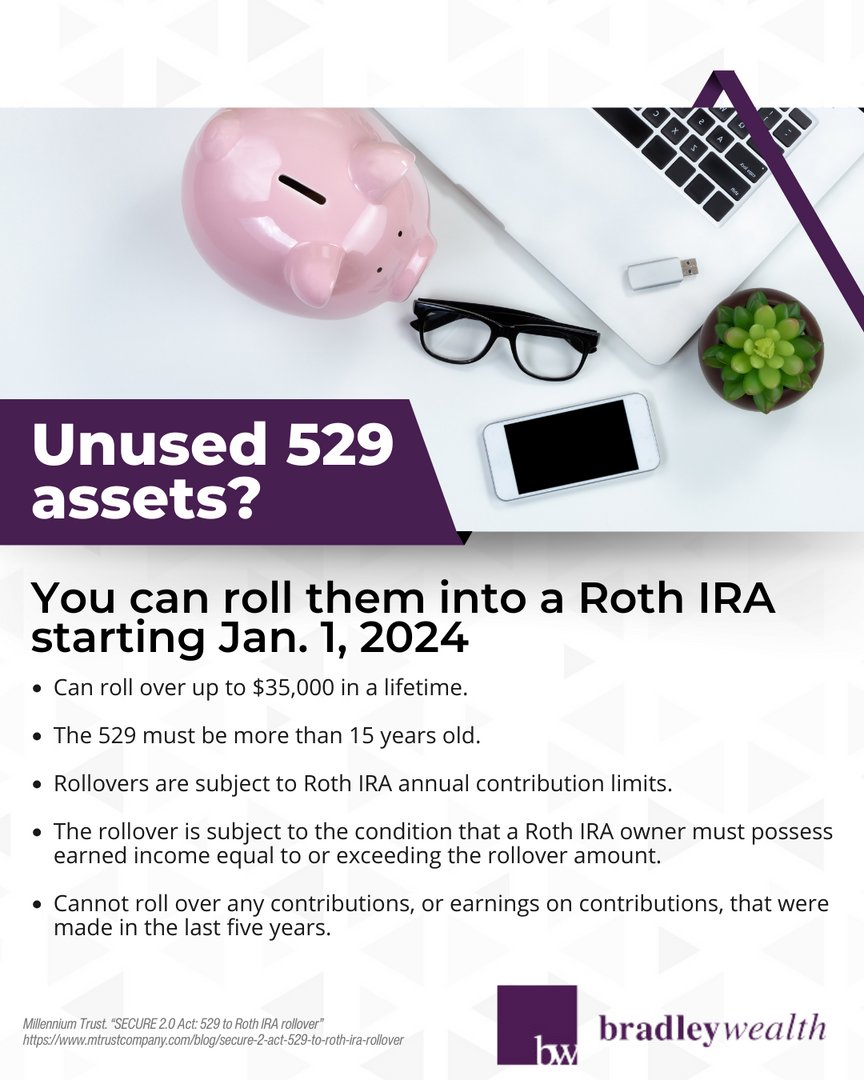

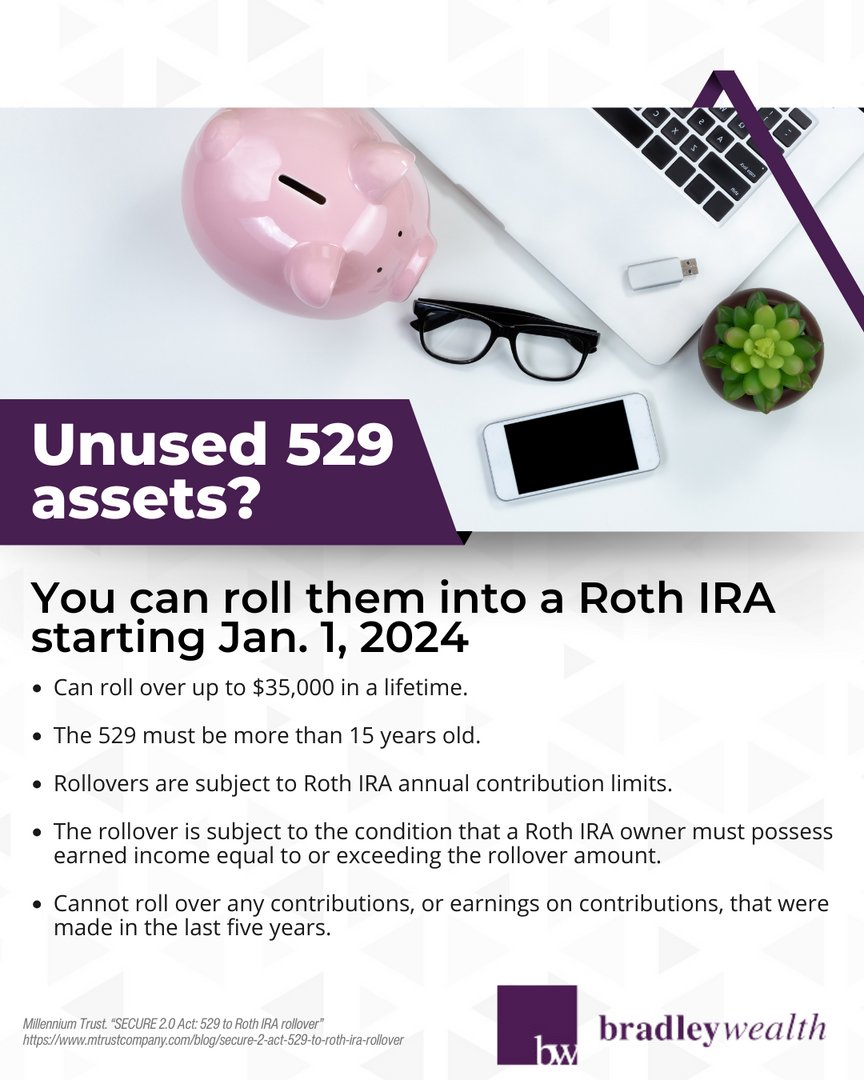

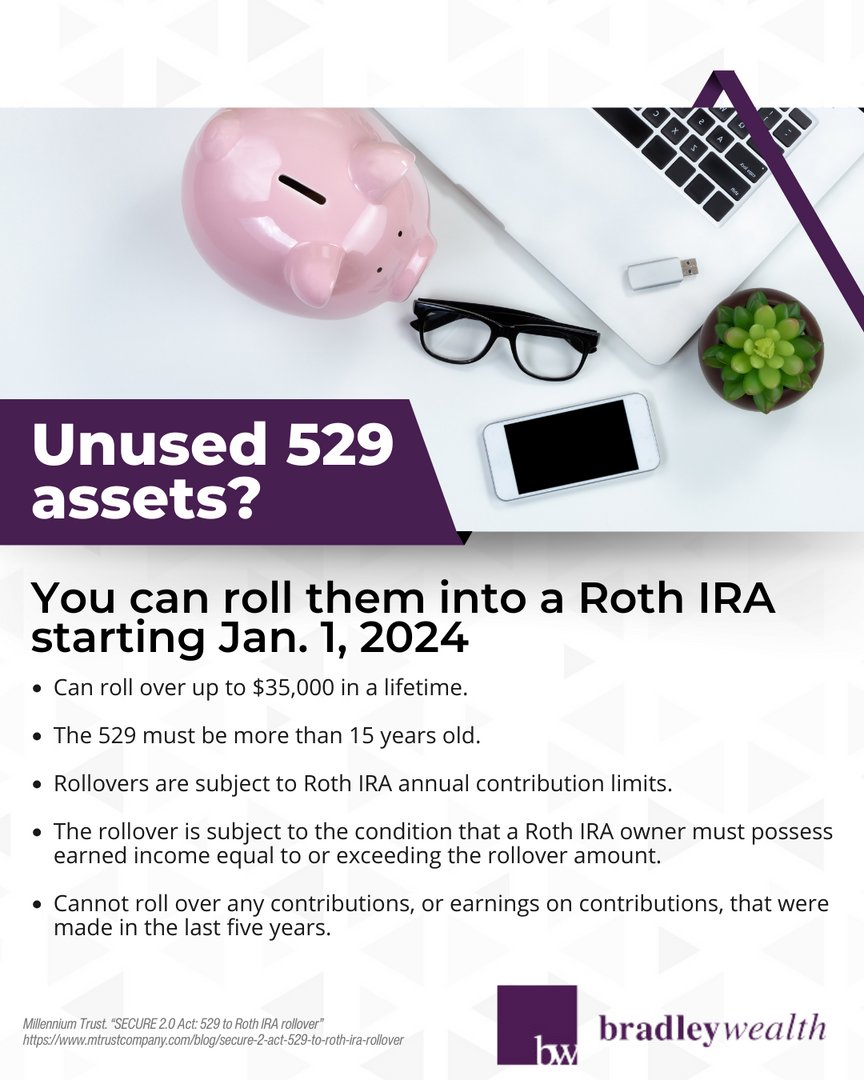

Secure 2.0 introduces a new option: rolling over unused 529 assets into a Roth IRA, starting January 1st, 2024. This strategic move may offer added flexibility and potential growth in your long-term financial plan. #LifePlanning #WeGuideYouDecide

Executives face uniquely evolving career and financial dynamics. Whether it's a promotion, changing companies, or changing careers, our job is to continuously adapt your retirement strategy to align with your career. #IndependentFiduciary #WealthManagement #WeGuideYouDecide

Navigating financial advice can be overwhelming. Remember, not all advice fits your unique situation. The right financial plan is tailored to your income, expenses, debt, savings, and long-term goals. #WeGuideYouDecide #TrustedAdvisor #TailoredFinancialPlan

Bradley Wealth's Tuesday Takeaway: The Housing Outlook 2024 Your Weekly Market Update... bit.ly/41GWX48 #WeGuideYouDecide #NewEraAdvisor

Bradley Wealth's Tuesday Takeaway: Disinflation, not Deflation Your Weekly Market Update... bit.ly/3Gv7WnG #WeGuideYouDecide #TrustedAdvisor

Bradley Wealth's Tuesday Takeaway: The Election Outlook is a Tax Outlook Your Weekly Market Update... bit.ly/3QGUuSe #WeGuideYouDecide #NewEraAdvisor

Bradley Wealth's Tuesday Takeaway: Consumer Spending Set for Slower Growth Your Weekly Market Update... bit.ly/3sJI1oZ #WeGuideYouDecide #TrustedAdvisor

Bradley Wealth's Tuesday Takeaway: Argentina: Is the Pendulum Swinging, Again? Your Weekly Market Update... bit.ly/3sMyhKO #WeeklyMarketInsights #WeGuideYouDecide

Bradley Wealth's Tuesday Takeaway: What Should the Fed Do? How About Nothing? Your Weekly Market Update... bit.ly/3Tmrang #WeGuideYouDecide #TrustedAdvisor

Weddings, home-buying, babies, and sometimes...divorce. These aren't just life events, they are money events too. Leverage us for insights and conversation. #WeGuideYouDecide #TrustedAdvisor

Navigating financial advice can be overwhelming. Remember, not all advice fits your unique situation. The right financial plan is tailored to your income, expenses, debt, savings, and long-term goals. #WeGuideYouDecide #TrustedAdvisor #TailoredFinancialPlan

Ladies, make your money work harder by investing more. It’s a powerful step that can help close the wealth gap and achieve your goals. #ClientCentricApproach #WeGuideYouDecide

Investing doesn’t have to be complicated. Let’s deconstruct and learn together. #ReturnOnLife #WeGuideYouDecide

We're here to help you stay on the right course, no matter the conditions ahead. #WeGuideYouDecide #NewEraAdvisor

Embracing solo retirement? Let's focus on what matters most: your health, finances, and housing. Let's work together to craft a plan. #LifeOfSignificance #WeGuideYouDecide

Need help understanding your options? Let's have a conversation. #WeGuideYouDecide #StartYourJourney

Don't stress if finance feels like a foreign language. We understand that money matters can be complex and confusing. We're here to provide clarity and support every step of the way. Your financial confidence is our mission. #WeGuideYouDecide #TrustedAdvisor

Outcome bias is making a decision based on the outcome of previous events, without regard to how the past events developed. Successful investing isn't just about the results, but the rationale behind your decisions. #WeGuideYouDecide #DoWealthDifferently

Executives face uniquely evolving career and financial dynamics. Whether it's a promotion, changing companies, or changing careers, our job is to continuously adapt your retirement strategy to align with your career. #IndependentFiduciary #WealthManagement #WeGuideYouDecide

Bradley Wealth's Tuesday Takeaway: The Housing Outlook 2024 Your Weekly Market Update... bit.ly/41GWX48 #WeGuideYouDecide #NewEraAdvisor

For executives, a tailored financial plan is paramount in working towards a prosperous future. These key considerations form the foundation of a comprehensive financial strategy designed to align with your unique professional trajectory. #LiveLifeByDesign #WeGuideYouDecide

Secure 2.0 introduces a new option: rolling over unused 529 assets into a Roth IRA, starting January 1st, 2024. This strategic move may offer added flexibility and potential growth in your long-term financial plan. #LifePlanning #WeGuideYouDecide

As you celebrate your end-of-year bonus, don't forget to factor in taxes. Being mindful of the potential financial implications can help ensure you make the most of this well-deserved reward. #ClientCentricApproach #WeGuideYouDecide

Bradley Wealth's Tuesday Takeaway: What Should the Fed Do? How About Nothing? Your Weekly Market Update... bit.ly/3Tmrang #WeGuideYouDecide #TrustedAdvisor

Bradley Wealth's Tuesday Takeaway: Disinflation, not Deflation Your Weekly Market Update... bit.ly/3Gv7WnG #WeGuideYouDecide #TrustedAdvisor

Medical professionals, your financial well-being deserves careful consideration. Our team understands the nuances of your unique career path. Together, we can craft a tailored plan for long-term that aligns with your goals. #WeGuideYouDecide #DoWealthDifferently

Bradley Wealth's Tuesday Takeaway: Argentina: Is the Pendulum Swinging, Again? Your Weekly Market Update... bit.ly/3sMyhKO #WeeklyMarketInsights #WeGuideYouDecide

Bradley Wealth's Tuesday Takeaway: Consumer Spending Set for Slower Growth Your Weekly Market Update... bit.ly/3sJI1oZ #WeGuideYouDecide #TrustedAdvisor

Bradley Wealth's Tuesday Takeaway: The Election Outlook is a Tax Outlook Your Weekly Market Update... bit.ly/3QGUuSe #WeGuideYouDecide #NewEraAdvisor

Need help understanding your options? Let's have a conversation. #WeGuideYouDecide #StartYourJourney

Investing doesn’t have to be complicated. Let’s deconstruct and learn together. #ReturnOnLife #WeGuideYouDecide

We're here to help you stay on the right course, no matter the conditions ahead. #WeGuideYouDecide #NewEraAdvisor

Supercharge your wealth-building journey by harnessing the potential of tax savings in your investments. #WeGuideYouDecide #NewEraAdvisor

For executives, a tailored financial plan is paramount in working towards a prosperous future. These key considerations form the foundation of a comprehensive financial strategy designed to align with your unique professional trajectory. #LiveLifeByDesign #WeGuideYouDecide

Medical professionals, your financial well-being deserves careful consideration. Our team understands the nuances of your unique career path. Together, we can craft a tailored plan for long-term that aligns with your goals. #WeGuideYouDecide #DoWealthDifferently

Embracing solo retirement? Let's focus on what matters most: your health, finances, and housing. Let's work together to craft a plan. #LifeOfSignificance #WeGuideYouDecide

Ladies, make your money work harder by investing more. It’s a powerful step that can help close the wealth gap and achieve your goals. #ClientCentricApproach #WeGuideYouDecide

Weddings, home-buying, babies, and sometimes...divorce. These aren't just life events, they are money events too. Leverage us for insights and conversation. #WeGuideYouDecide #TrustedAdvisor

Budgeting isn't about restricting your life; it's about making your money work for you. Learn how a tailored budget can set the foundation for financial freedom. #NewEraAdvisor #WeGuideYouDecide

Align your savings with benchmarks tailored to your income and age. Recommended savings targets can help ensure a solid financial foundation for your retirement. #WeGuideYouDecide #StartYourJourney

Outcome bias is making a decision based on the outcome of previous events, without regard to how the past events developed. Successful investing isn't just about the results, but the rationale behind your decisions. #WeGuideYouDecide #DoWealthDifferently

Don't stress if finance feels like a foreign language. We understand that money matters can be complex and confusing. We're here to provide clarity and support every step of the way. Your financial confidence is our mission. #WeGuideYouDecide #TrustedAdvisor

As you celebrate your end-of-year bonus, don't forget to factor in taxes. Being mindful of the potential financial implications can help ensure you make the most of this well-deserved reward. #ClientCentricApproach #WeGuideYouDecide

Paying attention to 401(k) matching can help you make the most of your employer's generosity, accelerate your savings, and secure a comfortable retirement. It's a valuable opportunity to invest in yourself and create a brighter future. #PlanforYourFuture #WeGuideYouDecide

If you feel like you have been ghosted by your financial advisor, you are not alone. Many financial advisors struggle with consistent communication. Not us! We are here if you have questions or need a second opinion. #WeGuideYouDecide #TrustedAdvisor

Secure 2.0 introduces a new option: rolling over unused 529 assets into a Roth IRA, starting January 1st, 2024. This strategic move may offer added flexibility and potential growth in your long-term financial plan. #LifePlanning #WeGuideYouDecide

The best investment portfolio is one that is personalized to you and considers your risk tolerance, financial goals, time horizon, and tax situation. Let's talk more about how to personalize your investment portfolio. #SignatureServiceExperience #WeGuideYouDecide

Executives face uniquely evolving career and financial dynamics. Whether it's a promotion, changing companies, or changing careers, our job is to continuously adapt your retirement strategy to align with your career. #IndependentFiduciary #WealthManagement #WeGuideYouDecide

Navigating financial advice can be overwhelming. Remember, not all advice fits your unique situation. The right financial plan is tailored to your income, expenses, debt, savings, and long-term goals. #WeGuideYouDecide #TrustedAdvisor #TailoredFinancialPlan

Something went wrong.

Something went wrong.

United States Trends

- 1. Sonny Gray 7,499 posts

- 2. Rush Hour 4 9,819 posts

- 3. Godzilla 20.9K posts

- 4. Dick Fitts N/A

- 5. Red Sox 7,348 posts

- 6. Raising Arizona N/A

- 7. National Treasure 5,570 posts

- 8. Happy Thanksgiving 21.7K posts

- 9. Gone in 60 2,035 posts

- 10. 50 Cent 4,645 posts

- 11. Chelsea 324K posts

- 12. Clarke 6,551 posts

- 13. Giolito N/A

- 14. Brett Ratner 3,097 posts

- 15. #yummymeets N/A

- 16. Lord of War 1,474 posts

- 17. Valley Girl N/A

- 18. #ThanksYouTube N/A

- 19. #GMMTV2026 3.86M posts

- 20. Academic All-District N/A