#whatyourbotmissed 검색 결과

Your bot isn't competing with humans anymore. It's up against clones - trained on the same data, chasing the same setups, losing the same trades. Originality is the new alpha. #WhatYourBotMissed #QuantSentrix

Your bot “won” the setup. But poor execution flipped profit into loss. Direction is just half the story, execution seals the outcome. #WhatYourBotMissed

Bots don't fear losses. But they inherit your code's bias: -Optimized for the past -Overfit to perfect backtests Bias in, bias out. #WhatYourBotMissed

Your bot reads the move, not the source. A sudden spike doesn’t mean truth. Last month’s oil cut buzz? Price jumped but the story had no backing. #WhatYourBotMissed #QuantSentrix

Bots chase every panic candle. Pros map out the cycles behind panic. Retail rides waves of fear Smart money patiently fades them. The real edge? Knowing exactly where fear runs dry. #WhatYourBotMissed #QuantSentrix

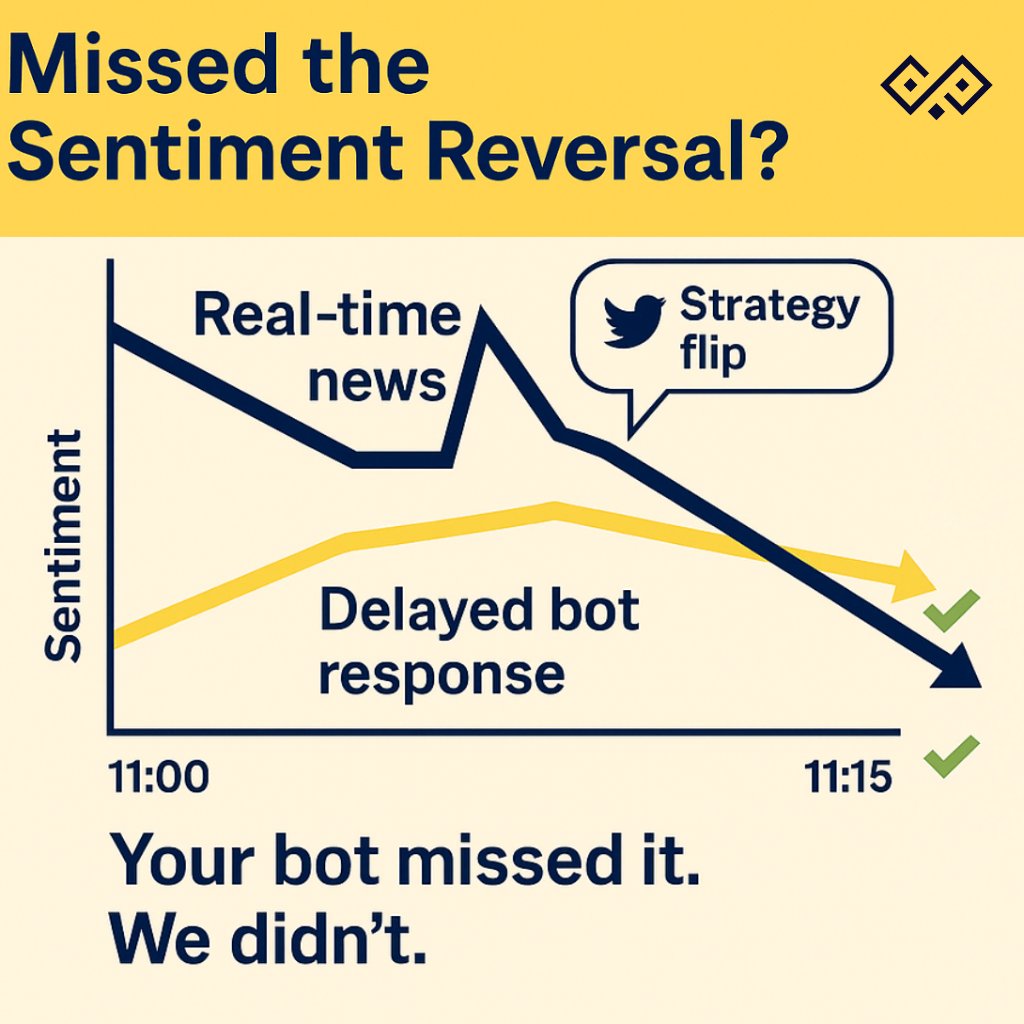

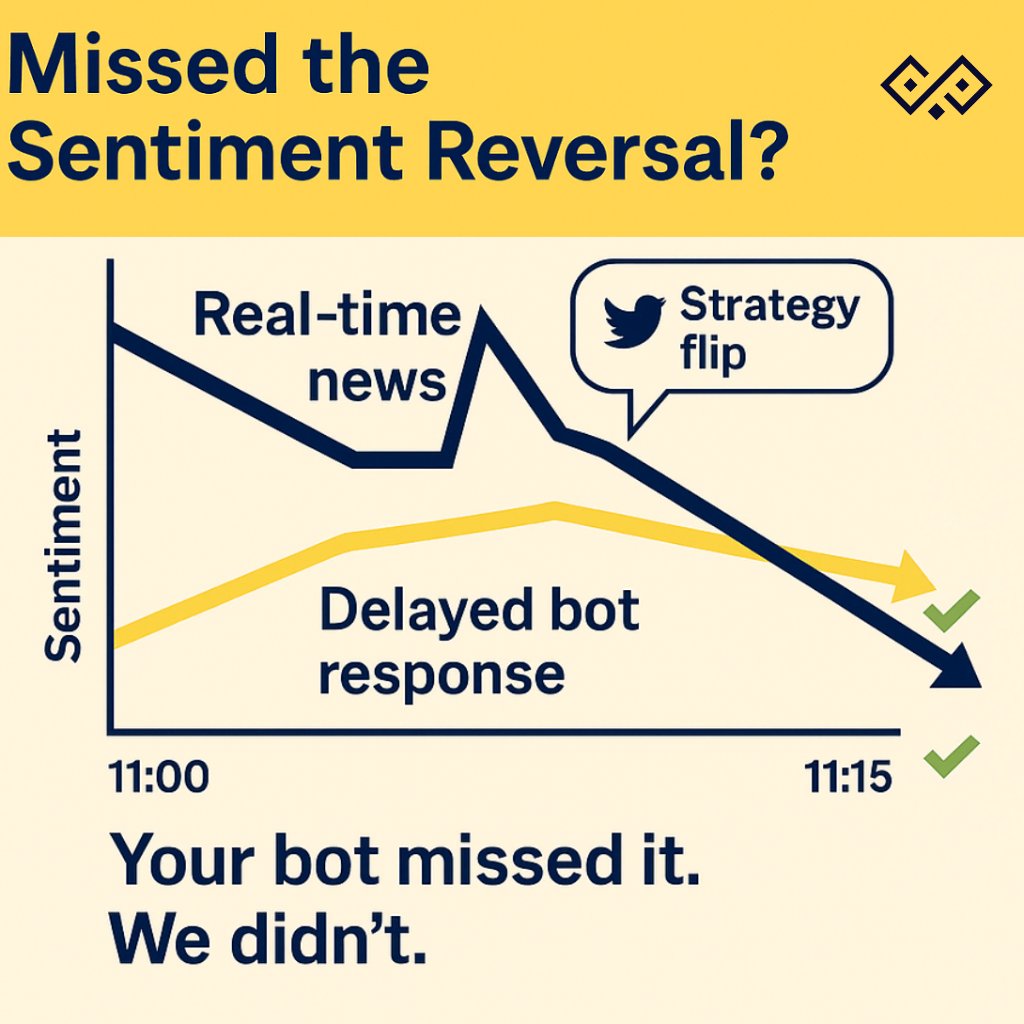

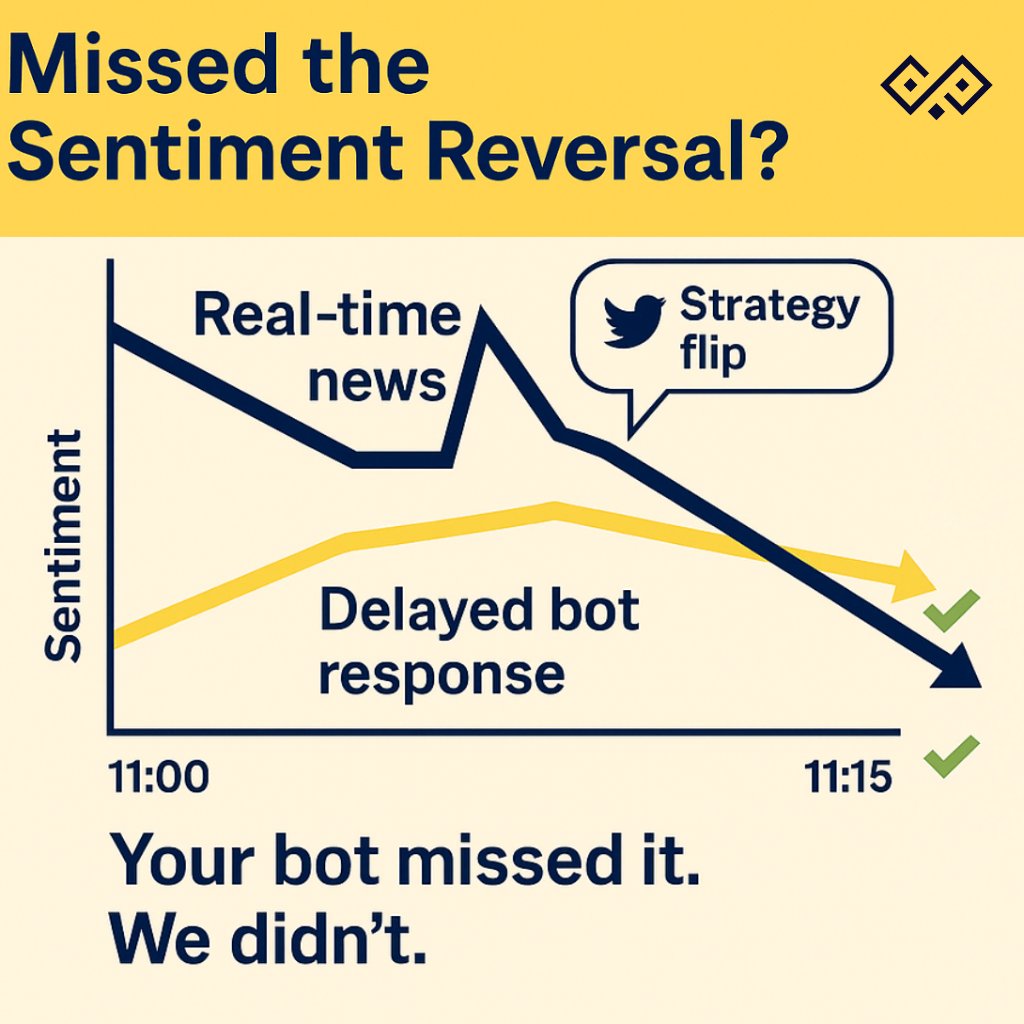

On June 5, U.S. jobless data surprised the market. $USD spiked. Bonds moved. Equity sentiment flipped. Did your bot react? Nope. It was still checking MACD. No Live news. No Real-time adaptation. #WhatYourBotMissed

Your bot saw “breakout.” It missed: 📉 liquidity vacuum 📈 delta imbalance ⚡ market maker unwind That's why it entered late and exited worse. #WhatYourBotMissed #QuantSentrix

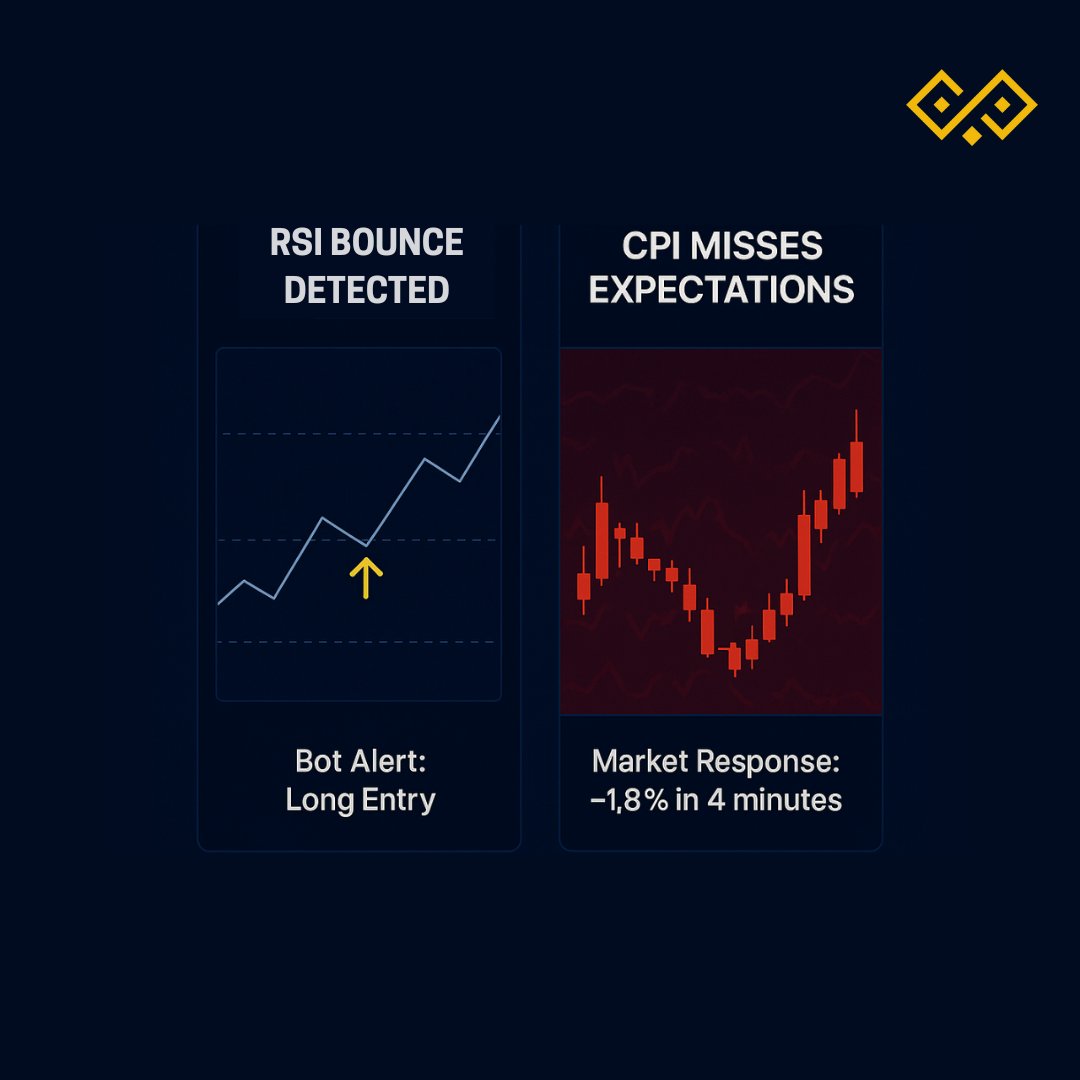

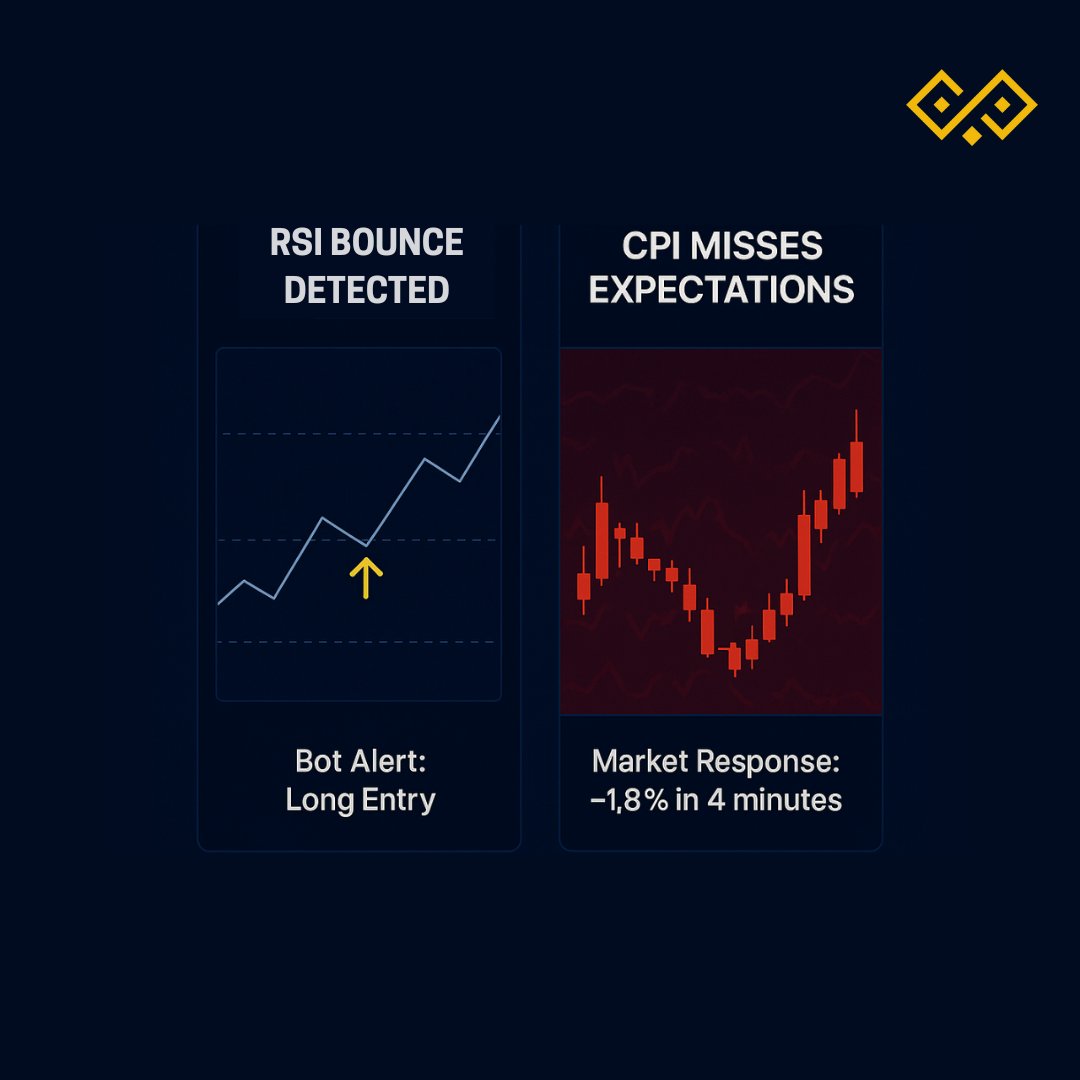

Same CPI print. One month: cuts priced in → rally. Next month: sticky inflation fear → drop. Bots read numbers. Smart layers map narrative shifts. #WhatYourBotMissed #QuantSentrix

Your bot slammed “buy” at full size. But did it stop to ask: →How volatile is this regime? →How much total risk is already on? →What’s the max drawdown so far? Bots chase price. Desks size to survive. #WhatYourBotMissed #QuantSentrix

Your bot saw green candles but not the cause. →Shorts rushing to cover. →Retail panic-buying late. →Desks offloading into the frenzy. Price action ≠ intent. Without reading behavior, bots only react to what’s already happened. #WhatYourBotMissed #QuantSentrix

Some of the biggest intraday moves come out of volatility pockets - tight, low-volume coils before sudden expansion. Bots see a “quiet market.” We see a spring ready to snap. Neuro Flux is learning to map them before they pop. #WhatYourBotMissed #QuantSentrix

Last Wednesday, the Bank of Japan dropped a surprise monetary policy shift. USD/JPY surged. US equities shook. But your bot? Still asleep - tracking yesterday's CPI print. This is what it missed. 📉📈 #WhatYourBotMissed #QuantSentrix

During the Ethereum flash crash last quarter, Exchanges API hiccup sent ETH down 20% in minutes. Bots bought the dip. But it wasn't a dip - it was a data error. Retail bots lost big. This is what your system didn't see. #WhatYourBotMissed

June FOMC minutes dropped. Retail bots stood still. No signal. No shift. Just candles. We're building a system designed to catch: ✅ Sentiment flips on $USD pairs ✅ Panic spikes in language feeds ✅ Options flow divergence in minutes #WhatYourBotMissed

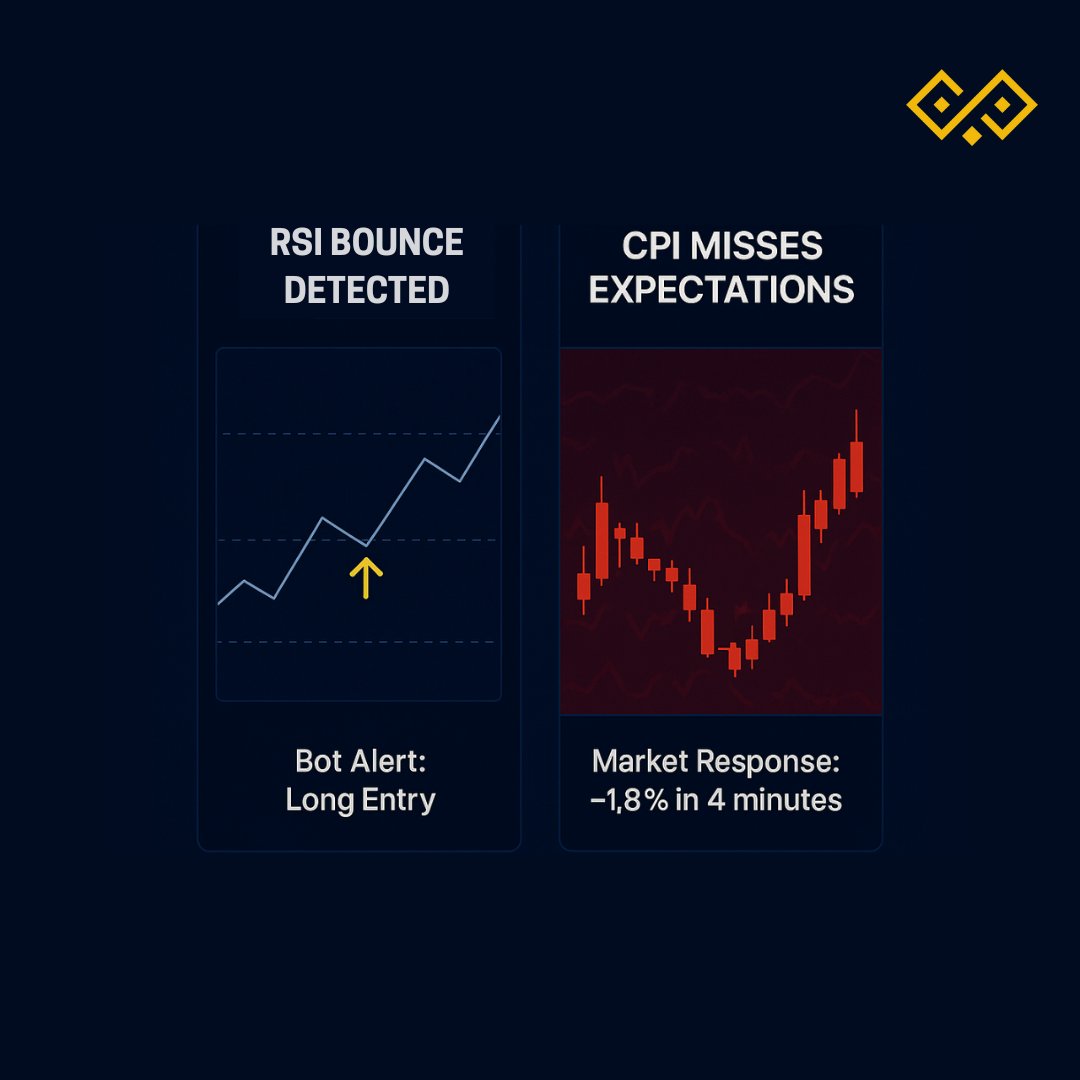

Your bot said "RSI bounce." CPI/PPI said "brace for impact." One read a chart. One ignored the world. We're building a system that listens to the full market, not just a candle. #WhatYourBotMissed #QuantSentrix #MarketAwareness

Your bot saw a dip. The market saw a cliff. #WhatYourBotMissed #QuantSentrix

During the Ethereum flash crash last quarter, Exchanges API hiccup sent ETH down 20% in minutes. Bots bought the dip. But it wasn't a dip - it was a data error. Retail bots lost big. This is what your system didn't see. #WhatYourBotMissed

Your bot fired a “buy” in high-volatility chop. It was built for calm waters. Wrong regime → right signal, wrong outcome. #WhatYourBotMissed

Your bot isn't competing with humans anymore. It's up against clones - trained on the same data, chasing the same setups, losing the same trades. Originality is the new alpha. #WhatYourBotMissed #QuantSentrix

Your bot saw a dip. The market saw a cliff. #WhatYourBotMissed #QuantSentrix

During the Ethereum flash crash last quarter, Exchanges API hiccup sent ETH down 20% in minutes. Bots bought the dip. But it wasn't a dip - it was a data error. Retail bots lost big. This is what your system didn't see. #WhatYourBotMissed

Your bot saw “breakout.” It missed: 📉 liquidity vacuum 📈 delta imbalance ⚡ market maker unwind That's why it entered late and exited worse. #WhatYourBotMissed #QuantSentrix

Your bot “won” the setup. But poor execution flipped profit into loss. Direction is just half the story, execution seals the outcome. #WhatYourBotMissed

Your bot fired a “buy” in high-volatility chop. It was built for calm waters. Wrong regime → right signal, wrong outcome. #WhatYourBotMissed

Bots don't fear losses. But they inherit your code's bias: -Optimized for the past -Overfit to perfect backtests Bias in, bias out. #WhatYourBotMissed

Your bot slammed “buy” at full size. But did it stop to ask: →How volatile is this regime? →How much total risk is already on? →What’s the max drawdown so far? Bots chase price. Desks size to survive. #WhatYourBotMissed #QuantSentrix

Your bot saw green candles but not the cause. →Shorts rushing to cover. →Retail panic-buying late. →Desks offloading into the frenzy. Price action ≠ intent. Without reading behavior, bots only react to what’s already happened. #WhatYourBotMissed #QuantSentrix

Bots chase every panic candle. Pros map out the cycles behind panic. Retail rides waves of fear Smart money patiently fades them. The real edge? Knowing exactly where fear runs dry. #WhatYourBotMissed #QuantSentrix

Some of the biggest intraday moves come out of volatility pockets - tight, low-volume coils before sudden expansion. Bots see a “quiet market.” We see a spring ready to snap. Neuro Flux is learning to map them before they pop. #WhatYourBotMissed #QuantSentrix

Your bot reads the move, not the source. A sudden spike doesn’t mean truth. Last month’s oil cut buzz? Price jumped but the story had no backing. #WhatYourBotMissed #QuantSentrix

Same CPI print. One month: cuts priced in → rally. Next month: sticky inflation fear → drop. Bots read numbers. Smart layers map narrative shifts. #WhatYourBotMissed #QuantSentrix

Speed ≠ edge. ETH fake breakouts trap bots chasing momentum. Whale orders stack, retail stops get swept. Reading intent > chasing candles. #WhatYourBotMissed #QuantSentrix

Your bot said "RSI bounce." CPI/PPI said "brace for impact." One read a chart. One ignored the world. We're building a system that listens to the full market, not just a candle. #WhatYourBotMissed #QuantSentrix #MarketAwareness

During the Ethereum flash crash last quarter, Exchanges API hiccup sent ETH down 20% in minutes. Bots bought the dip. But it wasn't a dip - it was a data error. Retail bots lost big. This is what your system didn't see. #WhatYourBotMissed

Last Wednesday, the Bank of Japan dropped a surprise monetary policy shift. USD/JPY surged. US equities shook. But your bot? Still asleep - tracking yesterday's CPI print. This is what it missed. 📉📈 #WhatYourBotMissed #QuantSentrix

June FOMC minutes dropped. Retail bots stood still. No signal. No shift. Just candles. We're building a system designed to catch: ✅ Sentiment flips on $USD pairs ✅ Panic spikes in language feeds ✅ Options flow divergence in minutes #WhatYourBotMissed

On June 5, U.S. jobless data surprised the market. $USD spiked. Bonds moved. Equity sentiment flipped. Did your bot react? Nope. It was still checking MACD. No Live news. No Real-time adaptation. #WhatYourBotMissed

Your bot “won” the setup. But poor execution flipped profit into loss. Direction is just half the story, execution seals the outcome. #WhatYourBotMissed

Same CPI print. One month: cuts priced in → rally. Next month: sticky inflation fear → drop. Bots read numbers. Smart layers map narrative shifts. #WhatYourBotMissed #QuantSentrix

Last Wednesday, the Bank of Japan dropped a surprise monetary policy shift. USD/JPY surged. US equities shook. But your bot? Still asleep - tracking yesterday's CPI print. This is what it missed. 📉📈 #WhatYourBotMissed #QuantSentrix

Some of the biggest intraday moves come out of volatility pockets - tight, low-volume coils before sudden expansion. Bots see a “quiet market.” We see a spring ready to snap. Neuro Flux is learning to map them before they pop. #WhatYourBotMissed #QuantSentrix

Your bot saw green candles but not the cause. →Shorts rushing to cover. →Retail panic-buying late. →Desks offloading into the frenzy. Price action ≠ intent. Without reading behavior, bots only react to what’s already happened. #WhatYourBotMissed #QuantSentrix

Your bot slammed “buy” at full size. But did it stop to ask: →How volatile is this regime? →How much total risk is already on? →What’s the max drawdown so far? Bots chase price. Desks size to survive. #WhatYourBotMissed #QuantSentrix

Your bot isn't competing with humans anymore. It's up against clones - trained on the same data, chasing the same setups, losing the same trades. Originality is the new alpha. #WhatYourBotMissed #QuantSentrix

During the Ethereum flash crash last quarter, Exchanges API hiccup sent ETH down 20% in minutes. Bots bought the dip. But it wasn't a dip - it was a data error. Retail bots lost big. This is what your system didn't see. #WhatYourBotMissed

June FOMC minutes dropped. Retail bots stood still. No signal. No shift. Just candles. We're building a system designed to catch: ✅ Sentiment flips on $USD pairs ✅ Panic spikes in language feeds ✅ Options flow divergence in minutes #WhatYourBotMissed

Your bot reads the move, not the source. A sudden spike doesn’t mean truth. Last month’s oil cut buzz? Price jumped but the story had no backing. #WhatYourBotMissed #QuantSentrix

Your bot said "RSI bounce." CPI/PPI said "brace for impact." One read a chart. One ignored the world. We're building a system that listens to the full market, not just a candle. #WhatYourBotMissed #QuantSentrix #MarketAwareness

Bots chase every panic candle. Pros map out the cycles behind panic. Retail rides waves of fear Smart money patiently fades them. The real edge? Knowing exactly where fear runs dry. #WhatYourBotMissed #QuantSentrix

Bots don't fear losses. But they inherit your code's bias: -Optimized for the past -Overfit to perfect backtests Bias in, bias out. #WhatYourBotMissed

On June 5, U.S. jobless data surprised the market. $USD spiked. Bonds moved. Equity sentiment flipped. Did your bot react? Nope. It was still checking MACD. No Live news. No Real-time adaptation. #WhatYourBotMissed

Your bot fired a “buy” in high-volatility chop. It was built for calm waters. Wrong regime → right signal, wrong outcome. #WhatYourBotMissed

Your bot saw “breakout.” It missed: 📉 liquidity vacuum 📈 delta imbalance ⚡ market maker unwind That's why it entered late and exited worse. #WhatYourBotMissed #QuantSentrix

Something went wrong.

Something went wrong.

United States Trends

- 1. Knicks 12.8K posts

- 2. Shamet 2,779 posts

- 3. #AEWDynamite 21.1K posts

- 4. Philon 1,788 posts

- 5. Brandon Williams N/A

- 6. #Survivor49 3,778 posts

- 7. #CMAawards 5,379 posts

- 8. Vucevic 5,438 posts

- 9. #AEWCollision 8,562 posts

- 10. Derik Queen 3,732 posts

- 11. Vooch 1,085 posts

- 12. Blazers 4,014 posts

- 13. #mnwild N/A

- 14. Simon Walker N/A

- 15. Vucci Mane N/A

- 16. Wallstedt N/A

- 17. NO CAP 14.2K posts

- 18. Bristow 1,103 posts

- 19. Jackson Blake N/A

- 20. Coby White N/A