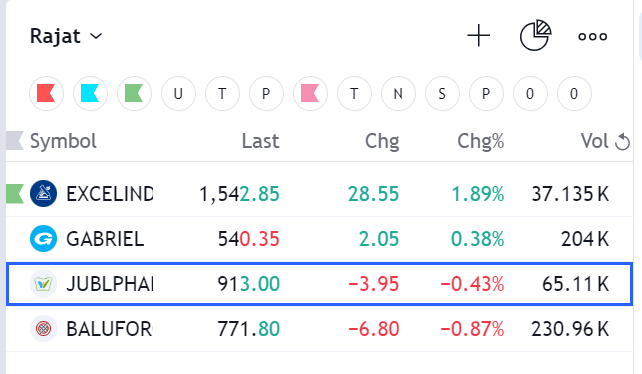

#excelindus search results

#Excel Industries Ltd #EXCELINDUS chat.whatsapp.com/Lk7gV2RwSfXKxR… t.me/+7OasKuG31ClmM… ⚠️ Disclaimer: We do not provide buy/sell/hold recommendations here. Please read Risk Disclosures, MITC, Investor Charter & Client Consent on eyeontrade.com

Excel Industries Ltd Excel Industries enters long-term supply arrangement, projecting revenue of ₹37.5 Cr p.a. over 5 years from Jobwork Charges. CAPEX for project is estimated at ₹40 Cr. Trade advance ₹25 Cr. MCap: 1,250.16 Cr. CMP: 994.50 #EXCELINDUS #Breaking

Excel Industries Ltd Excel Industries signs deal for contract manufacturing and supply of specialty chemicals. Capex for new line: ₹39.5 Cr. Jobwork income is estimated ₹35-40 Cr annually.Advance of Rs 25 Cr from customer MCap: 1,250.09 Cr. CMP: 994.45 #EXCELINDUS

#EXCELINDUS 1. Breakout: The stock has recently broken above a key resistance level around 1,313.90 INR, indicating a potential bullish move. 2. Volume: The breakout is accompanied by an increase in volume, which confirms the strength of the move. 3. Moving Averages: The stock…

Only chart that I am tracking for an entry on Monday... I may trade it intraday nd if got the cushion will move it towards very short term Swing (2-3 days) 👇 #excelindus will enter above PDH

#EXCELINDUS GST Demand Notice: Excel Industries Ltd has received Show Cause Notices for a demand of Rs. 4,06,11,539 regarding non-payment of GST from September 26 to 27, 2025. stockinsights.ai/in/EXCELINDUS/…

#EXCELINDUS looking good in this market. Chances to break Trendline .Keep monitoring #stockmarketcrash #stockstowatch @sunilgurjar01 @Jagadeesh0203 @KommawarSwapnil

#EXCELINDUS Show Cause Notice: Excel Industries Ltd received a Show Cause Notice on September 25, 2025, from the GST Authority demanding a penalty of Rs. 2,91,51,023 for non-payment of GST from 2019 to 2022, although the company believes the notice lacks merit.…

📈 EXCEL INDUSTRIES UPDATE 🎯 Remember at 770 support? ✅ Reversal DELIVERED! 770-1,224 = +58% move! Volume surge confirming breakout RSI healthy at 56 Next Levels: Resistance: 1,300-1,350 Support: 1,100-1,150 This is why we respect key support levels! 📊 #EXCELINDUS

Excel Industries is trading in range for some years and is now heading to crucial support at 770. If sustained, or signs of reversal from this level, it could be ideal swing trade opportunity. However, this view remains valid only as long as the support holds. #ExcelIndustries

Excel Industries Ltd (#EXCELINDUS) has initiated the disbursal of final dividend for FY25, to eligible shareholders today, i.e. 28 August 2025. #Dividend

Excel Industries (#EXCELINDUS) has recommended final dividend of ₹13.75 per share for FY25 Record Date - TBA Share Price - ₹1157 Dividend Yield - 1.2% Basic EPS - ₹68 Payout Ratio - 20% Payment Date - TBA Dividend History FY25 - ₹13.75 FY24 - ₹5.5 FY23 - ₹11.25 #Dividend

Bought #EXCELINDUS at 1550 with 10% sizeas everything became risk free in the PF. Chart looked similar to #PPLPHARMA.

Excel Industries Advanced Enzyme Technologies Mawana Sugars Capital India Finance #EXCELINDUS #ADVENZYMES #MAWANASUG #CIFL #Q3FY24 #q3results #results #earnings #q3 #Q3withTenshares #Tenshares

POWERFUL REVERSAL BREAKOUT STOCK #EXCELINDUS CMP 982 CHART TO STUDY #investing #trading #chart #darvasbox

Excel Industries Ltd Excel Industries enters long-term supply arrangement, projecting revenue of ₹37.5 Cr p.a. over 5 years from Jobwork Charges. CAPEX for project is estimated at ₹40 Cr. Trade advance ₹25 Cr. MCap: 1,250.16 Cr. CMP: 994.50 #EXCELINDUS #Breaking

#EXCELINDUS Excel Industries Ltd. signed a binding 5-year term sheet for contract manufacturing and supply of specialty chemicals. This deal, estimated to generate Rs 175-200 Cr in income, includes a Rs 25 Cr advance and requires a Rs 39.5 Cr CAPEX for capacity expansion.

Excel Industries Ltd Excel Industries signs deal for contract manufacturing and supply of specialty chemicals. Capex for new line: ₹39.5 Cr. Jobwork income is estimated ₹35-40 Cr annually.Advance of Rs 25 Cr from customer MCap: 1,250.09 Cr. CMP: 994.45 #EXCELINDUS

#Excel Industries Ltd #EXCELINDUS chat.whatsapp.com/Lk7gV2RwSfXKxR… t.me/+7OasKuG31ClmM… ⚠️ Disclaimer: We do not provide buy/sell/hold recommendations here. Please read Risk Disclosures, MITC, Investor Charter & Client Consent on eyeontrade.com

#EXCELINDUS GST Demand Notice: Excel Industries Ltd has received Show Cause Notices for a demand of Rs. 4,06,11,539 regarding non-payment of GST from September 26 to 27, 2025. stockinsights.ai/in/EXCELINDUS/…

#EXCELINDUS Show Cause Notice: Excel Industries Ltd received a Show Cause Notice on September 25, 2025, from the GST Authority demanding a penalty of Rs. 2,91,51,023 for non-payment of GST from 2019 to 2022, although the company believes the notice lacks merit.…

Excel Industries Ltd (#EXCELINDUS) has initiated the disbursal of final dividend for FY25, to eligible shareholders today, i.e. 28 August 2025. #Dividend

Excel Industries (#EXCELINDUS) has recommended final dividend of ₹13.75 per share for FY25 Record Date - TBA Share Price - ₹1157 Dividend Yield - 1.2% Basic EPS - ₹68 Payout Ratio - 20% Payment Date - TBA Dividend History FY25 - ₹13.75 FY24 - ₹5.5 FY23 - ₹11.25 #Dividend

📈 EXCEL INDUSTRIES UPDATE 🎯 Remember at 770 support? ✅ Reversal DELIVERED! 770-1,224 = +58% move! Volume surge confirming breakout RSI healthy at 56 Next Levels: Resistance: 1,300-1,350 Support: 1,100-1,150 This is why we respect key support levels! 📊 #EXCELINDUS

Excel Industries is trading in range for some years and is now heading to crucial support at 770. If sustained, or signs of reversal from this level, it could be ideal swing trade opportunity. However, this view remains valid only as long as the support holds. #ExcelIndustries

#EXCELINDUS has shown a uptrend recently, with a 18.46% return in the last month. What could the future hold for this stock? Further details available on app and blog: blog.xcaldata.com #NSE #NIFTY #STOCKSOFINTEREST #AI

#EXCELINDUS has seen a recent uptrend, with a 14.78% return in the past month. What does the future hold for this stock? More details on app and blog: blog.xcaldata.com #NSE #NIFTY #STOCKSOFINTEREST #AI

#EXCELINDUS Earnings Call Transcript: Excel Industries Ltd announced the transcript of their earnings call held on May 16, 2025, discussing financial results for Q4 and FY 2024-25, which ended on March 31, 2025. stockinsights.ai/in/EXCELINDUS/…

Good Q4 results:- #hikal #excelindus #NelcastLtd #PPLPharma #baluforge #NRBBearingsLtd #Rama #AsahiGlass #BansalRoof

Excel Industries Ltd (#EXCELINDUS) - Final Dividend Record Date - August 14, 2025 Date of AGM - August 21, 2025 Payment on or before September 20. #Dividend

Excel Industries (#EXCELINDUS) has recommended final dividend of ₹13.75 per share for FY25 Record Date - TBA Share Price - ₹1157 Dividend Yield - 1.2% Basic EPS - ₹68 Payout Ratio - 20% Payment Date - TBA Dividend History FY25 - ₹13.75 FY24 - ₹5.5 FY23 - ₹11.25 #Dividend

Excel Industries (#EXCELINDUS) has recommended final dividend of ₹13.75 per share for FY25 Record Date - TBA Share Price - ₹1157 Dividend Yield - 1.2% Basic EPS - ₹68 Payout Ratio - 20% Payment Date - TBA Dividend History FY25 - ₹13.75 FY24 - ₹5.5 FY23 - ₹11.25 #Dividend

#Excel Industries Ltd #EXCELINDUS chat.whatsapp.com/Lk7gV2RwSfXKxR… t.me/+7OasKuG31ClmM… ⚠️ Disclaimer: We do not provide buy/sell/hold recommendations here. Please read Risk Disclosures, MITC, Investor Charter & Client Consent on eyeontrade.com

#EXCELINDUS 1. Breakout: The stock has recently broken above a key resistance level around 1,313.90 INR, indicating a potential bullish move. 2. Volume: The breakout is accompanied by an increase in volume, which confirms the strength of the move. 3. Moving Averages: The stock…

#EXCELINDUS looking good in this market. Chances to break Trendline .Keep monitoring #stockmarketcrash #stockstowatch @sunilgurjar01 @Jagadeesh0203 @KommawarSwapnil

#EXCELINDUS Excel Industries Ltd. signed a binding 5-year term sheet for contract manufacturing and supply of specialty chemicals. This deal, estimated to generate Rs 175-200 Cr in income, includes a Rs 25 Cr advance and requires a Rs 39.5 Cr CAPEX for capacity expansion.

#EXCELINDUS Weekly chart looking good @jitu_stock ,@caniravkaria @chartmojo ,@Goldforestinves @ArindamPramnk ,@nakulvibhor

⭐️#EXCELINDUS Buying it in range: 1548 TO 1555 and on dips till 1520 Stoploss: 1505 Target: 1702/1857+

#EXCELINDUS has recommended a final dividend of ₹11.25 per share. Record Date - TBA Share Price - ₹918 Dividend Yield - 1.22% Basic EPS - ₹63.6 Payout Ratio - 18% Payment Date - TBA Dividend History FY23 - ₹11.25 FY22 - ₹22.5 FY21 - ₹11.25 FY20 - ₹10 #Dividends #Excel

POWERFUL REVERSAL BREAKOUT STOCK #EXCELINDUS CMP 982 CHART TO STUDY #investing #trading #chart #darvasbox

Something went wrong.

Something went wrong.

United States Trends

- 1. Wemby 34.5K posts

- 2. Steph 72.5K posts

- 3. Spurs 31.9K posts

- 4. Draymond 14.5K posts

- 5. Clemson 11.2K posts

- 6. Louisville 11K posts

- 7. Zack Ryder 16.1K posts

- 8. #SmackDown 51.9K posts

- 9. #DubNation 2,049 posts

- 10. Aaron Fox 2,299 posts

- 11. Harden 14.5K posts

- 12. Massie 56.3K posts

- 13. Marjorie Taylor Greene 46.8K posts

- 14. Brohm 1,668 posts

- 15. Dabo 1,995 posts

- 16. Bill Clinton 188K posts

- 17. Mitch Johnson N/A

- 18. UCLA 8,749 posts

- 19. Landry Shamet 5,997 posts

- 20. Matt Cardona 2,925 posts