#financebasics search results

"Struggling with checkbook management? 📘💡 Our latest guide demystifies it for you! #FinanceBasics #CheckbookChampion

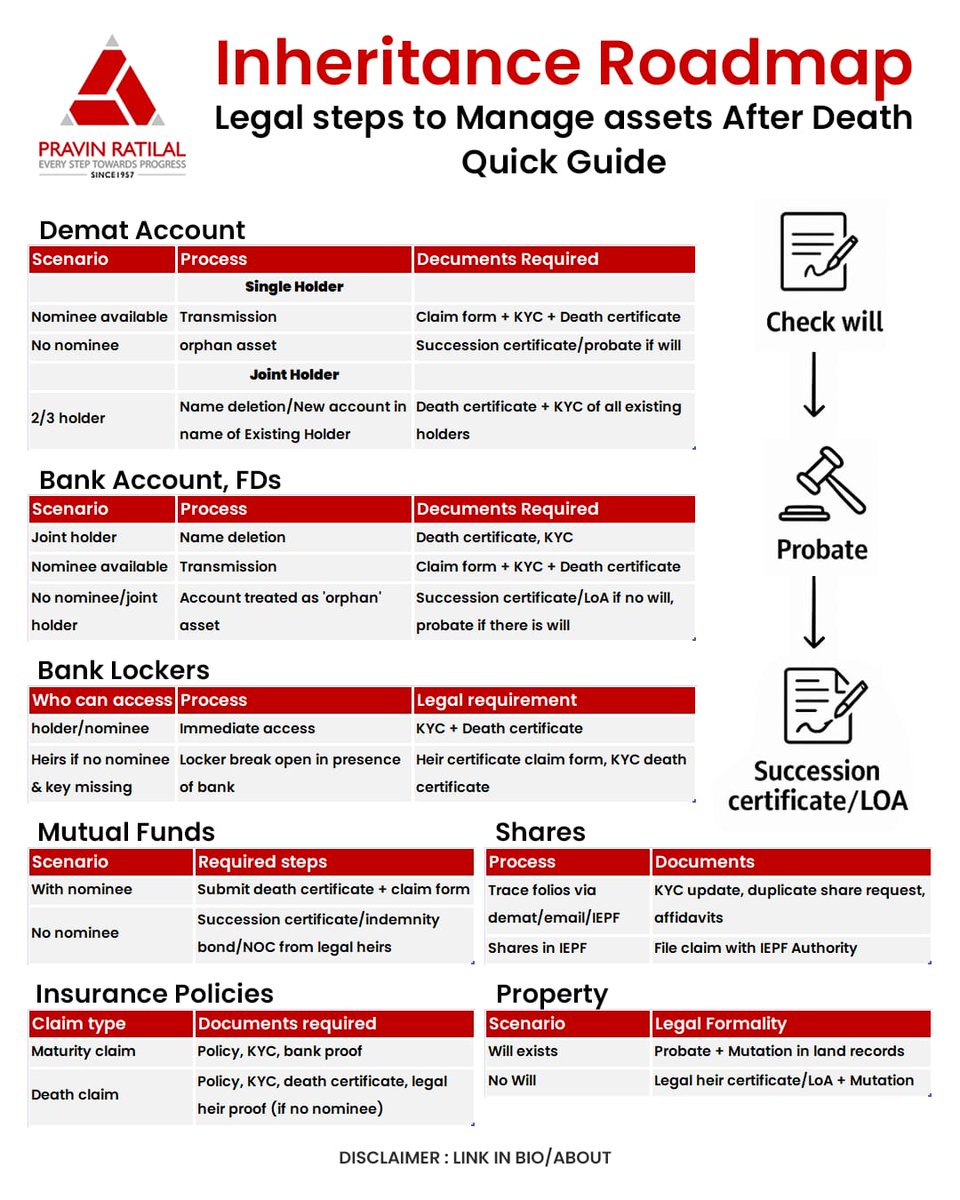

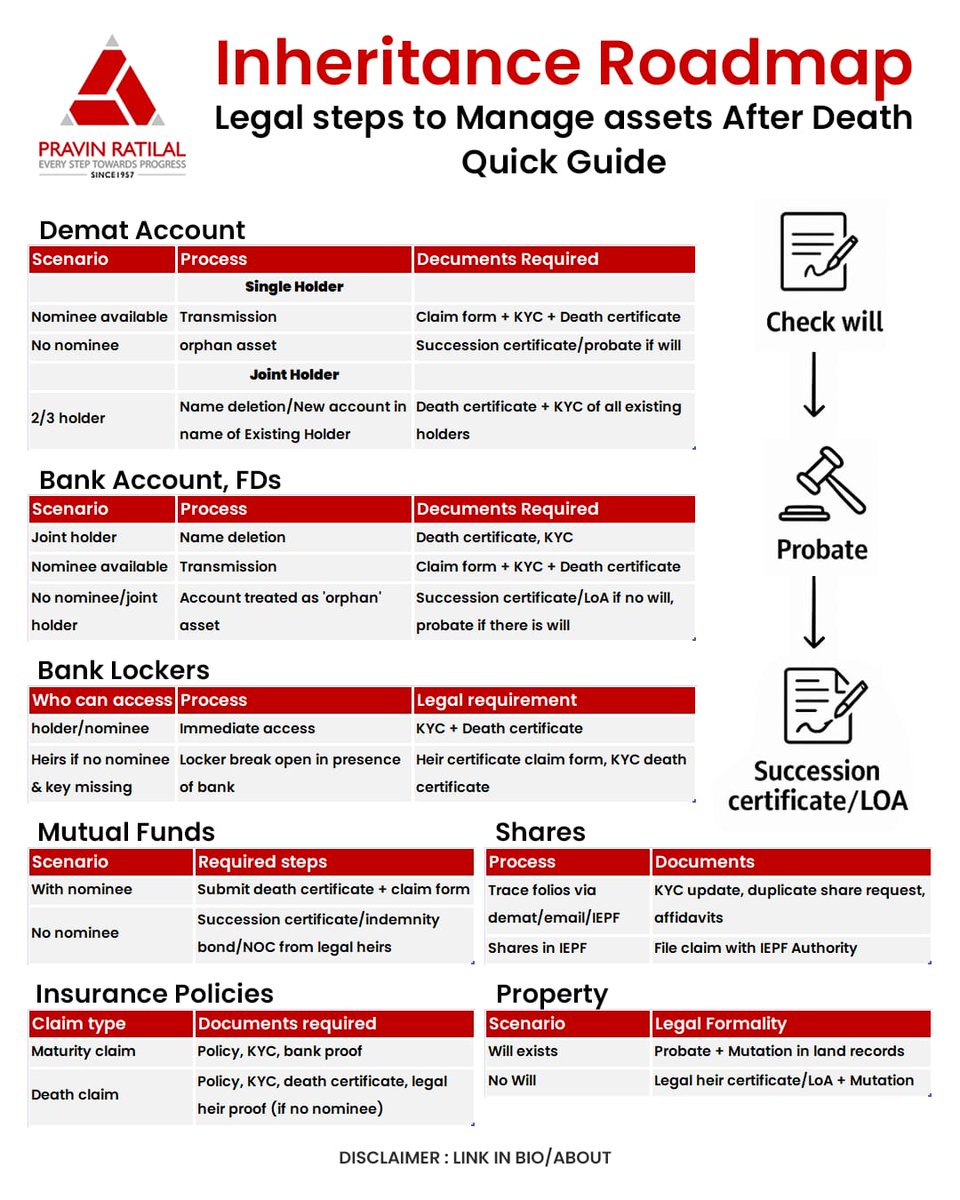

Secure your family’s future with the right legal steps. This quick Inheritance guide helps you understand every asset - Demat, Bank, Property & more at a glance. #InheritancePlanning #FinanceBasics #WealthManagement #familyplanning #SmartInvesting #LegalGuide #PravinRatilal

Adulting rule #47: Always have an emergency fund. Because tyres burst, phones fall, AC chooses violence, and your boss might too. And if life strikes before your savings do, CASHe is the backup for your backup. #Emergencyfund #CASHe #Financebasics #Adulting101

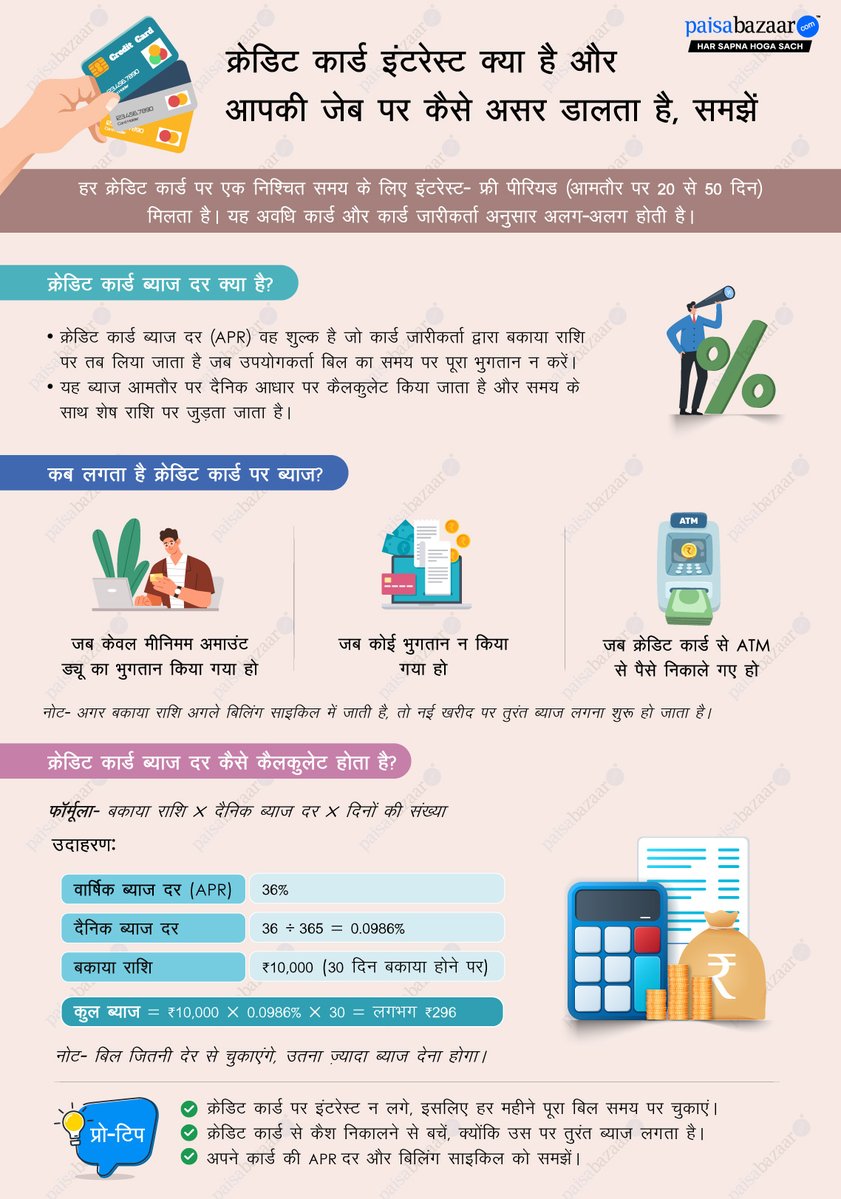

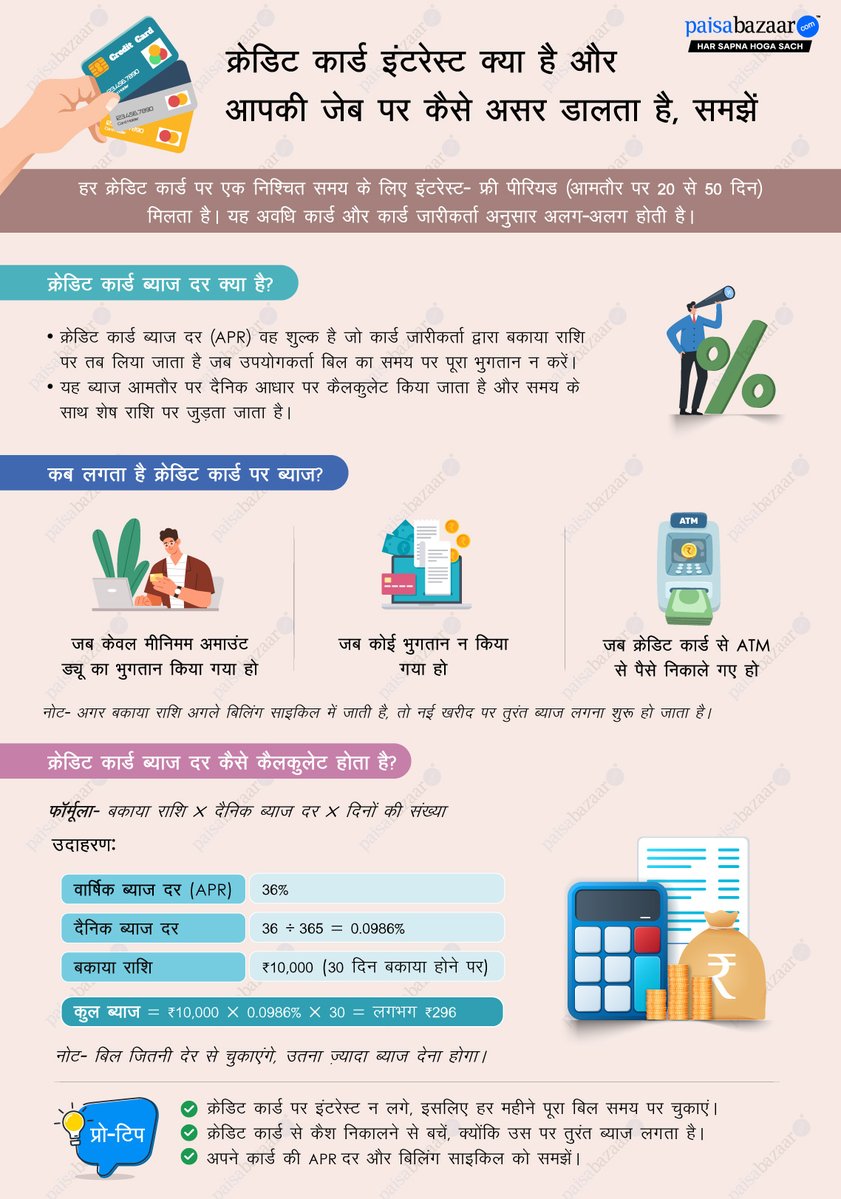

Understand how #creditcard interest works and how it impacts your pocket. Know when interest is charged, how it's calculated, and why timely payment is key to avoiding extra costs. Stay smart, spend smarter! 💳📊 #CreditCardTips #FinanceBasics

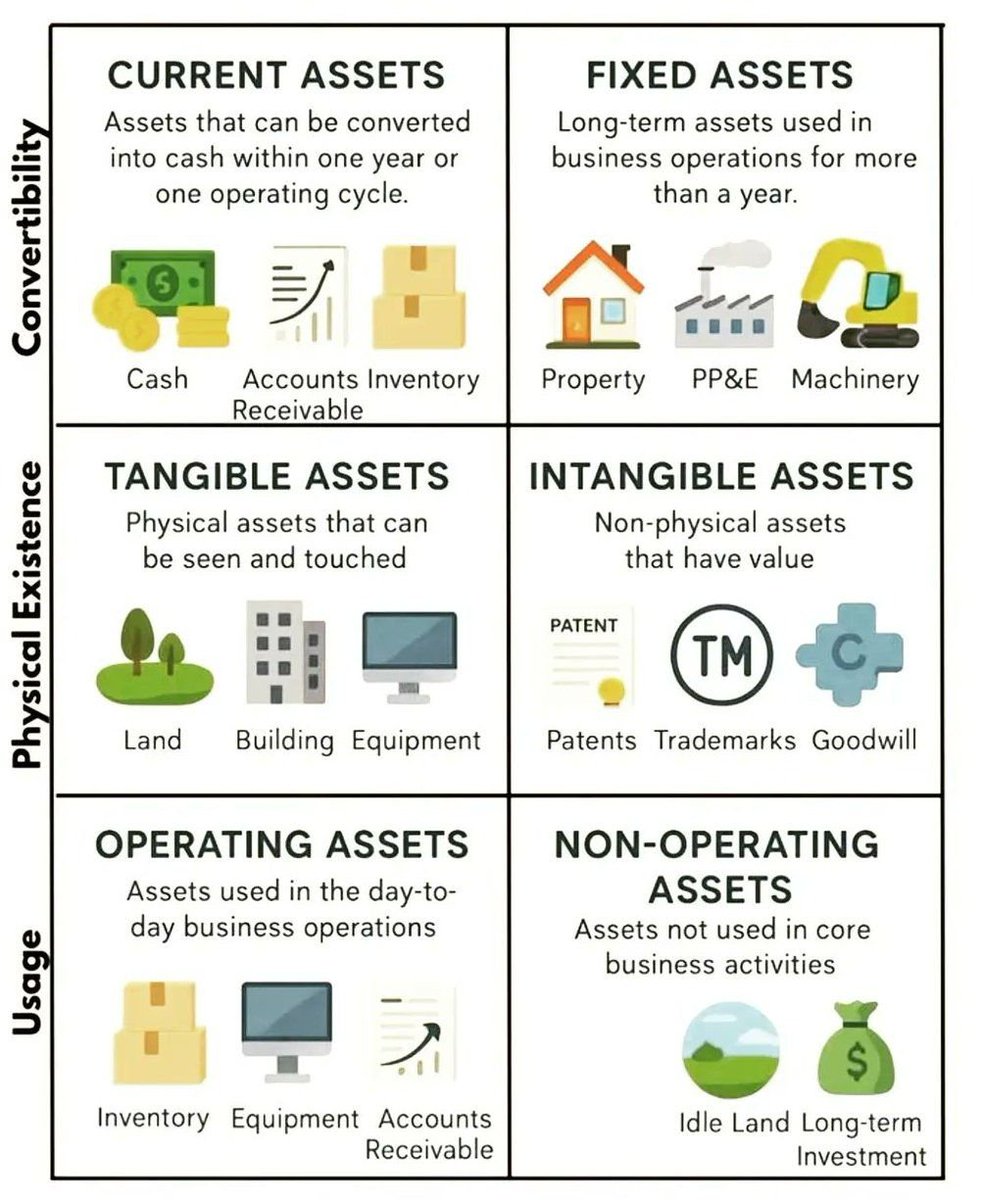

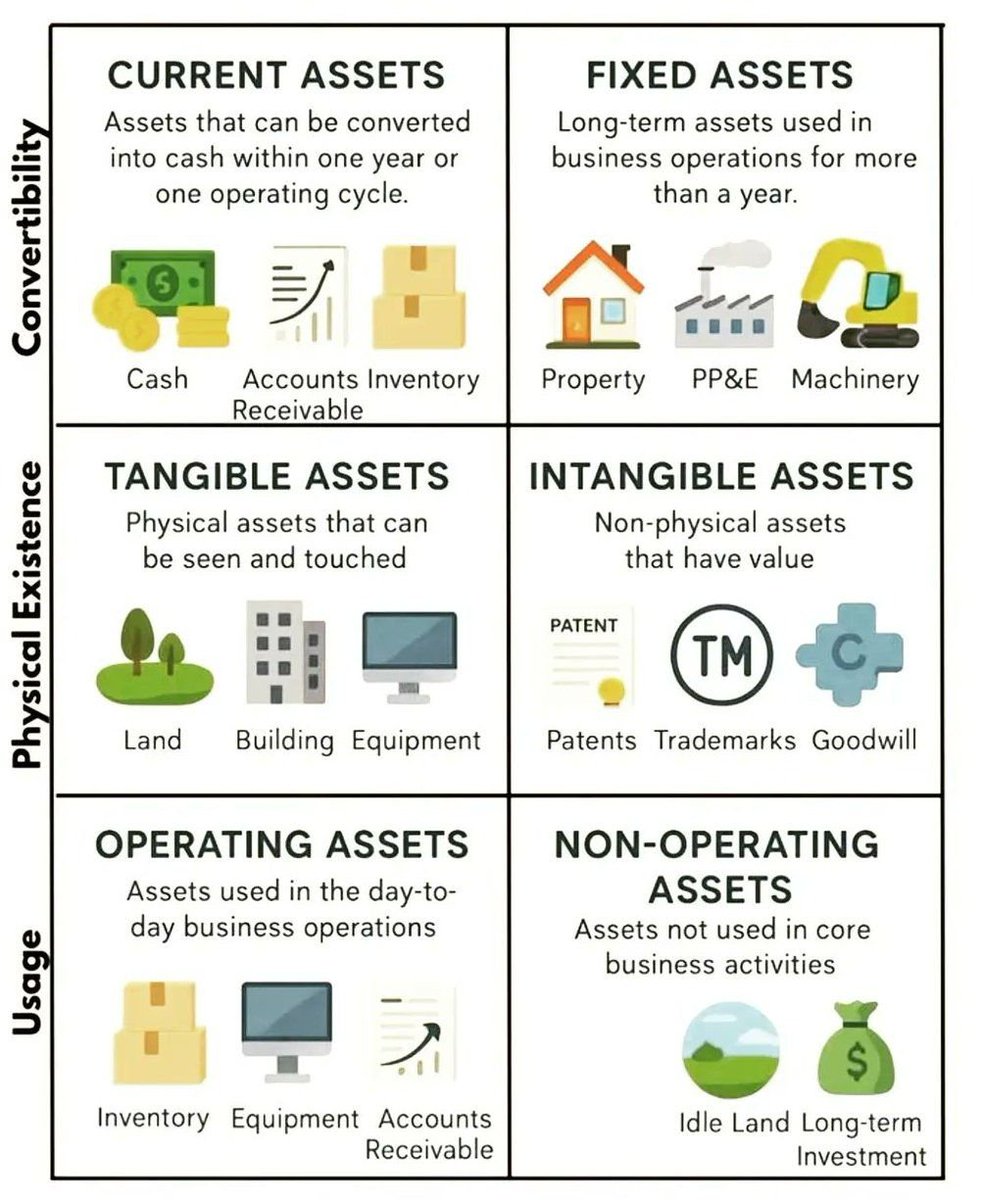

Types of Assets Made Simple! 💡 From cash to land, machines to patents — assets are classified by convertibility, physical form & usage📊 #FinanceBasics #BusinessFundamentals #AccountingMadeEasy #WealthEducation

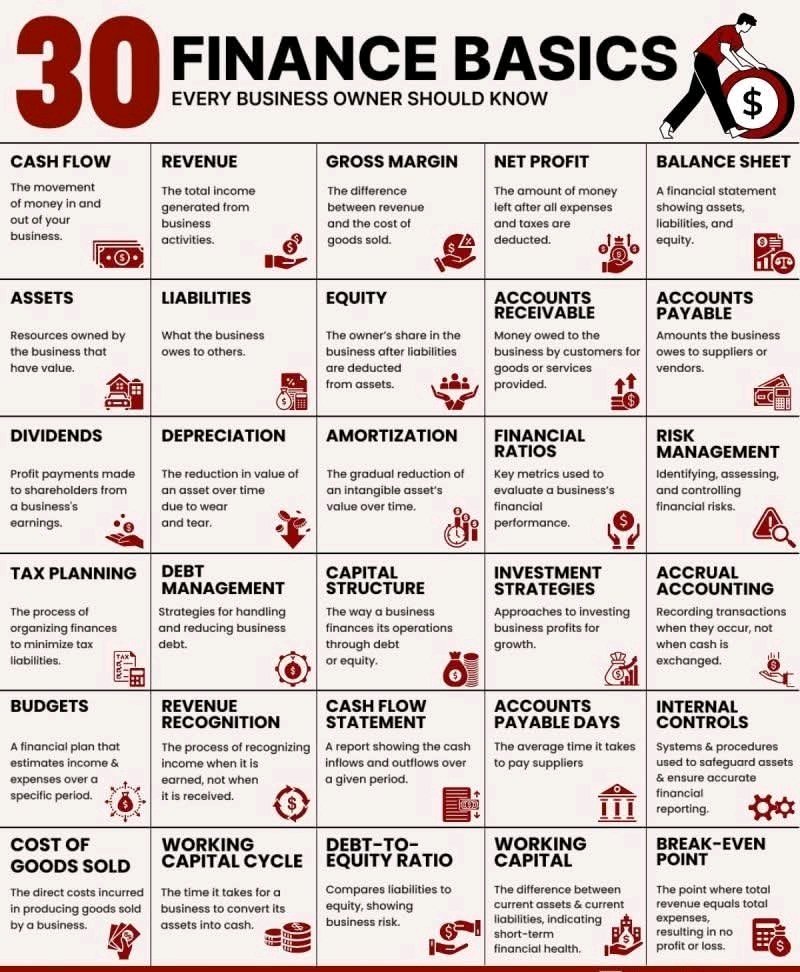

Mixing up gross profit and net income? 🤔 Gross profit is sales minus COGS, while net income is the bottom line after all expenses, interest, taxes, and non-operating items. #FinanceBasics #SmallBusiness

I wish schools taught tax basics. First salary → first shock: deductions, slabs, refunds. If you’re 18+ and earning, know where your rupee goes. Tax literacy = money control. #IncomeTax #FinanceBasics

Feeling overwhelmed by personal finance? You're not alone! Many give up thinking nothing works. But mastering budgeting, saving, and investing takes time. Share your journey or tips below! Follow us on social media. #FinanceBasics #InvestSmart

Finance: The only subject where 'interest' can be both what you earn and what you lose. 💰📷#DoubleEdgedInterest #FinanceBasics

What’s a company really worth? Book Value = What it owns minus what it owes. #BookValue #FinanceBasics #InvestingInsights #StockMarketIndia #FinancialEducation #CapitalClassroom #InvestmentTips #KnowYourWorth #AccountingMadeSimple #InvestorLearning #ShareIndia…

Understanding finance starts with the right foundation. Begin your financial journey today. Enroll now at online.nism.ac.in//module/Financ… #NISM #FinancialAwareness #FinanceBasics #FinancialFreedom

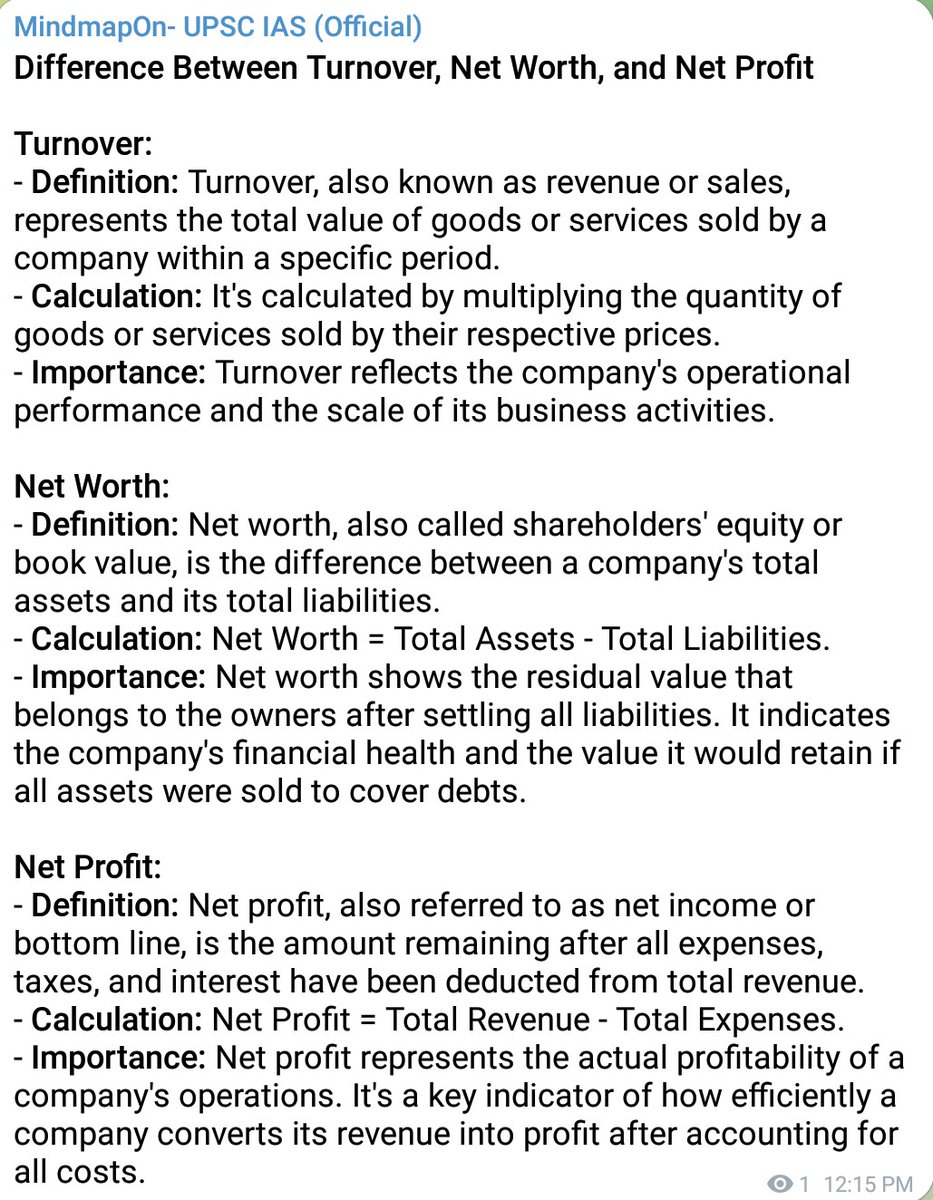

Turnover: Total value of goods/services sold. Net Worth: Assets minus liabilities. Net Profit: Actual profit after deducting all expenses. #FinanceBasics #BusinessMetrics #UPSC #Economic_terms

Finance for non-Finance Managers ⏱️ 1.9 hours ⭐ 4.25 👥 2,443 🔄 Aug 2025 💰 FREE comidoc.com/udemy/finance-… #FinanceBasics #BizSkills #Management #udemy

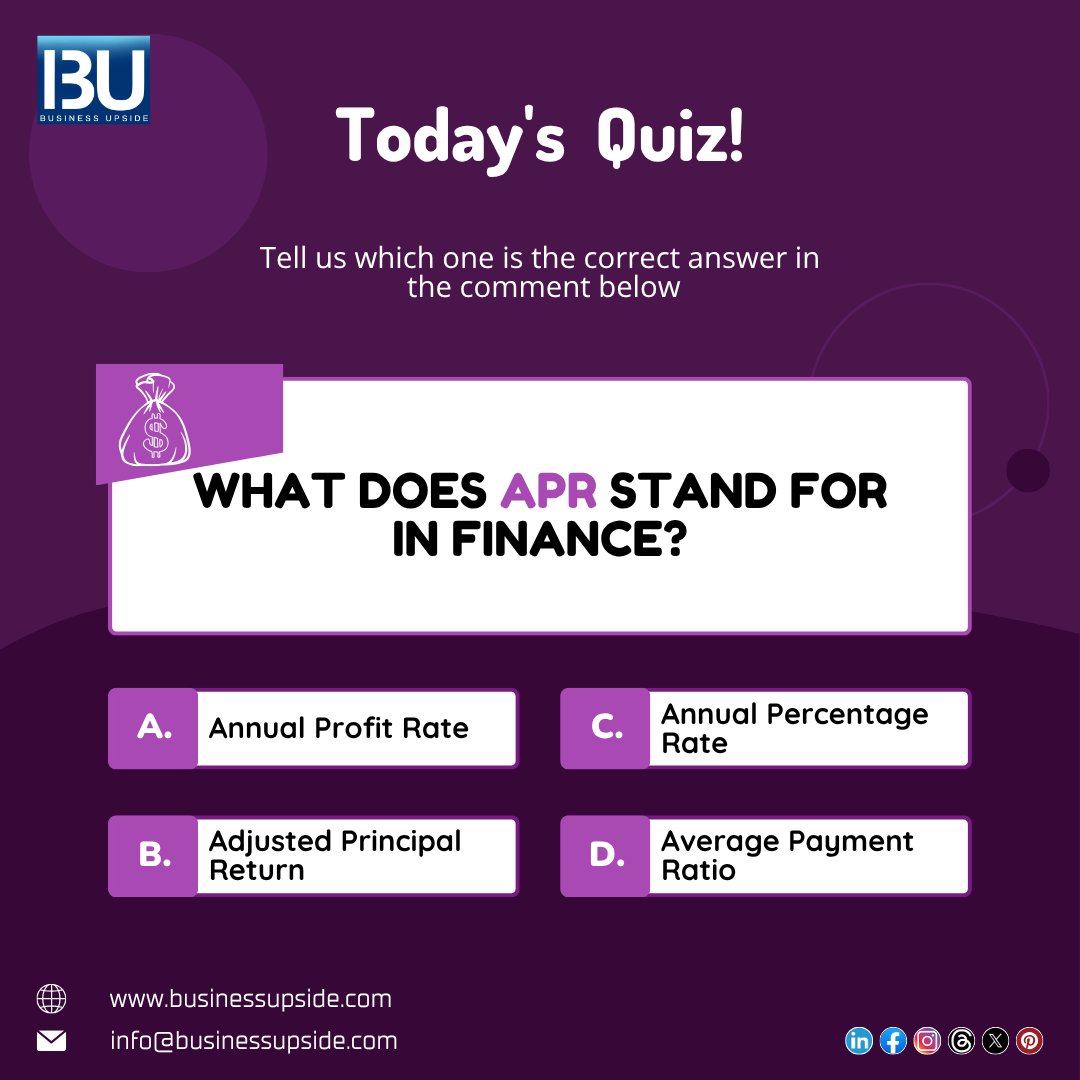

"What is APR in Finance? Understand Annual Percentage Rate Easily!" . For more such informative content, keep your eyes on Business Upside✨ . #WhatIsAPR #AnnualPercentageRate #FinanceBasics #PersonalFinanceTips #LoanEducation #CreditCardTips #APRExplained #FinancialLiteracy

Looking for a stable and predictable way to manage your funds? T-Bills offer fixed returns and government backing. 💡 #YourNextMoneyMove #FinanceBasics #PDAX

Understanding Your P&L: The Ultimate Year-End Reset #FinanceBasics #ProfitAndLoss #YearEndReview #FinancialLiteracy #BusinessReset #IncomeTracking #SmallBusinessFinance #P<ips #FinancialPlanning #2024Goals

Derivatives are financial tools that get their value from other assets like stocks or commodities. They're used to manage risk or make bets on price changes. Knowing how they work can improve your investment decisions! 📊💡 #FinanceBasics #Derivatives #Investing101

When I began studying finance, these three terms felt like three different planets. Everyone used them… But no one explained them simply. So here’s the breakdown I wish someone gave me 👇 #FinanceBasics #BeginnerFinance

What is TradFi? TradFi (Traditional Finance) is the regular financial system: banks, stock exchanges, regulators, and institutions controlled by central authorities. #TradFi #FinanceBasics #Web3Learning

🚀LEVEL UP YOUR FINANCE SKILLS! From Zero → Pro, here's your roadmap to master: 💰Money basics 📈Stock market 🧾IPOs 🛡️Risk management 📊Portfolio building 🎯Smart investing Want to Learn More? Follow @Pfxtalks DM me #FinanceBasics #Investing #StockMarket #IPOs #LearnAndEarn

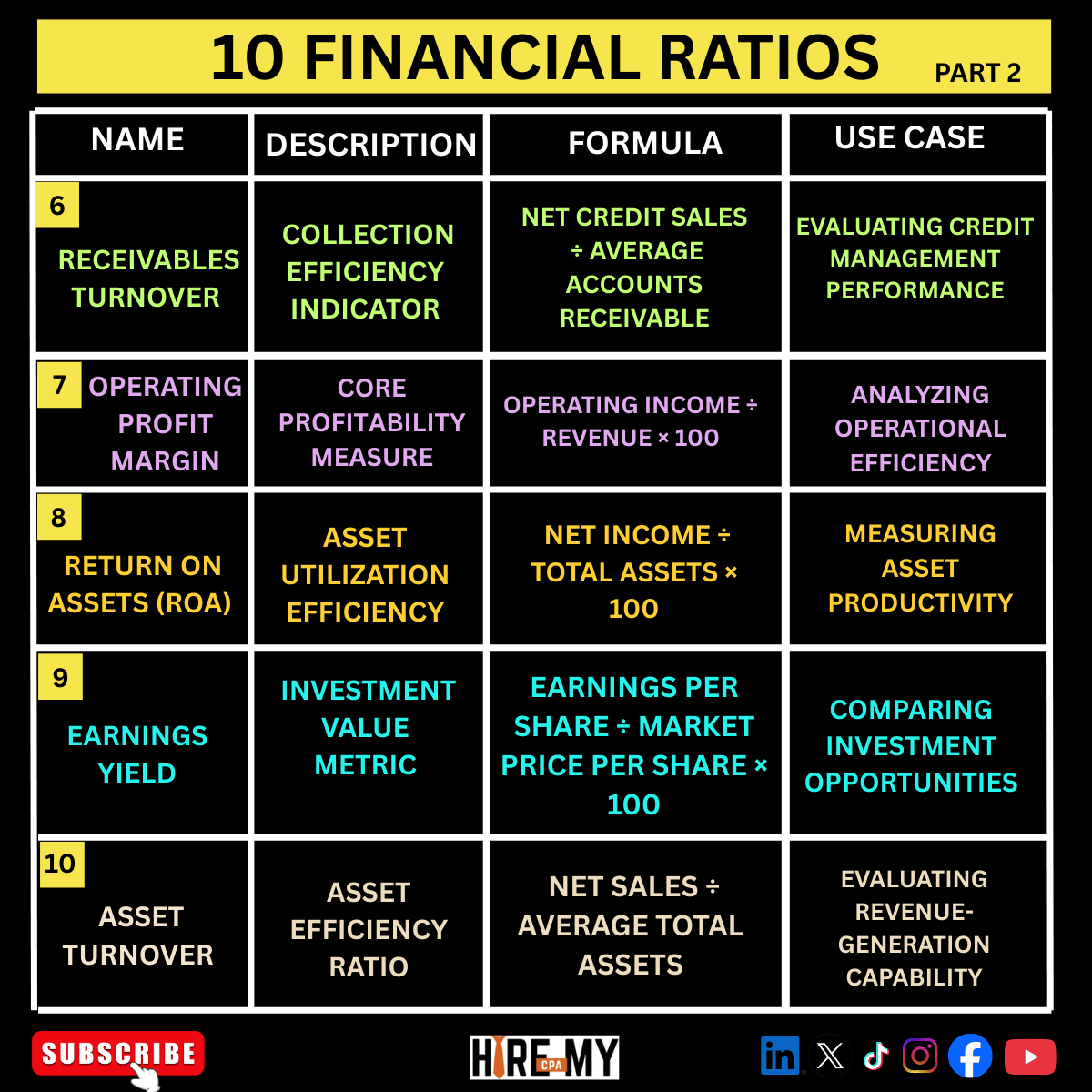

10 financial ratios part 2 Quick, simple, and perfect for beginners, business owners, and finance students. #FinancialRatios #FinanceBasics #Investing101 #BusinessFinance #Accounting #CPATips #FinancialAnalysis #FinanceForBeginners #BusinessTips

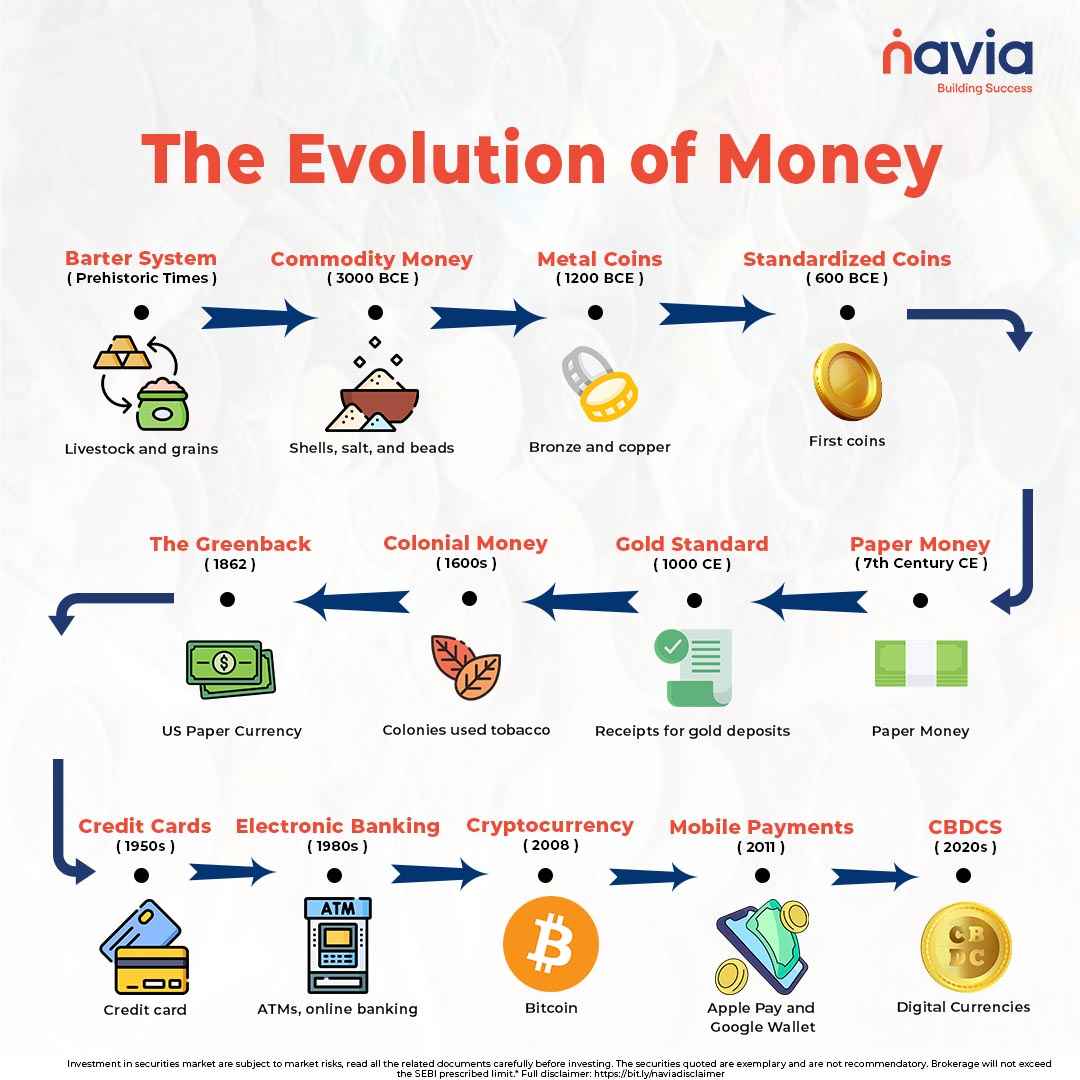

Money didn’t evolve overnight, it evolved with us. From barter to digital value, the evolution of money is one of humanity’s greatest innovations. #NaviaAllInOneApp #EvolutionOfMoney #FinanceBasics #MoneyHistory #LearnFinance #EconomicInsights #Money #Infographic

4. Dilution Dilution means your percentage goes down. You used to own 50. New investors come in. Now you own maybe 30 or less. It’s normal. But only when you understand it. #FinanceBasics #SME

One quick way to avoid tax confusion: stop mixing personal and business money. Use a dedicated account or wallet for each of them. When everything is jumbled, you lose reliefs and overpay completely avoidable tax. #SmallBusinessNigeria #TaxTalk #FinanceBasics #TaxTips

Secure your family’s future with the right legal steps. This quick Inheritance guide helps you understand every asset - Demat, Bank, Property & more at a glance. #InheritancePlanning #FinanceBasics #WealthManagement #familyplanning #SmartInvesting #LegalGuide #PravinRatilal

If stocks are the fireworks, corporate bonds are the groundwork. Read now: navia.co.in/blog/beyond-eq… #NaviaAllInOneApp #CorporateBonds #FinanceBasics #MarketEducation #InvestorMindset #EconomicInsights

Learn how #banks and credit unions differ in service, savings, and access. #financebasics cpix.me/a/208488446

Finance for non-Finance Managers ⏱️ 1.9 hours ⭐ 4.25 👥 2,443 🔄 Aug 2025 💰 FREE comidoc.com/udemy/finance-… #FinanceBasics #BizSkills #Management #udemy

Understand how #creditcard interest works and how it impacts your pocket. Know when interest is charged, how it's calculated, and why timely payment is key to avoiding extra costs. Stay smart, spend smarter! 💳📊 #CreditCardTips #FinanceBasics

Just tried @EdgenTech and wow—AI explains earnings reports in plain English. How accurate is it on small caps? Anyone using this daily? Feels like cheating (in a good way). #BeginnerCrypto #FinanceBasics

If you don’t know your cost basis, you’re guessing. #InvestorTips #FinanceBasics #SmartInvesting

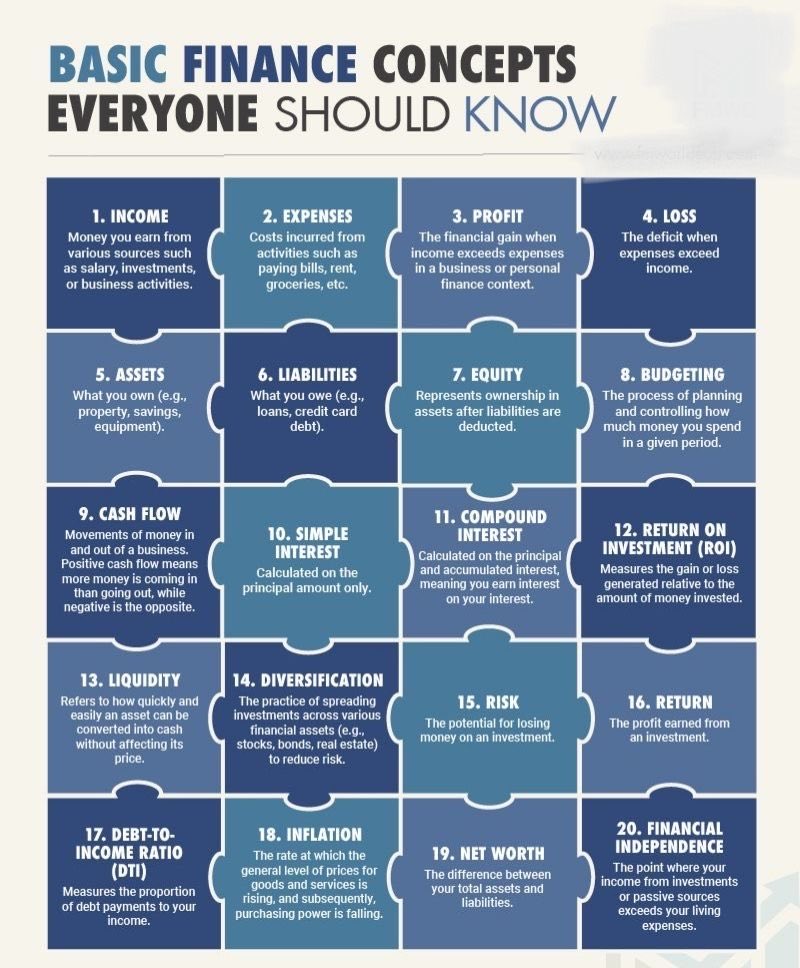

Financial literacy is the foundation of wealth. Before investing, master the basics: 1. Budgeting – Track income & expenses. 2. Saving – Build an emergency fund (3–6 months). 3. Financial Goals – Set SMART goals to guide decisions. Get these right, and your money starts…

Basic Finance Rules ✅ Pay credit card bills on time ✅Don't buy a house Immediately ✅Create multiple source of income ✅Buy Health & Term Insurance ✅Invest 25%+ more of income ✅Build a 6 month emergency fund #Investing #PersonalFinance

#FinanceFriday ~Get a job, increase earnings over time. ~Build a 3-6 month emergency fund. ~Have medical and life insurance. ~Enroll in a retirement fund. ~Invest the rest as follows, √money needed under 5 years put in an MMF or treasury bills. √money needed over 5 years…

Finance Basics Explained to Kids: Asset = Things that make money Liability = Things that cost money Net worth = Difference between what you own & owe Stock = Ownership in a business Index Fund/ ETF = A group of stocks Dividends = Profits shared with investors Bond = A loan…

"Struggling with checkbook management? 📘💡 Our latest guide demystifies it for you! #FinanceBasics #CheckbookChampion

Types of Assets Made Simple! 💡 From cash to land, machines to patents — assets are classified by convertibility, physical form & usage📊 #FinanceBasics #BusinessFundamentals #AccountingMadeEasy #WealthEducation

💭"Hisse senedi sahibi olmak, geniş kitlelerin bir ülkenin büyümesi ve gelişmesine katılımını mümkün kılan, şimdiye dek icat edilmiş en iyi yöntemdir." ~Peter Lynch & John Rothchild /Learn to Earn (1995) #FinanceBasics #TemelFinans

Finance: The only subject where 'interest' can be both what you earn and what you lose. 💰📷#DoubleEdgedInterest #FinanceBasics

🌟 An emergency fund is your financial safety net! 🛡️ Aim for 3-6 months of expenses saved up. It helps you tackle unexpected costs without stress. Start saving today—your future self will thank you! 💰✨ #FinanceBasics #EmergencyFund Pick: $SPY A solid choice for long-term g...

👥 Shareholder vs Stakeholder – what’s the difference? Shareholders own. Stakeholders impact. Who do you think shapes a company’s growth more? . . . #BusinessInsights #FinanceBasics #ShareholderVsStakeholder

🚨 Life is unpredictable! An emergency fund is your safety net for unexpected expenses—think car repairs or medical bills. Aim for 3-6 months' worth of living expenses. Start saving today! 💰 #FinanceBasics #EmergencyFund Pick: $VTI A solid investment for broad market exposur...

🌈 Diversification Simplified! Think of your investments like a fruit salad—mixing apples (stocks), bananas (bonds), & berries (real estate) gives you a tasty balance! 🍏🍌🍓 Spread the risk and enjoy the rewards! #InvestSmart #FinanceBasics Pick: $VTI A strong choice for div...

🌈 Thinking about investing? Don't put all your eggs in one basket! Diversifying your portfolio means spreading your money across different types of investments. It helps reduce risk and can boost your returns! 📈💼 #InvestSmart #FinanceBasics Pick: $VTI A solid investment fo...

Bookkeeping vs. accounting: Bookkeeping records transactions and maintains ledgers 📚. Accounting analyzes data, preps taxes, and guides decisions 📊. Knowledge = power 💪🏼 Reply "freedom journal" for more 🚀 #FinanceBasics

🌟 Build your safety net! An emergency fund is your financial cushion for unexpected expenses. Aim for 3-6 months of living costs. Start small, save consistently, and breathe easy! 💪💰 #FinanceBasics #EmergencyFund Pick: $SHY A good investment for emergency funds, $SHY offer...

Looking for a stable and predictable way to manage your funds? T-Bills offer fixed returns and government backing. 💡 #YourNextMoneyMove #FinanceBasics #PDAX

Feeling overwhelmed by personal finance? You're not alone! Many give up thinking nothing works. But mastering budgeting, saving, and investing takes time. Share your journey or tips below! Follow us on social media. #FinanceBasics #InvestSmart

Mixing up gross profit and net income? 🤔 Gross profit is sales minus COGS, while net income is the bottom line after all expenses, interest, taxes, and non-operating items. #FinanceBasics #SmallBusiness

Cash market = Buy now, pay now . . #CashMarket #InvestSmart #FinanceBasics #ghlindia #investment #WealthBuilding

🤑 Want to master your money? Start with smart credit use! Use credit cards for purchases you can pay off each month. Build your credit score 💪, avoid debt, and unlock better financial opportunities! #FinanceBasics #SmartSpending Pick: $MA Mastercard's robust growth in digit...

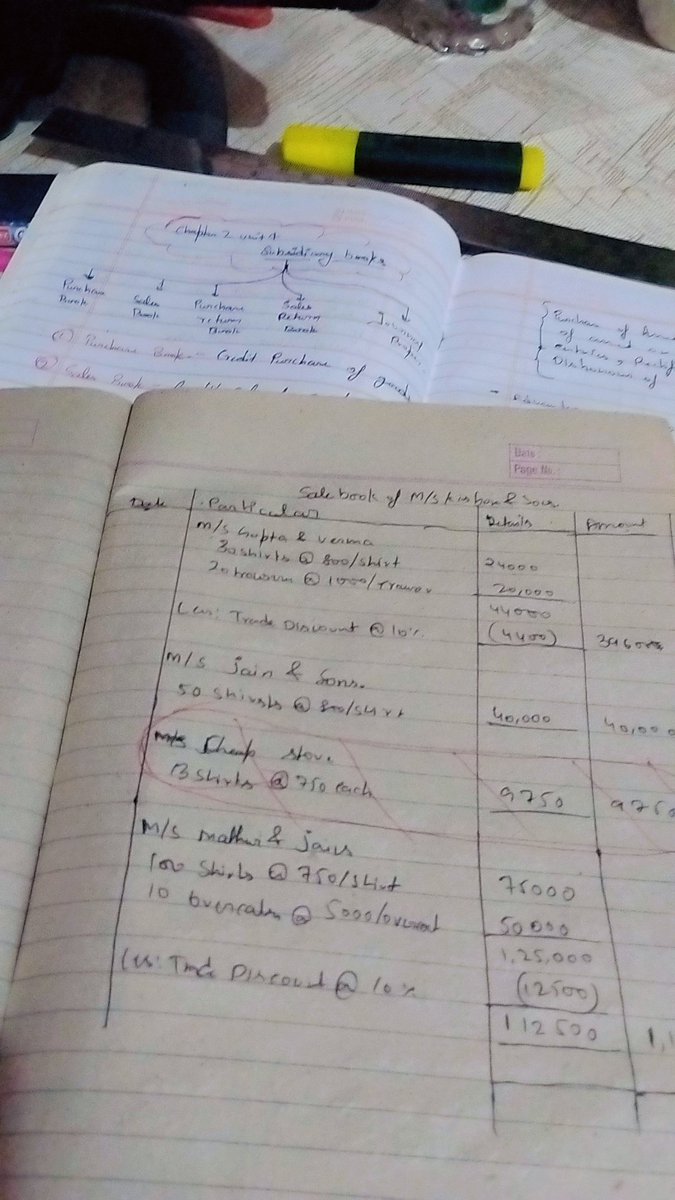

✅ Just completed Chapter 2 – Unit 4: Subsidiary Books! #LearningInPublic 📘 | #AccountingJourney #FinanceBasics

"What is APR in Finance? Understand Annual Percentage Rate Easily!" . For more such informative content, keep your eyes on Business Upside✨ . #WhatIsAPR #AnnualPercentageRate #FinanceBasics #PersonalFinanceTips #LoanEducation #CreditCardTips #APRExplained #FinancialLiteracy

Something went wrong.

Something went wrong.

United States Trends

- 1. #DMDCHARITY2025 419K posts

- 2. #TusksUp N/A

- 3. #AEWDynamite 20.5K posts

- 4. #TheChallenge41 2,175 posts

- 5. Ryan Leonard N/A

- 6. #Survivor49 2,842 posts

- 7. Skyy Clark N/A

- 8. Jamal Murray 6,852 posts

- 9. Earl Campbell 2,141 posts

- 10. Claudio 29.3K posts

- 11. Diddy 74K posts

- 12. Yeremi N/A

- 13. Hannes Steinbach N/A

- 14. Steve Cropper 5,850 posts

- 15. seokjin 151K posts

- 16. Kevin Overton N/A

- 17. Klingberg N/A

- 18. Monkey Wards N/A

- 19. Ryan Nembhard 3,699 posts

- 20. Milo 12.5K posts