Maximus

@69PostMax

Ex GS CEO (maybe, maybe not)

You might like

The market is facing a supply–demand imbalance. On the demand side, buyback activity is likely to decline as companies redirect capital toward substantial capital expenditure requirements. On the supply side, the market is set to absorb significant new issuance, including two…

$SPW SP500 Equal Weight: +1% $NDX Nasdaq: -1% That probably didn't happen very often.

The New Circularity: Ai is compressing software terminal values. But to displace software you need enormous compute, memory, and power. The lost value *should* accrue to the physical stack. And the market isn’t pricing in nearly enough of that migration. The problem is…

While there might be a short-term bottom (I'm not calling it), keep in mind that investors will need to make room for the Anthropic and SpaceX IPOs and will likely sell more software as a result. Not a short-term event, but something to keep in mind.

I’d rather listen to someone who spoke with Warsh and Bessent on Friday than someone who is only able to quote Warsh articles from 10 years ago.

The weekend crypto sell-off appears to be driven by market manipulation rather than macro factors. Crypto markets held up well on Friday, so the move can’t reasonably be attributed to the Warsh nomination or the selloff in gold and silver. It’s more likely that a large player or…

I’ve been reading a lot of takes on Warsh. Most of them are either outdated (e.g. “read what I wrote 10 years ago about him”) or from people who have had no recent interactions with Warsh, or any ever. Here’s what we know: In early 2009, Warsh played an important role in shaping…

They're not trying to reverse the direction of the Dollar. They want it weaker. They are just trying to manage the pace of its depreciation.

HASSETT: THERE ARE A LOT OF GOOD REASONS TO WANT A STRONG DOLLAR

Unless you’re a day trader (aka gamblers for the Precious Metal space), the Warsh appointment doesn’t matter as much as what Fintwit is saying. Moving on. Next risks are Iran (strike seems certain but extent of it is the unknown) and earnings; on the latter, interesting to…

Why is a weaker USD wanted by the Trump administration? 1. The global imbalance: the current account deficit. You fix that with tariffs and a weaker USD. 2. The domestic imbalance: too much consumption, not enough investment. That’s a 20-year problem. And it's why productivity…

The move in Gold has little to do with inflation, and more with a replacement valve. A lot of the spending today is sitting on government balance sheets, and normally higher sovereign yields are the system’s natural brake. But once governments get comfortable borrowing and…

The move in Gold has little to do with inflation, and more with a replacement valve. A lot of the spending today is sitting on government balance sheets, and normally higher sovereign yields are the system’s natural brake. But once governments get comfortable borrowing and…

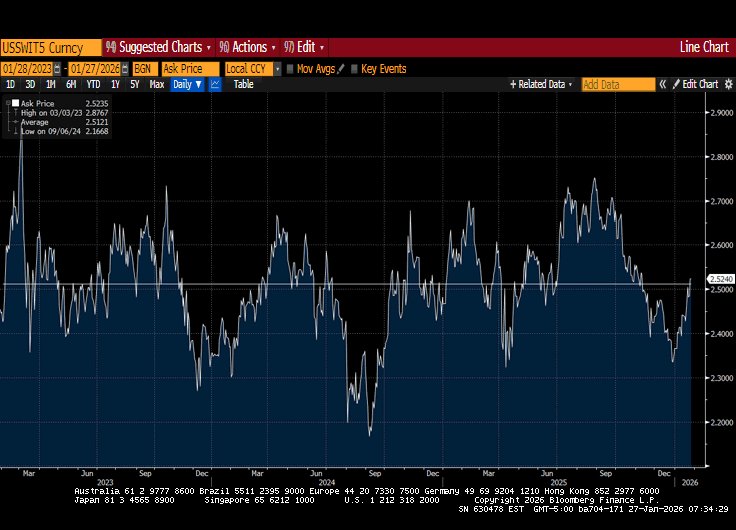

I'm uncomfortable with the idea that this move in gold/silver is about the market pricing forward inflation. 1) I think its mostly something else 2) This idea ignores the fact there's a market that prices forward inflation, and it hasn't moved during this whole gold bull market.

Lots of posts calling for a Precious Metal correction. But can they really correct if the USD depreciates -0.5%/-0.7% everyday?

The market ready to hit the sell Oil button as soon as the US attack Iran

Old promise: growth will be protected, market will be smoothed, liquidity will be flush. New promise: build something real or accept the risk. Have fun owning crypto.

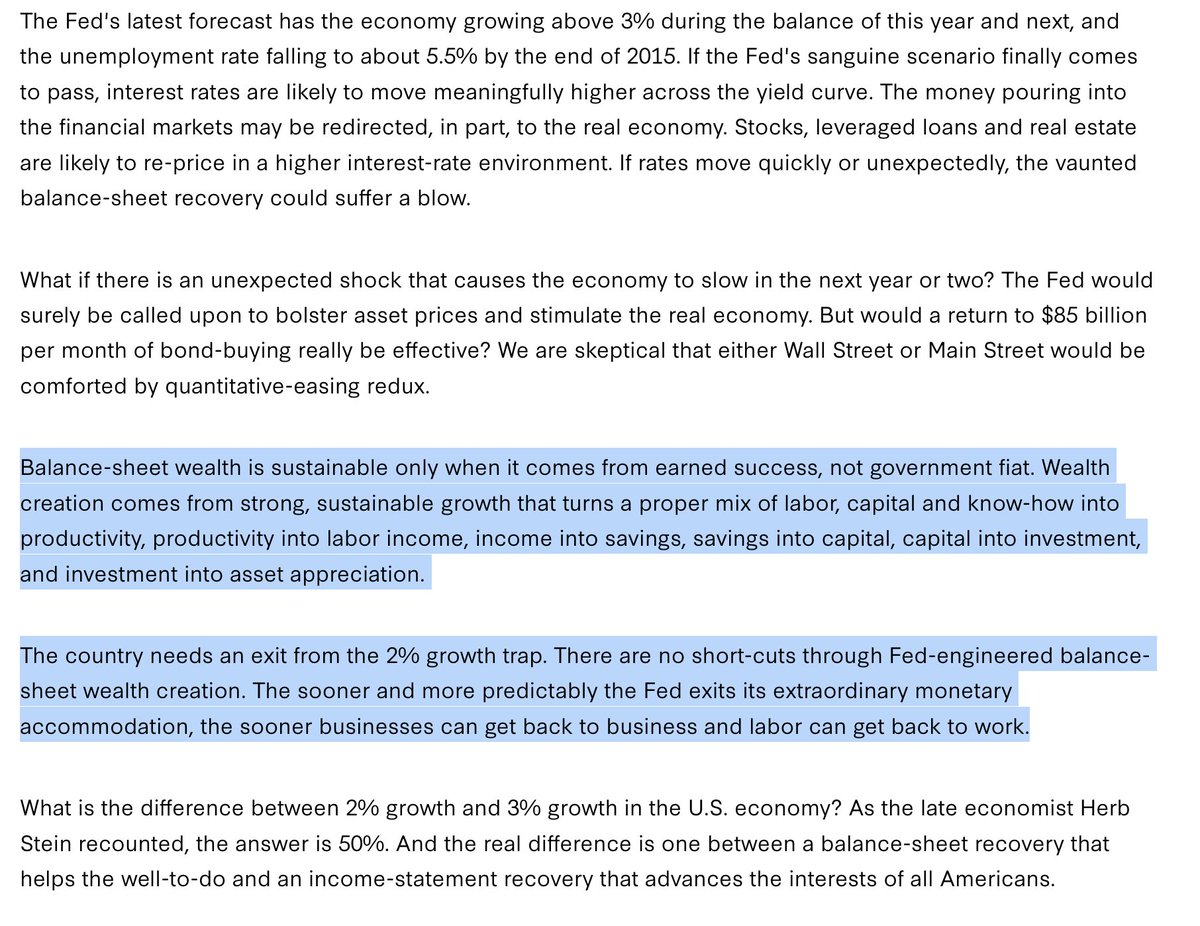

"Balance-sheet wealth is sustainable only when it comes from earned success, not government fiat. Wealth creation comes from strong, sustainable growth that turns a proper mix of labor, capital and know-how into productivity, productivity into labor income, income into savings,…

At this pace, the systematic community is going to be max short going into December FOMC. You know what happens next :)

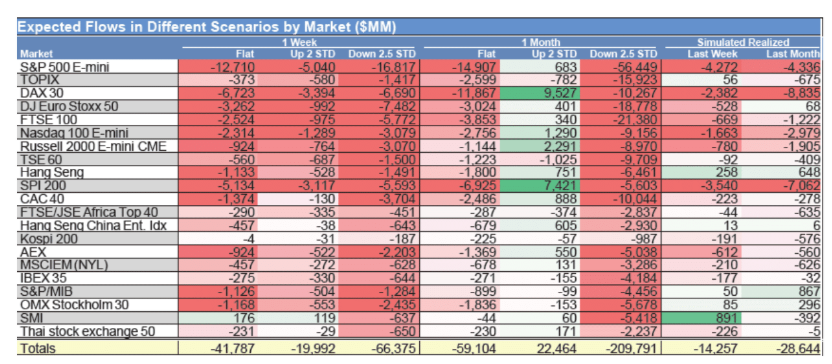

The "meaningful left tail risk" Goldman's Coppersmith flagged seems to be coming to roost after Thursday's reversal as Goldman updates their CTA estimates. The results aren't pretty. Looking at SPX they see notable selling in all scenarios over the next week and in all but an up…

Reasons Turnaround Tuesday could work: - yields should start fading as we beging receiving labor data - nvda earnings tomorrow should slow the pace of selling - sentiment in stocks and crypto at extreme fear - vix and vvix elevated

Many probably thought a major deal would be announced after the Xi-Trump meeting, not as early as this weekend. The last major headwind being removed means Vol is going to crater; $Vix is headed for low teens in the next few months.

there was always that remote possibility a deal wasn't made and trump went on a tirade where stocks went down for 1-3 days and then he backtracked to save them

United States Trends

- 1. Cam Thomas N/A

- 2. Pacers N/A

- 3. Zubac N/A

- 4. Opus 4.6 N/A

- 5. $AMZN N/A

- 6. Clippers N/A

- 7. Mathurin N/A

- 8. Pat Riley N/A

- 9. Dizzy N/A

- 10. Hali N/A

- 11. Lookman N/A

- 12. Seth Jarvis N/A

- 13. Blaze Alexander N/A

- 14. Milwaukee N/A

- 15. Sankey N/A

- 16. Kawhi N/A

- 17. Josh Harris N/A

- 18. Phase N/A

- 19. Shams N/A

- 20. Heat N/A

You might like

-

Nick Gerli

Nick Gerli

@nickgerli1 -

Garic Moran

Garic Moran

@GaricMoran -

Gold Mansacks

Gold Mansacks

@Gold_Mansack -

Judah Rhodie

Judah Rhodie

@judahrhodie -

Kevin Duffy | The Coffee Can Portfolio

Kevin Duffy | The Coffee Can Portfolio

@kevinduffy1929 -

Doug Casey

Doug Casey

@RealDougCasey -

RenMac: Renaissance Macro Research

RenMac: Renaissance Macro Research

@RenMacLLC -

Scott Patterson

Scott Patterson

@pattersonscott -

Wait Capital

Wait Capital

@WaitCapital -

Kalshi

Kalshi

@Kalshi -

New Liberals 🇺🇦🇹🇼🇬🇱🌐

New Liberals 🇺🇦🇹🇼🇬🇱🌐

@CNLiberalism -

Jay Soloff

Jay Soloff

@jsoloff -

Cameron Dawson

Cameron Dawson

@CameronDawson -

Mike Larson

Mike Larson

@RealMikeLarson -

Macro Twain

Macro Twain

@macrotwain

Something went wrong.

Something went wrong.