BitOoda

@BitOodaCompute

Financializing the Global Compute Market through an Institutional Fintech Platform

You might like

Etherealize launched just 24 hours ago The response from the ETH and TradFi ecosystems has been nothing short of incredible Players from the Ethereum app layer, the infra layers, the L2s, and from all parts of Wall St reached out — and want to help It’s truly inspiring (1/2)

INTRODUCING ETHEREALIZE An institutional marketing and product arm for the @ethereum ecosystem Our goal? To accelerate adoption by bringing institutions to Ethereum: the digital economy of tomorrow All roads flow through ETH. We’ll show the world why Here’s our plan: (1/7)

ETHEREUM’S RECENT WINS: - Trump bought $47mm ETH and a basket of tokens mostly issued on ETH (Trump’s WBTC settles on Ethereum — the future utility layer for the Bitcoin network) - Trump staked his ETH with Lido - The EF allocated 50k ETH for use DeFi - Coinbase’s new BTC…

To commemorate the inauguration of Donald J. Trump as the 47th President of the United States, $WLFI is proud to announce the following strategic purchases today: $47,000,000 ETH $47,000,000 wBTC $4,700,000 Aave $4,700,000 LINK $4,700,000 TRX $4,700,000 ENA Excited for the…

2024 was the year everything changed for Ethereum ETH achieved regulatory acceptance, scaling, and a spark of institutional adoption The war against ETH is now over… …meaning it’s time for ETH to go to war 5 catalysts for why ETH will win in 2025: (0/6)

2024 was indeed the perfect storm of fundamental catalysts for Ethereum Rumors of ETH’s death were greatly exaggerated. In fact, the only recurring complaint was that ETH price was “only” up ~50% Zooming out, let’s reflect on 5 unbelievable developments for ETH in 2024: (1/8)

Saylor is pivoting from a zero sum Bitcoin-maxi future to a positive sum future where we see an Ethereum Renaissance This opens the door for a corporate ETH treasury playbook to complement MSTR’s BTC strategy The spotlight will shift to ETH in 2025 🚀 coinpedia.org/news/bitcoin-a…

2024 was indeed the perfect storm of fundamental catalysts for Ethereum Rumors of ETH’s death were greatly exaggerated. In fact, the only recurring complaint was that ETH price was “only” up ~50% Zooming out, let’s reflect on 5 unbelievable developments for ETH in 2024: (1/8)

We are about to see the perfect storm of upside catalysts for ETH In hindsight, the second half of 2024 will be the most obvious bullish setup for the Ethereum ecosystem in recent history Three headwinds that have held ETH back will become tailwinds, starting this week: (1/9)

Coinbase is one of the biggest drivers for the crypto renaissance And Base is largely possible (from a regulatory perspective) because it is built as an Ethereum L2 Ethereum is the most secure, open, reliable blockchain economy (Though many are incentivized against saying it)

Coinbase, a publicly traded business in the US, seems to have pulled off the impossible — they built a blockchain that is being widely adopted although they were under intense regulatory scrutiny. $COIN

One of the bigger Ethereum catalysts for 2025: **Staked ETH ETFs will come quickly, before any new crypto ETFs are approved** This makes it ~6x more profitable for asset managers to focus their growth on ETH ETFs than BTC ETFs! Here’s the math: (1/5) coinage.media/s3/sec-commiss…

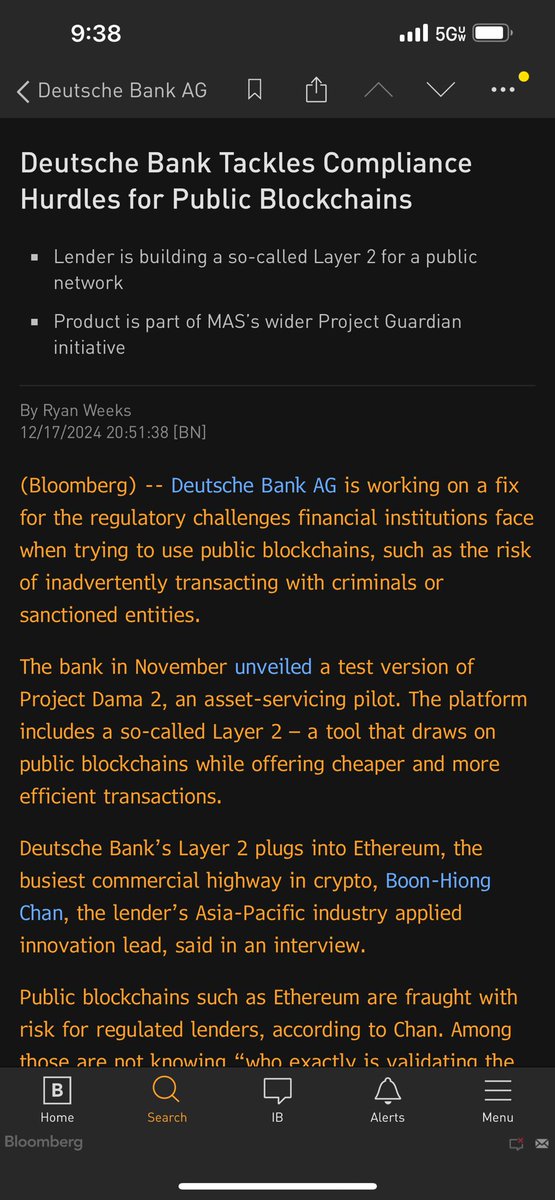

Ethereum institutional adoption update: 1. Deutsche Bank is launching an L2 to compliantly switch on public blockchain connectivity (via @zksync) 2. Hashkey is launching an L2 on ETH (via @Optimism) L2s are the optimal way to scale Ethereum. theblock.co/post/331401/ha…

Appreciate the debate, and your points are interesting. My thoughts: > What will the US use ETH for? Staking? Why would they stake if they already print money for free? Yes as a store of value (alongside btc) and for staking - it’s a whole new uncorrelated source of yield. See…

***WHAT IS ETH?*** Here’s an explainer for the institutional crowd: We know what a US treasury is: the de-facto store of value in the US economy. Now imagine a US treasury bond - but it captures upside from the US economy doing well. That’s ETH. (1/3)

**A US STRATEGIC CRYPTO RESERVE WILL LIKELY INCLUDE ETHEREUM** There is mounting evidence that a national strategic crypto reserve will include ETH in addition to BTC as its core holdings Here’s why: (1/9)

***WHAT IS ETH?*** Here’s an explainer for the institutional crowd: We know what a US treasury is: the de-facto store of value in the US economy. Now imagine a US treasury bond - but it captures upside from the US economy doing well. That’s ETH. (1/3)

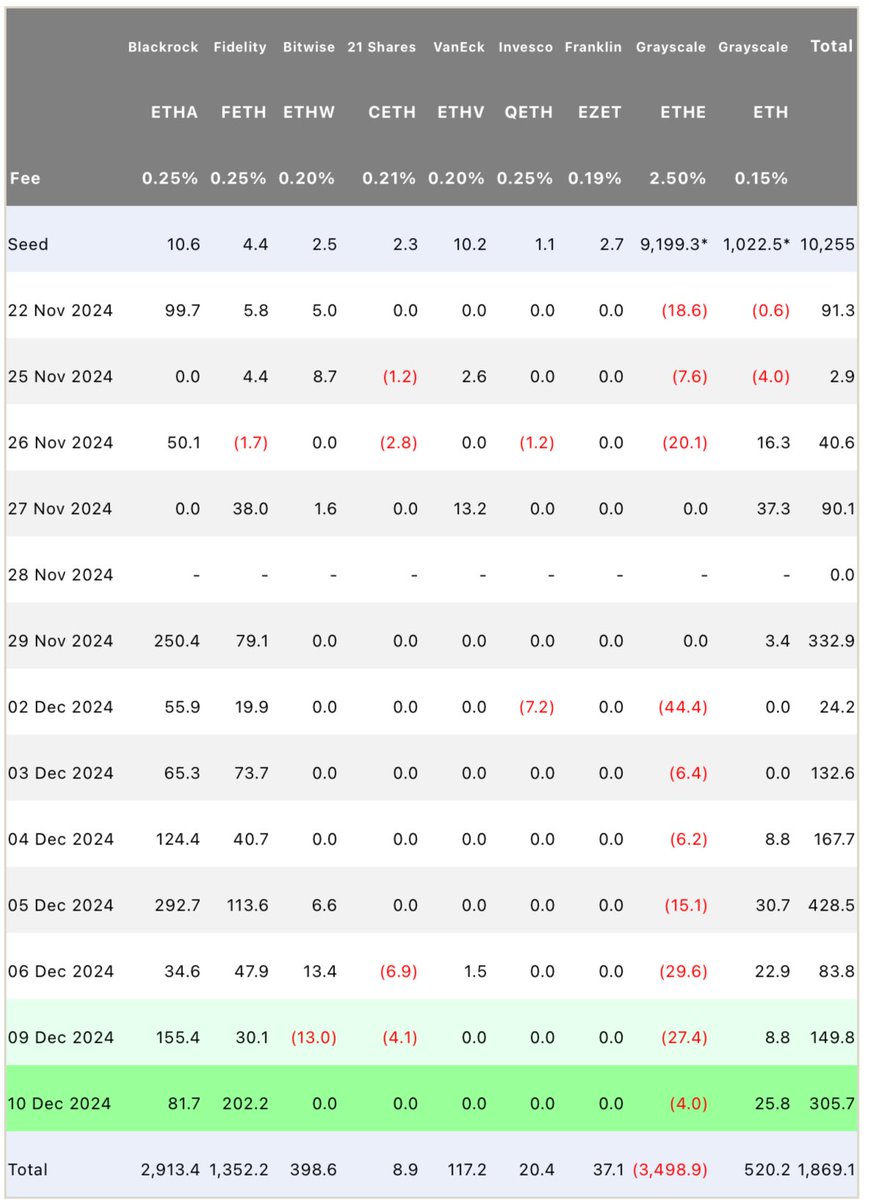

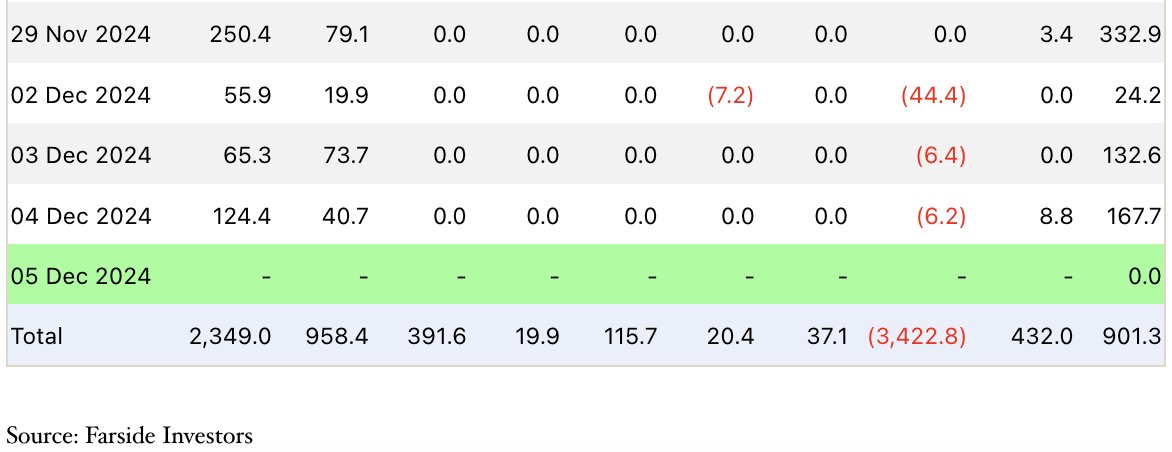

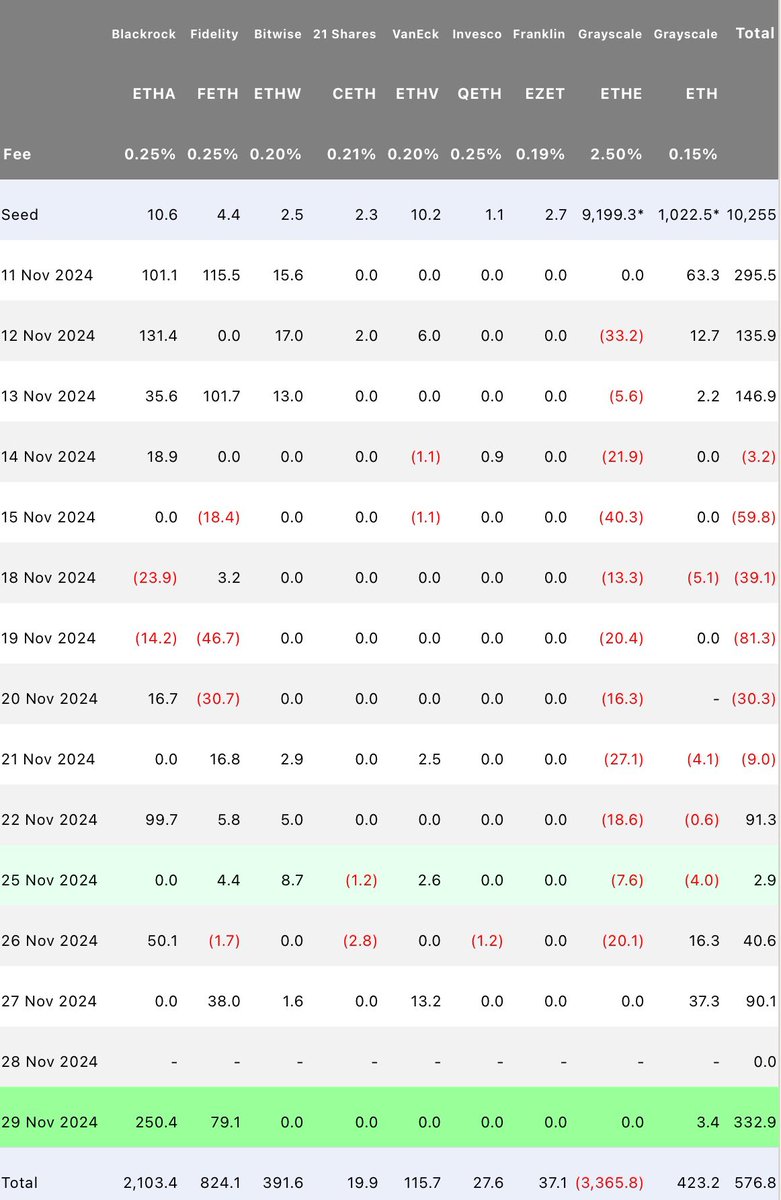

Some constructive stats about the ETH ETFs over the past 8 days: - Over $1.05bn inflows into the Blackrock ETH ETF (as Nate mentioned, top 4 ETF launch for 2024) - Over $610mm inflows into the Fidelity ETH ETF, with yesterday being $202mm (largest one day ever for FETH) (1/2)

Make that 8 straight days of inflows into iShares Ethereum ETF... Over $1bil total. Top 4 ETF launch of 2024 (out of approx 675 ETFs).

Ethereum is the most secure, most liquid, and most reliable platform for tokenization Any large-scale institutional tokenization effort will take place on Ethereum — and the US Treasury is recognizing the benefits of tokenizing assets

BREAKING: U.S. TREASURY REPORT SAYS "TOKENIZATION HAS THE POTENTIAL TO UNLOCK THE BENEFITS OF PROGRAMMABLE, INTEROPERABLE LEDGERS TO A WIDER ARRAY OF LEGACY FINANCIAL ASSETS"

Add $295mm to the ETH ETF tally… Nearly $1bn in new inflows since Thanksgiving 🚀

ETH ETF inflows are accelerating Since Thanksgiving, ETH ETFs have seen $657mm in inflows ~75% of total net inflows since inception have come in the last 4 days Combined Blackrock + Fidelity ETF AUM is almost > all outflows from ETHE The ETH ETF onramp is getting warmed up..

Prediction: there are 2 possible outcomes for new crypto ETFs in 2025 — Outcome (1): we see a wave of indiscriminate approvals, where we either get 10+ new crypto ETFs… (This would include XRP, DOGE, LTC, ADA, SOL, AVAX, DOT, LINK, etc) (1/4) cointelegraph.com/news/us-regula…

cointelegraph.com

US regulators mull approving Grayscale crypto index ETF

United States regulators are reviewing a request to list the first ETF holding a diverse basket of cryptocurrencies, including altcoins SOL, XRP and AVAX.

The ETH ETFs saw ~$549mm in net inflows over the past 7 days Of which $333mm was on 11/29 This compares to a 7-day net inflow of ~$1.36bn for the BTC ETFs ($320mm on 11/29) 7 day net ETH issuance: 9,695 ETH ~= $34mm 7 day BTC issuance: 450 BTC * 7 = 3,150 BTC ~= $302mm (1/3)

**ETH should be a core part of a US Digital Asset Strategic Reserve** The Ethereum network has become systemically important global technology ETH = blockchain technology adoption and growth 4 reasons why ETH needs to be a US Strategic Reserve asset (alongside BTC): (1/7)

Bitcoin was the start of the crypto movement - but it doesn’t represent crypto’s full potential BTC is analogous to gold - a pristine store of value meant to be tucked away and held The true innovation that came after gold was finance and capital markets - debt, equity, fiat,…

United States Trends

- 1. Snoop 10.9K posts

- 2. Spurs 70.4K posts

- 3. Merry Christmas 1.98M posts

- 4. #NFLonNetflix 12.4K posts

- 5. Vikings 21.5K posts

- 6. Thunder 36.6K posts

- 7. Wemby 29.7K posts

- 8. #DETvsMIN 1,420 posts

- 9. Christmas Day 784K posts

- 10. #Skol 1,924 posts

- 11. Al Horford 1,344 posts

- 12. Knicks 33K posts

- 13. Lainey Wilson N/A

- 14. Chet 12.6K posts

- 15. #OnePride 2,287 posts

- 16. Anthony Davis 1,573 posts

- 17. Teslaa 1,823 posts

- 18. Max Brosmer 3,981 posts

- 19. Caruso 4,357 posts

- 20. Cavs 19.7K posts

You might like

-

Hashrate Index 🟧⛏️

Hashrate Index 🟧⛏️

@hashrateindex -

Cipher Mining

Cipher Mining

@CipherInc -

TFTC

TFTC

@TFTC21 -

WhatsMiner

WhatsMiner

@Whatsminer_MBT -

Kevin Zhang

Kevin Zhang

@SinoCrypto -

karim helmy

karim helmy

@karimhelpme -

Chase Lochmiller

Chase Lochmiller

@ChaseLochmiller -

Leo ⌛

Leo ⌛

@Leozayaat -

William Szamosszegi

William Szamosszegi

@Will_Saz -

Bryan Bishop

Bryan Bishop

@kanzure -

EZ Blockchain

EZ Blockchain

@ez_blockchain -

P

P

@phjlljp -

Ryan Porter

Ryan Porter

@RyPorts -

T K 🇺🇦

T K 🇺🇦

@tmskulyk -

Lee ₿ratcher

Lee ₿ratcher

@lee_bratcher

Something went wrong.

Something went wrong.