Bitfinex'ed 🔥🐧 Κασσάνδρα 🏺

@Bitfinexed

Exposed Bitfinex/Tether as one the largest financial frauds in history. "A powerful force working to harm Tether." - Tether CEO - Ludovicus Jan van der Velde

You might like

Tethers lawyer Jason Weinstein claims that they produced forensic evidence showing that Tethers were fully backed every single day. That's strange. The CFTC said the exact opposite. How come Tether doesn't produce this forensic evidence for the public to see it, to end the FUD?

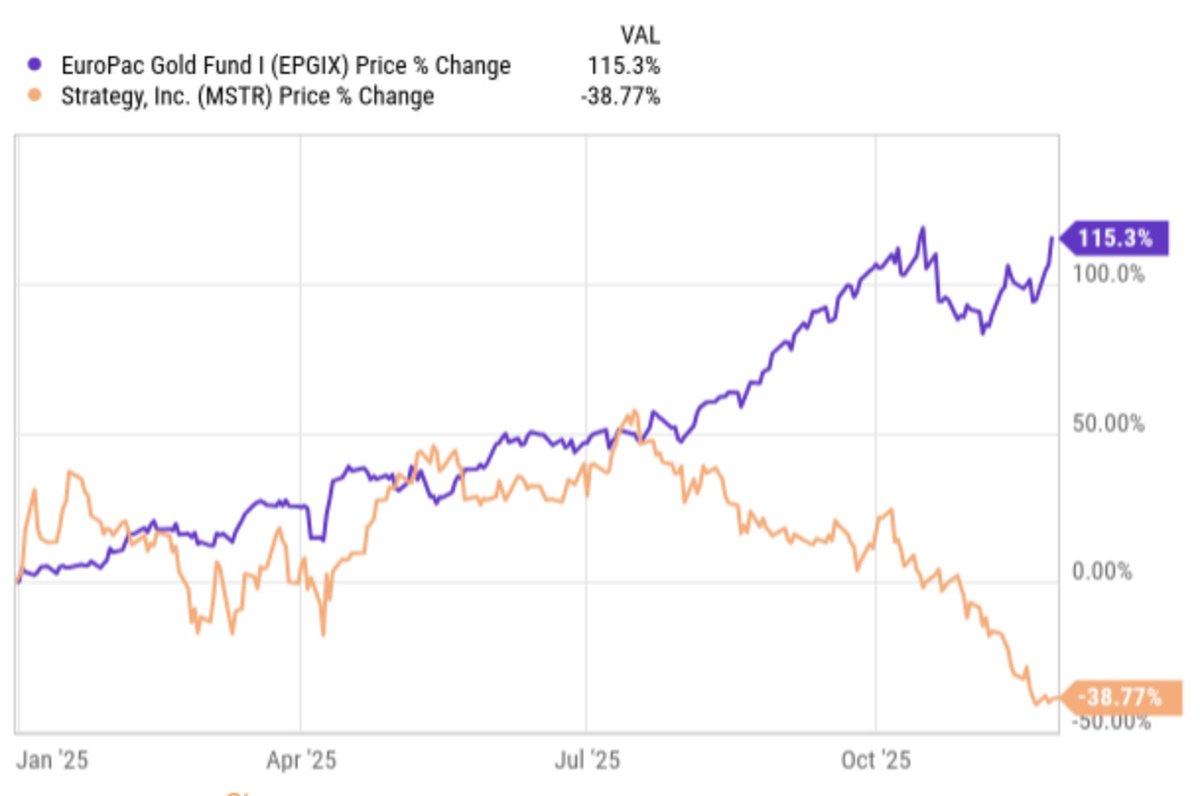

schiff vs. saylor YTD

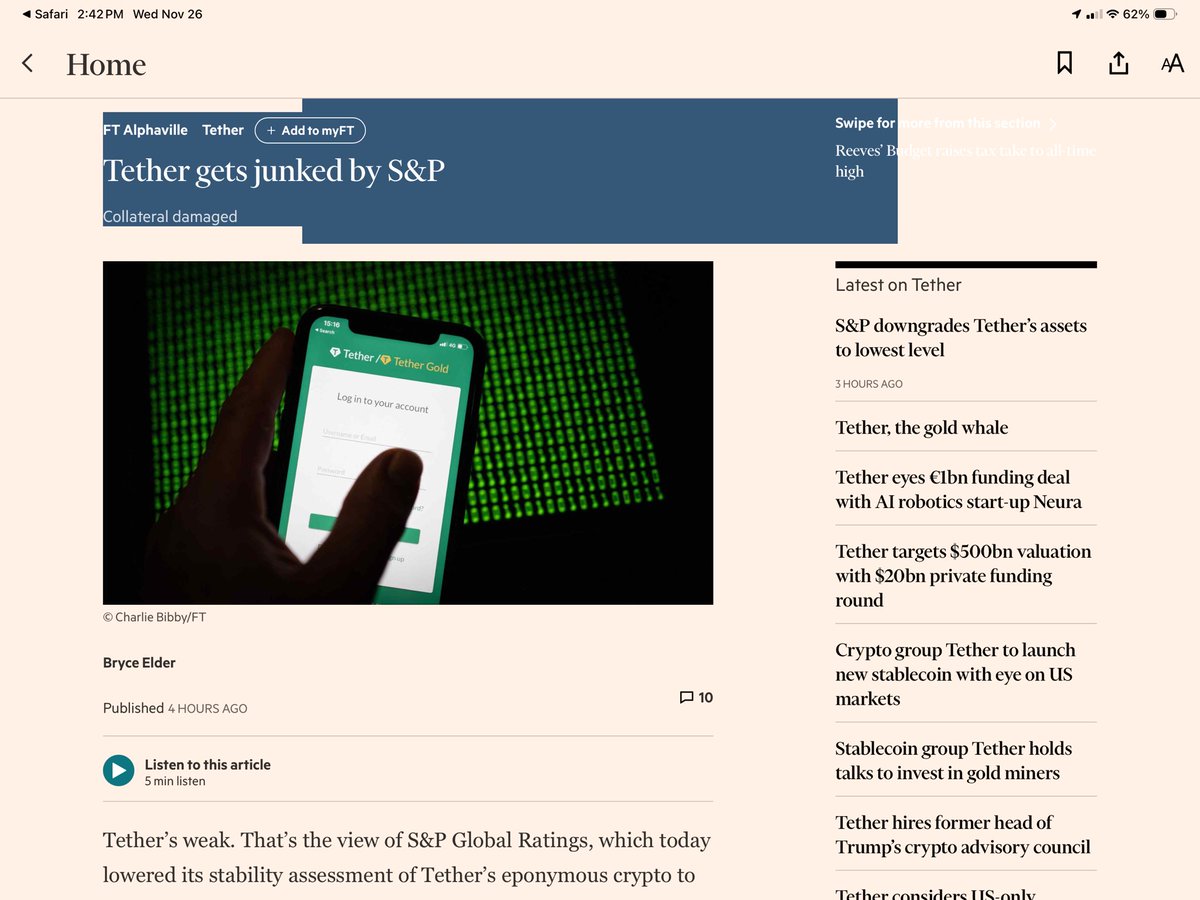

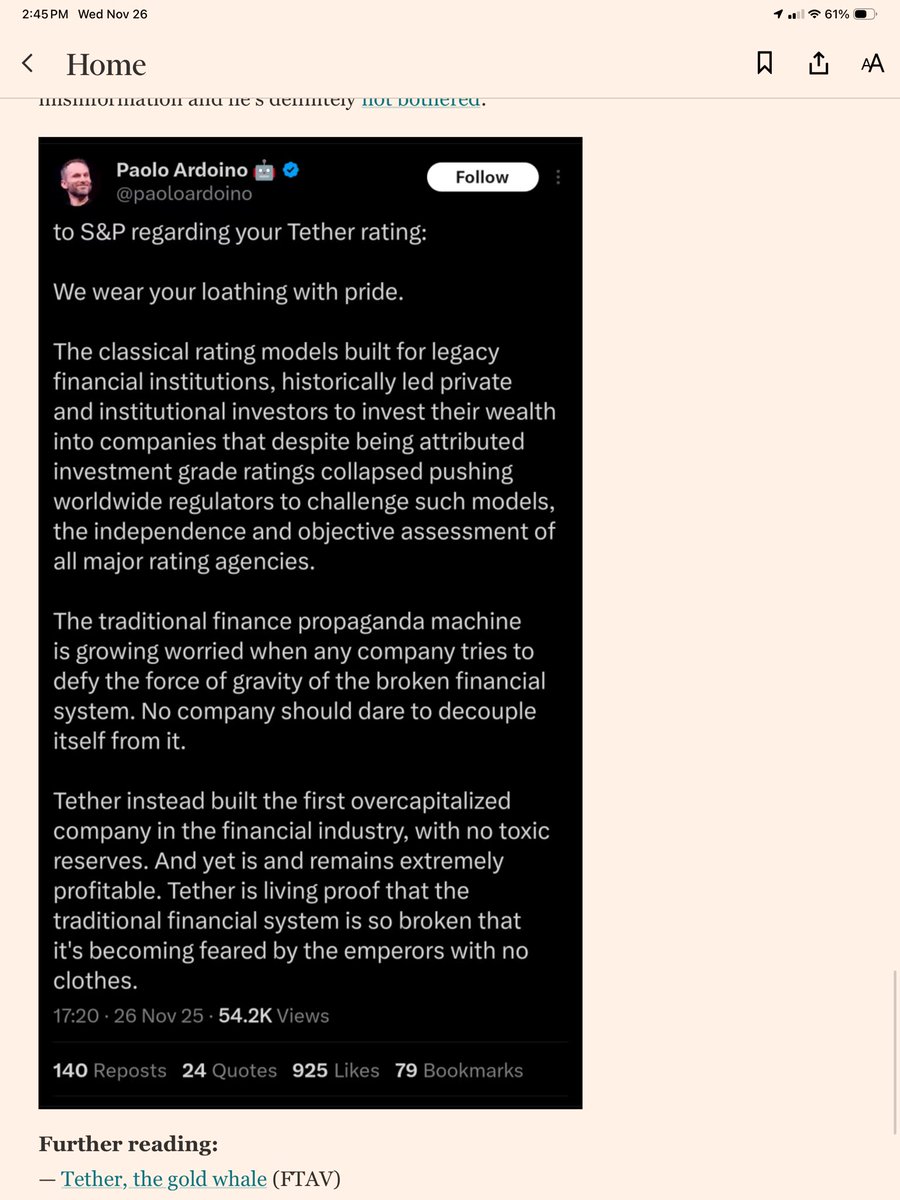

The article is bad enough for Tether. But the Tether guy’s response at the end is pure Saylor-esque messianic utopian paranoid propaganda without actual semantic content. And nobody mentions that all those “other” assets don’t really work under the “GENIUS” act do they?

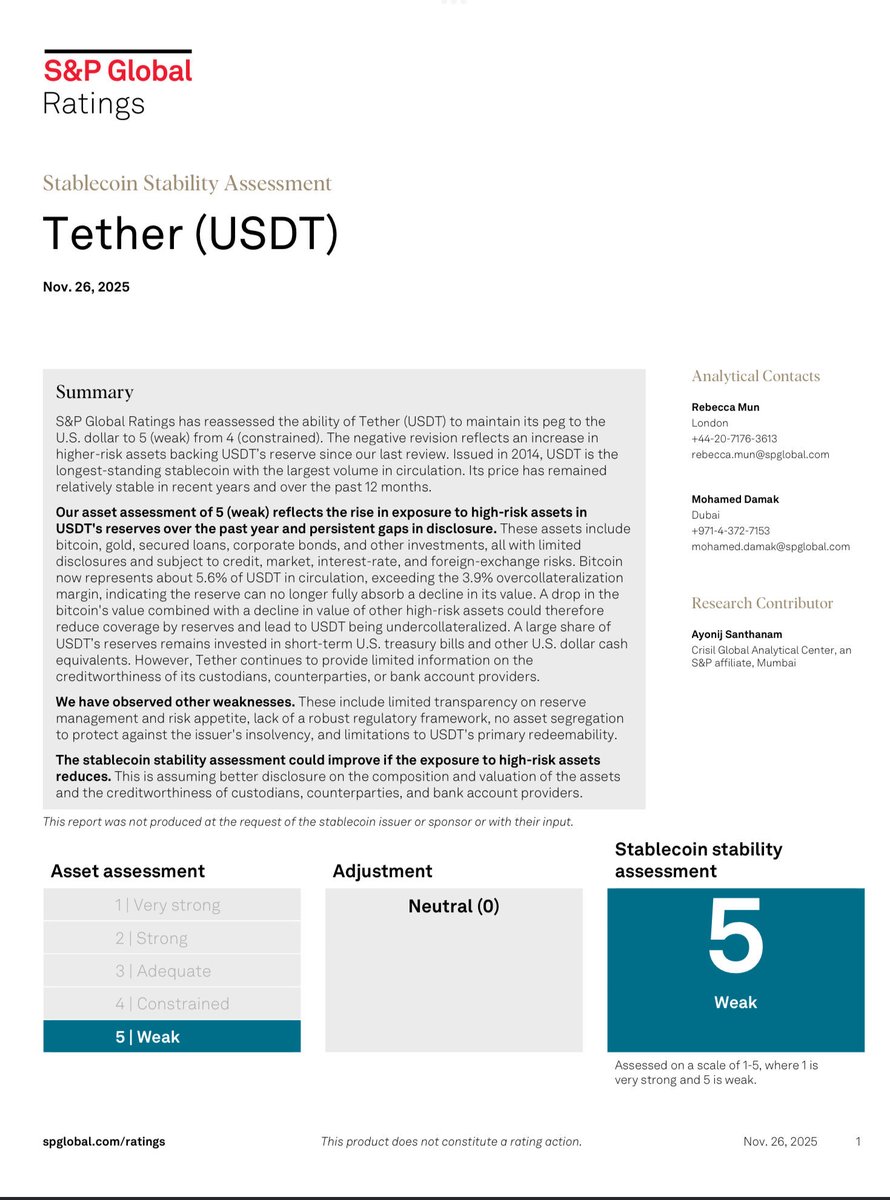

S&P JUST DOWNGRADED TETHER TO “WEAK” The $184 billion backbone of crypto markets is one crash away from insolvency. The math is devastating: Bitcoin holdings: 5.6% of reserves Safety buffer: 3.9% Read that again. The volatile asset exceeds the cushion meant to absorb its…

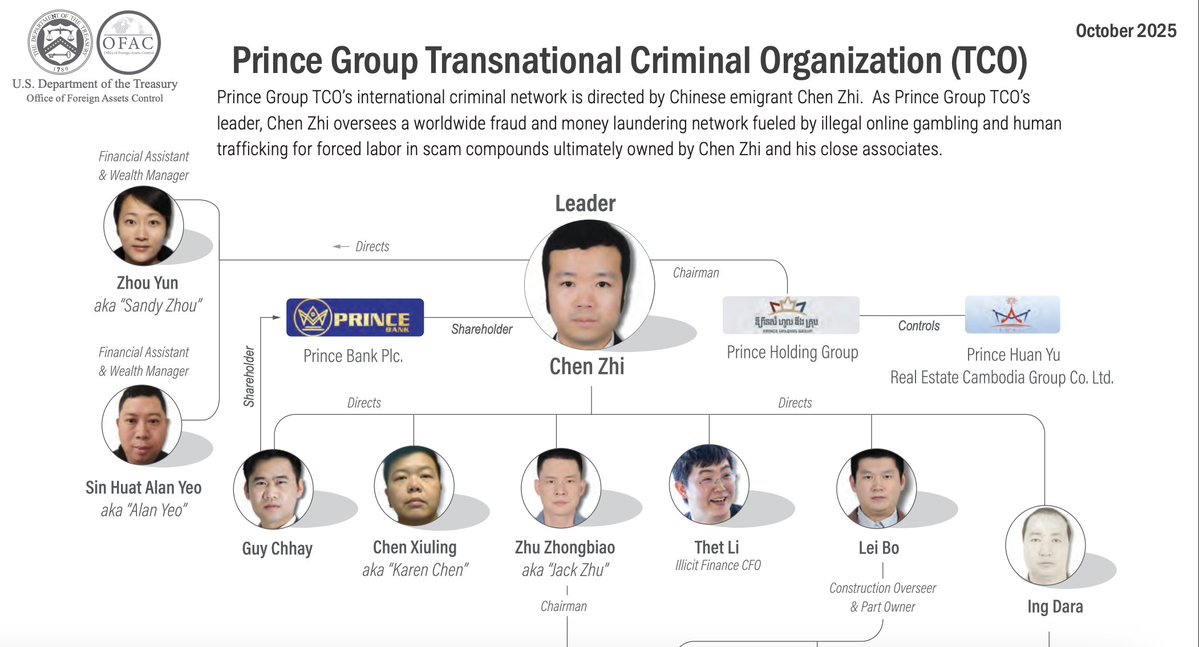

my pet theory is that the root cause of the turmoil in the crypto markets is the Prince Group takedown and massive bitcoin seizure etc.

The U.S. and U.K. froze many assets of the massive Cambodia-based alleged cyber-scam and money laundering network “Prince Group Transnational Criminal Organization.” But one man sanctioned as an alleged associate has amassed properties and companies using a different identity.…

Bo is being a faithful lapdog and criticizing S&P’s downgrade of Tether. But USAT, the US Tether stablecoin that Bo is leading, must comply with every factor the S&P cited in its Tether downgrade (reserve risk, disclosure, redemptions) Bo is a deeply unserious person.…

I bought 80 tons of gold yesterday. I just provided the same amount of proof as tether.

What if the Tether fraud was just a scam to steal a bunch of gold all along? You know that gold is going to disappear, right?

Tether has the weakest rating possible. Congratulations Tether fraud!

Tether, “The Stable Company” just saw S&P cut its assessment rating from 4 to 5 - the lowest rating possible - citing persistent gaps in disclosure and high risk assets being held in its reserves. Only in crypto would the bedrock stablecoin of crypto trading be viewed as so…

Strategy and Saylor will be another crypto Shakespearean tragedy. So when you see comments like this from Strategy, the most famous quote of Queen Gertrude in Hamlet seem apt “the lady doth protest too much, me thinks”

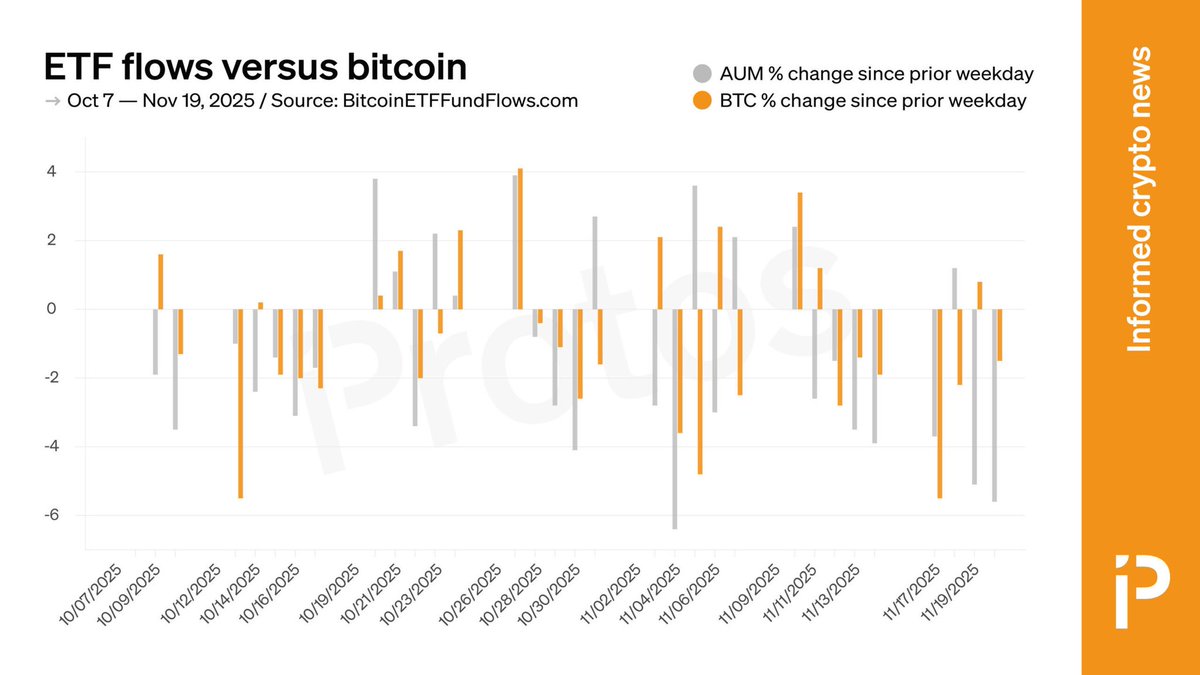

💨 THE ETF EXODUS BTC ETFs have shed a staggering $58B, dropping 35% - far outpacing BTC's 28% slide. The supposed safe haven for $BTC exposure is amplifying losses as investors flee, proving the hype was just that. AUM has collapsed from $168B to $110B in 8 weeks… 🧵

DUMPSTER FIRE BitMine $BMNR, chaired by permabull Tom Lee, has crashed 81% in 5 months, performing just as badly as Michael Saylor's Strategy. It's another casualty of the disastrous "digital asset treasury" model that has torched investors in 2025 🧵

These sorts of Saylor-isms are going to be catnip for the lawyers when the inevitable shareholder litigation arrives. You can have all the risk factors in your SEC filings, but if the CEO spouts off clearly factual b.s. you’re in trouble in litigation. It’s not hard to figure…

"Bitcoin could go to $1, and we're still not getting liquidated" "We'll just buy all the Bitcoin and it'll go back up again" - Michael Saylor

🚨🚨🚨 An explosive new House Judiciary Committee report exposes the Trump family’s multi-billion-dollar crypto empire, fueled by self-dealing and corrupt foreign interests, the dismantling of anti-corruption safeguards, and pardons for corporate cronies. forbes.com/sites/danalexa…

Binance founder Changpeng Zhao accused of facilitating payments to Hamas on.ft.com/4a7KJrx

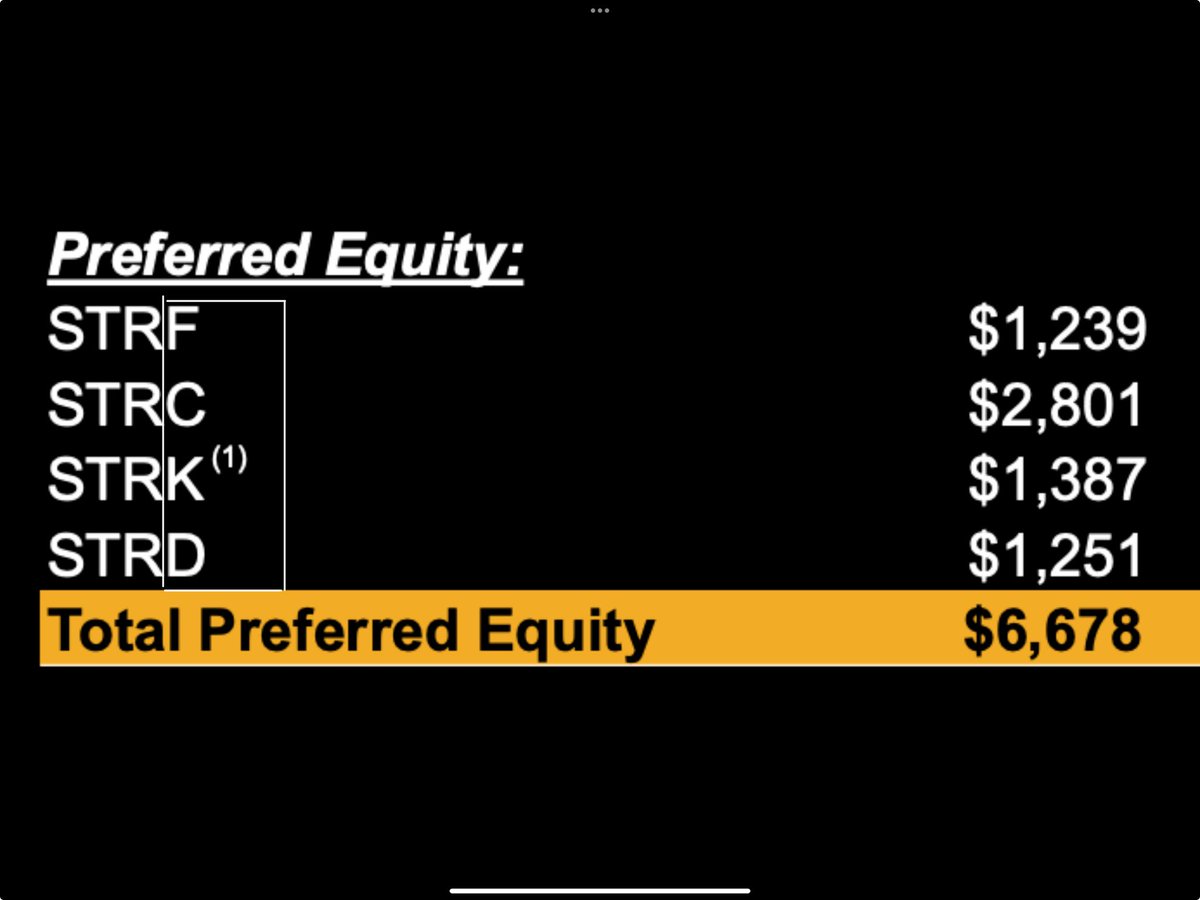

One odd question about #MSTR is how they named their preferreds. Every company I’ve seen lists them alphabetically by issue. So, the first is “A” followed by B, C etc. Not Strategy. Their preferreds are F C K D Can’t call that random……

Season 1, Episode 6: THE ONE WHERE HOWARD LUTNICK GETS IN BED WITH TETHER AND SCORES A MASSIVE PAYDAY On May 17, 2024, Giancarlo Devasini, reportedly owner of the majority of Tether’s voting stock, told an associate that he had given @HowardLutnick a large number of @Tether_to…

So what did JPM do to merit this? Nothing really. Their market strategist mentioned in a note this week that if MSCI removes MSTR from MSCI indexes (as they’ve said they are considering) that could result in $2.8B of MSTR being sold by funds/ETFs that use MSCI indexes. MSCI…

I cancelled my JPM account and moved entire account to Wells. Also, don’t use chase credit card if you’re worried about fraud. More to come.

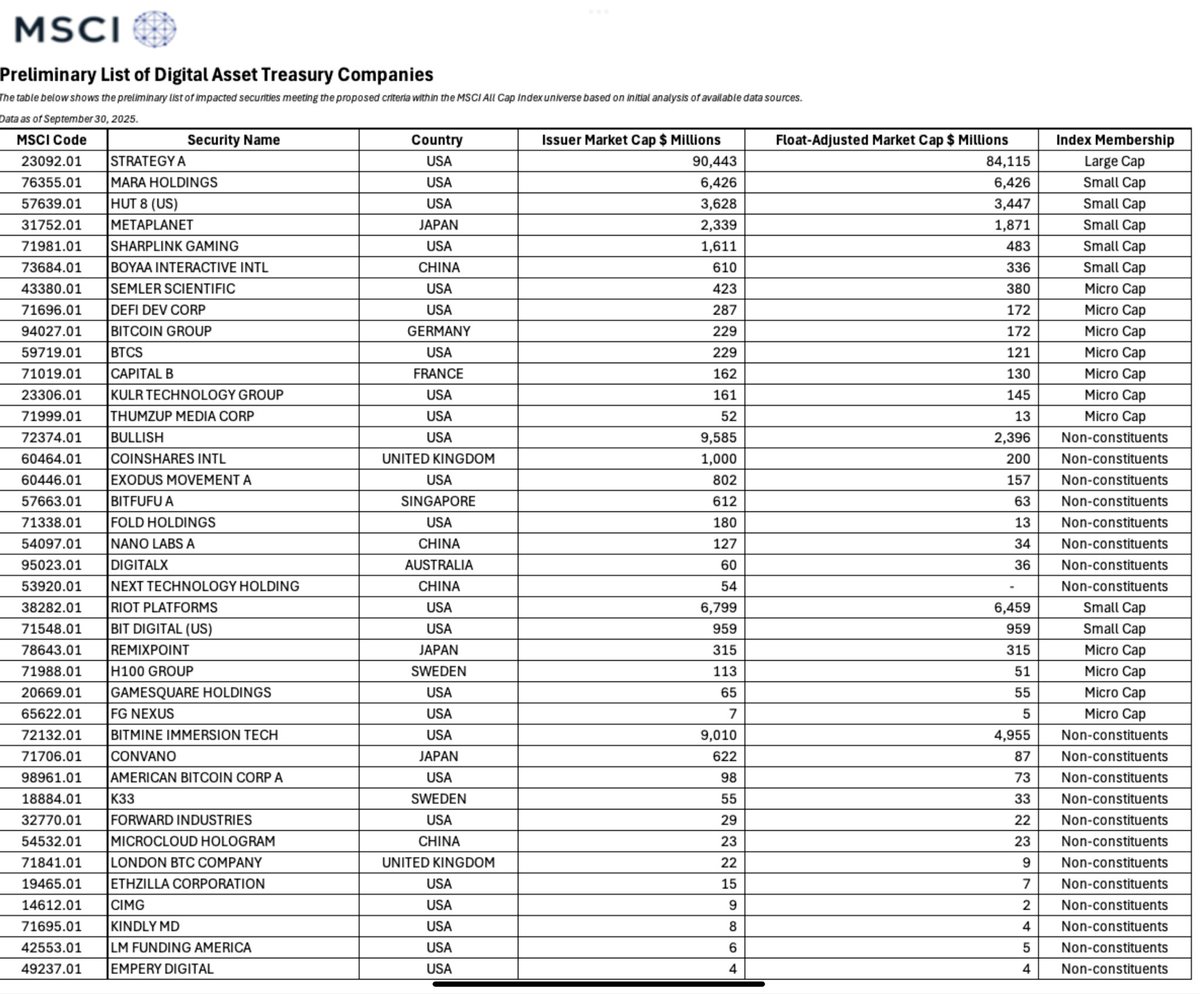

Here is MSCI’s list of DATs that they are considering excluding from the various MSCI indexes. MSCI doesn’t include “investment vehicles” in their indexes, and are considering those firms who business activity is the holding of digital assets as de facto investment vehicles.

Another growing risk to MSTR will be Wall St analysts. They’re all massively bullish (the bankers are making a fortune in fees from Saylor) Wall St. has a mean price target $500 and every analyst is underwater on their recommendation. Unless BTC materially recovers soon, MSTR…

United States Trends

- 1. Eagles 91K posts

- 2. Jalen 22.8K posts

- 3. Caleb 43K posts

- 4. Ben Johnson 5,032 posts

- 5. AJ Brown 3,057 posts

- 6. Patullo 6,415 posts

- 7. Black Friday 490K posts

- 8. Swift 56.3K posts

- 9. Swift 56.3K posts

- 10. #CHIvsPHI 1,924 posts

- 11. Tush Push 4,401 posts

- 12. Lane 50.6K posts

- 13. Nebraska 13.5K posts

- 14. Nahshon Wright 1,863 posts

- 15. Sirianni 3,179 posts

- 16. Philly 17.9K posts

- 17. #BearDown 1,153 posts

- 18. Al Michaels N/A

- 19. Kevin Byard 1,583 posts

- 20. Sydney Brown 1,328 posts

You might like

-

Arthur Hayes

Arthur Hayes

@CryptoHayes -

Conks

Conks

@conksresearch -

Adam Back

Adam Back

@adam3us -

Flood

Flood

@ThinkingUSD -

Lyn Alden

Lyn Alden

@LynAldenContact -

Laura Shin

Laura Shin

@laurashin -

Joseph Young

Joseph Young

@iamjosephyoung -

Paolo Ardoino 🤖

Paolo Ardoino 🤖

@paoloardoino -

otteroooo

otteroooo

@otteroooo -

Jack Mallers

Jack Mallers

@jackmallers -

Randy

Randy

@nondualrandy -

Jimmy Song (송재준)

Jimmy Song (송재준)

@jimmysong -

Hasu⚡️🤖

Hasu⚡️🤖

@hasufl -

Dylan LeClair

Dylan LeClair

@DylanLeClair -

Protos

Protos

@Protos

Something went wrong.

Something went wrong.