Bright™ Futures

@BrightFuts

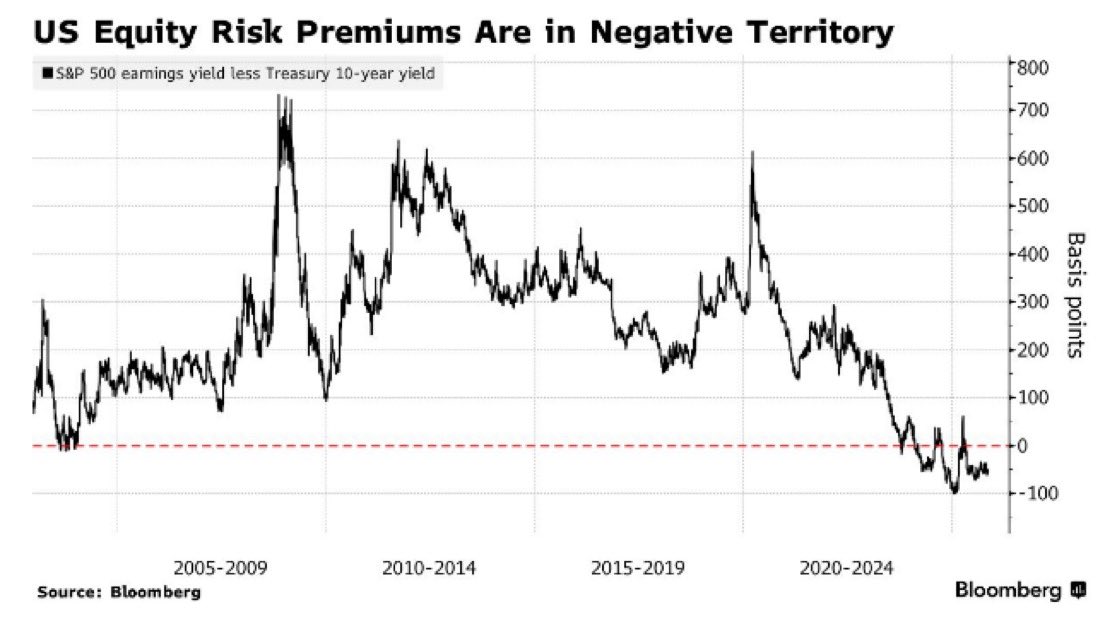

Entropy wins.

Dit vind je misschien leuk

The CME is bringing back single stock futures. They had them back in the 90’s and were fairly popular amongst fund managers. cmegroup.com/media-room/pre…

#Silver bounced from the 423% extension to the 686% in 4 days. She's still got frenzy. (Modified Schiff fork from the 2025 low).

The biggest product of the 'crypto industry' is charlatans. lots and lots of charlatans.

#Silver did go back to that 686% extension. But now the arbitrage with Shanghai silver futures is utterly insane and unsustainable. Dealers will take COMEX delivery and ship it to China because the spread is far larger than logistics costs and VAT.

#Silver could potentially drift down all the way back to the 686% extension. However that can only happen if Shanghai prices ease towards $100. Alternatively it could also be a fast intraday move on CME alone without Shanghai prices easing.

#Silver could potentially drift down all the way back to the 686% extension. However that can only happen if Shanghai prices ease towards $100. Alternatively it could also be a fast intraday move on CME alone without Shanghai prices easing.

#Silver surged above the 686 extension, but then closed below. Price might go sideways for a few days. It may also dip before continuation.

It is surprising that todays massive run in #silver did not trigger the CME dynamic circuit breakers even once. Just a year ago a move from $30 to $33+ would have triggered the breaker. It's not actually crazy yet.

Thank you Jimmy ❤️❤️❤️ We’re going to $500 boys. I don’t make the rules. #silver

Lots of talk about the gold:silver ratio coming back into historical averages. Well here’s a different viewpoint. #gold #silver

Many people believe $20 #crudeoil is on the horizon, because they wrongly think Venezuelan oil will flow freely at Maduro prices. It will flow freely, but only at attractive prices, Chevron are not fucking socialists... Venezuela's oil infrastructure is dilapidated. Wood…

The Santa Rally ain't rallying. The Santa Rally starts on the open of the 24th (#ES_F 6959.50). It rallied on the 24th and broke back under the Santa open on the 28th. Now still below with 3 more days to go. (Santa Rally = 5 trading days in Dec and first 2 days in Jan)

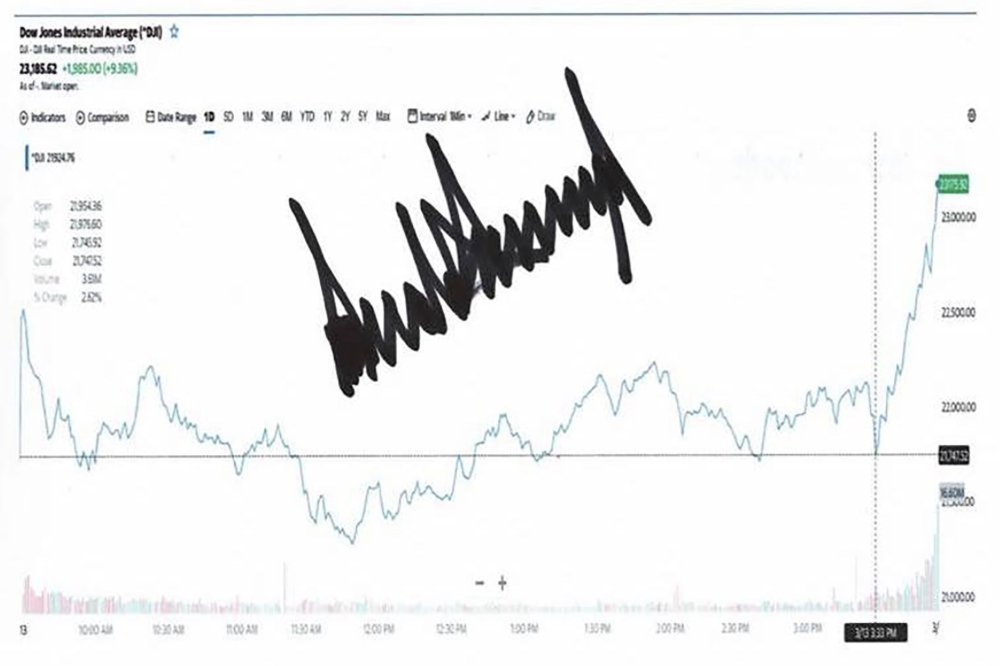

Remember during the COVID meltdown on March 13, 2020, when the Dow had a +1,985 point day and Trump gave himself an award and autographed the chart? The Dow then went on to lose 20% from that day's close. Yesterday's action in #Silver was the same (but inverse). #SI_F #SLV #PSLV…

The best, most enjoyable nicotine delivery method known to man! I spent 20+ years smoking and vaping and I can’t say I ever enjoyed nicotine as much as I do with pouches. Thank you @sweden.

Happy Mega Witching Day for those who celebrate

🚨FRIDAY SET FOR RECORD “WITCHING DAY” Roughly $7.1 trillion in options tied to stocks, ETFs, and indexes are set to expire today, making Friday the largest “witching day” on record, according to Citigroup strategists. These quarterly events occur when multiple derivatives…

#Silver sideways 👍

#Silver likely to face resistance here at the 423% extension of the modified Schiff fork from the April 7 lows. A remarkable run, with more to go, but for now some sideways action likely warranted.

#Silver likely to face resistance here at the 423% extension of the modified Schiff fork from the April 7 lows. A remarkable run, with more to go, but for now some sideways action likely warranted.

United States Trends

- 1. Valentine's Day N/A

- 2. Rubio N/A

- 3. Forever Young N/A

- 4. Bill Maher N/A

- 5. Jordan Stolz N/A

- 6. Ungrateful N/A

- 7. Clemson N/A

- 8. Finland N/A

- 9. McBride N/A

- 10. Iowa State N/A

- 11. #Caturday N/A

- 12. Roses N/A

- 13. #ARCA N/A

- 14. Nysos N/A

- 15. Munich N/A

- 16. Mick Cronin N/A

- 17. Carbon Monoxide N/A

- 18. Padres N/A

- 19. #ด้วงกับเธอEP3 N/A

- 20. Oilers N/A

Dit vind je misschien leuk

-

Christine Anderson

Christine Anderson

@AndersonAfDMdEP -

Angelo Giuliano 🇨🇭🇮🇹

Angelo Giuliano 🇨🇭🇮🇹

@angeloinchina -

Zhao DaShuai 东北进修🇨🇳

Zhao DaShuai 东北进修🇨🇳

@zhao_dashuai -

Atlantic Council GeoEconomics Center

Atlantic Council GeoEconomics Center

@ACGeoEcon -

Gavin M. Wax

Gavin M. Wax

@GavinWax -

Peter Borbe

Peter Borbe

@PeterBorbe -

Cam

Cam

@noremacback -

⭐️ Monica Kingsley ⭐️ 🇬🇷

⭐️ Monica Kingsley ⭐️ 🇬🇷

@Monica___K -

Andrea Mazzalai

Andrea Mazzalai

@icebergfinanza -

Nick Palmisciano

Nick Palmisciano

@Ranger_Up -

przidnt🥭

przidnt🥭

@przidnt1 -

HA Bull

HA Bull

@HABull10 -

bob

bob

@bobleavitt4 -

Andrés Gruzdis

Andrés Gruzdis

@AndresGruzdis -

NickPJ

NickPJ

@NickPJ2

Something went wrong.

Something went wrong.