Eric Dubin

@Zeitgeist_Scan

Polymath - Geopolitics; Markets (analyst, global macro/ground-up), financial media; Journalist; (radio/podcast/written, Exec./Managing Editor)

Re. a potential US military strike on Iran and its timing, I asked SuperGrok the following framed question for a review of history: grok.com/share/c2hhcmQt…

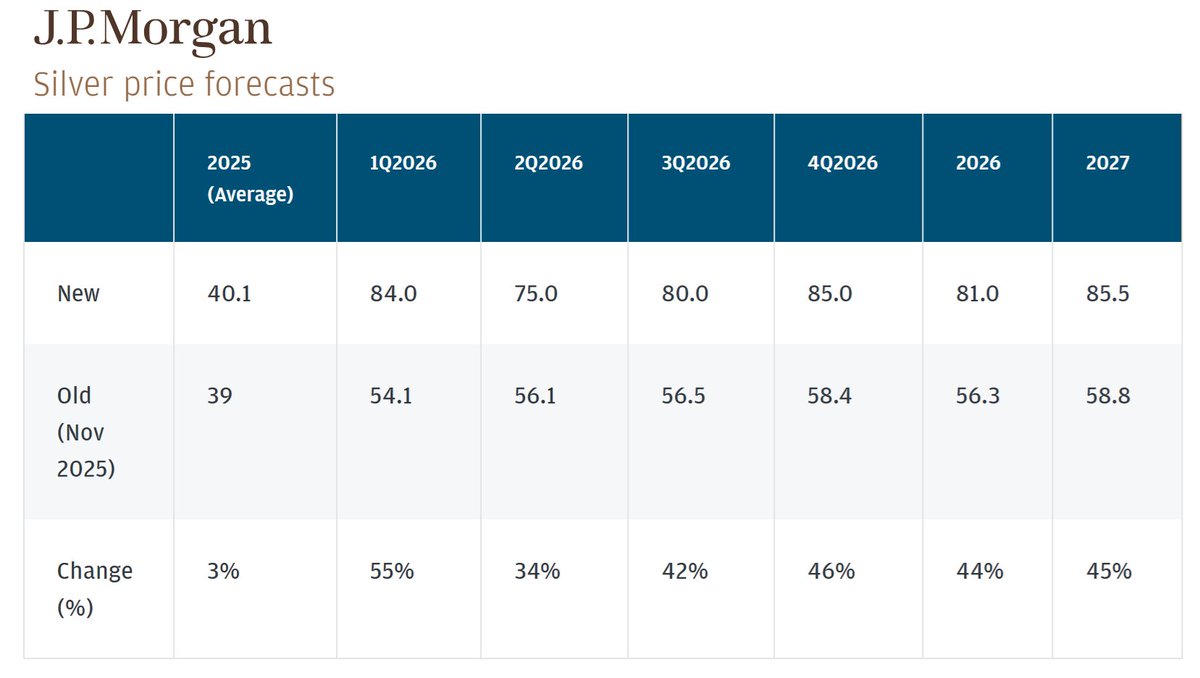

JP Morgan Silver Price Forecasts Looking glass into JP Morgan analyst perspectives. Estimates on industrial demand segments, Fed policy and supply deficit in its sixth year are found in the full article: tinyurl.com/37xea46k

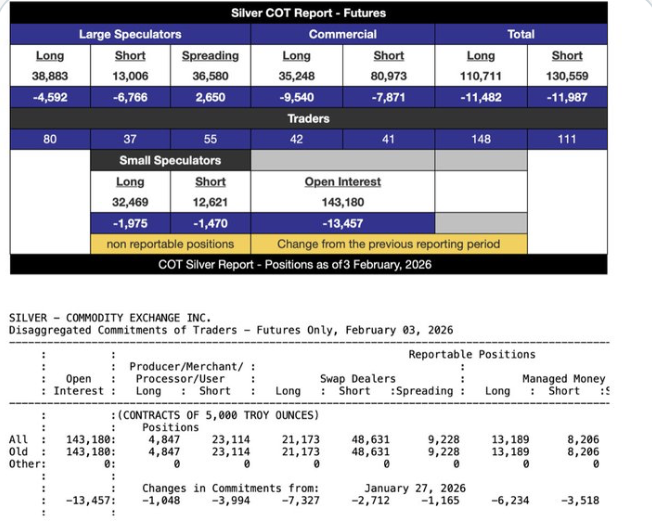

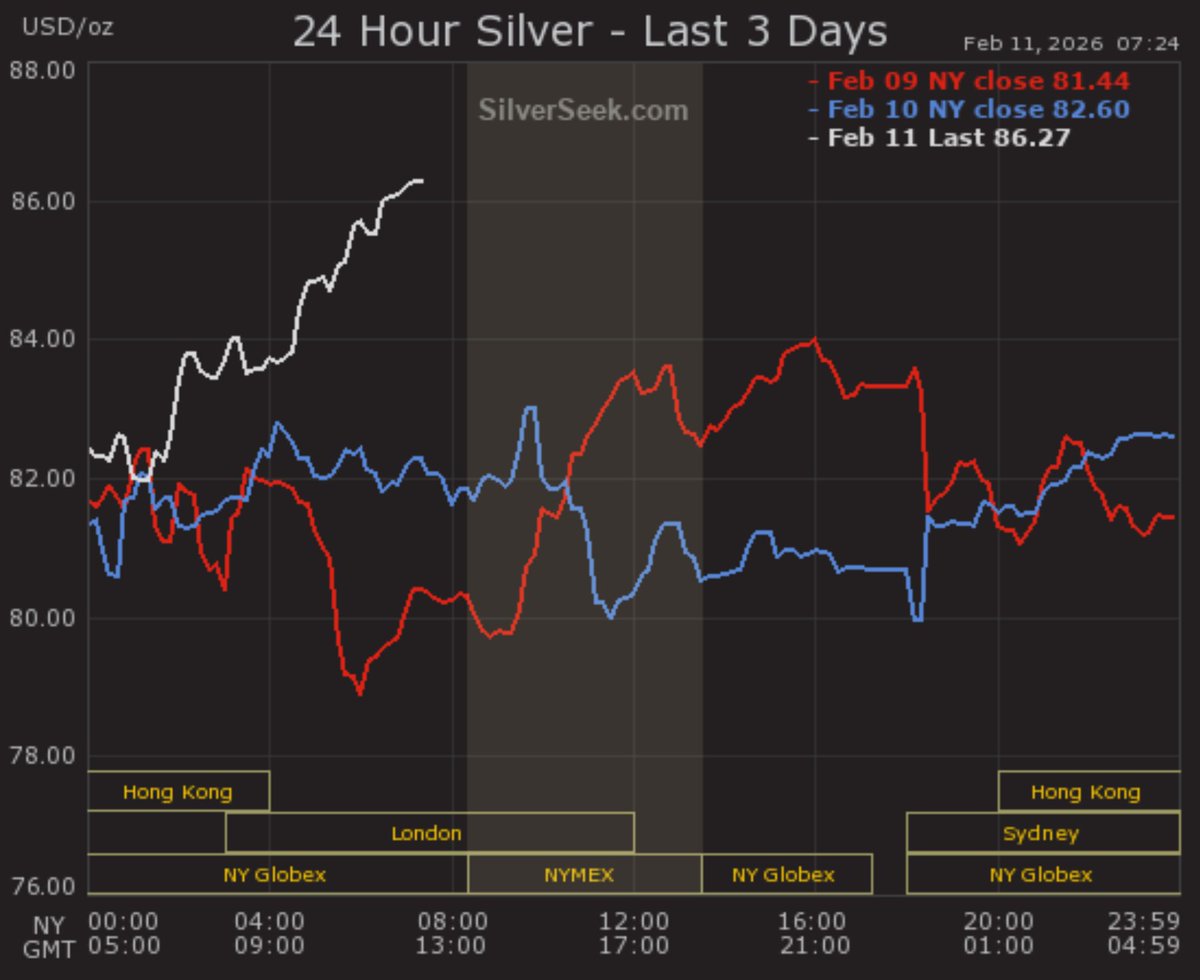

If you believe that this is just a rush of hedge funds and managed money dumping longs, I'll remind you of last week's CoT report. What? Did Managed Money simply decide to dump their puny little 13,189 longs all at once? This is not just Speculator selling. It is *something*…

If this were actually true, the world would have just “discovered” 11 million tonnes of gold, silver, copper and zinc — conveniently at the exact moment when global inventories (especially silver) are collapsing and COMEX can’t hide the shortages anymore. That would be such a…

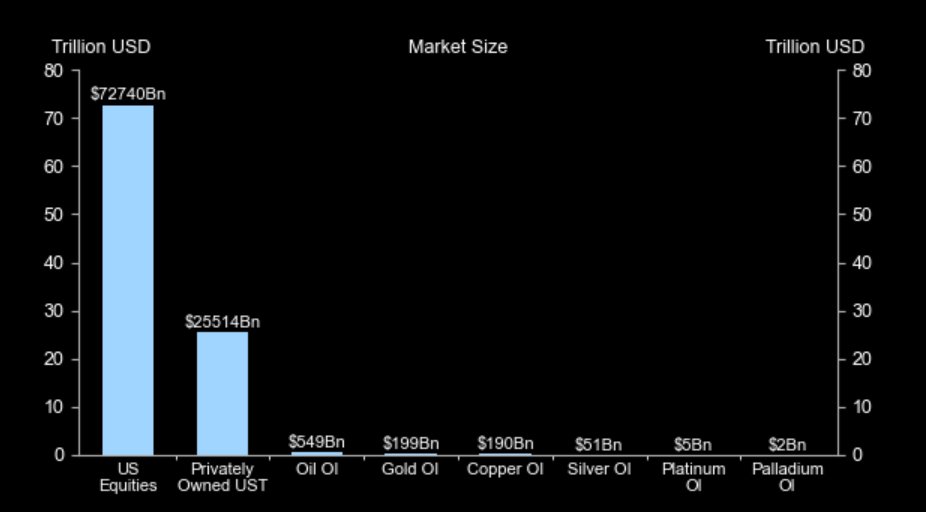

🔥The Silver Derivative Market's Doomsday Clock is 2 Minutes To Midnight 🔥 The silver derivative markets (futures, options, promissory note OTC claims) require a minimum threshold of liquid free float vault stock (actual physical silver) be available in order to function. When…

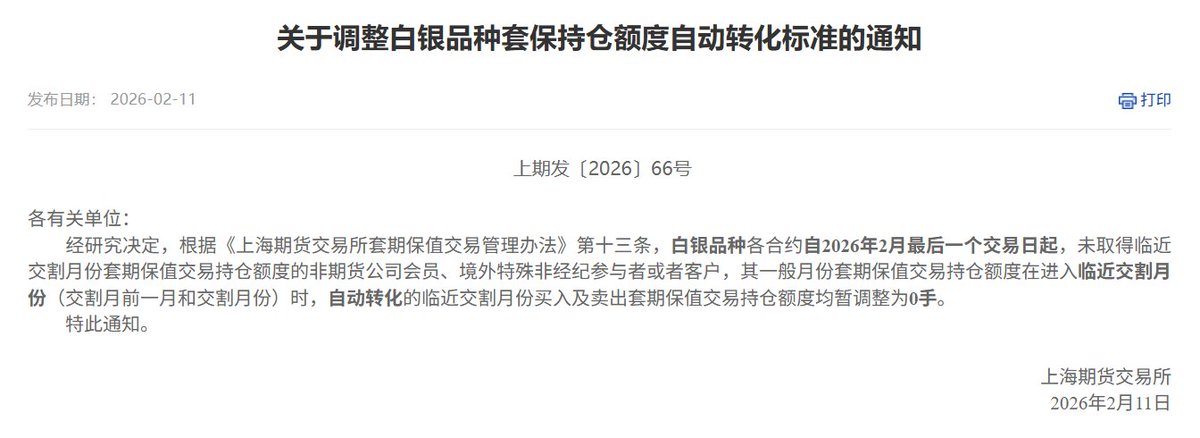

China - a Communist country running a mixed/command economy - seems to care more about sound futures market regulation than the West. Go figure... This echoes the May 2004 CFTC letter by Michael Gorham, Director of the Division of Market Oversight. @SemperVigilant1 is spot-on…

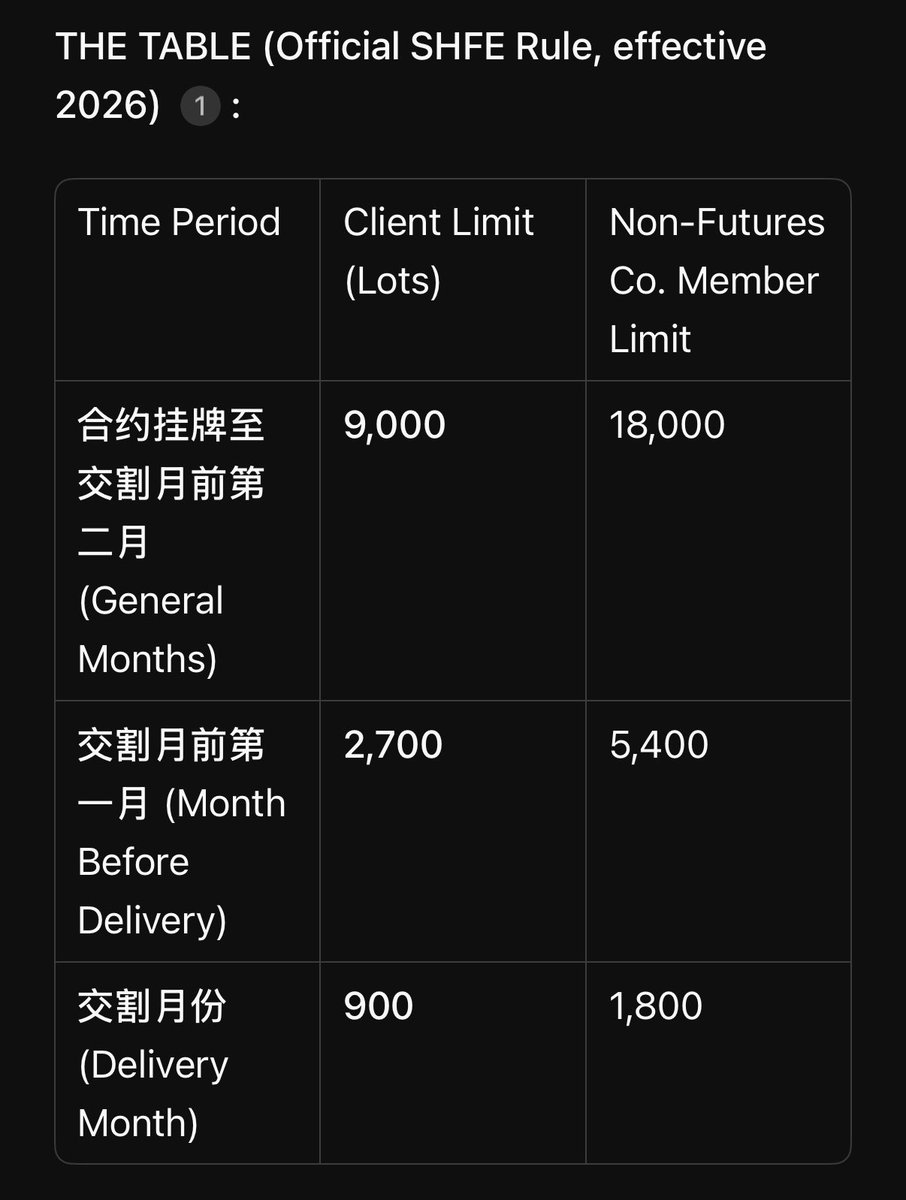

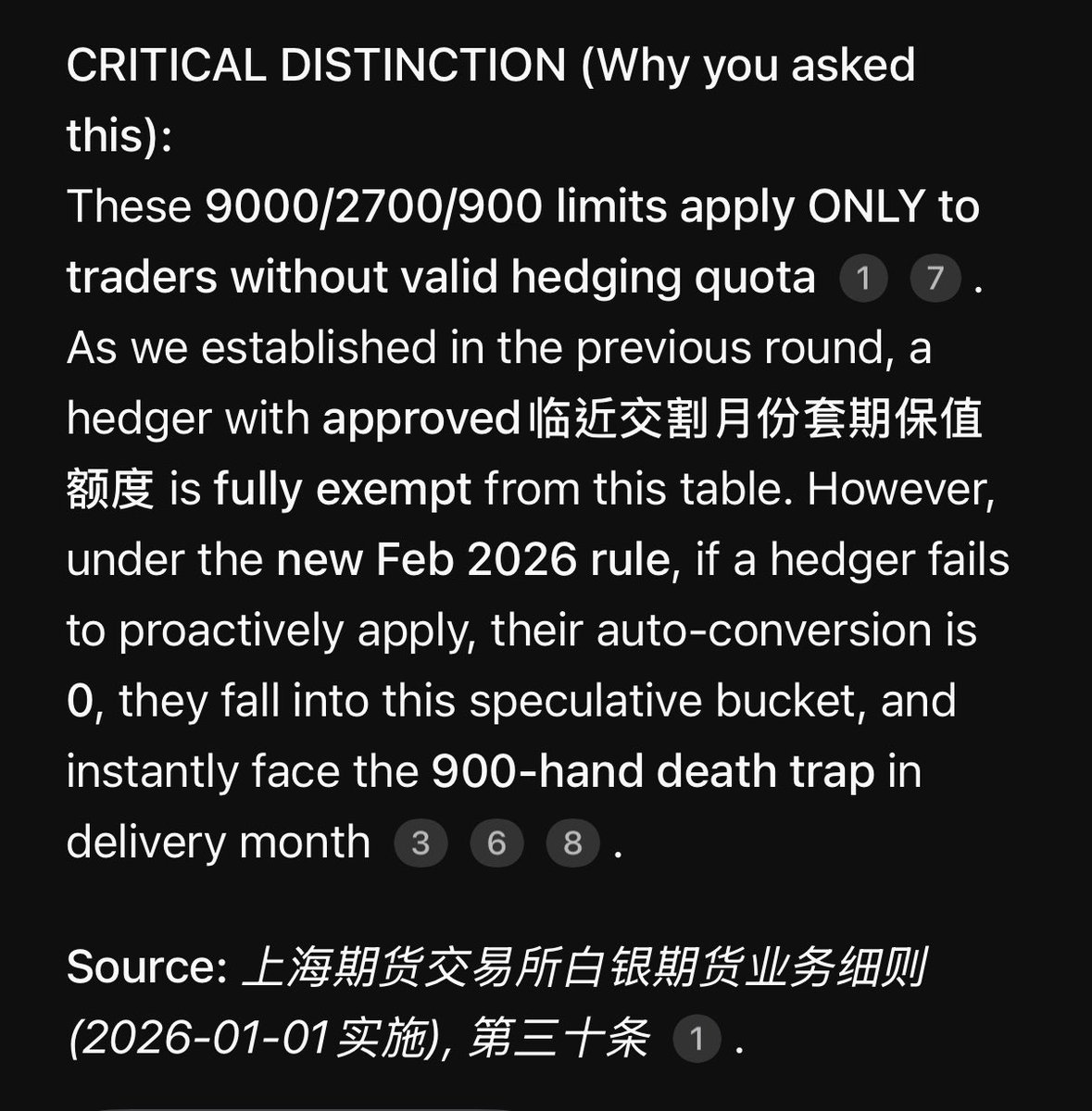

This is significant. The Shanghai The Shanghai Futures Exchange (SHFE) has effectively extended strict position limits to both long and short hedged silver futures positions if traders fail to obtain approved hedging quotas from the exchange. This change will make large-scale…

BREAKING 🚨: Starting from the last day of February, FOR ALL SILVER CONTRACTS, SHFE participants who have not obtained hedging transaction position quotas for the near- delivery month, will have ZERO LOTS delivery allocation Silver physical shortage is now officially extreme

The major bullion banks that manipulate precious metals prices (especially silver) are now effectively shooting themselves. "Mr. Slammy" is playing with fire. #SilverSqueeze

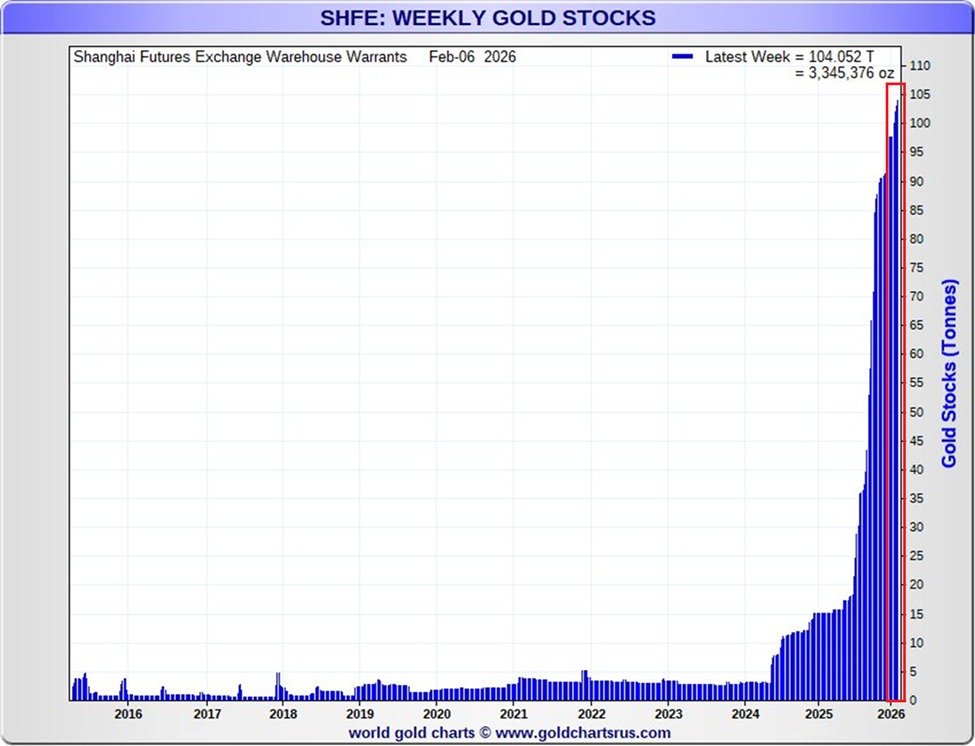

Gold inventories at the Shanghai Futures Exchange vaults are skyrocketing: Deliverable gold in the Shanghai Futures Exchange, measured by warehouse warrants, is up to a record 104 tonnes. Warehouse warrants represent physical gold stored in approved exchange vaults that can be…

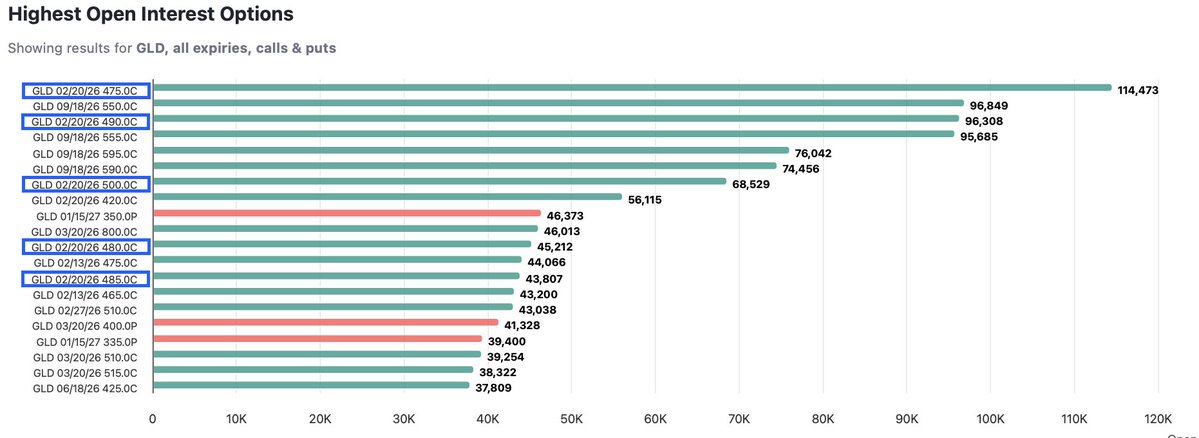

GLD That is an extraordinary concentration of open interest clustered around the $475-$500 strike in GLD, particularly given how little theta these options are currently offering. When you see this much notional exposure parked at a narrow strike range, it’s no longer about…

This is where the outperformance will be generated in the months and years ahead. The same dynamic applies across commodities. Capital is migrating toward scarcity, cash-flow durability, and real assets after a decade of financialisation. The dispersion is only just…

Gold is holding support. In fact the correction in gold has been fairly mild. Once gold starts to get traction back up silver will follow and no amount of suppression or margin hikes will be able to stop it as the shortages will just get more extreme as long as price is held…

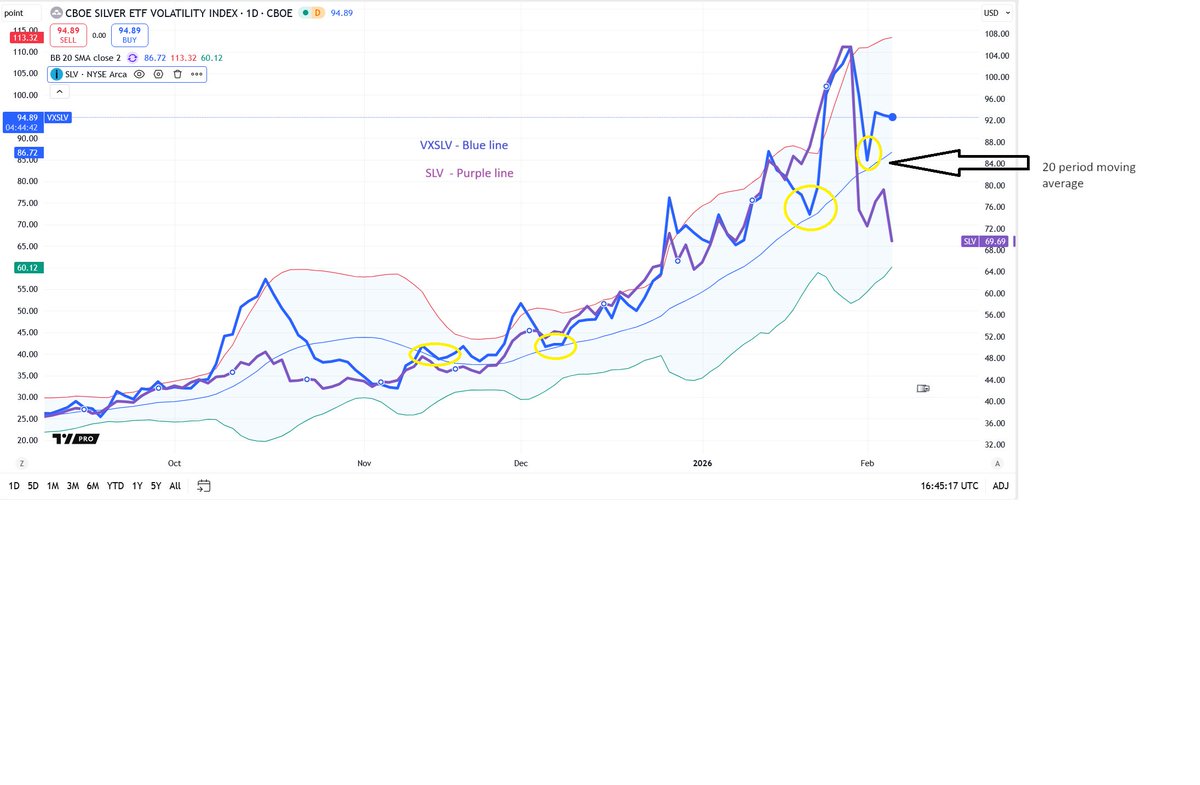

Silver Backwardation ALERT Silver Futures on the Comex has grown to a 65 cent discount to London Spot currently. At the same time, Volatility Index on SLV options (VXSLV) just pulled back to a key support line and bounced. This 20 period support line has held each pullback in…

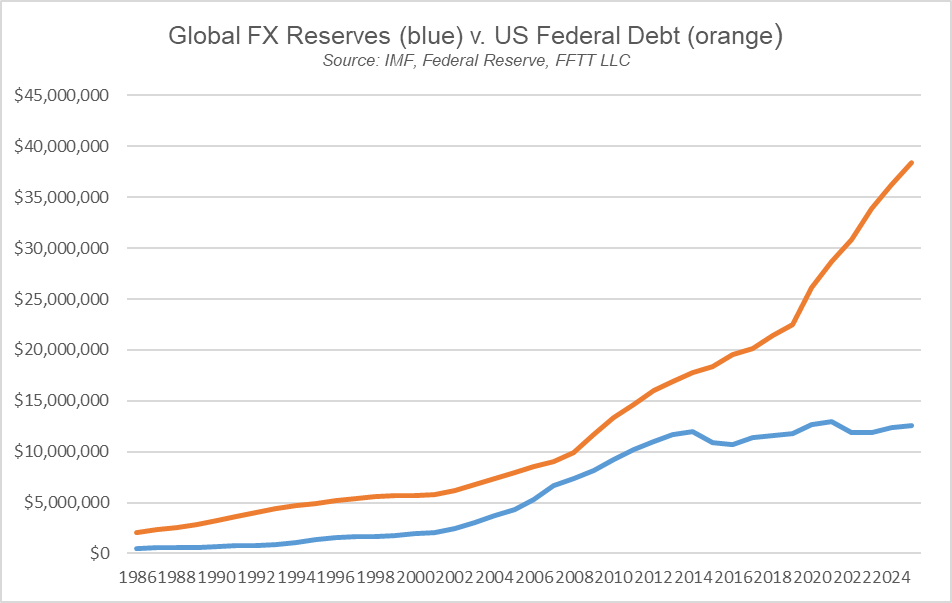

Price-insensitive buyers of USTs in blue (global FX reserves, ex-gold) v. US Federal debt (orange). Since 2022, biggest marginal buyer of "the gap" has been highly-levered hedge funds in the Caymans... which is fine, as long as volatility NEVER rises ANYWHERE, in ANYTHING.

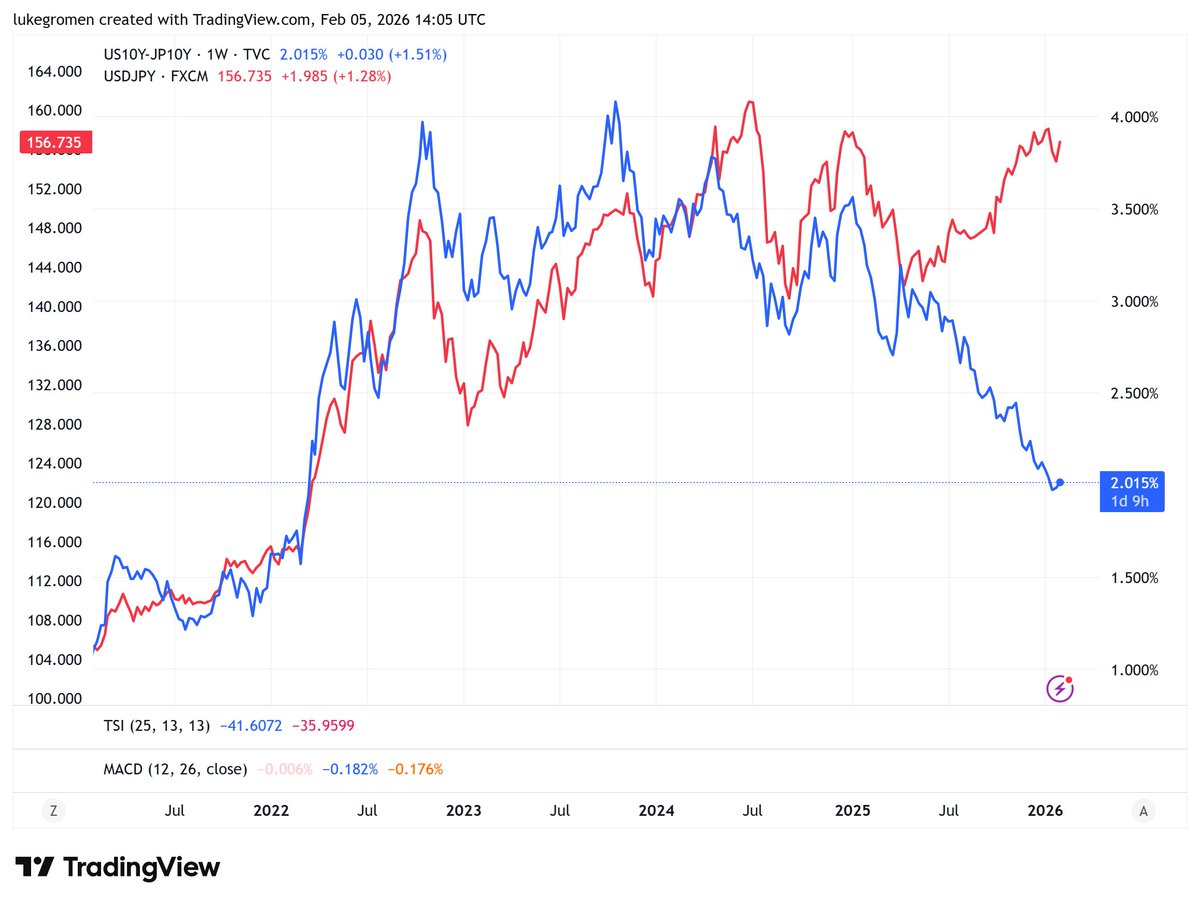

Perhaps most important chart in macro right now 10y UST yld - 10y JGB yld (blue) v. USDJPY Markets appear to be discounting that the rate that forces BOJ back into YCC to avoid a Japan (& then global) debt crisis may not be too far north of here BTC crash & gold vol = symptoms

Just to give you another perspective of what happened today: there are ~13.5m/oz of physical silver left in SHFE vaults and today ~1.3bn/oz were traded, mostly sold short, during the 2 hours morning session. Only God knows what happens when all physical in the vaults will be gone

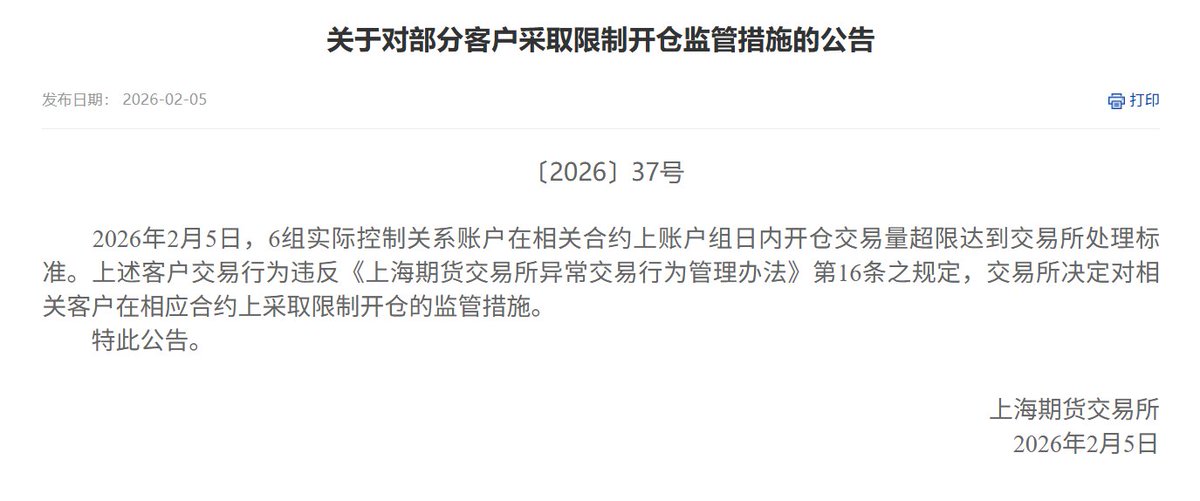

BREAKING: We now have the confirmation they attacked and tried to break the silver market at SHFE today - The SHFE is now will restrict the relevant accounts. Translation from Chinese below. "On February 5, 2026, six groups of accounts under actual control exceeded the daily…

Silver diving again! In addition to the stress caused by the Chinese speculators that piled into the UBS SDIC Silver Futures fund, Chinese billionaire Bian Ximing now controls a silver short position larger than entire exchange vault inventory. Bob Coleman's (@profitsplusid)…

United States Trends

- 1. Anthony Kim N/A

- 2. #AEWGrandSlam N/A

- 3. Chivas N/A

- 4. #RivalsUniteInDokkan N/A

- 5. Tessa N/A

- 6. Raven Johnson N/A

- 7. Elvis Presley N/A

- 8. Janis Joplin N/A

- 9. #OPLive N/A

- 10. Flau’jae N/A

- 11. South Carolina N/A

- 12. #MCRMEXICO2 N/A

- 13. Dirty Diana N/A

- 14. Marilyn Monroe N/A

- 15. Boardwalk Empire N/A

- 16. #NBAAllStar26 N/A

- 17. Gonzaga N/A

- 18. Texas Tech N/A

- 19. Dawn Staley N/A

- 20. Jardine N/A

Something went wrong.

Something went wrong.