Weekly update from @jackmallers about $XXI, really appreciate You taking the time to answer these questions, the community response has been overwhelmingly positive! Here's the TL;DR, full Q&A segment about Twenty One is down below in the video. 1) Being the CEO of both Strike…

Let's do an experiment, issuing shares of $MSTR when their site proclaims that the mNAV is 1.08x! MSTR's stack is 709,715 Bitcoin, and their fully diluted share count is 362,606,000, that puts their Bitcoin per share at 0.00195726 BTC MSTR's latest price was $163, let's issue…

Why is $MSTR using their enterprise value for mNAV calculations on their website? IMO it's misleading to investors thinking MSTR is issuing shares at a premium. They should use share price / Bitcoin per share * Bitcoin price instead. That would show the actual mNAV were they to…

Why is $MSTR using their enterprise value for mNAV calculations on their website? IMO it's misleading to investors thinking MSTR is issuing shares at a premium. They should use share price / Bitcoin per share * Bitcoin price instead. That would show the actual mNAV were they to…

Imagine if $XXI achieves a yearly 30% Bitcoin yield, and Bitcoin itself grows by 30% per year. Now assuming good cash flows, the mNAV should also expand, let's assume 1.5x in 5 years. In 5 years stock price should be $210, that's why I'm investing in Twenty One.

At $8.4 per $XXI share and BTC price at $90k, the mNAV is about 0.82x Effective Bitcoin price if buying shares instead of Bitcoin is $74k Use the discount.

Questions I'd ask @jackmallers about $XXI if I had the chance: 1) How will you balance being CEO of both Strike and Twenty One while giving your best to each? 2) What's holding back more details on the business side of Twenty One now that the merger is fully completed?…

$XXI has lagged behind Bitcoin's performance over the last couple of days. I expect it to act like this until some news comes out on the business lines. At $9.73 per share and Bitcoin at $96k, the mNAV is 0.89. Basically buying Bitcoin at $85k if you were to buy the shares…

Weekly update from $XXI CEO, nothing new pretty much, more to share on the business lines "soon" The proof of reserves addresses were updated, so all good in that way, no Bitcoin sold at all. The 1 Bitcoin sent was for a contractor doing work for XXI.

Well seems like $XXI was just moving funds around, we have not been rugged! Very bullish! 😭 Back at 43k Bitcoins

$XXI has moved a big part of their Bitcoin recently from their proof of reserves wallets. I'm thinking it's to do with their business part of the company, perhaps using their Bitcoin stack to start producing cash flow via lending? If so XXI would be the first to actually use…

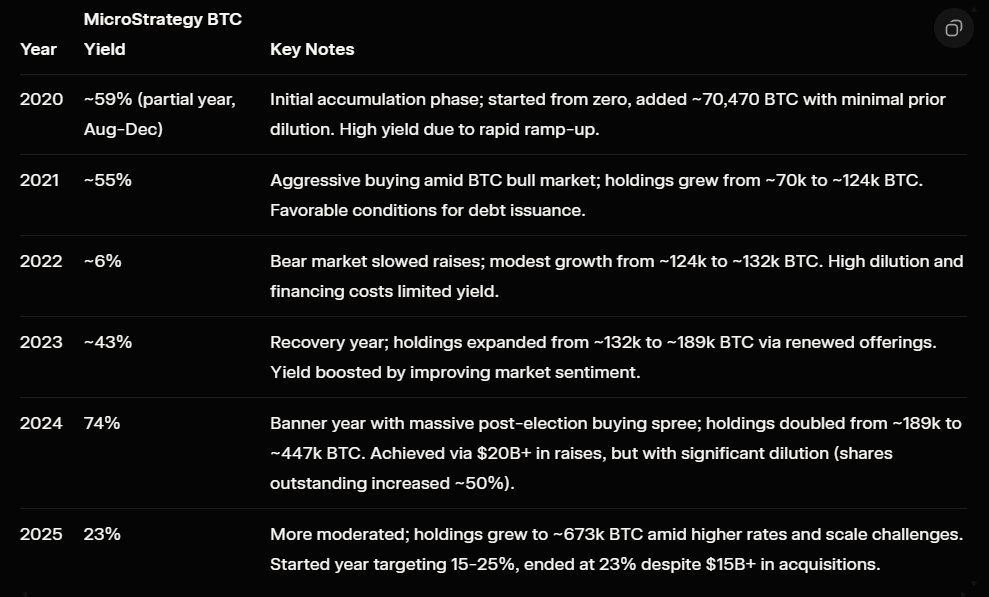

Looking back at what yield percentages MSTR had over their Bitcoin accumulation years, I think it's fair to assume that $XXI can achieve around 40% yearly Bitcoin yield in the first years of the company operating. If that yield were to drop by 3% every year (more capital…

REMINDER: At $9.75 per share of $XXI and Bitcoin price of $93k, you can still get Bitcoin at $86.5k by buying shares instead of BTC. (0.93x mNAV) And you get a free Bitcoin generator with your 7% discount. Deal of the year here.

Today is the last day $XXI will trade in 2025. Price action has been really bad leading up to it, but we should look ahead to what 2026 will bring. I'm confident $XXI will outperform every other Bitcoin related company next year and I'd love to hear what everyone else thinks the…

Only $MSTR investors will flex that their company is taking on infinite high interest debt and call it a "product"

Reminder: $XXI isn't doing anything at all. $MSTR is selling Digital Credit.

Goal for 2026 is to achieve my $XXI share count yield of 25% - 50%, achieved through options selling and regular investing. Might be irresponsible, but I'm all in right now.

Why isn't $MSTR issuing loads of preferred stock right now and use their established USD stockpile to cover the dividends for the 2 years while the stock and Bitcoin is doing so bad? Would be the perfect time to not dilute the common stock while it's trading at these mNAV lows…

Here's some values plugged in for $XXI's performance. This is projected over 5 years starting from around 88k Bitcoin price and 0.00011334 Bitcoin per share. Best part is that most profits go into an asset that's going to keep appreciating instead of melting fiat ice cubes. How…

The bear is the time to build. Keep buying $XXI Don't be the person who FOMO's back into the stock at all time highs later on just to be exit liquidity for someone else.

United States 트렌드

- 1. Paddy N/A

- 2. #UFC324 N/A

- 3. Alex Pretti N/A

- 4. Ilia N/A

- 5. O'Malley N/A

- 6. Derrick Lewis N/A

- 7. Derrick Lewis N/A

- 8. Arman N/A

- 9. Suga N/A

- 10. Muratalla N/A

- 11. WHAT A FIGHT N/A

- 12. #SNME N/A

- 13. Moro N/A

- 14. #UFCParamount N/A

- 15. #Skyscrapperlive N/A

- 16. Silva N/A

- 17. Kyle Rittenhouse N/A

- 18. Battle of Gods N/A

- 19. Dragon Ball N/A

- 20. Yadong N/A

Something went wrong.

Something went wrong.