Brian Brookshire (Bitcoin Overflow)

@btc_overflow

Bitcoin and Bitcoin Treasuries | frmr Head of Bitcoin Strategy @H100Group

You might like

Look, the strategy is really simple. Keep DCA-ing into #Bitcoin. That's it. Seriously, you can stop reading here.

Vanguard clients are coming.

Starting tmrw vanguard will allow ETFs and MFs tracking bitcoin and select other cryptos to begin trading on their platform. They cite how the ETfs have been tested performed as designed through multiple periods of volatility. Story via @emily_graffeo

One under appreciated aspect of CBs is that demand for them is highest during ideal conditions--market euphoria. Given ongoing cost of financing, prefs are actually more ideally suited for Bitcoin bear markets. But that's also going to be the most difficult time to issue them.

I'm glad $MSTR's green dots weren't share buybacks and was extremely skeptical that they would be. For tiny dips below 1x mNAV, I'd rather a company just keep buying BTC. And it wouldn't have been a good look to make a big deal about what could only have been a tiny buyback.

Green dots meant a cash reserve to fund dividend payments. I like this move.

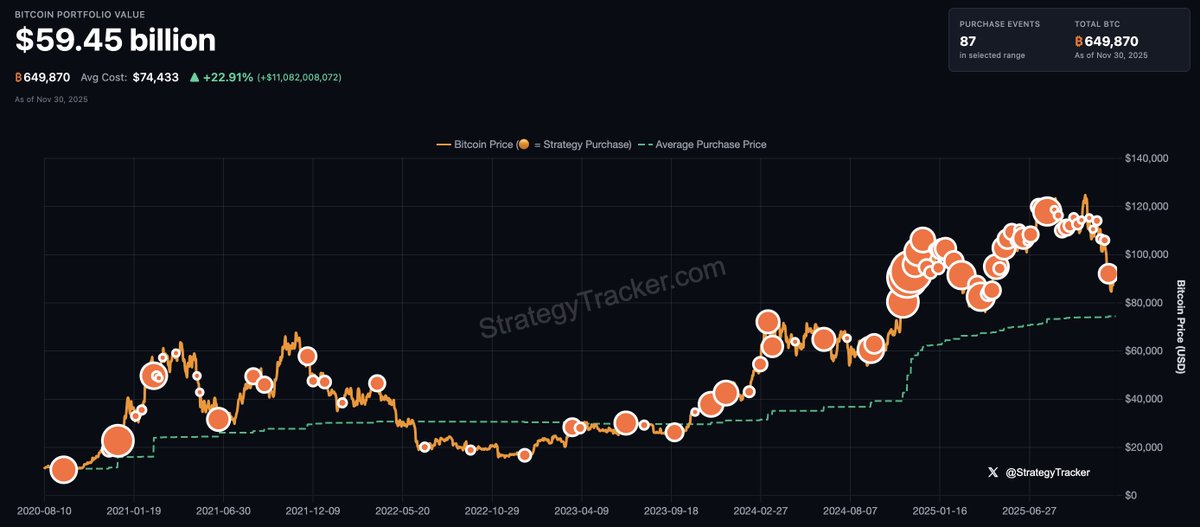

$MSTR announces the formation of a $1.44 billion USD Reserve and an increase in its BTC Reserve to 650,000 $BTC.

Green dots. 🤔

I'll say it until I'm blue in the face, but either we're all wrong about Bitcoin, or Strategy's ambitious preferred share financing strategy wins. You can't have it both ways. Not even an ordinary end of cycle drawdown year would stop Saylor.

I believe the market will take either MSTR (enterprise value) below 1x or MSTR stock below its Bitcoin cost basis. Once MSTR proves to the market AGAIN that nothing happens—the first put date for the convertible note is 18 months away—both Bitcoin and MSTR will rally hard. Even…

👀 We're in a bull market for Bitcoin payments and infrastructure.

Today is my final day at @H100Group. I’d like to thank our shareholders who have been along for the journey with us. And, of course, @Sanderandersenn and @Wiik_Johannes, for giving me the opportunity to be part of the story of the Nordics’ leading Bitcoin Treasury Company. To…

Happy Thanksgiving! I have a pumpkin pie as orange as bitcoin ready for the family gathering. Pumpkin pie is hands down best treat of the season.

At $81K, X was convinced bitcoin needed to drop to $75K before a rebound. Instead we're back at ~$90K.

Bitcoin at $1M turns treasury companies into billion-dollar giants - @btc_overflow takes on the State Of Bitcoin Markets.

We’re excited to welcome @elisenolsen as our new Marketing and Communications Manager at H100. Elise brings strategic marketing and sales experience from the Norwegian SaaS unicorn Meltwater and agency work in Norway, combined with a performance-driven mindset from her career as…

I've long since made my peace with the fact that most people won't and will not even want to custody their own BTC. But credible threat of withdrawal and a healthy contigent of those who do self custody are still critical to preserve what makes it valuable in the first place.

I’m going to be completely honest with all the Bitcoiners on here. Cold storage $BTC scares me. What happens if I lose my password? What if a criminal wants my cold storage $BTC? When I buy $MSTR or $IBIT I don’t have to worry about any of these problems and I sleep well at…

The States are coming.

TEXAS BOUGHT THE DIP! Texas becomes the FIRST state to purchase Bitcoin with a $10M investment on Nov. 20th at an approximately $87k basis! Congratulations to Comptroller @KHancock4TX and the dedicated investments team at Texas Treasury who have been watching this market…

Direct defiance of Trump's "Guaranteeing Fair Banking For All Americans" executive order.

Operation Chokepoint 2.0 regrettably lives on. Policies like JP Morgan’s undermine confidence in traditional banks and send the digital asset industry overseas. It’s past time we put Operation Chokepoint 2.0 to rest to make America the digital asset capital of the world.

I am, once again, reminding you, to be careful what you read in Bitcoin Treasury land. The errors are not hard to spot. For example, today it was claimed that the $19.5B $MSTR raised this year was spent entirely on debt service and none on bitcoin. 🤦♂️

Be careful what you read in Bitcoin Treasury land. Markets are challenging and it's natural to see posts that embody sentiment, but lately it feels like 9/10 posts are distortions at best and outright fabrications at worst.

Bitcoin looks more like it's following liquidity than its own pre-programmed 4-year pattern. I remain optimistic about liquidity headwinds flipping to tailwinds over the coming months and throughout 2026.

JPMorgan has kicked the cyberhornets nest.

I just pulled $20M from chase and suing them for credit card malfeasance

Yes, I did, in fact, HODL.

Did you HODL this week?

133156 vote · Final results

H100 Update ($H100 $GS9 $HOGPF) Nov 22, 2025. There are two main news items from H100 this week. Firstly, we released our earnings presentation for the interim period May 1 - September 30, 2025. I encourage shareholders who have not yet done so to view the presentation quote…

Tune in as CEO @Wiik_Johannes and Executive Chairman @Sanderandersenn present H100’s interim five-month financial report and provide an update on our Bitcoin Strategy.

United States Trends

- 1. Australia 1.24M posts

- 2. Bills 103K posts

- 3. Patriots 107K posts

- 4. Drake Maye 15K posts

- 5. McDermott 6,329 posts

- 6. Pats 11.3K posts

- 7. Zay Flowers 2,002 posts

- 8. #FlyEaglesFly 4,922 posts

- 9. Islam 540K posts

- 10. Trevor Lawrence 4,729 posts

- 11. #Browns 3,420 posts

- 12. Beane 1,773 posts

- 13. #Bears 5,477 posts

- 14. Hanukkah 352K posts

- 15. Henderson 12.5K posts

- 16. Dallas Goedert 1,543 posts

- 17. Bondi Beach 903K posts

- 18. Greg Roman N/A

- 19. Vrabel 1,946 posts

- 20. #ChiefsKingdom 2,421 posts

You might like

Something went wrong.

Something went wrong.